Volume 240

Published on November 2025Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

In recent years, with the persistent growth of cultural confidence and transition of consumption structure, the public has increasing demand in emotional consumption and cultural recognition. As the museum cultural and creative industry is the crucial vehicle for cultural inheritance and innovative development, it has functioned significantly in promoting cultural industry development and improving cultural soft power. This research will take the Palace Museum as a core example and utilize comprehensive applications, such as reference analysis, interpretation of policy, and classic case analysis, to systematically organize the development process, product type, and innovative features of the cultural and creative industry in the Palace Museum. Research finds that the Palace Museum successfully reaches the transformation of cultural resources to lifestyle products through cross-sector integration and digital innovation. However, it still faces several challenges, which include the balance of entertainment and cultural inheritance, the disability of internationalization, the superficial dissemination of culture, and underdeveloped technological application. This text will go through critical analysis from three dimensions—society, market, and technology—and give strategic suggestions such as deepening the spread of cultural value, enhancing the digital innovation, and expanding international routes. This will provide theoretical reference and practical guidance in sustainable development for China Museum Cultural and Creative Industries (CCIs).

View pdf

View pdf

This study investigates the impact of Buy-Now, Pay-Later(BNPL) application on consumer purchase behavior and price sensitivity. Our findings suggest that different BNPL schemes will lead to opposite results, and the outcomes also vary when considering different specific products. We examine impulsive buying behavior across three customer segments, which are defined by three key dimensions: the buying decision-making process, the difficulty of reaching a decision, and the experience of post-purchase regret. We also apply several questionnaires to set diverse purchasing scenarios and send them to respondents through network. Our data reveals that month-end BNPL usage will promote the overall purchase, while installment-based BNPL usage will lead to decreased purchase when the price turns out to be five-sevenths of the total balance. It is worth noting that this effect becomes increasingly evident as the price accumulates, yet such effect fades away once a state of full balance is reached. Additionally, this phenomenon is concentrated among those with independent sources of income. Our study also highlights the appropriate application and regulation of BNPL could boost the sales of online merchants as well as assisting individuals with effective handling of their finance management and better financial health.

View pdf

View pdf

This study takes the case of Woolworths Group, a leading Australian retailer, acquiring the local e-commerce platform MyDeal, to explore its strategic motivations and integration outcomes in the context of the retail industry’s accelerating digital transformation. Adopting a case study approach, this paper examines Woolworths' multifaceted motivations for the acquisition, including market expansion beyond groceries, enhancement of digital capabilities, cost structure optimization, and supply chain integration, and evaluates the post-acquisition outcomes across both financial and operational dimensions. Although the acquisition initially aligned well with Woolworths’ omnichannel retail strategy, MyDeal's underperformance and continued financial losses led to the closure of its consumer-facing platform in 2025. However, the integration process yielded strategic learning outcomes, offering Woolworths valuable experience in digital platform operations, customer engagement, data-driven personalization, and third-party seller ecosystem management. The Woolworths–MyDeal case shows that even without the expected financial returns, such acquisitions can accelerate digital maturity and inform platform development. It also highlights the need for strategic fit, scalability, organizational readiness, and effective integration for sustainable omnichannel transformation, serving as both a cautionary tale and a strategic guide for traditional retailers.

View pdf

View pdf

The proliferation of digital nudges in e-commerce interfaces has reshaped consumer decision-making, yet their psychological mechanisms and societal implications remain contested, particularly in non-Western markets. This paper examines how three dominant interface defaults—social proof (“Top ranked”), monetary framing (“40% off”), and urgency cue (“Livestream ends in 3 minutes”)—influence willingness to pay and decision difficulty in China’s fast-paced digital marketplace. Using a randomized survey experiment with 519 respondents, we measure the causal effects of these nudges on engagement, purchase intent, and cognitive strain. Results show that nudges collectively increase WTP by 0.775 points (on a 5-point scale), with urgency cue producing the largest gains (1.063 points) but also raising decision difficulty by 0.304 points. Social proof and monetary framing boost WTP without increasing cognitive load. Heterogeneity analyses reveal stronger responses among women to social proof, greater sensitivity among lower-income users to discounts, and lower decision difficulty among tier-1 city residents. These findings highlight that the effectiveness and costs of digital nudges depend on demographic context and user characteristics, underscoring the need for ethical, user-centered interface design in digital commerce.

