1. Introduction

ESG represents Environmental, Social, and Governance. “Environmental” factors represent factors about the natural world, which include the use of solar energy, trees, and wind energy which are renewable, and oil, gas, and coal which are not renewable. “Social” factors represent factors that can influence people’s lifestyle and decisions, which contain the human capital for society, connections between neighborhoods, and education. “Governance” factors represent factors that include the applicability of regulation, and the keeping of the balance between the interest of shareholders and managers of a firm. Issues corresponding with “Environmental” include global warming, resource depletion, noxiousness in air, desertification, etc. Problems about “Social” contain civil liberties, forced labor, hiring children, working conditions, employment relationships, etc. Issues related to “governance” include tax planning, executive compensation, trade associations, and bribery and corruption. The generation of a firm’s long-term returns is highly dependent on the stable, well-functioning environmental, social, and governance system of the firm [1].

ESG could also be considered as a corporate performance evaluation system and investment concept that comprehensively evaluates corporate environment, social responsibility fulfillment, and internal governance, which implies a greener development trend, a corporate image that pays more attention to responsibility fulfillment and a more efficient governance system, which is in line with the demand for high-quality transformation. The concept of ESG not only fits in with the development of eco-civilization construction and socio-economic construction in a macroscopic way but also, and even more critically, can stimulate enterprises to achieve sustainable development, thus realizing both social and market values. The concept of ESG is not only in line with the development of ecological civilization and social and economic construction on a macro level, but also, more critically, can stimulate the motivation of enterprises to achieve sustainable development, thus realizing both social and market values. As a result, investors have gradually taken ESG performance into consideration in recent years, and the number of firms that focus on their performance related to ESG has increased significantly, and how a firm’s value and a firm’s ESG performance could interact with each other became worthy to be investigated.

2. Analysis of Firms in the Technology Industry

In the past few years, lots of researchers have started to investigate how ESG performance could affect a firm’s value. The views on the effect could mainly be divided into two categories. One view stands for ESG performance and disclosure of nonfinancial reports could have a crucial role in improving the value of the firm and the possibility of sustainable development. Some reasons are exhibited to support this view that contains if firms applying sustainable environmental innovations in their manufacturing processes could reduce inputs and wastes and also enhance energy efficiency [2], thus firms could reduce production costs, improve production efficiency, and also build foundations for future sustainable development. And for the firms that redesigned their products to emphasize the environmental and social attributes could capture more attention from socially responsible investors [3], thus these firms could accumulate social capital, increase reputation and acquire government support. These effects contribute to the improvement of a firm’s value. However, the other views point out that ESG performance was not only meaningless for a firm’s value but also harmful to the firm’s value, especially for firms in developing countries [4]. The reasons to support this view are that firms should put the maximization of firm profits and shareholders’ wealth as the priority, if firms take activities that include plenty of environmental and social responsibilities, these activities will not only increase the firm’s costs and waste limited resources but also bring negative impacts on shareholders' rights and interests. Ultimately, these actions will reduce the firm’s value and make the firm less competitive in the future [5].

Environmental, Social, and Governance rating (ESG rating) provided by third parties could be used as an indicator to exhibit the ESG performance of the firm, and the consideration of ESG ratings have been becoming a necessary part of the financial investment decision-making process. And legal requirements are gradually being imposed on a growing number of firms and financial services providers to publish and integrate ESG rating information, especially for firms belonging to the EU (European Union) and U.S. firms [6]. In this article, the trend of ESG ratings and stock prices of firms would be used to investigate what effects a firm’s ESG performance could bring to its value. Due to the later concentration in the activities related to ESG of technology firms and most technology firms have lower ranks relative to most firms that from other industrial fields [7], so the selected firms would be divided into three main fields (like technology, energy, and finance) and to be investigated the effects that the better firm’s ESG rating could bring to this firm’s stock price respectively to avoid essential differences which could lead to systematic errors for the resulting relationships between firms from different industrial fields.

