1. Introduction

Foreign scholars have conducted mature theoretical research on the motivations of transnational acquisitions, believing that companies are driven by various interest factors when making acquisition decisions, including acquiring new resources for strategic integration, purchasing new technologies to enhance strength, and increasing brand awareness. Lee conducted a study on the motives of corporate acquisitions, building a cross-border acquisition model based on data from corporate acquisition cases from 1985 to 2007. He then selected data from companies in developed countries around the world for acquisition activities to test the model. Ultimately, the study found that if companies make cross-border acquisitions to expand the market, companies in developed countries are the preferred acquisition targets [1]. Ramsin et al. believe that cross-border mergers and acquisitions can help both parties strategically restructure their corporate resources [2]. For the study of how to evaluate acquisition performance, scholars have explored various value evaluation application methods. Different methods can obtain different research results under the limitations of research methods and backgrounds [3][4][5]. Therefore, the evaluation methods should be selected according to the actual situation of companies in different case studies. At present, most of the research on Chinese enterprises’ overseas M&A focuses on the risks and synergies of M&A, and the industries studied are mainly the energy industry and traditional manufacturing industries, while there are few studies on the dairy industry [6][7][8]. In 2015, Bright Dairy completed the acquisition of Israel’s Tnuva Food Company, which is the largest cross-border merger and acquisition in China’s dairy industry. The study on the performance of Bright Dairy’s acquisition of Tnuva can help predict the impact of this type of transnational acquisition on the company’s stock price and profitability. At the same time, this case study can provide a reference for Chinese dairy enterprises to conduct overseas mergers and acquisitions, helping them to prevent financial risks [9][10].

2. Background

2.1. Background Information of Bright Dairy Food and Tnuva

Bright Dairy Food was established in 1996. In 2000, Bright Dairy completed its shareholding reform and was listed on the Shanghai Stock Exchange. Enterprise capital is composed of state-owned capital and social capital. As one of the giants in China’s dairy industry, Bright Dairy has diversified products, rich marketing channels, and an excellent brand reputation. The core business of the group consists of modern agriculture, food manufacturing, chain business, and trade, with the food industry chain as the core. Tnuva Foods is the largest food company in Israel. It was originally founded as an agricultural cooperative and has been established for more than 85 years. Tnuva Foods is an Israeli integrated food company with a monopoly advantage, focusing on milk and dairy products. At present, the group’s business includes the production, processing, and sale of a variety of food products, including dairy products, meat products, pastries, etc. The company has a local market share of more than 50% in Israel and is also widely involved in the Middle East, Europe, and the United States.

2.2. Motivations of the Acquisition

Transnational merger and acquisition is an important step in Bright Dairy’s long-term strategic development. In 2015, Bright Dairy set its sights on the Middle East market, choosing one of Israel’s oldest and most iconic food companies as its target. Israel has a very high degree of agricultural modernization and has unique advantages in the development of agriculture and animal husbandry. Tnuva Food, as an excellent supplier of milk powder, can provide high quality and reliable raw materials for Bright Dairy to develop the powder market. At the same time, Tnuva Food has a unique agricultural and animal husbandry industry, which is reflected in mature breeding technology and high-quality dairy cows. In addition, Tnuva also has world-leading technology for producing organic yogurts, cheeses and butters. Bright Dairy takes this opportunity to obtain advanced production technology and upgrade the industrial chain.

3. Performance Analysis

On November 12, 2014, Bright Group established Bright Singapore Company in Singapore. Its main business is to assist Bright Food Israel Limited Partnership in completing the acquisition of 100% equity in AP.MS.TN and 0.01% equity in T.A.M. Milk. On March 31, 2015, Bright Dairy planned to acquire 100% equity in Singapore Holdings through the non-public issuance of A-shares in order to indirectly own the equity of Tnuva Group. In this acquisition, 56% of the shares held by Apax Partner, a shareholder of Tnuva Food Company, and 21% of the shares held by Mivtach Shamir were acquired by Bright Dairy Food. The market value of the acquired Tnuva reached 2.5 billion US dollars, or approximately 15.3 billion RMB. In order to analyze the short-term and long-term effects of the acquisition activity on Bright Diary Food, this paper tries to use the FAMA-French three-factor model for short-term performance analysis and the financial indicators method for long-term performance analysis [11][12].

