1. Introduction

The availability heuristics has significant implications in various domains, including marketing and stock market investments. In marketing, many marketing tools apply the availability heuristics to influence consumer behavior and attract potential clients to achieve the purpose of increasing sales. For example, the tool of pitching problems can make the solution seem more necessary to the consumer, thereby increasing the likelihood of a purchase. Additionally, marketers can use availability heuristics to promote their products by advertising the success or benefits of previous users. In the stock market, recent news or performance can lead investors to overestimate the likelihood of certain events due to the availability heuristics. When choosing stocks, investors tend to invest in stocks that are experiencing abnormal trading volume or have an extreme one-day return. As a result, they may make biased investment decisions that do not consider all relevant information.

This article will discuss the application of availability heuristics in various domains, focusing on marketing and stock market investing. Examples of how the availability heuristics can influence behavior and decision-making in each area will be provided through a review and analysis of the relevant literature. Additionally, the article discusses potential causes of possible biases in reliance on availability heuristics, or provide possible strategies to mitigate the problems, and illustrates the application of availability heuristics to marketing tools, and choosing stock.

2. Availability Heuristics

When considering the number of people killed by sharks and hippos, many people would overestimate the number of people killed by sharks and underestimate the number of people killed by hippos. This bias is caused by the availability heuristics, which is characterized by individuals relying on the ease of accessible or recallable information to make judgments and decisions, instead of a more thorough analysis of all relevant information. In people's impression, sharks are considered more ferocious than hippos, and when considering their lethality, the lethality of sharks is usually considered higher.

Tversky and Kahneman define availability heuristics as the phenomenon of determining the likelihood of an event according to the ease with which one can recall similar instances. The availability heuristics can be characterized as a cognitive shortcut in which people use the ease of imagining a particular outcome to estimate its likelihood. This means that emotionally charged possibilities are often perceived as more probable than those that are harder to imagine or comprehend. In essence, the availability heuristics serves as a rule of thumb for decision-making [1].

Compared to other biases or heuristics, availability heuristics focus on the ease of recall of information rather than the emotional attachment to existing preferences, resistance to change, initial reference points, or presentation of options. The availability heuristics operates on the principle that people judge the frequency or probability of an event based on how easily they can recall or imagine it, rather than on objective data or statistics. This mental shortcut can lead to flawed decision-making and inaccurate judgments, as it can cause individuals to overestimate the likelihood of more easily recalled or vivid events in their minds. Additionally, the availability heuristics can lead to stereotypes and prejudices, as individuals may rely on easily accessible information or stereotypes to judge groups or situations.

Therefore, Understanding the workings of the availability heuristics is essential for individuals and organizations to make better decisions and to avoid cognitive biases that can lead to sub-optimal outcomes.

3. Application on Marketing

In business, marketers apply availability heuristics on marketing tools to motivate purchases. This paper will interpret two marketing tools, pitching the problem and advertising the success or benefits of previous users, depending on the principle of the availability heuristics. Both of them are familiar with not only marketers but also consumers in the real business world and are practical marketing tools.

