1. Introduction

1.1. Background

At present, a new round of global scientific and technological revolution and industrial transformation are developing vigorously. The integration of relevant technologies in the fields of automobile and energy, transportation, information and communication is accelerating [1]. Electrification, interconnection and intelligence have become the development trend for the automobile industry. Vehicles of new energy, new materials, large data, and a variety of transformational technologies such as artificial intelligence, have pushed the vehicle itself from the pure traffic to the mobile intelligent terminals, energy storage unit and digital space transformation. Besides, new types of vehicles can be supportive for upgrading energy, transportation, information and communication infrastructure, promoting energy structure optimization, and making transportation system and urban operation intelligent. To conclude, the new energy vehicles (NEVs) are of great significance for building a clean and beautiful world.

China's "Plan 2021–2035" advocates for a sustainable, environmentally friendly vehicle sector. The strategy aspires for a 20% market share for NEVs by 2025 [2]. This policy update compares Plan 2021–2035 to its predecessor. China's 2021–2035 strategy targets autonomous, networked, electrified, and shared transportation [2]. Its three main goals are to create a globally competitive auto industry with advanced NEV technologies and a good brand reputation, transition to an energy-efficient and low-carbon society with a convenient charging service network, and improve national energy security, air quality, climate change, and economic growth in the auto, energy, and transportation sectors [3]. Plan 2021–2035 details NEV market growth, tech innovation, and service expansion [4]. Chinese President Xi Jinping declared in 2014 that creating energy vehicles is the only path to become an auto power. A few years ago, most Chinese were unfamiliar with "new energy automobiles" and "technology." These concepts implied industry reform the technical development. According to the impact report released by Tesla, its initial electric vehicle (EV) sales in China since 2012 were fewer than expected [5]. As of May 2021, China has 5.8 million EV owners, half the world total [6]. For Tesla, there is still a great untapped market to reach, Besides, the NEV manufacturers can apply for high subsidies from the Chinese government, given China's “Plan 2021–2035”. The detail of government subsidies can be seen as the chart below.

Table 1: EV type and subsidies given by Chinese government.

NEV Subsidy (Unit: thousand RMB) | |||

XEV Type | Electric Range | 2021 | 2022 |

BEV | R<300 | 0 | 0 |

300 \( ≤ \) R<400 | 13 | 9.1 | |

400 \( ≤ \) R | 18 | 12.6 | |

PHEV | 50≤𝑅(NEDC) | 6.8 | 4.8 |

43≤𝑅(WLTC) | 8 | 6 | |

The vehicle’s price must be below 300k RMB to qualify for the subsidy. | |||

To be specific, vehicles with both battery and hybrid powertrains are called NEVs. Currently in China’s NEV market, more than 10 percent of NEV purchases were made by BYD, a local automobile company. There will be more than 70 percent adoption by 2030, according to the research conducted by BYD [7].

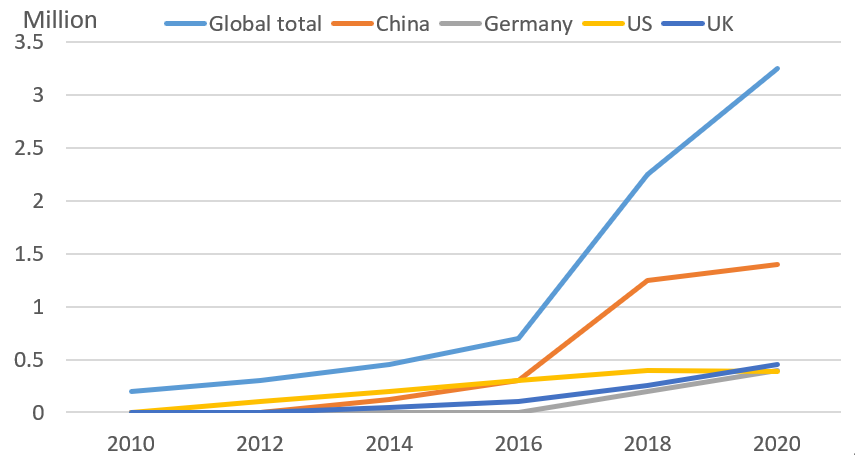

It was a record year for China's new-energy vehicle sector in 2021. It developed and sold 3.52 million NEVs, including battery-electric vehicles and plug-in hybrids. Sales increased by 181% from 2020 and surpassed the preceding three years' combined total. NEVs accounted for 15.7% of the country's automotive market in 2021 [4]. Is this an indication for the future blooming of NEV sales in China?

Figure 1: Sales of EV around the world.

