1. Introduction

Meituan was set up in 2010 as a group purchasing platform. In the following years, Meituan expanded the business and grew into one of the biggest online to offline platforms providing lifestyle services in China. Dianping, a consumer review website, was set up in 2003 and its services include viewing the information of various restaurants and stores, giving scores and making comments. As the competition of O2O platforms were getting increasingly fierce, Meituan decided to seek a way, facing the external challenges. In 2015, the leader of Meituan announced Meituan’s merger of Dianping, forming a new company called Meituan Dianping. Meituan first exchanged ordinary shares and preferred shares for 40% of Dianping's ordinary and preferred shares, with the remaining 60% sold in 2017 [1]. However, Meituan and Dianping still retained their former brands and business. In 2018, Meituan Dianping went public through an IPO and its stock began to be traded on Hong Kong Stock Exchange at the price of 69 HKD. In 2020, Meituan Dianping declared to be renamed as Meituan.

Nowadays, almost all of the internet companies are facing many external challenges and flaws. Merger can serve as one of the effective solutions dealing with similar problems and Meituan’s merger of Dianping can bring enlightenment and inspire decision makers. Through analyzing the case of Meituan’s merger of Dianping, what can be obtained are the motivation and effectiveness of the deal. The following sections of this paper are organized as follows: Section 2 analyzes the motivation of the deal including the challenges Meituan faced before the merger and the objective of Meituan through the merger; Section 3 analyzes both advantages and disadvantages as well as stylized facts and future prospects.

2. Motivation Analysis of Meituan’s merger with Dianping

2.1. Challenges Meituan Faced before the Merger

In the market of O2O lifestyle service platforms, Meituan’s major competitors were Dianping and Baidu Nuomi before Meituan’s merger of Dianping. The similarity is that these three companies all focused on group purchasing service in various areas such as restaurants, hotels, film tickets and so on. However, Dianping was Meituan’s familiar competitor while Nuomi was a burgeoning one. In 2015, Meituan announced its annual revenue of 4.02 billion yuan. Dianping had never exceeded Meituan in revenue. However, according to the 2015 annual report of Baidu, the firm said that Nuomi created the revenue of over 7 billion yuan. Comparatively, the revenue of Nuomi is much higher than that of Meituan. Higher revenue means bigger market share, which could lead to positive feedback of the future revenue. From 2014 to 2015, the market share of Meituan was gradually squeezed by the growth of Nuomi.

Moreover, merchants tend to put the products on the shelf of different platforms, including platforms in all sizes like Meituan, Nuomi and some small platforms, in order to be exposed to bigger customers group. As the same group purchasing product can be available to customers via different platforms, customers prefer to choose the cheapest one. In this situation, the platforms have to lower the price of the product or use discounted coupons to attract customers, which is considered as conducting low-price strategy in the intense competitive environment [2]. Meituan was involved in the price war and continued to burn money.

Despite the price of the group purchasing product, customers also put emphasis on the public praise of the platform. Trust of the customers to the platforms can be built through customers’ own experience and friends’ recommendation. Moreover, most customers tend to rely on the comments on the platforms about the group purchasing products. These comments including reviews and rating stars affect sales of the products highly [3]. However, Meituan was reported to use fake comments and fabricated data on its platform. By contrast, Dianping was highly praised for its reviewing and rating system as only who had actually bought the product were allowed to make comments. As the scandal was exposed to the public, some of the loyal customers lose trust of Meituan and turn to other platforms. This meant the decline in Meituan’s sales and the increase in the sales of competing platforms such as Dianping and Nuomi.

Facing the intense horizontal competition, losing market share and crumbling reputation, Meituan had to take action to take up the challenges.

2.2. Objective of Meituan Through the Merger

Meituan hoped to bring the lost market share back and expand business through the merger. The ultimate objective of Meituan’s merger of Dianping was to seek for opportunities to increase revenue. Both improving market share and expanding business could devote to the revenue of Meituan.

