1. Introduction

1.1. Industry-related concepts

Concept of real estate: Real estate is a legal right and also an objective material form [1]. Real estate refers to the generic word for real estate, including land, permanent buildings on the land, and the rights obtainable from them, as a material manifestation of objective reality [1]. Any houses constructed on land, including retail stores, factories, warehouses, and office buildings, are known as real estate. The expression "real estate" defines the land as well as the area above and below it, including any ground roads, subterranean utilities, etc. Because of its fixed and immovable location, real estate can be referred to as real estate in economics. A kind of property right, which refers to the many economic interests that constitute the real estate entity and various rights produced therefrom, such as ownership, use right, mortgage right, pawn right, lease right, etc., is the essence of real estate in the legal sense [1]. Since the government began acting after 2008, it is strongly tied to the government's financial revenue and overissuance of currency. The real estate market in China began to expand unnaturally, adversely impacting urban industry, commerce, and the quality of life for citizens. The activity of real estate development firms to build housing and infrastructure on state-owned land in urban planning areas, transfer real estate development projects, or sell and rent commercial properties is referred to as real estate development and management. Among them are the following: the real estate development enterprise, also known as the real estate developer, is the main entity in real estate development and management. It is a profit-oriented enterprise that is required by law to have four levels of qualification and to engage in the corresponding scope of business. A lengthy investment cycle, substantial funding, sluggish turnover, low liquidity, high risk, and high return identify the real estate development and operation sector.

1.2. Real estate policy

Firms are committed to engaging in arduous struggles to guarantee the timely delivery of accommodations for commodity housing initiatives and mitigate and address the risks associated with default. In adherence to the tenets of marketisation and the principle of rule of law, we will implement categorical disposal strategies for commercial housing projects currently under construction that have been sold yet remain unfulfilled, facilitate the progression and completion of these projects, and robustly safeguard the legal entitlements and interests of consumers.

The second is to further develop the role of urban real estate financing coordination mechanism to meet the reasonable financing needs of real estate projects [2]. Urban governments should promote projects that meet the conditions of the "white list," and commercial banks should "lend as much as possible" to compliant "white list" projects to meet the reasonable financing needs of projects under construction.

The government will endeavor to facilitate the absorption of the inventory of commercial housing. City administrations are committed to a "demand-oriented" approach and can arrange for local state-owned enterprises to acquire a portion of the inventory of market-oriented housing at a fair price for use as affordable housing.

The existing land resources will be managed and utilised effectively. Currently, undeveloped or incompletely developed land parcels will be addressed through appropriate measures, including government acquisition, market-based circulation and transfer, and further development by enterprises. Such initiatives aim to assist real estate companies in overcoming challenges, diminishing debt burdens, and enhancing the productivity of land resources.

1.3. Land system in China

China's land system pertains to the legal statutes, policies, and regulatory frameworks governing ownership of land, rights to land use, and land transfer. Predominantly, the system is characterised by state-owned land, which encompasses rural collective land ownership and urban state-owned land ownership, while also acknowledging the existence of private land ownership [3]. China's land ownership system predominantly embraces state ownership, with the land belonging to the entire populace. The state exercises comprehensive management and regulation over the land resources. The state allocates Urban land to individuals or entities, whereas rural land is demarcated by the agricultural collective economic organisations and authorised for utilisation. Rural land may be transferred or leased by individual farmers via the conveyance of contractual management rights, and urban land can be transferred through formal procedures such as sale or exchange.

1.4. China’s real estate industry downturn reasons

Chinese consumers' appetite for real estate has significantly waned, with demand being the pivotal factor influencing the market. No matter how superior the market offerings may be in terms of quality and excellence, they are rendered ineffective without corresponding demand.

Real estate, due to its exorbitant cost, fundamentally constitutes a luxury goods market [4]. As a luxury, it is susceptible to market saturation. Given China's population density, despite the real estate sector's measures of price reduction, the aggregate demand across the market is persistently on a downward trajectory, attributable to market saturation.

