1. Introduction

Fintech and digital transformation are some of the most popular topics in the financial industry right now. With the rapid development of financial technology, digital transformation has brought many opportunities and challenges to the financial industry. In terms of opportunities, digital transformation can help financial institutions achieve business growth and profit improvement by improving efficiency, reducing costs, and improving customer experience. Fintech can also meet the changing needs of customers through innovative products and services. Digital transformation can also improve the risk management capabilities of financial institutions, and better identify, evaluate, and respond to risks through technologies such as big data analysis and artificial intelligence.

During the widespread of the Covid-19 pandemic, digitalized fintech system seems to be more important since people got more concerned about touching or facing each other. As people were aware of social distances between each other, the field of using digital currencies and platforms is growing rapidly. People tend to realize how vital it is to make every transaction online so that they could minimize the possibility of getting sick. Thus, the duration of Covid-19 tends to cultivate a soil ground to make enterprises and their business digitalized. As technology is also constantly advancing, the combination of finance and technology became mainstream and digital transformation is engraved in people’s minds.

However, digital transformation also brings many challenges and risks. Digital transformation requires financial institutions to invest a lot of time, and human and financial resources and may require organizational structure and cultural adjustments. Digital transformation may also face risks such as security and privacy, requiring financial institutions to strengthen information security management.

Therefore, digital transformation requires financial institutions to take appropriate risk management measures, including but not limited to risk identification, risk assessment, risk control, etc. Financial institutions should formulate clear digital transformation strategies and plans, clarify risk management responsibilities and processes, and strengthen monitoring and management of supplier and third-party risks. In addition, financial institutions should focus on employee training and education to improve employees' risk awareness and management capabilities.

2. Blockchain & NFT

Blockchain technology and NFT technology can help companies achieve more efficient, safer, and more reliable transactions in the digital economy. Blockchain is one of the core technologies of digital transformation. The basic features of this database technology were outlined in 1991, but it was not until 2009 that the blockchain was first used in practice for the digital currency Bitcoin. Since then, the possible uses of blockchain have grown rapidly. Blockchain technology is a distributed ledger technology that can store and transmit data in a decentralized network and has the characteristics of non-tampering, decentralization, and transparency. NFT is a digital asset based on blockchain technology. Each NFT is unique and irreplaceable and can be used in digital copyright protection, art auctions, game asset transactions, and other fields.

The first application of blockchain technology, the emergence of virtual currency brought about by Bitcoin, makes free payment a huge advantage. As a decentralized, tamper-proof, point-to-point, free currency that cannot be tampered with transactions, Bitcoin makes every transfer record publicly published on the network by uploading relevant transaction information to the chain [1, 2]. Although all transaction information can be seen by everyone, personal information is hidden, which greatly guarantees the transparency and disclosure of information, Bitcoin's risk and volatility have always been one of its biggest problems [3]. This volatility is both a strength and a weakness of cryptocurrencies. This volatility characterizes the currency's limited supply (21 million bitcoins, of which at least 80% have been mined), while demand for bitcoins is constantly increasing. At the same time, it is precise because cryptocurrencies are not supervised that cryptocurrencies have become a method of money laundering. Because of the anonymity of their information, it is difficult to recover illegal property unless they have more than 51% of the computing power of the entire network.

As another application of blockchain, NFT's ability to help improve market efficiency is its most obvious advantage. Converting physical products into digital assets has the potential to improve supply chains, reduce intermediaries and increase security. At the same time, for some assets such as fine art, real estate, and expensive jewelry that are difficult to divide today, computer replicas of structures are easier to split among multiple owners than physical copies [4]. Digitization has the potential to significantly expand markets for specific assets, increasing liquidity and prices. Enterprises can use NFT technology to create and trade unique digital assets, expand the business scope and increase profitability. Alone, it has the ability to improve the structure of financial portfolios, allowing greater diversification and more precise position sizing. From a technical point of view, because NFT is created based on blockchain technology, it inherits the tamper-proof and unmodifiable characteristics of blockchain, making every transaction safe and traceable, and can also be used for Confirmation of rights in the virtual digital economy. However, because NFTs are still in their early stages, the industry is illiquid. Second, NFTs themselves do not generate income, unlike stocks and bonds or real estate whose owners receive dividends, interest, and rent, NFTs do not provide such income. The return on NFT investment, just like the return on antiques and other collectibles, is based on price appreciation. At the same time, the value of the virtual currency is also another factor affecting its own price, making its own risk uncontrollable.

