1. Introduction

In recent years, the global toy industry has undergone a notable transformation, driven by the rise of designer toys and collectibles. At the forefront of this transformation is Pop Mart, a Chinese toy company that has achieved significant popularity and revenue both domestically and internationally. Founded in 2010, Pop Mart emerged during a period when the designer toy industry was transitioning from a niche subculture – represented by Japanese and Hong Kong based creators through street fashion, such as graffiti and hip-hop – toward broader acceptance within mainstream pop culture. However, Pop Mart is not merely a witness to this evolution, it actively shaped and accelerated the transformation. By serving as a cultural platform that merges diverse Intellectual Properties (IPs) with a unique blind-box business model, Pop Mart set itself apart from contemporary competitors [1].

A particularly compelling aspect of Pop Mart’s trajectory is its globalization strategy. For Chinese companies in creative industries, expanding internationally often involves a trade-off: over-westernizing risks losing cultural authenticity, while directly translating domestic concepts may result in cultural misalignment across diverse consumer markets. Pop Mart has skillfully navigated this challenge by developing a hybrid visual language that allows cultural flexibility and localization, while retaining its unique artistic identity [2].

Since its listing on the Hong Kong Stock Exchange in 2020, Pop Mart’s stock price has shown dramatic fluctuations. After an initial decline, it soared to an all-time high on June 16, 2025, before entering a period of volatility and gradual decline. This stock price trajectory reflects the company’s evolving business performance and possibly signals a degree of market saturation or shifting investor sentiment [3].

Understanding Pop Mart offers valuable insights into modern consumer behavior, the strategic use of IP branding, and how differentiation can be effectively built in a competitive landscape. Coupled with stock price analysis, which serves as a real-time indicator of market response, this research aims to evaluate the company’s current positioning and forecast its future potential from an investor’s perspective—considering both internal capabilities and external environmental influences.

The primary objective of this research is to examine the key factors that have contributed to Pop Mart’s success. In addition, by analyzing the correlation between its stock price movements and major corporate developments, the research seeks to assess Pop Mart’s future prospects and provide potential stock price forecasts for investors.

Based on this framework, the research will be guided by the following questions:

1. What are the key factors behind Pop Mart’s success?

2. To what extent does Pop Mart’s current market valuation align with its underlying financial performance and long-term growth strategies?

2. Overview of Pop Mart

2.1. History

Pop Mart International Group Limited was established in Beijing in 2010 by Wang Ning. It was originally an exclusive boutique selling fashionable toys priced between 29 yuan and 89 yuan. In 2014, however, it pivoted toward becoming a designer toy brand, capitalizing on the growing demand among Chinese youth for collectible figurines [4].

In 2015, Pop Mart entered the blind—box business model—where consumers purchase sealed packages without knowing which specific character from a series they will receive. The element of surprise ignited considerable popularity, especially amongst millennials and Gen Z viewers. In 2016 Pop Mart jointly announced the strong cooperation with Hong Kong designer Kenny Wong entered the Molly series. Following Molly’s success, the series once again verified the commercial prospects of original IP characters in China.

The company continued to expand its IP portfolio by collaborating with other designers such as Pucky, Skullpanda, and Dimoo between 2016 and 2017. In 2017, Pop Mart introduced its “Robo Shops”—automated vending machines located in malls and public areas, providing 24/7 access to blind box products [2]. Furthermore, in the year of 2017, Pop Mart launched the Beijing Toy Show which is a significant celebration of designer toy culture.

In 2020, Pop Mart was listed on the Hong Kong Stock Exchange, raising approximately USD 676 million [5]. Following its IPO, the company accelerated international expansion, establishing a presence in South Korea, Japan, Singapore, and subsequently the United States and United Kingdom. It opened flagship stores in key city centers and was involved in major pop culture events like ComplexCon and Anime Expo to raise its profile around the world.

