1. Introduction

In 2020, the COVID-19 swept through China's mainland, making the high-turnover housing enterprises worse. The prospect of the field became even bleaker. Many housing enterprises have begun to lay off employees and reduce wages, and the real estate industry has entered a downward period [1]. To be specific, the value of residential investment was 6,023.8 billion yuan in 2022, which has been sharply decreased to about 5.8% [2].

However, the real estate industry has been hit not just by COVID-19. As early as 2008, various housing enterprises have been walking on the road of high debt and high turnover. The model of relying on liabilities to auction land and build buildings and build buildings is inherently unsustainable because it is provided for urban land Give limited. The contradiction of real estate often leads to the bursting and looping of the asset bubble of debt default, where the economic cycle is the core contradiction of the instability of the financial market. In this period when deep reform is urgently needed, the new crown epidemic has broken out. It makes the funds in the hands of many people no longer abundant, and the real estate enterprises that are not full of cash flow are even worse. Therefore, the government aims to make the real estate industry sustainable and healthy. A series of policies have been introduced to help housing enterprises reduce debt. The "three red lines" are one of the influential policies. The introduction of this policy has tightened the financing channels and significantly reduced the scale of investment [3]. To explore the impact of real estate in the context of the epidemic due to the reactions of different groups, we will bring them to the masses of the people separately Fee-payers) [4], housing enterprises (producers) [5], government perspective [6] based on literature research methods and feature analysis methods. The analytical method is carried out in-depth and obtains the results of the objective study as much as possible. The rest part of the paper is organized as follows. The Sec. 2 will explain through income factor. The Sec. 3 will explain from market factor. The Sec. 4 will present the limitations and prospects while a brief summary will be given in Sec. 5.

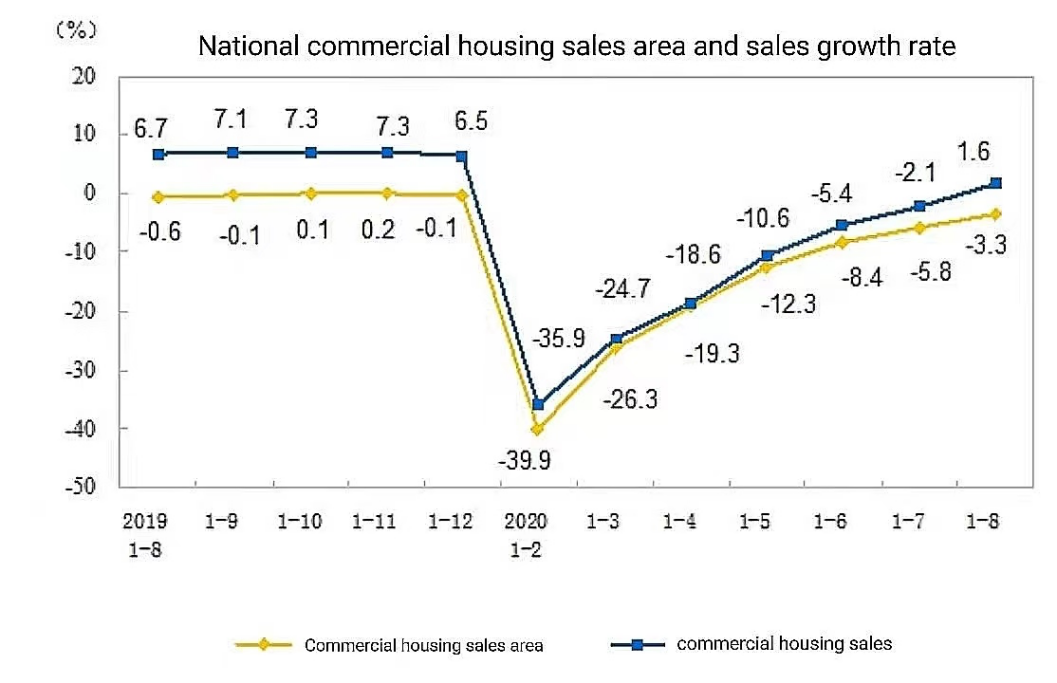

Figure 1: Real estate commercial housing sales and pending sales from January to August 2020.

