1. Introduction

With the acceleration of global capital flows, Chinese concept stocks seeking financing in the United States have become an important channel to break through the funding bottleneck [1]. Under such circumstances, Luckin Coffee adopted the "Internet + Coffee" model, which perfectly met modern demands and rapidly expanded, achieving a National Association of Securities Dealers Automated Quotations (NASDAQ) listing in just 18 months to become the fastest-listed Chinese concept stock. Its market capitalization once reached as high as $12 billion. However, in January 2020, Muddy Waters' short-selling report revealed the financial fraud of Luckin Coffee. In April of the same year, Luckin admitted to its fraudulent behavior and was delisted on June 29, moving to the Pink Sheets market [2]. This incident not only exposed numerous issues in governance structure, information disclosure and accounting practices but also sounded an alarm for emerging enterprises. From these three key perspectives, the AB-share structure formed by corporate governance led to excessive concentration of control and ineffective supervision, ultimately resulting in agency problems due to serious conflicts between management and ownership, laying the groundwork for financial fraud. In the disclosure process, taking advantage of regulatory differences between China and the United States to only disclose data useful for corporate profitability, as well as a severe imbalance between strategic description and financial analysis, and the failure to fully disclose potential risks of the VIE structure as required by the SEC, provided opportunities for financial fraud [3]. Furthermore, in accounting practices, the abuse of authority to falsify orders and contracts, thereby inflating sales, legitimized financial fraud and ultimately led to its occurrence.

In existing research, most literature conducts in-depth analysis from a single perspective, such as business model, fraud motivation, internal control, and audit. These analyses effectively illustrate that the financial fraud of Luckin Coffee is rooted in negligence and deficiencies in business and financial supervision, audit and internal control, corporate governance structure, and cross-border supervision. They provide a diverse perspective for understanding the development dilemmas and transformation paths of emerging enterprises driven by capital. However, these perspectives are relatively independent and scattered, lacking a systematic analysis of the entire process of fraud generation and crisis rebirth. This paper adopts a case study approach, taking Luckin Coffee as a typical case. Based on Luckin's financial reports and public data from 2019 to 2023, it conducts a systematic analysis of the formation of financial fraud under special equity structures from three perspectives: governance structure, information disclosure, and accounting treatment. It deeply analyzes the entire chain of fraud from the business side to the financial side and addresses the question of how governance reconstruction and technology empowerment can synergize to promote Luckin's rebirth. It constructs a model for "system-technology" collaborative processing and solving financial fraud. This analytical approach not only expands the application scenarios of agency theory in emerging markets but also provides an operable implementation path for enterprise management in crisis, offering significant reference value to Chinese enterprises in transition.

