1. Introduction

The exploration for wealth, a key indicator of personal and societal status, has long attracted interest. The dimension of net worth plays a crucial role in the concept of wealth, providing insight into the intricate tapestry of affluence. In addition, net worth affects people in many ways. In sociology, for example, net worth becomes a powerful determinant of an an individual's political agency, adding another layer of complexity to power dynamics. In addition, its sociopolitical implications, personal net worth stands also a foundational measure of economic well-being. This broad range of indicators encompasses a range of resources, including not only savings, but also potential value locked into home equity, business holdings and real estate portfolios [1], which can reflect an individual's overall economic situation. In order to gain insight into the inner workings of people and society, it is essential to have a thorough comprehension of net worth. Researchers have been consistently fascinated by this pursuit throughout history.

Previous research has indicated a number of essential elements that have a strong correlation with affluence. A study showed that self-esteem and crop income [2] are positively correlated. People who have a strong sense of self-worth may be more inspired and ready to take calculated chances, which can result in increased crop revenue. They may be more assured in their agricultural choices and more able to withstand difficulties. A different body of research has suggested that having a strong sense of self-worth can have an effect on people's financial choices by encouraging them to put money into high-risk investments and by inspiring them to build up their wealth [3]. Studies have also suggested that educational attainment is a major factor in addressing income and wealth disparity [4]. Generally speaking, people who have attained a higher level of education tend to have higher earnings. The "college wage premium" is the term used to describe the increased income linked to a college degree. Research indicates that this premium has been on the rise over the years [5]. Furthermore, it is commonly noted that those with more abilities tend to be more attractive to employers. There should be a correlation between wealthier individuals and lower insurance purchase in theory [2]. Wealthy people are able to protect themselves from potential risks and losses without having to buy insurance to spread out the risk. Rather, they can depend on their monetary resources to tackle unforeseen requirements, which is referred to as self-insurance. In addition, obtaining insurance necessitates the payment of insurance premiums, which can add to the financial strain for those with greater wealth. Consequently, this theoretical viewpoint implies that, for those who are able to protect themselves, setting aside money may be a more economical and effective strategy than purchasing insurance.

Previous studies have mainly focused on the net worth of individuals and the elements that affect it. However, it is crucial to recognize that net worth can also function as an indicator of a household's overall wealth. Therefore, this research aims to analyze the links between essential factors and net family income, broadening its scope to include net income at the family level. It is imperative to determine the applicability of these recognized connections to the realm of familial finances through this extension.

This research predicted that age, self-esteem, educational attainment, and insurance coverage would have a beneficial effect on the net family income. Based on previous studies, it was also postulated that there would be a negative correlation between the quantity of children residing in a household and the net income of the family.

2. Methods

2.1. Study Population

This research adopts the National Longitudinal Survey of Youth 1979 (NLSY79), a program sponsored by the U.S. Bureau of Labor Statistics, consisting of 12,686 respondents in total. The participants in the survey were asked to answer a variety of questions related to economics, society, demographics, and behavior. Our analysis centers on individuals who possess comprehensive information regarding their net family income, educational attainment, self-esteem, insurance coverage, age, and the quantity of children residing in their household.