2. Industry Overview

2.1. Current Situation of China’s NEV Industry

2.1.1. Background in Terms of Politics and Economic

As an American company who try doing business to take Chinese market, the political situation between China and the U.S should be taken serious by the corporate. Since early 2020, Chinese officials have pursued legislation and regulations to enhance government control over corporate activity inside and beyond China. These initiatives show that the Chinese government is motivated to enhance and align China's national economic security instruments to achieve global economic, technical, and military leadership and control of critical technology or global supply networks [4]. China's extraterritorial actions challenge U.S. sanctions and export regulations. Despite certain similarities, China's metrics highlight fundamental disparities in operating conditions between the US and China. China's attempts force U.S. and international corporations to follow its rules and regulations, undermining U.S. authority. Certain Chinese operations look geared to force American and international corporations to work around government officials in the U.S. and other countries, which might violate U.S. and other nations' laws by punishing companies that violate China's regulations. As if to codify and legitimize the Chinese government's trade retaliation and brinkmanship, as well as its use of economic coercion, numerous Chinese measures provide for retribution.

Xi Jinping has been establishing China's national security institutions since 2014 to provide wide rationale, authority, and methods for national security-related trade, investment, and economic activities. Recent actions are part of this endeavor. China's approach includes stronger export controls and security evaluations for Chinese enterprises doing business overseas to promote data sovereignty. China's government looks to be increasing its grasp on foreign data (such as personal identifying and health information), IP, technology, and research transferred to or generated in China, raising the stakes for US government, commercial, and academic interests in these domains. China's 14th Five-Year Plan (2021-25) aims to expand the authority of its courts, including in the U.S., which might undermine American authorities [2]. China challenges specific U.S. decisions and the reach of some U.S. and foreign authorities in trade, investment, intellectual property, and antitrust issues. China is developing alternatives to American-controlled trade, money, and geospatial systems.

2.1.2. Brand History and Current Market Situation in China

From 2016 through 2019, NEV sales in China rise steadily. Tesla is a leading U.S. manufacturer and distributor of electric automobiles, solar panels, and energy storage devices [8]. Tesla was founded in 2003, but the Roadster wasn't released until 2008. Between 2012 and 2015, three different models were released. Tesla sold 140,000 Model 3 electric vehicles in the U.S. in 2018, one of its most popular vehicles [5].

When entering Chinese market, Tesla’s pure electric vehicle technology and goods have caught Chinese consumers' attention. Tesla's ascent in the global auto market has encouraged many automakers to create NEVs (including pure electric vehicles and hybrid vehicles). For example, BAIC (China) makes the "Beiqi EU-Series," BYD (China) the "Yuan EV," Nissan (Japan) the "LEAF," and BMW (German) the "530e," among others. Even in such a competitive environment, Tesla’s 2019 sales were 63,148 each month and 367,820 year, which is a outstanding performance [5]. Tesla’s NEV sales rose gradually from 2015 to 2019, peaking at 1.25 million in 2018. The category set a record. Despite a drop in sales in 2019, 4.6% of all vehicles were sold. For Tesla, reaching untapped market is the priority to ensure its expanding in next decades and thus Tesla chose China and aligned Chinese market with its global expansion strategy. According to the Foresight Industry Research Institute, China is the world's largest NEV market in terms of geographical distribution.

2.1.3. Industry Prospect Analysis

To help the NEV industry grow over the next 15 years while also promoting a move to more environmentally friendly technology, the Chinese government has kept up its support and encouragement efforts. The latest strategy aims to do just that.

2035 Goals in China. Since 2015, China's overall production and sales of NEVs have ranked the country first globally, according to this strategy, which took into account years of continuous effort in China's NEV industry. China's international competitiveness was predicted to rise significantly as a result of breakthroughs in critical technologies such as batteries, drive motors, and vehicle operating systems [9]. As far as Chinese NEVs are concerned, it is estimated that the safety of these NEVs would improve considerably by 2025, and that by that time, pure electric passenger vehicles will use 12 kWh per 100 kilometers, accounting for 20% of all vehicle sales [9]. Over the same period of time, charging or changing electrical systems would become significantly easier. Even though only 5% of new vehicle sales are NEVs, electric passenger vehicles already use more than 15 kWh per 100 kilometers on average, according to industry sources.

For the mainstream type of vehicles in recent future, Pure electric vehicles (PEVs) will be commonplace by 2035, according to current projections. To be specific, PEVs will be the primary mode of transportation in China by the year 2035, according to the country’s development plan. In addition, China plans to expand the use of highly automated vehicle driving applications, with the purpose to increase the transportation efficiency and lower the labour cost [10].

