1. Introduction

1.1. Background: The Fed and Rate Hike Policy

The U.S. Federal Reserve System (Fed) plays a crucial role globally, exerting influence on financial markets and macroeconomics. As the central bank of the United States, its main responsibility is to set and implement monetary policy to foster economic growth, maintain price stability, and achieve full employment. The recent increase in interest rates by the Federal Reserve has captured wide-spread attention and ignited extensive research across the financial community and economics discipline.

In recent years, the Federal Reserve’s decision to raise interest rates has sparked widespread controversy and concern. Official data published on the Fed’s website [1] reveals that they implemented a series of rate hikes starting from March, with increments of 25 basis points in March, 50 basis points in May, and 75 basis points in June, July, September, and November. These increases were aimed at combating high inflation. However, this process is not always smooth as market expectations and reactions tend to fluctuate. Furthermore, considering the intricate interdependence of the global economy, the Federal Reserve’s decisions on interest rates carry significant implications beyond just the United States. This paper aims to explore the reasoning behind their interest rate hike policy by closely analyzing its motivations, implementation process, overall impact while also referencing relevant literature and research to enhance understanding of its effect on economies.

1.2. Research Purpose: To Explore the Impact of Monetary Policy on Global Financial Markets

This article aims to investigate how the Federal Reserve’s policy of increasing interest rates affects two key markets: stocks, bonds. It emphasizes the crucial role of monetary policy in maintaining global economic stability and securing the financial system. Additionally, this study examines the challenges and risks posed by the Fed’s interest rate hike on global financial markets. It highlights uncertainties in implementation, complexities within the global financial system, and potential effects on various market economies’ affordability.

The transmission mechanism of interest rates is a crucial aspect of the Federal Reserve’s monetary policy. By directly influencing shortterm interest rates in the United States, particularly through changes in the federal funds rate, the Fed has a significant impact on both the domestic economy and financial markets. Given that the United States holds a prominent position as the world’s largest economy and a major financial hub, it becomes evident that the actions taken by the Fed hold substantial implications for global financial markets. When the Federal Reserve decides to raise interest rates, this shift creates an environment where higher interest rates prevail within US borders. Consequently, international investors may find investing in American assets more attractive, potentially leading to an influx of foreign capital into US markets. However, such circumstances also pose risks for other countries facing potential outflows of capital and depreciation of their currencies.

2. The Background and Objectives of the Fed’s Interest Rate Hike Policy

2.1. The Role and Responsibilities of the Federal Reserve

As the central bank of the United States, the Fed has a number of important roles and responsibilities: (1) monetary policy formulation and implementation: the Fed formulates and implements monetary policy, affecting economic growth, price stability and employment by adjusting interest rates [2]; (2) Financial stability supervision: As one of the financial regulators, the Federal Reserve supervises and supervises the banking system, ensures the safety and stability of the financial system, and prevents and responds to financial risks; (3) Payment and settlement services: The Fed provides payment and settlement services to ensure the normal operation of the payment and settlement system in the financial system and promote the smooth conduct of economic transactions; (4) Economic data and research: The Fed collects, analyzes and publishes economic and financial data, conducts economic research, and provides support and guidance for policy formulation; (5) International cooperation and representation: The Fed plays an important role in international financial affairs, cooperating with other countries’ central banks and international financial institutions. Promote coordination and cooperation in global financial policies.

In summary, the roles and responsibilities of the Fed include monetary policy setting and implementation, financial stability regulation, payment and settlement services, economic data and research, and international cooperation and representation. These responsibilities make the Fed an important role in maintaining economic stability and the security of the financial system [3].

2.2. The Reason for the Rate Hike Policy

The reasons for the Fed’s interest rate hike policy may be inflationary pressures, economic overheating, tight labor markets, international factors, etc. The motivation for the Fed’s interest rate hikes varies widely (Table 1). There are three types of Fed rate hike drivers: economic overheating, inflation, and pure monetary policy shocks. The reason for the Fed’s interest rate hikes in recent years is to cope with the negative economic impact caused by Covid-19, which is a high inflation-driven rate hike.

