1. Introduction

In 2017, the Nobel Prize in Economics was awarded to the field of behavioral economics. Since then, behavioral economics has entered the public eye as a hot topic. The rational man hypothesis in western classical economics believes that man is completely rational and can make choices that maximize his own interests [1]. However, some economists disagree. In their view, economic behavior is rooted in social institutions and social psychology, and rationality is limited, which is not in line with classical economic assumptions. Behavioral economics combines psychology and economics discipline, which studies how people's behavior systematically deviates from the traditional assumption of a "rational person" in economics, that is, in what ways people behave irrationally. Researchers have found that humans are profoundly influenced by various behavioral economic theories, and that the anchoring effect is one of the most prevalent phenomena in everyday life.

In many cases, people start with an initial estimate and then adjust to arrive at the final answer. Initial values or starting points can be suggested by the formulation of the problem, or they can be the result of partial calculations. In either case, tuning is usually not enough. That is, different starting points will produce different estimates, which will be biased towards the initial value [2]. This is the definition of the anchoring effect. On the topic of anchoring effects, scholars have explored the possible mechanisms of basic anchoring and the relationship between these mechanisms and other judgment and correction processes, discussed the positive and negative effects of anchoring phenomena on human psychology and behavior, and the relationship between the setting effect and other psychological phenomena [3,4].

Some scholars have studied the anchoring effect of different markets, such as the Chinese art market [5]. This paper will take Luckin Coffee and Cotti Coffee as cases to study the reasons for the anchoring effect and how the anchoring effect affects consumers' consumption decisions. This study conducted a questionnaire among Chinese high school students to show the existence of anchoring effect and explain how individuals make consumption decisions. In addition, this paper explores factors that prevent people from being influenced by anchoring effects, including personal values, how they make purchasing decisions, and access to information. Finally, this paper gives corresponding suggestions from two perspectives of merchants and consumers, that is, how sellers can use the anchoring effect to deepen consumers' cognition and impression of products so as to increase sales, and how can consumers avoid falling into the consumption trap created by the anchoring effect and make more rational and objective decisions.

2. Conceptual Framework

According to the theory of behavioral economics, merchants know that most people are bounded rationality, that is, when people consider whether to buy goods, they are often limited by factors such as incomplete information, limited time, and limited cognitive resources, and cannot fully and accurately analyze problems and make decisions [6]. Optimal decision-making, so merchants use the influence of anchoring effects on consumers to formulate discount price strategies to increase sales. Part of the reason for the anchoring effect is information asymmetry. Therefore, the generation of significant anchoring effects depends on the reinforcement of information asymmetry. The so-called information asymmetry refers to the existence of information asymmetry between buyers and sellers of products on the quality and performance of products in market transactions. Usually, the seller of a product has more information about the product he produces or provides, while the buyer of the product has less information about the product he wants to buy [7].

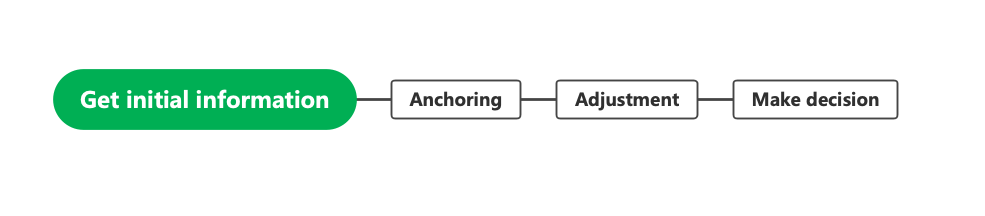

Figure 1: Flow chart of individual consumption decisions.

The above Figure 1 is the flow chart of how individuals make consumption decisions. Consumers have obtained some initial information, such as the original price of the product or the average price of the market. Due to the asymmetric information between buyers and sellers, consumers do not know the actual value of the commodity, so consumers use the initial information as a reference point or "anchor point" to estimate the value of the commodity. However, due to the existence of initial information, consumers may over-rely on anchors and ignore other information. This leads to the valuation of consumers will be biased towards the anchor point. Consumers then start to consider other factors, such as product quality, functionality, and brand reputation, to adjust estimated prices, but these adjustments are often insufficient. Finally, the consumer compares the estimated item value with the discounted price. If the estimated price is higher than the current price, consumers may feel that the product has a large discount and make a purchase decision. Conversely, if the estimated price is lower than the current price, consumers may feel that the price of the item is too high and will not buy it. Most consumers value the product higher than the current price, so consumers feel that they have made a profit, so consumers make a decision to buy the product.