Policy Support. Chinese policymakers expect that the NEV industry and other sources of renewable energy will continue to work together more effectively between now and the year 2035. NEV integration with weather and renewable energy forecasting systems will be pushed forward, as will the coordination of energy use by NEVs with wind and photovoltaic power producing systems.

To conclude, in order to ensure the domestic production, development, and distribution, Chinese government has evaluated its market parameters and even leverage the domestic market size with the purpose to encourage the automobile manufacturers, especially whom with NEV technology, to enter Chinese market in the form of joint venture [2].

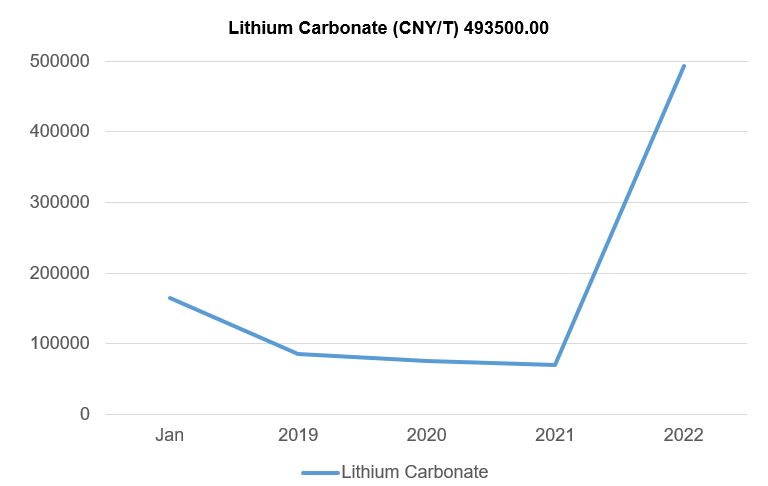

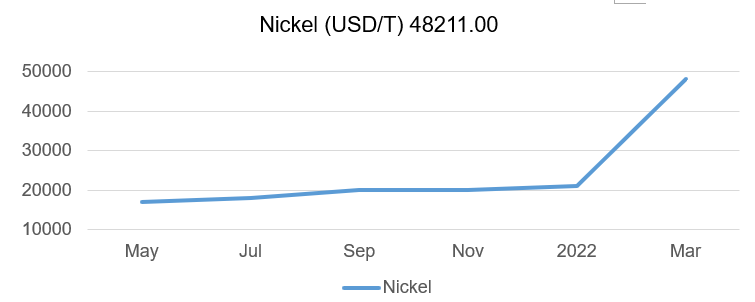

Supply Chain. Over the next 15 years, to ensure sufficient power supply for the NEV industry, China plans to boost the entire battery supply chain system. Increased and guaranteed supply of critical battery raw materials are essential, and thus the trading volume of such raw material is gradually expanding (see Figure 2 and 3). Lithium, nickel, and cobalt are a few of the materials that will be included.

Besides, it will be necessary for the businesses in the country for them to strengthen their technological innovation capability as well as speed up breakthroughs in critical manufacturing equipment as well as enhance production processes and efficiency throughout supply chains [11].

Figure 2: Lithium sales comparison.

Figure 3: Nickel sales comparison.

Raw Ingredients for Batteries. Basic materials of battery include lithium, cobalt, nickel, and other chemical compounds, which may be predicted to benefit from the NEV 15-year plan. As a major component in NEV batteries, there have been noticed an uptick in lithium prices recently, as demand from downstream purchasers is bolstered by a reviving NEV industry and less producers are demanding higher prices. There was a little increase in the spot price range for lithium carbonate, 99.5 percent Li2CO3 min, battery grade on October 2021 from the previous week’s 39,000-41,000 yuan ($5,972-6,121) per tonne, according to Fastmarkets’ weekly price assessment. The scarcity of the elements of NEV batteries determines that the supply of NEV batteries raw material can hardly reach a balance. Therefore, how to ensure the stability of battery raw material supply will be a problem for NEV enterprises like Tesla.

3. Poter’s Force Analysis on Tesla

Starting an electric vehicle startup isn't simple. Tesla has been in business for 15 years and has billions in debt, yet it can't make a profit. In the U.S., another electric vehicle maker seems improbable. China and Europe are manufacturing more electric vehicles, but they won't equal Tesla for years. In addition, General Motor (GM), Chrysler, Fiat-Chrysler, Audi, Ford, and other well-known automakers are becoming interested in electric vehicles, which brings more and more competition to the industry. German automakers spent $45 billion on electric vehicle technology through 2017. These factors make immigrants a modest threat.

Buyers have more electric vehicle alternatives, creating market competition. Because of the high cost of vehicles, a person who just bought a vehicle from a firm won't buy another from the same company soon. New vehicle purchasers can readily swap brands. Customers are pressuring Tesla to lower the price of its electric vehicles to compete with new competitors. The large competition among companies in the same industry and the large number of potential entrants make Electric vehicle buyers have strong bargaining power.

