1. Introduction

The COVID-19 pandemic first surfaced around the end of 2019 and is still active today. The COVID-19 outbreak wasn’t given much attention at initially. However, the pandemic not only makes the countries and cities lockdown but also makes the world’s economy at a standstill, or even leads to its recession. Many industries have been influenced at varying degrees and more and more sectors have no profit and huge deficit. As for people’s lives, COVID-19 made unemployed rate increase quickly. For 29 European nations, the poverty rate is predicted to rise from 4.9% to 9.4%, and the average loss rate for low-wage workers is predicted to range between 10% and 16.2%. When comparing the COVID-19 epidemic to the 2008 financial crisis, the former has caused much more harm. A total of 255 million jobs have been lost as a result of the COVID-19 catastrophe as of January 25, 2021, which is four times as much as the 2008 financial crisis (from ILO). And among all sectors, banks seem to be the “first victims”. The banks play an important role in the economic world because they facilitate internal and international trade, and banks are the core of a country’s financial system. If a bank collapse in a crisis, the chain reaction consequences will be unimaginable. COVID-19 has brought a series of intractable problems to banks, such as staff shortage, less commerce and more risks. Since the outbreak of the COVID-19, countless banks have fallen into financial crisis, with insufficient liquidity, insolvency and other problems emerging frequently. All these questions invariably point to the same word, risk management.

Faced with such a severe situation, how to effectively manage risks has become a key issue for the banking industry in the post-epidemic era. Today’s risk environment requires the banking industry not to make any mistakes, which can lead to serious consequences such as bankruptcy. For example, the Silicon Valley Bank (SVB), founded in 1983 in the United States, is a medium-sized commercial bank ranked 16th in the US. Due to its poor investment policy, most of its assets are invested in US treasury bond bonds, within some years great losses are caused by the combined effect of tightening liquidity and raising interest rates by the Federal Reserve. At the same time, it has not hedged risks in a timely manner, resulting in a mismatch in terms of maturity, and there is still a fluke mentality within the bank, from operational stuff to the management layer. Eventually, on March 10th, the California DFPI announced the closure of the Bank of Silicon Valley on the same day due to “insufficient liquidity and insolvency”, and designated the FDIC as the receiver.

Risk management in banks plays an important role that determining the healthy and sound development of the banking sector. Currently, the main risks faced by banks include liquidity risk, credit risk, market risk, systemic risk, etc. We theoretically review the influencing factors of various risks and propose effective methods for current risk management of the banking sector and validate them with specific bank examples.

2. Credit Risk

Credit risk, commonly referred to as default risk, is the chance that borrowers, issuers of securitized debt obligations, or counterparties will be unable or unwilling to uphold the terms of a contract for a variety of reasons, leading to a breach of contract and losses for banks, investors, or counterparties. There are two aspects of factors that cause credit risk in a bank. The first one is the internal unresolved problems inside the bank such as its low asset quality and huge loan amount, which will continue to result in a high asset and liability ratio. Once insolvency occurs, it will be difficult for banks to fulfill their contracts. Additionally, credit risk is linked to bank profitability as shown by the negative association between ROA and ROE levels and credit risk levels. Another point is the external credit rating of the bank. A bank’s insufficient asset capacity, short operating life, and non-standard financial systems are all disadvantages, which can hinder the bank’s financing activities.

At the same time, these will bring difficulties to the bank’s credit rating. A bank with a lower credit rating means a higher probability of non-performing loans. Therefore, it is a must for banks to effectively manage credit risk. Most importantly, bank management need to think of strategies to lower the ratio of non-performing loans (NPLs). The NPL ratio is the percentage of financial institutions’ total loan balance that are non-performing loans. When evaluating the quality of bank loans, the classification of loans into the five risk-based categories of normal, concerned, secondary, suspicious, and loss is referred to as “non-performing loans”. Non-performing loans are the collective term for the latter three groups. methods for banks that include clearing, canceling, and changing the credit structure for specific loan accounts. In addition, commercial banks can use valuation to offset the credit risk. Precisely determine a price or discount rate for a risky asset and deduct all expected risk values (including liquidated damages, expected depreciation, etc.). Through valuation, the probability of bank credit risk will be minimized.