2. Income Factor

Since 2019, the outbreak of the COVID-19, a major public health event, has had a great impact on China. During the epidemic, employees were unable to work in the company and had to work from home, resulting in a sharp drop in office efficiency. In addition, due to the outbreak of the epidemic, people have to isolate themselves at home, which greatly reduces the opportunity to go out and reduces the willingness and ability of residents to consume. Meanwhile, corporate sales fell, thus the profits fell. Especially in small and medium-sized enterprises, it is difficult to maintain the normal operation of the company. Therefore, in order to save the company's expenses, they had to choose to lay off staff. Layoffs have left a large portion of workers unemployed and their incomes reduced.

However, residents’ income is a significant factor in the demand for real estate products. The sharp decline in income has led households who originally had the intention and behavior of buying a house to abandon or delay their home purchase plan, weakening the willingness to buy a house, reducing purchasing behavior, and consumers being more interested in real estate. According to the official data, the consumption level of residents is indeed affected by the reduction in income under the new crown epidemic. From the data in Figure 1, especially from December 2019 to February 2020, when the epidemic just broke out, the sales area of commercial housing and the sales of commercial housing dropped significantly.

3. Market Factor

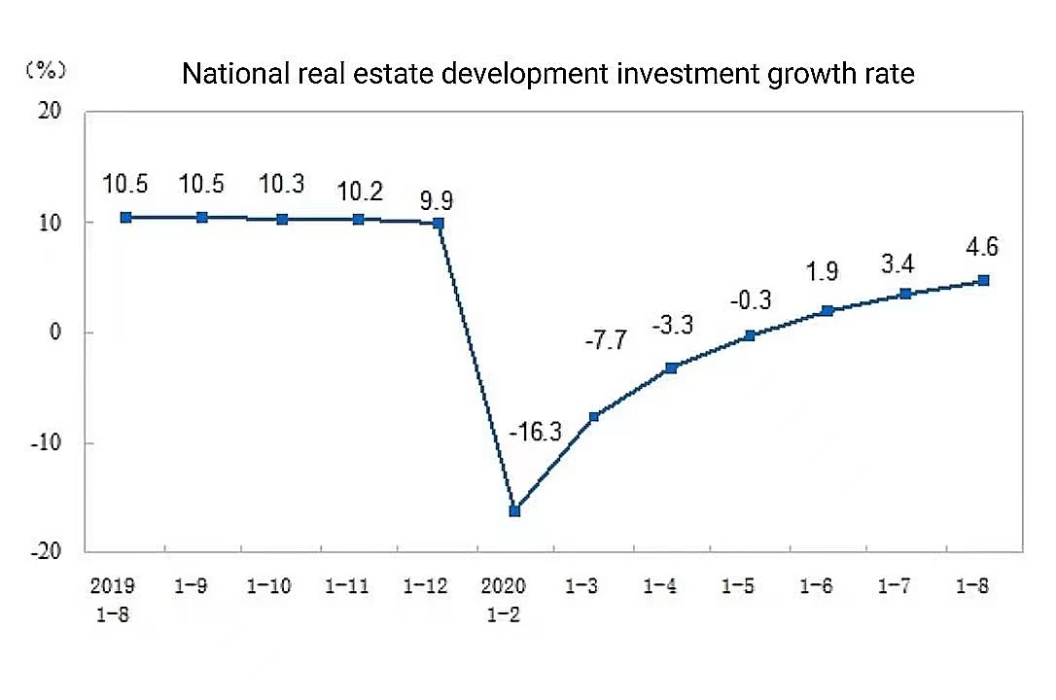

Affected by the epidemic, not only the income of residents has been affected, but the supply of housing companies has also been affected. To be specific, real estate construction had to be postponed or suspended. It was difficult to quickly resume production under the subsequent improvement of the epidemic situation, resulting in some real estate opening times later than the original time. In addition, the epidemic has caused many enterprises to lack funds and reduce investment in real estate development. Seen from Figure 2, the national real estate development investment was 1,011.5 billion yuan from January to February, decreasing of 16.3% than former year. Situations similar to this have caused a supply gap in the real estate market, which has caused many inconveniences and brought trouble to real estate consumers, thereby affecting real estate consumption behavior.

Figure 2: Real estate development investment completion from January to August 2022.

As an important uncertainty factor affecting the world, COVID-19 will undoubtedly have a certain impact on China's real estate industry. During the pandemic, the development of various industries is restricted and the income of most people is reduced, which leads to the demand for real estate will be delayed. From the perspective of real estate enterprises, relevant enterprises may modify the way of management or governance [7]. In the short term, the work stoppage "lockdown" and other factors may cause a certain impact on real estate enterprises [8].