Today's environment has several modes of transportation, therefore replacement is common and possible. Gas or hybrid vehicles are alternatives to electric vehicles, providing more options for potential consumers. Only the power source differs between electric and gas-powered vehicles. Despite not being comparable to buses and subways, electric vehicles must compete with them. Many and diverse substitutes pose a high danger when consider bargaining power [12].

Many of GM and Chrysler's suppliers went bankrupt during the financial crisis, resulting into the fact that the number of part suppliers of automobiles is getting less [13]. In the past, Tesla controls the quality and quantity of supplier parts. Tesla can even pressure suppliers towards the end of 2018 to reimburse previous payments on parts and negotiate lower future contracts. Carmakers have long-standing connections with their suppliers, and their parts can't be sold elsewhere. Automakers have more influence over suppliers than suppliers have over automakers, reducing suppliers' negotiating power. However, with the fact that more and more competitors join the NEV industry competition, suppliers have greater bargaining power than before, as they have more options [14]. To some degree, Tesla still keeps its power in this part as it has big volume of order for its suppliers and such actions weakens the bargaining power of it supplier. In summary, there are strong force in the competition in the industry, moderate force in the threat of new entrants, moderate force in the bargaining power of suppliers, strong force in the bargaining power of customers, as well as strong force in the threat of substitute products or services.

4. Corporate Background of Tesla

4.1. Employee Management and Wellbeing

The most crucial point about Tesla is that electric vehicles had already been invented and sold to the general public before Elon Musk and his friends founded Tesla Motors in 2003. As a result of Tesla CEO Elon Musk's visionary leadership, the industry has taken action and aroused worldwide interest in a world without diesel [5]. This appears to be commonly employed in the workplace for both hiring new employees and keeping existing ones motivated. One of the company's greatest strengths is its corporate culture, which encourages employees to think like owners [15]. They are more likely to show initiative and commitment when they approach their work with the mindset that they stand to gain personally and professionally from the company's success.

Tesla's top executives have been taking advantage of this purely material advantage to improve their ability to communicate and grow as leaders. Motivated by the beliefs of others, a large number of people are drawn to work at Tesla Motors because they share their convictions. Other people, on the other hand, are more practical and focus on the financial benefits of working with the organisation in question. In this sense, Tesla also has the upper hand by providing its employees with benefits such as paid time off, health insurance, maternity breaks, and holidays, among others. According to Kim (2020), a “fair exchange” feature is necessary in order for a company to reward its top employees monetarily [16]. By creating a fertile foundation for a reaction, this technique positively improves the leadership capacities of the firm and strengthen the employee base for its future development.

4.2. Environmental Impact

Tesla's greatest strength is shown in the environment area. Given the fact that electric vehicles consume less energy than other types of vehicles such as gas-powered ones, Tesla's products are positioned as being more environmentally and sustainably. It is a great improvement as in the past decades since vehicles are invented, the huge amount of carbon emissions directly brings about global warming, melting of Arctic glaciers and other climate problems on a globe level. Even in 2021, according to China Automotive Low Carbon Action Plan Research Report (2021), the total life-cycle carbon emissions of China's passenger vehicle fleet is about 670 million tCO2e in 2020, with gasoline vehicles accounting for 98% of carbon emissions.

It is obvious that an electric vehicle company like Tesla can make a difference on environment protection. Tesla’s vehicles meet a variety of environmental standards, and thus there is little influence on carbon emissions (compared to traditional gasoline vehicles). Depending on this point, environmental focus for brand recognition, there are few companies that can match Tesla globally.

4.3. Product Impact

When it comes to Tesla's products, innovation is at the core of everything the company does. An integral part of the corporate identity is a constant emphasis on new ideas. Energy storage solutions are one area where the company is continually searching for improvements. Continuous innovation aids in the development of cutting-edge electric vehicles and other products in the context of the business analysis [17].

Even defined as a technology company, Tesla states that manufacturing is and will be the core competition of Tesla [5]. On the surface is the renewal of the product, behind is the highly automated production line developed by Tesla itself. Tesla has minimized labor on the production line and greatly improved the production speed and quality of the lines. before, its product was the car; but now, its product is the factory. How to adjust the factory parts and processes in order to increase production and make the production speed of the factory keep up with the sales speed is a problem that Tesla urgently needs to solve.