Currently, China is grappling with a significant fertility challenge, with many households embracing the notion of fewer births. Consequently, the number of newborns is dwindling, a trend that is expected to slow down population growth. In the face of this reality, the Chinese real estate sector is bound to be impacted. Consequently, numerous real estate enterprises need help to adapt, including established firms like Evergrande, Wanda, and Vanke, which have experienced economic setbacks to varying degrees.

2. Analysis of the bankruptcy situation and causes of Country Garden Evergrande

2.1. Explanation of relevant concepts

Clearing petition and liquidation: A liquidation petition is not equal to liquidation. The liquidation petition is a request made by the creditor to the court, and liquidation is the court's decision after trial. Liquidation means the company will stop operating and sell all assets to repay debts.

High leverage [5] refers to an enterprise increasing the proportion of debt in its financial structure through borrowing or other forms of debt financing. It usually refers to enterprises or individuals using relatively small amounts of self-owned capital (equity) to control significant assets or debts.

High turnover: The high turnover model refers to an operational mode in the real estate development process that achieves a rapid flow of funds and projects through rapid sales, quick capital recovery, and quick turnover of project means, thereby obtaining high returns.

2.2. Case analysis of relevant companies

2.2.1. Country Garden Group

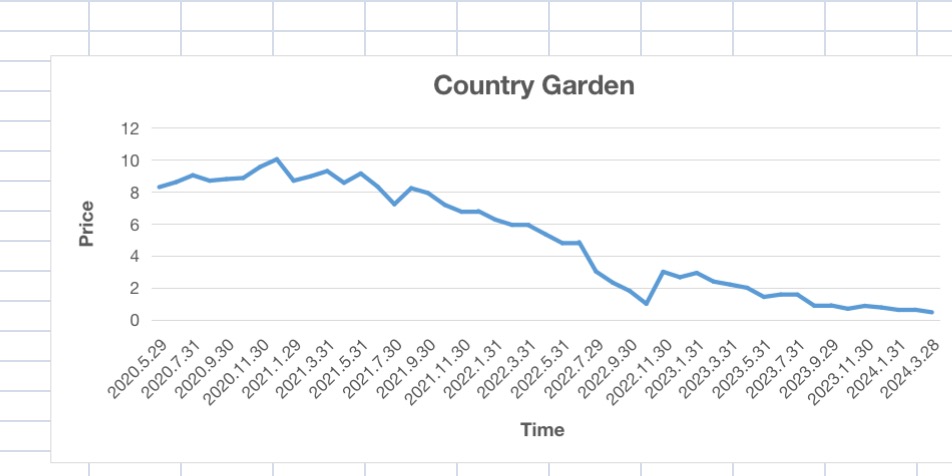

First of all, the relevant situation of Country Garden. The main problem it faces is the liquidation petition. Country Garden, once one of the largest real estate developers in China, was established in 1992. It started with residential development and gradually expanded to business, hotel, education and other fields [6]. The company is known for its rapid expansion and large-scale land reserves, and its main market is concentrated in China's second and third-tier cities. Country Garden's business model focuses on high turnover and cost control to achieve scale effect and market share growth. On February 28, 2024, Country Garden announced on the Hong Kong Stock Exchange that the company learned Ever Credit Limited had filed a liquidation petition against Country Garden to the Hong Kong High Court on February 27.

The main reason for the liquidation petition is that Country Garden failed to repay Ever Credit Limited's debt of up to HK$1.6 billion. This situation has long been foreshadowed. First of all, its company issued an announcement in August 2023 showing that there have been financial problems. The net loss in the first half of the year is expected to be about 45 billion yuan to 55 billion yuan, which is in sharp contrast to the net profit of 1.91 billion yuan in the first half of 2022. The reduction in earnings is primarily attributed to the downturn in the real estate sector, which has led to a decrease in the gross profit margin, an escalation in the impairment of real estate assets, and anticipated losses from currency exchange rate shifts. As it was affected by financial problems, its stock price showed a downward trend. The stock price fell 14% at the opening of the market on August 11, 2023, the stock price fell below 1 Hong Kong dollar, and the subsequent continuous decline showed no sign of recovery. Due to its high-leverage operation mode, its high debt costs also break the capital chain due to unrepayable financial problems, which is the direct cause of its bankruptcy. According to the 2022 annual report, the company's total loan balance is 271.31 billion yuan, and the net debt ratio has dropped to 40%. However, in October 2023, Jiantao Group announced that Country Garden failed to repay HK$1.598 billion and issued a letter of statutory debt repayment to Country Garden. It can be seen that there is an early omen of its bankruptcy. The following figure shows the stock trend chart of Country Garden.

