1. Introduction

In recent years, with the progress and development of the economy, when a company's share price increases to a nominal level that may make some investors uncomfortable or is beyond the share prices of similar companies in the same sector, the company's board may decide on a stock split. A stock split can make the shares seem more affordable, even though the underlying value of the company has not changed. It can also increase the stock's liquidity.

When a stock splits, it can also result in a share price increase—even though there may be a decrease immediately after the stock split. This is because small investors may perceive the stock as more affordable and buy the stock. This effectively boosts demand for the stock and drives up prices. Another possible reason for the price increase is that a stock split provides a signal to the market that the company's share price has been increasing; people may assume this growth will continue in the future. These further lifts demand and prices [1]. But we don't know if the reality will match the theory. Although extensive research has been carried out the effect of stock split as a signal, no single study exists which the event of stock split has effect on price. Thus, this paper will study on whether stock split have effect to price. Furthermore, in 2022 Google and Amazon both underwent very special 1:20 stock splits. Therefore, this paper made them as the main subject of the event study.

The present research explores the effects of price due to stock splits. However, due to practical constraints, this paper cannot provide a comprehensive review of whether the impact was caused by the stock split alone.

This essay contains four main parts. Firstly, the article gives a brief overview of the literature on stock splits. The second chapter is concerned with the methodology used for this study, including market model and event study. Chapter three is the main part of this paper. It focuses on the results of the analysis of Google and Amazon data. The final section is about the conclusion and limits.

2. Literature Review

Numerous researchers such as Pavabutr, and Sirodom, Chen and Wu, and Yu, and Webb document that the stock market seems to underreact to stock splits, and frequently report that splits are associated with positive abnormal stock return [2-4]. Stock split is considered as an informational event that is accepted by its effect on stock return, marketability, volatility, and ownership structure. Fama et al. find that firms experience 30% percent excess return for two years before the month of split announcement [5]. Grinblatt et al. point a major critic on monthly data in study of Fama et al. [6]. They mention that the effect of other contamination announcements is neglected during the month that split is announced [6]. Grinblatt et al. by using sample stock that purified of other events report 3.94% excess return for three days around split announcement day, and by the help of these pure splits conclude the stock splits have valuation effects on the stock price [6] .

Grinblatt et al. also examine Ex-date^2 effects of stock splits on abnormal return, which indicate one percent abnormal return in Ex-date [6]. Although they try to argue that when-issued shares are the main reason of this effect in Ex-date, but authors could not find any reason for abnormal return one day before and two days after the ex-date [6]. They find a valuation effect for a pure split data with positive return, and conclude the stock splits convey some, but not perfect information, and that is more like as ambiguous and risky information [6]. Their results indicate an increase in return of all the pure data on the announcement date and conclude that is not only because of cash dividend payment, but also because of conveying information by split which managers implement to send a signal [6].

Desai and Prem examine the market reaction to stock splits for a large sample of 5,596 split announcements during the period 1976-91 and find 7.11% excess return in the announcement month [7]. Dennis and Strickland extend the abnormal literature by investigating the relation between liquidity and abnormal return and find firms with larger enhancements in liquidity have a large amount of excess return in the announcement day [8].

3. Data and Methodology

3.1. Data

This paper uses daily stock prices of Amazon, Google and NASDAQ Index as data, which is from ‘Yahoo Finance’. The time range of the data is approximately 2 years, starting from June 2020. NASDAQ was chosen because it is the same market as Google and Amazon. In order to be used in the event study method, the data was processed and the daily return on the stock was calculated.

3.2. Methodology

This is the market model.

\( {R_{t}}= α + β{R_{mt}} + {ϵ_{t}}… \) (1)

where \( {R_{t}} \) is the return of the stock (Amazon or Google) at time t, and \( {R_{mt}} \) is the return of the market (NASDAQ) at time t. \( α \) is the intercept, and \( β \) is a coefficient that measures the linear relationship between individual stock return and market return. \( {ϵ_{t}} \) is residual at time t.

This paper first finds a linear relationship between individual stock and the market before the event (Figure 5 and 6). After the event, the actual return of individual stock is compared with the predicted return of individual stock based on this linear relationship. If the difference is large, it means that the stock and the market no longer meet the previous linear relationship. In other words, events have had an additional impact on individual stock.

Event Study method was also used, which allows us to analyze the impact of an event on a company over a certain period of time.