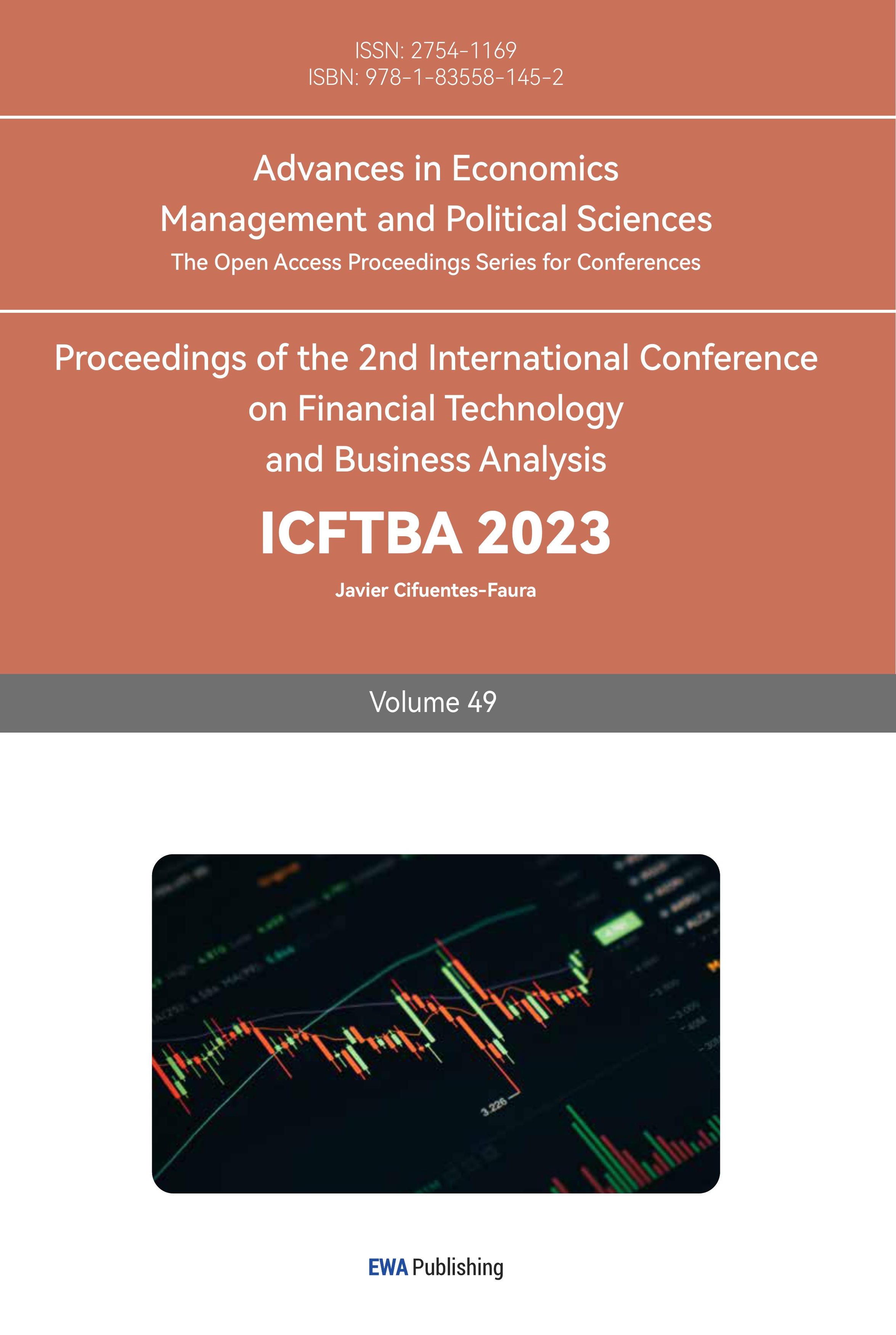

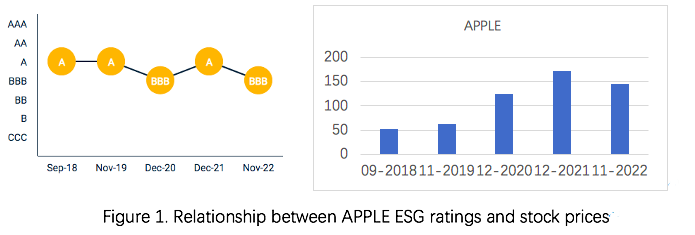

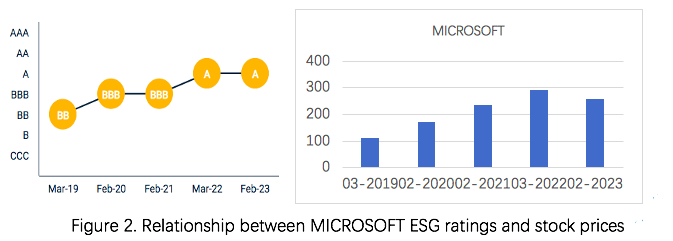

According to the rank of the largest technology firms by market cap, three firms from the top 10 list which are Apple, Microsoft, and NVIDIA, would be selected to investigate how the firm’s ESG rating trend would influence the growth rate of the firm’s stock prices for the technology field.

Based on each firm’s MSCI ESG rating history for the past five years and corresponding stock prices, Apple and Microsoft exhibit the trend of ESG ratings have a similar pattern as the trend of stock prices which means their stock prices and their ratings have a positive relationship (as shown in Figure 1 and Figure 2). Thus, they provided evidence to support the view that a higher ESG performance would be beneficial for the firm’s value.

Figure 1: Relationship between APPLE ESG ratings and stock prices.

Figure 2: Relationship between MICROSOFT ESG ratings and stock prices.

However, the stock prices of NVIDIA and its ESG ratings are supposed to be uncorrelated based on the resulting historical trends of stock prices and ESG ratings respectively (as shown in Figure 3).

Figure 3: Relationship between NVIDIA ESG ratings and stock prices.

Even though the ESG ratings of NVIDIA maintained at an extremely high level for the past four years, its stock prices were very volatile for the past four years. One explanation for this phenomenon is that researchers showed that NVIDIA's stock price is strongly correlated with the demand for semiconductors, as NVIDIA is the leading manufacturer in the world [8]. Despite Apple, Microsoft, and NVIDIA being all the firms that belong to the technology field, the products of Apple and Microsoft are more well-known and