2.2.2. China Evergrande Group (hereinafter referred to as "Evergrande")

The situation of Evergrande is slightly different from that of Country Garden. Compared with Country Garden's liquidation petition, it has been liquidated. Evergrande Group is a large-scale comprehensive enterprise group in China, founded in 1996 and headquartered in Guangzhou. Evergrande Group's business covers real estate development, property management, new energy vehicles, health industry and other fields. On January 29, 2024, the Hong Kong High Court issued a liquidation order for China Evergrande, which marked that China Evergrande officially entered the bankruptcy liquidation process. Evergrande Real Estate's total liabilities are as high as 2388.2 billion yuan, while its total assets are 1743.9 billion yuan. In the first half of 2023, the company's operating loss was 17.38 billion yuan, the non-operating loss was 15.03 billion yuan, and the net loss totalled 39.25 billion yuan. Evergrande Real Estate's debt problem is so severe that the company cannot continue to operate. Its liquidation is mainly due to two reasons. The first is insolvency. Evergrande's total debt is as high as 2388.2 billion yuan, and the debt after deducting the prepayment of the house is 1784.2 billion yuan, while the total assets are only 1743.9 billion yuan. The second is the failure of the reorganisation plan. Evergrande once proposed a reorganisation plan, but the reorganisation plan failed to advance due to the failure of sales, the investigation of Evergrande Real Estate, and 45% of Class C creditors opposed the relevant restructuring plan. The following figure shows the stock trend chart of Evergrande.

2.3. Analysis of the main reasons and related influencing factors for the liquidation of the two

2.3.1. Internal factors

1) A high leverage ratio [7] refers to a company's excessive reliance on short-term loans and financing from the capital market, resulting in a consistently high level of debt. At the same time, market downturns lead to a contraction in revenue and a decrease in interest rates. At this point, high-interest expenses will result in tight cash flow and difficulty maintaining operations.

2) Blind expansion and investment under high turnover mode, ignoring market demand and real estate cycle, result in excessive construction of related real estate projects, making it difficult to digest and leading to market oversupply timely. At the same time, this model bears significant pressure for dismantling, is greatly affected by market fluctuations, and carries high financial risks.

3) High debt [7]: Excessive borrowing and rapid development lead to an enterprise's high debt accumulation. Once loans tighten or the funding chain breaks, the enterprise will likely face bankruptcy.

4) Poor internal management within the company: improper cost control, project delays, financial fraud, and other internal management issues can all lead to a deterioration of the company's financial situation.

2.3.2. External factors

2.3.2.1. Changes in the environment (economic, financial, and emergencies)

(1) Macroeconomic environment: In recent years, during a period of macroeconomic downturn, the number of citizens holding money and observing has increased, which directly affects real estate developers' capital recovery and housing delivery plans.

(2) Bank credit tightening: With the government's regulation and risk prevention of the real estate market, banks are becoming increasingly strict and cautious in their credit policies towards real estate enterprises. This makes it more difficult for real estate companies to obtain loans from banks and increases financing costs.

(3) COVID19: The epidemic has led to a increases financial risks [8] which may decrease in people's willingness to buy houses.

2.3.2.2. Related markets

(1) The theme market is relatively single: almost all income relies on real estate investment, making it impossible to hedge risks when facing market changes, resulting in high operational risks.