View pdf

View pdf

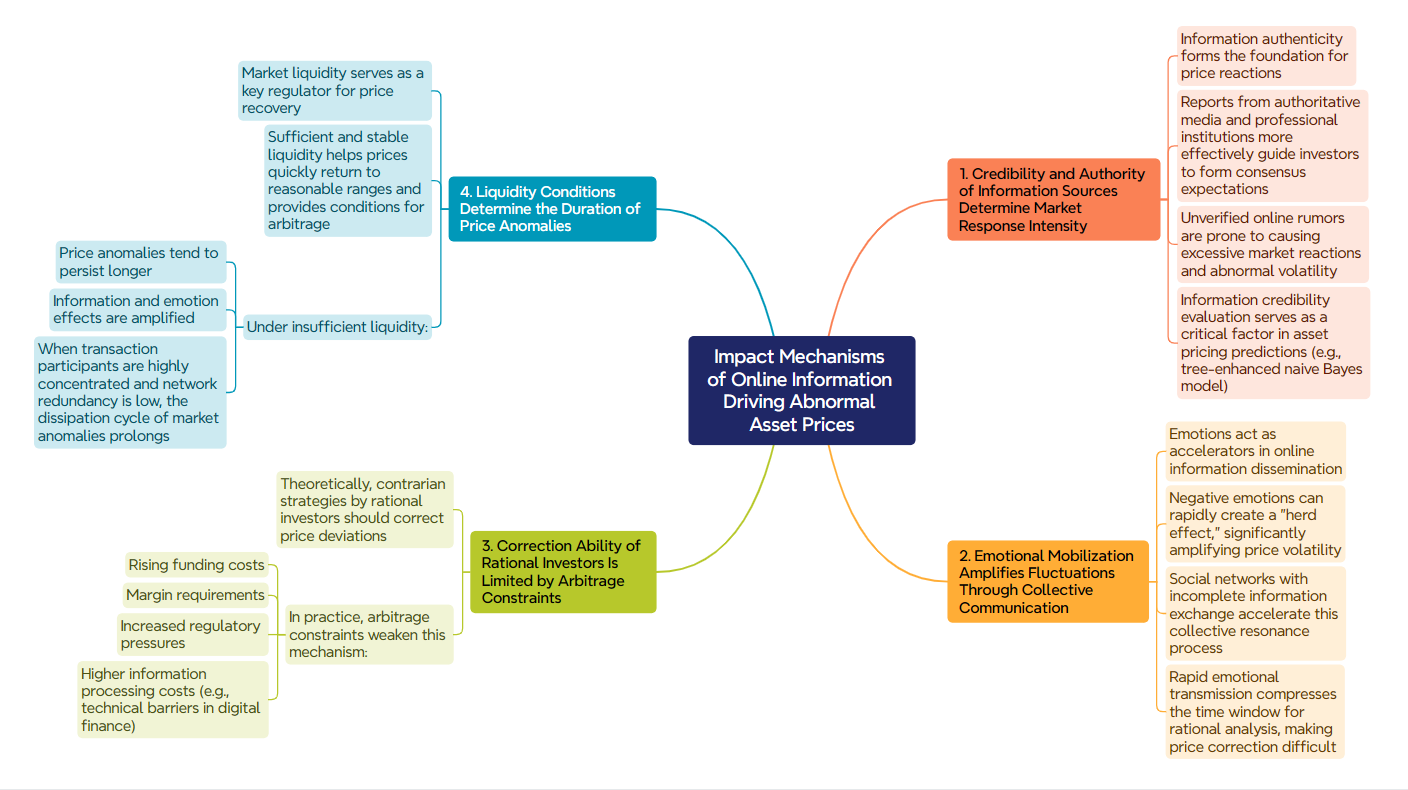

Under the background of the deep integration of the digital economy and capital markets, based on this article focuses on a very urgent phenomenon is the Internet Information caused by abnormal asset prices, in order to clarify the inherent effect of the Internet Information caused by abnormal asset price: through combining a mix of domestic and overseas studies by means of a mixed method and thorough investigation by mixing thorough investigation and case study by a mixture of case study and quantitative methods. First, the credibility and authority of the source of online information is the initial point from which we can assess how intensely and in which direction market participants will react to the information; Second, the emotional tendencies in the information get blown out of proportion through the collective spreading of information across all social media platforms; It will further exacerbate the volatility of assets; And Third Some practical restraints such as transaction costs and short-selling prohibitions reduce how much rational actors can take advantage of arbitrage opportunities and make it difficult for price distortions to be corrected promptly; The degree of market liquidity determines the duration of abnormal prices. These 4 act mutually supportive to disrupt the balance among intrinsic value of assets and current market transaction price. This research work will provide more specific theoretical guidance and references for various investors who make more rational investment choices.

