1. Introduction

1.1. Background

At present, in the world, a new round of technological revolution and industrial reform is developing rapidly, and the related technologies in the fields of automobile and energy, transportation, information and communication are being integrated faster. Electrification, networking and intelligence have become the development direction and development direction of the automobile industry. With the integration of new energy, new materials, the Internet, big data's new energy vehicles, artificial intelligence and other transformative technologies, cars can be transferred from simple vehicles to mobile intelligent terminals, energy storage units, and digital space, thus driving the transformation and upgrading of energy, transportation, information and communication infrastructure, thereby improving the optimization of energy consumption structure, transportation system and the intelligent level of urban operation. In recent years, with the major automobile countries in the world strengthening the planning of new energy vehicles, new energy vehicles have become the main force in the transformation and development of the global automobile industry, and it is also an important engine to promote the sustainable development of the world economy.

1.2. Related Research

For Tesla, Long et al. used data from a survey of a representative sample of 2123 Canadian purchasers to investigate overall consumer perceptions of vehicle brands and compared consumer perceptions of the future development of vehicles for the study. The study found that forty percent of respondents believed that Tesla would be better developed as a representative brand for the future of new energy vehicles, and they believed that Tesla was more innovative [1]. Similarly, Dolbec and Fischer use market research to examine how Tesla is driving the market for the electric vehicle industry. Innovative entrants and other stakeholders were investigated about the changes in new market opportunities. The study found that a shift in social perception from energy consumption to sustainability has driven the development of Tesla's new energy vehicles [2]. In terms of technological innovation, Lehtinen analyses the system innovations of Tesla Motors about electric vehicles. The study investigates how Tesla has achieved disruptive innovation through systemic innovation and a major restructuring of its business system. The study finds that Tesla has systematically innovated at the level of battery technology and the level of the finished car, resulting in disruptive innovation throughout the company [3].

BYD, Wang and Zhang analyze the current state of development of cloud innovation in the new energy vehicle industry and investigate the pattern of cloud innovation in innovation development models. The study found that cloud innovation has significant advantages of low cost, and high efficiency, and is an open innovation, and BYD has used cloud innovation to create a new operating system [4]. Huckman and Maccormack use a comparative study to examine the development of BYD's labor-intensive model in battery manufacturing. The sources of BYD's competitive advantage in the marketplace are examined. The study finds that BYD has taken advantage of China's low labor costs and is an industry leader in the integration of battery technology [5]. In the market research, Pneva used a sample of Chinese consumers to study the level of acceptance of new technologies in the automotive industry. The study found that while BYD was initially unsuccessful in attracting Chinese consumers as the country's leader in electric vehicles, consumer acceptance of new energy electric vehicles is increasing as new energy technologies develop and consumer perceptions change [6].

According to the new energy vehicle industry policy, Gyrfi used a questionnaire survey of Chinese consumers to examine the impact of subsidies on consumer purchases of electric vehicles. The study found that China's mercantilist policy in the new energy vehicle industry, which heavily subsidizes domestic private sector companies, and the fact that subsidies account for a large proportion of new energy vehicle revenues, make new energy vehicle companies vulnerable to changes or subsidy policies [7]. In the government policy support, Zhang examines the Chinese government's support policies for the initial stages of new energy industry development by analyzing growth models and environmental technology R&D decisions. The study finds that the Chinese government's industry subsidy policies for new energy vehicles have stimulated innovation and increased the market share of new energy vehicle manufacturers [8]. In the new energy vehicle market research, Xu conducted a questionnaire survey of 285 4S car sales shop customers and driving school students to investigate the factors that influence the decision-making of mobile buyers of new energy vehicles. The study found that there are five main factors that consumers focus on after-sales service, cost of ownership, quality, energy consumption, and peripheral factors. The lack of after-sales service and the lack of vehicle safety protection are the main reasons why consumers do not choose new energy vehicles [9]. In addition to the factors that affect the purchase of cars, the paper also makes a comparative study of the development strategies of cars in different countries. Zhang and Zhao investigated the differences in goal orientation between China and the United States through a comparative study of the development strategies of the new energy vehicle industry in China and the United States. The study found that China develops new energy enterprises to boost total GDP, while the US develops a new energy vehicle industry to reduce emissions and optimize air quality. The reason for the differences lies in the different characteristics of the two countries' industrial players, which lead to different motivations [10].

