1. Introduction

Real estate is an important part of a country's economy. With its large industry size, multiple industrial chains and credit expansion, it becomes a leader in promoting economic development. China's real estate industry has also played such a role. This following text will review the main characteristics and problems of China's real estate development.

First, the Chinese real estate market has experienced rapid growth over the past few decades. With the advancement of China's urbanization process and the flow of population, the demand for real estate continues to increase, and housing prices are also gradually rising. Through a series of policy adjustments, the government reasonably bundled the real estate and financial industries, effectively pulling in the growth of the national economy and promoting employment [1]. However, behind the rapid development, there are also problems, including the overheating of housing prices leading to bubble problems and the rapid expansion of real estate companies leading to excessive debt and capital chain fusing, such as Evergrande Group [1, 2]. Due to the particularity of a commodity like a house—just needed, the civilian cannot avoid entering the real estate market. However, the bankruptcy of real estate companies is not only related to the survival of a listed company, but also linked to people's livelihood and well-being. In recent years, the government has continuously introduced policies to stabilize housing prices, strictly controlled the source of funds of enterprises, and strengthened management from a macro perspective [3]. At the same time, the problems and development direction of real estate enterprises are also worthy of attention.

Therefore, it is necessary to analyze and find out the challenges and problems that real estate companies are currently facing, and to put forward future prospects. This study will use the method of case analysis and data comparison to find the future development direction of real estate enterprises.

2. New Situation and Policies in the Real Estate Industry

2.1. The Development Trend of Social Economy under the New Situation

After 20 years of rapid economic development with demographic dividends, China will enter the stage of population aging in the next few years. According to the "China Population Forecast Report 2023 Edition", China's demographic dividend will end around 2035. This is undoubtedly a shock to the demand of the real estate market. At the same time, population migration continues to affect the demand for commercial housing. Dr. Zhang Hongqin of Shanxi University of Finance and Economics said the influx of migrants to the eastern region has had positive impacts on the region, including increasing the total workforce and boosting economic development. In addition, this population movement also alleviates the population aging problem in the eastern region and stimulates the growth of local housing demand. However, for the Midwest, emigration poses serious problems. The loss of population has led to an increase in the pension burden of the population in the region, insufficient economic growth momentum and a decline in housing demand. This situation has led to the unfavorable concentration of resources such as population in the region, forming a vicious circle between low population growth, high pension burden and low housing demand [4]. Therefore, it is foreseeable that the demand for commercial housing in first-tier cities in the eastern region will remain high in the future, while the real estate market in second- and third-tier cities will decline due to population decline and population migration, market differentiation will intensify, and market concentration will continue to rise.

2.2. The Impact of the New Policy on the Real Estate Industry

Affected by the international situation, the epidemic and the economic downturn, China's real estate industry was in a downturn in 2022. According to factors such as frequent disturbances of the epidemic situation in some domestic cities and changes in the macro environment at home and abroad, residents' income expectations have turned pessimistic, resulting in a weak willingness to buy houses. The financial risks of enterprises are constantly increasing, and the unfavorable factors of the industry are accumulating. These factors have comprehensively affected the development of the housing market [5]. In order to boost the market, the government has introduced many real estate policies in the past two years. The core part is the "guaranteed delivery of buildings", which strictly controls the capital operation and management of real estate companies. "Guaranteed delivery" refers to ensuring that the real estate is delivered to buyers on schedule in accordance with the agreed quality and quantity. The guiding direction of this policy is that when companies face short-term debt maturities and increased leverage ratios, they can speed up the return of funds by selling at reduced prices to optimize their asset structure. At the same time, there is also a special loan channel for "guaranteed delivery buildings", which is undoubtedly a move to stabilize the industry foundation and enhance public confidence in the entire industry.

In addition, in 2022, the central bank cut the loan prime rate (LPR) several times to stimulate demand in the real estate market. In January and May, the LPR was lowered, and the interest rate for the corresponding term was lowered. In August, the LPR was lowered again, with an even bigger drop. Among them, the LPR with a period of more than 5 years has dropped from 4.6% to 4.3%. As the LPR with a period of more than 5 years continues to decrease, the interest rate of commercial bank mortgages will continue to decline. In addition, the central bank has also introduced differentiated credit policies, including lowering the lower limit of first-home loan interest rates and gradually relaxing restrictions in some cities. These policy measures have played a positive role in stabilizing and promoting the real estate market. The cancellation of purchase restrictions and the sharing of provident funds in some second- and third-tier cities have also increased the enthusiasm of the market to a certain extent.