Table 1: Table of reasons and background of Fed interest rate hikes.

Time | Reason | Specific Background |

1955/4/15 | Economic overheating | Low and stable inflation and generally strong growth characterized the U.S. economy in the 1950s and 1960s. |

1958/9/12 | ||

1963/7/17 | ||

1972/3/1 | Inflation | Oil supply shocks superimposed on ambiguous policy targets; the U.S. enters a vicious cycle of stagflation. |

1976/12/1 | ||

1980/8/7 | ||

1983/5/2 | ||

1986/12/16 | Inflation | Inflation control gradually became the Fed’s policy objective, and the Taylor rule was gradually introduced to clarify the positive relationship between high inflation and interest rate hikes. During this period, the dollar depreciated, inflation rose, and the government responded by raising interest rates. |

1988/3/29 | ||

1994/2/4 | Economic overheating | The economy rebounded quickly after the recession and the economy and stock market showed the first signs of overheating. |

1999/6/3 | Inflation | With the ripples of the Asian financial crisis, the Federal Reserve responded by cutting interest rates. In 1996, the Federal Reserve decided to withdraw its monetary policy easing and started to raise interest rates. |

2004/6/30 | Economic overheating | In 2001, the stock market crash triggered a recession and the Federal Reserve cut interest rates sharply. Since then, the economic recovery and rising home prices have raised concerns about asset bubbles, and the Fed has once again started the process of raising interest rates. |

2015/12/16 | Pure monetary policy shocks | After the long-term zero interest rate and quantitative easing (QE) policy, the Federal Reserve opened the monetary policy normalization process. |

2022/3/16 | Inflation | Fiscal and monetary policy super-strong demand stimulus under the new crown epidemic, combined with supply factors such as global supply chain disruptions and the Russia-Ukraine conflict, has led to a record high inflation rate since 1982. |

Reference: Financial Market Research,2022 [4] | ||

3. U.S. Financial Markets

3.1. Stock Market Reaction and Volatility

The impact of interest rate hike policy on the stock market is mostly negative, because rising interest rates may lead to outflows of stock market funds to the bond market, worsening consumer sentiment, and increased borrowing costs for economic activities. In 2022, the Federal Reserve will raise interest rates six times, in March, May, June, July, September and December, with a total of 150 basis points. We take the 2022 trend chart of the US S&P 500 Index as an example to analyze the impact of interest rate hikes on the stock market. Affected by multiple unfavorable factors such as fears of economic recession caused by the Fed’s continued interest rate hikes, the war between Russia and Ukraine, supply chain tensions, and soaring inflation, the U.S. stock market will have its worst annual performance in 2022 since 2008.

Figure 1: S&P 500 index.

Data source: Capitaliq.com, 2019 [5]

Photo credit: Original

According to Figure 1, the S&P 500 has fallen 19.44% year-on-year, the worst performance in 14 years. On March 15, the Federal Reserve announced the start of the process of raising interest rates. Prior to this, we can see that although the index value of the S&P 500 declined slightly at the beginning of the year, it remained stable overall. Since March 30, there has been an obvious downward trend, and after falling to a low point in June, it fluctuated and stabilized.

Figure 2: SP 500 and SPY Volume.

Data source: Federal Reserve System [1]

Photo credit: Original

The holdings of SPDR S&P 500 Index ETF (SPY) are composed of large and medium-sized constituent stocks of S&P 500, so the trend is roughly similar to that of S&P 500. In addition, its total market capitalization and trading volume are the first among all types of ETFs in the United States. Therefore, SPY has quite abundant liquidity, and its trading volume can be used as one of the reference indicators for observing the overall market behavior.

Through Figure 2, it can be found that the trading volume of spy continued to decline after the Fed announced the interest rate hike, which shows that the interest rate hike has seriously reduced investor confidence.

3.2. Changes in Interest Rates in the Bond Market

U.S. Treasury bonds are bonds issued by the U.S. government to raise funds for domestic spending and international affairs. U.S. debt is one of the safest investment options in the global financial market because the U.S. government has a good credit rating and debt repayment ability. Therefore, U.S. Treasury bond prices and yields are one of the important indicators to measure global market sentiment and investor confidence.