more accessible to people and also have wider customer bases than the products of NVIDIA. The distinguishes from the stability of product demand and customer bases contribute to the different relationships between ESG performance and firm’s value among these technology companies.

3. Analysis of Firms in the Energy Industry

According to the rank of the largest energy firms by market cap, three firms from the top 10 list which are Saudi Aramco, ExxonMobil, and Shell, would be selected to investigate how the changes in the firm’s ESG ratings could be related to the corresponding changes in its stock prices for firms in the energy (oil and gas) field.

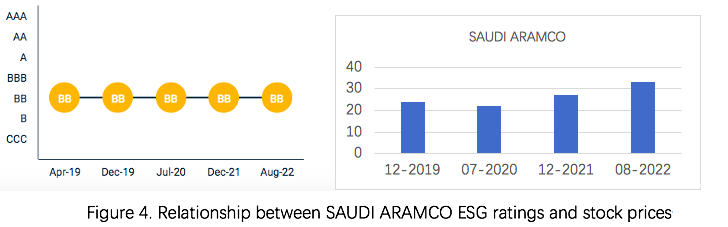

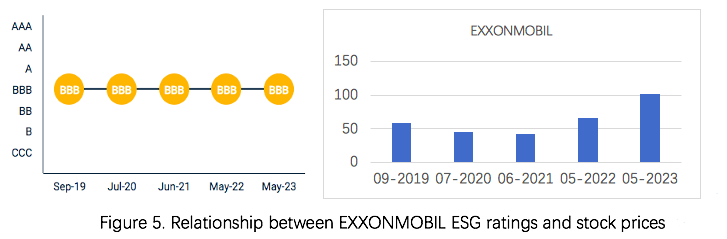

From the MSCI EGS ratings history data over the last five years or since records began, the ESG ratings for Saudi Aramco and ExxonMobil are maintained at a stable level which is BB and BBB respectively (as shown in Figure 4 and Figure 5). One possible reason for the higher average stock prices of ExxonMobil for every period between two ESG rating announcements is that the average stock price of Saudi Aramco would be the ESG ratings of ExxonMobil tends to be better than that of Saudi Aramco. The other possible reasons would be the more restrictions on buying stocks of Saudi Aramco compared with the purchase of ExxonMobil stocks because the biggest owner of Saudi Aramco is the government of Saudi Arabia and the stocks of Saudi Aramco could only be traded on the Saudi Tadawul exchange which means an individual investor who wants to purchase the stocks of Saudi Aramco must be a Saudi or GCC national or a registered Saudi Arabian resident and would also need to meet conditions set out by the Securities Depository Center Company (Edaa).