2.2. First Assessment of Variables

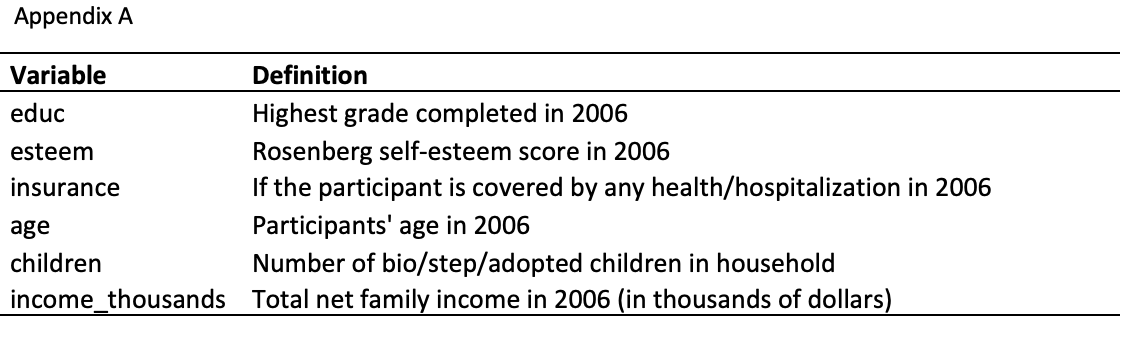

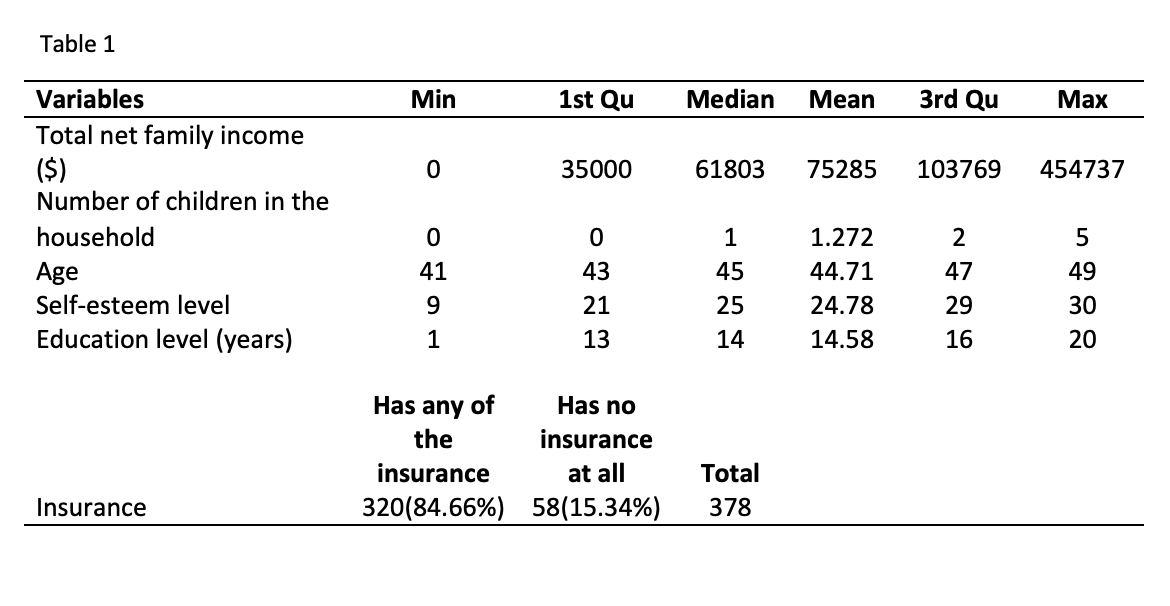

A self-reported questionnaire was utilized to gather demographic information, including age, economic and social circumstances. Quantitative variables encompass total net family income, education level, age, self-esteem level, and the number of children in a household. The net family income, education level, and the number of children all assume positive values. The age bracket spans from 40 to 49. The Rosenberg self-esteem scale, which measures global self-worth by measuring both positive and negative self-perceptions on a scale from 0 to 30, is used to evaluate self-esteem. Scores that fall within the range of 15 to 25 are considered to be within the normal range, whereas scores below 15 are indicative of a lack of self-esteem. The only variable that can be classified into two categories is insurance status, which is assigned a code of 0 for no health insurance and 1 for any type of health insurance (Table 1).

Table 1: Definition.

2.3. Statistical Analysis

The participant characteristics for the categorical variable "insurance" are displayed in percentage format, whereas the remaining quantitative variables are described using fundamental statistical measures like minimum, median, maximum, mean, 1st quartile, and 3rd quartile. A multiple regression analysis (OLS) was conducted to evaluate the correlation between net family income and the selected socio-demographic factors, estimating their corresponding p-values. The R version 3.6.2 was used for all statistical analyses, and statistical significance was established at a two-sided p-value threshold of less than 0.05.