4.4. Publicity and Marketing

The company's economic success, brand awareness, and growth all contribute to its success. When Tesla started earning money and gaining a significant share of the luxury and sports vehicle markets, it quickly established itself as the mind-shaper it is today. Tesla was able to successfully develop a niche and a high-end brand image because of the celebrity effect [18], Unlike Volkswagen and Honda, which typically spend a lot of money on TV advertising and marketing, Tesla's first batch of customers included Brad Pitt, Larry Page and Sergey Lin of Google, Jeff Skoll of eBay, and Xiaomi's CEO Lei Jun. This group of consumers have good reputation in their communities and thus bring the positive exposure for Tesla.

Besides the celebrity effect, Tesla’s consumer groups are financial-independent people with good education background. According to the results of the survey, more than 70% of Tesla buyers had at least a bachelor's degree. For some Tesla consumers, they possess more than one vehicle as it is a statement of their riches, status and taste. Owning the same brand of vehicle as a world-famous celebrity and millionaire is a great way to get their name out there.

5. Difficulties Encountered by Tesla in China

5.1. High Tax Rates

Compared to other automobiles imported to China, Tesla has a 40% import charge, according to Elon Musk's electric vehicle firm [19]. Other vehicles imported to China only have a 15% tariff. According to Tesla, it costs between 55% and 60% more to create its vehicles than “the exact same automobile” manufactured by Chinese manufacturers. Tesla claims that the electric vehicle market in China is “by far the greatest” in the world.

5.2. Low Adaptability

Urban traffic jams prevent Tesla vehicles from operating at their peak performance levels. Superior acceleration, steering, grip, and handling performance are just a few of its tremendous capabilities. Although these talents are noticeable when travelling a long distance, they are not very useful on China's crowded metropolitan road networks. It is obvious that the manufacturer does not account for the differences between Chinese metropolitan life and its western counterpart.

5.3. Brand Competition

Tesla's NEVs are greatly sought after by Americans in the United States, but when Tesla initially entered Chinese market, Chinese people in China have hesitated from buying them. Only 2,499 and 3,692 Tesla were sold in China in 2014 and 2015. Following that, Tesla withheld information on its sales in China for an extended period of time. Due to tariffs and transportation charges, Tesla's selling price in China is up to 63% more expensive than in the United States. As a result of China's low average income compared to countries like the United States, Tesla has had difficulty reaching the country's working class. As a result, the vehicle's high performance isn't fully utilized. Prices for Tesla vehicles are determined by the services they provide, such as real-time help from the company's artificial intelligence system. Because of poor network coverage and traffic congestion in urban areas, these services appear to be pointless, making them lose their attraction.

NEVs from domestic manufacturers such as NIO, Xiaopeng, Ideal, BYD, and BAIC are also available to Chinese consumers. Only the essential services that are popular among Chinese people, at relatively affordable prices, and capable of adapting to the congested road market in China are offered by these domestic enterprises [20].

5.4. Impact of the Epidemic on Tesla’s Production

Before the epidemic happens, Tesla has encountered difficulties in delivery. As of October 2017, Tesla had only shipped 220 Model 3s. A year and a half after more than 400,000 customers paid $1,000 each to preorder the vehicle, the company still hasn't built a single one. There is a growing sense of unease among investors as the stock price fell 6.8% and the company reported a loss of $671.1 million in the third quarter of 2017. During the gap between 2017 and 2020, Tesla has increased its production pace by building the super factory in China.

Then the pandemic comes. Tesla has paused most production at its Shanghai plant due to challenges procuring electric vehicle parts, according to an internal letter seen by Reuters. The facility aims to make less than 200 vehicles on Tuesday, according to a document, significantly fewer than the 1,200 it has been making each day since reopening on 19 April following a 22-day shutdown. Two sources stated supply difficulties stopped manufacturing. Shanghai’s Covid-19 shutdown has tested manufacturers' capacity to work despite mobility restrictions.

Tesla intended to resume pre-lockdown production right after the city goes normal. Sources who requested anonymity because manufacturing plans are confidential said it was unclear when supply concerns would be handled. Tesla didn't immediately comment. Tuesday, the China Passenger Vehicle Association plans to announce Tesla's April sales. Zero-Covid lockdowns stopped manufacturing, curtailed showroom visitors, and slowed expenditure, according to another automobile group. Besides, Tesla's main wire harness supplier, suspended shipping from a Shanghai site after Covid-19 infections were identified.

The Giga factory 3 in Shanghai has a significant meaning for Tesla. It produces the Model 3 vehicle and Model Y crossover for China and export. Even suffering from Shanghai lockdown, Tesla planned to expand Shanghai factory capacity to 2,600 vehicles per day to recover from the lockdown as soon as possible.

