1. Introduction

The "destructive sanctions" against Russia announced by the United States and Europe since the Russian-Ukrainian conflict started in February 2022 have had a significant impact on the Russian economy, the global financial market, energy, food, semiconductor chips, automobiles, and other supply chains. The economy has repeatedly fluctuated accordingly. The Ukraine crisis has lowered expectations for global economic growth by 1% and slowed growth in 2022 to just 3.1%. The prices of food, gold, crude oil, and other commodities all increased, while the renminbi and the euro both declined somewhat versus the dollar. The value of the ruble and the euro also declined. The crisis between Russia and Ukraine has also "worsened" the global industrial and supply chains, global inflationary pressures continue to rise, and the recovery of the world economy is facing more uncertainties. From a global perspective, this conflict has broken the original energy pattern, and the world oil and gas map will show a development trend of "two strengthening" and "two enhancements". The "two strengthening" are that the United States and Europe strengthen cooperation in the field of natural gas, and Russia strengthens the diversification of oil and gas exports. On the one hand, it is anticipated that the volume of natural gas trade between the United States and Europe will keep growing. A record-breaking 22 billion m3 of U.S. LNG was imported into the EU in 2021, making up 6% of all imports. With the start of the Russian-Ukrainian conflict, the US and Europe came to an agreement that the US would double its present annual LNG supply to the EU to 50 billion m3 by 2030. On the other hand, Russia is actively enlarging the global oil and gas market, speeding up the construction of LNG projects like "Arctic 2" and pipeline projects like "Power of Siberia," and working to boost its market share in the Asia-Pacific area. Russia's oil commerce with India heated up quickly following the start of the Russian-Ukrainian conflict, and Moscow became India's fourth oil supplier in April. Large oil suppliers' market share increased to a record 6%. The "two upgrades" are the strengthening of America's and the Middle East's influence in the energy discourse and the strengthening of Africa's position in the European oil and gas market. On the one hand, the production of fossil fuels has "shifted west" across the world. Both Saudi Arabia and Russia are anticipated to lose their positions as the leading exporters of oil and natural gas to the United States. The energy crisis will be advantageous for Gulf nations like Saudi Arabia and Qatar, and Iran may reenter the global energy market this year. However, the importance of African natural gas to Europe is growing. Africa's natural gas reserves make up around 7.1% of the world's total reserves, and its average yearly shipments to Europe account for 18% of the continent's total natural gas imports, suggesting that Africa may eventually replace Europe as the continent with the most natural gas reserves.

2. The U.S. Economy

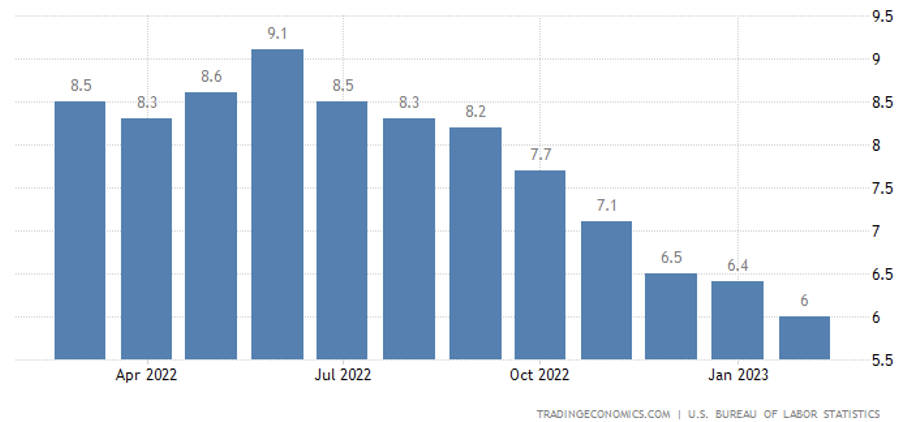

High inflation and rising interest rates have kept U.S. consumers and businesses under pressure, and the U.S. economy experienced a shift from a sharp slowdown to a persistently weak recovery in 2022 (see Figure 1). In 2022, months of rising inflation in the United States broke a four-decade record and hit a new high. The US economy is at risk of continued "stagflation".