3. Results

3.1. Descriptive Statistics

Table 2 presented that descriptive statistics offer a comprehensive examination of crucial variables within the dataset. A total of 378 participants are included in this study. There is a significant range in the total net family income, with a minimum of $0 and a maximum of $454,737. The median income of the distribution stands at $61,803, while the mean income is recorded at $75,285. The number of children in the households varies from 0 to 5, with a median of 1. Participant ages span from 41 to 49, with a mean age of approximately 44.71 years. The median score for self-esteem levels on a scale of 9 to 30 is 25, with an average score of 24.78. The educational attainment of individuals, quantified in years, varies from 1 to 20, with a median of 14 and a mean of 14.58 years. Out of the 378 people in our sample, the majority (84.66%) have some type of insurance, while a minority (15.34%) do not have any type of insurance. The data from these statistics gives a strong basis for further research, revealing the socioeconomic status of the population being examined.

Table 2: Descriptive statistics.

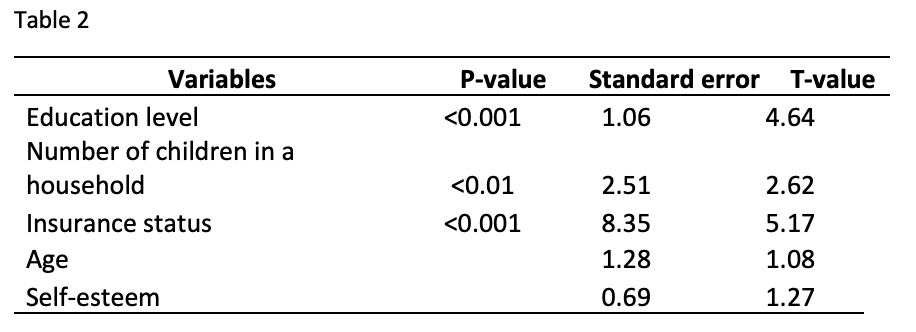

3.2. Regression Analysis

The purpose of this multiple linear regression analysis was to illustrate the relationship between total net family income and various socio-demographic factors. Equation1 was constructed.

\( Net Family Income= \)

\( -125.74+ 4.93educ+1.39age+0.89esteem+6.59children+43.19insurance \) (1)

Table 2 illustrates several noteworthy discoveries that merit further examination. Initially, there was a strong and statistically significant positive correlation between education level ("educ") and income (p < 0.001), as indicated by an estimated coefficient of 4.9290, accompanied by a narrow standard error (1.0635). This strong outcome highlights the importance of higher education in forecasting a rise in income, indicating that gradual improvements in educational achievement are closely associated with higher income levels. Secondly, the number of children in the household ("children") had a statistically significant positive influence on income (p = 0.00915), with an estimated coefficient of 6.5895 and a standard error of 2.5148. This suggests that an increased number of children was linked to increased income, even after accounting for other influential factors. Furthermore, individuals benefiting from insurance coverage ("insurance1") demonstrated a notably substantial and statistically significant positive relationship with income (p<0.001). Additionally, individuals who received insurance coverage ("insurance 1") exhibited a significantly substantial and statistically significant positive correlation with their income (p<0.001). This discovery highlights the fact that people who have insurance generally have a much higher income than those without insurance. Despite this, it is noteworthy that neither age nor self-esteem had a statistically significant effect on income in the context of this model. To conclude, this thoroughly examined model demonstrated a strong statistical significance (p<0.001), providing a clear understanding of the differences in income. Within this framework, education, the number of children, and insurance coverage emerged as the predominant predictors of "income_thousands," emphasizing their significant influence on income dynamics (Table 3).

Table 3: Regression.

