1. Introduction

With the gradual development of behavioral finance, compared with rational simplified models, behavioral models that study irrational behavior take into account the psychological impact of people in real life, which is more convincing in explaining abnormal phenomena, and more practical in predicting and considering people's intuitive reactions to economic phenomena.

The conventional wisdom is that decision-makers will make rational decisions if they implement responsible decisions [1]. However, behavioral finance argues that individual biases can affect the execution of accountable decisions and hinder rational investment decisions in mutual fund selection behavior [2].

Researchers have focused on describing the psychological biases that influence investor behavior in the finance framwork for mutual fund selection. There are many psychological biases have been described and discussed detailedly in the behavioral finance documents.

The rest of this article will focuse on the application and influence of endowment bias in the field of investment.

Combined with the psychological behavior research of mutual fund investors and a study of biases affecting investor behavior in India, this article proves the influence of endowment effect on investors’ decisions-making, analyzes the causes of endowment effect, hoping to provide some references for participants in the field of investment. At the end of the paper, the authors summarized the conclusions of the study and point out the limitations of the two studies.

2. Literature Review

2.1. The Origin of Endowment Bias -- Endowment Effect and Loss Aversion

Richard Thaler, the brilliant theorist of behavioral economics, coined the word “endowment bias” in 1980 [3]. He argued that this cognitive bias can explain the loss aversion, a theory developed by Tversky and Kahneman in 1979, which is a psychological tendency that describes investors are more likely to aviod the losing more, rather than make gainings, because they usually feel pain of losing in psychologically more powerful than the pleasure of gaining [4]. Specifically, Thaler used the endowment effect as an explaination of the loss of value related with selling or giving up the entity you owned, which is always further than any financial or emotional gaininng from acquiring the item.

2.2. The Experiment of Endowment Bias -- Down by Thaler, Jack Knetsh and Daniel Kahneman

At the beginning of 1990s, the experimental evidence for the endowment bias have been provided by Thaler, in collaboration with Daniel Kahneman and Jack Knetsch. In their thesis, the researchers looked for college students, who were randomly assigned half to either seller or buyer groups. Reserchers gave the seller group mugs with a logo of university and told them that they can either sell their mugs to the buyer group or keep them. Then, the group of buyers was asked to try to buy the mugs. The writers also instructed students what at price they are willing to sell or buy the mugs. The results showed that students who had mugs priced their own mug twice as much as those who were not in possession of a mug. This experiment has been replicated successfully for many times and demonstrated that people generally think that the things belong to them are more value than the items that do not [5].

2.3. The Article about Endowment Effect and Financial Market -- Published by John A. List

John A. List--a professor of the Maryland University has published a high correlated and unique paper named “Does Market Experience Eliminate Market Anomalies?” [6]. Some critical directions of endowment effect are reviewed.

2.4. Ownership and Attachment

Morewedge and Giblin made up with two methods in which self-association or attachment increases the value of goods in 2015. Attachment theory takes for that owernership can create a non-transferrable between things and self. Goods are incorporated into the owner's self-concept, become part of her accordance, and are endowed with particularity concerned with her self-concept. The Self-association may take the form of an emotional attachment to something beautiful. In case of attachment is took shape, the potential loss of something good is considered as a threat to the self [7].

3. Methodology

3.1. An Analysis of Mutual Fund Investor’s Psychological Behavior in Investing Based on Endowment Bias

In the mutual fund investment, the influence of endowment bias is very obvious. Bobde, Bagde and Goje conducted a psychological behavior analysis of mutual fund investors with reference to endowment bias in 2017 to research whether endowment effect is reflected in the mutual fund investment decisions [8]. The study involved a random sample of 470 investors of mutual fund in Nagpur city.

To investigate the adaptability of behavioral finance, the experimenters used raw data in their experiments--where structured questionnaires served as data collection tools. In the questionnaire, two questions were asked about the behavior of endowment bias. Before the experiment, Bobde, Bagde and Goje make two hypotheses to evaluate mutual fund investors’ donation preferences:

Hypothesis 0: There is no striking difference in the behavior of investors when they find chances to create a profitable portfolio by selling the non-performing funds they owned or donated by their family and buy funds with performance.

Hypothesis 1: When investors find opportunities to create profitable portfolios by selling non-performing funds that they own or that their family donated to buy performing funds, there is a marked difference in their behavior.

Among them, if H0 is proved, it means that the investment decision is not dominated by endowment bias. On the contrary, if H1 is proved, it means that the investment decision is dominated by endowment bias.