Firstly, four events were defined, which are also four key dates.

On March 9, 2022, Amazon announced that it would execute a 1:20 stock split plan.

On June 3, 2022, Amazon split its stock.

On February 2, 2022, Google announced that it would execute a 1:20 stock split plan.

On July 18, 2022, Google split its stock.

Then this article select the estimation window and the event window in the obtained stock return data.

For Amazon, a total of 436 trading days from June 1, 2020 to February 18, 2022 was chosen as the estimation window. And a total of 24 days centered on the split announcement day was chosen as the event window.

For Google, a total of 412 trading days from June 1, 2020 to January 14, 2022 was chosen as the estimation window. And a total of 24 days centered on the split announcement day was chosen as the event window.

Then this paper use the actual individual stock return within the event window ( \( {R_{t}} \) ), and predicted stock return ( \( {\hat{R}_{t}} \) ) using the coefficients ( \( \hat{α} , \hat{β} \) ) in the estimation window and the market return ( \( {R_{mt}} \) ) in the event window. The difference between them is AR.

Since there are four events in total, we do the results four times.

\( A{R_{t}}= {R_{t}}-{\hat{R}_{t}}= {R_{t}} - (\hat{α} + \hat{β}{R_{mt}} + {ϵ_{t}})… \) (2)

where \( {AR_{t}} \) is abnormal return of the stock, and \( {\hat{R}_{t}} \) is the predicted return of individual stock. Here \( {R_{t}} \) is the return of the stock within the event window, and \( {R_{mt}} \) is the return of the market within the event window.

Then, to measure the impact of event over a given period, cumulative abnormal returns was used.

\( CAR(T) \) = \( \sum _{t=-T}^{T}{AR_{t}} \) …(3)

where \( 2T \) is the length of the event window.

Next, the hypothesis test is carried out in this paper.

Null hypothesis: AR \( = \) 0,Alternative hypothesis: AR \( ≠ \) 0

If the estimated value of CAR at some point exceeds the confidence interval, the null hypothesis should be rejected.

Finally, robustness is checked by changing the length of the event window.

4. Results and Findings

4.1. Study about Amazon

Amazon conducted a 1:20 stock split on June 6, 2022, the fourth stock split since the group went public. A 1:20 stock split means that each share owned will receive an additional 19 shares after the stock split. Amazon's stock rose two percent to $124.80 by the end of the day after the June 6 stock split.

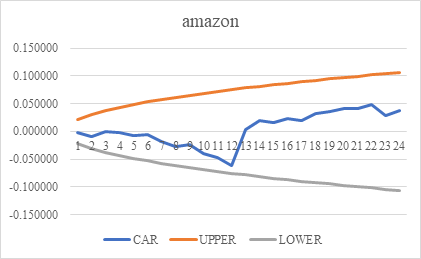

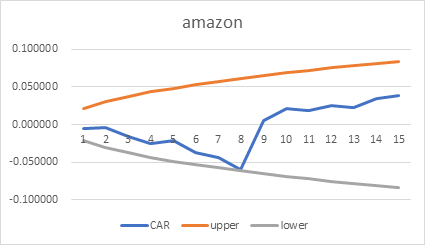

Figure 1: Amazon's announcement day event window.

Regarding the announcement day as the time window of the event, the results found that the cumulative abnormal returns are in the 90% confidence interval in Figure 1. So the null hypothesis cannot be rejected, which declares that the stock split has no effect on Amazon’s return during the period after they announce a stock split. But there is also an upward trend of CAR after the event date (day 12).

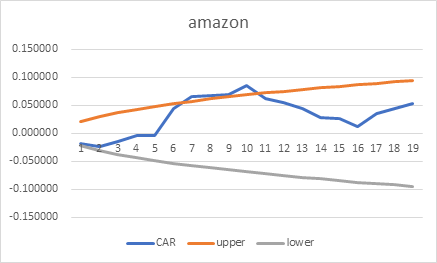

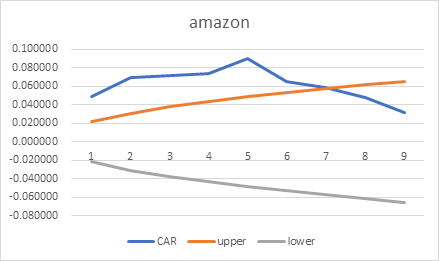

Figure 2: Amazon's implementation day event window.

