1. Introduction

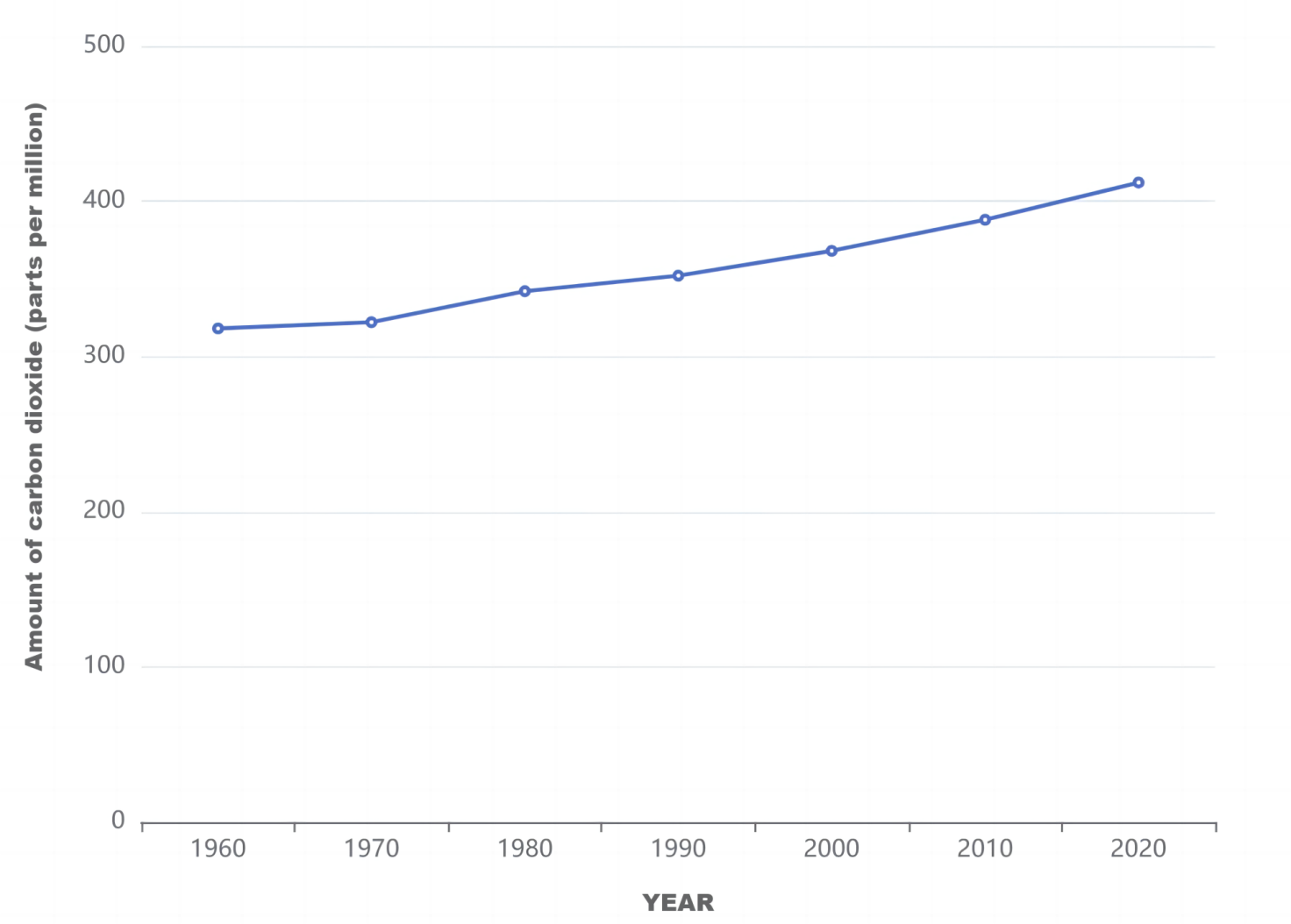

The consequences of global warming related to increased carbon dioxide levels are widespread and severe. Increasing global temperatures, melting polar glaciers, increasing sea levels, more frequent extreme weather occurrences like storms and disturbances to ecosystems and biodiversity are all consequences. Carbon dioxide concentrations are rising primarily because of human use of fossil fuels as a source of energy. More CO2 is being released into the atmosphere by people, humans are quickening the earth’s inherent atmospheric warming. A range of 40 to 80 US dollars per ton of carbon dioxide in 2020, increasing to 50 to 100 US dollars per ton of carbon dioxide by 2030, was determined to be necessary by the Commission on Carbon Prices at a High Level, led by Joseph Stiglitz and Nicholas Stern [1][2]. The criticality of the global climate change crisis has forced stakeholders to rethink their investment plans. Investors are faced with the task of measuring and mitigating carbon risk in their portfolios as carbon emissions continue to contribute to environmental deterioration and regulatory changes [3].

Figure 1: Atmospheric Carbon Dioxide over time.