3. Overview and Current Situation of Yuexiu Property Company

3.1. Company Background and Development

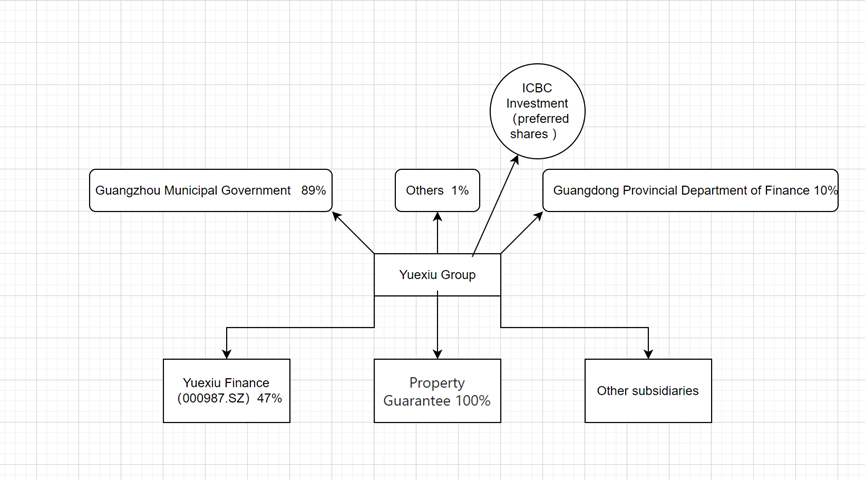

Yuexiu Property has been deeply involved in real estate in the Guangdong-Hong Kong-Macao Bay Area for 40 years, backed by the parent company Yuexiu Group, a Fortune 500 company. As a state-owned enterprise, the Guangzhou Municipal Government holds nearly 90% of the shares. The company's organizational structure is shown in Figure 1. Since the group was listed in Hong Kong in 1983, it has expanded rapidly in Guangzhou by riding the wind of reform and opening up. Relying on the original model of "development + operation + finance", Yuexiu Property has built multiple commercial and residential areas in Guangzhou and has become a leading real estate enterprise in Guangzhou. After 2010, Yuexiu Property established a new development strategy of "based in Guangzhou, developing the Pearl River Delta, and deploying nationwide", aiming its development direction at the whole country. As of the end of 2022, Yuexiu Property has entered 30 cities across the country, with key investments in first-tier cities in the east. Its business scale has continued to expand and its sales have exceeded 100 billion [6].

Figure 1: Company structure.

3.2. Industry Status and Competitive Advantage

The predecessor of Yuexiu Property was "Guangzhou Urban Construction". As a time-honored state-owned enterprise that has been deeply involved in the Pearl River Delta region for 40 years and the first real estate company in Guangzhou, Yuexiu Property has become a leader in the industry. According to the 2022 Guangzhou land auction data, Yuexiu Property won 7 land parcels throughout the year, the most among all real estate companies in Guangzhou. As shown in Table 1, Poly Group, a similar enterprise, only obtained 5 plots. Today, Yuexiu Property has played an indispensable role in the construction of key projects in Guangzhou: the Urban Renewal Group was established in 2017, focusing on cooperating with state-owned enterprises and participating in urban renovation projects. At the end of August 2022, Yuexiu Property successfully delivered the first batch of the second phase of the Guangzhou International Campus project of South China University of Technology. This project is their exploration in industry-university collaboration and aims to build a top education base in Guangzhou. Yuexiu Property has also demonstrated their determination and attitude to cultivate the area in the Nansha area. As one of the first real estate development companies to enter Nansha District, it was still desolate and full of barren land. Today, the total investment of Yuexiu Group in Nansha District has exceeded 20 billion yuan, and nearly 20 projects have been successfully developed [5]. Behind the deep cultivation of Guangzhou, Yuexiu Group has invested in more than 20 cities across the country, and will enter the market of two super first-tier cities in Beijing and Shanghai in 2021. Although Yuexiu Property’s strategic layout is gradually moving towards the whole country, the company's dependence on Guangzhou real estate is still very high. According to the performance report released by the company in mid-2022, the cumulative national contract sales of 48.9 billion yuan, Guangzhou accounted for 29.34 billion yuan, and Guangzhou Sales in the region account for 60% of the total, and the company's performance is highly tied to property prices in Guangzhou. It is foreseeable that Yuexiu Property is still a leader in the industry when property prices in Guangzhou remain stable.