3.1. Short-term Performance Analysis

Usually, after a listed company releases a major event announcement in accordance with the requirements of the stock exchange, market investors will quickly judge the possible impact of the announcement event, and the reaction of investors will be reflected in the recent stock price fluctuations of the company, thus affecting the stock return rate. Event study is a commonly used empirical method to evaluate enterprise performance. Based on the market efficiency theory, the market can quickly and effectively reflect the value of the company. Therefore, the short-term performance evaluation of the acquisition plan is carried out through the event study method, and the investors’ attitude toward the acquisition event is illustrated according to the reaction of the stock market to the share purchase arrangement of Bright Dairy Food.

3.1.1. Determining the Event Day and the Window Period

The first step in applying the event study method is to determine the event day and period of the study. The event day does not necessarily refer to the day on which the event occurred, but the day on which the event was definitively informed to the public. On March 30, 2015, Bright Israel Partnership paid all the equity transfer payments to the original equity holders of AP.MS.TN and T.A.MMilk and completed the necessary property transfer procedures. Bright Israel Partnership actually controlled the financial and operating policies of Tnuva Group, enjoyed the corresponding interests, and assumed the corresponding risks. Bright Diary Food was suspended from March 7, 2015, to June 8, 2015, because of restructuring matters related to the acquisition of Tnuva, and resumed trading on June 9, 2015. In order to ensure the accuracy and reliability of the results, the window period excluded the market trading day during the suspension period without any trading data. The event day is determined to be June 9, 2015.

Secondly, the estimation window period generally selects a period of time before the event occurs and is used to calculate the expected normal rate of return of the company when the event does not occur. This paper selects February 24, 2014, to March 6, 2015 as the estimated window period of the study, including 253 trading days. In addition, the event window is between June 9, 2015 and July 7, 2015.

3.1.2. Calculation of Expected rate of Return

If the market is efficient, the event is unexpected, and the occurrence of the event is related to the stock value of a specific company, the abnormal stock return can be calculated by subtracting the estimated stock return rate from the actual stock return rate. The result of this calculation can also help to analyze whether stock holders pay much attention to this M&A event.

Stock prices are not only affected by the overall market economy but also by many other exposures, so this paper uses the FAMA-French three-factor model for long-term performance analysis. Besides considering market risk, the FAMA-French three-factor model also analyzes the impact of the scale factor and the book market value factor. Therefore, the formula used to estimate the expected rate of return by the market model is expressed as:

\( {R_{t}}={β_{1}}*{RiskPremium_{t}}+{β_{2}}*{HML_{t}}+{β_{3}}*{SMB_{t}}+{ε_{t}} \) (1)

RiskPremiumt is the market risk premium factor on day t; SMBt is the Scale factor on day t; HMLt is the Book value factor on day t.

Collect the data on individual stock return rate during the estimation window period. According to the parameters listed above, the relevant data for Bright Dairy Food stock during the estimation window period from February 24, 2014, to March 6, 2015, were collected through the single stock return rate (day) of the Csmar database and the index (day) of the Fama-French three-factor model. Three indexes — the market risk premium factor, scale factor, and book market value factor — were selected as independent variables of the regression model, and the expected rate of return was selected as a dependent variable to carry out linear regression work.

Table1: The regression result of the Fama-French three-factor model.

Variable | Coefficient | Std.Error | t-Statistic | Prob |

RiskPremium | 0.712228 | 0.106253 | 6.703117 | 0.0000 |

HML | -0.980885 | 0.233936 | -4.192968 | 0.0000 |

SMB | -0.273436 | 0.184399 | -1.482850 | 0.1394 |

C | -0.000809 | 0.001233 | -0.655788 | 0.5126 |

As shown in Table1, the regression coefficient of RiskPremium is about 0.712 (t=6.703, p=0.000<0.01), which means that RiskPremium has a significant positive influence on the stock return rate. The regression coefficient of HML was approximately -0.981 (t=-4.193, p=0.000<0.01), indicating that HML had a significant negative effect on Rt. However, the regression coefficient of SMB is -0.273 (t=-1.483, p=0.139>0.05), which means that SMB has an insignificant influence on Rt. Therefore, according to the results of the significance level, the SMB factor is removed and the expected return rate is obtained, as shown in the equation. \( \hat{{R_{t}}}=0.71*RiskPremium-0.98*HML \)