Then consider the data in the event window for the day the stock split was implemented. As shown in Figure 2, the line diagram of CAR exceeded the 90% confidence interval from day 7 to day 10. So it rejects the null hypothesis that the implementation of the stock split has an effect on Amazon’s returns after they split the stock. It also shows that the line of CAR exceeds the upper bound, thus it has a positive effect on Amazon’s return.

The main reason for amazon's stock split is mainly due to the rapid growth of amazon's stock price. During the period of rapid development of technology stocks, amazon's stock also increased greatly, which would prevent many investors from entering amazon's stock market. However, Amazon's stock has been losing money this year, so the group is considering to split its stock so that more investors can join in. This applies to the idea that the stock split mentioned earlier might spur an increase in trading volumes. As a result, amazon chose to split its stock, and our data did show that the stock price was affected during our selected event window.

In addition, the decline in Amazon's stock price may be due to the Federal Reserve's decision to raise the benchmark interest rate and the Federal funds rate by 0.75 percent after its June 15 meeting. After the increase of the benchmark interest rate, the loan cost of individuals or enterprises from the bank will increase, which will shrink the credit and reduce the social mobility, thus making the price of Amazon stock fall back.

4.2. Study about Google

Google's stock split was implemented on July 18, 2022, the second time since the company went public, the first time Google officially implemented a stock split was in 2014, eight years after this one. Each Google shareholder received 19 additional shares for every one share held at the close of business on 1 July. Trading resumed on 15 July, and Google’s post-split adjusted stock was well-received by the market, showing gains of 1.28% and closing at $111.78.

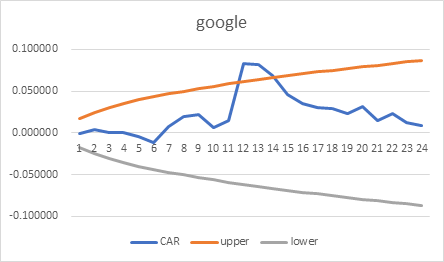

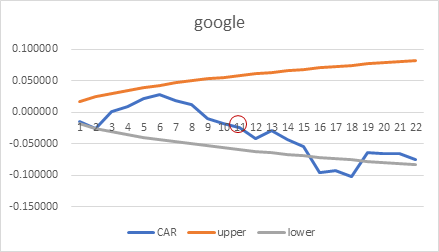

Figure 3: Google's announcement day event window.

Regarding the time window with the date of announcement as the event, the line graph of the CAR exceeded the 90% confidence interval from day 12 to 14 in Figure 3. Therefore, the null hypothesis was rejectes that the announcement of the stock split affects the post-split returns of Google stock. It also shows that the line graph of CAR exceeds the upper limit, indicating that it has a positive impact on Google's return.

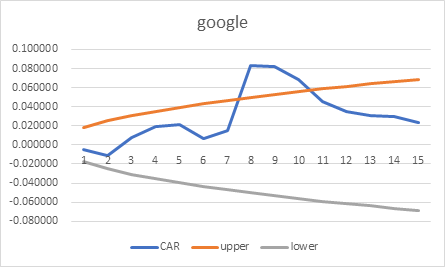

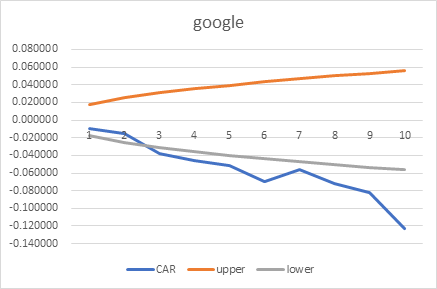

Figure 4: Google's implementation day event window.

Then observe data with the event window of a few days before and after Google's implementation of the stock split. As shown in Figure 4, the null hypothesis that the implementation of the stock split has no effect on Google's returns after they split the stock is rejected by the line diagram of CAR, which shows a deviation from the 90% confidence interval from days 15 to 18. Additionally, it demonstrates that the CAR line exceeds the lower bound, which has a negative impact on Google's return.