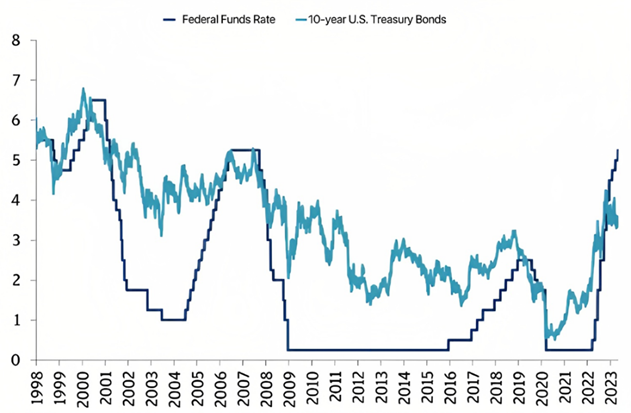

As of March 2023, the Federal Reserve has approved another rate hike (0.25 percentage points). With the Federal Reserve raising interest rates nine times in the past year, U.S. bond interest rates have recovered rapidly after falling due to the new crown epidemic (please see Figure 3)

As of March 2023, U.S. Treasury yields have risen sharply in the short term, led by short-term yields, with the 2-year yield breaking through 5% for the first time since 2007. The gap between 2-year and 10-year Treasury yields once widened by 104 basis points, the worst inversion since 1981. An inversion in treasury bond rates is considered a harbinger of a recession, as historically, many in-versions in treasury bond rates have been accompanied by recessions.

Figure 3: Federal funds rate and 10-year treasury bonds.

Data source: Federal Reserve System [1]

Photo credit: Original

4. Global Financial Markets

The Fed’s interest rate hike has slowed economic growth. At present, the inflation level in the United States remains high and there is obvious inflation stickiness. Historical data shows that under high inflationary pressures, the Fed has had to accept rising unemployment in exchange for effective control of price stability. Since 1950, the Fed has deflected 10 times, 8 of which have had recessions, and the greater the disinflation, the deeper the recession is likely to be. Therefore, it may be difficult for the United States to achieve a “soft landing” of inflation while avoiding a recession. Globally, the center of economic growth is declining. In January 2023, the International Monetary Fund (IMF) projected that global economic growth would slow to 2.9% in 2023 from 3.4% in 2022, with about 57% of economies expecting growth to grow below their historical pivot level, and more than 90% of economies growing at a compound growth rate below their historical pivot level from 2020 to 2023 [6].

On the other hand, the Fed’s rapid tightening of monetary policy has weakened risk appetite and triggered violent fluctuations in capital markets. In 2022, the Fed’s interest rate hike runs through negative news such as the spread of stagflation and political turmoil, and “stocks, bonds, foreign exchange, and currency” have experienced a sharp decline in valuation and trading volume, while the sharp contraction of liquidity has aggravated the volatility and vulnerability of the financial market, causing chaos in the global financial market. In 2022, the VIX index rose by 31%, and the MSCI global index fell by 19.8%, of which the MSCI Developed Markets Index and the MSCI Emerging Markets Index fell by 19.5% and 22.4% respectively [7]; The yield on the US 10-year bond rose sharply by 236 basis points, and the yield on the eurozone 10-year bond also rose by 275 basis points; The dollar index rose by 7.8%, the euro and the yen depreciated by 5.9% and 13.9% respectively against the dollar, and the price of bitcoin fell by more than 60% [8].

5. Challenges and Risks of Monetary Policy

5.1. Uncertainties and Market Expectations

The relationship between uncertainty and market expectations is often dynamically correlated [9]. For the Fed’s monetary policy to raise interest rates, the uncertainty is mainly due to fluctuations in economic data, policy guidance, and economic and political changes around the world. For example, the adjustment of the magnitude of the interest rate hike policy and the implementation time depends on the analysis of relevant economic data such as inflation and employment rate. The volatility of these data will bring uncertainty about the Fed’s interest rate hike policy. Market expectations are usually correlated with market participant sentiment, interest rate movements and asset prices. Market expectations will affect investor attitudes, form market volatility reactions, and further increase monetary policy uncertainty.

