1. Introduction

Studying and addressing the effects of inflation in New York are manifold and far-reaching. First of all, as a global financial and business center, New York's inflation may have a huge impact on the U.S. and global economies, triggering social instability such as wealth inequality and rising unemployment. Therefore, through in-depth research on inflation in New York, policymakers can more accurately formulate corresponding economic and social policies to slow down or avoid its negative impacts. By scientifically and comprehensively studying inflation in New York and proposing targeted solutions, we can provide valuable reference for inflation problems in other regions and even the world. Additionally, for New Yorkers, understanding this phenomenon can help them plan their personal finances and lives more effectively. Finally, this research will also provide interdisciplinary research materials and theoretical support for economics, sociology, political science and other disciplines.

According to a May 2023 study based on a simple quantitative New Keynesian model, the leading cause of inflation in New York in recent years is mainly attributed to two key factors: the impact of oil prices and loose monetary policy [1]. These two not only directly push up the prices of goods and services, thereby increasing the cost of living, but also indirectly affecting consumption and investment behavior. Another Research took advantage of the very close direct correlation between the price of coffee (a commodity) and the Consumer Price Index (CPI) in New York (Pearson's correlation coefficient was 0.61), indicating that changes in commodities prices are reflected in New York's Consumer Price Index (CPI)—an effective indicator of inflationary [2]. The conflict between Russia and Ukraine and the Covid-19 pandemic has fueled the worst inflation in nearly four decades in the U.S. and other developed countries, pointing to misallocation of fiscal relief funds and rising fiscal deficits as the main factors behind the rise in inflation, which rose by as much as 7.7 percentage points [3]. Moreover, the data from the World Bank confirms this correlation through Engel Granger's cointegration analysis. The results suggest that investing mainly in renewable energy technologies may be able to deal with New York’s severe inflation problem to a certain extent [4].

This study will illustrate the basic situation of inflation in New York from more aspects, such as official data from the US government website to explain the basic situation of inflation in New York, and then use cases to describe the negative impact of inflation in New York, and then propose relatively feasible solutions based on the problems and reference materials. To a certain extent, it will help New York policymakers solve the current inflation problem.

2. Data Illustration

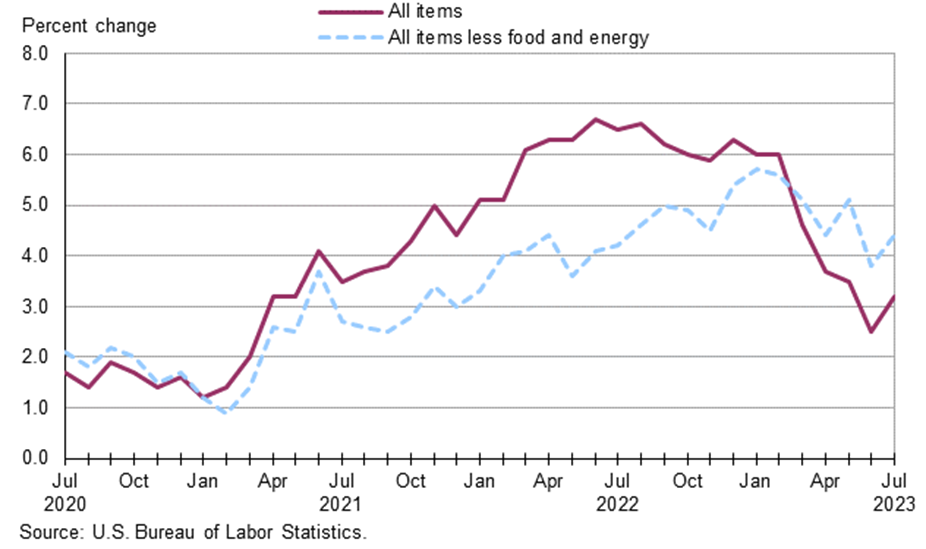

Figure 1 is the region's Consumer Price Index (CPI-U) increased 0.4% in July 2023, according to the U.S. Bureau of Labor Statistics, and has increased 3.2% overall over the past 12 months [5]. The growth has been driven largely by rising housing prices, but there has also been an increase in food prices, particularly the cost of eating out. In relative terms, energy prices fell by 11.5%, especially gasoline prices, which dropped by 21.7%, but electricity costs increased by 8.1%. Prices for other consumer goods such as new and used cars and clothing also rose. Taken together, the data paint a complex and diverse picture of inflation, involving price changes in housing, food, energy and other daily consumer goods, providing a reference for us to study inflation in the New York area.