View pdf

View pdf

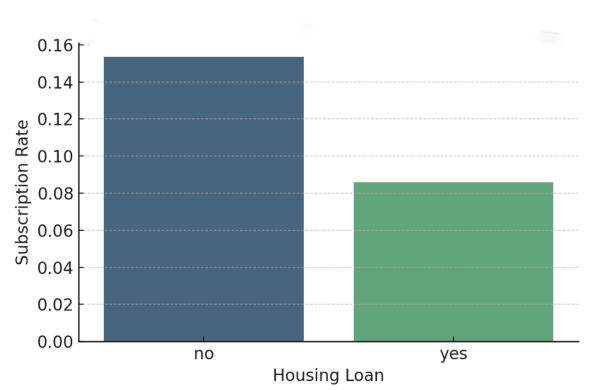

Banks face the challenge of determining which customers are most likely to react effectively to marketing initiatives in a financial climate that is becoming more and more competitive. Using a large dataset of campaign-related, financial, and demographic data, this study applies machine learning techniques to forecast term deposit subscriptions. To compare many classifiers based on various performance metrics, the study uses a methodical procedure that includes data pretreatment, exploratory data analysis, model training, and evaluation. The findings show that, in comparison to traditional models like logistic regression and decision trees, ensemble approaches—in particular, gradient boosting—achieve improved prediction accuracy and generalization. Gradient Boosting is the most effective classifier for reducing class imbalance in subscription prediction since it attains the biggest area under the Receiver Operating Characteristic (ROC) curve while maintaining a fair balance between precision and recall. These findings demonstrate how targeted marketing campaigns in the banking industry could benefit from sophisticated predictive modeling. Machine learning models maximize marketing return on investment, decrease needless interactions, and improve customer happiness by more accurately identifying high-potential clients. The study emphasizes how crucial it is for financial marketing strategy to include data-driven decision-making as a fundamental element.

