1. Introduction

1.1. Research Background and Significance

Over the past decade, the global economy has gone through phases of recovery and stabilization as well as turbulence and challenges, especially as the spread of global epidemics in 2020 and the Russian-Ukrainian war starting in 2021 have also added new factors of instability to global economic development. China and the United States, as two very important economies and consumer markets in this decade, have a significant impact on global economic development, coupled with the occurrence of a trade war between China and the United States have had an impact on the USD/CNY exchange rate market. According to Escudero et al., to paraphrase, Governments, financial organizations, and investors place a high premium on forecasting the future behavior of currency pairs because they use this information to assess the state of a nation's economy and decide whether to buy and sell products and services there [1]. With increasing uncertainty in the world's Foreign Exchange Market (FEM), market participants, traders, and policymakers alike have become more concerned about exchange rate volatility and developments. The requirement to accurately predict the value of the USD/CNY exchange rate is a very complex and difficult task, because of the complex couplings that it is subject to. The exchange rate is not only subject to market-level coupling and macro-level coupling, which are interrelated with financial markets and economic fundamentals, respectively but also faces deep coupling resulting from the interactions between the above two couplings. It is also worth noting that the exchange rate between different currencies over a given period of time is one of the fundamental elements of a country's economy and is very important for accurate forecasting of exchange rate movements in both academia and industry [2]. In summary, it is meaningful to forecast the exchange rate of USD/CNY using ARIMA and ETS models forecast.

1.2. Literature Review

A time series is a category of data that is continuously tracked through time, typically with the use of a time series model. The unemployment rate, stock prices, sales demand, birth rate, temperature, and website traffic are a few examples of time series. Time series forecasting is an intriguing field for academics and businesspeople [3]. Time series forecasting techniques are typically chosen over explanatory or mixed models for predicting for a number of reasons. For instance, they can be helpful in modeling complex systems since, unlike explanatory models, there is no compulsory requirement for these time-series models to forecasts or predict the forthcoming values of various indicators in order to forecast the parameter of concern. Moreover, time series forecasting techniques can generate higher-quality results than explanatory or mixed models [4]. Both the ETS and the ARIMA models are common time series models. They can be used in many different sectors. Among the traditional parametric methods learned by linear regression are ARIMA and ETS [5]. To find patterns and model components, the ARIMA technique, fundamental statistics, autocorrelation function (ACF), partial autocorrelation function (PACF), and transformations are used. This model offers least-squares and maximum likelihood estimates, and it is validated using graphs, ACF, and PACF of the residuals. Use the model if it is accurate; otherwise, return to the first step. Finally, the method utilizes confidence intervals and straightforward statistics to forecast and monitor the model's performance [6]. Since its introduction in the late 1950s, the Exponential smoothing method has received much attention and practice, and has provided the basis and inspiration for a number of renowned predictive models. The underlying logic of exponential smoothing for forecasting is the calculation of a weighted average of previous data set [7]. In this model, the algorithm is given greater weight for the more proximate data is given [8]. Such a forecasting approach has proven its value and credibility in academic and industrial practice [9].

This study focuses on forecasting and analyzing the future trend of the USD/CNY exchange rate based on the monthly average USD/CNY exchange rate from January 2010 to June 2023. There are three main steps of this research, the observation of the original time-series data set and pre-processing, the selecting and exerting of the ARIMA models and the selecting and exerting of the ETS models

2. Method

2.1. Models Selection

There are two main form of methods that will be used within this study, the ETS models and ARIMA models, to forecast the exchange rate between USD/CNY. Both of them are classical and reliable regression methods for time-series models forecasting, that can generate result for varied data sets among wide range of industries, however, there are also differences in the main focus of the two models that allow the combination and cooperation between the two to provide complementary approaches to the problem, since the prior way focused on the autocorrelations in the data group and the latter one is more based on the trend and seasonality of the data [10].

To be specific, the ARIMA Models contain two main parts, autoregressive and moving-average models. The autoregressive models can forecast the interested variable with a group of previous parameters of the variable, which can be interpreting as regression of variable about itself. The second part, moving –average models with its great advantages in terms of flexibility. Moving average models, on the other hand, exploiting errors in the previous model for a new regression-like process. Combining the above two components allows ARIMA models to be more accurate, forecasting more complex and uncertainty-laden time series models.