(2) Market positioning: The main market is in third - and fourth-tier cities, which are easily affected by the macroeconomic environment. When the macroeconomic environment is unfavourable, consumer confidence decreases, real estate demand decreases, and company revenue is affected.

2.3.2.3. Government regulation

(1) Government policy changes: The government's regulatory policies on the real estate market, such as the frequent introduction of new policies on property regulation since 2016, including the "Shanghai Six Measures", new regulatory measures such as the "Three Red Lines", and bank measures such as the "Two Red Lines", may affect the purchasing power and investment willingness of homebuyers, thereby affecting the sales and revenue of real estate companies.

(2) Weak regulatory mechanism: The regulatory authorities' supervision in the real estate field is insufficient. They lack effective risk warning mechanisms and regulatory measures, resulting in similar risks and hidden dangers not being detected and resolved in a timely manner.

3. Comparison

This paper compares the layout of four companies' business investments. Firstly, the trade investments of the four companies are different, except for their real estate development. Evergrande Real Estate Group focuses on cultural tourism, health care fin, financial services and other fields [9]. Country Garden focuses on smart construction mod, ern agriculture, and smart catering. Then Poly Development emphasises real estate sales, investment and operation, brand building, social responsibility, and international layout. At the same time, Greenland focuses on finance, consumption, health, science and technology, innovation and other industries [9]. Besides a comparison of the strategic layout of this real estate, we found that Evergrande's main real estate development scope is concentrated in the area located in the third-tier cities. Country Garden's main real estate development scope is concentrated in the target third- and fourth-tier cities. Poly Development is concentrated in second-tier cities, and Greenland's main real estate development scope is concentrated in first- and second-tier cities. According to the evidence we found, there are three reasons why some companies go bankrupt [10] and others do not. At first, these four companies have diversified their business layout, relying on something other than real estate development business. Moreover, some companies like Evergrande Real Estate Group and Poly Development invest in too many areas and across too many industries. These two companies' rapid expansion,high-leverage,high-turnover operating model led to tight capital flow, poor returns and bankruptcy. However, Poly Development and Greenland do not have the rapid expansion of the other two companies but adhere to the significant principle of not speculating on housing prices, so they develop steadily. Greenland and Poly have a heavier layout in areas such as first-tier and second-tier cities, which will reduce the effect of market adjustments. Country Garden and Evergrande have a heavier layout in areas such as third - and fourth-tier cities. Moreover, Greenland and Poly are more cautious in risk management, maintaining good liquidity through active debt management and fund operation. Nevertheless, companies such as Evergrande may need to improve risk assessment and response for inadequate response to market changes [10].

4. Revelation on existing problems in the real estate industry

In the face of the problems encountered in the above industries, I propose stabilisation measures from the four aspects of government, enterprise, finance and market to make the future development of the real estate industry healthier.

4.1. At the government level

Optimise the policy environment [11]: The government should optimise the house purchase policy and adjust the down payment ratio and mortgage interest rate to improve residents' ability to buy houses and expand the house purchase market. At the same time, we will strengthen the construction of the housing security system and increase the diversity of housing types to meet the needs of different levels.

Strengthen market supervision: We will strengthen the supervision of the whole real estate development and construction process and stop illegal transactions and rising house prices. At the same time, we will improve the real estate statistics and information disclosure system, enhance the transparency of market information, and release market supply and demand information in a comprehensive, timely, and accurate manner.

Science and technology empowerment: In today's era of big data, effectively use the marketisation of data elements to improve data utilisation, fully exploit the value of data elements, and promote the development of the industry.

4.2. Enterprise level

Improve the business model: First, adopt a deleveraging and low-indebted business model to reduce risks. Adjust the company's asset structure: accelerate inventory turnover and gradually reduce the long-term proportion of heavy assets such as inventory and fixed assets; pay attention to brands and technology.