Table 1: Land auction situation of real estate enterprises in Guangzhou in 2022.

Yuexiu | Poly | GZCI | |

Amount of land taken | 7 | 5 | 3 |

Total transaction price(million) | 17788m | 15818m | 6216m |

In 2019, Yuexiu Property reached an agreement with Guangzhou Metro Company to introduce Guangzhou Metro as a strategic shareholder. Since then, it has launched in-depth cooperation with the Metro Company and became the first real estate company to develop a TOD project in Guangzhou. TOD is the abbreviation of transit-oriented development. It is a public transportation-oriented real estate development model. The project is mainly concentrated around railway stations, airports, subways, light rails, and bus stations. A comprehensive property development project integrating business and residence. In addition, the land of the TOD project belongs to the rail transit development company, and the developer participates in the project development in a cooperative manner. Although the development difficulty of TOD project is relatively high, it has been favored by developers in recent years due to its relatively low cost [7]. After Guangzhou Metro became the second largest shareholder of Yuexiu Property, the company's competitive advantage in auctioning land and developing land is ahead of the industry, and the selling point of the developed products is naturally more "the subway is covered, and the rail transportation is convenient". In addition, the company's diversified product operation model also brings competitiveness. The "development + operation + finance" model not only allows the company to sell commercial properties across the country, but also builds many urban commercial buildings: Guangzhou ICC, IFC Building, Hangzhou Victoria Center, etc. The two-way development of commercial and residential properties makes Yuexiu Property’s products more diversified and more competitive.

3.3. Financial Analysis of Yuexiu Property

Financial index analysis is an analysis method to extract and quantify from the financial data of the enterprise. This article will analyze the solvency, capital operation ability and profitability of Yuexiu Property. The main financial data of Yuexiu Property is shown in table 2.

Table 2: Financial data of Yuexiu Property.

2019 | 2020 | 2021 | 2022 | |

Revenue(million) | 38,339 | 46,234 | 57,379 | 72,416 |

Gross profit(million) | 13,117 | 11,626 | 12,482 | 14,806 |

Asset liability ratio | 76.50% | 75.60% | 76.30% | 68.80% |

Asset turnover | 19.10% | 18.60% | 19.90% | 22.00% |

Earnings attributable to equity holders(million) | 3,483 | 4,248 | 3,589 | 3,953 |

Solvency is generally used to measure the debt level of a company, and the better the solvency, the better the sustainability of business operations. This paper uses the asset-liability ratio for analysis. The asset-liability ratio can be obtained by dividing total liabilities by total assets, and the value is usually presented in the form of a percentage. If the asset-liability ratio is low, it means that the company bears relatively few debts, and the proportion of its own funds in the asset part is high, which may indicate that the company has a lower financial risk and is more repayable and financially stable. vice versa. According to the data of the China Commercial Real Estate Research Report, the asset-liability ratio of Chinese real estate companies has fluctuated between 70% and 72% in the past five years. In the case of a hotter market, a higher debt-to-asset ratio may mean that more leverage has been leveraged, which is not a bad thing from the perspective of expansion. But now that the market is cooling down, high asset-liability ratios may lead to insufficient funds. In the context of the market downturn, the asset-liability ratio of Yuexiu Property has also been lowered accordingly to stabilize the company's asset structure. Among them, the debt within one year is 15.74 billion, accounting for 18% of the total debt, and the operating cash flow reaches 2.1 billion. billion, covering all short-term accounts.

The asset turnover ratio (Sales/Capital employed) is generally used to reflect the capital operation and capital realization ability of the enterprise. The higher the asset turnover rate, the faster the asset operation speed and the better the sales ability. Despite the overall downturn in the market, Yuexiu Property's capital realization ability and sales performance have risen instead of falling, and its operating level has remained at a relatively high level.