3. Robo-Advisor & Artificial Intelligence

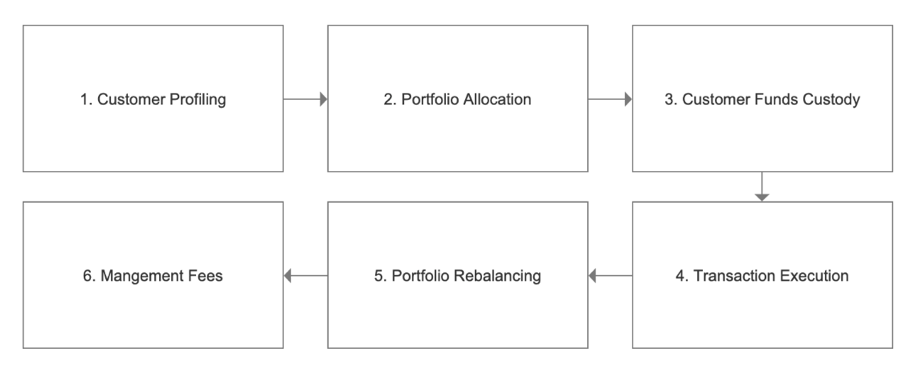

One of the growing applications of artificial intelligence (AI) in the financial technology (FinTech) space is robo-advisors. A robo-advisor is a fully automated online advisory platform that helps investors manage their wealth through specific algorithm-based portfolio allocation. The implementation of robo-advisors is inseparable from the support of AI, which can help improve the performance of robo-advisors and reduce risks, with make characteristic to be a significant feature for robo-advisor [5]. By applying methods derived from human intelligence, such as machine learning, neural networks, and big data analytics, AI can improve outcomes at scales beyond humans. In financial services, AI can also use a series of intelligent algorithms and theoretical models such as investment portfolio optimization according to the risk tolerance level, income goals, and style preferences provided by individual investors to provide users with the ultimate investment reference and provide market insights, and give suggestions for asset allocation rebalancing. A typical robo-advice should mainly consist of the following steps in Figure 1. The investment platform provides a comprehensive service to its customers that includes customer profiling, portfolio allocation, customer funds custody, transaction execution, and portfolio rebalancing. The customer profiling process involves assessing the customer's investment objectives and risk tolerance using questionnaires. Based on the customer's risk preferences, the system recommends a personalized portfolio from a pool of alternative assets. Customer funds are transferred to a third-party custodian, and the platform acts as an agent to execute trading instructions to buy and sell assets. Regularly, the platform monitors and adjusts positions in real-time based on market conditions and changes in user demand through portfolio rebalancing. Corresponding management fees are charged for the service provided.

Figure 1: Main steps for robo-advice.

Robo-advisors can be divided into fully-robot-advisors and semi-robot-advisors. Full robo-advisor means that the asset allocation advice is completely given by the artificial intelligence algorithm of the robo-advisor, and only the necessary limited intervention or no intervention is done manually. It is mainly used in investment portfolio construction and transaction execution. However, whether human intervention should be discussed is the issue. For people of different occupations, people of different ages, and whether AI can recognize human expressions and tone are some issues worthy of consideration [6].

However, there are also a number of investment advisory products in the current market that do not have relevant fund investment advisory business qualifications, but inexperienced people cannot control this risk. At the same time, under the current regulatory environment, the risks and returns for banks to develop robo-advisory businesses are insufficient, and they lack the motivation to continue exploring [7]. Customers generally have low-risk appetite for bank wealth management business, because investment portfolios that only include equity funds are prone to losses and cause customer loss; in order to reduce the probability of losses, banks need to add deposits, wealth management, fixed income funds, and other products to investment combination. However, the supervision has not yet introduced the investment specifications of relevant fund products, which makes a large number of products not have the corresponding qualifications, making more people deceived [8].

At the same time, if robo-advisors are incorporated into the financial regulatory framework, regulators and the robo-advisor market will send a signal that robo-advisors and their platforms need to be supervised rather than laissez-faire. However, if the regulations are too vague, and the regulatory norms involved are not enough to cover the existing or potential problems in the development process, the legal regulations will become a mere formality, making it difficult to implement at the regulatory level.