View pdf

View pdf

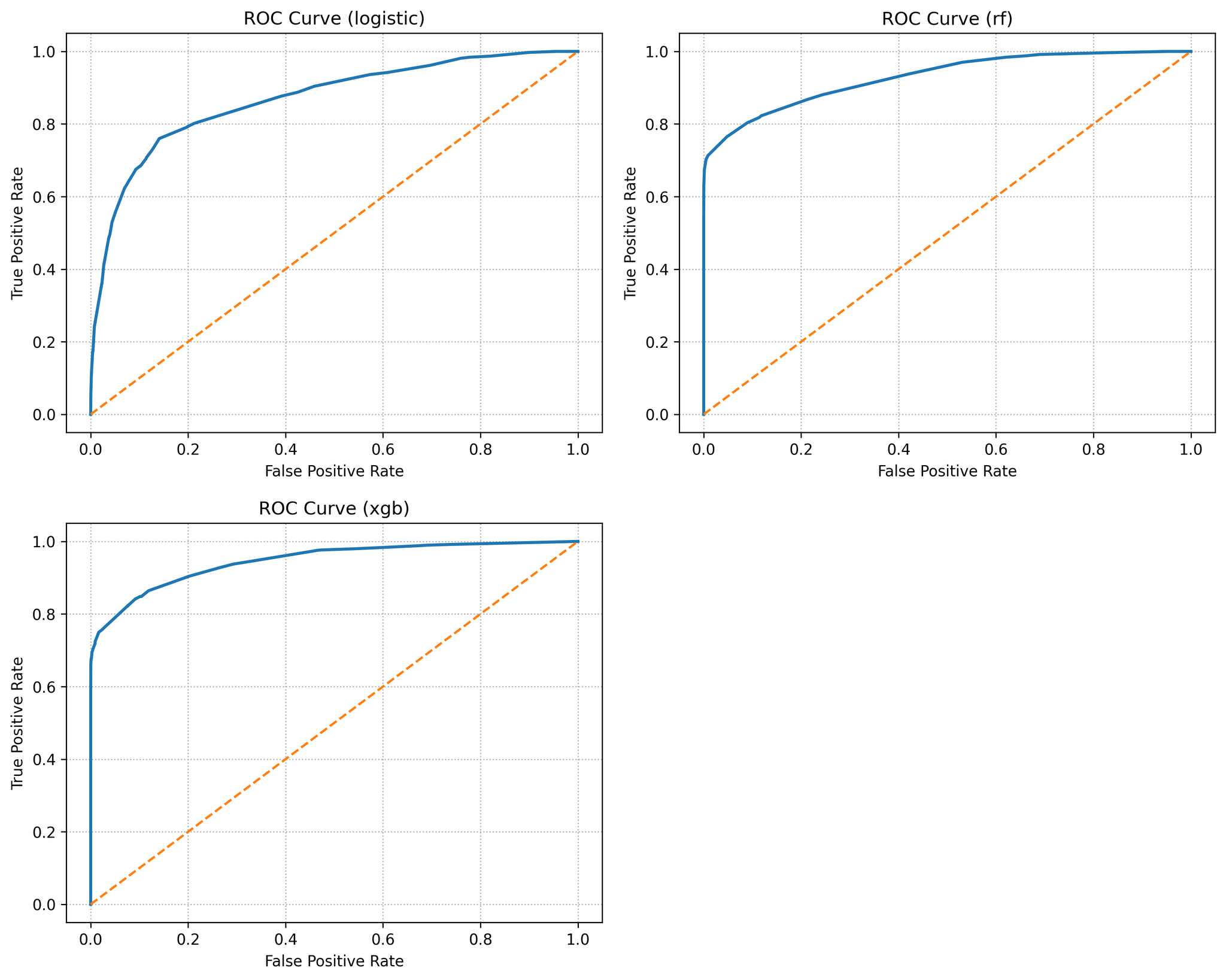

Predicting the likelihood that a borrower will default on a loan is a fundamental task in credit risk management. Traditional credit scoring relies on logistic regression models, but the rise of machine learning has brought more flexible alternatives such as Random Forest and XGBoost. While these methods can yield higher predictive accuracy, they also raise concerns about probability calibration, cost‑sensitive decision rules, and interpretability. This work compares Logistic Regression, Random Forest and XGBoost on a publicly available credit risk dataset. After standardising numerical variables, encoding categorical variables and handling missing values, this study trains each model using cross‑validated hyper‑parameters. It evaluates discrimination (Receiver Operating Characteristic Area Under the Curve and Precision–Recall Area Under the Curve, thereafter, ROC AUC, PR AUC), calibration (Brier score and reliability curves) and derive cost‑sensitive thresholds assuming false negatives are five times more costly than false positives. Results show that XGBoost achieves the highest AUC (≈ 0.95) and PR AUC (≈ 0.89) while maintaining good calibration. Appropriate threshold tuning reduces expected losses substantially—e.g. lowering the Logit cut‑off to 0.2 increases recall from 17 % to 78 %. A detailed discussion of feature importance and model interpretability is presented, and the research outlines implications for deploying modern scoring models under regulatory constraints. This paper aims to bridge the gap between algorithmic advances and their responsible application “from scores to decisions.”