Insufficient Capacity of Supply Chain. Tesla’s difficulties are industry-wide. In late June, GM stated 96,000 vehicles were missing components due to microprocessor shortages and supply chain difficulties. Tesla has evaded the worst of the chip shortage thus far [21]. Tesla delivered a record 308,600 units in Q4 2021, up 87% from lockdown-hit 2020 levels. Tesla manufactures vehicles from start, rather than adding parts over decades, unlike incumbent automakers. Elon Musk, Tesla's CEO, noted that relying on in-house software engineering has helped keep manufacturing lines operating. He also stated Tesla could swiftly modify software to accommodate alternate processors into its vehicles if chip shortages arose.

5.5. Safety Issues

Tesla vehicles suffer safety issues such as battery safety and brake failure issues. Along with external obstacles, internal problems with the vehicles made Tesla's introduction into China difficult. A string of Tesla vehicle fires in 2013 reduced the company's market value by close to 28%. Although its battery has a few advantages over those of other electric vehicles, it is still far from up to par. As a result, Chinese buyers who had reservations about Tesla's quality control saw their enthusiasm for the company decrease even further. Tesla automobiles nearly vanished from the public's view in the years that followed, lasting until 2020.

6. Application and Recommendations Based on the Theories of Orgnisational Behaviour

6.1. Making Use of the Chinese Government’s Preferential Policies

First, Tesla should make good use of the preferential policies and subsidies of the Chinese government for NEVs, including policies and measures such as unlimited license plate numbers of NEVs on the road, no registration lottery for NEVs, financial subsidies, and preferential vehicle purchase policies of the Chinese government for NEVs, so as to attract consumers to buy Tesla. Second, in addition to the Chinese government in the city and the planning and construction of highway and charging stations, Tesla should also expand the Tesla exclusive coverage of the charging station, to promote the Tesla. This strategy is vital to the development of China's market as expanding the number of Tesla's exclusive charging stations in China can solve the problem of consumers “range anxiety”, and can improve consumer experience as a after-sale benefit.

6.2. Conducting Marketing Tailored to the Chinese Market

It is suggested that a shift from a highly selective and limited advertising strategy to the production of unique advertisements that help drive sales and reinforce how Tesla's brand is made. This would suggest a shift away from the current strategy of focusing on developing emotionally compelling advertisements for the extent of globalization and technology use [13]. Advertisements that are able to appeal to the consumers’ emotions are more likely to succeed in persuading them that they are an integral part of the brand [13].

According to a body of research, emotionally engaging advertising not only boosts customer loyalty but also adds to the differentiation of different brands [13]. As such, Tesla needs to continue to emphasize increasing its brand awareness globally through emotionally appealing commercials. Tesla can continue to set up more Tesla vehicle club for the Chinese market, such as Tesla vehicle club formed by region. Such clubs demonstrate Tesla's efforts to cultivate its users into key opinion leaders through buzzing marketing, which will help the company optimize its cost structure and attract more customers as time goes by.

6.3. Taking Advantage of COVID-19

Tesla should take advantage of the COVID-19 opportunity to increase product and brand awareness in the Chinese market. For example, during the COVID-19 pandemic, Tesla maintained a high level of employee benefits, minimized layoffs in the Chinese market, and donated masks to China's hard-hit areas. In addition, when the epidemic improves, Tesla can organise employees in order to arrange the production. All this makes Chinese consumers feel the social responsibility of Tesla as a company.

6.4. Improving Technology and Supply Chain Capability

Tesla should first retain its software and hardware expertise, including completing technical progress and effectively solving user difficulties, such as improving the battery life of Tesla vehicles, improving the full battery capacity of Tesla vehicles, braking and fully autonomous driving technology, with the purpose to make consumers feel more secure with Tesla vehicles.

To save cost on delivery and increase market share, Tesla could increase production and delivery times in China. At the same time, Tesla can also cooperate with local battery and chip suppliers in China, thereby reducing the time and cost of transportation and increasing the production capacity of Tesla's factories in China to meet the Chinese consumers’ requirement.

Tesla’s hardware manufacturing plant can also engage in this process such as producing supercharger stations. Besides, it can build a big number of experience shops and service centers to make client achieve the goal. Tesla may develop electric vehicles beyond vehicles in the future. Tesla's current offerings are primarily aimed at high-end vehicle and sports vehicle buyers. Tesla may produce electric buses, taxis, trucks, and mature autonomous driving technology in the future [13]. Tesla can expand its consumer base through the research and development of different types of vehicles, and always maintain the competitiveness of Tesla brand.