2. The financial fraud methods of Luckin Coffee

2.1. Centralized control in the equity structure

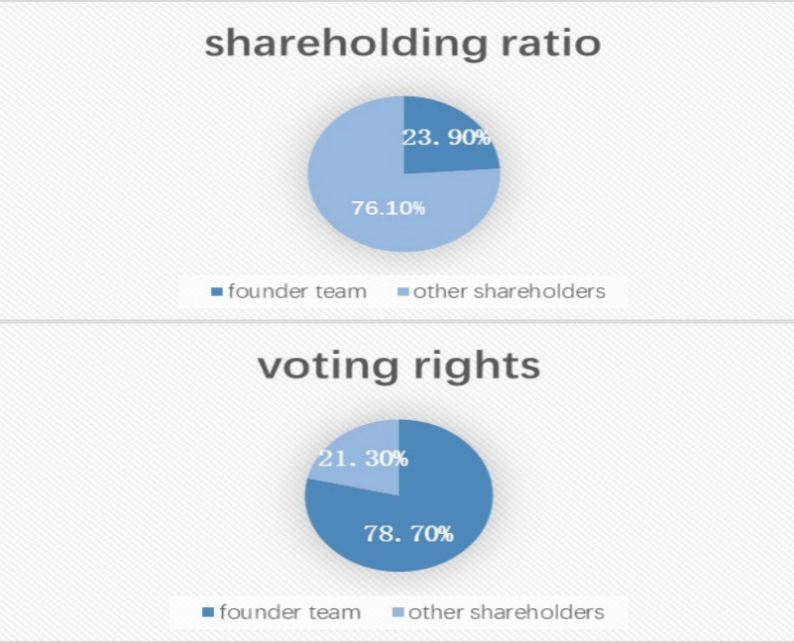

This financial fraud behavior of Luckin is influenced by power imbalances and institutional deficiencies. The AB share design adopted by Luckin Coffee constitutes an important root cause of its corporate governance issues. Specifically, as shown in Figure 1, the founder team was able to obtain 78.7% of the voting rights with only 23.9% of the shareholding ratio. Such an equity structure arrangement does improve decision-making efficiency to a certain extent, enabling it to better adapt to market changes. However, such a structural arrangement also brings about many governance risks [4]. Under such a structure, the supervisory role that the board of directors should have played is significantly weakened. Take 2019 as an example, all six major investment decisions were made by unanimous vote, yet four of them had not gone through the pre-approval process of the audit committee before the decision was made. This phenomenon fully reflects the fact that under an extremely centralized control structure, the supervisory function of the board of directors has long been nominal.

The "Priority Clause for Founder Dismissal Rights" in Luckin Coffee's "Shareholder Agreement" also restricts the supervision rights of minority shareholders [5]. When shareholders raise questions about store expansion, this clause directly deprives them of their proposal rights. This governance structure suffers from a mismatch between rights and responsibilities, leaving financial fraud without an important restraint mechanism. Relevant research has also pointed out that if the benefits of control far outweigh the costs of violating regulations, then the occurrence of fraudulent behavior is somewhat inevitable at the institutional level. The case of Luckin aptly confirms this conclusion. The founder team can earn huge profits through market value management, and because of the absence of internal control and effective external supervision, the costs of violating regulations are extremely low [6]. This unreasonable incentive mechanism of "high returns and low risks" may lead to more widespread financial fraud.

2.2. Full-chain financial fraud

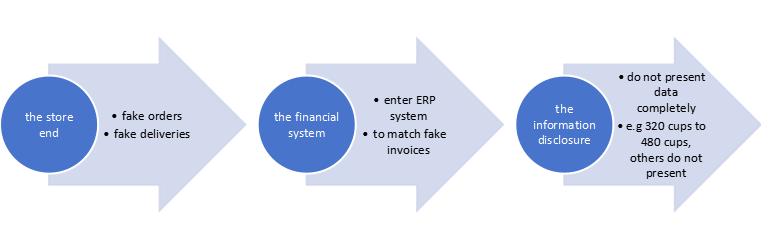

Luckin Coffee employs a full-chain operation method in financial fraud, as shown in Figure 2. On the store side, its employees use specialized software to generate fake orders, which have complete time records and payment information. They even arrange for fake deliveries to achieve the goal of forming a closed loop [7]. On the financial side, when fictitious transactions are entered into the ERP system, they are matched with forged supplier invoices and bank statements, creating a situation where the accounts and documents appear to match on the surface. As for information disclosure, Luckin leverages its new "Internet + Coffee" model to adjust order quantities and inflate revenue. For example, in 2019, Luckin Coffee's revenue exceeded expectations by RMB 2.112 billion, but the sources of these revenues are unverifiable [8]. Furthermore, Luckin's accounting information is incomplete. The sales data related to business transactions between the three companies under the name of Chairman Lu Zhengyao are not displayed in the corresponding statements, and their authenticity remains to be confirmed [8].

This kind of fraud exhibits a characteristic of gradual escalation. According to Luckin's annual report and related reports, in the second quarter of 2019, the proportion of its inflated revenue reached 38%, and by the fourth quarter, this proportion had risen to 112%. The reason for this situation is that for every one yuan of inflated revenue, it can drive the market value to increase by approximately 3.8 yuan, while the direct cost required for fraud is only 0.12 yuan. Under the combined influence of capital drive and institutional loopholes, fraud becomes a choice with high returns but low risks.

3. Governance reconstruction and business recovery after the crisis of Luckin Coffee

3.1. Adjustment and reconstruction of control rights by Luckin

After the Da Zheng Capital entered the scene, it did not adopt a single controlling model. Instead, it established a structure consisting of 31.3% shareholding and 53.6% voting rights [9]. This structure has its characteristics, which is to set the upper limit of voting rights for a single shareholder at 55% through the "Shareholder Agreement". In this way, it can effectively avoid the situation of low decision-making efficiency due to dispersed equity, while also preventing the problem of excessive concentration of power. Additionally, three independent directors with special permissions have been added to the board of directors. These independent directors not only have veto power over key matters such as auditing and compensation, but also have direct access to the company operating data. In 2023, all 37 rectification opinions proposed by these independent directors were adopted, including important decisions such as terminating 12 related-party transactions and reorganizing 8 regional management teams.