The lost market share can be seen through the decline in the overall revenue from 2014 to 2015. According to the public information, the revenue of Meituan dropped from 46 billion yuan in 2014 to 4.02 billion yuan in 2015. In the meantime, an increase was seen in the revenue of Nuomi from 3.82 billion yuan in 2014 to 7 billion yuan in 2015. Higher revenue means higher market share. It is evident that Nuomi became the leading company among the O2O lifestyle service platforms according to the high revenue in 2015. In order to seize back the lost market share, the first step was to increase the number of customers. With more than 200 million active users, Dianping was the target company of Meituan. Through the merger of Dianping, Meituan hoped to gain customers who were used to be Dianping users. The former users of Dianping might turn to Meituan as they became a joint company.

What’s more, Meituan also hoped to broaden its business scope through the merger of Dianping. Firstly, expand business types and form into a comprehensive O2O lifestyle service platform. Initially, Meituan preferred to launch its own products while Dianping served as a review site and adopted the products of other companies [4]. Through Meituan’s merger of Dianping, the joint platform would provide self-support products and also introduce the reviewing system of Dianping which eliminate the problem of fake comments and rating. Secondly, expand business to vast area. Dianping occupied the customers in big cities such as Beijing, Shanghai, Nanjing and Suzhou [4]. By contrast, Meituan was more influential only in in small to mid-sized cities. After the merger, Meituan could have access to customers in big cities.

3. Effectiveness Analysis of Meituan’s Merger with Dianping

3.1. Advantages and Disadvantages

3.1.1. Advantages

After Meituan’s merger of Dianping, a new company was formed called Meituan Dianping which was lately renamed as Meituan. The former business of Meituan and Dianping was kept and operated with the former brands and teams separately. In this way, Meituan and Dianping could share information and products. Meituan served as a product supplier as well as a platform while Dianping kept concentrating on reviewing services and adopted Meituan’s products instead of products of other suppliers. With Meituan’s products exposed to customers on both platforms, the sales of products increased, leading to the rise in revenue as well.

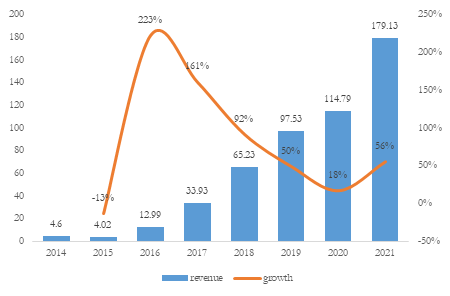

Meituan fulfilled its objective of increasing revenue through the merger of Dianping. According to figure 1, although 2015 witnessed a decent in the revenue of Meituan, a growth of 223% can be seen in the revenue of 2016 after Meituan’s merger of Dianping at the end of 2015. In the following years, the annual revenue ascended at a high growth rate. Though the growth rate descended gradually, the annual revenue continued to increase in this period. According to the latest annual report of 2021, Meituan’s annual revenue reached 179.13 billion yuan, which was over 40 times more than that in 2015. It seems that the annual revenue will sustain the increasing trend at a rather stable growth rate in the future. As it is mentioned before, higher revenue means larger market share. This helped Meituan to improve competitiveness with Nuomi.

|

Figure 1: Meituan’s annual revenue in billion yuan & annual revenue growths. |

Data source: Statista |

Photo credit: Original |

Meituan’s merger of Dianping also led to the data sharing between these two companies. Both companies could have access to the merchants’ information and customers’ information collected by Meituan and Dianping, which could help to improve the products and services. The quality and price of the products and services can highly decide customers’ experience and customers’ experience decides whether customers will stick to the platform or turn to other platforms. Thus, pricing-location decision and comprehending consumer behavior are required to establish and retain sustainable competitive advantage in congested O2O marketplaces [5]. Firstly, through analyzing the historical consuming data of the customers, the platform can have an insight to the consumer preference and recommend appropriate products to customers later [6]. Also, the price of the products can be measured at a proper location. Secondly, with the help to big data system, the reviews and rating of customers can be collected and analyzed automatically. The platform can get to know about the shortcomings and make changes in time. Moreover, by automatically extracting useful keywords from massive user reviews, big data system can help Meituan quickly and effectively discovering valuable information and providing information about user purchasing behavior and feedback for Meituan to improve service quality [7]. In this way, loyal customers can be cultivated and customer satisfaction can be improved. All these efforts are aimed at promoting customer experience and devote to the overall revenue.