1.3. Objective

This paper focuses on product analysis of Tesla and BYD, exploring the selling prices of their product ranges and finding the price strategy and sales gap between the two companies. It also compares the product ranges of the two companies and compares and analyses the marketing strategies of the two companies. In terms of investment decisions, this paper analyses the net profit, current assets, current rate, and return on equity of BYD and Tesla, and compares the data to analyze the profitability and solvency of the two companies to help investors in their investment decisions.

2. Company Product Perspective

2.1. Product Prices

Tesla currently sells four main types of products are shown in Table 1.

Table 1: Tesla product introduction.

Product | Price | Speed | 0-100 acceleration capability | Endurance |

Roadster | $195,300 | 402km/h | 1.1s | 1000km |

Model S | $120,000 | 320km/h | 2.1s | 719km |

Model X | $126,500 | 250km/h | 3.9s | 605km |

Model Y | $41,990 | 217km/h | 5.1s | 660km |

Model 3 | $98,950 | 225km/h | 5.6s | 550km |

The first car developed by Tesla was the Tesla Roadster, an all-electric sports car based on the British Lotus Evora, which was the first car to use lithium-ion batteries and the first electric car to travel over 200 miles on a charge.

The Model 3 is the world's best-selling new energy vehicle, with 3,124,000 units delivered worldwide. The Model Y, Tesla's best-selling SUV, is due for release in 2019. The Model X is the world's fastest SUV, with three electric motors on its body. The Model S, Tesla's main luxury model, was released in 2009 and caused a worldwide craze for electric cars as soon as it was issued.

BYD sells its products in two series - Dynasty and Ocean are shown in Table 2.

Table 2: BYD dynasty series product introduction.

Product | Price | Speed | 0-100 acceleration capability | Endurance |

BYD-Tang | $43,000 | 180km/h | 4.3s | 500km |

BYD-Qin | $19,830 | 180km/h | 5.9s | 400km |

BYD-Yuan | $19,800 | 180km/h | 8.5s | 305km |

BYD-Han | $38,000 | 240km/h | 3.9s | 550km |

BYD-Song | $19,830 | 150km/h | 9.96s | 405km |

The BYD Dynasty series, named mainly after Chinese dynasties, was launched with the BYD-Tang, BYD-Qin, BYD-Yuan, BYD-Han, and BYD-Song. The BYD-Tang and BYD-Han are BYD's mid-range models. The BYD-Qin, Yuan, and Song are the three-lower-end BYD models, as shown in Table 3.

Table 3: BYD ocean series product introduction.

Product | Price | Speed | 0-100 acceleration capability | Endurance |

BYD-Sea Gull | $10,500 | 130km/h | 5.9s | 305km |

BYD-Sea Seal | $36,000 | 180km/h | 3.8s | 550km |

BYD-Dolphin | $18,000 | 150km/h | 7.5s | 405km |

BYD-destroyer 05 | $21,000 | 200km/h | 7.3s | 1200km |

BYD-frigate 07 | $28,500 | 240km/h | 4.7s | 1200km |

The BYD Marine Series, named primarily after marine animals, is available as BYD-Sea Gull, BYD-Sea Seal, and BYD-Dolphin.

BYD-Sea Gull and Dolphin are BYD's low-end models. BYD-destroyer 05 and Frigate 07 are BYD's mid-range models. BYD-Sea Seal is BYD's high-end car.

