1. Introduction

In the modern world, the endowment effect is one important economic concept [1]. The focus of this economic concept is on how the decision-maker makes decisions and evaluates the worth of the deals they hold. At the same time, it continues to play a significant part in the economic activity in the real estate or land market [2]. The empirical examination about logical connections on endowment effect as well as peasant household rural land transferring preference is relevant to this paper's discussion on real estate and farmland market applications. There are examples of typical explanations for the common finding that selling prices exceed buying prices. It includes the assumption that buyers critically consider the future transactions by comparing their current deals and owners of products consider their possible loss is more serious and considerable than non-owners and buyers who consider their possible acquisition (the so-called endowment effect) [3].Regarding real-estate and land market applications, the empirical study of the connections between endowment effect and farmers’ rural land transferring willingness is pertinent [4]. The significance of evaluating the endowment effect is thus readily apparent after defining what the endowment effect is, what it is defined as in the rural-land market and why it matters. With the logical supporting of the three applications for the endowment effect, it is clear to see how it influences farmers' economic and consumption behaviour as well as how it creates a variety of situations when it interacts with various social hierarchies [5].

In order to establish academic conceptual foundations of endowment effect in this paper, academic papers that address the reference state, evidence, manipulations and survey about endowment effect under background of a college housing lottery, reference price theory of endowment effect, origin of private property's endowment effect as well as one article about the influences on the endowment effect upon in terms of households' farmland transfer are used [6].

In terms of the detailed data resource and application resources, the inquiry of 878 people in the Chengdu City, which is in the Sichuan Province, was discussed first [7], which tests endowment effects on various sorts of farmers whose rural homesteads may be lost. Then, it conducts an empirical analysis using a binary logistic model to probe emotional relationship, land-owning right situation as well as potential substitutability about rural homesteads which are used to evaluate diversity and vital elements about villagers' endowment effects which are associated with WRH. According to the findings, 70.62% of the tested villagers demonstrate extensive endowment effects following WRH. At the same time, the endowment effects on villagers grow as non-agricultural economic activity rises. With this application, it is obvious to see that this example could be the basic application of this paper which indicates the linear relationship between the potential factors with farmers' endowment effect.

Also, the second case about agricultural land transaction market and relevant situations in Shaanxi Province [8]. By setting market price as the benchmark to gauge magnitude of supplying-side as well as demanding-side endowment effect, this application redefines endowment effect which is relevant with agricultural-land management rights. Discrepancy about sellers' willingness to accept and rural land market renting price is known as supplying-side endowment effect. The difference between market renting price and purchasers' willingness to pay is classified as demanding-side endowment effect. Based on application, it could be regarded as the critical thinking of farmers' land market behaviour which means farmers also have possibilities to buy some other individuals' property.

A third case is about China's "three rights separation" policy for agricultural land [9]. This application offers inspiration and fresh perspectives on how the application will develop in the future. For instance, it used behavioural insights to construct the theoretical framework that examines effect about rural-land and agricultural property ownership on endowment effects from irrational viewpoints, which draws inspiration from China's "three rights separation" legislation. Its theoretical underpinnings and empirical analyses clarify how the "three rights separation" system's endowment effect about villagers is influenced by clarity, integrity and stability of subjective rural land and agricultural property ownership. With critical thinking about other applications and academic resources, the findings also serve as a reminder to the reader that when enacting reforms to land property rights, it is important to strike a balance between objective clarity, integrity, stability and the endowment effect. This could be used as a guide in the future to incorporate behavioural economics into the optimization of land-use policies.

Based on the three cases, this paper will evaluate the key factors which influence the extent of endowment effect such as emotional connection, the degree of substitution across items, income levels, price preference in the demand as well as supply side of land market, forecasted risk of future income, predictable danger of the farmland's property rights stability, the labour situation among different kinds of farmers, age, whether farmers belonged to cooperatives as well as if there is local intermediate organisation which is on the duty of land transferring. Also, critical thinking on how endowment effect has impact on supplying-side also with demanding-side of the land as well as property market, how could government provide guidance or make policies to fund the economic behaviour to support or decline the endowment effect in the land market as well as taking advantage of the chance to emphasise the importance of "three rights of separation" in the farm-land and agricultural market will be discussed in this paper [10]. The potential solutions are provided.