5.2. The Complexity of the Global Financial System

The complexity of the global financial system is embodied in international trade relations, debt markets, policy coordination and risk contagion [10]. The Fed’s interest rate hike policy will directly affect the US dollar interest rate, bring global capital flows and foreign exchange market volatility, thereby affecting global capital markets and trade. On the other hand, it could lead to higher interest rates and raise the cost of debt. These market fluctuations will affect market investor sentiment, which in turn will lead to risk contagion. Therefore, these intertwined factors increase the challenge of implementing monetary policy.

5.3. The U.S. Economy May Have a “Soft Landing”

The real estate market and the US dollar strengthened due to the Fed’s interest rate hike. Activity in the U.S. housing market continues to be low due to high mortgage rates. Housing activity has weakened significantly over the past few quarters. The 30-year fixed rate increased from 3.25% at the beginning of 2022 to about 7% in mid-November. Most measures of housing activity – such as affordability, builder sentiment, housing starts and turnover, have fallen sharply. The impact of a stronger dollar on the U.S. economic outlook has been mixed, with the dollar up about 15% since the start of 2022 to a nearly 20-year high. A strong dollar makes imports cheaper and lowers the price of a range of dollar-denominated globally traded commodities such as oil, metals, and agricultural products. On the other hand, the strengthening of the dollar has also hurt the revenue and profits generated by US companies in international markets.

Retail sales and non-farm payrolls data outperformed expectations. US retail sales recorded a monthly rate of 3% in January 2023, well above market expectations of 1.80%. By item, all 13 retail categories saw growth last month, with a surge in auto sales, higher oil prices, and improved furniture and appliances and catering, buoying retail sales growth. Data from the U.S. Department of Labor showed that U.S. nonfarm payrolls rose by 517,000 after the quarterly adjustment in January, beating expectations of 185,000 and the previous value of 223,000, while employment in a number of industries, including leisure and hospitality, professional and business services, and health care, increased.

Expectations of a soft landing have increased, and expectations of the Fed maintaining a hawkish stance have increased. Since 2023, high-frequency economic data such as US non-farm payrolls, retail sales data, and PMI data have performed stronger than expected, the performance of the labor market is still relatively strong, the downward trend of inflation has slowed down, and the expectation of a soft landing of the economy has continued to increase. The expectation of a soft landing of the US economy is increasing, and although the expectation of a continuous decline in US inflation remains unchanged, the pace of decline has slowed down, which will strengthen the Fed’s determination to continue to maintain a tight policy and raise interest rates in the face of persistent inflation.

6. Conclusion

This article explores how interest rate hikes by the Federal Reserve affect global financial markets. As the United States’ central bank, the Federal Reserve holds considerable sway over these markets and impacts macroeconomics at large. Through an analysis of pertinent literature and research findings, it is evident that monetary policy has several key effects on global financial markets. Firstly, when interest rates are increased, there is a detrimental effect on the stock market. Such hikes can lead to capital outflows, reduced consumer confidence, and higher borrowing costs for economic activities. For instance, in 2022, consecutive interest rate hikes coupled with other unfavorable factors resulted in a historic decline for the US S&P 500 index. Secondly, an increase in interest rates affects bond markets by influencing changes in interest rates themselves. Rising rates for government bonds may raise debt expenses while inverted yield curves could indicate an impending recession. Lastly, changes in foreign exchange rates are influenced by interest rate hikes within the exchange market. By attracting investments into the United States due to higher yields, other countries become vulnerable to capital outflows and currency depreciation. In summary, this study sheds light on how the Fed’s decision to raise interest rates impacts global financial markets—an understanding crucial for predicting and responding to corresponding changes. Given their negative repercussions on financial markets noted above, investors should consider adjusting their portfolios accordingly to mitigate vulnerabilities within stock and bond sectors. Additionally, prudent attention ought to be given towards monitoring both global economic dynamics and monetary policies so as to respond flexibly amidst market fluctuations. Consequently, developing tailored investment strategies that adapt well with changing market environments becomes imperative. These findings also provide valuable insights not only for investors but also policymakers. To ensure risk reduction amidst rising interest rates’ adverse effects on financial markets mentioned earlier—portfolio adjustments prove necessary. Moreover, timely surveillance of global economic trends alongside flexible responses becomes pivotal when navigating shifting market landscapes. Ultimately cultivating adaptive investment strategies enables better acclimation to evolving market conditions.