Among the post-2020 successes, what has attracted the most popularity and admiration worldwide was Labubu, a mischievous forest creature invented by the artist Kasing Lung, which soared. Limited editions of Labubu have fetched high prices on the secondary market, with some selling for over USD 1,000. The most expensive Labubu ever sold was a 225 cm tall, mint-green life-sized figure, which fetched approximately RMB 1.08 million (USD 150,000–170,000) at the Yongle International Auction in Beijing in June 2025.

2.2. Product and business mode

2.2.1. Innovation and emotional design

Pop Mart specializes in its innovative array of collectible designer toys and is best known for blind-box toys. Blind boxes are sealed packages containing a random figurine from a set, generating excitement, anticipation, and a strong element of surprise. Customers do not know which toy they will receive, which stimulates repeated purchases and fosters a collector's mindset.

Pop Mart has produced, marketed, and owned numerous IP’s – including Molly (Kenny Wong), Pucky, Skullpanda, Dimoo, The Monsters and the highly recognizable Labubu (Kasing Lung). Every character has an individual design, language, personality, and a story often influenced by youth culture, surrealism, or fantasy.

Beyond the intellectual property and backstories, what differentiates Pop Mart’s toys apart is the exaggerated style and artistic detail. The characters draw upon very large eyes, extravagant facial features, and complex textures. Skullpanda for instance, often wears dark eyeshadow and gothic imagery, whereas Molly's pouty mouth and defiant stare are her trademarks. The toys come with color palettes in tens of millions of pastel soft and bold neon shades, representing a variety of emotional terrain and seasonal themes. A lot of the figures come with neat accessories, textured clothing, or other accessories that boost the cinematic quality. That means everything here has a visual language that treats each toy not just as collectible, but also as a miniature piece of art [6].

Pop Mart also manufactures exclusive editions and operates collaborations with big international brands including Disney, Sanrio, Harry Potter, Moncler and Coca Cola, as well as artist-designed series. These partnerships lend even more cachet and broaden brand exposure outside of collector niches. Pop Mart is notably known to have released giant figures and life-sized merchandise, including human height Labubu models that have been auctioned off for US$150,000. These releases place Pop Mart in the category of designer art, not just commercial toys.

2.2.2. Supply chain management and inventory control

With increasing demand for visually appealing and emotionally resonant products, Pop Mart must ensure efficient production and delivery systems to support rapid consumption.

Pop Mart utilizes vertical supply chain and manufacturing capabilities providing quality products that stay in tune with market demand. While some of its production work is outsourced, it also works closely with its manufacturing partners, such as Dongguan City Zhida Toy Co., Ltd. and Shenzhen Yixiang Plastic & Hardware Co., Ltd. They focus on providing precise injection molding, painting and assembly of vinyl figures to meet a high design standard. By having the same communication system and on-site QC team, Pop Mart can achieve uniform product quality and quick production cycles.

To achieve refinement in demand forecasting, Pop Mart synchronizes digital data, offline POS data (from retail stores and Robo Shops), transaction data from its official app, and feedback data from customer comments on social media. It uses data such as historical sales patterns, seasonal demand fluctuations, and consumer preferences with predictive analytics tools and machine learning algorithms. This quantitative approach makes it possible for Pop Mart to plan limited edition offerings, process reorders, and adjust production schedules almost in real-time. Although exact internal figures are not disclosed, retailers with advanced systems typically target a forecast error below 10 percent, with best practice approaching 5 percent [7]. Pop Mart’s integrated system indicates performance within this effective range, allowing it to reduce mismatches between demand and supply.

Centralized warehouses under Pop Mart are mostly based in Shenzhen and Hangzhou. These are national distribution centers where products are consolidated, sorted and shipped out to retail store locations or to the consumer individually if it is an e-commerce fulfillment order. The warehouses have inventory tracking systems for real-time monitoring and are linked to Pop Mart’s retail and online platforms for efficient stock replenishment and logistic planning [8]. In 2024, Pop Mart’s Days Inventory Outstanding (DIO) was approximately 83 days, down significantly from 114.9 days in the prior year, though still above the leisure industry median of around 31 days [9]. Its inventory turnover ratio reached 2.2 turns per year, signaling an improvement in circulation but indicating room for further efficiency gains when compared with industry averages.