ETS models, as mentioned previously, are more focused on following and forecasting the trend and seasonality of the previous information. The most fitted ETS model in time series with different characteristics in the error, trend, and seasonality dimensions can be different. ETS models, as described by the exponential smoothing method, give more weight to later parameters in order to more accurately and more meaningfully model the time series data. more significant simulation of the time series data.

In this study, both of these methods will used. Meanwhile, the average value method, naive method, and seasonal naive method will also be mentioned and involved in analyzing and forecasting the exchange rate data.

2.2. Data Collection and Pre-processing

All data used and processed in this study are taken from the website of the CFETS (“CNY Central Parity Rate - CFETS”). The data range of this study began in January 2010 to June 2023, and appears in the form of monthly average.

All market makers receive an inquiry from CFETS on the morning of the business day, before the opening of the business, regarding the USD/CNY exchange rate for the day, as stated on the CFETS websites that PBC allowed. It is only after this step that the median price of the RMB against USD is determined. According to the transaction volumes of the various markets, the CFETS determines the weights, and finally providing the specific result [11].

Given that this data source is published on the official website, is continuously updated on a daily basis, and appears to have no significant bias in the data, this data source is considered credible and has been used for this study.

2.3. Applications of the Models

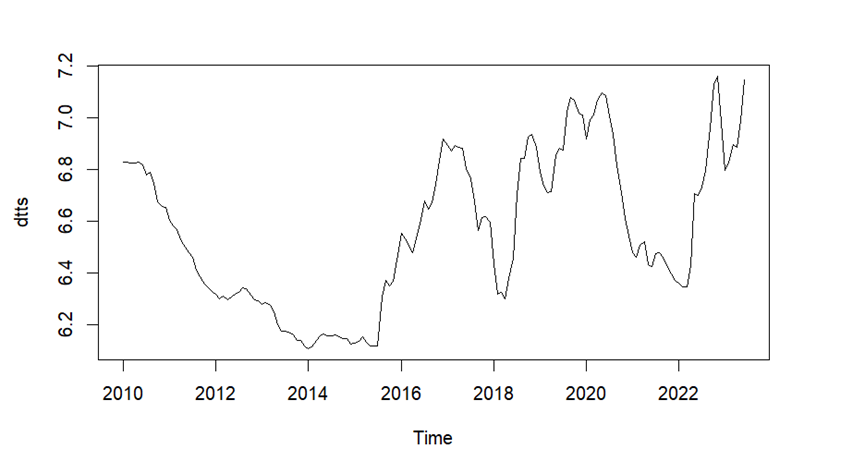

According to the observation of the time series behavior graphically presented below, there is no obvious pattern over time, and there is no one average value that all the peaks in this data set are concentrated around. The time-series behavior graphically presented in figure 1 indicates this is a random time series.

Figure 1: Plot of the USD/CNY exchange rate from January, 2010 to June, 2023.