Profitability is an indicator that investors are most concerned about, and it is also the most intuitive manifestation of a company's confidence in the market. The profit attributable to equity holders, also known as the profit attributable to the parent company, refers to the net profit realized by the company in a specific accounting period, after deducting the profit or loss related to minority shareholders. Minority shareholders are shareholders who hold shares in a company but do not have a say in controlling the company. Profit attributable to equity holders reflects the profitability of the company's operating business and expresses shareholders' share of profits. The level of profit attributable to equity holders can reflect the company's profitability and performance. A higher profit attributable to equity holders indicates that the company has achieved good performance in its operating activities and has the ability to generate more profits for shareholders. Based on the previous analysis, Yuexiu Property grew against the trend in 2022, improved its performance level in the context of market downturn, and the recovery of profit attributable to equity holders was also within the foreseeable range. Since the government issued the "three red lines" (asset-liability ratio, net debt ratio, and short-term cash-to-debt ratio) in 2020, Yuexiu Property has always remained within a safe range. But it was worth noting that the cash/short-term debt ratio had continued to decline since 2018, and this indicator was 2.23 in 2022. Relevant research believes that in the down cycle, Yuexiu Property has increased the strength of its land reserves in a contrarian manner, leading to an increase in the imbalance between capital inflows and outflows and short-term debts. During the period from 2019 to the first half of 2022, Yuexiu Property’s land payments and land auction deposits remained high, at 19.40 billion yuan, 17.96 billion yuan, 44.48 billion yuan, and 16.08 billion yuan, respectively. At the same time, short-term debt was also showing a continuous upward trend, reaching 7.14 billion yuan, 16.58 billion yuan, and 29.8 billion yuan from 2019 to 2021, with year-on-year increases of 23.4%, 132.2%, and 79.8%, respectively. Although Yuexiu Property's current financial situation is relatively stable, cash flow and short-term debt issues still need to be closely monitored. In terms of land reserves, it should avoid being too aggressive and put safety investment as primary purpose [8].

4. Problems and Prospects

4.1. Potential Problems Faced by Yuexiu Property

Under the new situation and policies, Yuexiu Real Estate still has many potential problems worthy of attention. The first is the short-term cash-to-debt ratio mentioned above. Although this indicator has not exceeded the red line, the year-on-year decline also reflects the risk trend of high leverage.

Secondly, the continuous downturn in the Guangzhou property market should also attract attention. Throughout 2022, the transaction volume of first-hand and second-hand housing in Guangzhou continued to decline. According to data from China Land Market Network, the transaction volume of new houses in Guangzhou in 2022 was 72,936, a year-on-year decrease of nearly 34%, and the transaction volume of second-hand housing was 82,739, a year-on-year decrease of 29%. In this market downturn, increasing the supply of housing needs to be done with caution. At the same time, thanks to the launch of multiple land plots in the core areas of Guangzhou, the average price of new houses in Guangzhou still increased by 14% in 2022, which also showed that the polarization of the market is emerging. According to research conducted by the National Business Daily, many real estate properties in peripheral areas such as Panyu District and Nansha District can only be sold at reduced prices due to the large supply and the pressure of capital return. However, the supply in these core areas of Tianhe District, Haizhu District is in a balanced state, which stabilizes the housing prices in the city [9]. Yuexiu property has sufficient housing reserves in Nansha District and Panyu District, and the destocking cycle is long, which may face the pressure of a long capital recovery cycle.

4.2. Future Prospects of Yuexiu Property

Although the current market outlook is generally considered low, the future direction of Yuexiu Property is still positive. For now, the potential problems faced by Yuexiu Property as analyzed above are all caused by the downturn in the market, and there are no problems in the company's own operations. Due to the particularity of China's economic system, the ability of leading state-owned enterprises to deal with risks is unquestionable. In terms of financing, the average borrowing cost of Yuexiu Property in 2022 will drop by another 10 basis points from last year to 4.16%. The diversification and low cost of financing channels are undoubtedly the embodiment of strong ability to deal with risks. At the same time, the investment credit rating of Yuexiu Property is excellent. In terms of the comprehensive strength of real estate enterprises in the country, Yuexiu property ranks among the top 30. Moody and Fitch Ratings scored Baa3 and BBB- on the credit rating of Yuexiu property, both of which belong to "stable outlook".

In the environment of intensified differentiation among real estate enterprises and rising market concentration, Yuexiu Property's operating advantages are also more easily manifested. Among Yuexiu Property's land reserves, 47% come from first-tier cities, which means that nearly half of its land can be converted into higher value. In terms of operation mode, according to the 2022 performance report of Yuexiu Property, the company will continue to deepen cooperation with state-owned enterprises to achieve strong alliances, focus on urban renovation and urban operation projects, and obtain government policy support. In the case of market uncertainty, this move can reduce the company's operational risks without affecting market expansion.