Figure 1: Over the year percent change in CPI_U, New York -Newark Jersey City; NY-NJ-PA, July 2020-July 2023.

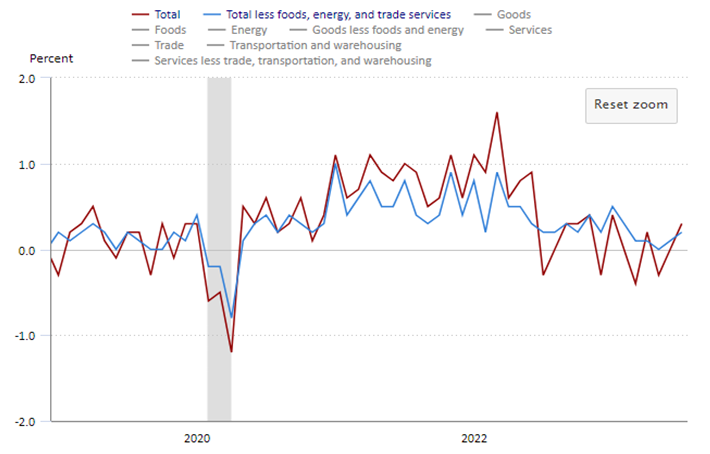

Figure 2 shows that the PPI index in New York indicates that current inflation levels are relatively high, especially after COVID-19 restrictions are lifted in 2022 [6]. During this period, the PPI for food, energy and social services continued to be high, implying that inflationary pressures remained high. Although the government took a series of monetary and fiscal measures to ease inflation in 2023, the results were not obvious, and the inflation level still had not returned to the state before the outbreak.

Figure 2: PPI for Final demand, 1-month percent change, seasonally adjusted from 2020-2023.

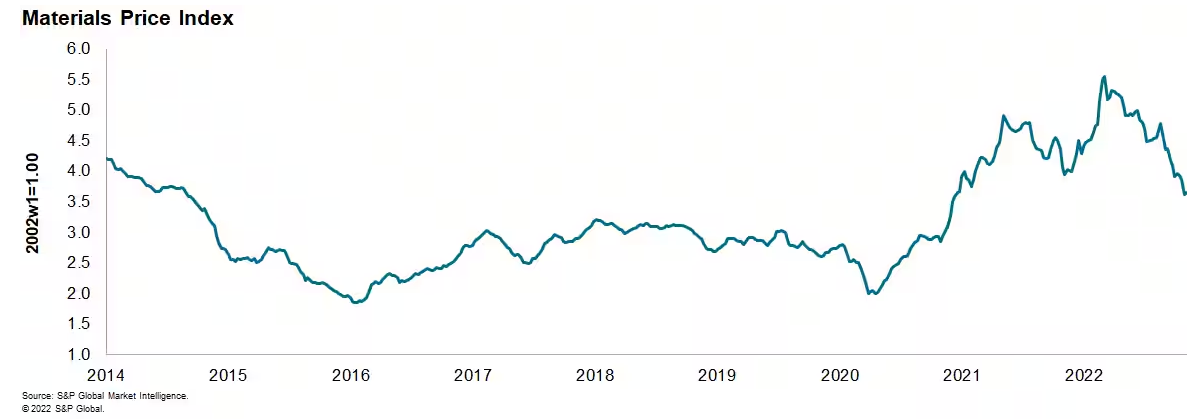

From a macro perspective (see figure 3), the overall U.S. MPI (Material Price Index) can show the overall current inflation situation in the whole United States [7]. In November 2022, the MPI increased by 0.6%. This is the first increase since early October 2022. Six of the ten subcomponents rose. Despite last week's price gains, the MPI remains 35% below its all-time high set in early March. However, commodity prices as measured by the MPI are still 29% higher than pre-pandemic levels in January 2020. This situation fully demonstrates that the overall inflation situation in the United States remains severe.

Figure 3: Materials Price Index from 2014-2023 from S&P Market Global market intelligence.

In addition to some basic data that can reflect the current status of inflation in New York, some daily life cases can also reflect the current status of inflation in New York.