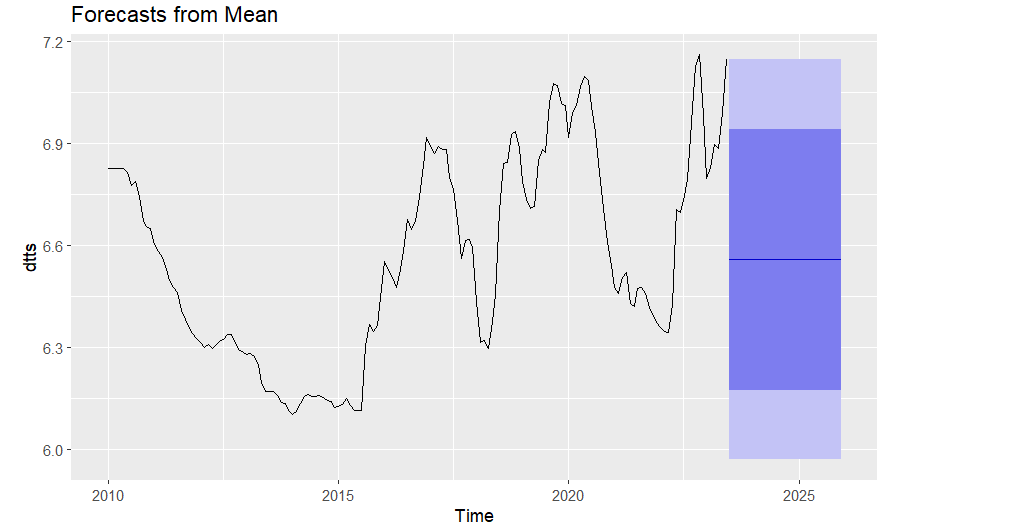

In the period analysis, the minimum value of this time series was achieved in April 2014, the USD/CNY exchange rate was 6.1043, and the maximum value achieved at 7.1628 in November 2022. The mean value, in this data set, from January 2010 to June 2023 is 6.559. According to Figure 2, the forecast value of the exchange rate from mean, which comes with residuals with p-value much less than 0.01.

Figure 2: Plot of forecasts using average method.

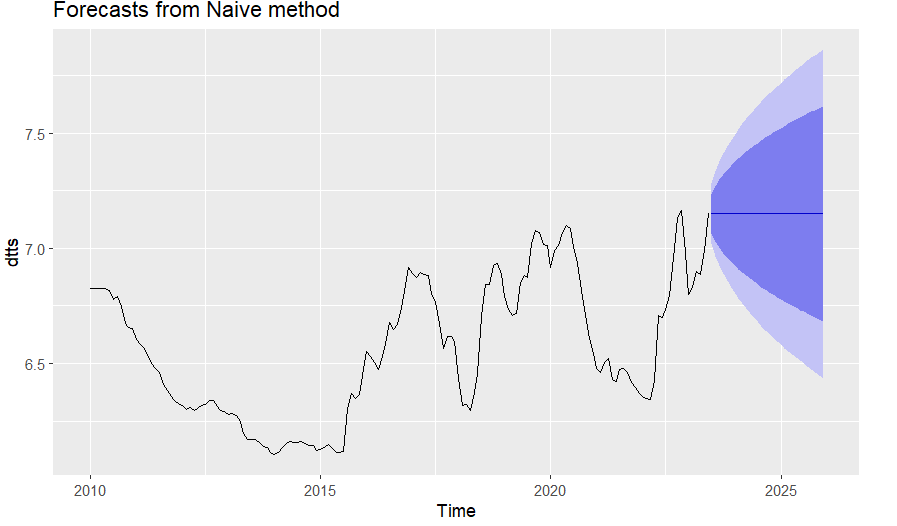

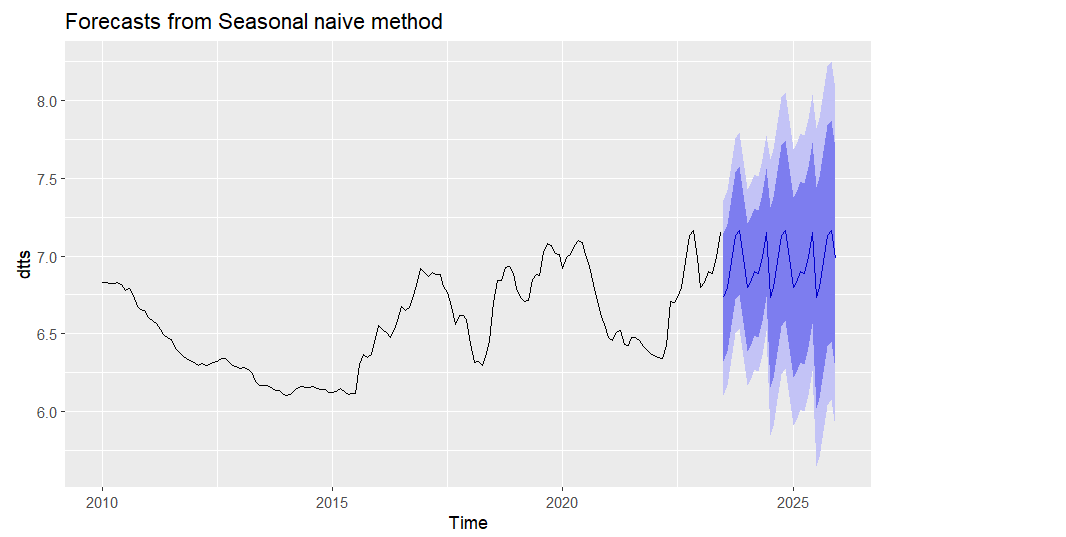

As for naive model and seasonal naive model, the results are show Figures 3-4. From both the seasonal naive model and the cooperation of residuals from both models can clearly indicates the seasonality of the original time-series data.