Figure 4: Relationship between SAUDI ARAMCO ESG ratings and stock prices.

Figure 5: Relationship between EXXONMOBIL ESG ratings and stock prices.

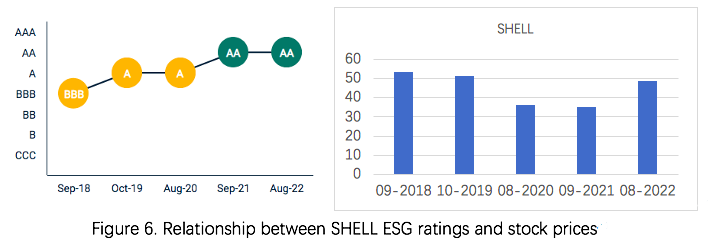

Based on the comparison between the trends of ESG ratings and stock prices of Shell, ESG ratings and stock prices tend to be positively correlated after August-2020, but the negative impacts on stock prices caused by higher ESG rating were exhibited before August-2020 (as shown in Figure 6). The situation which represents the stock prices decreasing continuously before June 2021 and increasing gradually after that time is faced by all of these three firms. The effects of COVID-19 on the energy market and industry would be a trustworthy explanation for this circumstance. Because of the COVID-19 epidemic, the oil and gas market's CAPEX and R&D investments fell by 30% to 40%, and petroleum consumption plummeted by over 25%. Furthermore, due to the reduction in petroleum consumption and numerous trade-restrictive measures posted during the COVID-19 epidemic, the number of oil exploitation projects decreased dramatically [9].

Figure 6: Relationship between SHELL ESG ratings and stock prices.

According to the comparison between ESG ratings and stock prices of Saudi Aramco and ExxonMobil respectively, and the positive relationship between ESG ratings and stock prices for Shell after August-2020, the ESG performance tends to bring benefits and positively relate to the firm’s value for firms belonging to the energy field. But the restrictions of stock purchasing may interfere with this resulting relationship because these restrictions could also contribute to lower stock prices not just the lower ESG ratings. For firms that belong to the energy (oil and gas) field, the demands for oil and gas were an essential part in the formation of their stock prices and values, unexpected disaster or pandemic like COVID-19 would always bring disruption to the gas and oil markets, thus the benefits of ESG performance to firm’s value would be overshadowed by the losses of firm’s value caused by the unexpected disaster or pandemic.

4. Analysis of Firms in the Finance Industry

According to the rank of the largest financial firms by market cap, three firms from the top 10 list which are Visa, JPMorgan Chase, and Mastercard, would be selected to investigate whether is there any correlation between the trend of the firm’s ESG ratings and the trend of its stock prices for firms in the financial field.