2. Applications on Rural Land Market

2.1. WRH Inquiry about Villagers from Chengdu City, China and Three-Rights-Separations in the China Rural Land Market

The rationality assumption is frequently used in classic economic research to explain how transaction participants behave. To that purpose, it should be noted that farmers frequently exhibit irrational psychological traits during land transactions, such as overvaluing the property they have contracted to sell and exercising excessive caution due to the possibility of loss. Additionally, farmers' "ownership effect" is strengthened by the growth of the endowment effect, supporting their assessment of loss as well as boosting their loss aversion.

However, about the detailed factors which may affect endowment effect in the rural-land and agricultural property market, family income level as well as situation, population scale, social security situation, homestead area situation, individual land as well as property building structure, property certificate owning, transit accessibility, public policies understanding, agricultural activities compensation standards as well as public welfare services are all elements that can influence villagers' inclination to leave rural homesteads. For example, in the example about exploring farmers’ voluntary as well as compensatory WRH in Chengdu. It shows that emotional connection modifies loss aversion by reducing the emotional pain associated with parting with an item. The stronger the endowment effects become, the more emotionally attached people are to certain things and the apparent loss become bigger. This emotional connection is sometimes linked to the length of time a person has monopoly power over a good. Rural homesteads in China guarantee the residence of villagers and their access to affordable lifestyles. For villagers, rural homesteads are more than just a source of income. They also serve as a source of pride in one's family and a psychological anchor [7].

Additionally, the degree of substitution across items was what caused the divergence of WTA (willingness to accept) and WTP (willingness to pay) for identical goods. They concluded that the loss of products' substitutability caused an endowment effect. The value of a good's objective functions to individuals is measured by its substitutability. For example, in WRH (the withdrawal from rural homesteads), the endowment effects get weaker with more dwellings a villager owns. The extent to which villagers were willing to leave their rural homesteads affected the magnitude of endowment impacts. The endowment effects were also influenced by household income levels. At the same time, the endowment effects are stronger the more substitution effect there is [7].

On the other hand, property certificates owning situation is one neutral variable. The villagers' understanding about homestead property rights and transactions will be clearer with the better ability to gather market information will be. The likelihood of a rural homestead property which they have right sale will be higher if there is enough market information. For instance, villagers typically have more logically, politically specified market-oriented cognition of rural homestead property rights and value in villagers with lower variation coefficient of villagers' abilities on receiving market information. As the result, there is a greater chance of a transaction occurring and they are more eager to receive the certificates which is about property rights. The villagers' understanding of property rights as well as the worth of agricultural properties and rural homesteads, however, are substantially varied with places where there is a significant variable coefficient in the residents' capacity to obtain market information.