For markets outside China, Pop Mart collaborates with international logistics companies like SF Express International and DHL Supply Chain. These third-party logistics providers manage customs clearance, international freight forwarding and last-mile delivery to local distribution centers or customers themselves. Pop Mart has also built local warehouses in high-demand regions like Japan and the United States, which can shorten transportation time and ensure convenient and quality service. This global product availability model makes it possible for worldwide coverage with controlled costs and delivery times. In comparison to the fast-moving consumer goods sector, where the out-of-stock rate typically averages around 8 percent, Pop Mart’s data-driven replenishment practices and localized warehouses likely enable it to operate below this threshold, enhancing customer satisfaction by minimizing instances of unmet demand [10].

2.2.3. Integrated online and offline sales mode

To complete the end-to-end value chain, Pop Mart has developed a sales model that bridges physical and digital customer touchpoints.

Pop Mart’s retail model combines online sales, offline sales, and vending machine sales to provide consumers with an integrated shopping experience. Pop Mart maintains more than 280 branded stores in China and nearly 2,000 Robo Shops [11]. Pop Mart sells through its own app, WeChat Mini Programs, and third-party platforms including Tmall and JD. com in China. It runs an international online store and regional apps to suit local tastes around the world.

They also let users earn points, chat in community forums, keep up with releases, and participate in limited-time digital or physical events. Drop day and in-store events drive consumer traffic as well as urgency among customers.

3. Drivers of popularity

3.1. Psychological drivers of consumer enthusiasm

Pop Mart's success, in essence, depends on how it can generate products which can meet new young consumers' psychological wants and propensities. Central to this is the idea that consumption is a source of emotional fulfillment and self-identification. In a generation where many young people are in the paradoxical situation of depression and high pressure to work, Pop Marts random arrays show directly visual enactment with answers to what ills there are.

So far away from the shopping streets, so near to us: one of the stunts in Pop Mart's long marketing tradition is to create a blind-box sales model that really takes advantage of cognitive biases related to indeterminacy, risk and want. In popular speech, this kind of behavior is often said to come from a gambler's frame of mind. That means people keep buying in the hope that sooner or later they will get the rare or valuable prize they are seeking, which is the belief that the probability of an event is lowered when that event has recently occurred, even though the probability of the event is objectively known to be independent from one trial to the next [12]. In this context, the gambler’s fallacy works as an incentive for customers to keep purchasing blind boxes because they are trapped in the belief that the next purchase definitely has a higher chance than the previous one. Moreover, the rarity of some figures (the 'limited edition' Labubu, for example) also serves to speed desirability, because rarity itself is an attraction to buyers.

The process of making a purchase brings about a mixture of feelings, including curiosity, suspense as well as some excitement. Such emotions lead to repeated buying visits, among young consumers in the 18-25 age group, who are more open to new things and better able to take on risks [13]. The psychological attraction of Pop Mart can be seen as part of the “lipstick effect”. It means people tend to spend more on affordable beauties when economic prospects are uncertain. Blind-box figures are still cheap in comparison with luxury goods. The products Pop Mart sells bring consumers a lot of excitement, immensely larger returns on investment, making them just the thing for all those people who seek happiness without imposing too much financial burden.

Social validation is also a very crucial source of consumer enthusiasm. Now, platforms such as TikTok and Instagram have been turned into ecosystems of unboxing videos, collection displays and discussions that elevate Pop Mart’s products beyond toys. Social media has also become a powerful feedback loop. Here, consumers validate their own enthusiasm by seeing and sharing the excitement of others. Through this process, what was originally individual consumption becomes a communal experience, promoting intimacy and cohesion within the brand community. Pop Mart's characters are explicitly designed to be highly appealing visually and emotionally, so they fit very naturally into these new virtual environments [14]. As a result, Pop Mart has not only put its physical products into the digital environment, but also its sub-cultural and emotional capital has been successfully woven into this new substrate of youth culture.