4. Peer-to-Peer Lending

P2P lending brings many benefits to fintech and digital transformation. P2P lending is an emerging financial model that connects borrowers and investors through the Internet platform, and refers to direct lending between individuals through the Internet platform. Peer-to-peer lending provides an alternative form of financing, allowing people who have traditionally been unable to obtain financing from traditional financial institutions to obtain financial support. This approach not only provides funds for borrowers, but also provides investors with high-yield investment opportunities, attracting more people to participate. This mode of connecting both parties is not available in traditional banks. Secondly, the P2P lending model realizes the digitization of financial services and accelerates the process of digital transformation of the traditional financial industry. Digital financial services can not only improve service efficiency, but also greatly reduce operating costs, improve service quality, and better meet user needs [9]. In addition, through digitization, transactions between borrowers and investors can be more transparent, reducing fraud and risk. Last but not least, the P2P lending model can also foster financial innovation. More personalized and diversified financial products and services can be developed on the P2P lending platform to meet the needs of different groups of people. At the same time, digital financial services can also provide more data analysis, enabling financial institutions to better understand the needs of borrowers and investors and provide more accurate financial services [10].

However, with the rapid development of online lending, the problems exposed by online lending will become more prominent, which will not only affect the security of funds but also disrupt the financial order. Negligence of its risk may cause the funds in the middle of the loan to be stranded, causing liquidity risk, credit risk, and operational risk, and increasing the risk of illegal activities such as money laundering and cashing out [11, 12]. The credit risk of P2P lending is relatively high. While the default rate is relatively low, there is no government insurance and no way to recover funds if a borrower defaults [13]. Meanwhile, due to the innovative changes brought about by digital transformation, it may bring some challenges to P2P lending. For example, the digital transformation of banks and other financial institutions may allow them to better process loan applications, which could expose P2P lending platforms to more competition [14]. Additionally, P2P lending platforms may need a digital transformation to better handle large amounts of data and customer interactions.

To sum up, P2P lending has some advantages and disadvantages in the field of Fintech and digital transformation. Although low-interest rates are a big advantage to attract borrowers, they come with higher credit risk. At the same time, P2P lending faces challenges from regulatory shortcomings and digital transformation.

5. Online Payment

With the development of digital transformation, more and more people choose online payment as payment method, so this technology brings many advantages for fintech and digital transformation. Online payment is a method of payment through the payment interface provided by a third party and the bank [15]. The advantage of this method is that the funds can be directly transferred from the user's bank card to the website account, and the remittance will arrive immediately. Manual confirmation is required. The security of online payment is guaranteed by the bank. When the user chooses online payment and needs to fill in the bank card information, he has actually left the server of this site and arrived at the payment gateway to the bank. The payment gateways of major banks in China all adopt internationally popular SSL or SET encryption to protect information from being stolen [16]. Compared with traditional payment methods, online payments can be easily and quickly conducted through mobile applications or websites, and consumers no longer need to go to physical stores to buy goods or use cash to pay. This makes it easier for consumers to purchase goods and services and helps make transactions more efficient [17].

Online payment can promote the development of the digital economy. Online payments can enable more people to participate in the digital economy, and both consumers and businesses can make better use of digital payments and e-commerce to promote business growth and expansion. In addition, digital payment can also promote the development and innovation of fintech, enabling fintech companies to better provide customers with more services and solutions [18]. Although the development of financial technology has brought many innovations and conveniences, there are still some challenges and risks. For example, since fintech companies are usually start-ups, they may face a shortage of capital and talent and lack a stable revenue stream and customer base. In addition, since the business of financial technology companies usually involves the transmission and storage of financial and personal information, they must have a high degree of security and privacy protection capabilities, otherwise, they may face information security risks and user trust issues.

In terms of digital transformation, online payment also has some challenges and obstacles. In many cases, traditional financial institutions may have built large IT systems and infrastructure, which are often complex, outdated, and difficult to update [16]. Therefore, digital transformation may require a lot of investment and time, and it also needs to face technical risks and personnel training challenges [19]. In addition, digital transformation may change the operation mode and business model of traditional financial services, which may affect and threaten existing business and profit models [20]. In conclusion, fintech and digital transformation bring many advantages and opportunities, but at the same time, many challenges and risks need to be faced. Therefore, when undertaking fintech and digital transformation, enterprises should comprehensively assess their risks and opportunities, formulate appropriate strategies and plans, and at the same time strengthen security and risk management measures to ensure the long-term success and stable development of their businesses.