3.1.3. Calculation of the Abnormal Return

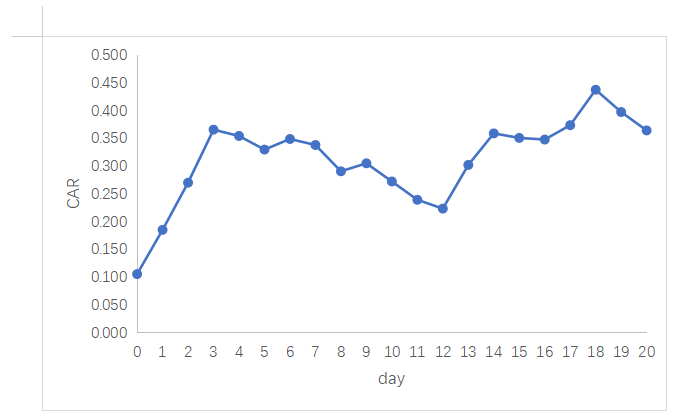

According to the formula in 3.1.2, the estimated daily return of the stock of Bright Dairy Food in the event window period can be calculated. Then, the author gets the actual daily return of Bright Dairy Food on these days from the Csmar database. The abnormal return (AR) of each day is the difference between the actual return and the estimated return. Accumulate the value of the abnormal return to obtain CAR. If the value of CAR is positive, it indicates that acquisition activities have a positive effect on the company’s stock price.

3.1.4. Analysis of Short-term Performance

As shown in Figure1, in the 20 days of the time window, the CAR value was always greater than zero and showed an overall upward trend, from 0.105 on day 0 to 0.364 on day 20. The news that Bright Dairy Food is about to successfully acquire Tnuva has brought positive abnormal returns to Bright Group’s stock in the short term. The acquisition event increased the stock price in the short term. This result shows that the shareholders of Bright Group were very concerned about the acquisition event and generally held a positive attitude toward it.

Figure1: CAR of the stock of BDF in the 20 days after the event day.

3.2. Long-term Performance Analysis

This paper uses the financial index method to analyze the long-term impact of the acquisition event on Bright Dairy Food. This trinational acquisition event had a long time span, and the impact of it on the performance of the company could be reflected over a long period of time. This paper selected the period of two years before and three years after the completion of the acquisition events, a total of five years, and comprehensively analyzed the impact of changes in various financial indicators on the long-term financial performance of Bright Dairy Food.

3.2.1. Profitability

Table 2: Financial indicators of the profitability of BDF between 2013 and 2017.

Year | 2013 | 2014 | 2015 | 2016 | 2017 |

EPS | 0.33 | 0.46 | 0.34 | 0.46 | 0.50 |

Net profit margin on sales | 2.91% | 2.86% | 2.56% | 3.34% | 3.77% |

Return on equity | 9.45% | 11.21% | 9.43% | 10.96% | 12.24% |

Return on total assets | 4.10% | 4.53% | 3.21% | 4.20% | 4.95% |

As shown in Table 2, the earnings per share of Bright Dairy had a relatively obvious decline in the year when the merger and acquisition occurred from 0.46 in 2014 to 0.34 in 2015, and showed a gradual upward trend in the two years after the completion of the merger. The EPS of BDF reached 0.50 in 2017, exceeding the EPS of the year before the acquisition. The decline in earnings per share in 2015 was due to the fact that the acquisition was paid for in the form of a private offering of stock, which somewhat diluted earnings for existing shareholders. Since then, the annual earnings per share have gradually increased, indicating that the merger and acquisition have brought good profitability to the enterprise over a long period of time.

The net profit rate on sales, return on equity, and return on total assets of Bright Dairy all experienced a decline in 2015, indicating that the acquisition activities had a certain degree of impact on the cost and profit of Bright Dairy, resulting in a decline in the profitability of Bright Dairy’s assets in that year. In 2015, the entire dairy industry’s raw milk price fluctuations, competition in the same industry, and other external environmental factors led the overall cost of China’s dairy industry enterprises to rise. From this point of view, merger and acquisition activities are the main but not the only reason for the reduction in profitability at Bright Dairy. In 2016, after the merger, all three values began to rise, indicating that the negative impact of the merger had dissipated. For instance, the net profit margin on sales of BDF increased from 2.56% in 2015 to 3.77% in 2017. In addition, the return on equity reached 12.24% in 2017, the highest in the five years before and after the M&A study. From the overall data of the past five years, the profitability of Bright Dairy was affected by merger and acquisition activities and some external factors, which led to a temporal decrease of some financial indicators in the year of the merger, but the indicators increased in the following year. On the whole, all indicators were stable and improved, indicating that the merger and acquisition activity had a positive effect on the profitability of the company.