3.2. Limited editions and localization strategy

Another one of Pop Mart ’s main points is the intense focus on limited edition releases and co-operation with others. It has continually launched short-run and co-branded products with internationally recognized intellectual property such as a thrilling edition of Harry Potter, as well as Pokémon. By doing so, it not only broadens its client base but also places its products within the parameters of cultural significance and highly collectible value. Limited editions also inject a sense of urgency into consumers, what is called `artificial scarcity’ by others [15]. This ruse, well known in the fashion and street wear sectors, prompts people to buy quickly before the goods go out of stock so as to both create stronger demand and enhance the brand's prestige.

The example of Labubu demonstrates the point. Possessing a motif of “ugly but sweet,” this enigmatic creature has become one of the symbols of Pop Mart's commodity portfolio. Limited-edition Labubu figures have attracted overwhelming consumer interest, with demand far outstripping supply and secondary market prices frequently four- or five-times retail value. This phenomenon turns Pop Mart products into cultural capital, indicating an individual's taste and identity and place among youth subcultures. Beyond issues of limited quantity, localization has become an important part of Pop Mart's global expansion strategy [16]. By establishing a network of both actual stores and automated vending locations, the company has spread out across Asia, Europe, North America and Oceania. And in these new territories too, the thrill that characterizes domestic consumers has been successfully reproduced. Limited-edition drops often sell out in minutes, bringing a sense of international uniformity to the brand's cultural appeal [17]. At the same time, Pop Mart has shown that it understands regional market conditions by differentiating promotional campaigns and character narratives according to local cultural contexts. Special events and locally based storytelling allow the company to reach diversified audiences while not backsliding on the universal quality of its brand. This localization not only makes for greater relevance but serves still more to strengthen the emotional links between the brand and consumers in a variety of markets. Thus, in transfusing global appeal with local specificity, Pop Mart transforms its reputation from that of only one of China's niche companies into a global cultural icon.

3.3. Synergy across retail channels

Pop Mart 's sustained consumer enthusiasm is also based on synergy across different retail channels, which is achieved through an omni-channel approach that not only includes manned stores and self-service vending machines-branded as Robo Shops but also online immersive marketing campaigns. Each sales channel has something unique about it [18].

Robo Shops are vending machines that simplify the purchase process, which provides more freedom and less social interaction to create an atmosphere that is product-emphasized. Robo Shops are throughout the cities and add convenience to one's daily routine. Its open refunding policy that allows refunds when slow also boosts popularity and acceptance among customers. In the first half of 2025, Pop Mart’s Roboshops generated approximately RMB 678.3 million in revenue—doubling (a 100.9% year‑on‑year increase) compared to RMB 337.6 million in the same period of 2024 [19]. On the other hand, manned retail shops carry function as cultural spaces outside of sales points. Themed decoration and periodic launch events make visiting the store more appealing.

Online, the company sells directly through its website and mobile app, while also leveraging major e-commerce platforms like Tmall and JD.com, as well as livestream commerce on platforms such as TikTok. These apps keep customers engaged by community service and gamification.

By combining these channels, the physical action of buying and digital sharing are linked. The curiosity intrigued by online posts causes purchasing, while new purchasing also induces posting. The cycle creates a loop where offline and online reinforce each other.

4. Valuation alignment

4.1. Valuation in context

Valuation is the price investors pay today for a company’s future cash flows. In equity analysis this is typically expressed through different financial metrics. In this section, price to earnings ratio(p/e) is used to analyze the company of Pop Mart in comparison with peers in toys and collectibles industry to offer a scope of the valuation alignment of Pop Mart. Because fast-growing firms can look expensive on P/E alone, a growth-adjusted view is also helpful: the PEG ratio, defined as P/E divided by expected earnings growth, relates price to the pace of expansion and allows more comparable assessments across companies.