6. Conclusion

This paper mainly discusses the impact of fintech and digital transformation and their risk management. The paper mentioned some of the advantages and challenges of fintech and digital transformation, as well as strategies to deal with them in terms of risk management. Blockchain, as a new coming out technology, was first built as making digital currency, bitcoin, which made a tremendous impact on the present currency system. As its derivative product, NFT has led the way in transferring substantial products to digital currency, which gives a new solution to the present financial system. The robo-advisor is also a brand new application that uses artificial intelligence to be the primary technology that gives human advice on stock portfolio allocation. As more and more AI technologies come up, such as ChatGPT, the traditional way of finance would ultimately pass and the whole financial system would be smarter. The pandemic of Covid-19 has also changed people’s life and the social system as well. During the Covid-19, people tend to use less real money but more digital currency, which has brought up the trend of using peer-to-peer lending and online payment. By using digital assets instead of real ones and using computers instead of lending money face to face, Covid-19 has accelerated the process of making enterprises and firms to be digitalized. Overall, the review of the present system may contribute to helping future research further explore the new ways for fin-tech and digital transformation and put some implications of other relevant technologies that can be combined with the traditional finance system.

References

[1]. Bitcoin - Open source P2P money. https://bitcoin.org/en/Bitcoin - Open source P2P money. https://bitcoin.org/en/, last accessed 2023/3/10.

[2]. Wu, J., Liu, J., Zhao, Y., & Zheng, Z.: Analysis of cryptocurrency transactions from a network perspective: An overview. Journal of Network and Computer Applications, 190, 103139 (2021).

[3]. Urquhart, A.: The inefficiency of Bitcoin. Economics Letters, 148, 80–82 (2016).

[4]. Bao, H., & Roubaud, D.: Non-Fungible Token: A Systematic Review and Research Agenda. Journal of Risk and Financial Management, 15(5), 215 (2022).

[5]. Faloon, M., & Scherer, B.: Individualization of Robo-Advice. The Journal of Wealth Management, 20(1), 30–36 (2017).

[6]. Zhang, Z.: Legal issues and regulatory paths of intelligent investment advisory under the background of artificial intelligence. Hebei Enterprise, 381(04), 141-143 (2021).

[7]. Wang, Q., & Xu, Y.: Is Intelligent Robo-Advising Really Intelligent? Financial Market Research, 89(10), 105-118 (2019).

[8]. Zhang, Q.: The Duty of Good Faith Based on the Perspective of Intelligent Robo-Advising. Modern Business, No.549(32), 136-137 (2019).

[9]. Hamarat, Ç., & Broby, D.: Regulatory constraint and small business lending: do innovative peer-to-peer lenders have an advantage? Financial Innovation, 8(1), 73 (2022).

[10]. Milne, A., & Parboteeah, P.: The Business Models and Economics of Peer-to-Peer Lending. Social Science Re-search Network (2016).

[11]. Wang, C.: Research on Credit Risk of P2P Online Lending Based on Text Analysis. South China University of Technology (2020).

[12]. Suryono, R., Purwandari, B., & Budi, I.: Peer to Peer (P2P) Lending Problems and Potential Solutions: A Sys-tematic Literature Review. Procedia Computer Science, 161, 204–214 (2019).

[13]. Serrano-Cinca, C., Gutiérrez-Nieto, B., & López-Palacios, L.: Determinants of Default in P2P Lending. PLOS ONE, 10(10), 0139427 (2015).

[14]. Liu, H., Qiao, H., Wang, S., & Li, Y.: Platform Competition in Peer-to-Peer Lending Considering Risk Control Ability. European Journal of Operational Research, 274(1), 280–290 (2019).

[15]. Guo, X., Zhou, T., & Jiang, B.: Design of B2C Online Payment Interface Based on ASP.NET. Modern Electronics Technique, 32(06), 97-99+103 (2009).

[16]. Hu, Y.: Research on Online Payment Network Security Risks and Prevention Technologies. Network Security Technology and Application, 160(04), 120+124 (2014).