7. Conclusion

Driven by the development of NEVs in China being in rapid advance, Tesla is considered as a representative company in the field of NEVs in the world. However, when Tesla tries to achieve for a higher goal, there are quite a lot problems such as the propaganda issue, the COVID-19, the production limitation, and insufficient industrial chain. Tesla chose to adapt to change, instead of staying to the same. To adjust to the Chinese market, Tesla started its adaptation scheme, learned developing itself with the help of the government subsidy, etc. Now, Tesla still need to gain Chinese mutual learning in the NEV’s view, and make more adjustments according to the actual situation of the Chinese market, to correct its weaknesses. Due to the lack of research on corporate financial accounts in this paper, it cannot prove how effective this approach is. The findings set the stage for further research on other international companies operating in China, as well as Tesla’s own marketing techniques.

References

[1]. Das, H. S. Rahman, M. M. Li, S. & Tan, C. W. Electric vehicles standards, charging infrastructure, and impact on grid integration: A technological review. Renewable and Sustainable Energy Reviews 120 (2020) 109618. DOI: https://doi.org/10.1016/j.rser.2019.109618.

[2]. Yeung, G. ‘Made in China 2025’: the development of a new energy vehicle industry in China. Area Development and Policy 4(1) (2019) 39-59. DOI: https://doi.org/10.1080/23792949.2018.1505433.

[3]. Sun, Y. & Cao, C. Planning for science: China’s “grand experiment” and global implications. Humanities and social sciences communications, 8(1) (2021) 1-9. DOI: https://doi.org/10.1057/s41599-021-00895-7.

[4]. Chu, Y. (2021). China’s New Energy Vehicle Industrial Development Plan for 2021 to 2035. The International Council in Clean Transportation, 2021.

[5]. Tesla, I. (2021). Tesla Impact Report 2021.

[6]. Wen, W. Yang, S., Zhou, P. & Gao, S. Z. Impacts of COVID-19 on the electric vehicle industry: Evidence from China. Renewable and Sustainable Energy Reviews 144 (2021) 111024. DOI: https://doi.org/10.1016/j.rser.2021.111024.

[7]. Cheng, E. In this context, "new energy vehicles" refers to vehicles powered by both battery and hybrid powertrains. Wang Chuanfu, the creator of BYD, said the category accounted for more than 10% of new car sales in China in March and rose to 11.4 percent in May. China economy, CNBC, 2021.

[8]. Long, Z. Axsen, J. Miller, I. & Kormos, C. What does Tesla mean to car buyers? Exploring the role of automotive brand in perceptions of battery electric vehicles. Transportation Research Part A: Policy and Practice 129 (2019) 185-204. DOI: https://doi.org/10.1016/j.tra.2019.08.006.

[9]. Liu, C. Liu, Y. Zhang, D. & Xie, C. The capital market responses to new energy vehicle (NEV) subsidies: An event study on China. Energy Economics 105 (2022) 105677. DOI: https://doi.org/10.1016/j.eneco.2021.105677.

[10]. Du, X. & Li, B. (2021, December). Analysis of Tesla’s Marketing Strategy in China. In 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 1679-1687). Atlantis Press. DOI: https://doi.org/10.2991/assehr.k.211209.270.

[11]. Xinyi, L. Chen, Z. & Bai, C. (2022). Case Study Research in Tesla (China) Marketing Strategy Application During Covid-19.

[12]. Dai, R. (2020). The Analysis of Tesla's Competitive Strategy for the Chinese Market. The University of Nottingham, (199).

[13]. Mangram, M. E. The globalization of Tesla Motors: a strategic marketing plan analysis. Journal of Strategic Marketing 20(4) (2012) 289-312.

[14]. Yang, X. (2022, July). Research on Tesla’s Market—Based on Porter’s Five Forces and Ratio Analysis Model. In 2022 2nd International Conference on Enterprise Management and Economic Development (ICEMED 2022) (pp. 773-777). Atlantis Press.

[15]. Doude, M. (2020). Organizational culture in the United States automotive industry. Theses and Dissertations. 3416. https://scholarsjunction.msstate.edu/td/3416.

[16]. Kim, H. Analysis of How Tesla Creates Core Innovation Capability. International Journal of Business and Management 15(6) (2020) 42-61. DOI: i:10.5539/ijbm.v15n6p42.

[17]. Hasan, F. & Islam, M. R. New Energy Vehicles from the Perspective of Market and Environment. Journal of Business Strategy, Finance and Management, 4(1) (2022).

[18]. Bilbeisi, K. M. & Kesse, M. Tesla: A successful entrepreneurship strategy. Morrow, GA: Clayton State University 1(1) (2017) 1-18.

[19]. Musk, E. (2021). The secret Tesla Motors master plan (just between you and me). Tesla Blog, 2.

[20]. Harwit, E. (2022). Tesla Goes to China. Asia-Pacific Issues (152), 1-8.