The adjustments made to this governance structure have genuinely enhanced the level of corporate governance. Relevant data indicate that in 2023, Luckin Coffee's corporate governance rating saw a significant improvement, rising from the crisis-era CCC level to the BBB level, outperforming 85% of Chinese concept stocks. This change is not accidental but rather the result of continuous reforms. The threshold for convening an extraordinary general meeting of shareholders at Luckin was lowered from a 10% shareholding ratio to 5%. This reform has made it easier for minority shareholders to participate in corporate governance. To enhance their voice in board decisions, the company adopted a cumulative voting system for director elections and established a dissenting shareholder buyback mechanism, providing dissenting shareholders with a reasonable exit path. After implementing these governance optimization measures, although approximately 23 million yuan is required annually for independent director salaries and special audit compliance costs, it has successfully avoided potential fraud losses of 800-1200 million yuan each year, achieving an input-output ratio of 1:35 to 1:52.

It is noteworthy that this innovation in governance structure is not a mere accumulation of systems, but a systematic design based on the actual situation of the enterprise. On the one hand, by setting the upper limit of voting rights, it achieves a power balance while maintaining decision-making efficiency; on the other hand, the special authority arrangement for independent directors ensures the effectiveness of the supervision mechanism. As pointed out in previous research on governance, a reasonable equity structure, from an institutional perspective, should be able to prevent fraudulent behavior [10]. Reasonable control rights arrangements can not only resolve crises but also lay a solid foundation for the long-term healthy development of the enterprise.

3.2. Introduction of block chain technology

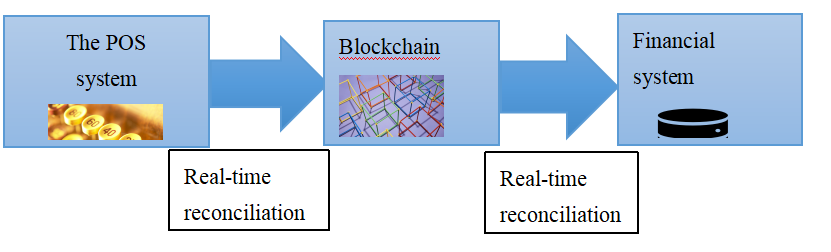

In terms of information disclosure, Luckin Coffee has incorporated block chain technology into its operations as shown in Figure 3. The Point of Sale System (POS) system in its stores is in real-time connection with block chain nodes [11]. The amount and time of each order are recorded in detail. Based on these data, the system can directly generate a digital fingerprint that includes the order time accurate to milliseconds, the hardware characteristics of the ordering device, and the precise ordering address. Each order corresponds to a unique digital fingerprint. After completing the above steps, further encryption is performed through algorithms, and a hash value is generated. The hash value generated for each transaction is tamper-proof [11]. To be on the safe side, Internet of Things (IoT) devices installed on coffee machines and cash registers automatically collect actual sales data and perform real-time reconciliation with the financial system. Once the system detects suspicious activities such as "more than 10 orders placed from the same address on the same day", it will immediately issue an alert. After preliminary manual review and final confirmation, abnormal orders will not be counted towards sales volume. The use of such a system can minimize false alarms, avoid unnecessary order losses, and prevent financial fraud from occurring at its root.

The effectiveness of these technical measures has been quite evident. In 2023, the data deviation rate saw a significant decrease compared to that in 2020. Looking at the information disclosure rating, it has also improved from the original "unqualified" status to "Grade A". Furthermore, the investment in technology has successfully translated into operational advantages. The benefit per square meter of a single store has increased significantly compared to the period when the company was engaged in fraud. This undoubtedly demonstrates the positive role that compliance management plays in promoting corporate efficiency.

3.3. Reconstructing the incentive mechanism for senior executives

Luckin Coffee has made significant adjustments to its executive compensation system, establishing an incentive mechanism oriented towards sustainable development. The design philosophy of this innovative compensation system stems from a profound understanding of the laws of enterprise development, aiming to guide the management to balance short-term performance and long-term value through institutional arrangements, thereby achieving healthy and sustainable development of the enterprise.