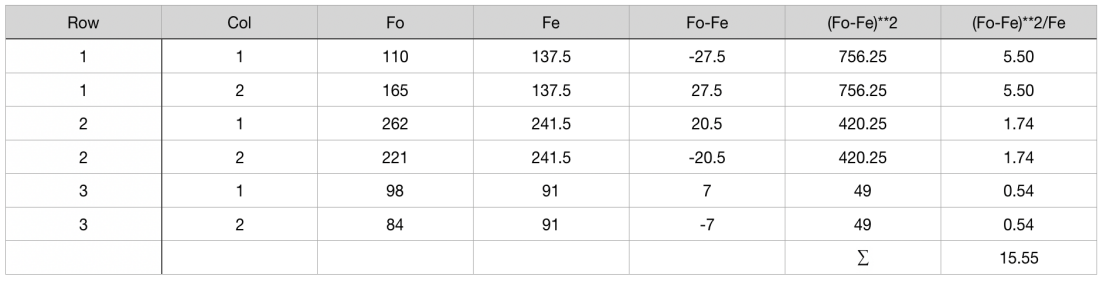

Q1: Investors were asked if they would be willing to sell their aunt’s endowed funds to buy performing funds. In this part, there are 262 investors do not want to sell the endowed funds, 110 want to sell it, and 98 can not decided.

Q2: Respondents were asked whether they wanted to sell the excess fund of same category to buy a fund with well performance. In case of commision aversion and purchased securities, 221 volunteers chose not to sale the fund while 165 choose to it and 84 were unable to decided.

Table 1: Calculation of chi-square.

Note: Data from Bobde A P, Goje N and Bagde P T [8].

It can be seen in table 1 that investor behavior is not significantly different, with endowment effect predisposing investors to hold the funds they endowed or bought by mistake, even though they are more likely to benefit from selling them.

The familiarity due to pre-ownership of funds create a sense of comfort for most investors, so the investor becomes emotionally attached to the entity he owns and the entity becomes more valuable to him when it comes to selling [9]. Investors’ emotional attachment to endowments or attachment to prior decisions show endowment bias in mutual fund investment decisions.

This result well reveals the negative impact of endowment effect on the investment field and can help investors to make more rational decisions by understanding endowment bias. However, this experiment ignores the influence of demographic factors on investment.

3.2. The Biases Influencing an Investor’s Behavior in India

A study of bias affecting investor behavior in India takes this question well into account. The methodology of this study is similar to the way of Bobde, Bagde and Goje’s research, both are based on a preliminary survey, developed a questionnaire, and surveyed Individual investors living in large cities in India by using a random sample [10].

The questionnaire consists of two parts. The first part mainly records the demographic factors of the investors for classification purposes. The second part is about the investment details, time horizon as well as sources of investment advice [11].

The sample size of the experiment is defined as individuals all across India who are concerned with financial investments and have basic knowledge of how the market operates. Among them, participants are concentrated in the 21-40 age group, and they are generally post graduates with fixed income. Therefore, all questioned investors can make rational investment decisions.

In addition to demographic factors, researchers also have a general understanding of investors’ investment factors through the second part of the questionnaire. Investors prefer less risky instruments such as fixed deposits, real estate and gold/commodities. The investment experience of the respondents is also clear. Most of the respondents (about 44%) are new investors or have only basic investment experience. From the perspective of the time horizon of the respondents’ investment, most of them prefer short-term investment, around 66% of the respondents choose to invest in one or two years. When respondents were asked to rank the different factors that mainly affect their investment-related decisions, it became obvious that the main factor affecting individual investments is profitability. About 50% of respondents ranked profitability first. At the same time, the source of investment information is very important given the high fluctuations in financial markets. Sources of information on investing include the Internet, newspaper articles, what friends and family say, new channels and financial advisers. According to the data, with 34 percent of respondents citing the Internet as the main source of information guiding their investment decisions.

After classifying and surveying the participating investors, the researchers began to analyze the endowment bias and its impact on investors.

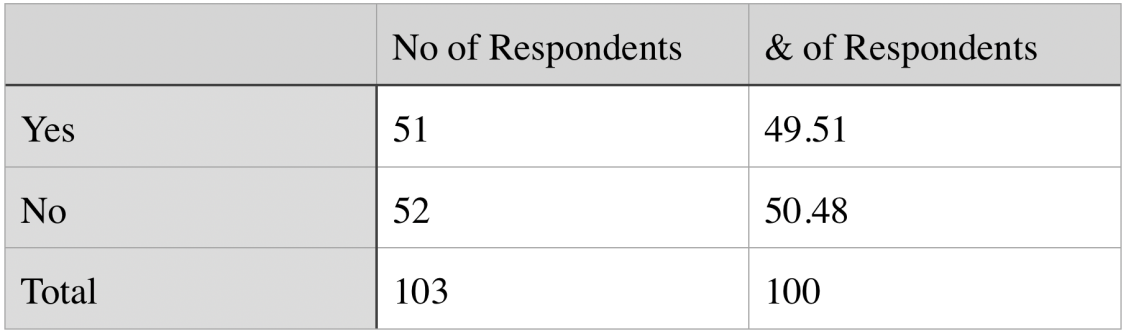

Q1: Investors were asked if they were willing to sell land that had fallen in price, bought for investment purposes, and make a profit. Fifty percent of the answers were yes, and the remaining 50% were no, those data are summarized in table 2.