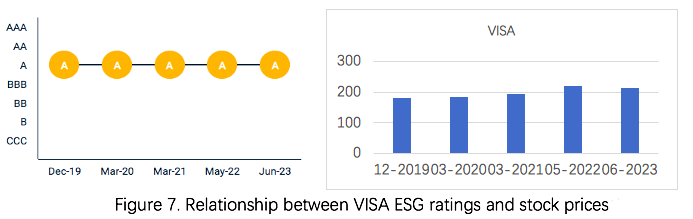

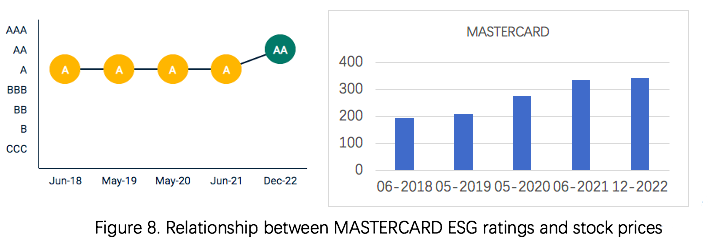

From the MSCI EGS ratings history data over the last five years or since records began, Visa and Mastercard both exhibited a strongly positive relationship between their ESG ratings and their stock prices (as shown in Figure 7 and Figure 8). The stable level of Visa’s ESG ratings for the last five years contributed to the stable increasing rate of stock price, even though a small decrease which is about 2.91% on Visa’s stock prices in June-2023 (as shown in Figure 7). The stock prices for Mastercard exhibited a continuous growing trend over the last five years and the largest growth rate happened from May-2019 to May-2020 which is about 32% (as shown in Figure 8). And in December-2022, the ESG rating of Mastercard upgraded from A to AA, but this upgrade rating did not lead to a significant increase in Mastercard stock prices, the growth rate was only about 2.31% (as shown in Figure 8). Even though a small decrease in a firm’s stock prices could happen along with an upgrade of the firm’s ESG rating (from A to AA), a higher and stable level of ESG rating could have a prominent role in maintaining the stability of stock prices over the years (as shown in Figure 8). For instance, the stock prices of Visa and Mastercard both showed a steady increase rate during December 2019 and June 2021 which is also the time of the COVID-19 epidemic

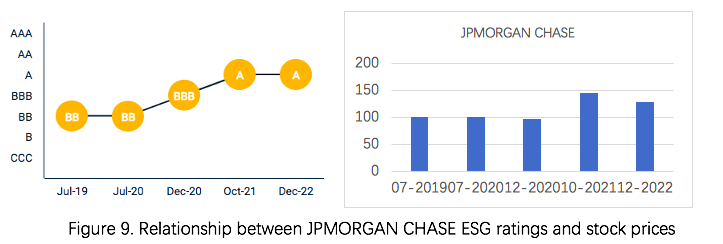

Based on the comparison between the trends of ESG ratings and stock prices of JPMorgan Chase, the positive correlation between its trend of ESG ratings and its trend of stock prices was not as great as the one between ESG ratings and stock prices for Visa and Mastercard. The only positive impact of JPMorgan Chase's ESG rating on its stock prices happened in the last five years was in the period from Decmeber-2020 to October-2021. JPMorgan Chase's stock prices increased by about 47.5% along with an upgrade of the firm’s ESG rating (from BBB to A). Even though JPMorgan Chase maintained its ESG rating from October-2021 to December-2022, its stock prices did not show a growing trend and decreased by about 11.7% (as shown in Figure 9). One possible explanation for this stock price decline would be the huge amount of bad loans for JPMorgan Chase, so about $428 million reserves were created for these bad loans and its program of share buybacks was postponed [10]. Despite JPMorgan Chase stock prices decreasing by a small amount which is about 3.4% along with an upgrade of the firm’s ESG rating (from BB to BBB) during the period between July-2020 and December-2020, Visa, Mastercard, and JPMorgan Chase all exhibited high stability of stock prices. Based on the distinctions between these firms’ ESG rating history and stock price growth trend, the firms in the financial field with higher average levels of ESG ratings (ESG performance) tend to have higher and more stable stock prices (firm value).

Figure 7: Relationship between VISA ESG ratings and stock prices.

Figure 8: Relationship between MASTERCARD ESG ratings and stock prices.

Figure 9: Relationship between JPMORGAN CHASE ESG ratings and stock prices.

5. Conclusion

After analyzing the MSCI EGS ratings history data over the last five years or since records began and the stock prices during the corresponding periods for firms belonging to technology, energy, and finance industries respectively, the benefits of a higher ESG performance of the firm on a firm’s value could appear more frequently in the technology and finance industries. In some circumstances, this positive effect would be offset by some specific issues faced by firms in the technology or finance industries. For instance, shortages of demand for the products of technology firms all over the world and the financial issues which are internal to the firm’s operation both could depress the benefits in the firm’s value brought by the firm’s ESG performance. For some firms in the energy industry, they might be controlled by the government, and trading of their stocks would face many limitations since energy could be an extremely important element for the country’s further development, and the protection of these firms’ financial trading acquired high priority from the government. And these trading limitations combined with poorer ESG performance might cause more severe damage to the firm’s value. The energy demand would be influenced dramatically by natural diseases, wars, and so on, and the effects of ESG performance would be relatively small under these situations. The firm’s ESG performance could never always bring positive effects on the firm’s value no matter the industry that the firms belong to, so environment-responsible investors should not only regard each firm’s ESG performance as the guidance of their investment strategies and the firm’s management team should always focus on keeping the balance between the activities about operational profits and activities related to ESG aspects. The effect of ESG performance that could be used for enhancing a firm’s value is finite, if the firm wants to pursue stable development, every firm also needs to make rational decisions under current circumstances and make adequate anticipation and preparation for possible changes in the future.

