1. Introduction

Pork is closely related to China. It has a long history in Chinese cuisine and culture and has always been at the top of China’s meat consumption. In 2021, the Chinese consumed almost 100 million tons of meat--27 percent of the world's total and twice the total consumption in the United States [1]. However, both Chinese hog consumers and producers are bothered by cyclic price fluctuations. China has experienced five pig cycles and is in the middle of the sixth. The government introduced different regulatory policies during these cycles to alleviate price fluctuations. It turned out that none of these policies effectively freed the clear "W" shaped cyclical pattern in pig prices. The market needs another regulation tool. It has been proved that futures effectively achieve the goal of smoothing price fluctuations in the hog market. Eventually, in 2015, the China Securities Regulatory Commission allowed the issue of futures contracts in life hogs. It is believed that hog futures would be compelling in soothing price fluctuations.

2. Main Body

2.1. The Theoretical Basis of the Cyclic Price Fluctuation in the Pig Market

2.1.1. Herding Effect

A typical phenomenon in mass groups of individuals is the "Herding Effect." This term was first used to describe how animals, such as sheep, blindly follow their herd leaders without considering the rationality of their behaviors [2]. Crowds with the herding effect may panic for no reason. For example, people rush out of a shopping mall upon hearing someone shouting that a fire broke out. They make their judgments without thinking twice. In economics, the herding effect refers to the phenomenon that producers blindly seek more benefits, thinking they will gain, or at least won’t lose money, if they copy the majority’s behavior. It is already proved that this asymmetry is more pronounced in bull markets and small companies [3]. Thus the impact is especially significant in hog markets, where small-scale pig farmers make up the majority. Because of their lack of technical support and expertise in the financial market, small-scale pig households aren’t prioritized in making rational decisions but can only follow the majority. Thus, the herding effect in the Chinese pig market leads to more violent spot price fluctuations and a cobweb pattern in the demand and supply diagram.

2.2. Cobweb Model

Cobweb theory describes a dynamic price adjustment process for goods with a supply response lag [4]. In our case, this lag refers to the time it takes pig producers and consumers to restore market supply and demand to equilibrium.

Basic principles of economics tell us that the current market supply of hog (St) determines the current hog price (Pt):

Pt=f(St)

The current price of the hog, in turn, determines the future market supply of hog (St+1):

St+1= f(Pt)

