1. Introduction

Under the pressure from the deep penetration of digital economy in the capital market, online information has become the “main engine” instead of a “reference variable” for assets price Social media is rampant and algorithms are recommended, so unverified industry rumors and biased reports can form a public agreement and cause irrational investor panic sales after a few hours. it leads to prices going up and down in ways that don't match how actual things are worth. Like traditional supply-demand imbalances or macroeconomic policies can create, these information-influenced price anomalies marked by suddenness, contagion, intricacy and complexity create new problems for the efficient market hypothesis in old finance theory.

To thoroughly study how online information causes unexpected ups and downs in prices will be something we must do practically to control our market risk. It’s also an indispensable part of making the rules around money work in cyberspace. There’s a lot of study on how content truthfulness pushes pricing, but they leave out the “amplification effects” in the way info trickles down – like people who speak up for something making folks believe it more (endorsement) or catching feelings from our friends easily (emotional contagiousness) At the same time, there is insufficient understanding of ordinary investors' psychological decision process and behavioral biases when faced with information shocks. That's why if we understand the whole process: from online info generated to online info distribute to online info impact on asset price, and at the same time, understand the differences between these online information and their effects on asset price (different online news is a positive/negative message, different online information is true or false), then it is a chance for investors to make rational decisions. 2. It can also provide some theoretical guidance for managers to design specific information handling strategies and keep capital markets calm.

2. Overview of research methods

2.1. Case analysis

Previous works mainly studied by case analysis of online information effects on asset prices Li Qingyuan, Yu Miao, Dong Yanfei analyzed some online public opinion emergencies in China's A-share market, and they discovered that sudden changes in sentiment levels always accompany abnormal trading volumes and price discrepancies [1]. In the multi-case studies on Stock Market Rumors, Li et al. have shown that false or over-exaggerated online news will have an abnormal return for a short period after being corrected by correction price [2]. Zhang studies information asymmetry events by the informed traders' perspective and proves online channels are much better to spread insider information [3].

Moreover, international suchas Chang Shiran have used conditional probability models to network information. This also highlights the predictive value of pricing under demonstrating and financial variable [4]. This paper, Cheng studied and discussed the branded and information disclosure of the Financial Institutions under Islam, and also analyzed the spillover effects of online reputations on asset pricing through a few cases [5]. It also proves that case studies can carry out in-depth research on the causal chain of specific information events and price anomaly, and it also provides a large number of practical experience.

2.2. Data analysis

Using quantitative research methods, researchers mainly used high-frequency trading data, sentiment indicators, network structure models for empirical research; Bécue et al. used Graph Neural Networks to model the interactive propagation of mixed-frequency information among multi-layer networks formed by the listed companies and concluded the positive relationship between information diffusions and asset pricing performance [6]. On the other hand, Cao proposed a herd behavior index based on network sentiment measurement, and they found investor sentiment resonance as an important trigger for producing large price movements [7].

Chelkani researched the correlation between secure storage of network information data and financerisks based on blockchain and edge computing [8]. Cui et al. analyzed investor’s trading behaviors and information efficiency by the application of complex network model [9]. Domestic and foreign literature mainly rely on event analysis, VAR models, and High-Frequency Sentiment Factor Regression as analytical tools to identify event relationships between network information shocks and abnormal price movements. Gao proposed a tree enhanced naive Bayes Information Credibility evaluation algorithms for online professional social network which provide methodology base on high dimensional data auto-screening [10].

And then through combining the case with the data analysis, we could show the inside of the network information which would result in a price anomaly from the micro-events as well as the macro structure.