References

[1]. Boffo, R. and Patalano, R. (2020) ESG Investing: Practices, Progress, and Challenges. OECD Paris. Retrieved from www.oecd.org/finance/ESG-Investing-Practices-Progress-and-Challenges.pdf

[2]. Albertini, E. (2013) Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organization & Environment, 26, 431–457.

[3]. Garcia, A.S. and Orsato, R.J. (2020) Testing the Institutional Difference Hypothesis: A Study About Environmental, Social, Governance, and Financial Performance. Bus Strat Env, 29, 3261–3272.

[4]. Xu, Z. (2022) Research on the Impact of ESG Performance on Corporate Value. Advances in Applied Mathematics, 11, 4313-4322.

[5]. Erhart, S. (2022) Take It with a Pinch of Salt-ESG Rating of Stocks and Stock Indices. International Review of Financial Analysis, 83, 102308.

[6]. Wong, W.C., Batten, J.A., Ahmad, A.H., Mohamed-Arshad, S.B., Nordin, S. and Adzis, A.A. (2021) Does ESG certification add firm value?. Finance Research Letters, 39, 101593.

[7]. Egorova, A.A., Grishunin, S.V. and Karminsky, A.M. (2022) The Impact of ESG factors on the performance of Information Technology Companies, Procedia Computer Science, 199, 339-345.

[8]. Jorgenson, D.W. and Weitzman, M.L., et al. (2023) NVIDIA Stock Price: A Leading Indicator of Semiconductor Demand. AC Investment Research Journal, 220.

[9]. Norouzi, N. (2021) Post-COVID-19 and Globalization of Oil and Natural Gas Trade: Challenges, Opportunities, Lessons, Regulations, and Strategies. Int J Energy Res, 45, 14338–14356.

[10]. Parihar, S.B. (2022) Investment Analysis of JP Morgan Chase & Co. Diss. Rashtrasant Tukadoji Maharaj Nagpur University.

Cite this article

Wang,R. (2023). How Does ESG Performance Affect Firm Value. Advances in Economics, Management and Political Sciences,49,26-33.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Boffo, R. and Patalano, R. (2020) ESG Investing: Practices, Progress, and Challenges. OECD Paris. Retrieved from www.oecd.org/finance/ESG-Investing-Practices-Progress-and-Challenges.pdf

[2]. Albertini, E. (2013) Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organization & Environment, 26, 431–457.

[3]. Garcia, A.S. and Orsato, R.J. (2020) Testing the Institutional Difference Hypothesis: A Study About Environmental, Social, Governance, and Financial Performance. Bus Strat Env, 29, 3261–3272.

[4]. Xu, Z. (2022) Research on the Impact of ESG Performance on Corporate Value. Advances in Applied Mathematics, 11, 4313-4322.

[5]. Erhart, S. (2022) Take It with a Pinch of Salt-ESG Rating of Stocks and Stock Indices. International Review of Financial Analysis, 83, 102308.

[6]. Wong, W.C., Batten, J.A., Ahmad, A.H., Mohamed-Arshad, S.B., Nordin, S. and Adzis, A.A. (2021) Does ESG certification add firm value?. Finance Research Letters, 39, 101593.

[7]. Egorova, A.A., Grishunin, S.V. and Karminsky, A.M. (2022) The Impact of ESG factors on the performance of Information Technology Companies, Procedia Computer Science, 199, 339-345.

[8]. Jorgenson, D.W. and Weitzman, M.L., et al. (2023) NVIDIA Stock Price: A Leading Indicator of Semiconductor Demand. AC Investment Research Journal, 220.

[9]. Norouzi, N. (2021) Post-COVID-19 and Globalization of Oil and Natural Gas Trade: Challenges, Opportunities, Lessons, Regulations, and Strategies. Int J Energy Res, 45, 14338–14356.

[10]. Parihar, S.B. (2022) Investment Analysis of JP Morgan Chase & Co. Diss. Rashtrasant Tukadoji Maharaj Nagpur University.