3.1.2. Disadvantages

According to table 1, the revenue statistics changed yearly from 2015 to 2018 before Meituan’s IPO. The revenue of different businesses all increased gradually. In 2016, In-store & Hotel & Travel business contributed the largest proportion of the annual revenue of about 54%. But in 2017, Food delivery business took up the largest percentage of 62% of the annual revenue. Food delivery business continued to take up the largest proportion but the figure dropped to 58% in 2018. The structure of the annual revenue was rather unstable. This meant the company was lack of long-term planning and preferred to be opportunistic.

Table 1: Meituan’s revenue in different businesses in million yuan.

Food delivery | In-store & Hotel & Travel | New business | |

2015 | 174.75 | 3773.72 | 70.48 |

2016 | 5300.99 | 7019.64 | 667.44 |

2017 | 21031.93 | 10852.81 | 2034.24 |

2018 | 38143.08 | 15840.36 | 11243.83 |

Data source: Meituan prospectus 2018 | |||

Although it seemed that both the overall revenue and separate revenue increased in this period, the gross profit rate descended year by year. According to table 2, the original gross profit rate was 69.16% in 2015. However, the figure dropped gradually to 45.74%, 36% and 23.16% in the following three years. The decline in gross profit rate was mainly because of the rising of cost. As the table shows, the cost of 2017 was even over 40 times higher than that of 2015, which was a dramatic figure. This phenomenon was possibly due to Meituan’s cash burning strategy. In order to attract customers and improve market share, Meituan reduced the price of products through allowance provided by its own capital [4]. It was undeniable that this strategy did increase the revenue and market share. According to Meituan prospectus 2018, Meituan’s market share rose from 31.7% in 2015 to 59.1% in 2018 [8]. But the company itself had to afford the excessive growth of cost.

Table 2: Meituan’s gross profit in million yuan and gross profit rate.

Revenue | Cost | Gross profit | Gross profit rate | |

2015 | 4018.95 | 1239.50 | 2779.45 | 69.16% |

2016 | 12988.07 | 7046.84 | 5941.23 | 45.74% |

2017 | 33918.98 | 21708.48 | 12210.50 | 36.00% |

2018 | 65227.28 | 50122.32 | 15104.96 | 23.16% |

Data source: Meituan prospectus 2018 | ||||

3.2. Stylized Facts and Future Prospects after the Merger

3.2.1. Stylized Facts

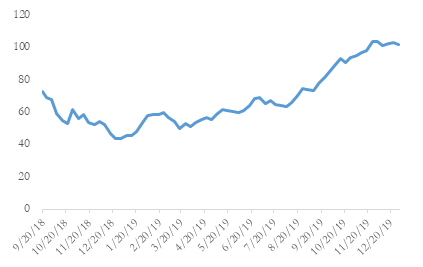

On September 20, 2018, Meituan went public on the Hong Kong Stock Exchange at the price of 69 HKD per share. According to figure 2, the close price per share continued to decrease since the first trading day. The lowest price even reached 41.20 yuan per share. It was not until the end of August, 2019 that the close price came back to about 72 yuan per share on the first trading day. After that, in the following period of time, the close price per share increased generally.

|

Figure 2: Close price per share of Meituan before from Sep 20, 2018 to Dec 20, 2019. |

Data source: Yahoo Finance |

Photo credit: Original |

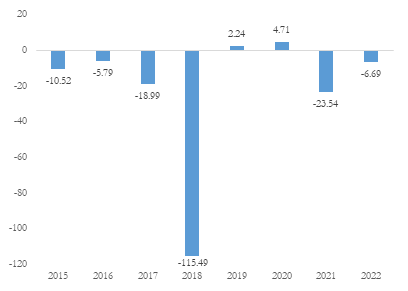

Through the IPO, approximately $ 4.2 billion was raised and it was one of the biggest IPOs in Hong Kong Stock Exchange. Meituan’s IPO is thought to be a successful case as it helped to make up the deficits and get surpluses. According to figure 3, Meituan remained to be an unprofitable company since its merger of Dianping in 2015. In 2018, the loss of Meituan even reached up to 115.49 billion yuan. However, after its IPO, 2019 witnessed the first year when Meituan made profit. Meituan earned profit of over 2.24 billion yuan and 4.71 billion yuan separately in 2019 and 2020. Although Meituan still lost more than 23.54 and 6.69 billion yuan in 2021 and 2022, the IPO did benefit Meituan as it brought about two years’ profit.