3. Analysis of the impact mechanisms

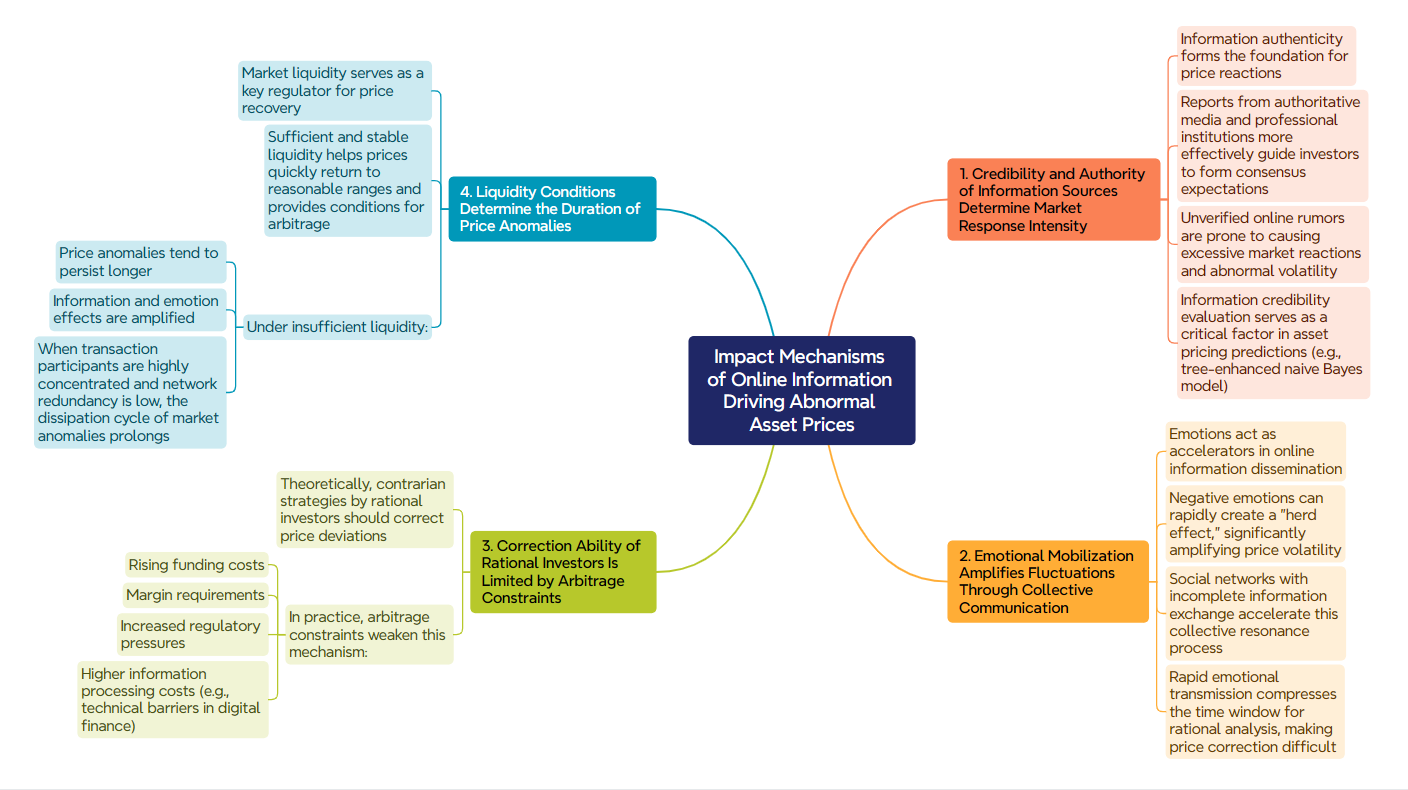

3.1. The credibility and authority of information sources determine the intensity of market response

Truth and the authority of the information are those that cause prices to react. Huang indicates that media relevance and the information disclosure quality will promote market momentum spill-over when it is high, indicating media and professional institution report has a good way to guide investors to reach a consensus expectation [11]. Huong also stresses that unverifiable online rumors create overly strong market responses and abnormal market volatility from the standpoint of financial information governance [12].