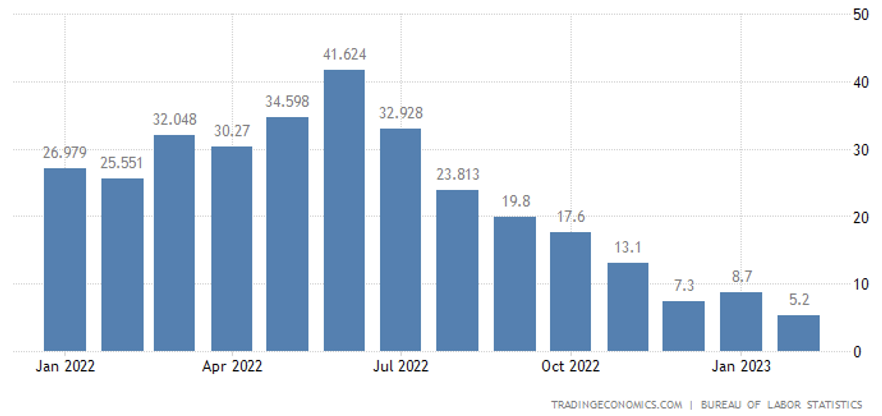

Average inflation in the second and third quarters of 2022 was as high as 8.6% and 8.3%. Under the high inflation rate, the rise in the housing and food price index became the main factor driving up prices in the United States. The food index in August 2022 was up 11.4% from a year ago, which was the peak in 50 years. Shelter costs in Feb 2022, which make up about one-third of CPI, rose 1.7% and are up the peak of 19.2% from a year ago. Since Feb of 2021, the cost of energy has continued to soar, with the energy inflation rate peaking at 41.624% in June [1]. The core consumer price inflation rate in the United States, which excludes volatile items such as food and energy, came to a peak of 6.6 in Sep 2022. It shows that the US economy has suffered a serious erosion (see Figure 2).

Figure 1: The inflation rate of the U.S [2].

Figure 2: Core CPI of the U.S [2].

High inflation can also create uncertainty and volatility in the markets, which can discourage investment and innovation. Moreover, high inflation can reduce US exports by making them less attractive to foreign buyers who have to pay more dollars for them. High inflation in the United States has dampened consumer spending by reducing real purchasing power. Rising prices, such as food and energy, are putting pressure on discretionary spending for all Americans, especially low-income households. Low-income households spend 75 percent of their income on necessities such as food, gasoline, and housing, more than twice as much as higher-income households. In particular, the Fed's successive interest rate hikes have dealt a heavy blow to the US real estate sector, with residential investment falling sharply and will have a broader impact on other economic dimensions. Consumer confidence fell to a six-month low of 113.8 in August 2022, down from a revised reading of 125.1 in July.

The rising costs meant more bad news for workers, whose Real average hourly earnings the lowest of 10.87 in June 2022 declined 0.1% for the month on an inflation-adjusted basis and are off 5% from a year ago. Unemployment fell to 5.2% in August 2022, down from a peak of 14.8% in April 2020 during the pandemic lockdowns. However, labor force participation remained low at 61.7%, indicating that many people have dropped out of the labor market or are discouraged from looking for work [1]. Manufacturing output increased by 0.4% in August 2022, following a revised decline of -0.1% in July. Manufacturing activity was hampered by shortages of materials and labor, as well as transportation bottlenecks [3].

As inflation run rampant, the Fed tightened its monetary policy. This could slow down economic activity by reducing aggregate demand and output. The US has passed several stimulus packages to provide relief and support to households, businesses, and state and local governments affected by the pandemic and the conflict. The US has also maintained low-interest rates and expanded its bond-buying program to inject liquidity and credit into the economy. However, anti-inflationary measures sometimes cause a recession since the Fed has to take drastic measures to bring inflation under control. For example, in the early 1980s, the Fed raised interest rates to double digits to combat stagflation (a combination of high inflation and low growth). This caused a severe recession that lasted from 1981 to 1982.

3. EU Economy

About 30% of the world's supply of wheat, 20% of the supply of corn, fertilizer, and natural gas, and 11% of the supply of oil come from Russia and Ukraine. As a result, the war between the two nations may seriously disrupt supply chains that affect Eastern European EU nations or even Western industrialized nations in particular areas.

In 2020, stock changes barely met 42.5% of the energy needs of the European Union, which imported 57.5% of the energy it used for internal use. The EU's primary source of coal, oil, and natural gas is Russia. As production and consumption patterns changed over time, as did the composition of the energy mix, the EU became more dependent on imports [1]. From the lowest value in 1990 (50.0%), it registered a peak in 2008 (58.4%) and a record high in 2019 (60.5%) before dropping in 2020 (57.5%). 24.4% of the energy used by the EU is imported from Russia. The energy, which cost €99 billion3, accounted for 62% of the EU's overall imports from Russia. The majority (96.1%) of Lithuania's energy requirements were met by Russian imports into the EU. Eight countries are more than 30% dependent on Russian energy; In 2021, two-fifths of the gas Europeans burned came from Russia [3]. As Table 1 shown, Lithuania, Slovakia, Finland, Austria, Hungary are total dependence on gas from Russia. Czech, Poland, Germany imported most of their gas from Russia.