The company has adopted a progressive assessment mechanism that links 50% of the bonuses to the compound growth rate of performance over up to three years, rather than solely relying on short-term stock price performance. In the first year, the company focuses on assessing revenue growth, requiring it to be no less than 15%. In the second year, the focus shifts to asset yield assessment, with an 8% yield as the minimum standard. In the third year, the company begins to establish ESG rating standards, stipulating that it must maintain a BBB rating or above. This progressive assessment system can effectively avoid short-sighted behavior by management in pursuing short-term goals that could harm the long-term development of the enterprise. It encourages executives to comprehensively consider key indicators at various stages of enterprise development. However, to ensure the adaptability and effectiveness of the incentive mechanism, the setting of assessment indicators is not static, but dynamically adjusted according to industry development trends and corporate strategic planning.

|

Indicator |

2020 |

2021 (Low Point) |

2023 |

Change Situation |

|

Revenue (¥100 million) |

40.3 |

- |

132 |

+227.5% (vs. 2020) |

|

Operating Cash Flow (¥100 million) |

-12.2 |

- |

+18.7 |

Turned positive, improved by ¥3.09 billion |

|

Gross Margin |

15.80% |

- |

58.30% |

+42.5 percentage points |

|

Number of Stores |

- |

3,700 |

7,000 |

+89.2% (vs. 2021) |

|

Market Share |

6% (during delisting crisis) |

- |

18% |

+12 percentage points |

|

Listing Status |

Delisting crisis |

- |

Relisted on NASDAQ |

Completed relisting |

The establishment of the ESG assessment system vividly demonstrates Luckin's innovative thinking in corporate governance. The company has increased the proportion of this indicator to 40%, with "information disclosure quality" and "compliant operations" each accounting for 20% of the total. This proportion not only reflects the emphasis on sustainable development but also maintains a balance with traditional financial indicators [12]. A particularly crucial point is that it sets out provisions related to "fraud recovery", explicitly stipulating that if financial fraud is involved, senior executives must return all compensation received within the past three years and bear joint and several liability. Violators will also be permanently prohibited from holding management positions in listed companies, and relevant adverse records will be included in the credit reporting system. Such a mechanism effectively constrains the management.

Through continuous improvement and restructuring, Luckin Coffee began to revive, as shown in Table 1. Its operating income gradually recovered, reaching 13.2 billion yuan in 2023, a significant increase from 4.03 billion yuan in 2020. The operating cash flow also turned from -1.22 billion yuan to +1.87 billion yuan, achieving a huge leap. The gross profit margin increased from 15.8% to 58.3%, and all financial indicators showed positive development.

Luckin Coffee has also regained its former dominant position, with the number of stores recovering from a low of 3,700 in 2021 to 7,000 in 2023, and its market share rising from 6% to 18%. In 2023, Luckin Coffee returned to the NASDAQ stock exchange, marking a significant transformation from crisis to rebirth.

4. Conclusion

The case of Luckin Coffee vividly reflects the complex ecosystem presented by the capital market. For enterprises, the lesson to be learned is that the AB-share structure does not necessarily equate to absolute advantage. Once there is a lack of proper checks and balances in terms of control, even a potentially promising business model is highly likely to gradually deviate from its normal development trajectory. The relevant experience of its recovery clearly shows that leveraging technological means to achieve transparency in governance, such as the data storage and certification system built through block chain technology, not only reduced the information disclosure deviation rate from 23% to 0.8%, but also pushed the shareholding ratio of institutional investors to rise back to 35% within two years. This model provides a replicable transformation path for crisis-stricken enterprises. It can help enterprises rebuild external trust in them, thereby promoting the recovery of their value.

From the perspective of regulatory authorities, it is necessary to establish a mechanism that enables the control rights and the intensity of information disclosure to be mutually compatible. AB-share enterprises should bear more stringent disclosure responsibilities, such as using block chain technology to store and verify core data. For investors, this case undoubtedly tells them that companies that only emphasize growth stories, avoid discussing key data, and completely disregard profitability may be hiding risks.

The development of Luckin Coffee over the years fully demonstrates that the formation of financial fraud is a result of the combined effects of governance imbalances, deficiencies in regulatory links, and strong capital drive. At the same time, it also strongly confirms that after encountering a crisis, enterprises can fully achieve the re-establishment of trust and effective recovery of value through a series of systematic measures such as mutual checks and balances of power, active application of technology, and reconstruction of incentive mechanisms.

This case provides emerging enterprises with reference content from both positive and negative perspectives. On the one hand, it demonstrates the harm that financial fraud can cause. On the other hand, it also offers practical experience in dealing with crises. In the future development process, with the continuous widespread application of technologies such as block chain, coupled with the continuous strengthening of cross-border regulatory cooperation, it is hoped to establish a more effective mechanism for preventing financial fraud. This, in turn, will enable the 'Luckin-style rebirth' to no longer be a special case, but rather a model that can be replicated.

References

[1]. Zheng, Z. G., Jin, T. & Cai, M. E. (2022) The Challenges and Future of Chinese Concept Stocks. Financial Review, 14, 1-12.