|

Figure 3: Meituan’s annual profit/loss in billion yuan. |

Data source: Meituan prospectus 2018 and annual reports from 2018 to 2022 |

Photo credit: Original |

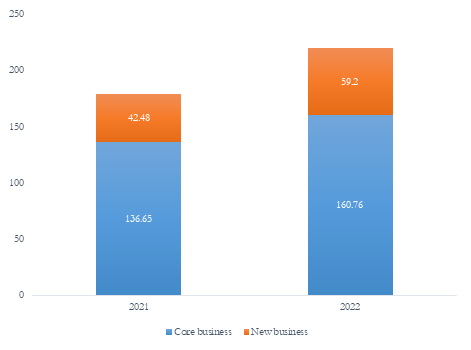

Based on the latest annual report of 2022 of Meituan, the structure of revenue in recent years is presented. The business is split into core business segment and new business segment. Core business, including food delivery and in-store, hotel and travel services, contributed to most of the revenue. Moreover, both core business revenue and new business revenue increased gradually according to figure 4. In detail, the revenue of core business segment rose from 136.65 billion yuan in 2021 to 160.76 billion in 2022. The revenue of new business segment increased by 39.3% from 42.48 billion yuan in 2021 to 59.2 billion yuan in 2022, which is mainly due to the expansion of the commodity retail business.

|

Figure 4: Structure of revenue of Meituan in billion yuan. |

Data source: Meituan annual report 2022 |

Photo credit: Original |

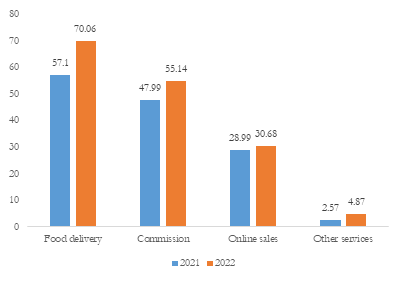

According to figure 5, the increase revenue of core business mainly depended on food delivery, rising from 57.1 billion yuan in 2021 to 70.06 billion yuan in 2022. And the rise in delivery service revenue was primarily attributable to the increase in transaction volume and the reduction in the cost of discount from food delivery, driven by the more effective user incentive strategy [9]. The increase in commission revenue by 7.15 billion yuan was primarily due to an increase in transaction volume and average spending in the food delivery, but the pandemic caused a decrease in transaction value in the in-store, hotel, and travel businesses. The revenue from online sales increased, which was also influenced by the pandemic. Also, online marketing by merchants led to the increased revenue of online sales.

|

Figure 5: Structure of core business revenue in billion yuan. |

Data source: Meituan annual report 2022 |

Photo credit: Original |

In the years after its merger of Dianping, the revenue of Meituan continued to ascend year by year and it is still in the upward trend. Meituan also successfully went public on Hong Kong Stock Exchange and had access to the capital market. In recent years, Meituan majors in food delivery service, which contributes a lot to the overall revenue. Nowadays, Meituan becomes a giant among the O2O lifestyle service platforms in China.

3.2.2. Future Prospects

First of all, Meituan should obtain its leading location in the food delivery market and expand its market share. With the continuous effort of Meituan on catering and food delivery services, a considerable number of loyal customers has been cultivated. Also, the market of food delivery is booming because of the influence of pandemic and change of living habits. In order to stabilize and expand the market share of food delivery business, Meituan should focus on the quality of delivering food, especially food safety. As food of wide pricing range is affordable by many customers, they begin to pursue high quality delivering food. If Meituan is able to ensure the quality of delivering food as well as the rationality of price, with the joint effort of brand reputation and customers’ trust, Meituan can seize wider customers and gain larger market share.