References

[1]. Federalreserve.gov. (2019). Federal Reserve Board - Home. [online] Available at: https://www.federalreserve.gov.

[2]. Burton, M., Nesiba, R.F. and Brown, B. (2015). An introduction to financial markets and institutions. London Routledge.

[3]. Bernanke, B. (2022). 21st century monetary policy: the Federal Reserve from the great inflation to COVID-19. New York, Ny: W. W. Norton & Company.

[4]. X Lu, M Zhang. (2022). Fed interest rate hike: historical cycle, internal and external impact and empirical enlightenment. Financial Market Research,2022, (12):48-55.)

[5]. Capitaliq.com. (2019). S&P Capital IQ. [online] Available at: https://www.capitaliq.com.

[6]. Elif C Arbatli Saxegaard, Melih Firat, Davide Furceri and Verrier, J. (2022). U.S. Monetary Policy Shock Spillovers: Evidence from Firm-Level Data. International Monetary Fund.

[7]. Yahoo Finance (2023). Yahoo Finance - Business Finance, Stock Market, Quotes, News. [online] @YahooFinance. Available at: https://finance.yahoo.com.

[8]. He, D. (2023). How big is the impact of the Fed’s continued rate hikes. [online] paper.ce.cn. Available at: http://paper.ce.cn/pc/content/202303/03/content_269889.html [Accessed 22 Jul. 2023].

[9]. Sabri, B. and Nguyen Duc Khuong (2019). Handbook Of Global Financial Markets: Transformations, Dependence, And Risk Spillovers. World Scientific.

[10]. Lane, P.R. (2012). Financial globalisation and the crisis. Basel: Bis.

Cite this article

Yan,L. (2023). Explore the Impact of International Monetary Policy Uncertainty on Global Financial Markets. Advances in Economics, Management and Political Sciences,44,213-220.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Federalreserve.gov. (2019). Federal Reserve Board - Home. [online] Available at: https://www.federalreserve.gov.

[2]. Burton, M., Nesiba, R.F. and Brown, B. (2015). An introduction to financial markets and institutions. London Routledge.

[3]. Bernanke, B. (2022). 21st century monetary policy: the Federal Reserve from the great inflation to COVID-19. New York, Ny: W. W. Norton & Company.

[4]. X Lu, M Zhang. (2022). Fed interest rate hike: historical cycle, internal and external impact and empirical enlightenment. Financial Market Research,2022, (12):48-55.)

[5]. Capitaliq.com. (2019). S&P Capital IQ. [online] Available at: https://www.capitaliq.com.

[6]. Elif C Arbatli Saxegaard, Melih Firat, Davide Furceri and Verrier, J. (2022). U.S. Monetary Policy Shock Spillovers: Evidence from Firm-Level Data. International Monetary Fund.

[7]. Yahoo Finance (2023). Yahoo Finance - Business Finance, Stock Market, Quotes, News. [online] @YahooFinance. Available at: https://finance.yahoo.com.

[8]. He, D. (2023). How big is the impact of the Fed’s continued rate hikes. [online] paper.ce.cn. Available at: http://paper.ce.cn/pc/content/202303/03/content_269889.html [Accessed 22 Jul. 2023].

[9]. Sabri, B. and Nguyen Duc Khuong (2019). Handbook Of Global Financial Markets: Transformations, Dependence, And Risk Spillovers. World Scientific.

[10]. Lane, P.R. (2012). Financial globalisation and the crisis. Basel: Bis.