3. Case Study on Cotti Coffee vs. Luckin Coffee

3.1. Background Information

Cotti Coffee is a coffee brand created by Ms. Qian Zhiya, founder and former CEO of Luckin Coffee, and the original core team of Luckin Coffee. Cotti's location, including its first store in Beijing, is in office lobbies, similar to Luckin's earlier entry into the market. In terms of products, Cotti specializes in coffee products such as raw coconut latte, thick milk latte and standard Americano, some of which have the same names as Luckin. In terms of product price, the current product price is between 20 RMB and 32 RMB [8].

The easiest way Cotti uses the anchoring effect to influence consumer decision making is through direct price cuts. Cotti recently launched its "Coffee Carnival in Hundreds of Cities and Thousands of stores", with more than 70 popular products on sale from 9.9 RMB until March 31, and a chance to invite new friends to get a free coffee. At the Cotti's store, there are lots of staff handing out coupons. The original price of the product is the anchor point for the consumer, who will make an estimate of the actual value of the product according to the anchor.

Take Cotti's product, the Classic Latte. The original price of the classic latte is 23 RMB. Consumers then compared their valuation of the classic latte with the price at which they could actually buy the classic latte, which is 9.9 RMB. Consumers then adjust the estimated value of the product considering other factors besides price. Cotti share the same core team with Luckin, and it is built by the founder and former CEO of Luckin [9]. In addition, according to media reports, during the merchants' meeting, Cotti mentioned Luckin many times, and even said that they could open stores next to Luckin. Since Luckin has a certain reputation and experience in the coffee market, Cotti uses Luckin's brand power as an anchor to make consumers' awareness of the quality and taste of Cotti's products rely on Luckin's products. At the same time, it also guides consumers to compare the prices of these two coffee brands, thereby affecting consumers' adjustments to the estimated value of Cotti's products. This anchor point makes consumers' adjustments to the estimated value even less sufficient. Under the influence of these two anchoring effects, consumers will be more inclined to buy Cotti's products.

Cotti went even further in the online group deals held by the Tik Tok platform. The 8.80 RMB free drink coupon is a hit with consumers. On March 12, Cotti sold 1,190,000 of the 8.80 RMB free drink coupon, according to the official Tik Tok platform, while the top-selling cherry latte sold 430,000 of the group's orders [10]. Luckin's group-buying also has the unintended effect of anchoring consumers, adding a comparable price for those who want to buy Cotti. The huge sales gap reflects the remarkable effect of Cotti's discounted pricing strategy based on the anchoring effect.

3.2. Questionnaire on Consumer Attitudes towards Cotti and Luckin

In order to study whether the anchoring effect exists in the sales of coffee and whether people are more willing to buy Cotti than Luckin, this paper conducted a questionnaire among Chinese high school students. A total of 117 valid questionnaires were collected for this survey. The questionnaire contains the following two hypothetical questions to test the existence of anchoring effect.

If a 300 milliliter medium cup of coffee is 19 RMB, and a 450 milliliter large cup of coffee is 21 RMB, would you choose to buy a medium or a large?

If a 300 milliliter medium cup of coffee is 19 RMB, and a 450 milliliter large cup of coffee is 28 RMB, would you choose to buy a medium or a large?

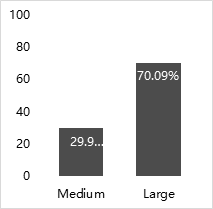

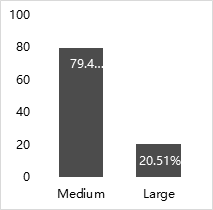

(a) (b)

Figure 2: Comparison of answers from question (a) and (b).

The results in Panel (a) of Figure 2 shows that 70.09% of respondents choose to buy a large cup, and among the answers about why they buy a large cup, 54.88% of respondents think that buying a large cup is cost-effective. In this question, the cost performance of a medium cup of coffee (the volume of coffee divided by the price) is about 15.79, and the cost performance of a large cup of coffee is about 21.43. It can be seen that the cost performance of a large cup of coffee is much higher than that of a medium cup.

However, the results shown in panel (b) of Figure 2 shows that 79.49% of respondents chose to buy medium cups, only 20.51% of respondents chose to buy large cups, and of the responses obtained about the reasons for buying medium cups, 56.99% of respondents believed that large cups were less cost-effective. In this question, the cost performance of medium cup of coffee is also about 15.79, and that of large cup of coffee is about 16.07. The cost performance of a large cup of coffee is still higher than that of a medium cup of coffee, but the number of respondents who choose to buy a large cup of coffee is 49.58% less.