During the early stages of the O2O lifestyle service sector, the majority of O2O platforms, including Meituan, developed their market share by recruiting businesses with large discounts and attracting customers with low, affordable prices [10]. This brought huge costs which even overtook the revenue, which indicated why Meituan was hard to make profit. As it is mentioned before, Meituan only made profit in 2019 and 2020. In the remaining years, Meituan kept losing money and it even lost over 115 billion yuan in 2018, which was a terrible number. Thus, Meituan should abandon the strategy of burning money in exchange of market share and try to attract customers through the quality of products and services. According to a research evaluating customer satisfaction, Meituan’s customer satisfaction is at a slightly satisfactory stage [11].

Meanwhile, Meituan can turn to the diversification strategy. Firstly, diversification strategy can help Meituan to overcome the negative influence of market and external environment. Focusing on a single business may take risks of competitiveness and market. Thus, it is recommended that Meituan should expand its business to outer space such as the popular financial services. Financial services including micro-finance and payment service are still in the early stage among O2O platforms and Meituan could seize the opportunity to occupy market share in the area of financial services.

4. Conclusion

As the competition among horizontal companies is increasingly intense in the internet industry, these internet companies can seize for opportunities to merge with horizontal companies in order to cope with challenges and competition. Meituan’s merger of Dianping was a big news in the area of O2O lifestyle service platforms and it is considered as a successful case. Based on the case of Meituan’s merger of Dianping, it is analyzed through the motivation and effectiveness of the merger. The Stylized Facts and Future Prospects are also worth discussing. The insight into the deal can provide advice for companies in similar predicaments.

The reason why Meituan managed to merge with Dianping is the challenges of horizontal competition and the losing market share. Meituan expected to seize back the lost market share, increase revenue and expand business with the help of the merger. Through the analysis of revenue and cost, the article found that the merger highly increased its overall revenue but its insistence on low-price strategy prevented itself from making profit. However, in most of Meituan’s fiscal year, its continued to lose money. But it is undeniable that Meituan’s merger of Dianping is a successful deal. It is analyzed that after the merger, Meituan brought the lost market share back and occupied the leading position in the area of food delivery service. In all, Meituan becomes a giant among O2O lifestyle service platforms. There are still shortcomings when it comes to the business of Meituan. Thus, Meituan should be advised to keep its market share in food delivery service, focus on attracting customers through quality of products instead of low prices and adopt diversification strategy to expand business. A company is sustainable if it has steady revenue of major business, occupies stable market share and loyal customers and possesses diversified business. All these advices can enhance the stability and sustainability of the company, laying the foundation for its long-term development.

References

[1]. Qiang, YX. (2022). Analysis of Meituan's Acquisition of Dianping. Academic Journal of Business & Management (7.0). https://doi.org/10.25236/AJBM.2022.040714.

[2]. Li, C., Yan, X., Deng, X., Qi, Y., Chu, W., Song, L., Qiao, J., He, J., & Xiong, J. (2019). Latent Dirichlet Allocation for Internet Price War. Proceedings of the AAAI Conference on Artificial Intelligence, 33(01), 639-646. https://doi.org/10.1609/aaai.v33i01.3301639

[3]. Chang, JR., Chen, MY., Chen, LS. et al. (2020). Recognizing important factors of influencing trust in O2O models: an example of OpenTable. Soft Comput 24, 7907–7923. https://doi.org/10.1007/s00500-019-04019-x

[4]. Ding, GG. (2015). The sustainability of cash burning is Dubious as Meituan was reported to loose 7.2 billion yuan annually. IT Time Weekly (09),20-21.

[5]. He, Z., Cheng, T.C.E., Dong, J.C., Wang, S.Y., (2016). Evolutionary location and pricing strategies for service merchants in competitive O2O markets. European Journal of Operational Research, 354(02), 595-609. https://doi.org/10.1016/j.ejor.2016.03.030.