As can be seen from the product prices, the BYD car price positioning is geared towards the low to mid-range consumer segment, while Tesla's prices cover a wide range of products that are mainly geared towards the mid to high-end consumer segment.

Tesla and BYD occupy the first and second places in the global new energy market. However, the sales gap between BYD and Tesla is huge, with Tesla holding the top spot in the new energy market. The above comparative analysis shows that Tesla's brand recognition remains the highest in the world and that its new energy vehicle products are the best sellers in the world.

2.2. Product Marketing Strategy

Tesla's strategy as a leader in new energy vehicles is to first develop high-performance electric sports cars such as the Roadster to establish a brand effect, followed by mid- to high-end models such as the Model X and mass production, and eventually by economical models for the mass market such as the Model S for maximum profit. Tesla Motors has had a very high brand value since its inception, thanks to the personal charisma and unique aura of CEO Musk. Tesla's brand communication does not rely on advertising but on social media communication, for example, using social media to discuss the topic after the launch of the Model 3, with over 300,000 orders booked in the first week.

BYD, a giant in China's new energy vehicle industry, has developed several new vehicles in recent years with Chinese elements in their names, such as BYD-Qin, Tang, Song, and Yuan. Its objective has shaped the cultural confidence and brand ethos of the Pinnacle brand. The low-price strategy it has carried out is an important competitive advantage. The price/performance ratio of the products is more advantageous in low and mid-range cars. Its brand communication relies heavily on the placement of advertisements and social media, the

There are significant differences between Tesla's and BYD's product marketing approaches. Tesla's product and brand effects have entered a mature stage, BYD's competitive strength is in the middle of the pack, its market influence and product influence perform better, and its market growth potential is greater, but its sustainability and international influence are slightly inferior compared to Tesla.

3. Financial Analyses

3.1. Corporate Profitability

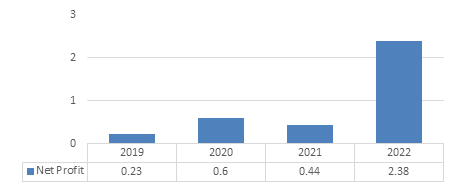

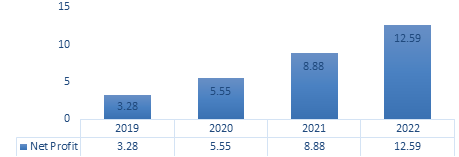

BYD: China's automobile industry will face a series of serious problems in 2022: insufficient supply of domestic chips, high cost of raw materials, slowing down on the supply side and suppressing demand for cars. In the face of difficulties and hardships, the Chinese authorities have introduced a set of new measures to promote the consumption of cars. The company has achieved its best performance since its inception, while BYD has worked with other manufacturers to ensure the production and delivery of its products. In terms of new energy buses, BYD has achieved a rapid increase in net profit through technological innovation and application. And technological innovation is the fundamental driving force to promote the company's high-quality development, led by pure electric and plug-in hybrid, represented by "blade battery", "DM-i super hybrid system" and "e-platform 3.0", promoting the company's technological progress in the field of new energy. In the field of secondary batteries, we will continue to conduct in-depth research to make our technology development at the forefront of China. This year, the company's product research and development and capacity improvement have made great progress, helping the company to achieve steady growth in the traditional battery field, but also helping the company in the field of storage development. as shown in Fig. 1.

Figure 1: Net profit-BYD (Unit: Billion).

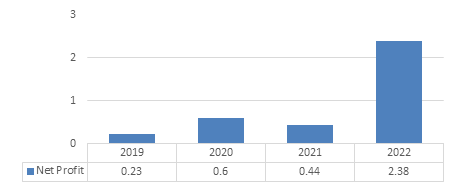

Tesla: In 2022, Tesla achieved an operating margin of 16.8%, doubled net profit, led the global automotive industry strongly, and a new delivery record of 1.31 million units was unmatched in the electric vehicle segment. the fourth quarter of 2022 was Tesla's 14th consecutive profitable quarter, achieving the highest single-quarter earnings, highest operating income, and highest net profit ever.