In these two independent questions, the respondents were obviously affected by the anchoring effect. The anchor point is the cost performance of the large cup in the first question. People do not accurately calculate the cost performance of each coffee. In question (a), only considering the price, people will first roughly estimate the cost performance of two coffees with different capacities, and then make a comparison and choose the large cup with the highest cost performance. But in the question (b), people will also estimate the cost performance of the medium cup and the large cup, but they will not compare each other. The cost performance of large cups in the previous question is the anchor point for people, so even if the cost performance of large cups is still higher than that of medium cups in the second question, people will still not choose to buy large cups. In the answer to the first question about why buying a large cup, 33 people think that the medium cup is not enough to drink, but in the answer to the second question about why they buy a large cup, only 15 people think that the medium cup is not enough to drink. This also shows the existence of the anchoring effect, and the anchor point of cost performance makes consumers focus on cost performance.

The questionnaire also asked whether consumers are more inclined to buy Luckin or Cotti. In this questionnaire, 88.03% of the respondents had heard of or bought Luckin, and only 13.68% had heard of or bought Cotti. The anchoring effect should have been effective in the marketing of coffee. Cotti is cheaper than Luckin, but in fact 74.36% of respondents still choose to buy Luckin. Therefore, for Cotti, they needs to do a good job of advertising in the early stage to further increase its popularity. After the market stabilizes, anchoring can achieve the effect of increasing sales.

While discount pricing strategies can often create anchoring effects, not all consumers are affected by them. Here are some reasons why consumers may not be affected by the anchoring effect. The first factor is different consumers have different price sensitivities. For those consumers who are very price sensitive, the discounted price strategy may be more effective. For those consumers who are less concerned about price, the discounted price strategy may be less effective.

Second, the way consumers obtain information will also affect their cognition and impression of products. If consumers do enough market research or price comparison before buying, they may not be influenced by the anchoring effect created by the discount price strategy. Third, Consumers make purchasing decisions differently. Some consumers may comprehensively analyze the utility of products, and pay more attention to product quality and factors such as their own budget and health, rather than price. For such consumers, even if the price of the product is anchored at a higher point, they will comprehensively analyze utility to make purchase decisions.

In addition to the above three factors of consumers themselves, there are also environmental factors. Consumers may show different purchasing behaviors in different environments. For example, if a consumer purchases a product on the recommendation of a friend or relative, they may pay more attention to the product's quality and features than to the price. Therefore, whether consumers will be affected by the anchoring effect created by the discount price strategy depends on many factors, including personal values, purchase decision-making methods, and information acquisition channels.

4. Suggestion

From the perspective of merchants, the goal of merchants is to use the anchoring effect to make consumers make irrational consumption decisions. First, sellers can set a relatively high benchmark price, which can be the suggested retail price or market price of the product. This benchmark price can be seen as an anchor point that customers refer to when comparing prices, thereby linking price comparisons and pricing decisions to the anchor point. Second, sellers can strengthen the anchor point through marketing and advertising, so that customers can have a deeper understanding of the value of this anchor point. Sellers can also display a benchmark price on an item's label or description, or compare it to other products. Third, sellers can increase the attractiveness of goods by providing added value, so that customers will be more inclined to buy goods instead of comparing them on price. Such as offering free gifts, free shipping, or better after-sales service. Fourth, sellers can adopt a transparent pricing strategy. For example, in the early stage of product release, sellers can use limited-time discounts, buy gift activities and other promotional methods to attract consumers' attention, let customers feel that they have obtained affordable prices, and strengthen consumers' awareness and impression of products, thereby increasing sales.

Finally, sellers can use brand image building to allow consumers to choose their own brand first when choosing to buy products. At the same time, sellers can enhance their brand image by adding their own brand logo to product design and increasing brand promotion in the market, thereby increasing consumers' trust and loyalty to the brand. In short, through the above strategies, sellers can use the anchoring effect to deepen consumers' awareness and impression of products, so as to achieve the purpose of increasing sales.

From the perspective of consumers, in order to avoid falling into the consumption trap created by the anchoring effect, first of all, consumers should consider whether they really need these goods, spend more time collecting and comparing information, including referring to multiple different sources, and minimize information asymmetry with merchants to avoid over-reliance on a single anchor. Second, consumers should set a budget before shopping and try to avoid breaking it. This can help consumers better control their shopping behavior and avoid being attracted to high-priced items. Third, consumers should analyze the actual value of goods from a deeper perspective, rather than just focusing on the reference price, such as considering the function, quality, durability and other aspects of the goods. Fourth, consumers should be aware of their possible biases and consumption psychology, such as being aware that they may be influenced by the anchoring effect before making a purchase, and try to avoid it. Finally, discussing shopping decisions with others and listening to different opinions and suggestions from others helps consumers to think from different perspectives, so as to better avoid the impact of anchoring effect on them. Set up your own standards and goals, do not be controlled by the marketing means of merchants, and make more rational and objective decisions.