To place Pop Mart’s valuation in context, this section sets its trailing and forward P/E alongside the typical levels observed for global toy and collectibles peers, then examines the PEG ratio against the same group to show how price relates to expected growth. It also compares Pop Mart’s gross and net profit margin with its own recent history to highlight any shift in corporate business over time and predict trend of how the company will develop in the future. Interpreting these ratios requires a brief link to fundamentals, so the discussion ties them to recent movements in revenue and earnings, margin profile, and cash conversion (including inventory turns and working-capital needs).

4.2. Financial analysis

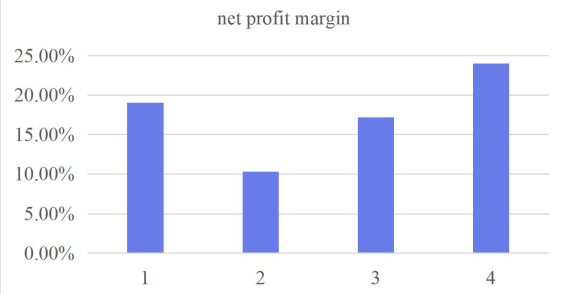

Pop Mart’s fundamentals show rapid expansion supported by significant margins, with operating efficiency the main area to watch. On growth, the company’s latest financials show gross revenue up ~178% and EPS up ~343% [20]. The toy-and-collectibles industry average is far weaker—revenue −~5.5% and EPS +~6.6%—so Pop Mart is expanding against a largely stagnant peer set. Profitability trends reinforce the picture. As seen from Figure 1, gross margin moved from 61.0% (2021) to 57.49% (2022), then recovered to 61.32% (2023) and reached 68.0% (2024) [21]. As seen from Figure 2, net margin followed a similar arc—19.02%, 10.30%, 17.18%, 23.97%—suggesting the 2022 dip likely reflected the impact of store lockdowns and rising production costs due to covid.

Efficiency is more mixed. Based on earlier disclosures mentioned before, days-inventory-outstanding (DIO) of ~83 days implies an inventory turnover rate of ~4.4x (≈365 ÷ 83). That is slower than a typical sector median near 31 days DIO (≈ 11–12x turns), indicating heavier working-capital needs and potential risk if sell-through slows. Continued improvement in forecasting and replenishment will be important and helpful to protect cash conversions [22].

There are also signs that could be alerting to investors. Its trailing P/E ratio is 123.54 and forward P/E ratio is 47.17. Compared to industry average of 24.9 and 18.5, it still indicates risks of overpricing even though its peers are relatively stagnant on their performance [23].

4.3. Alignment, risks and outlook

The central question that lies in the alignment between Pop Mart’s stock price and long-term performance is whether it can sustain the current rapid growth. From the comparison between the financials of Pop Mart and that of average in the industry, the high EPS and revenue growth rate explain why the stock valuation is high and sustained recently. The annually developing gross and net profit margin since covid also delivers a positive message that Pop Mart is controlling all types of expenses well regardless of the large-scale investment required for its expansion. The path suggests stronger mix from limited editions, better cost absorption as scale builds, and tighter operating control.

The current growth relies on the mechanism of combined momentum: a steady cadence of limited editions and collaborations, blind-box mechanics that drive repeat purchase, an omnichannel network of flagship stores, Robo Shops, and e-commerce, and a disciplined push overseas supported by localization. However, if earnings growth moderates from triple digits to something closer to high double digits while cash conversion strengthens—particularly through lower inventory days—the current forward multiple can remain defensible. If growth slows quickly and working capital stays heavy, the valuation will likely compress toward peer levels.