In 2022, despite challenges such as increased raw material, commodity, logistics, and warranty costs, as well as higher 4680 battery production costs and capacity creep at its two new Gigafactory, Tesla achieved a significant increase in electric vehicle deliveries, as well as growth in its other businesses, resulting in industry-leading operating margins that stood out in a sluggish car market.

Tesla has invested a lot of money in production and technology, more money than other fuel vehicle companies. The income from R&D investment will reduce production and operating costs. Thanks to Tesla's innovative production process, which is economical and efficient, Tesla's new generation of products will be launched at a record price on the Chinese mainland in January 2023, making all-electric vehicles more acceptable to the public.

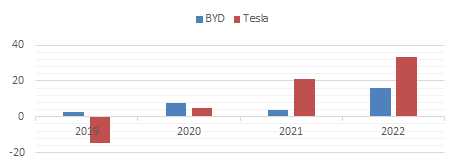

Both Tesla and BYD have seen a spurt of growth in sales in 2022. Although both manufacturers are facing rising raw material prices and chip shortages, both manufacturers have achieved production growth through their ability to innovate. Although BYD also achieves significant growth in 2022, its production scale and sales volume are a far cry from Tesla. Tesla's brand recognition and profit margins are much higher than Tesla's, resulting in a gap in profits between the two companies, as shown in Fig. 2.

Figure 2: Net profit-Tesla (Unit: Billion).

3.2. Ratio Analysis

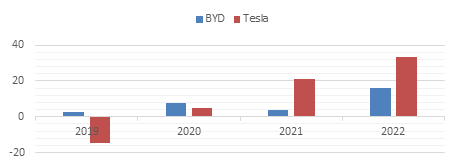

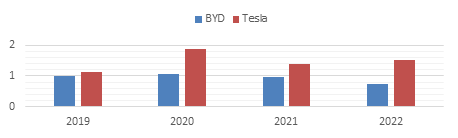

Return on Equity: Fig. 3 shows that the profitability of Tesla's ownership interest is weaker in 2019 and 2020, and BYD is in a slow growth position. In 2021, Tesla's ROE metric already exceeds BYD's, and Tesla's ability to earn net income exceeds BYD's. In 2022 BYD and Tesla see a spurt of growth and a substantial increase in earnings.

Figure 3: ROE comparison (Unit: Percent).

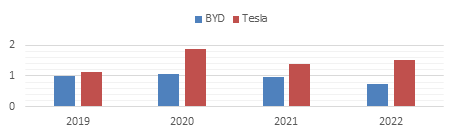

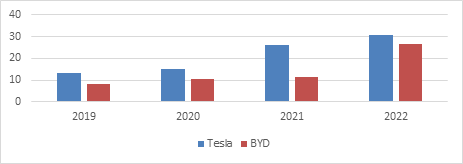

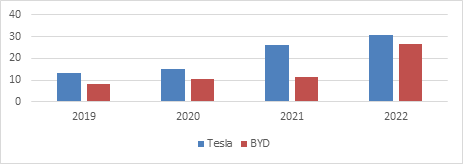

Current ratio: Fig. 4 reveals that Tesla's ability to repay its debt is stronger than BYD's ability to repay its debt and has higher asset security. BYD's quick ratio, on the other hand, gradually decreases each year to reach 0.72 in 2022, decreasing the company's ability to repay its debt and decreasing the safety of investors' assets.

Figure 4: Current ratio comparison.