3.3. Discussion

The findings suggest that there is a positive correlation between the net family income and factors such as education level, the number of children in the household, and insurance. It is also interesting to observe that age and self-esteem level have no correlation with net family income.

The correlation between education and net family income is well-established. Studies suggest that there is a strong correlation between education and wealth. Increased earnings frequently result in more effortless savings, an essential element in the accumulation of wealth. People with less money usually have a less affluent income, which makes it more difficult to save and pay off debts. Moreover, people with higher levels of education tend to make financial decisions that contribute to wealth accumulation [6], such as maintaining liquid assets, diversifying investments, and keeping debt relative to assets low. Highly educated people also tend to allocate a larger proportion of their savings into stocks, bonds, and businesses, which often provide higher returns [7] (though also entail greater risk).

Insurance also contributes to the growth of familial riches. Health insurance is an especially important type of insurance in this context. Investing in health insurance can provide additional protection for personal possessions from a medical insurance view. Health insurance provides essential protection for medical costs, such as treatments, surgeries, drugs, and emergency care. Without health insurance, people may be subject to exorbitant healthcare expenses, which could result in medical debt that has a major effect on their creditworthiness and financial health. Wealthy people, on the other hand, are more likely to raise their insurance needs due to their aversion to risk [8]. The researchers evaluate this explanation by looking into how much of the people in the sample allocate their funds to more vulnerable financial investment. An increased aversion to take risks usually results in a greater demand for insurance, as it is closely linked to the consequences of a more pessimistic outlook [9]. Furthermore, studies indicate that an increase in income volatility also raises people’s request for insurance coverage, both life insurance and property insurance [1]. Those with greater financial resources may be more prone to fluctuating spending habits, thus making them more vulnerable to various external forces. The consequences of these elements can be far-reaching, influencing their future spending, income, or prosperity, thus emphasizing the potential for insurance to become more essential for these people.

This paper’s results concerning the quantity of children in a family and family wealth are different from previous research findings. The majority of previous research has suggested that in the United States, a significant number of births occur unintentionally [10], with a higher probability of these unintended births happening among women with lower incomes rather than those with higher incomes. This phenomenon may be influenced by various factors [11]. At the outset, those with limited financial means may find it more difficult to obtain the necessary contraception or sexual health education. Conversely, those with limited financial resources may encounter more obstacles to obtaining medical care, such as reliable birth control techniques and family planning services, which could potentially raise the chances of unplanned pregnancies. Nevertheless, there are also studies that corroborate the results presented in this paper. These researchers contend that this relationship is more intricate. Despite the fact that women with higher incomes in the general population usually have fewer children, this correlation does not apply to all educational groups, including those with a higher level of education. Contrary to popular belief, men with higher incomes have not experienced a decline in the population of children, and their rates of childlessness have also decreased. Additionally, among individuals with a high level of education and the overall population with a college education, there is a positive correlation between higher male incomes and fertility rates [12].

In addition to investigating statistically significant results, two additional factors that do not show any correlation with family wealth are also captivating. The results associated with the two factors are different from the findings of previous studies. Firstly, it is found in this paper that there is no correlation between high self-esteem and family wealth. However, some studies suggested that higher self-esteem usually goes with better wealth. According to the self-consistency theory, an individual's behavior will be consistent with their perceived self-worth [1]. People who have higher levels of self-esteem would be more motivated to maintain and elevate their socioeconomic status. Consequently, people who have a strong sense of self-worth may find more satisfaction in having money because of the prestige it provides and the improvement of their self-image. Furthermore, having a strong sense of self-worth may result in investing in riskier investments with a track record of greater profits [3]. Age is yet another factor that has not been corroborated by prior research. Previous studies have revealed that young people are more likely to take advantage of loans as it provides them with the opportunity to obtain the items they desire in the present. Due to the initial low income of the majority of young people, combined with their financial obligations, the accumulation of family finances is minimal. As one ages, their earnings tend to rise. As the debt is paid off, the family's riches slowly build up [4]. These financial behaviors are also a way to get ready for retirement. As a result, there is a positive relationship between age and family wealth. This research, however, revealed a negative correlation between family wealth and age, which could be due to the fact that people interviewed in 2006 were mostly in their 40s, which is considered to be in the middle-aged bracket. Hence, there was no discernible pattern of the family's wealth increasing as one grew older.