Key risks are hidden in this logic. Heavy reliance on few IP figures poses risks when new IPs do not intrigue consumers’ enthusiasm as much. Consumer interest in collectibles is sensitive and can shift quickly if new launches fail. Trend fatigue or a weaker hit pipeline would soften purchase frequency and pricing power. Greater dependence on licensed IP could lift costs or increase volatility. Governmental regulations on the gambling-like blind box mechanism could take away the cornerstone of its sales strategy. International expansion brings localization, compliance, and currency challenges and requires delicate tuning of products to meet customers’ taste from different cultural background to succeed. Together these risks define the operating discipline required to keep valuation justified by growing at a sustained pace.

The outlook is therefore conditional rather than absolute. The data points to a company converting customer’s enthusiasm towards unique toys into earnings with improving margins. It is a high-growth stock accompanied by high expectations. Its success hinges on sustaining IP innovation, growing overseas revenue, maintaining strong margins and diversifying business.

5. Conclusion

This essay shows that Pop Mart’s market story rests on fast growth, rising margins, and a unique product system built on scarcity, design IP, and broad distribution. Limited editions and collaborations keep demand fresh. The blind-box format encourages repeat purchases and creates new purchases from posts and conversation in customers’ communities. Flagship stores, Robo Shops, and e-commerce work together to keep products visible and easy to buy. Expansion outside China adds new customers and spreads influence across markets. Financial results point in the same direction: revenue and earnings have grown much faster than most peers, and margins have recovered after an earlier dip, suggesting great expense control. At the same time, operating efficiency is the main pressure point. Inventory days remain high versus typical industry levels, which ties up cash and can force discounting if sell-through slows. Taken together, Pop Mart is a company that relies on the sustainability of customers’ enthusiasm created by its unique mechanism to realize the current high stock valuation in the future.

There are also limitations in this analysis. This analysis relies on public sources and a small peer set, not internal records. It does not include edition-level launch calendars, license terms, or cohort data to support repeat purchase and lifetime value. Robo Shops, flagships, and e-commerce are discussed as one system, so differences in productivity, costs, and retention may be hidden. Forward estimates used for valuation can change quickly. The study does not model currency exposure, regulatory scenarios for chance-based formats, or alternative merchandising strategies by market.

Further improvements could be made in the future to better illustrate the company. First, offer more sales data of Pop Mart’s most popular products to showcase the money generation. Second, provide pictures of a few of the most popular Labubu types to better explain how the customers' enthusiasm is linked to products’ appearance. Finally, create valuation bridges that map EPS growth bands and inventory turns to forward P/E and PEG, providing a clear view of how execution shifts fair value.

References

[1]. Liu, Feier, Linfeng Lyu, and Kaize Yang. (2021) Analysis of Success Factors and Developing Potential of Pop Mart. 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021). Atlantis Press. 2901-2906

[2]. Song, Ziming. (2023) The Strategy Research of IP Image Design Based on Visual Context—Take “POP MART” as an Example. 4th International Conference on Language, Art and Cultural Exchange (ICLACE 2023). Atlantis Press. 274-282

[3]. Cai, Ruyao, (2020) Macroeconomic Analysis of POP Mart. Chulalongkorn University Theses and Dissertations (Chula ETD). 7364.

[4]. Zhao, Hanbing. (2025) Cultural Strategy and Identity Construction in Chinese Emerging Brands' Global Expansion: The Case of Pop Mart. Lund University Publications Student Papers. 9203080

[5]. Tee Josephine. (2021) Pop Mart: how millennial entrepreneur Wang Ning became a billionaire selling US$9 mystery Molly dolls from vending machines across China. Retrieved from https: //www.scmp.com/magazines/style/celebrity/article/3121164/pop-mart-how-millennial-entrepreneur-wang-ning-became?module=perpetual_scroll_0& pgtype=article

[6]. Jiang, Ruixuan. (2022) Analysis of Trend Culture from the Perspective of Social Currency: ---Taking the Pop Mart as an Example. BCP Business & Management18: 183-188.

[7]. Miller Kristi. (2025) Forecast Accuracy in Retail: How to Measure & Improve

[8]. Bincan, Tang. (2024) The Marketing Strategy Of Trendy Toys-A Case Study Of Pop Mart. Diss. Siam University. 6617195002.