The investment and development of intangible assets such as art and services increases the long-term competitive advantage of enterprises. Second, enterprises should expand the source of funds as much as possible [12], avoid using too much of their funds, enrich financing channels, obtain low-cost financing, or reasonably use supply chain advantages to obtain as much "interest-free" as possible by getting involved in the financial field. At the same time, enterprises should control the scale of bank loans and bond financing and reduce the encroachment of financial expenses on profits. In terms of operation, through the export of brand and management mode and the cooperative development of projects with other enterprises, the complementarity and sharing of resources can be achieved, the effect of

Promote diversified development [6]: On the one hand, enterprises should improve their risk-hedging ability by enriching their market diversity and increasing the diversity of income sources. On the other hand, we should enrich our service scope, improve the service level, increase the satisfaction of customers buying houses, and improve our reputation to increase our popularity.

4.3. Financial aspect

Financial institutions [12]: First of all, from the perspective of home buyers, should provide stable credit support and increase the amount of provident fund loans to meet the loan needs of first-time home buyers. Commercial banks should increase support for mortgage loans in the housing sector and moderately lower mortgage interest rates. Secondly, in the face of the financing of real estate enterprises, we should make a fair and reasonable evaluation of the main body of real estate enterprises, increase the provision of sufficient loan support for well-qualified real estate enterprises, and improve the financing environment.

Real estate enterprises: Consider accelerating the development of direct financing, including bond financing, trust financing, equity financing, asset securitisation ABS, etc., optimise the financing structure of real estate enterprises, and expand diversified funding sources for real estate enterprises.

4.4. Market level

Market confidence recovery: promote the recovery of market confidence through policy support and market regulation. For example, restrictive measures such as purchase, loan, and price limits can be relaxed to promote the soft landing of the real estate market.

Market supply and demand balance: promote the balance of supply and demand in the real estate market through policy guidance and regulation. For example, promote the strategy of urban agglomeration, the linkage between people and land, financial stability, and the merger of rent and purchase to realise the balanced and healthy development of supply and demand in the real estate market.

5. Conclusion

The whole article first introduced and analysed the background of real estate in China and found that it has experienced significant fluctuations in recent years, especially for some large real estate developers, who are also facing severe financial problems. Therefore, we analysed the financial stocks of two large real estate companies, Country Garden and Evergrande, as well as green space and protection. The two companies with good operating conditions at present have made a comparative analysis and found the disadvantages of the business model of China's real estate industry and the impact of the external environment. Based on this, the measures taken by the company and relevant government departments to cope with the current situation are proposed to make the future development of China's real estate more stable.

Acknowledgement

Liang Erti and Li Ran contributed equally to this work and should be considered co-first authors.

References

[1]. Hualv. (2022) What is real estate. https: //mbd.baidu.com/ma/s/nH1fBzi7

[2]. Chinese Government Website. (2024) The Party Central Committee and the State Council attach great importance to real estate work. https: //www.gov.cn/xinwen/jdzc/202405/content_6952083.htm

[3]. xshy10203gf. (2023) Land Administration Law of the People’s Republic of China. https: //mbd.baidu.com/ma/s/lI5p4bly

[4]. Gujinlishiji. (2024) The reason why China’s real estate continues to be depressed. https: //m.163.com/dy/article/J57ITS3A055619ZE.html

[5]. Tucker, V. E., & Matson, L. J. (2024). Collaboration for School Mental Health Needs: A Case for High-Leverage Practices in a Culturally Responsive Framework. TEACHING Exceptional Children, 56(3), 148-158. https: //doi.org/10.1177/00400599221115623

[6]. Jia Y .FINANCIAL RISK ANALYSIS AND COUNTERMEASURES OF COUNTRY GARDEN COMPANY [J].Advances In Industrial Engineering And Management, 2022, 11(2): https: //aiem.com.my/wp-content/uploads/2022/11/Vol.-11-No.-2-2022-1-6.pdf

[7]. Zhao Y .Analysis of Financial Condition of Chinese Listed Real Estate Companies Based on DuPont Analysis Method: A Case Study of China Evergrande Real Estate [J].Accounting, Auditing and Finance, 2023, 4(1): http: //clausiuspress.com/assets/default/article/2023/07/20/article_1689842962.pdf