Nonetheless, there are still a number of restrictions in this study. Firstly, it was not possible to determine if there was a link between net family income and socio-demographic factors. Therefore, it may be necessary for government officials to adjust their regulations instead of executing precise and focused plans to increase net family income. Secondly, this study is a retrospective analysis of survey data. It is possible that the study's results may have been affected by economic status and childhood experiences, which were not taken into account when making adjustments for environmental factors.

4. Conclusion

To put it succinctly, net family income provides a thorough measure of the resources that have been amassed, demonstrating the importance of long-term financial stability and economic stability. An increase in family wealth is essential for improving both personal health and social progress. Having a higher family net income provides individuals with the financial security to access quality education, healthcare, and an enhanced quality of life. As a result, it helps to ensure the security and steadiness of the entire population. In addition, having a higher income is often linked to better mental and physical wellbeing, as it helps to reduce the pressure caused by financial constraints. Thus, it is of great necessity to understand the elements associated with it. The study's findings reveal a strong correlation between education level, insurance, and the quantity of children in a household with a net family income. While education and insurance align with previous researches, the relationship between the quantity of children in a household and net family income goes against earlier findings. Future researches can explore into this contrasting relationship in greater detail, since this study focused on correlations rather than cause and effect. Researchers could investigate if changes to the insurance system could potentially result in a higher net family income. They could also investigate the correlation between educational attainment and net family income, taking into account individual abilities and family financial circumstances.

References

[1]. Fischer, S. (1973). A Life Cycle Model of Life Insurance Purchases. International Economic Review 14 (1), 132–152. Rampini, A. and S. Viswanathan (2019). Financing Insurance. Working Paper .

[2]. Koijen, R., S. Van Nieuwerburgh, and M. Yogo (2016). Health and Mortality Delta: Assessing the Welfare Cost of Household Insurance Choice. The Journal of Finance 71 (2), 957 – 1010. https://www.sciencedirect.com/science/article/abs/pii/S016726812100158X

[3]. Individual wealth management: Does self-esteem matter? Available at: http://m.www.na-businesspress.com/JABE/Jabe102/ChatterjeeWeb.pdf (Accessed: 04 October 2023).

[4]. Wolla, S.A. and Sullivan, J. (no date) Education, income, and wealth, Economic Research - Federal Reserve Bank of St. Louis. Available at: https://research.stlouisfed.org/publications/page1-econ/2017/01/03/education-income-and-wealth (Accessed: 04 October 2023).

[5]. Valletta, Rob. "Higher Education, Wages, and Polarization." Federal Reserve Bank of San Francisco Economic Letter. January 12, 2015; http://www.frbsf.org/economic-research/publications/economic-letter/2015/january/wages-education-college-labor-earnings-income/.

[6]. Scott A. Wolla and Jessica Sullivan, "Education, Income, and Wealth," Page One Economics®, January 2017

[7]. Boshara, Ray; Emmons, William R. and Noeth, Bryan. "The Demographics of Wealth: How Age, Education and Race Separate Thrivers from Strugglers in Today's Economy." Essay No. 2: Education and Wealth, May 2015; https://www.stlouisfed.org/~/media/Files/PDFs/HFS/essays/HFS-Essay-2-2015-Education-and-Wealth.pdf.

[8]. Wealth and insurance choices: Evidence from US households - NBER. Available at: https://www.nber.org/system/files/working_papers/w29069/w29069.pdf (Accessed: 04 October 2023).