Along with the stock split announcement, Google released its Q4 earnings report, which beat forecasts across the board. Google's overall revenue, EPS, and cloud business revenue, which act as an engine for future growth, were all greater than expected for the quarter. Its stock price has outperformed the broader market with an annual total return of 44%, which is much higher than the S&P 500's 17% and above many of its competitors. This demonstrates that the management is optimistic about the stock price increase's future and believes that by lowering the entry barrier, more investors will be able to participate in it. Despite the positive earnings news, The Motley Fool, a stock analysis and investment website in the United States, issued a warning that Google shares cannot increase further because supply concerns will adversely damage its advertising business[9].

Alphabet's third-quarter revenue and profit fell short of market expectations, according to FactSet research [10]. Revenue growth has been growing slowly year over year, net profit has drastically decreased, and the company's core advertising business has seen a setback. Google's anxiety is growing as a result of this string of negative headlines.

Unlike this year's poor performance, shares of Apple (AAPL.US) and Tesla (TSLA.US) hit new all-time highs in the months following the stock split in 2020. Kim Forrest, founder, and chief investment officer of Bokeh Capital Partners, said investors in Google's parent company should not expect such price action will be repeated [11]. The stock split did little to boost the stock price due to widespread concerns about Fed rate hikes and cooling economic growth [11].

Figure 5: Robustness Check on the Event Window of Amazon's Announcement Day.

Figure 6: Robustness Check on the Event Window of Amazon's Implementation Day.

Figure 7: Robustness check on the event window of google's announcement day.

Figure 8: Robustness check on the event window of google's implementation day.

Also, after the Event Window for four events was shortened, the results are still robust (As you can see in Figure 5, 6, 7, 8). The four figures correspond to Figure 1, 2, 3, and 4 respectively. Although the changing trends of Figure 6 and 8 are not exactly the same as those of the corresponding Figure 2 and 4, this can still reject the null hypothesis. Therefore, the conclusion remains unchanged.

5. Conclusion

In general, the stock split did have an impact on both companies in the short term, but this paper cannot be sure whether it had a positive or negative impact, as it had a positive impact on Amazon and a negative impact on Google.

Fan said that so far this year, the Russia-Ukraine conflict, supply chain disruptions due to the epidemic blockade, higher-than-expected inflation levels, and slowing economic growth factors have had an unprecedented impact on the technology industry [12]. The slow growth of the entire industry is reflected in the Nasdaq Composite Index, which has fallen by more than 23%. Severe supply chain bottlenecks are a major cause of inflation spiking to historic peaks during the epidemic. Apple and Tesla in their recent earnings reports have both warned of supply chain risks [13]. These may indicate that the storied tech bubble is about to burst.

Looking back over the last five years, Google's P/E ratios are at low levels in terms of value concerns. The long-term outlook for Google is very positive, with upside potential in the advertising business through product/AI-driven upgrades and relatively rapid development in the YouTube monetization and cloud computing businesses. This is true even though tech stocks are still under selling pressure in the near term.

However, if the period of the time window was extended, the results find that the stock of Amazon has slipped about 20%, this is because inflation has had a significant impact on equities. The purchasing power of money declines in an economy with significant inflation, which has the effect of reducing people's wealth [14]. And interest rates are rising inflation. The rising inflation cause a higher costs on Amazon. Therefore consumers may buy fewer non-essential items on Amazon. These factor all couse the decreased trend of Amazon price.

But in the long run, stock splits are really important and have an impact on the company. As mentioned above, Amazon's stock price did drop, which helped attract more investors. It would be much easier to buy a split Amazon. That factor could help Amazon's stock eventually accelerate.

In general, through the analysis of the data, the stock split does have an impact on the stock price, but for a very large volume company, it is impossible for the stock split to affect its stock price volatility. A stock split may have a very significant impact on the stock price in the short term, say a week or so, but then in the long term, it can also have an impact on the stock price and the company itself in different ways, such as liquidity. In addition, our current data analysis only focuses on the single event of stock price and stock split. This article did not discuss the influence of other factors on stock split. For example whether they also affect stock risk also needs to be further discussed from the perspective of individual stocks and a group of stocks as portfolios.

References

[1]. Hogg, R. (2022) Will Amazon stock split help the share price rebound? https://capital.com/amazon-stock-split-2022-all-you-need-to-know.

[2]. Pavabutr, P., Sirodom, K. (2010) Stock splits in a retail dominant order driven market. Pacific- Basin Finance Journal,18: 427-441.

[3]. Chen, C., Wu, C. (2009) Small trades and volatility increase after stock splits. International Review of Economics and Finance,18: 592-610.