[9]. Charlie Tian. (2024). Pop Mart International Group (HKSE: 09992) Days Inventory. Retrieved from Pop Mart International Group (HKSE: 09992) Days Inventory

[10]. Bobkilcoyne. (2025). Stockout. Retrieved from Stockout - Wikipedia

[11]. Bincan, Tang. (2024) The Marketing Strategy Of Trendy Toys-A Case Study Of Pop Mart. Diss. Siam University. 6617195002.

[12]. Clotfelter, Charles T., and Philip J. Cook. (1993) The gambler's fallacy in lottery play. Management Science 39.12: 1521-1525.

[13]. Kamal, А. М., and Shnarbekova, М. К. (2021). Modern trends in consumer behavior of young people in the digital age. ҚазҰУ Хабаршысы. Психология және әлеуметтану сериясы, 77(2), 127-132.

[14]. Qi, Ruiyuan. (2021) Strategic Direction for the Development of SMEs-Based on the Successful Experience of POP MART. 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021). Atlantis Press. 2352-5428

[15]. Li Yang. (2025) How Pop Mart Won Young Customers in a Fragmented Attention Economy. How Pop Mart Won Young Customers in a Fragmented Attention Economy.

[16]. Zhang Zhiyan. (2024) An Analysis of Consumer Behavior and Marketing Principles in Blind Box Purchasing A Case Study of Pop Mart. Retrieved from https: //www.researchgate.net/publication/379910691_An_Analysis_of_Consumer_Behavior_and_Marketing_Principles_in_Blind_Box_Purchasing_A_Case_Study_of_Pop_Mart

[17]. Chen, Xiaolin. (2021) Research on Blind Boxes Consumers---Taking Pop Mart as an Example. International Conference on Economic Development and Business Culture (ICEDBC 2021). Atlantis Press.

[18]. Gao, Jiahui, and Run Chen. (2022) Understanding consumer behaviors of Generation Z under China’s blind box economy: case company: POP MART. International Conference on Economic Development and Business Culture.

[19]. Zhen, Shiqi. (2025) Analysis Of Blind Box Marketing Strategies Driven By The Consumption Psychology Of Generation Z: A Case Study Of Pop Mart. Global Media and Social Sciences Research Journal 6.1: 124-130.

[20]. Qiu, Ting. (2020) Financial Analysis And Revenue Forecasts Of POP MART. Chulalongkorn University Theses and Dissertations (Chula ETD). 7187.

[21]. Fairfield, Patricia M. (1994) P/E, P/B and the present value of future dividends. Financial Analysts Journal 50.4: 23-31.

[22]. Aljaaidi, K., and O. Bagais. (2020) Days inventory outstanding and firm performance: Empirical investigation from manufacturers. Accounting 6.6: 1111-1116.

[23]. Khajeheian, Datis. (2018) Market analysis, strategy diagnosis and opportunity recognition in toy industry. International Journal of Entrepreneurship and Small Business 33.2 : 220-240.

Cite this article

Zhang,J. (2025). Pop Mart: Valuation, Fundamentals, and the Mechanics of Growth. Advances in Economics, Management and Political Sciences,219,18-27.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Financial Framework's Role in Economics and Management of Human-Centered Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu, Feier, Linfeng Lyu, and Kaize Yang. (2021) Analysis of Success Factors and Developing Potential of Pop Mart. 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021). Atlantis Press. 2901-2906

[2]. Song, Ziming. (2023) The Strategy Research of IP Image Design Based on Visual Context—Take “POP MART” as an Example. 4th International Conference on Language, Art and Cultural Exchange (ICLACE 2023). Atlantis Press. 274-282

[3]. Cai, Ruyao, (2020) Macroeconomic Analysis of POP Mart. Chulalongkorn University Theses and Dissertations (Chula ETD). 7364.