During this period, the short-term operation of real estate enterprises was negatively affected, the transaction rate was reduced, and land transfer and enterprise resumption were limited. The related enterprise capital face is tight, small and medium-sized real estate enterprise debt repayment pressure increases [9]. The shutdown caused by the epidemic also involved the sales department of real estate enterprises, and offline sales activities were almost completely stopped. As a type of enterprise with high leverage and fast turnover, real estate enterprises undoubtedly bore huge pressure. Under these circumstances, many real estate enterprises will choose to lower the housing price and implement preferential policies to stimulate sales. Even if it will bring losses to the company, these losses will be short-term and limited. On the contrary, the rolling cash flow brought by such policies can bring greater profits to the next project [10].

In the short term, the land transaction volume will decrease, which will lead to a decrease in the quantity of real estate construction, which means that the newly started area, construction area, completed area, newly approved commercial housing and market area of real estate projects will decrease. However, in terms of medium and long-term impact, the recovery of real estate development depends on the recovery and development of the social economy. When the epidemic can be controlled, the state will encourage the resumption of production and work and provide support for real estate enterprises [11]. During the epidemic, many real estate enterprises are facing a crisis of survival. Mergers and acquisitions among real estate enterprises will be a very significant way of industry integration. When land resources are released, many real estate enterprises will carry out equity cooperation in various ways, and opportunities such as overall mergers and acquisitions will gradually emerge. The impact of the pandemic on the real estate market cannot be underestimated. A series of shutdowns caused by the epidemic have slowed down the development of the real estate industry, which has also affected the economic growth rate. However, this situation will not last for a long time. After the epidemic, the country and government will give support, and real estate enterprises will return to normal operation [12].

Local governments need real estate enterprises to purchase land to supplement finance, while local governments maintain the stability of the real estate market. Therefore, real estate enterprises can make profits in the stable real estate market to continue to operate. Thus, in the era of an epidemic, only when the real estate enterprises complete the land development process and complete the sales cycle, can the government ensure the normal operation of land finance in the future is sustainable [13]. Nevertheless, the current situation of the land auction market is not optimistic or even more severe than that in 2020. As shown in Table 1, from January to July of 2020, the area of land purchased nationwide dropped by 48.1% over the same period. It can be inferred that real estate enterprises can no longer carry out land development and provide land finance for the government. To this end, the government carried out macro-control and announced a series of measures, such as easing purchase and sales restrictions, increasing the proportion of provident fund withdrawals, and reducing payment and interest on housing loans.

Table 1: National real estate development and sales from January to July 2022.