3.2.2. Debt-paying Ability

Table 3: Financial indicators of the debt-paying ability of BDF between 2013 and 2017.

Year | 2013 | 2014 | 2015 | 2016 | 2017 |

Asset-liability ratio | 56.57% | 59.64% | 65.93% | 61.69% | 59.60% |

Equity ratio | 43.43% | 40.36% | 34.07% | 38.31% | 40.40% |

Long-term debt-paying ability mainly refers to debt repayment ability with a payment term of one year or more. The higher the asset-liability ratio, the more assets the enterprise obtains by borrowing, which may lead to certain financial risks. It is generally believed that the asset-liability ratio of enterprises had batter to be between 40% and 60%. As can be seen from Table 3, the asset-liability ratio of Bright Dairy showed an upward trend from 2013 to 2015, increasing from 56.57% in 2013 to 65.93% in 2015. Although the value decreased to 61.69% in 2016, the year after the acquisition, it was still higher than the asset-liability ratio before in 2013 and 2014. The equity ratio is a measure of how much of a business’s assets are invested by its owners. According to table 3, the overall shareholder equity ratio of Bright Dairy decreased to 34.07% in 2015, indicating that the amount of debt borrowed by the enterprise in the process of using financial leverage to expand business activities has increased compared with that before the acquisition. From the asset-liability ratio and shareholders’ equity ratio, the long-term debt-paying ability of Bright Dairy Food has decreased compared with that before the acquisition.

4. Conclusion

Bright Dairy and Tnuva are both large dairy production companies, and many of their products and production lines are similar. Therefore, Bright Dairy’s decision to acquire Tnuva will help the company obtain high-quality raw materials, expand overseas markets, and solve the problem of overcapacity. In addition, as one of the largest food production companies in Israel, Tnuva has leading technology patents in the field of milk powder production, so the acquisition of Tnuva can provide strong technical support for Bright Dairy, helping it enter the middle-to-high-end milk powder market. From a short-term perspective, the stock of Bright Dairy Food had a positive abnormal return during the event window, which shows that the acquisition event increased the stock price in the short term and that the shareholders of Bright Group generally held a positive attitude toward the acquisition event. From a long-term perspective, on the one hand, merger and acquisition activities have improved the profitability of Bright Dairy, the owner of the merger. Whether the information of earnings per share or return on assets shows an upward trend, it indicates that the sales channels of products are broadened and the overall sales and profits of enterprises are steadily improving. On the other hand, after the merger, the debt-paying capacity of Bright Dairy was slightly weakened. In conclusion, shareholders were optimistic about Bright Dairy’s decision to acquire Tnuva, and Bright Dairy’s profitability indeed improved after the acquisition. The data used in this article is financial data disclosed in domestic and foreign public markets. In data analysis, this paper uses the average method to ensure the objectivity of the data, but the quality of the data is inevitably flawed. In addition, there is a problem of insufficient sample size in the linear regression. In order to further improve the research, the sample size can be expanded to select more time points that affect M&A activities and shareholders’ reactions.

References

[1]. Lee D. Cross-Border Mergers and Acquisitions with Heterogeneous Firms: Technology vs. Market Motives [J]. The North American Journal of Economics and Finance, 2017, 42: 20–37.

[2]. Ramsin Y, Richard N, Patrik S. Chinese foreign acquisitions aimed for strategic asset-creation and innovation upgrading: The case of Geely and Volvo Cars [J]. Technovation, 2018, 36: 70–71.

[3]. (Katherine) K M,Jorge F. The impact of political freedoms on cross-border M&A abandonment likelihood [J]. Quarterly Review of Economics and Finance, 2023, 91.

[4]. Ping L,Boqiang L,Mengting L, et al. Empirical Study of Factors Influencing Performance of Chinese Enterprises in Overseas Mergers and Acquisitions in Context of Belt and Road Initiative — A Perspective Based on Political Connections [J]. Emerging Markets Finance and Trade, 2019, 56(7).