[8]. T. L O .The 2020 Pandemic: Economic repercussions and policy responses [J].Review of Financial Economics, 2020, 39(1): 20-26. https: //doi.org/10.1002/rfe.1123

[9]. Huifenghangdichanyinxiao. (2018) Evergrande, Vanke, Country Garden and other 58 housing enterprises land reserve panorama https: //mbd.baidu.com/ma/s/HY75hGL9

[10]. Dingzuyupinjialoushiguanhao. (2020) Country Garden Vanke Sunac participated in the enterprise market value of 500 billion. https: //mbd.baidu.com/ma/s/IVn69q3q

[11]. Han T, Zhang J.The impact of continuous tightening policies on China's real estate industry [J].International Journal of Monetary Economics and Finance, 2023, 16(3-4): 188-196. https: //www.inderscienceonline.com/doi/epdf/10.1504/IJMEF.2023.131891

[12]. Antai School of Economics & Management Shanghai Jiao Tong UniversityShanghai, P. R. ChinaMarch, 2010 https: //kns.cnki.net/reader/flowpdf

Cite this article

Liang,E.;Li,R. (2025). Looking at the Market Through Enterprises--Analysing China's Real Estate Enterprises and Markets. Advances in Economics, Management and Political Sciences,217,1-9.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Hualv. (2022) What is real estate. https: //mbd.baidu.com/ma/s/nH1fBzi7

[2]. Chinese Government Website. (2024) The Party Central Committee and the State Council attach great importance to real estate work. https: //www.gov.cn/xinwen/jdzc/202405/content_6952083.htm

[3]. xshy10203gf. (2023) Land Administration Law of the People’s Republic of China. https: //mbd.baidu.com/ma/s/lI5p4bly

[4]. Gujinlishiji. (2024) The reason why China’s real estate continues to be depressed. https: //m.163.com/dy/article/J57ITS3A055619ZE.html

[5]. Tucker, V. E., & Matson, L. J. (2024). Collaboration for School Mental Health Needs: A Case for High-Leverage Practices in a Culturally Responsive Framework. TEACHING Exceptional Children, 56(3), 148-158. https: //doi.org/10.1177/00400599221115623

[6]. Jia Y .FINANCIAL RISK ANALYSIS AND COUNTERMEASURES OF COUNTRY GARDEN COMPANY [J].Advances In Industrial Engineering And Management, 2022, 11(2): https: //aiem.com.my/wp-content/uploads/2022/11/Vol.-11-No.-2-2022-1-6.pdf

[7]. Zhao Y .Analysis of Financial Condition of Chinese Listed Real Estate Companies Based on DuPont Analysis Method: A Case Study of China Evergrande Real Estate [J].Accounting, Auditing and Finance, 2023, 4(1): http: //clausiuspress.com/assets/default/article/2023/07/20/article_1689842962.pdf

[8]. T. L O .The 2020 Pandemic: Economic repercussions and policy responses [J].Review of Financial Economics, 2020, 39(1): 20-26. https: //doi.org/10.1002/rfe.1123

[9]. Huifenghangdichanyinxiao. (2018) Evergrande, Vanke, Country Garden and other 58 housing enterprises land reserve panorama https: //mbd.baidu.com/ma/s/HY75hGL9

[10]. Dingzuyupinjialoushiguanhao. (2020) Country Garden Vanke Sunac participated in the enterprise market value of 500 billion. https: //mbd.baidu.com/ma/s/IVn69q3q

[11]. Han T, Zhang J.The impact of continuous tightening policies on China's real estate industry [J].International Journal of Monetary Economics and Finance, 2023, 16(3-4): 188-196. https: //www.inderscienceonline.com/doi/epdf/10.1504/IJMEF.2023.131891

[12]. Antai School of Economics & Management Shanghai Jiao Tong UniversityShanghai, P. R. ChinaMarch, 2010 https: //kns.cnki.net/reader/flowpdf