[9]. The impact of the COVID-19 pandemic and policy responses on ... - NBER. Available at: https://www.nber.org/system/files/working_papers/w28930/w28930.pdf (Accessed: 04 October 2023). https://www.nber.org/system/files/working_papers/w29069/w29069.pdf

[10]. Ryder, Norman B. and Charles F. Westoff, 1969 "Fertility planning status: United States,1965." Demography 6 (November): 435-444.

[11]. Cutright, P. (1971). Income and Family Events: Family Income, Family Size, and Consumption. Journal of Marriage and Family, 33(1), 161–173. https://doi.org/10.2307/350162

[12]. Weeden J, Abrams MJ, Green MC, Sabini J. Do high-status people really have fewer children? : Education, income, and fertility in the contemporary U.S. Hum Nat. 2006 Dec;17(4):377-92. doi: 10.1007/s12110-006-1001-3. PMID: 26181608.

Cite this article

Sun,M. (2023). Analyzing the Relationship Between Family Net Income and Socio-Demographic Factors by Using a Multiple Linear Regression Analysis. Advances in Economics, Management and Political Sciences,64,33-39.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fischer, S. (1973). A Life Cycle Model of Life Insurance Purchases. International Economic Review 14 (1), 132–152. Rampini, A. and S. Viswanathan (2019). Financing Insurance. Working Paper .

[2]. Koijen, R., S. Van Nieuwerburgh, and M. Yogo (2016). Health and Mortality Delta: Assessing the Welfare Cost of Household Insurance Choice. The Journal of Finance 71 (2), 957 – 1010. https://www.sciencedirect.com/science/article/abs/pii/S016726812100158X

[3]. Individual wealth management: Does self-esteem matter? Available at: http://m.www.na-businesspress.com/JABE/Jabe102/ChatterjeeWeb.pdf (Accessed: 04 October 2023).

[4]. Wolla, S.A. and Sullivan, J. (no date) Education, income, and wealth, Economic Research - Federal Reserve Bank of St. Louis. Available at: https://research.stlouisfed.org/publications/page1-econ/2017/01/03/education-income-and-wealth (Accessed: 04 October 2023).

[5]. Valletta, Rob. "Higher Education, Wages, and Polarization." Federal Reserve Bank of San Francisco Economic Letter. January 12, 2015; http://www.frbsf.org/economic-research/publications/economic-letter/2015/january/wages-education-college-labor-earnings-income/.

[6]. Scott A. Wolla and Jessica Sullivan, "Education, Income, and Wealth," Page One Economics®, January 2017

[7]. Boshara, Ray; Emmons, William R. and Noeth, Bryan. "The Demographics of Wealth: How Age, Education and Race Separate Thrivers from Strugglers in Today's Economy." Essay No. 2: Education and Wealth, May 2015; https://www.stlouisfed.org/~/media/Files/PDFs/HFS/essays/HFS-Essay-2-2015-Education-and-Wealth.pdf.

[8]. Wealth and insurance choices: Evidence from US households - NBER. Available at: https://www.nber.org/system/files/working_papers/w29069/w29069.pdf (Accessed: 04 October 2023).

[9]. The impact of the COVID-19 pandemic and policy responses on ... - NBER. Available at: https://www.nber.org/system/files/working_papers/w28930/w28930.pdf (Accessed: 04 October 2023). https://www.nber.org/system/files/working_papers/w29069/w29069.pdf

[10]. Ryder, Norman B. and Charles F. Westoff, 1969 "Fertility planning status: United States,1965." Demography 6 (November): 435-444.

[11]. Cutright, P. (1971). Income and Family Events: Family Income, Family Size, and Consumption. Journal of Marriage and Family, 33(1), 161–173. https://doi.org/10.2307/350162

[12]. Weeden J, Abrams MJ, Green MC, Sabini J. Do high-status people really have fewer children? : Education, income, and fertility in the contemporary U.S. Hum Nat. 2006 Dec;17(4):377-92. doi: 10.1007/s12110-006-1001-3. PMID: 26181608.