3. Case Description

Since the end of the COVID-19 pandemic, inflation has become a growing problem in New York City, especially among New Yorkers, whose daily lives have been severely affected. As can be seen from the following two cases, the impact of inflation has penetrated deeply into the daily lives of New York citizens.

3.1. Residents Under Multiple Pressures of Highest Inflation in Four Decades

In a news update on July 13, 2022, CBS New York (CBS2) revealed the impact of US inflation reaching a 40-year high, especially on New York City residents [8]. According to the U.S. Department of Labor, consumer prices rose 9.1% year-over-year, the fastest increase since 1981. This upsurge raises many socioeconomic questions: how supermarkets respond to rising costs, how residents make ends meet under the pressure of soaring rents and food prices, and how these pressures exacerbate social inequality. Several New York residents and experts were quoted in the news, including West Side residents Kevin Salazar and Ana Gonzalez, as well as New York City broker Bill Kovalchuk and financial policy expert Michelle Bang Germany, they analyzed this issue from daily life and professional perspectives respectively. The nonprofit City Harvest reported a 36% increase in food-insecure residents than before the outbreak. This series of changes and shocks provides a comprehensive but condensed overview of the inflation situation.

3.2. Inflation and Office Vacancies in New York

Another report in June 2023 stated that New York City’s inflation rate was the highest in the past 40 years, reaching 6.0% [9]. These problems put enormous pressure on individual consumers, businesses and even the entire urban economy. Inflation in particular, with food prices up 8.4% over the past 12 months, energy prices up 4.4%, and so-called core inflation (which excludes food and energy) also rose 5.7%. That leaves nonprofits like Citymeals on Wheels facing a 33% increase in food costs. Declining office occupancy also results in about $12 billion in lost economic activity annually, including reduced spending at restaurants, transportation and other areas. City Comptroller Brad Lander's latest report also shows that the purchasing power of the current $15 minimum wage will drop to just $13 due to the effects of inflation.

4. Analysis on the Problems

4.1. Reasons of Inflation Happens in New York

4.1.1. Wars and Regional Conflicts

The conflict between Russia and Ukraine has been going on for more than 500 days. In addition to causing widespread damage to warzone economies, it also hurt the economies of other countries, the United States being one of them. Judging from New York's current high inflation rate and the trend of sharply rising energy prices, this conflict is one of the main factors leading to New York's recent inflation. As a major global energy exporter, Russia's actions in its war with Ukraine could destabilize energy supplies, especially given that Ukraine is one of the key corridors for natural gas transportation. This instability has the potential to drive up global energy prices, further fueling inflationary pressures in New York. Geopolitical uncertainty can also make Wall Street investors worried about the global economic outlook, leading to financial market volatility, currency depreciation and rising inflation. As the war expands, disruptions in supply chains or the availability of certain key commodities, such as food, metals or French fries, could cause prices for those goods to spike, pushing up inflation in New York. The U.S. government's economic and monetary policy responses, such as whether to raise interest rates or implement fiscal stimulus, also affect the final level of inflation. With the war still ongoing and the future of Russia and Ukraine difficult to accurately predict, a combination of these factors is likely to affect inflation in New York to varying degrees.

4.1.2. Global Pandemic Issues

Although New York City lifted the restrictions on the new crown epidemic in the second half of 2022, the COVID-19 epidemic has had a multifaceted impact on New York City's economy in the past two years, which has led to an exacerbation of the recent inflation problem. During the outbreak, many businesses had to temporarily close or reduce production, disrupting their supply chains and creating severe shortages of goods and services, driving up prices. During the Pandemic, many local workers in New York were sick or needed to be quarantined, resulting in a severe labor shortage. Such a situation results in companies having to raise wages for active workers and increase business costs, and these costs are ultimately passed on to consumers through increased prices of goods and services. The New York City government has also increased expenditures in response to the epidemic, such as issuing relief funds and purchasing and importing masks, protective clothing and medical equipment. These additional financial expenditures may increase the supply of US dollars, thereby triggering inflation. COVID-19 has also changed people's consumption habits. New Yorkers' increased demand for medical supplies, toilet paper, and food may also lead to higher prices. To sum up the overall situation, the central bank may adopt monetary easing policies, such as lowering interest rates or increasing money supply, to stimulate economic recovery, but this may also increase inflation. In the past decade, due to the high degree of financialization and the hollowing out of the real economy, as well as the high degree of globalization of the supply chain, it has been difficult for the United States to experience serious inflation. However, the COVID-19 crisis and the out-of-control epidemic have directly led to the collapse of the overall supply chain in the United States. For example, key logistics personnel such as port dock workers and long-distance transport drivers are often short of or go on strike due to the epidemic. All this has become a driving force for New York's recent key factor in inflation.