Figure 3: Plot of forecasts using naive method.

Figure 4: Plot of forecasts using seasonal naive method.

2.4. Applications of the ARIMA Models

Modeling procedures of ARIMA models in this study include analyzing ACF and PACF; differencing data; estimating parameters in the model; and forecasting with R. Before using or testing any specific models, a unit root test was first performed, which revealed that a unit root existed, which can be seen an indication for an unstable group set. After a second-order differencing of the data, both the p-value and L-Jung Box test result fall below 0.01, which indicates the data set is suitable for ARIMA forecasting.

The ARIMA model suitable for forecasting the training data set was determined to be ARIMA(0,1,2), detailed data is shown in table 1. The model also has a residual P-value that is less than 0.05, proving its suitability.

Table 1: ARIMA(0,1,2) Model’s estimation results.

Coefficients | MA(1) | MA(2) |

0.5263 | 0.1643 | |

s.e. | 0.0801 | 0.0851 |

AIC | AICc | BIC |

-451.95 | -451.79 | -442.74 |

2.5. Applications of the ETS Models

Modelling procedures of ETS models in this study include analysing the Error, Trend, and Seasonality of the data set; estimating parameters in the model; and forecasting with R.

Through computer software simulation, ETS(M,Ad,N) was identified as the fitted model, detailed data is shown in table 2. Through residuals test, this judgment can be confirmed.

Table 2: ETS(M,Ad,N) Model’s estimation results.

Smoothing parameters | alpha | beta |

0.9992 | 0.6145 | |

Parameters | AIC | AICc |

-75.40726 | -74.86532 |

3. Result

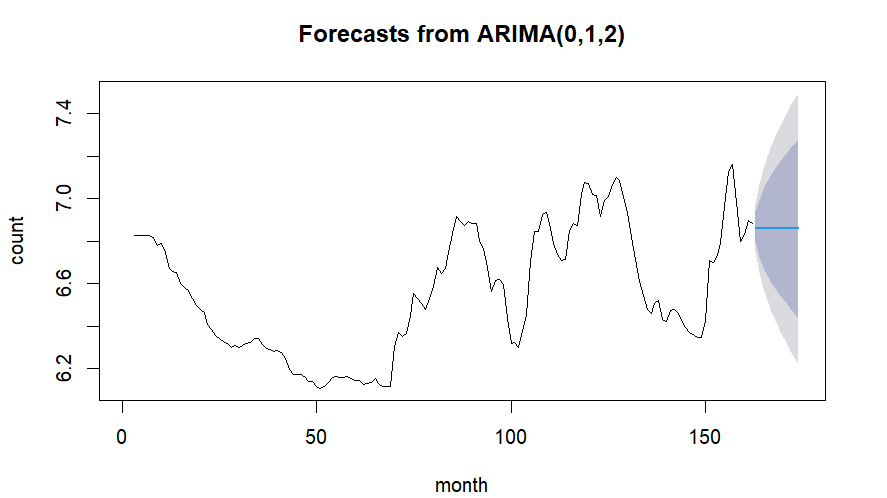

3.1. Result of the ARIMA Model

Using the monthly average exchange rate of USD/CNY, based on the forecast of ARIMA (0,1,2), the predicted exchange rate of USD/CNY is 6.8661, 6.8588 and 6.8588 in July 2023, January 2024 and June 2024, respectively. There is an extremely slight decrease in the beginning part of the forecast and reminds constant after that. The minimum value is 6.2206 in June 2024, the lower 95% boundary, and the maximum value occurs in June 2024, 7.4969, which is the higher 95% boundary. Also, if practicing the same method in the long run, the value will appear to be finally stabilized at around 6.8588 (in Figure 5).