Table2: Endowment bias 1.

Note: data from De S [10].

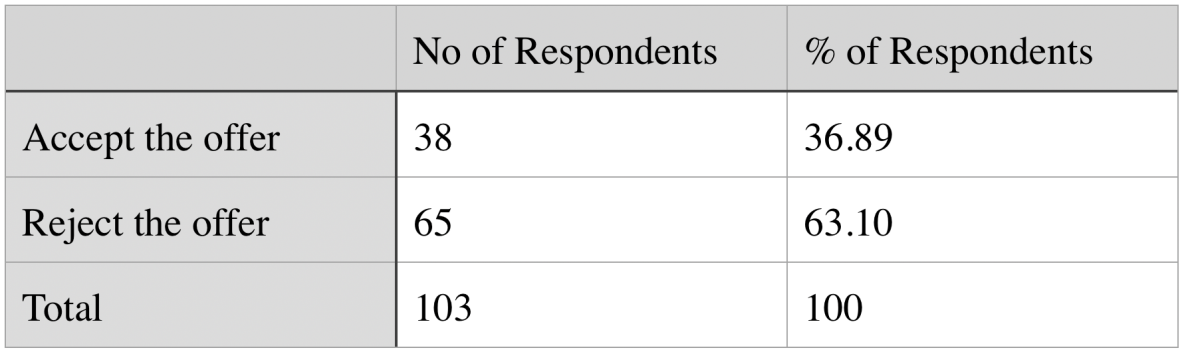

Q2: When the respondents were questioned if they would accept to sell the house at the market price in which they have been living, at a price lower than the asking price, 63% of them would prefer to reject the offer, which are summarized in table 3.

Table3: Endowment bias 2.

Note: data from De S [10].

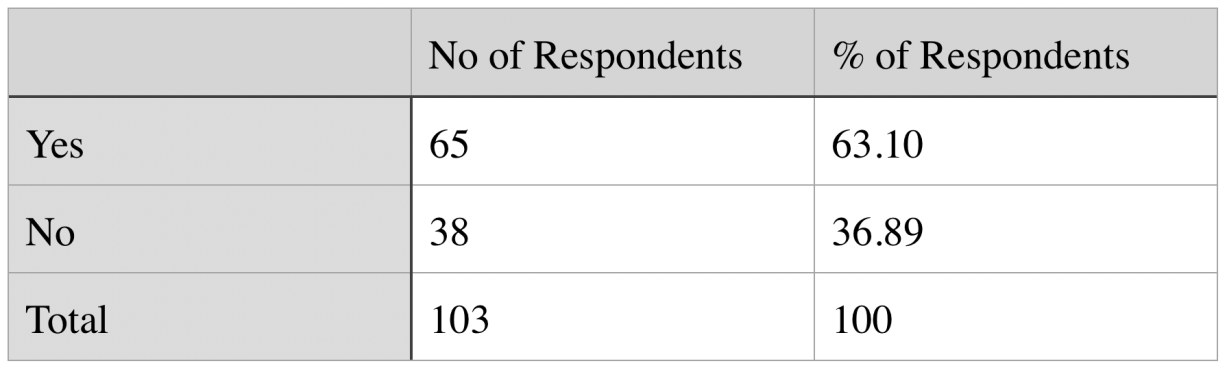

Q3: When respondents were asked if they would sell the gold jewelry they bought for their family if they were in financial difficulty and had no other options, 62% said they are willing to sell the jewelry and use the money to pay off their bills. As the data above in table 4, thirty-six percent are reluctant to sell.

Table4: Endowment bias 3.

Note: data from De S [10].

In Q1, half of people are reluctant to sell land that had fallen in price even without emotional dependence. They are optimistic about the land they own—which is one of the endowment bias embodiment, overconfidence. Buying land represents the behavioral recognition, and its corresponding balance of psychology is confidence in their investment products. This optimism comes from people’s psychology of instinct, rather than recognition of investment products. Q2 is also an example of endowment effect, where ownership causes people to become emotionally attached to the items they own, and this emotional attachment causes investors to overestimate the value of their own house [12]. In Q3, nearly two fifths of the people are not willing to sell the gold jewelry which bought for their family when the family economic difficulties. One reason is that some people think the price of gold products are likely to rise--optimism, another reason is that people have emotional attachment to gold bracelet. This kind of emotional attachment not only comes from ownership, but also the affection for the owners of gold jewelry—their families.