4.1.3. Manufacturing Outflow

New York's manufacturing outflow is very serious. Most of the low-end goods in New York are mainly imported from China, Mexico and other places. Manufacturing outflows, also known as “deindustrialization,” may have been intended to reduce production costs, but when such capital outflows affect key industries or necessities, supply chains can become destabilized, driving up commodity prices. At the same time, as the epidemic sweeps the world, product manufacturing countries such as China and Mexico are also facing serious supply chain and transportation collapses. Manufacturing outflows could also exacerbate the U.S. trade deficit and put downward pressure on the dollar. Due to the high cost of domestic labor in the United States, a large number of cheap goods are dependent on imports. The rising cost of imported products will directly lead to increased inflation in New York. Due to the long-term outflow of manufacturing and the impact of the epidemic, rising unemployment in New York City will reduce the purchasing power of consumers. While the government may counteract this effect through fiscal and monetary policies such as increasing public spending or lowering interest rates, it is also highly likely to stoke inflation. Capital may flow from the real economy to the financial market, triggering asset bubbles and economic instability. The outflow of manufacturing will not only affect New York, but also the overall U.S. supply chain, while the COVID-19 epidemic and any instability in the global economy may in turn affect inflation in New York.

4.2. Analysis of the Problems Caused by Inflation in New York

4.2.1. Increase in Consumer Goods Prices

As noted in the first case, New York residents are experiencing the highest increase in consumer prices since 1981, rising 9.1% year-over-year. This not only sharply increases the cost of daily life, but also further exacerbates the problem of social inequality between rich and poor. For example, many people are finding it increasingly difficult to afford basic living expenses as food and rent prices soar. The report of the non-profit organization "City Harvest" further shows that due to the increase in food prices caused by inflation, residents buy more cheap food, and the proportion of residents facing food insecurity has increased by 36% compared with before the outbreak.

4.2.2. Office Spaces Vacancies

High inflation has directly led to higher rents for shops and offices in New York City, which has directly led to a sharp decrease in the occupancy rate of office space in New York City, resulting in an annual loss of about $12 billion in economic activity, including restaurants, transportation and other areas. expenditure.

4.2.3. Decreased Purchasing Power of Money

High inflation puts enormous pressure on the entire urban economy. In the above cases, City Comptroller Brad Lander's report shows that the purchasing power of the current $15 minimum wage will drop to just $13 due to inflation.

4.2.4. Increase Crime Rate

High inflation will lead to greater financial pressure on relatively poor families and individuals in New York. When they struggle to maintain basic living through legitimate means, some people may turn to illegal or immoral activities to obtain income, such as robbery, drug dealing, theft, marches, and demonstrations.

5. Solutions on the Problem

5.1. Government Regulation Solves the Increase of Consumer Goods Prices

The inflation problem New York currently faces is similar to what China experienced in the late 1940s: consumer goods prices’ rose sharply and the real purchasing power of the currency weakened. In Zhang, Shan Xi's research article, he describes in detail how China's new government quickly responded to this economic challenge in the 1950s [10]. At that time, China's consumer goods prices soared to unprecedented heights. In order to stabilize the economy, the new government decided to take a series of measures: first, it concentrated most of the national revenue to the central government to ensure that financial resources were used to the maximum extent; second, important materials were concentrated and targeted to those in shortage. regions; in addition, the new government has also significantly reduced unnecessary spending, cleaned up obsolete warehouse inventories, strengthened tax policies, issued public bonds to raise more funds, and emphasized the importance of savings in government spending. This series of measures significantly stabilized and lowered prices in just one year. Compared with New York, these suggestions are instructive: The New York City government can consider more centralized management and distribution of critical supplies to ensure that they are used rationally and effectively where they are most needed to slow down price increases caused by shortages; merchants should be Encourage the liquidation of obsolete or low-selling inventories to release more liquidity; the government can increase fiscal revenue by raising taxes or issuing public bonds; finally, considering the current high price environment, the government should manage and economize expenditures more carefully in order to Ensure adequate resources are available to deal with economic problems and stabilize consumer goods prices.