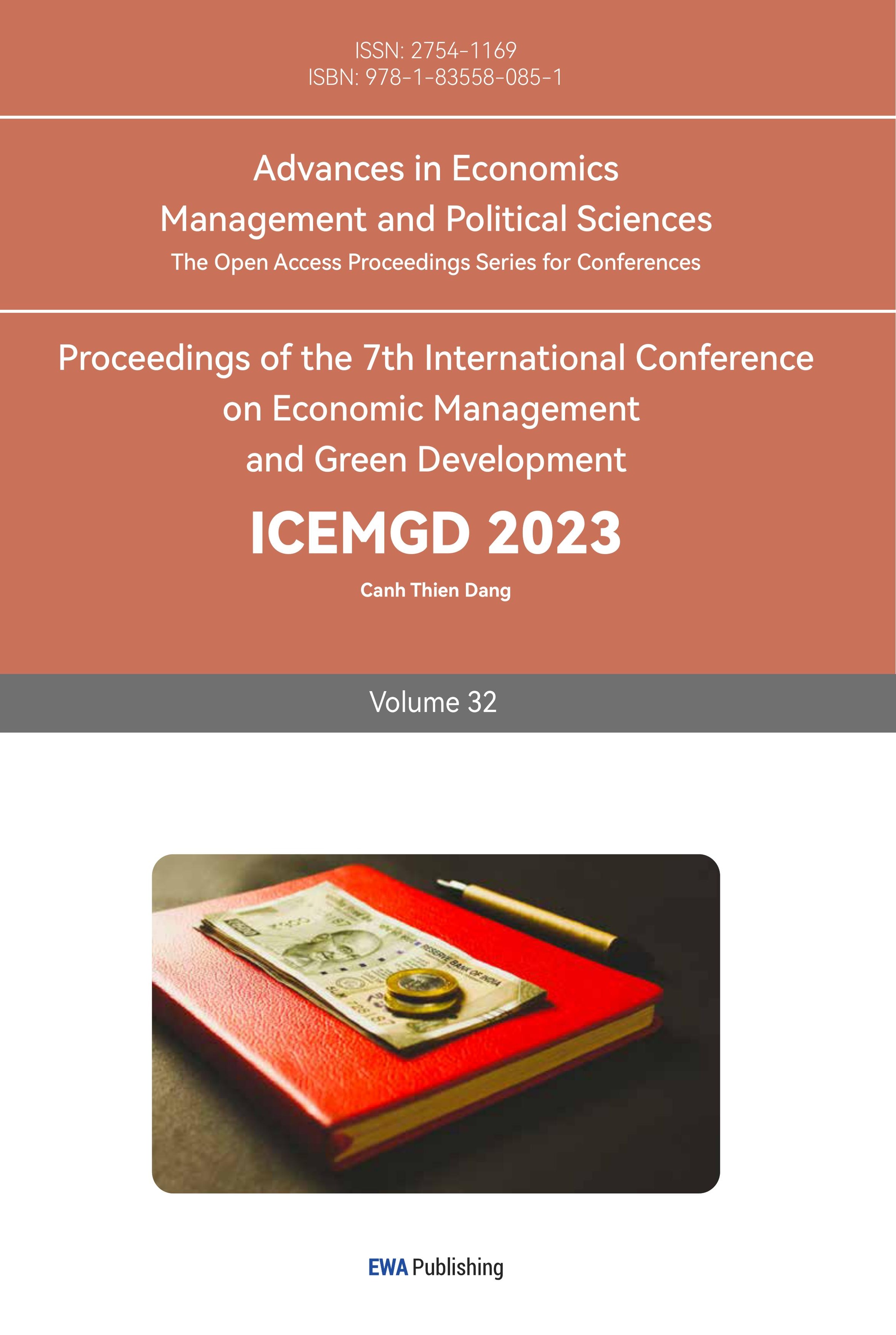

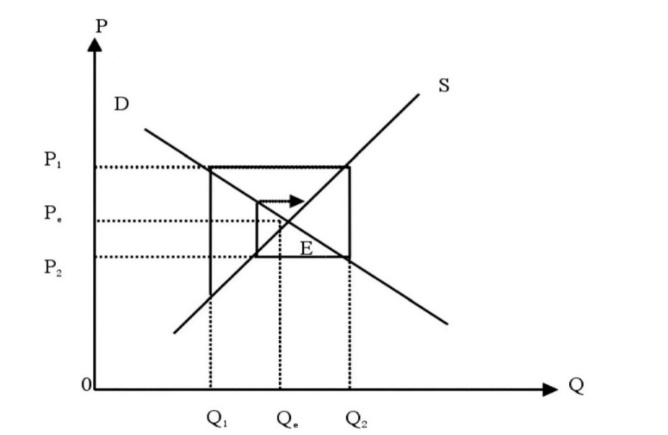

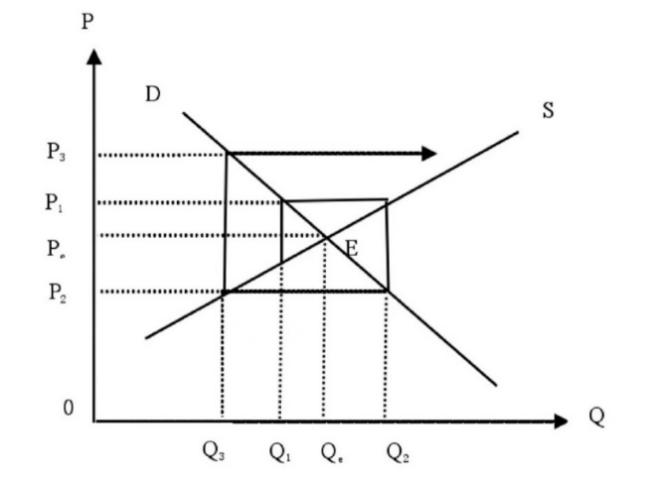

Assuming the hog market is not influenced by external forces. The hog supply and demand will always fluctuate once it is out of equilibrium. We can categorize the cobweb model into three classes (Figure 1, Figure 2, and Figure 3):

Figure 1: A convergent cobweb occurs when the elasticity of demand is greater than that of supply. (Convergent cobweb)