[21]. Xia, X. (2022). SCM PMA Supply Chain Models---A Case Study of Tesla Motors. International Journal of Frontiers in Engineering Technology 4(4). DOI: DOI: 10.25236/IJFET.2022.040405

Cite this article

Tang,B. (2023). Analysis of Tesla’s Organisational Management in the Chinese Market and Countermeasures. Advances in Economics, Management and Political Sciences,9,1-11.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Das, H. S. Rahman, M. M. Li, S. & Tan, C. W. Electric vehicles standards, charging infrastructure, and impact on grid integration: A technological review. Renewable and Sustainable Energy Reviews 120 (2020) 109618. DOI: https://doi.org/10.1016/j.rser.2019.109618.

[2]. Yeung, G. ‘Made in China 2025’: the development of a new energy vehicle industry in China. Area Development and Policy 4(1) (2019) 39-59. DOI: https://doi.org/10.1080/23792949.2018.1505433.

[3]. Sun, Y. & Cao, C. Planning for science: China’s “grand experiment” and global implications. Humanities and social sciences communications, 8(1) (2021) 1-9. DOI: https://doi.org/10.1057/s41599-021-00895-7.

[4]. Chu, Y. (2021). China’s New Energy Vehicle Industrial Development Plan for 2021 to 2035. The International Council in Clean Transportation, 2021.

[5]. Tesla, I. (2021). Tesla Impact Report 2021.

[6]. Wen, W. Yang, S., Zhou, P. & Gao, S. Z. Impacts of COVID-19 on the electric vehicle industry: Evidence from China. Renewable and Sustainable Energy Reviews 144 (2021) 111024. DOI: https://doi.org/10.1016/j.rser.2021.111024.

[7]. Cheng, E. In this context, "new energy vehicles" refers to vehicles powered by both battery and hybrid powertrains. Wang Chuanfu, the creator of BYD, said the category accounted for more than 10% of new car sales in China in March and rose to 11.4 percent in May. China economy, CNBC, 2021.

[8]. Long, Z. Axsen, J. Miller, I. & Kormos, C. What does Tesla mean to car buyers? Exploring the role of automotive brand in perceptions of battery electric vehicles. Transportation Research Part A: Policy and Practice 129 (2019) 185-204. DOI: https://doi.org/10.1016/j.tra.2019.08.006.

[9]. Liu, C. Liu, Y. Zhang, D. & Xie, C. The capital market responses to new energy vehicle (NEV) subsidies: An event study on China. Energy Economics 105 (2022) 105677. DOI: https://doi.org/10.1016/j.eneco.2021.105677.

[10]. Du, X. & Li, B. (2021, December). Analysis of Tesla’s Marketing Strategy in China. In 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 1679-1687). Atlantis Press. DOI: https://doi.org/10.2991/assehr.k.211209.270.

[11]. Xinyi, L. Chen, Z. & Bai, C. (2022). Case Study Research in Tesla (China) Marketing Strategy Application During Covid-19.

[12]. Dai, R. (2020). The Analysis of Tesla's Competitive Strategy for the Chinese Market. The University of Nottingham, (199).

[13]. Mangram, M. E. The globalization of Tesla Motors: a strategic marketing plan analysis. Journal of Strategic Marketing 20(4) (2012) 289-312.

[14]. Yang, X. (2022, July). Research on Tesla’s Market—Based on Porter’s Five Forces and Ratio Analysis Model. In 2022 2nd International Conference on Enterprise Management and Economic Development (ICEMED 2022) (pp. 773-777). Atlantis Press.

[15]. Doude, M. (2020). Organizational culture in the United States automotive industry. Theses and Dissertations. 3416. https://scholarsjunction.msstate.edu/td/3416.

[16]. Kim, H. Analysis of How Tesla Creates Core Innovation Capability. International Journal of Business and Management 15(6) (2020) 42-61. DOI: i:10.5539/ijbm.v15n6p42.

[17]. Hasan, F. & Islam, M. R. New Energy Vehicles from the Perspective of Market and Environment. Journal of Business Strategy, Finance and Management, 4(1) (2022).

[18]. Bilbeisi, K. M. & Kesse, M. Tesla: A successful entrepreneurship strategy. Morrow, GA: Clayton State University 1(1) (2017) 1-18.

[19]. Musk, E. (2021). The secret Tesla Motors master plan (just between you and me). Tesla Blog, 2.

[20]. Harwit, E. (2022). Tesla Goes to China. Asia-Pacific Issues (152), 1-8.

[21]. Xia, X. (2022). SCM PMA Supply Chain Models---A Case Study of Tesla Motors. International Journal of Frontiers in Engineering Technology 4(4). DOI: DOI: 10.25236/IJFET.2022.040405