4. Value Investment Judgement

4.1. Research and Development Investment

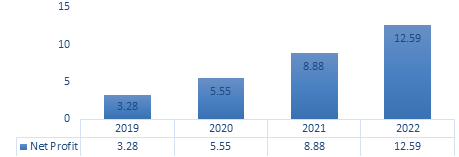

Fig. 5 shows the R&D investment costs of Tesla and BYD. The comparison shows that Tesla's R&D investment is much higher than BYD's. This means that Tesla focuses on improving the company's innovation ability and invests a lot of money and effort to develop new products, technologies, and services every year, thus improving the company's competitiveness in the market. Tesla spends a lot of R&D expenses on improving electric vehicle technology as well as battery management systems, thus reducing production costs and helping the company to expand and achieve profit growth.

The increase in R&D investment can also help Tesla to improve the efficiency of production factors, reduce expenditure links and gain a larger market share in the new energy vehicle industry. BYD has a lower level of innovation compared to Tesla, but the growth rate of R&D investment is higher and still has a strong competitiveness in the market. In contrast, the investment value of Tesla is higher than that of BYD, and investors can reap more returns through the growth of the company's innovation capability.

Figure 5: R&D expenses comparison (Unit: Billion).

4.2. Earning Capacity

The profitability of a company is an important indicator for investors to choose an investment. In 2022, the new energy industry is affected by the chip, supply chain, and rising raw materials, Tesla still achieved 81% year-on-year growth in the first quarter to $18.756 billion; a total gross profit of $5.460 billion, up 147% from $2.215 billion a year earlier, with a gross margin of 29.1%. This means that for every Model 3 Tesla sells, it earns a gross profit of more than $13,000. In 2023, the price of model 3 and model Y in China once fell, further stimulating consumers' desire to buy. Tesla's average inventory cycle shrinks to three days, which shows that Tesla has almost no inventory, new cars are delivered upon arrival, and no car company can make more money than Tesla.

BYD's total vehicle sales in 2022 are 1.86 million units. Net profit is $2.426 billion and net profit per vehicle is $1,284.3 per vehicle. BYD is close in sales compared to Tesla. But the net profit per vehicle is much different compared to Tesla. BYD's main profit comes not only from car sales but also from national new energy subsidy income and battery sales. From the perspective of product profitability, Tesla is more profitable and can bring more returns to investors.

4.3. Future Development Prospects

Tesla is currently the number one manufacturer in the electric vehicle industry. With China's strong support for the new energy vehicle industry, the outlook for the new energy vehicle market is getting better and better. The problem Tesla is currently facing is not a lack of demand, but a lack of production capacity. In the future, the first point of Tesla's main direction lies in expanding its production capacity. With the further increase of Tesla's production capacity, the price of Tesla may be reduced accordingly in the future, thus creating more demand and consolidating its role as an industry leader. The second point is to develop new energy technologies and equipment, through the development of more advanced energy technologies and equipment to improve production efficiency, reduce costs and improve profit margins. The third point is to adopt a diversified operating model, Tesla plans to work in 2023 to achieve the transformation and upgrade from a car manufacturer to an integrated operator in the new energy sector, not only relying on its single-car products, to reduce market risk and better respond to market changes.

The problem BYD is currently facing is the lack of international market recognition. The company's future development will focus on the first point to increase investment in research and development of new energy vehicle technology, such as battery technology, drive system, and other aspects of innovation. The second point is to accelerate the international development process. BYD plans to form an industrial layout with three major business sectors, namely electric vehicles, rail transportation, and batteries and will expand and promote its brand in Europe and South America to enhance the international recognition of its brand.

BYD and Tesla's development prospects are generally in a positive form, which enhances investors' confidence and helps companies attract more investors.

5. Conclusion

This article has examined the R&D investment, profitability, and prospects of Tesla and BYD for the period 2019-2022. By comparing the two companies, the study finds that Tesla has a higher share of R&D investment, higher returns through improved electric vehicle technology, and higher growth in innovation than BYD. In terms of profitability, Tesla's average profit per vehicle is much higher than BYD's, but BYD's main sources of profit are national new energy subsidies and battery sales, so from a product perspective alone, Tesla's profitability is stronger. Tesla is facing a shortage of production capacity in the future, and Tesla should focus on improving production efficiency in the future to drive up production capacity. BYD is facing the problem of low brand recognition in the future, and its future development should focus on promoting its brand and going global to enhance international recognition.