And the rest of the foreigners also say the number. Merkaš employ a tree improved naive Bayes model to show that evaluating information credibility is a factor in predicting asset ratings in professional social networks [13].

3.2. Emotional mobilization amplifies fluctuations through collective communication

Emotions is like accelerator for online info distribution. Pang analysis of the emotional index data of main social sites, they believed that the negative emotions of netizens were easily formed into a 'crowd effect' and magnified the fluctuation of netizens' price changes [14]. Sun also show that social networks that have less information exchange contribute to this group resonance [15].

This kind of research shows that fast collective feelings of emotional transmission don't only make up for the difference between the price, but also shorten the time of reasonable analysis; thus makes sense of traditional value investment or fundamental analysis unable to quickly make those prices right. So emotions-led collective action is what makes networked info lead to more up-and down price changes.

3.3. The correction ability of rational investors is limited by the arbitrage constraint

From theory, we know that rational investor contrarian strategies have prices which correct. But in fact, there is a certain arbitrage restriction in real life. So it will make the above effects weaker. Vander found that the rise in funding costs, margin requirements and regulation makes it difficult for informed traders to execute timely contrarian operation [16]. Wang found that risk prevention measures and technical obstructions in digital finance increase the cost of information processing, which makes it hard for arbitrage [17].

3.4. Liquidity conditions determine the duration of price anomalies

Market liquidity is a regulator that decides whether or not a price anomaly can revert very quickly. Yu found by using the “broadband China” policy natural experiment and showed that digital infrastructure dramatically increased the liquidity of household risk asset holdings and facilitated faster adjustments to their prices [18]; Yu observed that industries that are less liquid remained out of whack (out of line) with their fair value for longer and also saw even larger swings [19, 20].

Zhang studies on the trading behaviors of the complex networks have found that with the clustering degree of the transactions and the redundant network small, the drop in market liquidity increases the time to dissipate the anomaly in the market. The studies found that sufficient, steady liquidity allows market prices to quickly return to a normal range, it provides room for rationally priced investors to use the above arbitrage opportunity. But insufficient liquidity will increase these information and emotional effects, making the price continue to be abnormal for a long time.

The impact mechanism of online information above can be summarized in four paths, as can be seen in figure 1.

4. Conclusion

4.1. Main findings

The research shows four major mechanisms of abnormal asset price through case study and data analysis, the source of information, and the degree of credibility and authority are the foundation of the market reaction, emotions mobilize, increase volatility due to the process of social network shared, arbitrage restraint will reduce the correction behavior of rational investors with capital, institution, information obstacles. The liquidity conditions determine how long the abnormal prices will continue. these mechanisms do not exist singly, instead they work together to disrupt the traditional balance between an asset’s inherent value and its market price, this shakes the soundness of the efficient-market hypothesis. Also from the research we can see that the asset price anomaly during the digitization process is finally affected by the interaction of network information characteristic, investor behavior and market characteristic. In fact, these conclusions are good for understanding the market volatility characteristics of the digital period, and give some good advice for risk management strategies.

4.2. Outlook

Future research can proceed in mainly three aspects: First, expanding research scenarios by introducing new assets such as cryptocurrencies and digital collection to analyze their influences of online information on decentralized market. The second is to combine neuroscience, behavior experiments and improve the model studies by adding experiments, thereby better explaining investors' psychological decision-making caused by the information shock and so on. Third, emphasizing application-oriented approach, which develops a dynamic early warning models in terms of the mechanism analysis, and provides regulators with action-able tools for promptly warning online information risks. Furthermore, formulate distinctive regulation policies. Digital techs becoming more related in markets makes the impact of online info on assets prices more complex too. Study later, after having a new rise of phenomena, challenges that should be kept up with, and always improve the theory and praxis.

References

[1]. Bécue, A., Gama, J., & Brito, P. Q. (2024). AI’s effect on innovation capacity in the context of industry 5.0: a scoping review. Artificial Intelligence Review, (3), 17–28.