Table 1: EU gas import dependency on Russia, 2017-2022.

Country | 2017 | 2018 | 2019 | 2020 | Degree of Dependence |

Lithuania | 100 | 100 | 100 | 100 | Total dependence |

Slovakia | 100 | 99 | 100 | 99 | Total dependence |

Finland | 100 | 100 | 100 | 98 | Total dependence |

Austria | 100 | 100 | 100 | 100 | Total dependence |

Hungary | 100 | 100 | 100 | 100 | Total dependence |

Czech | 64 | 60 | 62 | 66 | Highly dependence |

Poland | 76 | 74 | 72 | 65 | Highly dependence |

Germany | 55 | 55 | 55 | 56 | Highly dependence |

French | 35 | 30 | 25 | 16 | Dependence |

Italy | 42 | 47 | 43 | 37 | Dependence |

Ireland | 21 | 15 | 18 | 23 | Independence |

Spain | 0 | 0 | 0 | 0 | Independence |

British | 10 | 10 | 10 | 11 | Independence |

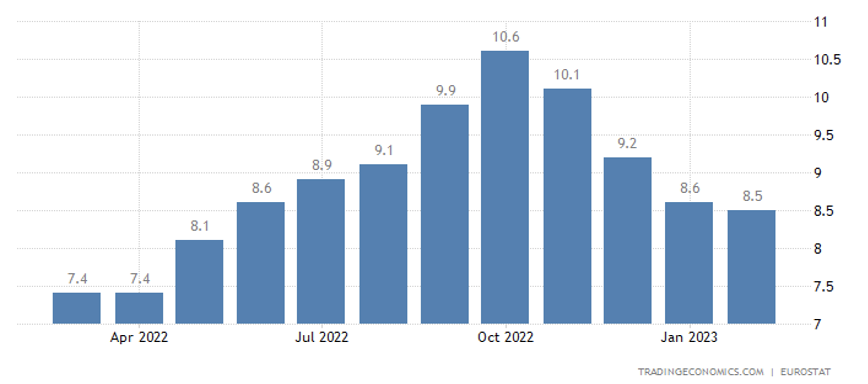

On March 14, the European Union declared that it will apply sanctions on Rosneft, Transneft, and Gazprom Neft, restricting their ability to lend money and finance debt, in response to the war between Russia and Ukraine. The Executive Committee of the European Commission intends to reduce Russian gas imports by two-thirds by 2022 and to cease all reliance on Russia by 2030. Energy prices soared, and European gas prices also reached a record high of 2,200 euros/thousand cubic meters since the embargo from Ukraine. UK gas prices peaked at 501p/sem from 211p/sem on 23 February [4]. EU countries face both energy and fiscal pressures. The price of gas and electricity in the EU will increase as a direct result of the increase in global energy prices, which will also have an immediate effect on other nations' living standards and economic growth. The cost of electricity in Spain and the Netherlands surged by more than 300% to 300 euros per megawatt hour. Finding replacement suppliers as quickly as feasible is crucial as EU energy businesses leave the Russian market; otherwise, both the company's profitability and the energy supply on the market would suffer. The rise in energy, gas, and oil prices in the EU has led to high inflation rate in the EU. The inflation rate arrived at a peak of 10.6% in Oct. 2022. (see Figure 3) France, Germany, the United Kingdom, and other European countries are demonstrating, the protests are intensifying, due to the reduction of real wages caused by inflation, so people in all countries are calling for higher wages.

Figure 3: The inflation rate of the EU [2].

The external supply shock is the primary cause of the EU27 CPI's continued annual increase rate in May. 15.1% of the CPI was allocated to the "food" category, of which "bread and cereals" accounted for 2.77% and "fats" for 0.47%. Gas and "liquid fuel" accounted for 2.20 percent and 0.73 percent, respectively, of the "energy" category. The prices of the aforementioned four increased by 11.9%, 27.8%, 52.4%, and 77.3% year-on-year in May 2022, respectively, and contributed 0.33%, 0.13%, 1.20%, and 0.56% to the CPI, respectively [4].

After the outbreak of the Russian-Ukrainian conflict, the nominal value of workers' compensation increased by 7.8%, and the per capita wage level increased by about 5.3%, but the per capita wage level increased by a lower rate than the consumer price index of 8.6% in June, the real wage level in the eurozone is shrinking, and it is doubtful whether the income of workers can continue to rise in the face of deteriorating business operations. The unemployment rate in the eurozone was 6.6% in May 2022, compared to 6.9% in January, significantly lower than the 2021 average [5].