5.2. Taking Roosevelt’s New Deal as a Reference

For the situation of office jobs and store vacancies caused by inflation, there was a reference solution during Roosevelt’s New Deal in 1933. In the article State Capacity and Economic Intervention in the Early New Deal, Theda Skocpol and Kenneth Finegold talked about how the 1933 U.S. Roosevelt's New Deal addressed such problems during the Great Economic Crisis in New York [11]. Roosevelt's New Deal took a variety of measures to address the problem of store closings. One of the key policies is the establishment of the National Recovery Administration (NRA), which aims to restore store operations by establishing industry regulations for various industries, including wages and labor conditions. In addition, the NRA also encourages businesses to comply with minimum wage standards to increase hiring rates. Another key measure was the establishment of the Public Works Administration (PWA), which funded and managed various infrastructure projects such as roads, bridges, and school construction. These projects provide more business opportunities for stores and create more jobs. Roosevelt's New Deal also implemented the Social Security system, which helped reduce the financial pressure on the elderly and unemployed, thereby reducing the impact of economic instability on stores. Roosevelt's New Deal in 1933 helped stores overcome the difficulties during the Great Depression through a series of policies and measures. Corresponding to today's inflation issue in New York, it is also of great reference value. First of all, the New York government can consider formulating or adjusting industry regulations, funding infrastructure projects, and implementing new safety measures to help current New York shops and offices survive inflation. Period, maintain economic stability and sustained growth

5.3. Monetary Policy Solve the Problem of Low Purchasing power

After Japan's economic bubble burst in 1990, the country suffered a sharp decline in the purchasing power of its currency. Krugman's article delves into Japan's economic stagnation and liquidity trap at the time [12]. Although Japan suffered primarily from the effects of deflation, its currency's low purchasing power was very similar to New York's today, so New York could learn from Japan's strategy at the time. The Bank of Japan has adopted a zero or ultra-low interest rate policy and expanded the money supply by purchasing government bonds and other assets. In addition, the government has promoted a large amount of fiscal stimulus, such as infrastructure investment, tax breaks and subsidies. In order to achieve long-term economic growth, Japan has carried out structural reforms in many areas, also adopted an export-oriented growth strategy, and signed free trade and investment agreements with many countries. In order to break the long-term deflationary mentality, the Bank of Japan set an inflation target of 2% and purchased high-risk assets such as stock exchange funds. These measures helped restore Japan's currency purchasing power to a large extent. Today, New York can learn from Japan’s post-1990 economic bubble strategy. Specific recommendations include: adopting loose monetary policies and lowering interest rates through the Federal Reserve Bank to stimulate investment and consumption; promoting large-scale public investment such as infrastructure construction to promote employment and economic growth; implementing in areas such as the labor market, agriculture and corporate governance Structural reforms; encourage New York businesses to expand exports to enhance their global competitiveness; set clear inflation targets to manage public expectations; and support financial institutions to purchase riskier assets to further stimulate the economy. Although the situation between New York and Japan is still different today, these measures will help New York under inflation solve its low purchasing power problem to a certain extent.

5.4. Lower the Crime Rates During Inflation Requires Combination Strategies

Gary Becker detailed the relationship between inflation and crime in his 1968 article, and Robert Merton detailed the effects of inflation in his research and discussed how social inequality and educational inequality affect crime rates [13,14]. It can be concluded from the history of crime control in the United States that addressing high crime rates during periods of inflation often requires a combination of strategies. From an economic policy perspective, controlling inflation is key, and is usually achieved through monetary policy and fiscal policy. Lowering inflation not only relieves the economic stress associated with it but can further reduce crime rates. In addition, since high unemployment is often associated with high crime rates, creating more job opportunities is also an effective means to alleviate this problem. From a social policy perspective, education and training are particularly important. By providing more and better educational and job training opportunities to low-income and high-risk groups, such as educating citizens about the current drug abuse landscape in New York, the probability of crime related to drug abuse can be fundamentally reduced. At the same time, it is also necessary to strengthen the construction of the social welfare system. This includes providing food stamps, unemployment benefits, and housing subsidies to relieve economic stress and further reduce crime caused by New York's economic distress. Overall, these economic and social policies need to work together to form a comprehensive strategy to effectively address high crime rates in times of inflation.