[17]. Cheng, S., & Zhang, L.: Third-party Payment - An Evolutionary and Stable Strategy for Online Payment. Journal of Nanjing University of Technology (Social Science Edition), (04), 66-68+75 (2007).

[18]. Li, X.: The Impact of Online Payment on E-commerce. China Foreign Investment, 272(17), 42 (2012).

[19]. Xia, L.: Research on Online Payment Issues in E-commerce. Academic Forum, (05), 55-57 (2001).

[20]. Rong, F.: Liquidity Risk Assessment and Control Strategy of Third-party Payment in E-commerce. E-commerce, 148(04), 47-49 (2012).

Cite this article

An,S. (2023). The Impact of Digital Transformation on the Financial Ser-vices Industry: A Comprehensive Review. Advances in Economics, Management and Political Sciences,30,36-41.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bitcoin - Open source P2P money. https://bitcoin.org/en/Bitcoin - Open source P2P money. https://bitcoin.org/en/, last accessed 2023/3/10.

[2]. Wu, J., Liu, J., Zhao, Y., & Zheng, Z.: Analysis of cryptocurrency transactions from a network perspective: An overview. Journal of Network and Computer Applications, 190, 103139 (2021).

[3]. Urquhart, A.: The inefficiency of Bitcoin. Economics Letters, 148, 80–82 (2016).

[4]. Bao, H., & Roubaud, D.: Non-Fungible Token: A Systematic Review and Research Agenda. Journal of Risk and Financial Management, 15(5), 215 (2022).

[5]. Faloon, M., & Scherer, B.: Individualization of Robo-Advice. The Journal of Wealth Management, 20(1), 30–36 (2017).

[6]. Zhang, Z.: Legal issues and regulatory paths of intelligent investment advisory under the background of artificial intelligence. Hebei Enterprise, 381(04), 141-143 (2021).

[7]. Wang, Q., & Xu, Y.: Is Intelligent Robo-Advising Really Intelligent? Financial Market Research, 89(10), 105-118 (2019).

[8]. Zhang, Q.: The Duty of Good Faith Based on the Perspective of Intelligent Robo-Advising. Modern Business, No.549(32), 136-137 (2019).

[9]. Hamarat, Ç., & Broby, D.: Regulatory constraint and small business lending: do innovative peer-to-peer lenders have an advantage? Financial Innovation, 8(1), 73 (2022).

[10]. Milne, A., & Parboteeah, P.: The Business Models and Economics of Peer-to-Peer Lending. Social Science Re-search Network (2016).

[11]. Wang, C.: Research on Credit Risk of P2P Online Lending Based on Text Analysis. South China University of Technology (2020).

[12]. Suryono, R., Purwandari, B., & Budi, I.: Peer to Peer (P2P) Lending Problems and Potential Solutions: A Sys-tematic Literature Review. Procedia Computer Science, 161, 204–214 (2019).

[13]. Serrano-Cinca, C., Gutiérrez-Nieto, B., & López-Palacios, L.: Determinants of Default in P2P Lending. PLOS ONE, 10(10), 0139427 (2015).

[14]. Liu, H., Qiao, H., Wang, S., & Li, Y.: Platform Competition in Peer-to-Peer Lending Considering Risk Control Ability. European Journal of Operational Research, 274(1), 280–290 (2019).

[15]. Guo, X., Zhou, T., & Jiang, B.: Design of B2C Online Payment Interface Based on ASP.NET. Modern Electronics Technique, 32(06), 97-99+103 (2009).

[16]. Hu, Y.: Research on Online Payment Network Security Risks and Prevention Technologies. Network Security Technology and Application, 160(04), 120+124 (2014).

[17]. Cheng, S., & Zhang, L.: Third-party Payment - An Evolutionary and Stable Strategy for Online Payment. Journal of Nanjing University of Technology (Social Science Edition), (04), 66-68+75 (2007).

[18]. Li, X.: The Impact of Online Payment on E-commerce. China Foreign Investment, 272(17), 42 (2012).

[19]. Xia, L.: Research on Online Payment Issues in E-commerce. Academic Forum, (05), 55-57 (2001).

[20]. Rong, F.: Liquidity Risk Assessment and Control Strategy of Third-party Payment in E-commerce. E-commerce, 148(04), 47-49 (2012).