3.1. Pitching the Problem

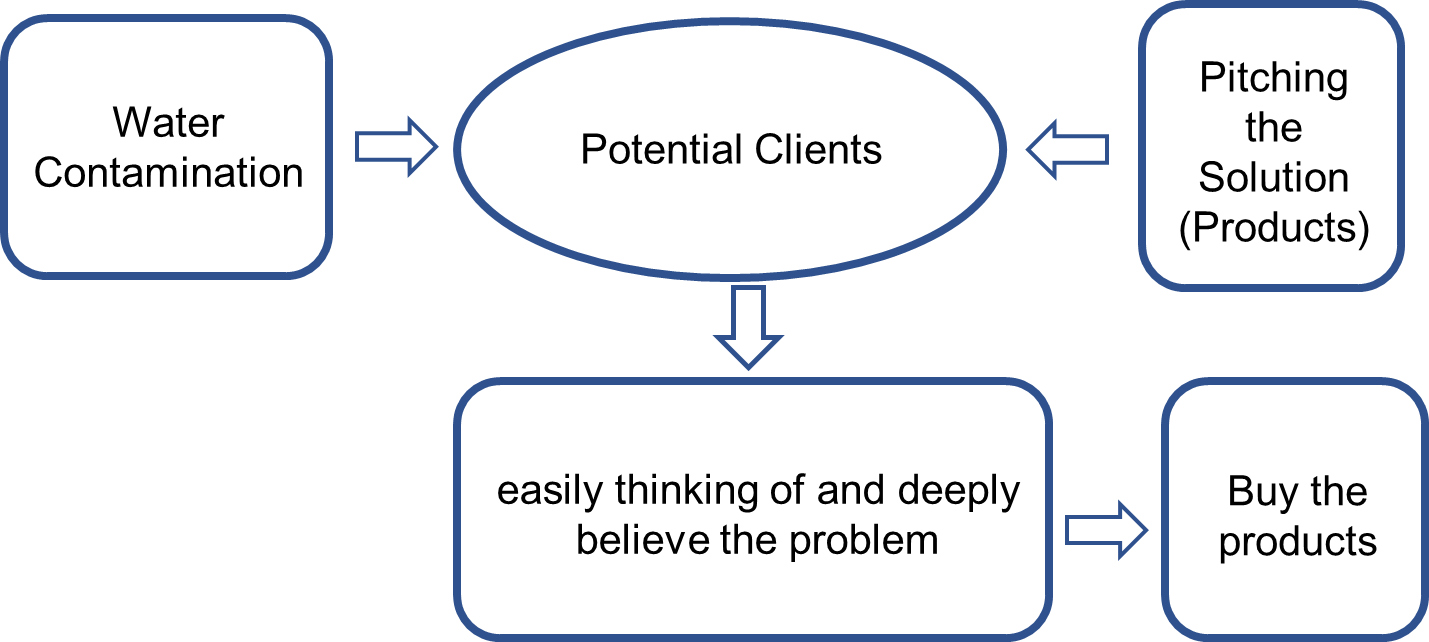

In the field of business, marketers are encouraged to seek solutions to problems rather than immediately trying to sell a product. To effectively sell solutions to potential clients, marketers must first pitch the problem to them. By doing so, the client easily recalls the issue and, as a result of the availability heuristics, tends to overestimate the problem's significance [2]. This overestimation increases the client's perceived need to solve the problem, making them more likely to purchase a product that offers a solution.

An example of pitching the problem is water filtration. A water filtration company might pitch the problem of contaminated tap water, highlighting the potential health risks. The company could then pitch its products, such as water filters or purification systems, as the solution to this problem. For clients, A lot of publicity of water contamination makes them believe the existence of the problem deeply without any research or deeper thinking of actual water quality. They believe that it is a severe problem that must be solved, thus when the company pitches them the products which can solve this problem, people would be prompted to buy these products.

Figure 1: Availability heuristics in water filtration.

3.2. Advertising the Success or Benefits of Previous Users

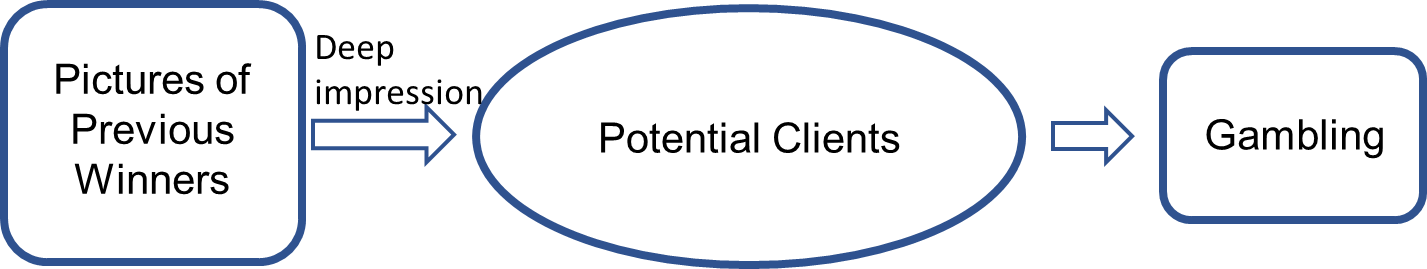

In addition to pitching the problem, marketers leverage the availability heuristics by showcasing the past performance of their products in the market or the benefits of previous users, making it easier for customers to envision success with their purchases [2].

For example, many casinos in Vegas post photos of past participants who have won from gambling and the amount of money they have won. These photos are always shown at the entrance of the casino. Through these pictures, customers might have a deep impression on the success of gambling, so when they hesitate about gambling, the expected probability of winning is high enough to make them participate in gambling. However, the actual probability of winning is much lower than their expectation. For example, the rate of keeping money for the roulette game ranges from 2.7% to 5.26%. Similarly, the data for the blackjack game ranges from about 0.5% to 1.5%. The data for slot machines can range from about 2% to 10% [3-5].

Figure 2: Availability heuristics on casinos in Las Vegas.

Numerous real-world examples indicate that pitching problems to increase demand can efficiently attract people to purchase commodities. Besides, if a marketer reveals the success stories of the company products to the client, there is a high possibility of the client purchasing the product.

As consumers, more research and deeper thinking can help us rationally identify our demands for products. For example, you can take time to consider what you really need, rather than what marketers tell you. This requires self-reflection and honesty about what you actually want and need. What’s more, we should be skeptical of claims and not be swayed by claims that seem real.