Figure 2: A divergent cobweb occurs when the elasticity of supply is greater than that of demand. (Divergent cobweb)

Figure 3: An enclosed cobweb occurs when the elasticity of supply and demand is the same. (Enclosed cobweb) [5]

It takes four months for piglets to fatten and get ready to be slaughtered. During this period, pig farmers continue to increase the hog supply according to the market. However, these piglets cannot be sold in the market, and the number of piglets may exceed the market demand. Four months later, the piglets grow up and are ready for slaughter. The bubble of the high price of live pigs burst, and the price dropped. Thus, the formation of the cobweb pattern is closely related to the cyclic price fluctuation in the hog market.

Historical data showed that pig prices from 2000 to 2003 pertained to Occlude (Enclosed) Cobweb Phenomenon, while pig prices from 2004 to 2012 pertained to Divergent Cobweb Phenomenon [6].

3. Hog Futures’ Functions and Actual Effects

Hog futures are commonly believed to offer traders dynamic data and information exposure, enabling them to make timely and fair predictions and avoid potential risks in the spot market. We examine the significant functions of hog futures, which are price guidance, hedging, vertical integration, and promotion of mass production, and how they have been and will continue to affect pig cycles. It is worth noticing that the hog futures have been open for trading for about two years. Only some have realized its significance because the Chinese hog market comprises many small-scale pig-farming households. Therefore, the current data should only be utilized to support theoretical speculations rather than to make accurate predictions.

3.1. Price Discovery

Price discovery is an essential mechanic of futures markets, including hog futures. It is deciding the appropriate price for a commodity or asset and clearing houses (A clearinghouse is a designated intermediary between a buyer and seller in a financial market. The clearinghouse validates and finalizes the transaction, ensuring that both the buyer and the seller honor their contractual obligations and provide a centralized marketplace for buyers and sellers to come together and determine the price of a specific commodity or security through the basic principles of supply and demand [7]. In the case of hog futures, the market allows buyers and sellers to agree on a price for the future delivery of hogs. By providing sellers and buyers with a transparent and centralized marketplace, price discovery in hog futures help market participants make informed decisions about production, marketing, and risk management. Thus with more information accessible before trades make deals, traders become more rational, and the price fluctuations in the hog market will be less violent.

Evidence has shown the more mature futures markets are; the more significant impacts price discovery will have. In developing countries like China, the leading role of the futures price is also becoming more and more critical.

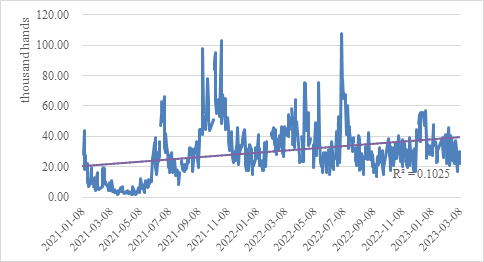

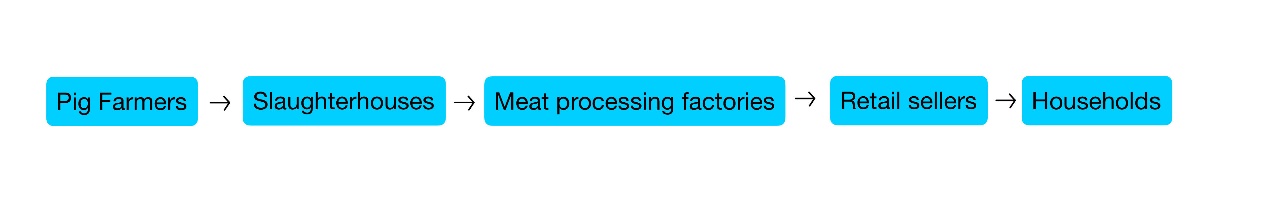

Price discovery in hog futures depends on several factors: liquidity, volatility, information efficiency, and market structure. A liquid and volatile market can attract more traders and enhance price discovery. An informationally efficient market can ensure that all relevant information is quickly and accurately reflected in the futures prices. A competitive and transparent market structure can prevent market manipulation and distortion. Chinese hog market is a highly volatile one, as can be seen from its continuous pig cycles. Moreover, hog futures are just established (China’s hog futures have been open for transactions since 1/8/2021.) in China. The figure below shows that the turnover volume has an overall increasing trend, but the actual fluctuation in the market has a weak relationship with the regression line (Figure 4).