Palladium, a component of automobile exhaust catalysts, as well as nickel, a common ingredient in steel manufacture, are also important exports from Russia. Both Russia and Ukraine are significant producers of argon, neon, and titanium, all of which are used, among other things, in the manufacture of airplanes. Also, both nations share considerable (by international standards) uranium reserves. The cost of the aforementioned goods has significantly increased since the start of the conflict in Ukraine on February 24, 2022 [6].

As an important node country of energy pipelines and a large energy demander, pipeline energy is very important for Germany, and Germany's joining the queue of sanctions against Russia is undoubtedly a huge challenge and obstacle for Germany. So in the 27 member states of the European Union. Across countries, Germany experienced the steepest decline, due to its industry focus and energy vulnerabilities [7]. The automotive industry, which is economically significant to Germany and some other EU countries, can be expected to experience a negative impulse in March 2022 insofar as the relative price of gasoline influences demand for cars or car production. This, in turn, is likely to temper the economic upswing in Germany and the Eurozone. Since demand for more fuel-efficient vehicles will increase as gas prices rise, the German and EU auto industries should anticipate benefits in the export market, particularly to the US. The Russian-Ukrainian war, however, creates additional loss risks for manufacturing in Eastern European EU nations as well as expropriation concerns in Russia, not just from a German standpoint. For instance, there are steel businesses who run factories in Poland and other Eastern European EU candidate nations and acquire their raw materials from Russia or Ukraine. The EU also intends to lend money or offer subsidies to key businesses to help them weather the energy crisis, although doing so will increase financial pressure on EU governments in addition to helping Ukraine's military budget.

4. Developing Countries

Increases in energy prices in high-income nations are mostly to blame for income declines, but increases in food prices in low- and middle-income nations account for the majority of the shock [8]. The most affected are developing nations, who are heavily reliant on imported food and fuel. For instance, Nicaragua purchases 89% of its wheat from Russia and Ukraine, the Republic of Congo 67%, and Egypt 46%. 94% of the coal in Algeria comes from Russia, as does the same percentage of natural gas in Kyrgyzstan.

Armenia, Georgia, Kyrgyzstan, and Tajikistan will suffer the greatest losses, with real household incomes falling by more than 5% on average. The poor in Egypt bear the brunt of the losses. Middle-income households in Georgia are the ones who benefit. While relatively wealthy households are anticipated to gain from increases in real income, poor households are anticipated to suffer. Increases in food prices are anticipated to worsen inequality in all three nations, with the bottom 40% experiencing consistently bigger losses. In our sample, impact heterogeneity is common [9]. The food and energy crises, like dominoes falling, have thrown Africa's already precarious financial situation into disarray. Global economic growth in 2022 is expected to be revised down from 3.6% to 2.6% in 2022, given the ongoing Russia-Ukraine conflict and changes in macroeconomic policies in recent months, according to the March 2022 assessment report "Tapering in Conflict". Africa's overall economic growth is expected to fall from 2.9% to 1.8% [10]. The continent's economic recovery from the triple crisis of food, energy, and finance will be even more difficult.

Driven by the goal of "decoupling" from Russia's energy, in addition to the United States and Australia, the Middle East, and Central Asia will also become an important source to fill the gap in European oil and gas imports. At present, China also has certain advantages in new energy and other fields, and the manufacturing level of photovoltaic, wind power, new energy vehicles, and energy storage equipment is in the first echelon. In 2021, China's PV module shipments accounted for more than 75% of the world, wind power accounted for more than 50%, new energy vehicle production, and sales ranked first in the world for 7 consecutive years, and lithium battery shipments accounted for 63.8% of the world [11]. Therefore, the new changes in international energy after the conflict between Russia and Ukraine have also brought the following new opportunities for China to expand international energy cooperation. At the same time, major food-exporting developing countries bring more opportunities, such as Brazil, Thailand, India, and China.

5. Conclusion

Increased volatility in asset market prices and a rise in the unemployment rate could result in a recession as a result of the Russo-Ukrainian war. It also results in an increase in oil and gas prices, a decrease in EU trade with Ukraine and Russia, disruptions in some EU countries' energy-intensive industries (disruptions would be particularly severe in the chemicals, steel, and food sectors in the event of a Russian export embargo for gas or an EU import embargo for gas). The world's oil and gas map will be rebuilt more quickly. The Russia-Ukraine conflict and the energy-related sanctions have had an impact on the international energy market, world energy security, the energy settlement system, and global economic development, as well as having a significant and far-reaching impact on world energy development. Energy supply and demand is a crucial component of economic globalization and international trade. The goal of fiscal policy should be to reduce cost-of-living pressures while keeping a sufficiently restrictive posture in line with monetary policy. Monetary policy should continue its current trajectory to restore price stability. By increasing productivity and relieving supply limitations, structural reforms can help the battle against inflation even more, while multilateral collaboration is essential for advancing the transition to green energy quickly and avoiding fragmentation.