In Table 1, NYPD data are also shown in the inflationary era [15]. While crime numbers and rates remain high, extremely violent crimes such as murder, rape, and felonious assault have declined. The reports issued by these government departments and independent institutions can clearly show the relationship between inflation and crime rates, helping policymakers adjust their methods of controlling crime problems according to the current inflation situation to strive for maximum social stability.

Table 1 Index Crime Statistics in May 2023 from NYPD website.

May 2023 | May 2022 | +/- | % change | |

Murder | 32 | 48 | -16 | -33.3% |

Rape | 124 | 157 | -33 | -21.0% |

Robbery | 1351 | 1520 | -169 | -11.1% |

Felony Assault | 2350 | 2384 | -34 | 1.4% |

Burglary | 1127 | 1278 | -151 | -11.8% |

Grand Larceny | 4257 | 4183 | 74 | -1.8% |

Grand Larceny Auto | 1369 | 1033 | 336 | 32.5% |

Total | 10610 | 10603 | 7 | 0.1% |

6. Conclusion

After the epidemic is over, New York faces a serious inflation problem, which not only reduces citizens' living standards but also aggravates the crime rate. The goal of this study is to provide New York policymakers with practical recommendations for addressing this complex issue. We first conducted preliminary data analysis using professional economic indicators such as CPI and PPI to fully understand the inflation situation in New York. Then, through practical cases, it further highlights how inflation penetrates the daily lives of New York citizens. Putting this information together it can be concluded that inflation not only causes the cost of living to soar, but also closes shops, reduces the purchasing power of money, and increases crime rates. The study recommends that New York policymakers should prioritize several aspects: first, control inflation through fiscal and monetary policies; second, create more job opportunities to alleviate the link between high unemployment and high crime rates; third, strengthen The social welfare system, including the provision of food stamps, unemployment benefits, and housing subsidies, these suggestions can help New York slow the impact of inflation to a certain extent and enable citizens to better cope with the rising cost of living. However, the study has its limitations because it focused primarily on New York City rather than the United States. Future research will need to explore solutions to the inflation problem at a broader geographical and socioeconomic level.

References

[1]. Luca Gagliardone, (2023). Oil Prices, Monetary Policy and Inflation Surges, Working paper, Retrieved from: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.nber.org/system/files/working_papers/w31263/w31263.pdf.

[2]. Vochozka, M., Janek, S., & Rowland, Z. (2023). Coffee as an Identifier of Inflation in Selected US Agglomerations. Forecasting, 5(1), 153–169.

[3]. Cline, William. (2023). Fighting the Pandemic Inflation Surge of 2021-2022, Economics International Inc., Working Paper, Retrieved from https://ssrn.com/abstract=4408811

[4]. Dinçer, H., Yüksel, S., Çağlayan, Ç., Yavuz, D., & Kararoğlu, D. (2023). Can Renewable Energy Investments Be a Solution to the Energy-Sourced High Inflation Problem?. In U. Akkucuk (Ed.), Managing Inflation and Supply Chain Disruptions in the Global Economy, 220-238

[5]. Bureau of Labor Statistics. (2023). Consumer Price Index - New York Region, Retrieved from https://www.bls.gov/regions/northeast/news-release/consumerpriceindex_newyork.htm, last accessed 2023/9/9.

[6]. US Bureau of Labor Statistics. (2023). PPI for Final Demand, 1-month percent change, seasonally adjusted - New York Region. Retrieved from https://www.bls.gov/charts/producer-price-index/final-demand-1-month-percent-change.htm

[7]. Michael, Dell, Weekly Pricing Pulse: Commidity price growth returns, Nov 17th, 2022, Retrieved from https://www.spglobal.com/marketintelligence/en/mi/research-analysis/weekly-pricing-pulse-commodity-price-growth-returns.html

[8]. Rozner, L., & Brennan, D. (2022). New York City inflation hits new 40-year high. CBS New York. Retrieved from https://www.cbsnews.com/newyork/news/new-york-city-inflation-new-high/

[9]. David, G. (2023). New York inflation and office occupancy. The City. Retrieved from https://www.thecity.nyc/economy/2023/2/14/23600299/new-york-inflation-office-occupancy

[10]. Zhang, S.X, (1997) Inflation through the ages and its Management Strategies. Chinese Culture Forum,1997(1), 50-54.