[5]. Yao C. Integration and technology innovation in technology-sourcing M&As — A comparative study on overseas and domestic M&As of Chinese enterprises [J]. Asian Journal of Technology Innovation, 2022, 30(3).

[6]. You T. Research on Motivation and Performance of Chinese Enterprises’ Overseas M&A under the background of “One Belt and One Road” [D]. Central University of Finance and Economics, 2022.

[7]. Bing L. Case study of Harbin Pharmaceutical Group’s acquisition of GNC (Jiananxi) in the United States [D]. Shenyang University of Technology, 2021. DOI:10.27322/d.cnki.gsgyu.2021.001007.

[8]. Xiangxiang H,Yue S,Yunwen X. Valuation Methods in Case of Merges and Acquisitions: A Review [P]. 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022), 2022.

[9]. Kaixin L. Analysis on Risk of Debt of Leveraged Financing in Cross-border M&A [J]. The Frontiers of Society, Science and Technology, 2023, 5(7).

[10]. Nandan V. M&A: The Impact of M&A on Emerging Companies [J]. Journal of Global Economy, Business and Finance, 2023, 5(2).

[11]. Ke N. Analysing the Financial Synergy Effect of Corporate Mergers and Acquisitions — Yili’s Acquisition of Ausnutria [J]. Research in Economics and Management, 2023, 8(3).

[12]. Liu Y. Analysis of the Path of State-owned Enterprises’ Merger and Acquisition of Private Enterprises under the “Management Committee + Company Model” — Take the Acquisition of Company A as an Example [J]. Academic Journal of Business & Management, 2023, 5(14).

Cite this article

Zhong,R. (2023). A Case Study of Bright Dairy’s Acquisition of Israel’s Tnuva Foods. Advances in Economics, Management and Political Sciences,56,124-130.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Lee D. Cross-Border Mergers and Acquisitions with Heterogeneous Firms: Technology vs. Market Motives [J]. The North American Journal of Economics and Finance, 2017, 42: 20–37.

[2]. Ramsin Y, Richard N, Patrik S. Chinese foreign acquisitions aimed for strategic asset-creation and innovation upgrading: The case of Geely and Volvo Cars [J]. Technovation, 2018, 36: 70–71.

[3]. (Katherine) K M,Jorge F. The impact of political freedoms on cross-border M&A abandonment likelihood [J]. Quarterly Review of Economics and Finance, 2023, 91.

[4]. Ping L,Boqiang L,Mengting L, et al. Empirical Study of Factors Influencing Performance of Chinese Enterprises in Overseas Mergers and Acquisitions in Context of Belt and Road Initiative — A Perspective Based on Political Connections [J]. Emerging Markets Finance and Trade, 2019, 56(7).

[5]. Yao C. Integration and technology innovation in technology-sourcing M&As — A comparative study on overseas and domestic M&As of Chinese enterprises [J]. Asian Journal of Technology Innovation, 2022, 30(3).

[6]. You T. Research on Motivation and Performance of Chinese Enterprises’ Overseas M&A under the background of “One Belt and One Road” [D]. Central University of Finance and Economics, 2022.

[7]. Bing L. Case study of Harbin Pharmaceutical Group’s acquisition of GNC (Jiananxi) in the United States [D]. Shenyang University of Technology, 2021. DOI:10.27322/d.cnki.gsgyu.2021.001007.

[8]. Xiangxiang H,Yue S,Yunwen X. Valuation Methods in Case of Merges and Acquisitions: A Review [P]. 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022), 2022.

[9]. Kaixin L. Analysis on Risk of Debt of Leveraged Financing in Cross-border M&A [J]. The Frontiers of Society, Science and Technology, 2023, 5(7).

[10]. Nandan V. M&A: The Impact of M&A on Emerging Companies [J]. Journal of Global Economy, Business and Finance, 2023, 5(2).

[11]. Ke N. Analysing the Financial Synergy Effect of Corporate Mergers and Acquisitions — Yili’s Acquisition of Ausnutria [J]. Research in Economics and Management, 2023, 8(3).

[12]. Liu Y. Analysis of the Path of State-owned Enterprises’ Merger and Acquisition of Private Enterprises under the “Management Committee + Company Model” — Take the Acquisition of Company A as an Example [J]. Academic Journal of Business & Management, 2023, 5(14).