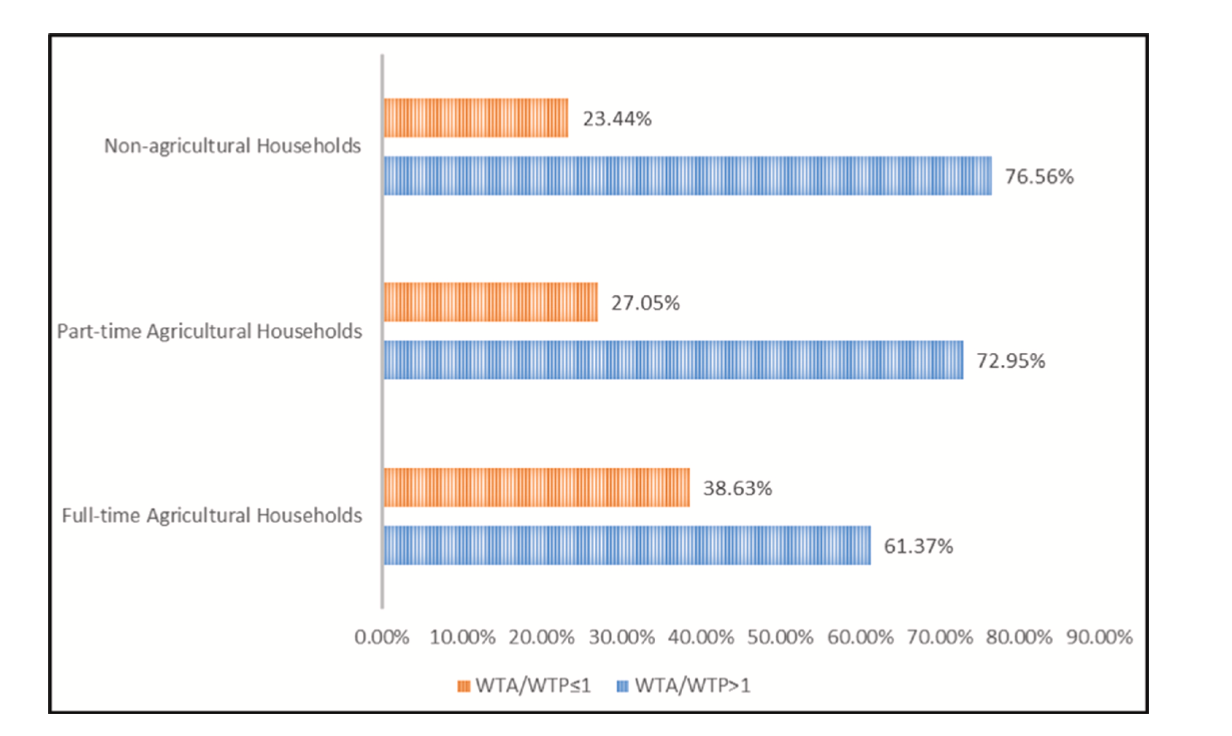

In terms of result of the survey,70.62% of the tested villagers show endowment effect one different degree, suggesting that endowment effect is mathematically prevalent as well as pertinent to WRH. There are three findings are drawn from this investigation. First, the extent of non-agricultural economic activity affects intensities, which in-turn shapes the endowment effects on villagers. From the Fig.1. below, the fraction of households engaged in full-time agriculture that display endowment effect is 61.37%. 76.56% of non-agricultural households are part-time farmers, compared to 72.95% of agricultural households. Second, emotional ties increase the level of suffering felt by villagers when they leave their rural communities, amplifying endowment effects. Third, analysis demonstrates that there are several ways of cognizing property rights and substitutability of endowment effects which depend on varied sorts of villagers [7]. In terms of full-time agricultural households, knowledge about mortgage rights improves safe feelings, which enhances their endowment benefits. Regarding substitutability, the ability of villagers to support themselves will have favourable impact on endowment effects in households that are fully engaged in agriculture and negative impact on endowment effects in non-agricultural households.

Figure 1: Diversities about endowment effects among varied types of farmers in terms of WRH.

2.2. Preference-Revealing in Land Transfer

In terms of the application, which is about the Shaanxi province’s farmers, the endowment effect is not just showing its impact on how the different kinds of villagers show their willingness to pay, the endowment effect could also affect the villagers’ price preference in the demand and supply side of land market.

For example, the endowment effect was demonstrated by 46.50 percent of the farmers during inquiry about market price measurement of rural-land transferring rents, which is established from results of supply-side endowment effects evaluation. In other words, minimum market renting price what farmers were willing to accept when they make trading on their rural land was higher than originally regional farmland market renting price [8].

However, supply-side endowment impact is not present on 53.5% in terms of farms. The survey interviews revealed there are primarily two causes which make this situation. First, some of the farmers interviewed believed that rural-land market’s supplying and demanding, rather than individual choice, drove rental rates of land-transferring. Since most of the transferred property was used to grow food crops and farmer enterprises already had meagre net profits, if price of transferred land was adjusted too high, none of farmers or villagers would sign contract.

Meanwhile, severe weather as well as natural disasters of some townships among the survey regions in 2018 and 2019 decreased crop yields, lowered food prices as well as dramatically decreasing villagers desire on transferring agricultural land although some villagers who actually don’t want to transfer their land. Second, there are a part of tenants in rural-land transaction market in some areas because of the small amount of arable rural land per capita as well as uneven distribution of plots. Most farmers who left their farms to go for additional working opportunities gave their rural-land to friends or relatives to utilise agricultural activities, which charges even one token sum of renting-price or charging none as one relative favour. As a result, some farmers were asked for prices that were equal to or less than market rates when they transferred their land.

From the data of this application, housing or property substitutability has one non-strong negative impact on the supporting of supply-side endowment effect. There are several causes for this. According to the survey and application, some villagers or farmers assess high value on their rural-land and agricultural property. For these farmers, farmland and agricultural property is still unparalleled. Although the intricacy of farmers' land has changed from complex to simple throughout the transition to a market economy, it is not completely erased. Although with their increased wealth and income, they felt secure if they owned one piece of rural-land or agricultural-land in their hometown. Also, it is now possible to choose to live in the urban area and travel back to the countryside for agricultural activities because the county town is only a one-hour drive away.