[2]. Ma, G. L. & Fu, X. L. (2025) How Delisted Enterprises Can Save Themselves: Recapping Luckin Coffee's Path Out of the Quagmire. China Collective Economy, 17, 96-99.

[3]. Pan, Y. Y. (2023) VIE Structure: Concept, Pros and Cons, and Policy Implications. International Finance, 7, 74-80.

[4]. Ruan, W. (2021) A Case Study of Financial Fraud in Luckin Coffee - From the Perspective of Corporate Governance Master's thesis, National Chengchi University, 20, 67-71.

[5]. Li, P. T. (2020) Analysis of the Financial Fraud Case of Luckin Coffee - Based on the GONE Theory. Times Finance, 34, 3-6.

[6]. Li, Q. & Mao, Y. (2014) Financial Fraud in Listed Companies: A Literature Review and Prospects. Economic Research Guide, 4, 163-164.

[7]. Luo, T. (2021) Case Analysis and Audit Enlightenment of Financial Fraud in Luckin Coffee. Modern Business, 2, 31-32.

[8]. Han, Y. J. (2024) Research on Accounting Information Disclosure Issues of Listed Companies - Taking Luckin Coffee as an Example. Modern Marketing, 15, 132-134.

[9]. Li, J. H. (2023) How Can Financially Fraudulent Enterprises Achieve a "Rebound From the Bottom" From the Perspective of Corporate Governance? Taking Luckin Coffee as an Example. Qilu Journal of Accounting, 6, 27-29.

[10]. Xing, C. (2021) Empirical Analysis of Corporate Governance Structure and Financial Fraud in Listed Companies. Modern Business, 34, 76-78.

[11]. Zhao, L. J., Zhang, L. J., Feng, L. L. et al. (2023) Research on the Impact Mechanism of Financial Fraud From a Block chain Perspective - Taking Luckin Coffee as an Example. China Township Enterprise Accounting, 1, 45-48.

[12]. Finance. (2023) Research on the Impact of Corporate ESG Information Disclosure Quality on Stock Price Crash Risk (Doctoral dissertation), 17, 56-60.

Cite this article

Zhuang,Y. (2025). Exploration and Analysis of Luckin Coffee's Financial Fraud and Self-rescue Path. Advances in Economics, Management and Political Sciences,221,7-14.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Global Trends in Green Financial Innovation and Technology

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zheng, Z. G., Jin, T. & Cai, M. E. (2022) The Challenges and Future of Chinese Concept Stocks. Financial Review, 14, 1-12.

[2]. Ma, G. L. & Fu, X. L. (2025) How Delisted Enterprises Can Save Themselves: Recapping Luckin Coffee's Path Out of the Quagmire. China Collective Economy, 17, 96-99.

[3]. Pan, Y. Y. (2023) VIE Structure: Concept, Pros and Cons, and Policy Implications. International Finance, 7, 74-80.

[4]. Ruan, W. (2021) A Case Study of Financial Fraud in Luckin Coffee - From the Perspective of Corporate Governance Master's thesis, National Chengchi University, 20, 67-71.

[5]. Li, P. T. (2020) Analysis of the Financial Fraud Case of Luckin Coffee - Based on the GONE Theory. Times Finance, 34, 3-6.

[6]. Li, Q. & Mao, Y. (2014) Financial Fraud in Listed Companies: A Literature Review and Prospects. Economic Research Guide, 4, 163-164.

[7]. Luo, T. (2021) Case Analysis and Audit Enlightenment of Financial Fraud in Luckin Coffee. Modern Business, 2, 31-32.

[8]. Han, Y. J. (2024) Research on Accounting Information Disclosure Issues of Listed Companies - Taking Luckin Coffee as an Example. Modern Marketing, 15, 132-134.

[9]. Li, J. H. (2023) How Can Financially Fraudulent Enterprises Achieve a "Rebound From the Bottom" From the Perspective of Corporate Governance? Taking Luckin Coffee as an Example. Qilu Journal of Accounting, 6, 27-29.

[10]. Xing, C. (2021) Empirical Analysis of Corporate Governance Structure and Financial Fraud in Listed Companies. Modern Business, 34, 76-78.

[11]. Zhao, L. J., Zhang, L. J., Feng, L. L. et al. (2023) Research on the Impact Mechanism of Financial Fraud From a Block chain Perspective - Taking Luckin Coffee as an Example. China Township Enterprise Accounting, 1, 45-48.

[12]. Finance. (2023) Research on the Impact of Corporate ESG Information Disclosure Quality on Stock Price Crash Risk (Doctoral dissertation), 17, 56-60.