4.3. Enlightenment of Yuexiu Real Estate's Operation Strategy to Peer Companies

Yuexiu Property's business strategy is to seek progress while maintaining stability, and it has also achieved certain profits in terms of performance, which can be used as a reference for other real estate companies in the same industry. Real estate in second- and third-tier cities is already saturated, and it is not suitable to continue to expand. According to the research of "China Price", the sales area and sales volume of commercial housing in the Northeast and Western regions both declined in 2022, of which 37.9% and 40.9% in the Northeast, both of which were the highest in China. In addition, there are more than 30 cities across China with a destocking cycle of more than 24 months [10]. At present, the inventory of commercial housing in second- and third-tier cities across the country is too large, and the long destocking cycle has become a fact, and the trend of population migration is still to gather in first-tier cities. The dwindling population and consumption power are not enough to support the excessive expansion of real estate in small cities. Therefore, when an enterprise bids for land, it should conduct a comprehensive survey of the local market demand to avoid the risk of excessive supply and inability to consume inventory, resulting in the inability to return funds and the risk of unfinished projects. When a real estate is facing the pressure of capital return, the company can also launch the building with the highest value at a price slightly lower than the market price to ease the financial pressure and avoid unfinished projects.

Group development by enterprises can effectively deal with market risks. According to data from the National Bureau of Statistics, in 2022, real estate companies had 14,897.9 billion yuan of funds in place, a decrease of 25.9% from 2021. In the case of limited loans, small and medium-sized enterprises can deal with risks through group development of land plots and joint ventures to avoid the risk of delays due to insufficient funds. In addition, the development of real estate enterprises should also closely follow the direction of urban development, and undertake some responsibilities for urban construction, such as old renovations and new district development, so as to obtain certain government policy support.

For real estate companies, the most critical strategic adjustment should be the transformation to a comprehensive development and operation business model. Taking Yuexiu Property as an example, there are many types of companies under its umbrella, including food companies, property management, education groups and real estate trust funds. The diversification of product lines means a wide range of business chains and multiple profit channels. Business can also open up new areas for the company and earn profits from different industries and different audiences and consumers. Different types of real estate companies have different transformation directions. In the future, small real estate companies can continue to focus on business development and meet consumer demand through regional deep cultivation or the launch of low-end projects. Medium-sized real estate companies can gradually develop service-oriented asset-light businesses on the basis of maintaining a certain scale of traditional development business, such as the development of commercial and residential integrated communities. Comprehensive large-scale real estate companies can not only use their existing scale to develop asset-light businesses (such as business management, agent construction, property management, etc.), but also expand asset management businesses and invest assets in real estate investment trusts (REITs) or real estate funds. Among them, income is obtained by collecting property management fees or fund management fees [11]. Real estate investment trusts (REITs for short) are an investment vehicle designed to enable ordinary investors to invest indirectly in the real estate market by purchasing REITs shares or fund shares. The main business is to purchase, operate and manage various types of real estate assets by collecting investors' funds. For investors, the advantage of REITs is to invest in the real estate market with relatively low capital, and for enterprises, it can broaden the scope of financing and reduce financing costs [12].

5. Conclusion

This study found that in an environment where the real estate market is declining, concentration is increasing, and differentiation among real estate companies is intensifying, Yuexiu Property has been able to achieve impressive sales performance and growth trends, enhancing investors' confidence in the company's sustained profitability. The reason for this lies in Yuexiu Property's timely adjustment of its strategic direction, namely the "1+4" regional layout strategy, focusing on the Greater Bay Area and East China region, as well as the "6+1" diversified land acquisition and storage strategy, deepening urban operations, urban renewal, and TOD (Transit-Oriented Development) projects. After a wave of bankruptcies among real estate companies nationwide, all enterprises should have clearer strategic directions and cautious strategic approaches. Therefore, Yuexiu Property's strategy has valuable lessons and inspirational significance within the industry. Boosting the real estate market cannot solely rely on policy subsidies and banks lowering loan interest rates; local state-owned enterprises should also take action. Urbanization in China's first-tier cities has already been largely completed, and the current focus should be on urban redevelopment and renewal, rather than excessive expansion. This should be the strategic direction adjustment for local enterprises. In addition, the transformation and expansion of real estate companies' business should also become a new development direction. Relying solely on the traditional real estate business leads to long-term operation with high debt and leverage. Exploring new businesses such as developing REITs (Real Estate Investment Trusts) is not only to cope with risk shocks but also to alleviate the financial pressure on companies. In the context of the current deep transformation of the real estate industry, the author believes that strategic adjustments by companies are particularly important, and also hopes that China's real estate industry can respond to market shocks steadily and revive investor confidence.

References

[1]. Lu, K.: Research on the Effect of Real Estate Economy on National Economic Growth [J]. Real Estate World No.373(17), 18-20 (2022).