Last but not least, the central bank should further strengthen its regulation of non-performing loans and establish a sound and complete regulatory system. For example, in 2007, the US subprime mortgage crisis broke out. Subprime loans, commonly referred to as subprime mortgage loans, are residential mortgage loans given to people with bad credit, no proof of income or repayment capacity, and other significant liabilities. With the reversal of interest rate levels, many subprime borrowers in the middle and late stages of repayment cannot bear the obligations after a significant increase in interest rates and can only choose to default [1]. Non-performing loans have rapidly accumulated, and the subprime crisis has begun to emerge and become increasingly intense. Citibank’s stock price has suffered its biggest decline in decades. That’s the most serious consequence brought by credit risk. If it hadn’t been for the three consecutive bailouts from the Federal Reserve, Citibank would have already collapsed. However, during the COVID-19 pandemic, Citibank has successfully controlled its NPL ratio. Data shows that the NPL ratio of Citibank in 2019 is 0.47%, while it slightly increased to 0.63% in 2020 and 2021, but it doesn’t matter to a bank that used to be the biggest one in the US. Citibank has also done well in valuation. On March 28th, 2023, Andrew Coombs, an analyst at Citibank, raised the company’s target price for UBS. N from 24 Swiss francs to 26 Swiss francs and maintained a buy rating on the stock. The analyst continues to believe that the transaction with Credit Suisse (CS. N) will increase earnings on a fundamental basis starting from 2025 and on a statutory basis starting from 2027. Including excess capital in the valuation has led Citigroup to raise its target price. In the post-epidemic era, effective management of non-performing loan ratios and precise valuation can minimize credit risk.

3. Liquidity Risk

Liquidity risk for a bank often manifests itself in three different ways: no liquidity, insufficient liquid assets in the portfolio to provide a liquidity safety valve, or difficulty for the bank to raise funds at normal prices. Liquidity risk is a common risk in financial markets, especially during financial crises and economic downturns. Banks’ “short borrowing and long lending” asset-liability structure, sensitivity to interest rate changes, and a sudden loss of deposits can all create liquidity risk.

The unprecedented government-imposed measures during the COVID-19 epidemic have caused many firms to close temporarily or permanently, upheaval in the financial markets, a decline in public faith in the economic systems, and increased uncertainty. The decline in economic activity caused by the epidemic leads to cash flow problems for businesses and individuals, which may result in a decrease in deposits for banks and may result in borrowers unable to repay their loans on time; market volatility and fluctuations in investor emotions caused by the epidemic may result in a decline in the price of certain market assets or the failure to sell them, which may result in the banks’ inability to quickly liquidate assets in their portfolios. The epidemic leads to disruptions in the banks’ operations and the safety of their employees, which may result in the banks’ inability to complete fund dispatches and payments on time; all of these increase the banks’ liquidity risk [2]. The main reason for Silicon Valley Bank’s bankruptcy was the liquidity crisis caused by the extreme mismatch between asset and liability maturities.

During the liquidity easing period after 2020, Silicon Valley Bank achieved a high increase in deposits and increased the proportion of long-term bond investments, making the duration of the asset side significantly longer. After 2022, when the Fed entered the interest rate hike cycle, Silicon Valley Bank’s customer deposit outflows greatly reduced the stability of the liability side. Silicon Valley Bank indicated that it would sell ASFs worth $21 billion in order to boost asset sensitivity and lessen the effect of the Fed’s interest rate increases on net interest margin. As a result, Silicon Valley Bank was trapped in a vicious cycle of “insufficient liquidity - selling bonds with losses—increasing market panic—exacerbating a run on deposits on the liability side” and eventually became insolvent.

Commercial banks use various instruments to prevent liquidity risk. These include raising the reserve requirement ratio, issuing bonds and conducting equity financing, establishing emergency financing mechanisms, adjusting asset portfolios, actively managing asset quality and risk, working with the central bank for short-term liquidity support, and strengthening risk monitoring and reporting [3]. For example, Citibank has increased the scale of market borrowing by issuing bonds and commercial paper, optimized its balance sheet by reducing short-term borrowings and non-resident deposits and increasing long-term borrowings and resident deposits, and utilized short-term financing from the central bank and purchased government bonds for additional liquidity support. They also establish liquidity risk indicators, conduct real-time monitoring and assessment of risks, and adjust risk strategies and responses in a timely manner.

4. Market Risk

The risks resulting from numerous unfavorable changes in market pricing that lead commercial banks to perform both on and off balance sheet activities are referred to as market risk for commercial banks. Since interest rates, currency rates, stock prices, and commodity prices are the four main components of market pricing, the related market risks for commercial banks can be broadly categorized as exchange rate risk, interest rate risk, commodity price risk, and stock price risk. Commercial banks are now exposed to significantly greater market risks as a result of the ongoing pace of interest rate liberalization and the quick development of financial derivatives. The high unemployment rate and inflation caused by the COVID-19 epidemic further aggravate the market risk of banks.