[2]. Cao, L. (2022). AI in Finance: Challenges, Techniques, and Opportunities. ACM Computing Surveys, 55(3), 1–38.

[3]. Chang, S. R. (2025). Reflections on the Application of Information Technology in Financial Accounting Work. Journal of Sales and Management, (12), 42–44.

[4]. Chelikani, S., Kilic, O., & Wang, X. W. (2021). Past Stock Returns and the MAX Effect. Journal of Behavioral Finance, 23(3), 338–352.

[5]. Cheng, M. M. (2025). A Preliminary Study on Online Banking Loan Disputes in the Context of Internet Finance. Today's Wealth, (8), 52–54.

[6]. Cui, T., Du, N., Yang, X., & Ding, S. (2024). Multi - period portfolio optimization using a deep reinforcement learning hyper - heuristic approach. Technological Forecasting and Social Change, 198, 122944.

[7]. Gao, Q., Fan, H., & Yu, C. (2024). Systemic Importance and Risk Characteristics of Banks Based on a Multi - Layer Financial Network Analysis. Entropy, 26(5), 378.

[8]. Huang, J., Huang, L., Liu, M., Li, H., Tan, Q., Ma, X., Cui, J., & Huang, D. - S. (2022). Deep Reinforcement Learning - based Trajectory Pricing on Ride - hailing Platforms. ACM Transactions on Intelligent Systems and Technology, 13(3), 1–19.

[9]. Huong, T. M. (2023). Research on Asset Chain Pricing under Asymmetric Information. VNU University of Economics and Business, 3(4).

[10]. Li, Q. Y., Yu, M., Dong, Y. F., et al. (2025). Evidence - Based Analysis of Digital Infrastructure and Household Risk Financial Asset Investments under the "Broadband China" Policy. Financial Research, (6), 133–151.

[11]. Li, Y., Ma, W. C., Kong, Q. T., et al. (2025). Green Fund Network Linkages and Corporate Environmental Responsibility Implementation -- Analysis and Verification Based on Information Transmission and Barriers. Accounting Research, (6), 134–150.

[12]. Merkaš, Z., & Roška, V. (2021). The Impact of Unsystematic Factors on Bitcoin Value. Journal of Risk and Financial Management, 14(11), 546.

[13]. Pang, C., & Fan, H. (2023). Research on systemic risk in a triple network. Communications in Nonlinear Science and Numerical Simulation, 124, 107306.

[14]. Sun, R., Stefanidis, A., Jiang, Z., & Su, J. (2024). Combining transformer - based deep reinforcement learning with Black - Litterman model for portfolio optimization. Neural Computing and Applications, 36(32), 20111–20146.

[15]. van der Zwan, T., Kole, E., & van der Wel, M. (2024). Heterogeneous macro and financial effects of ECB asset purchase programs. Journal of International Money and Finance, 143, 103073.

[16]. Wang, M., Han, M., & Huang, W. (2020). Debt and stock price crash risk in weak information environment. Finance Research Letters, 33, 101186.

[17]. Yu, M., Hu, X., & Zhong, A. (2024). Network centrality, information diffusion and asset pricing. International Review of Financial Analysis, 93, 103223.

[18]. Yu, Y., Lu, J., Shen, D., & Chen, B. (2020). Research on real estate pricing methods based on data mining and machine learning. Neural Computing and Applications, 33(9), 3925–3937.

[19]. Zhang, R. (2025). Strengthening Financial Governance in Cyberspace Has Become a Critical Battlefield. The Economic Daily, (001).

[20]. Zhang, X., & Zhang, W. (2023). Information asymmetry, sentiment interactions, and asset price. The North American Journal of Economics and Finance, 67, 101920.