Figure 5: Plot of forecasts from ARIMA(0,1,2) model.

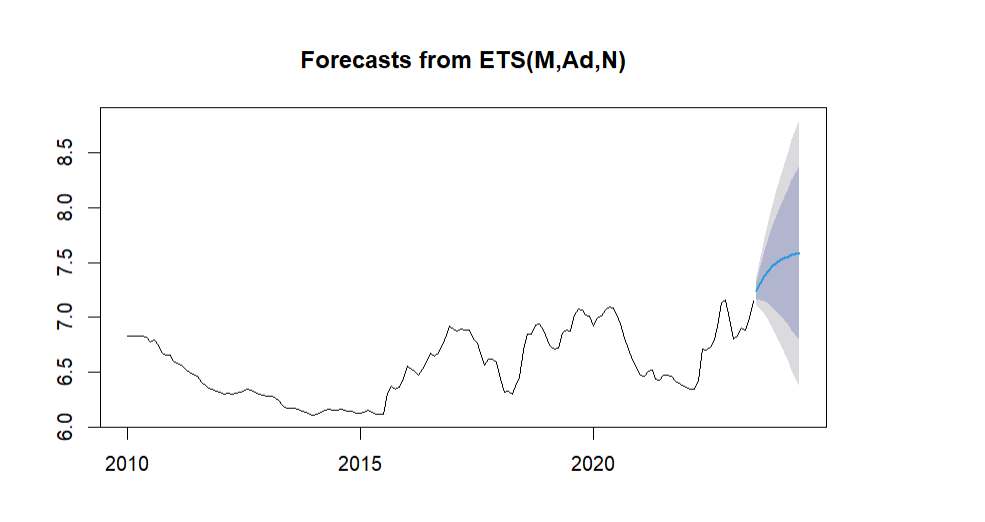

3.2. Result of the ETS Model

Based on the forecast given by ETS(M,Ad,N) model, the predicted exchange rate of USD/CNY is 7.2431, 7.5205 and 7.5867 in July 2023, January 2024 and June 2024, respectively. There is an overall increasing in the exchange rate with negative second-order derivatives shown through the graph. Thus, the minimum value of the exchange rate of USD/CNY is 6.3663 in June 2024, the lower 95% boundary, and the maximum value occurs in June 2024, 8.8072, which is the higher 95% boundary. Also, if practicing the same method in the long run, the value will appear to be finally stabilized at around 7.6 (in Figure 6).

Figure 6: Plot of forecasts from ETS (M,Ad,N) model.

4. Discussion

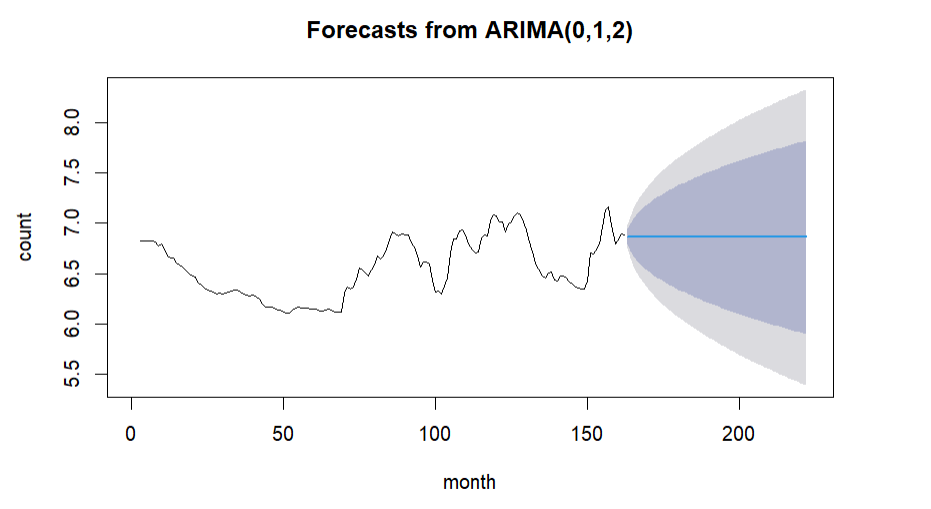

According to the above results, the forecasting effect of ETS model and ARIMA model on the USD/ CNY exchange rate, in the short term, the ETS model demonstrates an upward trend while ARIMA remains almost level. In the long run, both models converge to level, with the ETS model predicting a higher exchange rate than the ARIMA model (in Figure 7-8).