Figure 4: Turnover volume: hog (Data from Wind).

In a month, the turnover volume has never exceeded 110 hands (16 tons of live hog/hand (from Dalian Commodity Exchange Hog Futures Contract)). In comparison, the total annual turnover volume of the futures market is 7.269 billion hands in 2021(Data from the Chinese National Bureau of Statistics ). The market lacks participation from hedgers and speculators due to high entry barriers, regulatory restrictions, and market volatility. Those may explain the ineffectiveness of the price discovery mechanism of hog futures.

The lead-lag relationship between the spot market and the futures market has not yet proven to be of an apparent influence. However, as the hog futures continue to develop and the traders' experiences enrich, price discovery will enable traders to indicate the expected supply and demand for hogs at different intervals. Thus, violent fluctuations in pig prices will be avoided.

3.2. Hedging

In addition to providing pricing information, hog futures are important hedging tools for enterprises. Hedging means that when producers and operators buy or sell a certain amount of spot commodities in the spot market, they sell or buy futures contracts in the futures market with the same variety and quantity as the spot commodities but in the opposite direction. By participating in futures market trading, enterprises can effectively avoid the risk of price decline, maintain certain profits, and ensure the stability of operations, so they can better adapt to market changes.

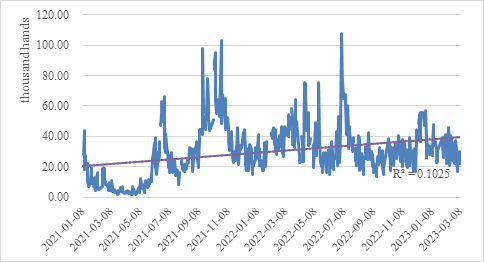

Assume the amplitude of price fluctuation is the same in the futures market and the spot market (Figure 5):

Figure 5: (Hypothetical hedging model).

By offering a high degree of correlation and convergence with the spot market, hog futures contracts enable hedging by reducing the basis risk (Basis risk is the potential risk that arises from mismatches in a hedged position. It occurs when a hedge is imperfect so that the wall does not precisely offset losses in investment). A low basis risk means that hedgers can lock in a more accurate and predictable price for their lean hogs using hog futures contracts [8].

We will give a hypothetical example to explain the mechanics of hedging. Suppose a large hog enterprise has ten thousand live pigs on hand. It is estimated that the enterprise can sell all its pigs in two months, but the company is afraid of experiencing a market price fluctuation. Thus it decides to use hog futures to hedge (Trading units of hog futures: 16 ton/hand ) (Table 1).

Table 1: A futures contract is not always the most profitable financial tool.

Date | Spot Market | Futures Market |

1-Jan | Spot market quotation: 15000¥/ton | The settlement price of live pigs: 15640 ¥/tonSell 1000 hands of hog futures |

1-Mar | Spot market quotation: 16800¥/ton | The settlement price of live pigs: 17200 ¥/tonBuy 1000 hands of hog futures |

Profit | p=28.8 million yuan | p=-24.96 million yuan |

It can be seen from the table above that a futures contract is not always the most profitable financial tool. But the effect of buying to preserve value is maximized, and the risks the enterprise takes are minimized.

Hog futures contracts can enable hedging by offering a high correlation and convergence with the spot market. Correlation refers to the extent to which two assets move together in the same direction or opposite direction. Convergence refers to where two investments have the same price at maturity or delivery. A high degree of correlation and convergence can ensure that an asset's hedging performance matches another asset's underlying risk exposure.

Such a relationship is developed since the futures contracts are settled by physical delivery. This eliminates the possibility of any discrepancy between the quality or location of the delivered live pigs and the futures contract specifications. Therefore, hog futures contracts align with the spot market prices of live hogs as they approach expiration.

In recent years, there has been widespread uncertainty over the supply and demand outlook of pork as China's hog production recovers from ASF while pork consumption remains depressed by COVID-19, along with the changes in consumer preferences. Since the economic environment is unstable, enterprises realize the increasing importance of hedging to improve their ability to cope with risks. With better risk management strategies, China's hog producers can become more particular about their trades, and the cyclic price patterns in China's hog market will be less severe.