[4]. Yu, S., Webb, G. (2009) The effects of ETF splits on returns, liquidity, and individual investors. Managerial Finance, 35: 754-771.

[5]. Fama, E.F., Fischer, L., Jensen, M.D., Roll, R.(1969) The adjustment of stock prices to new information. Int. Econ. Rev, 10:1-22.

[6]. Grinblatt, M., Masulis, R.W., & Titman, S. 1984. The valuation effects of stock splits and stock dividends. J. Finan. Econ. 13, 461-490.

[7]. Desai ,H., Jain, P. C. (1997) Long-run common stock returns following stock splits and reverse splits. Journal of Business ,70(3): 409-433.

[8]. Dennis, P., Strickland D.(2003) The effect of stock splits on liquidity and excess returns: Evidence from shareholder ownership composition. Journal of Financial Research, 26(3): 355-370.

[9]. Wall Street Insight , (2022). Google Q4 earnings beat expectations across the board with new high net income, soaring 7% after announcing 20-to-1 stock split. https://baijiahao.baidu.com/s?id=1723596748874075903&wfr=spider&for=pc.

[10]. Wang, J. (2022) Google's parent company, Alphabet, misses third-quarter earnings expectations. Economic Reference News,008.

[11]. XingLang Finance, (2022). The era of $1,000 technology stocks comes to an end: Alphabet 1 split 20 effective today. https://baijiahao.baidu.com/s?id=1738692049227989658&wfr=spider&for=pc.

[12]. Fan, R. J.(2022) Snap share price collapse spooks U.S. tech stocks. China Banking and Insurance Journal, 008.

[13]. Qian, T. X. (2022) U.S. tech stocks sell-off. Apple loses world's top market cap. First Financial Daily, A04.

[14]. Li, J. (2017) A Study of the Relationship between Stock Returns and Inflation. China Market (13):18-20+22.

Cite this article

Ge,X.;Li,L.;Leng,H. (2023). The Impact of Stock Splits on Stock Prices. Advances in Economics, Management and Political Sciences,18,46-54.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Hogg, R. (2022) Will Amazon stock split help the share price rebound? https://capital.com/amazon-stock-split-2022-all-you-need-to-know.

[2]. Pavabutr, P., Sirodom, K. (2010) Stock splits in a retail dominant order driven market. Pacific- Basin Finance Journal,18: 427-441.

[3]. Chen, C., Wu, C. (2009) Small trades and volatility increase after stock splits. International Review of Economics and Finance,18: 592-610.

[4]. Yu, S., Webb, G. (2009) The effects of ETF splits on returns, liquidity, and individual investors. Managerial Finance, 35: 754-771.

[5]. Fama, E.F., Fischer, L., Jensen, M.D., Roll, R.(1969) The adjustment of stock prices to new information. Int. Econ. Rev, 10:1-22.

[6]. Grinblatt, M., Masulis, R.W., & Titman, S. 1984. The valuation effects of stock splits and stock dividends. J. Finan. Econ. 13, 461-490.

[7]. Desai ,H., Jain, P. C. (1997) Long-run common stock returns following stock splits and reverse splits. Journal of Business ,70(3): 409-433.

[8]. Dennis, P., Strickland D.(2003) The effect of stock splits on liquidity and excess returns: Evidence from shareholder ownership composition. Journal of Financial Research, 26(3): 355-370.

[9]. Wall Street Insight , (2022). Google Q4 earnings beat expectations across the board with new high net income, soaring 7% after announcing 20-to-1 stock split. https://baijiahao.baidu.com/s?id=1723596748874075903&wfr=spider&for=pc.

[10]. Wang, J. (2022) Google's parent company, Alphabet, misses third-quarter earnings expectations. Economic Reference News,008.

[11]. XingLang Finance, (2022). The era of $1,000 technology stocks comes to an end: Alphabet 1 split 20 effective today. https://baijiahao.baidu.com/s?id=1738692049227989658&wfr=spider&for=pc.

[12]. Fan, R. J.(2022) Snap share price collapse spooks U.S. tech stocks. China Banking and Insurance Journal, 008.

[13]. Qian, T. X. (2022) U.S. tech stocks sell-off. Apple loses world's top market cap. First Financial Daily, A04.

[14]. Li, J. (2017) A Study of the Relationship between Stock Returns and Inflation. China Market (13):18-20+22.