4. Conclusion

The two studies above revealed several characteristics of people's investment behavior, proved the impact of endowment bias on investment decisions, and analyzed the reasons. The results show that the decision-making of investors is a combination of psychological and financial decision-making of a person, in which endowment effect has a great influence on the process of psychological--the investor will be emotionally attached to the entity he owns, this confirm the idea advanced in behavioral finance that individuals do not always behave and make decisions rationally, giving us a clearer picture of how people make investment decisions. By understanding the impact of endowment bias on investment behavior, investors can make more rational investments and create greater benefits for themselves.

At same time, the researchers suggest that the investment decisions of investors vary according to demographic factors, and the extent to which endowment bias affects people depends on factors such as age, experience, education and seniority. However, due to certain limitations, empirical analysis of the association between endowment bias and demographic factors cannot be established. It is hoped that in future researches on endowment bias, researchers can further explore the impact of demographic factors and investment factors on endowment effect.

References

[1]. Junior F H F C, Famá R. As novas finanças e a teoria comportamental no contexto da tomada de decisão sobre investimentos[J]. REGE Revista de Gestão, 2010, 9(2).

[2]. Nofsinger J R. The psychology of investing[M]. Routledge, 2017.

[3]. Building academic success on social and emotional learning: What does the research say?[M]. Teachers College Press, 2004.

[4]. Paul A M. Promotional intelligence[J]. Salon. com, 1999.

[5]. Kahneman D, Knetsch J L, Thaler R H. Experimental tests of the endowment effect and the Coase theorem[J]. Journal of political Economy, 1990, 98(6): 1325- 1348.

[6]. List J A. Does market experience eliminate market anomalies?[J]. The Quarterly Journal of Economics, 2003, 118(1): 41-71.

[7]. Morewedge C K, Giblin C E. Explanations of the endowment effect: an integrative review[J]. Trends in cognitive sciences, 2015, 19(6): 339-348.

[8]. Bobde A P, Bagde P T, Goje N S. An Analytical Study of Psychological behavior of investors investing in Mutual Funds with reference to endowment bias & Self-control bias[J]. International Journal of Engineering Development and Research, 5 (4), 644, 2017, 648.

[9]. Schneider F W, Gruman J A, Coutts L M. Applied social psychology: Understanding and addressing social and practical problems[M]. Sage Publications, Inc, 2005.

[10]. De S . The Biases Influencing an Investor's Behavior in India[J]. Social Science Electronic Publishing.

[11]. Bashir T, Javed A, Butt A A, et al. An Assessment Study on the ‘’Factors Influencing the Individual Investor Decision Making Behavior[J]. IOSR Journal of Business and Management, 2013, 9(5): 37-44.

[12]. Beggan J K. On the social nature of nonsocial perception: The mere ownership effect[J]. Journal of personality and social psychology, 1992, 62(2): 229.

Cite this article

Pan,Y. (2023). The Application of Endowment Bias in the Field of Investment. Advances in Economics, Management and Political Sciences,13,177-182.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Junior F H F C, Famá R. As novas finanças e a teoria comportamental no contexto da tomada de decisão sobre investimentos[J]. REGE Revista de Gestão, 2010, 9(2).

[2]. Nofsinger J R. The psychology of investing[M]. Routledge, 2017.

[3]. Building academic success on social and emotional learning: What does the research say?[M]. Teachers College Press, 2004.

[4]. Paul A M. Promotional intelligence[J]. Salon. com, 1999.

[5]. Kahneman D, Knetsch J L, Thaler R H. Experimental tests of the endowment effect and the Coase theorem[J]. Journal of political Economy, 1990, 98(6): 1325- 1348.

[6]. List J A. Does market experience eliminate market anomalies?[J]. The Quarterly Journal of Economics, 2003, 118(1): 41-71.

[7]. Morewedge C K, Giblin C E. Explanations of the endowment effect: an integrative review[J]. Trends in cognitive sciences, 2015, 19(6): 339-348.

[8]. Bobde A P, Bagde P T, Goje N S. An Analytical Study of Psychological behavior of investors investing in Mutual Funds with reference to endowment bias & Self-control bias[J]. International Journal of Engineering Development and Research, 5 (4), 644, 2017, 648.

[9]. Schneider F W, Gruman J A, Coutts L M. Applied social psychology: Understanding and addressing social and practical problems[M]. Sage Publications, Inc, 2005.

[10]. De S . The Biases Influencing an Investor's Behavior in India[J]. Social Science Electronic Publishing.

[11]. Bashir T, Javed A, Butt A A, et al. An Assessment Study on the ‘’Factors Influencing the Individual Investor Decision Making Behavior[J]. IOSR Journal of Business and Management, 2013, 9(5): 37-44.

[12]. Beggan J K. On the social nature of nonsocial perception: The mere ownership effect[J]. Journal of personality and social psychology, 1992, 62(2): 229.