3.3. Vertical Integration

Setting up hog futures can promote vertical integration in China’s hog market. Pig farmers’ speculation of potential profits determines Chinese hog supply. Moreover, China's demand for hogs has remained stable and will not fluctuate since pork is a daily necessity for Chinese households. This means future hog supply and hog price are determined by the present number of livestock in the hands of pig farmers.

Hog futures can enhance the coordination and efficiency of the supply chain by providing a standard price signal and a risk management tool for different market participants. For example, hog producers can use hog futures to lock in a profitable price for their output and plan their production accordingly. Hog processors can use hog futures to secure a stable supply of live hogs and hedge against price fluctuations. Hog consumers can use hog futures to anticipate the future price of pork and adjust their demand accordingly. This price transparency promotes the efficiency of the hog production chain. It encourages large-scale farms and processing enterprises to stipulate their rights and obligations in the form of contracts (Figure 6).

Figure 6: (China’s pig production chain in brief).

Thus, the futures market promotes vertical integration and increases production efficiency, making market pricing more transparent. In this way, pig farmers guarantee a stable supply of pigs, and a steady supply can lead to a regular price in the market.

3.4. Producer Scale of China's Hog Industry

The development of the hog market in China is favoring large-scale enterprises, especially after the establishment of the futures market. Hog futures may increase the market threshold for small-scale farmers in serval aspects:

1. Basic requirement of capital to open positions. Trading in futures usually requires a certain amount of capital deposit, which will change with fluctuations. Small-scale farmers may not have such sufficient funds to participate in futures trading. Therefore, it is difficult for them to enter the futures market.

2. Increase of market competition: Hog futures may attract more speculators into this market and intensify the competition. Small-scale farmers may face challenges as they compete with experienced financial management companies and other large-scale producers.

3. Increase difficulty in risk management: Expert skills in accurate predictions of market trends and analytical capabilities are also required when trading futures. Smallholder farmers may have more significant risks and losses without proper risk management strategies.

According to the data released by the National Bureau of Statistics in China, the total production was 54.04 million tons in 2019, and the total output of the top five pig producers was 16.6 million tons, which occupies 30.7% of the total. This data indicates that these large companies' output capability and practices can significantly impact the industry as a whole [9].

Currently, many retail hog farmers still make up most of the Chinese hog market. As small-scale farmers struggle to compete with larger companies, some are switching to another business. Moreover, fewer small-scale farming households are willing to enter the hog industry, scared off by the treacherous market. This can result in a loss of Chinese traditional farming culture.

The impact of producer scale on the cyclic pattern of the hog market is significant. There are fewer things small-scale producers can do since they typically have fewer production scales and capacity, higher production costs, etc... They have less impact on the cyclic pattern of the hog market than large companies. However, the number of small-scale farmers is a considerable amount of people. When the market is oversupplied, and the pig disease breaks out, their live hog output and revenue will be most affected.

In contrast, large companies occupy more live hog production as they have better productivity and risk tolerance, allowing them to withstand market fluctuations.

Due to the characteristics of a small-scale and decentralized market, data collection is complex, and statistics are difficult to retrieve. The source of data might be unofficial and scattered. Our analysis above is only effective in a specific scope.

4. Case Study

To better study the application of hog futures in the actual market, we make a case study based on the financial statements of Muyuan Food Co. Since we can only access information before 6/30/2022, the data in the following paragraphs may not be immediately up to date.

Muyuan Food Co. is one of the largest hog-breeding enterprises in China. The enterprise sold 61.2 million pigs in 2022, about 9 percent of the total hog market. The company is an integrated breeding enterprise, procuring raw materials and processing the feed independently, so risk management is essential to Muyuan. The company traded corn and other futures products along with hog since they account for a relatively high proportion of raw material procurement to avoid the adverse impact of large fluctuations in raw material prices on its operations.

The financial statement shows that from 2020 to 2021, the operating cost of pig production in Muyuan enterprises increased by 196.54% year-on-year. The increase in production cost reflects that pig production in China has not reached the same scale as in developed countries, and the technology is still relatively immature.

In the first year of Muyuan's participation in hog futures, a deposit of about 224,000 yuan was paid. The large margin is also a factor that hinders many small farmers from participating in the futures market. They cannot pay the margin like big companies, so the entry for small-scale farmers to enter the market is even higher after the pig futures are launched.