5. Conclusion

For the purposes of this paper, taking Luckin Coffee and Cotti Coffee as cases to study their anchoring effect, why there is an anchoring effect, and how the anchoring effect affects consumers' consumption choices. In addition, this paper distributes questionnaires to Chinese high school students, and collects and organizes questionnaire data in order to prove the existence of the anchoring effect and the thoughts of everyday consumers when they make consumption decisions. The paper concludes with a discussion of the factors that prevent people from being affected by anchoring, and offers suggestions for how anchoring can be used to increase sales and how consumers can make more rational consumption decisions. This paper mainly studies the anchoring effect of the catering industry. For this type of product, the anchoring effect is very significant, but there is also an anchoring effect for other large-value products in promotional activities such as Double 11. The anchoring effect in the sale of such high-value commodities is also worth analyzing. In the future, the classification of different commodities can be refined, and the anchoring effect in the sales of commodities with different characteristics can be studied to facilitate in-depth research on this topic.

References

[1]. Zhang Xukun. Differentiation and Analysis of the Hypothesis of Economic Man and Rational Man. Zhejiang Academic Journal (2), 9, (2001).

[2]. Tversky, A. , & Kahneman, D. Judgement under uncertainty: heuristics and biasis. Uncertainty in Economics, 185(4157), 17-34, (1974).

[3]. Wilson, T. D. , Houston, C. E. , Etling, K. M. , & Brekke, N. A new look at anchoring effects: basic anchoring and its antecedents. Journal of Experimental Psychology General, 125(4), 387-402, (1996).

[4]. Wang Xiaozhuang, & Bai Xuejun. Anchoring Effect in judgment and Decision. Advances in Psychological Science (1), 7, (2009).

[5]. Bian, T. Y. , Huang, J. , Zhe, S. , & Zhang, M. Anchoring effects in the chinese art market. Finance Research Letters(3), 102050, (2021).

[6]. He Daan. The Realization of Bounded Rationality of Behavioral Economic Man. Chinese Social Sciences (4), 11, (2004).

[7]. Yuan Gang. Application of anchoring effect in enterprise marketing from controllable factors. China Market (41), 4, (2013).

[8]. Beijing Business Today, http://m.bbtnews.com.cn/article/281113, last accessed 2023/3/15.

[9]. Cotti Coffee Homepage, https://www.cotticoffee.com/brand, last accessed 2023/3/14.

[10]. Tik Tok Homepage, https://www.douyin.com, last accessed 2023/3/15

Cite this article

Zhang,Z. (2023). Applying Anchoring Effect in Catering Industry ——A Case Study of Cotti Coffee vs. Luckin Coffee. Advances in Economics, Management and Political Sciences,29,9-14.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang Xukun. Differentiation and Analysis of the Hypothesis of Economic Man and Rational Man. Zhejiang Academic Journal (2), 9, (2001).

[2]. Tversky, A. , & Kahneman, D. Judgement under uncertainty: heuristics and biasis. Uncertainty in Economics, 185(4157), 17-34, (1974).

[3]. Wilson, T. D. , Houston, C. E. , Etling, K. M. , & Brekke, N. A new look at anchoring effects: basic anchoring and its antecedents. Journal of Experimental Psychology General, 125(4), 387-402, (1996).

[4]. Wang Xiaozhuang, & Bai Xuejun. Anchoring Effect in judgment and Decision. Advances in Psychological Science (1), 7, (2009).

[5]. Bian, T. Y. , Huang, J. , Zhe, S. , & Zhang, M. Anchoring effects in the chinese art market. Finance Research Letters(3), 102050, (2021).

[6]. He Daan. The Realization of Bounded Rationality of Behavioral Economic Man. Chinese Social Sciences (4), 11, (2004).

[7]. Yuan Gang. Application of anchoring effect in enterprise marketing from controllable factors. China Market (41), 4, (2013).

[8]. Beijing Business Today, http://m.bbtnews.com.cn/article/281113, last accessed 2023/3/15.

[9]. Cotti Coffee Homepage, https://www.cotticoffee.com/brand, last accessed 2023/3/14.

[10]. Tik Tok Homepage, https://www.douyin.com, last accessed 2023/3/15