About the examination about the influence on demanding-side's endowment effect, villagers' subjective expectations own one strong positive impact on demanding-side endowment effect when it came about estimating its influence. Reason for this is that farmers tend to feel quite in charge of their land, which shows that they have a strong emotional bond with it. This enhances the psychological value of agriculture. Contrarily, people who care less on the agricultural-land as well as less dependent on the land, own the weaker relationship with the rural-land and experience one greater inclination about selling their farmland when the advantages of making this trading so are justifiable.

Also, households who have more farmers is accustomed to transfer labour by agricultural property and rural land. It is logically obvious that why farmers transfer or make trading on their land: when they choose to stay within their hometowns and transfer land, increasing the extents of labour resource utilisation and increasing their revenue. While deciding whether to contract land, farmers usually evaluate the farmland's fundamental situations in terms of infrastructure inputs. The endowment effect is significantly smaller when the infrastructure basic situation is good since demand-side farmers don't need to invest additional budget on it and contracting cropland is then considerable and profitable.

Because of the joining of intermediaries, villagers might be reluctant to transfer their agricultural land. That is because even after paying intermediaries the meagre income, they obtain from making agricultural activities on the land does not amount to much. In terms of agricultural resources endowment, one villager is more likely to over assess trading price of agricultural land as well as rural land transferring transactions while endowment effect become higher when villagers rate the fertility of the farmland they own under this situation.

In the survey result of this application, first, there were significant supplying-side as well as demanding-side endowment effects during transferring of rural land, which means 46.50% among tested villagers experience supplying-side endowment effects as well with one mean value of 93.17 about entire sample. Mean value in entire experiment sample is 260.56 and it is statistically to see 73.15% in all sampled villagers experienced demanding-side endowment effects. Second, there were many factors that had distinct effects on villagers between the supplying and demanding sides. Regards to farmers who produce on the supplying side, psychological dependency as well as objective dependence led to positive and obvious benefits to supplying-side endowment effects, while rural land and agricultural property substitutability showed one considerable adverse impact [8].

In contrast to expected emotion, which showed one substantial as well as negative impact on demanding-side endowment effect, cost perception as well as risk perception owned the considerable and positive impact on demanding-side farmers. Third, although the supply-side endowment impact dramatically declined with age among farmers, the demanding-side endowment effect increased significantly. Influence on household characteristics was in the similar relationship with supplying side as well as demanding sides. Furthermore, this application demonstrated the endowment impact on villagers, which could be used to encourage land transferring among both supplying-side and demanding-side villagers who was unaffected by the presence of transfer intermediaries. Instead, it markedly boosted endowment effect as well as preventing transferring of cropland because of unordered market information exchange and trading organizing.

2.3. Discussion and Potential Solutions

In summarizing of evaluation of application above, age, whether the farmers' families were on low-income level, whether villagers had connections with cooperatives as well as if there had one local intermediate organisation about rural-land transferring were all among controlling factors that may alter supplying-side endowment effect.

Villagers who had elder age tended to love and value the land more. They only moved off the property because they were physically unable to plant it, which means supplying-side endowment effect has been diminished as a result. Due to their greater reliance on agriculture, low-income households placed higher mental and acceptable value on agricultural-land in land-transactions. Contrarily, membership with the local cooperatives decreased likelihood of endowment effects in transferring of rural farmland.

To deal with current conflicts between China land-market supplying-side endowment effect with demanding-side endowment effect, the mental aspects and whole social welfare situations on villagers between supplying sides and demanding sides are necessary to be thoroughly considered in order to further promote enhancement and improvement of rural-land transfer market. At the same time, endowment effect of farmers on the transfer of agricultural land could be lessened in the following ways.

First, as a result of affirming the rural-land contracting rights management, relevant institutions should take advantage of the chance to emphasise the importance of the "three rights of separation" as well as properly direct farmers' understanding of agricultural property rights which could result in declining increasing and positive impact on villagers' mental and psychological dependence about endowment effect.

Second, when developing rural-land transferring subsidy policies, it is essential to completely respect villagers' rights as well as interests on land transferring and trading. It is also vital to ensure that farmers occupy dominant position during land transaction since farmers' objective dependency on farmland. The primary beneficiaries from land transaction are necessary to be farmers, which means households should have access to open, clear and exact transfer subsidies.