Index | Absolute amount | Growth (%) |

Investment in real estate development (100 million yuan) | 79462 | -6.4 |

Including: residence | 60238 | -5.8 |

Office building | 3035 | -10.3 |

Commercial business premises | 6408 | -10.2 |

Building construction area (10000 square meters) | 859194 | -3.7 |

Including: residence | 607029 | -3.8 |

Office building | 33664 | -3.3 |

Commercial business premises | 77015 | -9.0 |

Newly started building area (10000 square meters) | 76067 | -36.1 |

Including: residence | 55919 | -36.8 |

Office building | 1904 | -35.4 |

Commercial business premises | 5202 | -37.5 |

Completed building area (10000 square meters) | 32028 | -23.3 |

Including: residence | 23279 | -22.7 |

Office building | 952 | -32.6 |

Commercial business premises | 2674 | -30.2 |

Land purchase area (10000 square meters) | 4546 | -48.1 |

Land transaction price (100 million yuan) | 2918 | -43.0 |

Sales area of commercial housing (10000 square meters) | 78178 | -23.1 |

Including: residence | 66087 | -27.1 |

Office building | 1838 | 9.7 |

Commercial business premises | 4750 | 6.2 |

Sales of commercial housing (100 million yuan) | 75763 | -28.8 |

Including: residence | 66328 | -31.4 |

Office building | 2480 | 3.1 |

Commercial business premises | 4772 | -2.0 |

Area of commercial housing for sale (10000 square meters) | 54655 | 7.5 |

Including: residence | 26092 | 14.1 |

Office building | 3905 | 5.1 |

Commercial business premises | 12352 | -3.5 |

Including: domestic loans | 11030 | -28.4 |

Utilize foreign capital | 53 | 20.7 |

Self raised funds | 31495 | -11.4 |

Deposit and advance payment | 28575 | -37.1 |

Personal mortgage loan | 14169 | -25.2 |

To sum up, the government has three purposes for regulation. Primarily, it is suggested to stimulate real estate market consumption to help real estate enterprises recover funds and reduce inventory pressure to prevent systemic financial risks. High debt and high turnover drive the growth mode of the development of real estate enterprises. At present, the debt ratio of real estate enterprises is generally 60% to 70%. From the perspective of debt structure, the debt of real estate enterprises mainly includes interest-bearing debt, interest-bearing debt, and implicit debt, where interest-bearing debt has three pressures on real estate enterprises: the pressure to repay the capital, the pressure to pay interest, and the pressure to default at maturity. When the proportion of interest-bearing liabilities due within one year of a real estate enterprise is too high, such as more than 30%, its short-term debt pressure will be high, the loan will be pinched, and the high turnover will not be there, which is also the fundamental reason for the debt default of the real estate enterprise in 2021.

In addition, it is also proposed to send a signal to increase the confidence of real estate enterprises, encourage real estate enterprises to purchase land to save the depressed land auction market, and ensure local fiscal revenue. The finance of major cities in China is highly dependent on land finance. In 2021, there will be 13 prefecture-level cities in China with more than 100% land dependence. Once the land finance support to the local government is stopped, according to the current land finance scale, the gap must be borne by individuals or enterprises. If individuals cannot bear it, the gap must be borne by enterprises, which means that the current tax burden of enterprises will double, resulting in two serious consequences: a large number of enterprises will suffer from loss deflation due to a large increase in enterprise costs. In this case, one has to reduce the business scale and go bankrupt. 3

We will continue to use real estate as the driving force for economic development to ensure stable and good economic development and achieve the annual GDP growth plan. The annual GDP target growth rate in 2022 is 5.5%. According to Table 2, China's GDP growth rate in the first quarter of the first half year and the second quarter year on year is 4.8% and 0.4% respectively, which means that if the original target is achieved, the average growth rate in the second half year must be 8%.

Table 2: Year on year GDP growth rate.

Particular year | Q1 | Q2 | Q3 | Q4 |

2017 | 7 | 7 | 6.9 | 6.8 |

2018 | 6.9 | 6.9 | 6.7 | 6.5 |

2019 | 6.3 | 6 | 5.9 | 5.8 |

2020 | -6.9 | 3.1 | 4.8 | 6.4 |

2021 | 18.3 | 7.9 | 4.9 | 4 |

2022 | 4.8 | 0.4 |

4. Limitations & Prospects

Since the exploration in this paper is carried out from multiple perspectives, the depth of research is not enough, and the exploration of many problems is only on the surface. Second, because the experience is not enough, the analysis of a lot of data may not directly reflect reality, and the analysis of data may not be accurate. In the future, we will cut from more perspectives and expand the depth of research based on more relevant data and complex analyzing approaches, as well as refer to the research results of others to enrich the results.

5. Conclusion

In summary, this article examines the factors affecting the real estate industry from the perspective of the COVID-19. According to the analysis, the purchasing power of consumers has been seriously weakened. To be specific, more people have turned to conservative consumption and real estate investment, and the growth rate has once dropped to negative values. Starting from the housing enterprises themselves, low-selling sales make most of the housing enterprises with huge liabilities face cash flow problems However, the cash flow problem is also the most restrictive problem for the expansion of housing enterprises. The series of shutdowns caused by the epidemic have reduced the development speed of the real estate industry, which has also brought about an impact on the economic growth rate. On the one hand, it is necessary to continue to transfer real estate as a driving force for economic development, ensure stable and good economic development, and achieve the annual GDP growth plan. On the other hand, it is necessary to stimulate property market consumption in a timely manner, help housing enterprises raise funds and reduce treasury pressure, prevent systemic financial risks, and release signals to enhance the confidence of housing enterprises. On this basis, it can encourage housing enterprises to buy houses in the land, save the depressed land auction market, and ensure local wealth and political income. This article broadens the breadth of real estate research and analyzes the plight of China's real estate market from multiple perspectives. It is conducive to sorting out the impact of the connection between various groups under the epidemic on the real estate market. Nevertheless, the study is not in-depth enough, and the analysis of some of the issues is not specific enough, and we will continue to delve into the problem later while looking for more perspectives that can be inserted. Overall, these results offer a guideline for analysis the impacts of certain issues on real estate market.