References

[1]. Long Z, Axsen J, Miller I, et al. What does Tesla mean to car buyers? Exploring the role of automotive brands in perceptions of battery electric vehicles[J]. Transportation Research Part A: Policy and Practice, 2019, 129.

[2]. Dolbec P Y, Fischer E. Changing Markets by Triggering Socio-Cognitive Transformations: How Tesla Boosted the Electric Car Market[C]// AMA Winter Academic Conference. 2019.

[3]. Lehtinen P. The advancement of electric vehicles - case: Tesla Motors. Disruptive technology requiring systemic innovating[J]. 2015.

[4]. Wang H, Zhang Y. Cloud Innovation: New Development Model for New Energy Automobile Industry——Based on BYD New Energy Automobile Industry[J]. Science and Technology Management Research, 2015.

[5]. Huckman R S, Maccormack A D. BYD Company, Ltd.[J]. Harvard Business School Case, 2006.

[6]. Pneva A. Chinese Consumers' Attitude Toward Electric Vehicles in the Case of BYD Company [D]. Sun Yat-sen University, 2010.

[7]. Gyrfi E I. How Can China Become A World Leader in Electric Vehicle Promotion: A Case Study of BYD.

[8]. Zhang J. R&D for Environmental Innovation and Supportive Policy: The Implications for New Energy Automobile Industry in China[J]. Energy Procedia, 2011, 5(1):1003-1007.

[9]. Guo-Hu X U. Impact Factors of Purchase Decision of New Energy Automobile[J]. China Population, Resources and Environment, 2010.

[10]. Zhang Z, Zhao F. The comparative study on the development strategies of the new energy automobile industry between China and America——based on the differences in the goal orientation[J]. Studies in Science of Science, 2014.

Cite this article

Cheng,Y. (2023). Tesla and BYD Comparison Analysis. Advances in Economics, Management and Political Sciences,38,225-232.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Long Z, Axsen J, Miller I, et al. What does Tesla mean to car buyers? Exploring the role of automotive brands in perceptions of battery electric vehicles[J]. Transportation Research Part A: Policy and Practice, 2019, 129.

[2]. Dolbec P Y, Fischer E. Changing Markets by Triggering Socio-Cognitive Transformations: How Tesla Boosted the Electric Car Market[C]// AMA Winter Academic Conference. 2019.

[3]. Lehtinen P. The advancement of electric vehicles - case: Tesla Motors. Disruptive technology requiring systemic innovating[J]. 2015.

[4]. Wang H, Zhang Y. Cloud Innovation: New Development Model for New Energy Automobile Industry——Based on BYD New Energy Automobile Industry[J]. Science and Technology Management Research, 2015.

[5]. Huckman R S, Maccormack A D. BYD Company, Ltd.[J]. Harvard Business School Case, 2006.

[6]. Pneva A. Chinese Consumers' Attitude Toward Electric Vehicles in the Case of BYD Company [D]. Sun Yat-sen University, 2010.

[7]. Gyrfi E I. How Can China Become A World Leader in Electric Vehicle Promotion: A Case Study of BYD.

[8]. Zhang J. R&D for Environmental Innovation and Supportive Policy: The Implications for New Energy Automobile Industry in China[J]. Energy Procedia, 2011, 5(1):1003-1007.

[9]. Guo-Hu X U. Impact Factors of Purchase Decision of New Energy Automobile[J]. China Population, Resources and Environment, 2010.

[10]. Zhang Z, Zhao F. The comparative study on the development strategies of the new energy automobile industry between China and America——based on the differences in the goal orientation[J]. Studies in Science of Science, 2014.