[11]. Skocpol, T., & Finegold, K. (1982). State Capacity and Economic Intervention in the Early New Deal. Political Science Quarterly, 97(2), 255–278.

[12]. Krugman, P. R., Dominquez, K. M., & Rogoff, K. (1998). It’s Baaack: Japan’s Slump and the Return of the Liquidity Trap. Brookings Papers on Economic Activity, 1998(2), 137–205.

[13]. Gary, S Becker. (2023). Crime and Punishment: An Economic Approach, The University of Chicago Press Journals, 76(2)

[14]. Merton, R. K. (1938). Social Structure and Anomie. American Sociological Review, 3(5), 672–682.

[15]. New York City Police Department , NYPD Announces Citywide Crime Statistics for May 2023, Retrieved on https://www.nyc.gov/site/nypd/news/p00083/nypd-citywide-crime-statistics-may-2023

Cite this article

Wang,Y. (2023). Strategies and Practices for Dealing with Inflation in New York. Advances in Economics, Management and Political Sciences,56,247-255.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Luca Gagliardone, (2023). Oil Prices, Monetary Policy and Inflation Surges, Working paper, Retrieved from: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.nber.org/system/files/working_papers/w31263/w31263.pdf.

[2]. Vochozka, M., Janek, S., & Rowland, Z. (2023). Coffee as an Identifier of Inflation in Selected US Agglomerations. Forecasting, 5(1), 153–169.

[3]. Cline, William. (2023). Fighting the Pandemic Inflation Surge of 2021-2022, Economics International Inc., Working Paper, Retrieved from https://ssrn.com/abstract=4408811

[4]. Dinçer, H., Yüksel, S., Çağlayan, Ç., Yavuz, D., & Kararoğlu, D. (2023). Can Renewable Energy Investments Be a Solution to the Energy-Sourced High Inflation Problem?. In U. Akkucuk (Ed.), Managing Inflation and Supply Chain Disruptions in the Global Economy, 220-238

[5]. Bureau of Labor Statistics. (2023). Consumer Price Index - New York Region, Retrieved from https://www.bls.gov/regions/northeast/news-release/consumerpriceindex_newyork.htm, last accessed 2023/9/9.

[6]. US Bureau of Labor Statistics. (2023). PPI for Final Demand, 1-month percent change, seasonally adjusted - New York Region. Retrieved from https://www.bls.gov/charts/producer-price-index/final-demand-1-month-percent-change.htm

[7]. Michael, Dell, Weekly Pricing Pulse: Commidity price growth returns, Nov 17th, 2022, Retrieved from https://www.spglobal.com/marketintelligence/en/mi/research-analysis/weekly-pricing-pulse-commodity-price-growth-returns.html

[8]. Rozner, L., & Brennan, D. (2022). New York City inflation hits new 40-year high. CBS New York. Retrieved from https://www.cbsnews.com/newyork/news/new-york-city-inflation-new-high/

[9]. David, G. (2023). New York inflation and office occupancy. The City. Retrieved from https://www.thecity.nyc/economy/2023/2/14/23600299/new-york-inflation-office-occupancy

[10]. Zhang, S.X, (1997) Inflation through the ages and its Management Strategies. Chinese Culture Forum,1997(1), 50-54.

[11]. Skocpol, T., & Finegold, K. (1982). State Capacity and Economic Intervention in the Early New Deal. Political Science Quarterly, 97(2), 255–278.

[12]. Krugman, P. R., Dominquez, K. M., & Rogoff, K. (1998). It’s Baaack: Japan’s Slump and the Return of the Liquidity Trap. Brookings Papers on Economic Activity, 1998(2), 137–205.

[13]. Gary, S Becker. (2023). Crime and Punishment: An Economic Approach, The University of Chicago Press Journals, 76(2)

[14]. Merton, R. K. (1938). Social Structure and Anomie. American Sociological Review, 3(5), 672–682.

[15]. New York City Police Department , NYPD Announces Citywide Crime Statistics for May 2023, Retrieved on https://www.nyc.gov/site/nypd/news/p00083/nypd-citywide-crime-statistics-may-2023