References

[1]. Liu, W.: The dark night forward of the local property owner: under the pressure of layoffs and salary reductions, choose to do not move according to the soldiers. China Real Estate Newspaper 07, (2021)

[2]. Stas Government of China. Retrieve from: http://www.stats.gov.cn /xxgk/sjfb/zxfb2020/202208/t20220815_1887364.html

[3]. Zhou, F., Chang, Z.: Research on the impact of the three red lines on real estate enterprises. China Storage and Transportation, vol.1, pp. 103-104, (2022).

[4]. Zhou, X.: The impact of the epidemic on the demand for real estate products and the market sales response strategy. Residential and Real Estate vol. 9, pp. 26-29, (2022).

[5]. Gao, J.: Discussion on the impact of the new crown epidemic on the management of transportation funds of real estate enterprises. China Management Informatization, vol. 23(16), 3 (2020).

[6]. Qi, D., Cheng, X.: A comparative analysis of real estate-related policies in China under the background of two rounds of epidemic. Shanghai Real Estate, vol.8, 3 (2020).

[7]. Huang, C., Liu, D., Wu, J., Xue, R.: On the impact of the epidemic on the real estate market and suggestions on the policy. vol.3, 5 (2020).

[8]. Wang, S.: Analysis of the impact of COVID-19 on the real estate industry. China Investment Development Report (2020).

[9]. Liu, Y.: The impact of the epidemic on China's real estate economy and the coping strategies of real estate enterprises. City dwellings, vol. 3, pp. 39-41 (2020).

[10]. Shi, H.: Analysis of the impact of the new pneumonia epidemic on the real estate market. China's Real Estate Industry, vol. 26, 262 (2020).

[11]. Li, Z.: Under the impact of the new crown epidemic, the real estate industry will usher in a high tide of mergers and acquisitions. China's real estate industry, vol. 22, pp. 42-43 (2020).

[12]. Liu Y.: Research on the current land and financial administration model in China. University of Sioux State (2012).

[13]. Cheng Z.: The CBRC investigated 60 large housing enterprises with a debt ratio of more than 70% in the capital chain. Enterprise reform and management, vol. 12, 1 (2010).

Cite this article

Lin,J.;Liu,Z.;Lu,J.;Wang,Z. (2023). The Effect of COVID-19 on China’s Real Estate Market via Different Angles. Advances in Economics, Management and Political Sciences,17,275-281.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu, W.: The dark night forward of the local property owner: under the pressure of layoffs and salary reductions, choose to do not move according to the soldiers. China Real Estate Newspaper 07, (2021)

[2]. Stas Government of China. Retrieve from: http://www.stats.gov.cn /xxgk/sjfb/zxfb2020/202208/t20220815_1887364.html

[3]. Zhou, F., Chang, Z.: Research on the impact of the three red lines on real estate enterprises. China Storage and Transportation, vol.1, pp. 103-104, (2022).

[4]. Zhou, X.: The impact of the epidemic on the demand for real estate products and the market sales response strategy. Residential and Real Estate vol. 9, pp. 26-29, (2022).

[5]. Gao, J.: Discussion on the impact of the new crown epidemic on the management of transportation funds of real estate enterprises. China Management Informatization, vol. 23(16), 3 (2020).

[6]. Qi, D., Cheng, X.: A comparative analysis of real estate-related policies in China under the background of two rounds of epidemic. Shanghai Real Estate, vol.8, 3 (2020).

[7]. Huang, C., Liu, D., Wu, J., Xue, R.: On the impact of the epidemic on the real estate market and suggestions on the policy. vol.3, 5 (2020).

[8]. Wang, S.: Analysis of the impact of COVID-19 on the real estate industry. China Investment Development Report (2020).

[9]. Liu, Y.: The impact of the epidemic on China's real estate economy and the coping strategies of real estate enterprises. City dwellings, vol. 3, pp. 39-41 (2020).

[10]. Shi, H.: Analysis of the impact of the new pneumonia epidemic on the real estate market. China's Real Estate Industry, vol. 26, 262 (2020).

[11]. Li, Z.: Under the impact of the new crown epidemic, the real estate industry will usher in a high tide of mergers and acquisitions. China's real estate industry, vol. 22, pp. 42-43 (2020).

[12]. Liu Y.: Research on the current land and financial administration model in China. University of Sioux State (2012).

[13]. Cheng Z.: The CBRC investigated 60 large housing enterprises with a debt ratio of more than 70% in the capital chain. Enterprise reform and management, vol. 12, 1 (2010).