4. Application on the Stock Market

4.1. Investor’s Attention

Individual investors tend to display attention-based buying behavior when choosing which stocks to purchase. Specifically, they tend to focus on stocks that have recently captured their attention, such as those in the news, with high abnormal trading volume, or with extreme one-day returns. This pattern of behavior can lead to bias, particularly pronounced on days when attention is high and individual investors are net buyers. For example, they may overestimate the likelihood of a certain stock performing well based on recent news coverage or the availability of positive information. This section concludes three factors that can catch investors' attention [6]: trading volume, return, and news:

Volume: Investors tend to pay more attention to a stock when it experiences abnormally heavy trading volume. Through empirical studies, Barber and Odean discovered that order imbalance for these investors increases monotonically with trading volume and verified that abnormal trading volume might catch the attention of investors so that these stocks perform high order imbalance [6].

Return: Investors would probably pay attention to stocks that display significant price changes. Such price moves, whether upward or downward, are often linked to new information regarding the company. From the empirical studies, Barber and Odean find out that the order imbalance of investors at the large discount brokerage varies based on the previous day's return performance [6]. Individual investors exhibit a pattern of being net buyers after experiencing both extremely negative and positive one-day returns.

News: Firms that are in the news are more likely to catch investors' attention than those that are not. Barber and Odean find that stocks in the news may experience more serious order imbalance caused by the concentration of attention of investors [6].

In addition, the outcome availability effect is negatively correlated with the firms' market capitalization, and positively correlated with the stock beta, as well as with historical return volatility [7].

The availability heuristics affects investors' decision-making in the stock market. Due to the limited information available to them, investors tend to rely on recent and easily available information to make decisions about long or short positions. In this context, investors pay more attention to abnormal news and data that may impact the stock's price. However, this type of information can be misleading, as it often only represents a small portion of the available data and does not necessarily reflect the overall performance of the stock or the company.

Moreover, information asymmetry between investors and the firms they invest in can also contribute to the availability heuristics and lead to bias in decision-making. Investors may face higher search costs to access accurate and up-to-date information about the company's financials, which can be a challenge for individual investors. This can cause investors to rely on more readily available information, which may be incomplete or biased.

As a result, investors' reliance on availability heuristics can cause them to make inadequate investment decisions in volatile stock market. Overcoming the availability heuristics requires investors to be aware of the bias and to engage in a deliberate and systematic approach to information gathering and analysis. This may involve seeking out a wider range of information sources, developing a long-term investment strategy, and avoiding impulsive decision-making based on recent events or headlines. By doing so, investors can improve their investment decisions and minimize the impact of cognitive biases in the stock market.

5. Conclusion

In conclusion, the availability heuristics is a powerful cognitive shortcut that can significantly influence our behavior and decision-making processes in various contexts, leading to potential biases and sub-optimal outcomes. In marketing, it is often used to influence customers by pitching the problem and emphasizing the success or benefits of previous users, which can increase purchases of potential clients efficiently. In the stock market, the availability heuristics can lead investors to make biased decisions based on attention-grabbing events when they choose the stocks to invest in, such as extreme one-day returns, abnormal trading volumes and specific news. Recognizing and understanding the operating ways and limitations of the availability heuristics can help make more informed and unbiased decisions in all these areas.

References

[1]. Tversky, Amos & Daniel Kahneman (1973). Availability: A Heuristic for Judging Frequency and Probability. Cognitive Psychology, 4, 207-232.

[2]. Zhang, Z. (2022). Availability of Heuristics Marketing Psychology. In Proceedings of the 7th International Conference on Economy, Management, Law and Education (EMLE 2021), 329-333.

[3]. Thorp, E. (1984). The Mathematics of Gambling. [Book].

[4]. Epstein, R. A. (2009). The Theory of Gambling and Statistical Logic. [Book].

[5]. Krupkov, P. (2010). Probability Theory: A Comprehensive Course. [Book].

[6]. Barber, B. M., & Odean, T. (2007). All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors. The Review of Financial Studies, 21(2), 785-818.

[7]. Kliger, D., & Kudryavtsev, A. (2010). The Availability Heuristics and Investors' Reaction to Company-Specific Events. Journal of Behavioral Finance, 11(1), 50-65.

Cite this article

Lyu,H. (2023). Research on Applications of Availability Heuristics. Advances in Economics, Management and Political Sciences,21,165-169.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tversky, Amos & Daniel Kahneman (1973). Availability: A Heuristic for Judging Frequency and Probability. Cognitive Psychology, 4, 207-232.

[2]. Zhang, Z. (2022). Availability of Heuristics Marketing Psychology. In Proceedings of the 7th International Conference on Economy, Management, Law and Education (EMLE 2021), 329-333.

[3]. Thorp, E. (1984). The Mathematics of Gambling. [Book].

[4]. Epstein, R. A. (2009). The Theory of Gambling and Statistical Logic. [Book].

[5]. Krupkov, P. (2010). Probability Theory: A Comprehensive Course. [Book].

[6]. Barber, B. M., & Odean, T. (2007). All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors. The Review of Financial Studies, 21(2), 785-818.

[7]. Kliger, D., & Kudryavtsev, A. (2010). The Availability Heuristics and Investors' Reaction to Company-Specific Events. Journal of Behavioral Finance, 11(1), 50-65.