View pdf

View pdf

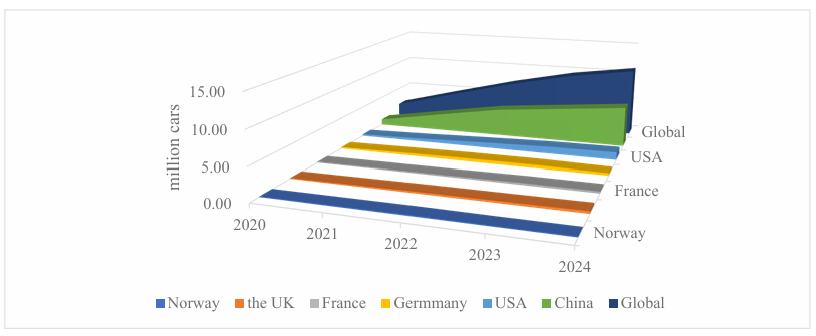

The new energy vehicle (NEV) industry is rapidly globalizing, driven by the worldwide push for decarbonization and proactive government policies. This has fostered a fiercely competitive landscape where continuous research and development and strategic agility are critical. Despite Tesla's first-mover advantage and technological prowess, it must navigate mounting pressures in this evolving market. This diagnostic analysis, applying the SWOT framework and 4P marketing theory, identifies a concerning rigidity in Tesla's strategic approach, manifesting as an overly standardized global marketing strategy and imprecise customer segmentation. It draws attention to Tesla's advantages in terms of financial strength, brand power, and technological innovation, but also its disadvantages in terms of high costs, a narrow focus on the market, and reliance on the supply chain. Global environmental regulations, entering the mid-to-low-end market, and utilizing AI technology are examples of opportunities; supply chain instability and escalating rivalry are examples of risks. BYD's 4P analysis, on the other hand, highlights its competitive price, varied product lines, and greater market adaptability. Consequently, this paper develops specific strategic interventions to enhance the marketing agility requisite for Tesla to preserve its market dominance.

View pdf

View pdf

As a leading company in the fields of power batteries and energy storage technologies, Contemporary Amperex Technology Co., Limited (CATL)'s financial status and development strategies have attracted significant attention. This paper analyzes CATL's financial situation using the Harvard Analysis Framework. The Harvard Analysis Framework consists of four components: strategic analysis, accounting analysis, financial analysis, and prospective analysis, providing a comprehensive assessment of the enterprise's financial status, market positioning, competitive advantages, and future development potential. The investment value of CATL is analyzed from the four dimensions of strategy, etc. CATL maintains a high market share and profitability through technological iteration, globalized production capacity, and refined operations. However, it also faces challenges such as accounts receivable turnover and ESG compliance costs. This study verifies the adaptability of the framework, providing reference for investors and enterprises. Its development path has become a benchmark in the industry, and in the future, by balancing scale and efficiency, it is expected to lead the industry. Based on the analysis results, this paper puts forward targeted suggestions. While promoting the sound development of CATL, it provides a useful paradigm for financial analysis, prospect prediction, and risk assessment of high - tech enterprises such as power battery companies.