Increasing interest rates is one example. Raising interest rates is the central bank of a nation or region acting in such a way that makes borrowing money from it more expensive for commercial banks, which in turn forces the market to do the same [4]. The most typical kind of market risk is that one. For banks, an increase in interest rates has both benefits and drawbacks. The increase in interest rates by the central bank will lead to an increase in deposit and loan rates, which will increase the number of deposits held by banks and enable them to have more available funds. However, this may also make it more difficult for banks to market loans by reducing the number of people who lend them. But as deposit rates continue to rise, in order to increase loan income or wealth management income, banks will either lend funds to enterprises with higher returns but greater risks or purchase wealth management products with higher risk levels to seek higher returns. When a large loss occurs (such as a huge investment failure or a huge loan that cannot be recovered), it may cause the bank to become insolvent and declare bankruptcy. In other aspects, it may result in the centralized withdrawal of deposits by customers. When such customers “withdraw the old and deposit the new” are concentrated to a certain extent, there is a risk of a run on the bank, which may lead to the bankruptcy of the bank due to the breakage of the capital chain. Especially when many of the bank’s loans are long-term limited, such as the SVB. Loans become less able to handle the risk of depositor runs and are more likely to result in bankruptcy when they cannot be repaid quickly [5].

Commercial banks must take some measures to manage market risk. The first thing to be mentioned for the management of market risk is the measurement of risk, and there are many methods to measure it, such as the standard method of market risk and the internal model method, which are both proposed in the New Basel Capital Accord. Besides, commercial banks also need to establish a complete internal control system. Improve the internal control mechanism for market risk management through the joint coordination of systematic decision-making, implementation, and supervision feedback [6]. Finally, commercial banks could build their systemic risk indicator by digital means which takes bank size into account. Thus, a network’s degree of connectivity (CQs) or the degree to which nodes are compromised (in our case, the market capitalization of banks), or even both, can contribute to total systemic risk.

5. Systemic Risk

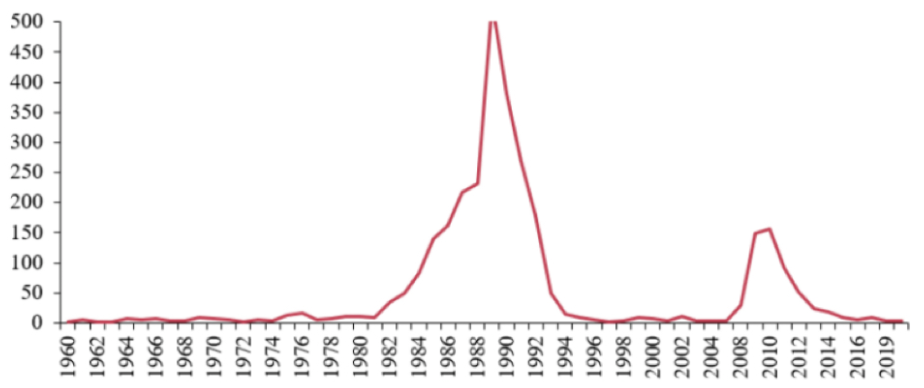

Systemic banking crises are characterized by serious turmoil in the entire financial system due to the outbreak of systemic banking problems, and their negative impact on the economy is often widespread and persistent. If a banking crisis fits either of the following two conditions, Laeven & Valencia suggest comparable criteria for the onset of a systemic banking crisis: it can be considered a systemic banking crisis: first, the banking industry is in significant distress; second, the government introduces strong intervention policies in response to large losses in the banking industry [7]. Using the aforementioned standards, the savings and loan crisis in the 1980s and the subprime mortgage crisis in 2008 qualify as two systemic banking crises that have occurred in the United States in the last 50 years. The impact of two crises was widespread and had a serious impact on the U.S. economy.

Figure 1: Number of commercial bank insolvencies from 1960 to 2019 [8].

In the post-epidemic era, Silicon Valley Bank, Signature Bank, First Republic Bank and Credit Suisse and a number of banks in succession “lightning”, also triggered market concerns about the outbreak of a systemic banking crisis, but this banking crisis, with certain industry, regional, and liquidity crisis characteristics, in the context of the rapid action of the Federal Reserve, has not formed a systemic banking crisis for the time being [9]. Looking at the assets and liabilities of the U.S. banking sector before the two systemic banking crises, we find that both systemic banking crises occurred during the interest rate hike phase after a period of low-interest rate levels in the United States. The root cause of both crises was the mortgage market, and since mortgages accounted for a relatively high proportion of total commercial bank assets, a large default on mortgages would have had a significant impact on the entire banking system [10]. Thus, the macro institutional environment, the type of banking business, and the quality of information all affect the systemic risk of banks.