Figure 7: Plot of forecasts from ARIMA(0,1,2) model in the long run.

Figure 8: Plot of forecasts from ETS(M,Ad,N) model in the long run.

The ARIMA model chosen for this study reflects the fact that the time series data used in the prediction model does not have a lag number by itself and requires first order differencing to obtain a stable series, and uses a second order lag number of prediction errors in the prediction model. The ETS model chosen represents the use of an Additive damped trend method with multiplicative errors.

Table 3: Errors measures for both models.

Model | Set | RMSE | MAE | MAPE | MASE |

ARIMA(0,1,2) | Training Set | 0.0568446 | 0.0370719 | 0.557208 | 0.1425068 |

Test Set | 0.1542361 | 0.1188440 | 1.695507 | 0.4568437 | |

ETS(M,Ad,N) | Training Set | 0.05883832 | 0.03774266 | 0.5669959 | 0.145085 |

Test Set | 0.19982177 | 0.15741042 | 2.2464733 | 0.605095 |

Overall, in this study, the ARIMA model gives relatively more reliable forecasts on the test set,and fit the training set a little bit better, according to the table 3.

It is finally concluded that the exchange rate of the USD/CNY will gradually level off and eventually stabilize at around 7.

At the same time, there are still deficiencies and contingent influences that have not been completely eliminated in this study. Firstly, the time series models used in this study are the very classical ETS and ARIMA models, and Long Short-Term Memory or other popular deep learning models are not considered, which should be further examined. In addition, this study only independently considered the change in the exchange rate of the USD/CNY from 2010 to June 2023 and based on this forecast. In real life, the exchange rate will be affected by the fiscal policy of the two governments and the monetary policy of the two central banks, and all of the above influences may influence the result. Finally, a global pandemic beginning in late 2019 and a Russian-Ukrainian war beginning in 2022 also have some impact on the exchange rate for both the U.S. and China. The time period in which COVID-19 would have a serious impact in both the U.S. and China and the differences in the responses taken by the two governments are also considered potential influences on the exchange rate. All of the above potential influences have not been considered individually, and subsequent studies could also develop more detailed studies and forecasts based on the above factors.

5. Conclusion

The world economic and political situation was once in a state of relative stability over the previous period, but influenced by the huge blow of the COVID-19 virus since the beginning of the 2020's and the shock of the Russo-Ukrainian war that began in 2021. In such times, the United States and China, as large economies and consumer markets, have also undergone important developments and changes, as the United States has adjusted its monetary policy since the 2008 financial crisis and China has begun to experience an economic transition from high-speed growth to a search for high-quality development. The exchange rate, as a measure of the value of one currency against another, is a very important economic parameter that partially reflects the economic development of a country. An appropriate and stable exchange rate is the goal of many countries, while exchange rate volatility is also a main factor to be assessed in the financial market. This study, which forecasts the USD/CNY exchange rate, provides a basis and reference for individual and collective decision-making, as well as a basis for studying and understanding the economic development of the United States and China. Two classical time series models, ETS models and ARIMA models, were used in this study. This study extracts the monthly average USD/CNY exchange rate for the period 2010-2023, which is obtained from the website of the CFETS. This study investigated the autocorrelation between the data, trend, seasonality and error of the data sets respectively and selected two models ARIMA(0,1,2) and ETS(M, Ad, N) for forecasting the time series data sets through software simulation. The study finds that according to the forecasts derived from both ETS models and ARIMA models, the result will flatten out in the future and remain stable at around 7 in the long run. Comparatively, the ETS models suggest that the result will remain higher at around 7.6, while the ARIMA models forecast that the exchange rate will remain at around 6.85. There are still many issues not covered in this study, including the specific impact of the epidemic on the Chinese and U.S. economies and the cycle of impact, the monetary policy adjustments of the Federal Reserve and the Chinese central bank, as well as the impact on both sides of the war in the face of Russia-Ukraine cannot be fully determined, and the post-epidemic era, coupled with the continued development of Russia-Ukraine war, the potential for economic turmoil will require further research to participate in the discussion.