In 2021, Muyuan profited 2.6619 million yuan from futures contracts. The exact amount that should be attributed to hog futures is unknown, but we can say that compared to the company's total annual profit of 7.668 billion in 2021, it accounts for a minimum part. It can be seen from above that China's hog futures are not only in its primary state of development, but companies are also familiarizing themselves with this novel area.

However, in 2021, the profit of the hog futures arbitrage of Muyuan is about 2,786,600 yuan, according to the statement. Also, in 2023, Mu Yuan increased the hedging quota of hog futures to 800 million yuan. It is not difficult to see that hog futures are indeed a good helper for

public companies to avoid risks and strengthen management (Data retrieved from the annual financial report of Muyuan Food Co. (2021) and the semi-annual financial report of Muyuan Food Co. (2022).).

5. Conclusion

It has been only about two years since the first hog futures contract is signed on 1/8/2021. Too little time has been given to let hog futures fully display their potential. Based on our study, this paper's conclusions are as follows:

1. Due to the characteristics of the Chinese hog market, the cyclic pattern in hog price fluctuations will continue to exist shortly and may even increase in amplitude. Based on our research, however, we believe that establishing hog futures will effectively alleviate the intensity of pig cycles since more information is available through hog futures, and traders will be more confident in their own decisions. Once hog supply is stabilized, the market will have more time to restore equilibrium.

2. China’s hog market will remain competitive. However, fewer and fewer hog farmers will enter the market, and large companies’ decisions give hints to the direction of development of the whole market. Their decisions will carry more weight and may prevent small-scale farming households from entering the hog market.

Acknowledgment

Completing this paper would not be possible without the guidance of Professor Martin Cherkes. We would also like to thank Ms. ZiYun for her assistance.

References

[1]. Grimmelt, A., Hong, S., Paula, R. U. de, Zhang, C., & Zhou, J. (2023, February 10). For the love of meat: Five trends in China that meat executives must grasp. McKinsey & Company. Retrieved March 10, 2023, from https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/for-love-of-meat-five-trends-in-china-that-meat-executives-must-grasp

[2]. Liu Xiaqing, Liu Baiyu & Han Xiaoning. (2019). Analysis of Herd Effect of Investor's Behavior from the Perspective of Behavioral Finance. (eds.) Proceedings of 2019 International Conference on Management, Education Technology, and Economics (ICMETE 2019) (pp.572-576). Atlantis Press.

[3]. Ren, B., & Lucey, B. (2023, February 1). Herding in the Chinese renewable energy market: Evidence from a bootstrapping time-varying coefficient autoregressive model. Energy Economics. Retrieved March 15, 2023, from https://www.sciencedirect.com/science/article/pii/S0140988323000245?via%3Dihub

[4]. Zuo, W., Yoshida, H., Steinlein, H., Phillips, A., Matsumoto, A., Mackey, M., Li, K., Jensen, R., Hommes, C., He, X., Guo, B., Goeree, J., Diks, C., Dieci, R., Guilmi, C. D., Day, R., Chiarella, C., & Brock, W. (2022, January 5). Production Delays and Price Dynamics. Journal of Economic Behavior & Organization. Retrieved March 16, 2023, from https://www.sciencedirect.com/science/article/abs/pii/S0167268121005436?via%3Dihub

[5]. Shiyang Wu. (2019). Research on the moderating effect of pig futures on fluctuations in pig prices (Master's thesis, Southwest University of Science and Technology).https://kns.cnki.net/kcms2/article/abstract?v=P6B9XB_UHlsKOnxO6MuxKPlDd4OuYqGEQQH5zKeekq29apN8skB_5Zlt-pWeliIJDOapZjDTU-CUCJu8qJ0ZNbUdfjcIDbrMIO5mSsg6XRMnWl6rBoeEROA==&uniplatform=NZKPT&language=CHS

[6]. Hao, M., Chen, R., & Fu, X. (2014, March 15). Effect of pig price volatility on Sichuan Pig Farmers' behavioral response in China. Journal of Agricultural Science. Retrieved March 27, 2023, from https://www.ccsenet.org/journal/index.php/jas/article/view/33054Hao, M., Chen, R., & Fu, X. (2014, March 15). Effect of pig price volatility on Sichuan Pig Farmers' behavioral response in China. Journal of Agricultural Science. Retrieved March 27, 2023, from https://www.ccsenet.org/journal/index.php/jas/article/view/33054