[4]. Zhao, Hanbing. (2025) Cultural Strategy and Identity Construction in Chinese Emerging Brands' Global Expansion: The Case of Pop Mart. Lund University Publications Student Papers. 9203080

[5]. Tee Josephine. (2021) Pop Mart: how millennial entrepreneur Wang Ning became a billionaire selling US$9 mystery Molly dolls from vending machines across China. Retrieved from https: //www.scmp.com/magazines/style/celebrity/article/3121164/pop-mart-how-millennial-entrepreneur-wang-ning-became?module=perpetual_scroll_0& pgtype=article

[6]. Jiang, Ruixuan. (2022) Analysis of Trend Culture from the Perspective of Social Currency: ---Taking the Pop Mart as an Example. BCP Business & Management18: 183-188.

[7]. Miller Kristi. (2025) Forecast Accuracy in Retail: How to Measure & Improve

[8]. Bincan, Tang. (2024) The Marketing Strategy Of Trendy Toys-A Case Study Of Pop Mart. Diss. Siam University. 6617195002.

[9]. Charlie Tian. (2024). Pop Mart International Group (HKSE: 09992) Days Inventory. Retrieved from Pop Mart International Group (HKSE: 09992) Days Inventory

[10]. Bobkilcoyne. (2025). Stockout. Retrieved from Stockout - Wikipedia

[11]. Bincan, Tang. (2024) The Marketing Strategy Of Trendy Toys-A Case Study Of Pop Mart. Diss. Siam University. 6617195002.

[12]. Clotfelter, Charles T., and Philip J. Cook. (1993) The gambler's fallacy in lottery play. Management Science 39.12: 1521-1525.

[13]. Kamal, А. М., and Shnarbekova, М. К. (2021). Modern trends in consumer behavior of young people in the digital age. ҚазҰУ Хабаршысы. Психология және әлеуметтану сериясы, 77(2), 127-132.

[14]. Qi, Ruiyuan. (2021) Strategic Direction for the Development of SMEs-Based on the Successful Experience of POP MART. 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021). Atlantis Press. 2352-5428

[15]. Li Yang. (2025) How Pop Mart Won Young Customers in a Fragmented Attention Economy. How Pop Mart Won Young Customers in a Fragmented Attention Economy.

[16]. Zhang Zhiyan. (2024) An Analysis of Consumer Behavior and Marketing Principles in Blind Box Purchasing A Case Study of Pop Mart. Retrieved from https: //www.researchgate.net/publication/379910691_An_Analysis_of_Consumer_Behavior_and_Marketing_Principles_in_Blind_Box_Purchasing_A_Case_Study_of_Pop_Mart

[17]. Chen, Xiaolin. (2021) Research on Blind Boxes Consumers---Taking Pop Mart as an Example. International Conference on Economic Development and Business Culture (ICEDBC 2021). Atlantis Press.

[18]. Gao, Jiahui, and Run Chen. (2022) Understanding consumer behaviors of Generation Z under China’s blind box economy: case company: POP MART. International Conference on Economic Development and Business Culture.

[19]. Zhen, Shiqi. (2025) Analysis Of Blind Box Marketing Strategies Driven By The Consumption Psychology Of Generation Z: A Case Study Of Pop Mart. Global Media and Social Sciences Research Journal 6.1: 124-130.

[20]. Qiu, Ting. (2020) Financial Analysis And Revenue Forecasts Of POP MART. Chulalongkorn University Theses and Dissertations (Chula ETD). 7187.

[21]. Fairfield, Patricia M. (1994) P/E, P/B and the present value of future dividends. Financial Analysts Journal 50.4: 23-31.

[22]. Aljaaidi, K., and O. Bagais. (2020) Days inventory outstanding and firm performance: Empirical investigation from manufacturers. Accounting 6.6: 1111-1116.

[23]. Khajeheian, Datis. (2018) Market analysis, strategy diagnosis and opportunity recognition in toy industry. International Journal of Entrepreneurship and Small Business 33.2 : 220-240.