References

[1]. International Monetary Fund. World Economic Outlook: Countering the Cost-of-Living Crisis, 2022.

[2]. Trading Economics. https://tradingeconomics.com/, last accessed 2023/4/1.

[3]. Welfens, P. J. J., Gloede, K., Strohe, H. G., & Wagner, D.: System Transformation in Germany and Russia. Experiences, Economic Perspectives, and Policy Options. Springer (1999).

[4]. National Reliance on Russian Fossil Fuel Imports Analysis. IEA. https://www.iea.org/reports/national-reliance-on-russian-fossil-fuel-imports, last accessed 2023/4/1.

[5]. Kirsch, W.: The distribution of power within the EU: perspectives on a Ukrainian accession and a Turkish accession. International Economics and Economic Policy, 19(2), 401–409 (2022).

[6]. IMF Staff Statement on the Economic Impact of War in Ukraine. IMF. https://www.imf.org/en/News/Articles/2022/03/05/pr2261-imf-staff-statement-on-the-economic-impact-of-war-in-ukraine, last accessed 2023/4/1.

[7]. International Monetary Fund. World Economic Outlook: War Sets Back the Global Recovery, 2022.

[8]. Welfens, P. J. J.: Russia’s Invasion of Ukraine. Springer eBooks (2022).

[9]. Boersch, A.: Eurozone economic outlook, December 2022. Deloitte Insights. https://www2.deloitte.com/us/en/insights/economy/emea/eurozone-economic-outlook.html, last accessed 2023/4/1.

[10]. Agricultural and energy importers in the developing world are hit hardest by the Ukraine war’s economic fallout. CEPR. https://cepr.org/voxeu/columns/agricultural-and-energy-importers-developing-world-are-hit-hardest-ukraine-wars, last accessed 2023/4/1.

[11]. War-induced food price inflation imperils the poor. CEPR. https://cepr.org/voxeu/columns/war-induced-food-price-inflation-imperils-poor, last accessed 2023/4/1.

Cite this article

Chen,Q. (2023). Inflation and Energy Crisis under Ukraine Conflict. Advances in Economics, Management and Political Sciences,32,1-7.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. International Monetary Fund. World Economic Outlook: Countering the Cost-of-Living Crisis, 2022.

[2]. Trading Economics. https://tradingeconomics.com/, last accessed 2023/4/1.

[3]. Welfens, P. J. J., Gloede, K., Strohe, H. G., & Wagner, D.: System Transformation in Germany and Russia. Experiences, Economic Perspectives, and Policy Options. Springer (1999).

[4]. National Reliance on Russian Fossil Fuel Imports Analysis. IEA. https://www.iea.org/reports/national-reliance-on-russian-fossil-fuel-imports, last accessed 2023/4/1.

[5]. Kirsch, W.: The distribution of power within the EU: perspectives on a Ukrainian accession and a Turkish accession. International Economics and Economic Policy, 19(2), 401–409 (2022).

[6]. IMF Staff Statement on the Economic Impact of War in Ukraine. IMF. https://www.imf.org/en/News/Articles/2022/03/05/pr2261-imf-staff-statement-on-the-economic-impact-of-war-in-ukraine, last accessed 2023/4/1.

[7]. International Monetary Fund. World Economic Outlook: War Sets Back the Global Recovery, 2022.

[8]. Welfens, P. J. J.: Russia’s Invasion of Ukraine. Springer eBooks (2022).

[9]. Boersch, A.: Eurozone economic outlook, December 2022. Deloitte Insights. https://www2.deloitte.com/us/en/insights/economy/emea/eurozone-economic-outlook.html, last accessed 2023/4/1.

[10]. Agricultural and energy importers in the developing world are hit hardest by the Ukraine war’s economic fallout. CEPR. https://cepr.org/voxeu/columns/agricultural-and-energy-importers-developing-world-are-hit-hardest-ukraine-wars, last accessed 2023/4/1.

[11]. War-induced food price inflation imperils the poor. CEPR. https://cepr.org/voxeu/columns/war-induced-food-price-inflation-imperils-poor, last accessed 2023/4/1.