View pdf

View pdf

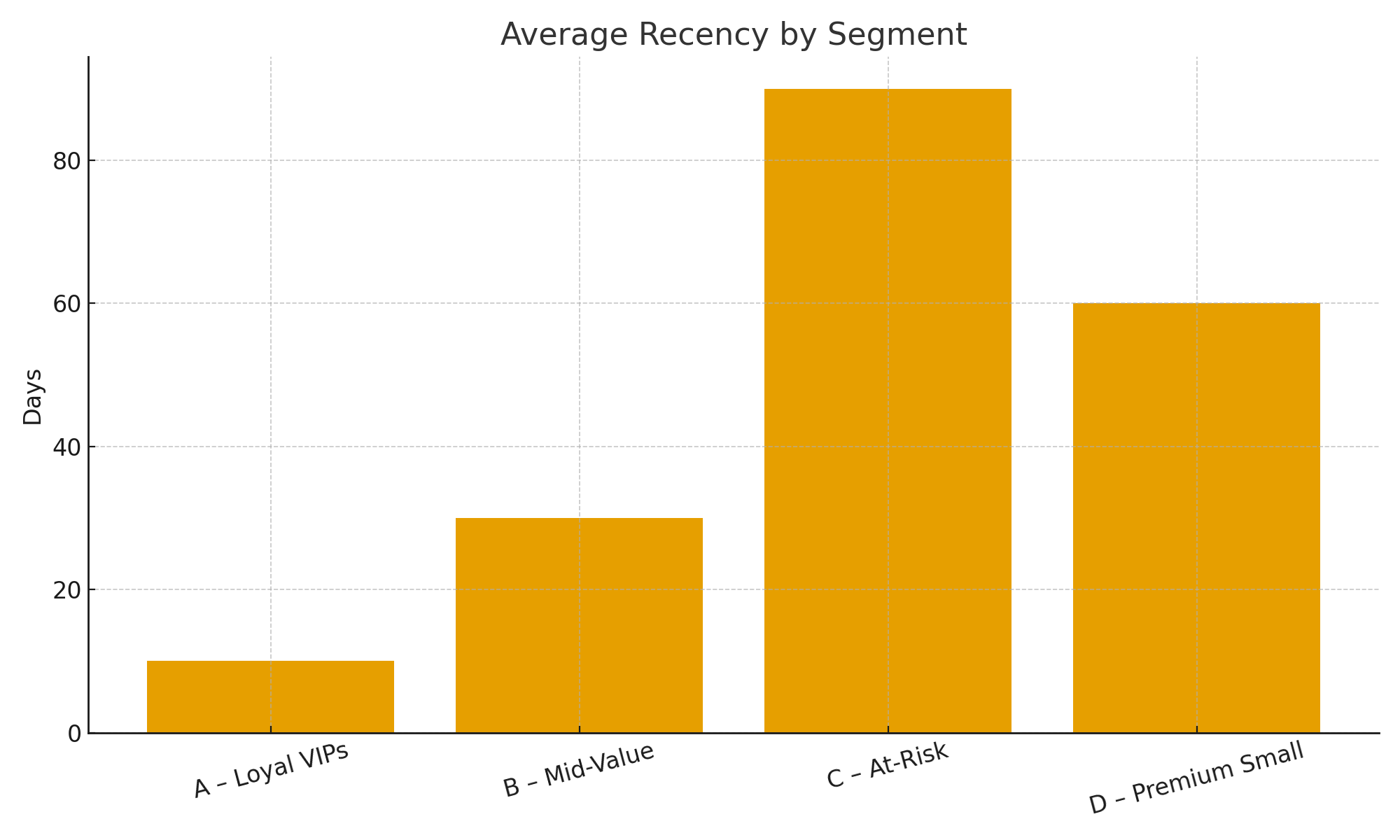

E-commerce has increased exponentially over the past few years, with opportunities for growth as well as daunting tasks for businesses selling in competitive online spaces. One of the persisting challenges is how to identify and retain valuable customers whose purchasing behavior changes quickly in response to promotions, new product launches, or social media. This study responds by developing a hybrid segmentation model that incorporates Recency-Frequency-Monetary (RFM) measures with the K-Means clustering algorithm. Using transactional-level data, it construct behavioral features and apply clustering to detect patterns not normally captured by static thresholds. Four segments are revealed through analysis: high-value loyal purchasers, mid-value customers with growth potential, disengaged segments at risk for churn, and a small premium spending segment. RFM affords interpretability, and K-Means detects latent structure that yields analytical insight. Overall, the findings provide managers with concrete recommendations for loyalty programs, reactivation campaigns, and premium services, showcasing how machine learning can complement the role of traditional metrics in e-commerce.

View pdf

View pdf