[2]. Yang, Y., Zhang, X.: Financial Risk Analysis and Enlightenment of Real Estate Enterprises under the Diversification Strategy——Taking Evergrande Group as an Example [J]. Investment and Entrepreneurship 34(02), 94-98 (2023).

[3]. Zhang, C.: The Dilemma and Outlet of Real Estate Enterprise Financing [J]. Quality and Market 01, 31-33 (2023).

[4]. Zhang, H.: Research on the Impact of China's Population Aging on Housing Demand [D]. Shanxi University of Finance and Economics, (2021).

[5]. Hou, Z.: Analysis on the Characteristics of Real Estate Policy in the First Half of 2022 [J]. China Real Estate 19, 10-14 (2022).

[6]. Yue, P.: Yuexiu Real Estate has handed over a new answer sheet for high-quality development in 40 years [J]. China Quality Miles No.358(02), 73-76 (2023).

[7]. Chen, Bo.: Yuexiu Real Estate Land Acquisition Strategy: TOD, Cooperation, Targeted Acquisition of Reserves [N]. Economic Observer 032, (2020).

[8]. Zhu, Y., Wang, H., Gong, X., Tang, Y.: Research on Yuexiu Real Estate’s counter-cyclical growth power [J]. China Real Estate 32, 35-41 (2022).

[9]. Huang, W.: Last year, the transaction volume of first-hand and second-hand housing hit a new low in recent years! The theme of the Guangzhou property market this year is still "destocking" [N]. Daily Economic News 002, (2023).

[10]. Zou, S.: Real estate market analysis in 2022 and outlook for 2023 [J]. China Price 03, 13-16 (2023).

[11]. Yan, Y., Yuan, H., Zhang, K., Peng, Y. T.: Analysis on the Deep Adjustment and Transformation Development of China's Real Estate Industry [J]. Real Estate World 03, 4-9 (2023).

[12]. Jin, B.: Asset securitization of the real estate industry under the new development model - real estate investment trust REITs [J]. Hebei Enterprise 04, 75-77 (2023).

Cite this article

Ye,W. (2023). Research on the Current Situation, Problems, and Prospects of the Development of Chinese Real Estate Enterprises under the New Situation ——Take Yuexiu Property as an Example. Advances in Economics, Management and Political Sciences,42,116-123.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Lu, K.: Research on the Effect of Real Estate Economy on National Economic Growth [J]. Real Estate World No.373(17), 18-20 (2022).

[2]. Yang, Y., Zhang, X.: Financial Risk Analysis and Enlightenment of Real Estate Enterprises under the Diversification Strategy——Taking Evergrande Group as an Example [J]. Investment and Entrepreneurship 34(02), 94-98 (2023).

[3]. Zhang, C.: The Dilemma and Outlet of Real Estate Enterprise Financing [J]. Quality and Market 01, 31-33 (2023).

[4]. Zhang, H.: Research on the Impact of China's Population Aging on Housing Demand [D]. Shanxi University of Finance and Economics, (2021).

[5]. Hou, Z.: Analysis on the Characteristics of Real Estate Policy in the First Half of 2022 [J]. China Real Estate 19, 10-14 (2022).

[6]. Yue, P.: Yuexiu Real Estate has handed over a new answer sheet for high-quality development in 40 years [J]. China Quality Miles No.358(02), 73-76 (2023).

[7]. Chen, Bo.: Yuexiu Real Estate Land Acquisition Strategy: TOD, Cooperation, Targeted Acquisition of Reserves [N]. Economic Observer 032, (2020).

[8]. Zhu, Y., Wang, H., Gong, X., Tang, Y.: Research on Yuexiu Real Estate’s counter-cyclical growth power [J]. China Real Estate 32, 35-41 (2022).

[9]. Huang, W.: Last year, the transaction volume of first-hand and second-hand housing hit a new low in recent years! The theme of the Guangzhou property market this year is still "destocking" [N]. Daily Economic News 002, (2023).

[10]. Zou, S.: Real estate market analysis in 2022 and outlook for 2023 [J]. China Price 03, 13-16 (2023).

[11]. Yan, Y., Yuan, H., Zhang, K., Peng, Y. T.: Analysis on the Deep Adjustment and Transformation Development of China's Real Estate Industry [J]. Real Estate World 03, 4-9 (2023).

[12]. Jin, B.: Asset securitization of the real estate industry under the new development model - real estate investment trust REITs [J]. Hebei Enterprise 04, 75-77 (2023).