Cite this article

Hu,H. (2025). Research on the Influence Mechanism of Network Information Driving Abnormal Asset Prices. Advances in Economics, Management and Political Sciences,240,58-62.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bécue, A., Gama, J., & Brito, P. Q. (2024). AI’s effect on innovation capacity in the context of industry 5.0: a scoping review. Artificial Intelligence Review, (3), 17–28.

[2]. Cao, L. (2022). AI in Finance: Challenges, Techniques, and Opportunities. ACM Computing Surveys, 55(3), 1–38.

[3]. Chang, S. R. (2025). Reflections on the Application of Information Technology in Financial Accounting Work. Journal of Sales and Management, (12), 42–44.

[4]. Chelikani, S., Kilic, O., & Wang, X. W. (2021). Past Stock Returns and the MAX Effect. Journal of Behavioral Finance, 23(3), 338–352.

[5]. Cheng, M. M. (2025). A Preliminary Study on Online Banking Loan Disputes in the Context of Internet Finance. Today's Wealth, (8), 52–54.

[6]. Cui, T., Du, N., Yang, X., & Ding, S. (2024). Multi - period portfolio optimization using a deep reinforcement learning hyper - heuristic approach. Technological Forecasting and Social Change, 198, 122944.

[7]. Gao, Q., Fan, H., & Yu, C. (2024). Systemic Importance and Risk Characteristics of Banks Based on a Multi - Layer Financial Network Analysis. Entropy, 26(5), 378.

[8]. Huang, J., Huang, L., Liu, M., Li, H., Tan, Q., Ma, X., Cui, J., & Huang, D. - S. (2022). Deep Reinforcement Learning - based Trajectory Pricing on Ride - hailing Platforms. ACM Transactions on Intelligent Systems and Technology, 13(3), 1–19.

[9]. Huong, T. M. (2023). Research on Asset Chain Pricing under Asymmetric Information. VNU University of Economics and Business, 3(4).

[10]. Li, Q. Y., Yu, M., Dong, Y. F., et al. (2025). Evidence - Based Analysis of Digital Infrastructure and Household Risk Financial Asset Investments under the "Broadband China" Policy. Financial Research, (6), 133–151.

[11]. Li, Y., Ma, W. C., Kong, Q. T., et al. (2025). Green Fund Network Linkages and Corporate Environmental Responsibility Implementation -- Analysis and Verification Based on Information Transmission and Barriers. Accounting Research, (6), 134–150.

[12]. Merkaš, Z., & Roška, V. (2021). The Impact of Unsystematic Factors on Bitcoin Value. Journal of Risk and Financial Management, 14(11), 546.

[13]. Pang, C., & Fan, H. (2023). Research on systemic risk in a triple network. Communications in Nonlinear Science and Numerical Simulation, 124, 107306.

[14]. Sun, R., Stefanidis, A., Jiang, Z., & Su, J. (2024). Combining transformer - based deep reinforcement learning with Black - Litterman model for portfolio optimization. Neural Computing and Applications, 36(32), 20111–20146.

[15]. van der Zwan, T., Kole, E., & van der Wel, M. (2024). Heterogeneous macro and financial effects of ECB asset purchase programs. Journal of International Money and Finance, 143, 103073.

[16]. Wang, M., Han, M., & Huang, W. (2020). Debt and stock price crash risk in weak information environment. Finance Research Letters, 33, 101186.

[17]. Yu, M., Hu, X., & Zhong, A. (2024). Network centrality, information diffusion and asset pricing. International Review of Financial Analysis, 93, 103223.

[18]. Yu, Y., Lu, J., Shen, D., & Chen, B. (2020). Research on real estate pricing methods based on data mining and machine learning. Neural Computing and Applications, 33(9), 3925–3937.

[19]. Zhang, R. (2025). Strengthening Financial Governance in Cyberspace Has Become a Critical Battlefield. The Economic Daily, (001).

[20]. Zhang, X., & Zhang, W. (2023). Information asymmetry, sentiment interactions, and asset price. The North American Journal of Economics and Finance, 67, 101920.