[6]. Shi, C., Pei*, Y., Li, D. i Wu, T. (2021). Influencing Factors of Catering O2O Customer Experience: An Approach Integrating Big Data Analytics with Grounded Theory. Tehnički vjesnik, 28 (3), 862-872. https://doi.org/10.17559/TV-20210124041130

[7]. Zhang, Z., & Zeng, J. (2019). Extracting keywords from user comments: case study of meituan. Data Analysis and Knowledge Discovery, 3(3), 36-44. https://doi.org/10.11925/infotech.2096-3467.2018.0573

[8]. Meituan Prospectus 2018. Retrieved April 19, 2023, from http://media-meituan.todayir.com/20180907112826231236667_tc.pdf

[9]. Meituan 2022 annual report. Retrieved April 19, 2023, from https://www1.hkexnews.hk/listedco/listconews/sehk/2023/0324/2023032400372_c.pdf

[10]. Zhao, X., Lin, W., Cen, S. et al. (2021). The online-to-offline (O2O) food delivery industry and its recent development in China. Eur J Clin Nutr 75, 232–237. https://doi.org/10.1038/s41430-020-00842-w

[11]. Wang, C., Customer Satisfaction Evaluation of Food Delivery Platforms-Taking Meituan as an Example. 2020 International Conference on Big Data Economy and Information Management (BDEIM). pp. 124-127, https://doi.org/10.1109/BDEIM52318.2020.00037.

Cite this article

Chen,T. (2023). Analysis of Meituan’s Merger of Dianping: Stylized Facts, Challenges and Outlook. Advances in Economics, Management and Political Sciences,34,230-239.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Qiang, YX. (2022). Analysis of Meituan's Acquisition of Dianping. Academic Journal of Business & Management (7.0). https://doi.org/10.25236/AJBM.2022.040714.

[2]. Li, C., Yan, X., Deng, X., Qi, Y., Chu, W., Song, L., Qiao, J., He, J., & Xiong, J. (2019). Latent Dirichlet Allocation for Internet Price War. Proceedings of the AAAI Conference on Artificial Intelligence, 33(01), 639-646. https://doi.org/10.1609/aaai.v33i01.3301639

[3]. Chang, JR., Chen, MY., Chen, LS. et al. (2020). Recognizing important factors of influencing trust in O2O models: an example of OpenTable. Soft Comput 24, 7907–7923. https://doi.org/10.1007/s00500-019-04019-x

[4]. Ding, GG. (2015). The sustainability of cash burning is Dubious as Meituan was reported to loose 7.2 billion yuan annually. IT Time Weekly (09),20-21.

[5]. He, Z., Cheng, T.C.E., Dong, J.C., Wang, S.Y., (2016). Evolutionary location and pricing strategies for service merchants in competitive O2O markets. European Journal of Operational Research, 354(02), 595-609. https://doi.org/10.1016/j.ejor.2016.03.030.

[6]. Shi, C., Pei*, Y., Li, D. i Wu, T. (2021). Influencing Factors of Catering O2O Customer Experience: An Approach Integrating Big Data Analytics with Grounded Theory. Tehnički vjesnik, 28 (3), 862-872. https://doi.org/10.17559/TV-20210124041130

[7]. Zhang, Z., & Zeng, J. (2019). Extracting keywords from user comments: case study of meituan. Data Analysis and Knowledge Discovery, 3(3), 36-44. https://doi.org/10.11925/infotech.2096-3467.2018.0573

[8]. Meituan Prospectus 2018. Retrieved April 19, 2023, from http://media-meituan.todayir.com/20180907112826231236667_tc.pdf

[9]. Meituan 2022 annual report. Retrieved April 19, 2023, from https://www1.hkexnews.hk/listedco/listconews/sehk/2023/0324/2023032400372_c.pdf

[10]. Zhao, X., Lin, W., Cen, S. et al. (2021). The online-to-offline (O2O) food delivery industry and its recent development in China. Eur J Clin Nutr 75, 232–237. https://doi.org/10.1038/s41430-020-00842-w

[11]. Wang, C., Customer Satisfaction Evaluation of Food Delivery Platforms-Taking Meituan as an Example. 2020 International Conference on Big Data Economy and Information Management (BDEIM). pp. 124-127, https://doi.org/10.1109/BDEIM52318.2020.00037.