References

[1]. Xue, T. S. F., Lu, H., & Qin, X. S. (2021). Exchange rate forecasting based on empirical modal decomposition and multi-branch lstm network. Journal of Guangxi Normal University (Natural Science Edition) (039-002).

[2]. Mansour, F., & AKAY, M. (2019). Predicting Exchange Rate by Using Time Series Multilayer Perceptron. In Science and engineering congress (IMSEC).

[3]. Zhanglu, T., Hui, Y. (2020). A study on the relationship between time series preprocessing and information noise - based on discrete wavelet transform and arima model. Practice and Understanding of Mathematics, 50(15), 13.

[4]. Hyndman, R. J., & Athanasopoulos, G. (2018). Forecasting : Principles and Practice (2nd ed.). Otexts. https://otexts.com/fpp2/

[5]. Nyoni, T. (2018). Modeling and Forecasting Naira / USD Exchange Rate In Nigeria: A Box—Jenkins ARIMA Approach. MPRRA 2018, 88622, 1–36.

[6]. Box, G. E. P., & Al, E. (2015). Time series analysis : forecasting and control. John Wiley & Sons.

[7]. Robert Goodell Brown. (1959). Statistical Forecasting for Inventory Control. McGraw/Hill.

[8]. Yan Xu. (2020). Application of time series modeling based on sas system. Neijiang Science and Technology, 41(3), 2.

[9]. Yang, Bofan, Lin Zhang, Bo Zhang, Yafei Song, & Erqi Ding. (2020). Dynamic multi-model exponential smoothing method fusion for online prediction. Systems Engineering and Electronics, 42(9), 9.

[10]. Mansour, F., & AKAY, M. (2019). Predicting Exchange Rate by Using Time Series Multilayer Perceptron. In Science and engineering congress (IMSEC).

[11]. CNY Central Parity Rate - CFETS. www.chinamoney.com.cn/english/bmkcpr/. last accessed 2023/07/20.

Cite this article

Yan,Y. (2023). Analyzing and Forecasting the Exchange Rate of USD/CNY. Advances in Economics, Management and Political Sciences,48,238-246.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xue, T. S. F., Lu, H., & Qin, X. S. (2021). Exchange rate forecasting based on empirical modal decomposition and multi-branch lstm network. Journal of Guangxi Normal University (Natural Science Edition) (039-002).

[2]. Mansour, F., & AKAY, M. (2019). Predicting Exchange Rate by Using Time Series Multilayer Perceptron. In Science and engineering congress (IMSEC).

[3]. Zhanglu, T., Hui, Y. (2020). A study on the relationship between time series preprocessing and information noise - based on discrete wavelet transform and arima model. Practice and Understanding of Mathematics, 50(15), 13.

[4]. Hyndman, R. J., & Athanasopoulos, G. (2018). Forecasting : Principles and Practice (2nd ed.). Otexts. https://otexts.com/fpp2/

[5]. Nyoni, T. (2018). Modeling and Forecasting Naira / USD Exchange Rate In Nigeria: A Box—Jenkins ARIMA Approach. MPRRA 2018, 88622, 1–36.

[6]. Box, G. E. P., & Al, E. (2015). Time series analysis : forecasting and control. John Wiley & Sons.

[7]. Robert Goodell Brown. (1959). Statistical Forecasting for Inventory Control. McGraw/Hill.

[8]. Yan Xu. (2020). Application of time series modeling based on sas system. Neijiang Science and Technology, 41(3), 2.

[9]. Yang, Bofan, Lin Zhang, Bo Zhang, Yafei Song, & Erqi Ding. (2020). Dynamic multi-model exponential smoothing method fusion for online prediction. Systems Engineering and Electronics, 42(9), 9.

[10]. Mansour, F., & AKAY, M. (2019). Predicting Exchange Rate by Using Time Series Multilayer Perceptron. In Science and engineering congress (IMSEC).

[11]. CNY Central Parity Rate - CFETS. www.chinamoney.com.cn/english/bmkcpr/. last accessed 2023/07/20.