[7]. Ganti, A. (2023, February 7). Clearinghouse: An essential intermediary in the financial markets. Investopedia. https://www.investopedia.com/terms/c/clearinghouse.asp

[8]. Phung, A. (2022, July 8). Futures prices converge upon spot prices. Investopedia. Retrieved March 27, 2023, from https://www.investopedia.com/ask/answers/06/futuresconvergespot.asp

[9]. National Bureau of Statistics Information Disclosure. Return to Home Page. (n.d.). http://www.stats.gov.cn/xxgk/sjfb/zxfb2020/202301/t20230117_1892123.html

Cite this article

Yang,X.;Li,S.;Zhou,Z.;Wang,M. (2023). How Will the Hog Futures Smooth Price Fluctuations in China’s Pig Market. Advances in Economics, Management and Political Sciences,32,62-70.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Grimmelt, A., Hong, S., Paula, R. U. de, Zhang, C., & Zhou, J. (2023, February 10). For the love of meat: Five trends in China that meat executives must grasp. McKinsey & Company. Retrieved March 10, 2023, from https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/for-love-of-meat-five-trends-in-china-that-meat-executives-must-grasp

[2]. Liu Xiaqing, Liu Baiyu & Han Xiaoning. (2019). Analysis of Herd Effect of Investor's Behavior from the Perspective of Behavioral Finance. (eds.) Proceedings of 2019 International Conference on Management, Education Technology, and Economics (ICMETE 2019) (pp.572-576). Atlantis Press.

[3]. Ren, B., & Lucey, B. (2023, February 1). Herding in the Chinese renewable energy market: Evidence from a bootstrapping time-varying coefficient autoregressive model. Energy Economics. Retrieved March 15, 2023, from https://www.sciencedirect.com/science/article/pii/S0140988323000245?via%3Dihub

[4]. Zuo, W., Yoshida, H., Steinlein, H., Phillips, A., Matsumoto, A., Mackey, M., Li, K., Jensen, R., Hommes, C., He, X., Guo, B., Goeree, J., Diks, C., Dieci, R., Guilmi, C. D., Day, R., Chiarella, C., & Brock, W. (2022, January 5). Production Delays and Price Dynamics. Journal of Economic Behavior & Organization. Retrieved March 16, 2023, from https://www.sciencedirect.com/science/article/abs/pii/S0167268121005436?via%3Dihub

[5]. Shiyang Wu. (2019). Research on the moderating effect of pig futures on fluctuations in pig prices (Master's thesis, Southwest University of Science and Technology).https://kns.cnki.net/kcms2/article/abstract?v=P6B9XB_UHlsKOnxO6MuxKPlDd4OuYqGEQQH5zKeekq29apN8skB_5Zlt-pWeliIJDOapZjDTU-CUCJu8qJ0ZNbUdfjcIDbrMIO5mSsg6XRMnWl6rBoeEROA==&uniplatform=NZKPT&language=CHS

[6]. Hao, M., Chen, R., & Fu, X. (2014, March 15). Effect of pig price volatility on Sichuan Pig Farmers' behavioral response in China. Journal of Agricultural Science. Retrieved March 27, 2023, from https://www.ccsenet.org/journal/index.php/jas/article/view/33054Hao, M., Chen, R., & Fu, X. (2014, March 15). Effect of pig price volatility on Sichuan Pig Farmers' behavioral response in China. Journal of Agricultural Science. Retrieved March 27, 2023, from https://www.ccsenet.org/journal/index.php/jas/article/view/33054

[7]. Ganti, A. (2023, February 7). Clearinghouse: An essential intermediary in the financial markets. Investopedia. https://www.investopedia.com/terms/c/clearinghouse.asp

[8]. Phung, A. (2022, July 8). Futures prices converge upon spot prices. Investopedia. Retrieved March 27, 2023, from https://www.investopedia.com/ask/answers/06/futuresconvergespot.asp

[9]. National Bureau of Statistics Information Disclosure. Return to Home Page. (n.d.). http://www.stats.gov.cn/xxgk/sjfb/zxfb2020/202301/t20230117_1892123.html