At the same time, local departments and governments need simultaneously enhance social welfare and security system about farmers' transactions on their land and reduce potentially risky factors on farmers' following rural land transferring. Finally, urban-rural binary structure and other institutional factors present several policy obstacles for migrant workers' citizenship. These difficulties point to household identifies registration, social welfare as well as security, educating accompanying children to the protracted citizenship process for migrant workers. In order to encourage the urbanisation of living model of migrant workers and raise enhanced substitutability of agricultural-land and rural life of farmers, it is logically available to speed up the reforming of agricultural household identifies transforming registration, reluctant employment, rural areas medical care, relevant areas' education conditions and housing situations that integrates urban as well as rural areas.

Furthermore, China central governments and local department could modify taxation policies to guide tax incentives as well as financial support more ag-friendly, considering the farmers' subjective expectations. Economic direct agricultural funding and subsidy polies, seed selecting and improvement subsidies as well as subsidies for purchasing of agricultural machinery, for instance, might lessen the villagers' or agricultural companies' operators' concerns about the state of the agricultural property, which results into encouraging the transfer of agricultural land. By setting up training sessions and creating practise grounds for the adoption of the use of effective agricultural land, the township government could do it another time, in terms of cost perception, to create professional and technical farmers who own strong agricultural skills and enhanced management expertise.

More crucially, it is vital to train agricultural companies' operators in managerial skills in order to create a new kind of agricultural enterprise with greater productivity and scale. Based on this, collaboration between large corporations and professional farmers can increase producing efficiency of agriculture industry and rural activities with fostering innovation as well as entrepreneurship. Also, the government can enhance public services (such as education, health facilities as well as basic conditions, social welfare as well as security and elder people's pension services) and infrastructure (such as transportation, water conservation, energy and digitalisation) in rural areas which could be regards as farmers' perceptions about potential life-risks to enhance rural-land transaction risk-prevention mechanism which also could supports villagers after land transaction.

Additionally, it is valuable to reconsider one innovative academic topic which is "three rights separation" reform among China rural land transferring market, which separates the ownership, contract as well as operating rights for farms. It could make the three levels about rural-lands' clarity, integrity and stability more developed. It makes no difference on the clarity of whether villagers have certificates on their individual comparable contract rights, operation rights or other rights [9] .However, it is essential to evaluate that there are varying degrees of subjective land ownership integrity because while integrated rural-land property rights is necessary to include subdivision rights like possession, using and benefit. It is obvious to see that the guidance of definition of disposal, rural-land contract signing rights and relevant agricultural activities operation rights are incomplete among the current China rural land market.

3. Conclusion

In this paper, to define the definition of endowment effect in China rural property and land transaction market, evaluate the key factors which have impact on the amounts of farmers who have the endowment effect as well as testing the differences between supplying-side as well as demanding-side of China rural land market, the author uses this statistic and information desk methodology which means reviewing the applications about Chengdu and Shaanxi farmers as well as critically thinking the “three rights separations” in China rural land market. In conclusion, the endowment effect is a key idea in economics that explains why selling prices frequently exceed buying prices. It is based on the idea that buyers carefully consider future transactions by comparing them to their current ones and owners of a good are more concerned about its potential loss than non-owners are about its potential acquisition. Regarding specific factors that may have impact on endowment effect in China rural-land and property market, family income conditions, population scale, social welfare as well as security, rural homestead total area, property building structure as well as infrastructure situation, owning of property certificates, transit accessibility, relevant policy understanding, public land-transferring compensation as well as funding standards and pertinent public services are all variables that may affect villagers' propensity to leave rural homes. At the same time, the endowment effect is not just affected by the experiment factors but also has impact on the farmers’ or people’s behaviour, which is back-up make the endowment effect more obvious. For example, the endowment effect is not only affecting the different types of villagers' willingness to pay; it may also influence the villagers' preferences for price on the supply and demand sides of the land market. Other control factors that could affect the supply-side endowment impact included age, whether villagers were belonged to cooperatives and whether there are existed local intermediary organisation that on duty of land-transferring. Older farmers tended to cherish and love the land more. They only left the property because they were unable to plant it physically. As a result, supplying-side endowment effect has been lessened. Since low-income level households relied more on agriculture, farmland had the higher acceptable value from them in their exchanges. In contrast, belonging to local cooperative declined possibility and extent of endowment effects during land-transferring of agricultural land. Psychological aspects and overall social welfare as well as security level of villagers on both supplying and demanding sides could be carefully re-thought in order to further promote improvement of rural land transferring market and resolve conflicts between land-market's supplying-side endowment effect and demanding-side endowment effect.