6. Conclusion

In the modern interconnected world, the impact of exogenous shocks on the economy can be significant and far-reaching. Short-term market volatility can lead to liquidity crises for banks, which, if left unchecked, can eventually become systemic crises. However, the central bank can play a crucial role in resolving such crises by providing timely liquidity relief. The recent shutdown of Silicon Valley Bank has been cited as an example of a failure of a bank, but also a fiasco of regulatory measures and monetary policy. This incident highlights the need for a robust regulatory framework that can mitigate risks and ensure financial stability. It also underscores the importance of effective coordination between regulatory bodies and central banks to prevent the spread of risks and restore market confidence. The scale of the potential risks is vast, with mutual funds and insurance funds holding more than three times the amount of U.S. bonds compared to the banking system. The risk of contagion is high, and the final outcome will depend on whether regulators can stabilize the situation and give the market confidence.

In conclusion, the central bank’s role in resolving liquidity crises cannot be overstated, and effective coordination between regulatory bodies and central banks is crucial in mitigating risks and ensuring financial stability. It is imperative that policymakers continue to prioritize the development and implementation of robust regulatory frameworks to prevent similar incidents from occurring in the future.

References

[1]. Marcu, M. R.: The Impact of the COVID-19 Pandemic on the Banking Sector. Management Dynamics in the Knowledge Economy 9(2), 203–224 (2021).

[2]. Raghavan R. S.: Risk management in banks. Chartered Accountant 51(8), 841-851 (2003).

[3]. Varotto S, Zhao L.: Systemic risk and bank size. Journal of International Money and Finance 82, 45-70 (2018).

[4]. Ahmed, H.M., El-Halaby, S.I. & Soliman, H.A.: The consequence of the credit risk on the financial performance in light of COVID-19: Evidence from Islamic versus conventional banks across MEA region. Futur Bus J 8, 21 (2022).

[5]. Baumöhl, E., Bouri, E., Van Hoang, T. H., Shahzad, S. J. H., & Výrost, T.: From physical to financial contagion: the COVID-19 pandemic and increasing systemic risk among banks. EconStor Preprints (2020).

[6]. Chen, W., Chen, Y., & Huang, S.: Liquidity risk and bank performance during financial crises. Journal of Financial Stability 56, 100906 (2021).

[7]. Laeven L, Valencia F. Systemic banking crises revisited. IMF Economic Review 68, 307-361 (2020).

[8]. Duan, Y., Ghoul, S. E., Guedhami, O., Li, H., & Li, X.: Bank systemic risk around COVID-19: A cross-country analysis. Journal of Banking and Finance 133, 106299 (2021).

[9]. Haldane, A., & May, R. M.: Systemic risk in banking ecosystems. Nature 469(7330), 351–355 (2011).

[10]. Imbierowicz B., Rauch C.: The relationship between liquidity risk and credit risk in banks. Journal of Banking & Finance 40, 242-256 (2014).

Cite this article

Gao,W.;Liu,Y. (2023). Risk Management in the Banking Sector During the COVID-19 Crisis: Challenges & Responses. Advances in Economics, Management and Political Sciences,31,48-53.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Marcu, M. R.: The Impact of the COVID-19 Pandemic on the Banking Sector. Management Dynamics in the Knowledge Economy 9(2), 203–224 (2021).

[2]. Raghavan R. S.: Risk management in banks. Chartered Accountant 51(8), 841-851 (2003).

[3]. Varotto S, Zhao L.: Systemic risk and bank size. Journal of International Money and Finance 82, 45-70 (2018).

[4]. Ahmed, H.M., El-Halaby, S.I. & Soliman, H.A.: The consequence of the credit risk on the financial performance in light of COVID-19: Evidence from Islamic versus conventional banks across MEA region. Futur Bus J 8, 21 (2022).

[5]. Baumöhl, E., Bouri, E., Van Hoang, T. H., Shahzad, S. J. H., & Výrost, T.: From physical to financial contagion: the COVID-19 pandemic and increasing systemic risk among banks. EconStor Preprints (2020).

[6]. Chen, W., Chen, Y., & Huang, S.: Liquidity risk and bank performance during financial crises. Journal of Financial Stability 56, 100906 (2021).

[7]. Laeven L, Valencia F. Systemic banking crises revisited. IMF Economic Review 68, 307-361 (2020).

[8]. Duan, Y., Ghoul, S. E., Guedhami, O., Li, H., & Li, X.: Bank systemic risk around COVID-19: A cross-country analysis. Journal of Banking and Finance 133, 106299 (2021).

[9]. Haldane, A., & May, R. M.: Systemic risk in banking ecosystems. Nature 469(7330), 351–355 (2011).

[10]. Imbierowicz B., Rauch C.: The relationship between liquidity risk and credit risk in banks. Journal of Banking & Finance 40, 242-256 (2014).