References

[1]. Weaver, R., and Frederick, S.: A Reference Price Theory of the Endowment Effect. Journal of Marketing Research, vol. 49(5), pp. 696–707. (2012).

[2]. Knetsch, J. L., & Wong, W.-K.: The endowment effect and the reference state: Evidence and manipulations. Journal of Economic Behavior & Organization, vol. 71(2), pp. 407–413. (2009).

[3]. Hou, C.: A Study of Influences of Endowment Effect upon Peasant Household’s Farmland Transfer Willingness in the Perspective of Property Rights Economics. Proceedings of the 2016 2nd International Conference on Social Science and Higher Education. (2016).

[4]. Wachter, S. M., & Megbolugbe, I. F.: Impacts of housing and mortgage market discrimination racial and ethnic disparities in homeownership. Housing Policy Debate, vol. 3(2), pp. 332–370. (1992).

[5]. Gintis, H.: The Endowment Effect and the Origin of Private Property. Institutional Change and Economic Behaviour, pp.160–177. (2008).

[6]. Nash, J. G., & Rosenthal, R. A.: An investigation of the endowment effect in the context of a college housing lottery. Journal of Economic Psychology, vol. 42, pp. 74–82. (2014).

[7]. Liu, R., Jiang, J., Yu, C., Rodenbiker, J., & Jiang, Y.: The endowment effect accompanying villagers’ withdrawal from rural homesteads: Field evidence from Chengdu, China. Land Use Policy, vol. 101, pp. 105-107. (2021).

[8]. Zhang, H., Li, J., Shen, J., & Song, J.: Measurement of Supply-and Demand-Side Endowment Effects and Analysis of Their Influencing Factors in Agricultural Land Transfer. Land, vol. 11(11), pp.2053. (2022).

[9]. Yan, J., Yang, Y., & Xia, F.: Subjective land ownership and the endowment effect in land markets: A case study of the farmland “three rights separation” reform in China. Land Use Policy, vol.101, pp.105-137. (2021).

[10]. Gintis, H.: The evolution of private property. Journal of Economic Behavior & Organization, vol. 64(1), pp.1–16. (2007).

Cite this article

Liu,T. (2023). The Endowment Effect in China Rural Land and Property Market. Advances in Economics, Management and Political Sciences,29,1-8.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Weaver, R., and Frederick, S.: A Reference Price Theory of the Endowment Effect. Journal of Marketing Research, vol. 49(5), pp. 696–707. (2012).

[2]. Knetsch, J. L., & Wong, W.-K.: The endowment effect and the reference state: Evidence and manipulations. Journal of Economic Behavior & Organization, vol. 71(2), pp. 407–413. (2009).

[3]. Hou, C.: A Study of Influences of Endowment Effect upon Peasant Household’s Farmland Transfer Willingness in the Perspective of Property Rights Economics. Proceedings of the 2016 2nd International Conference on Social Science and Higher Education. (2016).

[4]. Wachter, S. M., & Megbolugbe, I. F.: Impacts of housing and mortgage market discrimination racial and ethnic disparities in homeownership. Housing Policy Debate, vol. 3(2), pp. 332–370. (1992).

[5]. Gintis, H.: The Endowment Effect and the Origin of Private Property. Institutional Change and Economic Behaviour, pp.160–177. (2008).

[6]. Nash, J. G., & Rosenthal, R. A.: An investigation of the endowment effect in the context of a college housing lottery. Journal of Economic Psychology, vol. 42, pp. 74–82. (2014).

[7]. Liu, R., Jiang, J., Yu, C., Rodenbiker, J., & Jiang, Y.: The endowment effect accompanying villagers’ withdrawal from rural homesteads: Field evidence from Chengdu, China. Land Use Policy, vol. 101, pp. 105-107. (2021).

[8]. Zhang, H., Li, J., Shen, J., & Song, J.: Measurement of Supply-and Demand-Side Endowment Effects and Analysis of Their Influencing Factors in Agricultural Land Transfer. Land, vol. 11(11), pp.2053. (2022).

[9]. Yan, J., Yang, Y., & Xia, F.: Subjective land ownership and the endowment effect in land markets: A case study of the farmland “three rights separation” reform in China. Land Use Policy, vol.101, pp.105-137. (2021).

[10]. Gintis, H.: The evolution of private property. Journal of Economic Behavior & Organization, vol. 64(1), pp.1–16. (2007).