Jose Salazar coined the phrase “Environmental Finance” for the first time in 1998 [4]. He stressed the need for the financial sector to put environmental governance and protection at the top of its operational priorities, promote environmental awareness, and use its financing capabilities to steer societal resource allocation in the direction of environmentally friendly enterprises. This tactic aims to strike a balance between ecological and economic growth. Although this notion has been put out before, it may be challenging for investors to compare and evaluate the environmental impacts of various investments due to the lack of established criteria and measures.

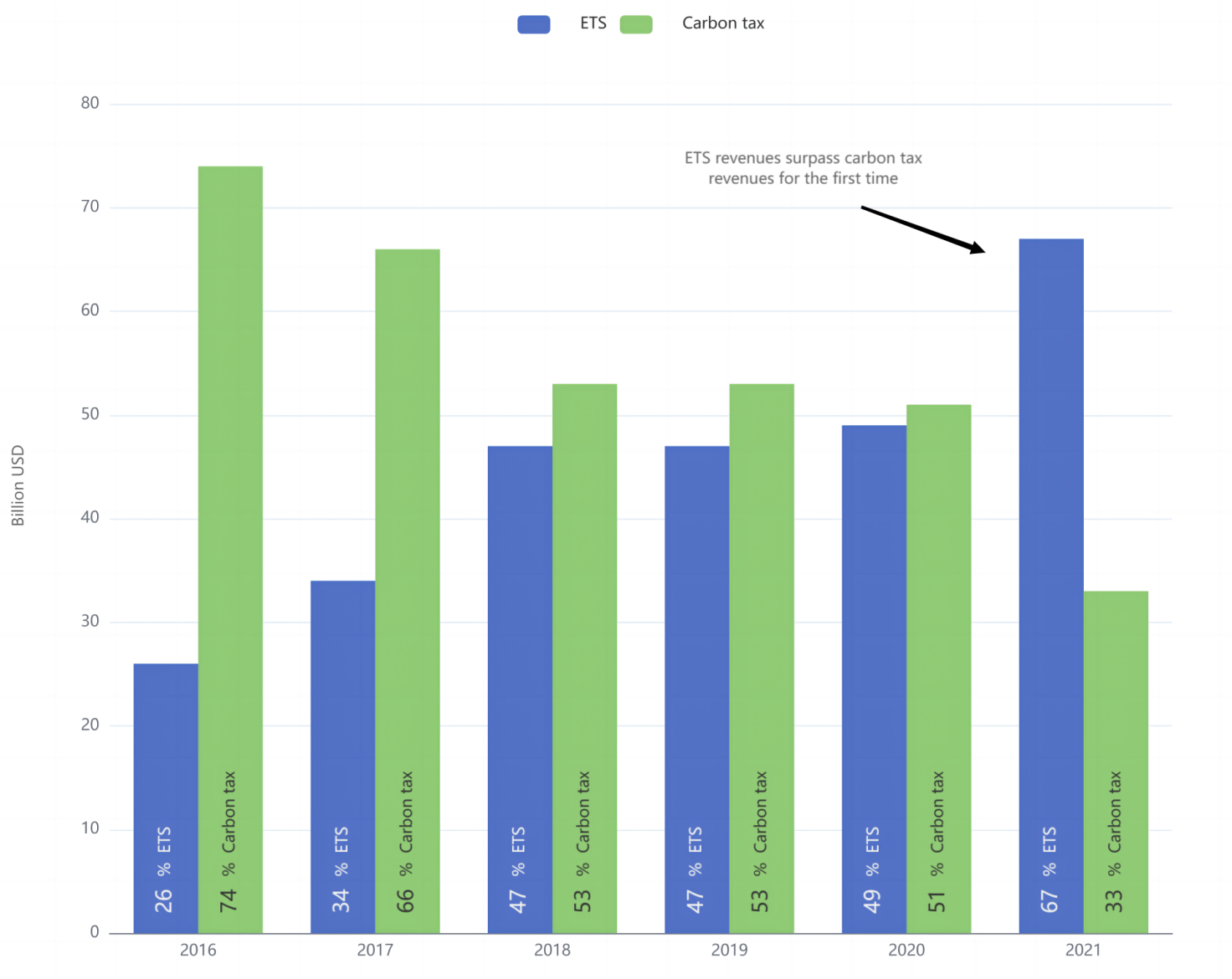

In contrast, carbon pricing provides a clear and standardized cost associated with carbon emissions. A carbon price is a widely agreed-upon method by economists for encouraging polluters to reduce greenhouse gas emissions [5]. According to the report of the World Bank from 2022, income from global carbon pricing increased by about 60% in the previous year, reaching almost USD 84 billion [6]. Taking this into account, the increase in revenue brought about by global carbon pricing marks a substantial advance in the fight against climate change. The money raised by carbon pricing may be wisely used to support investments in low-carbon technology research, renewable energy projects, and energy efficiency programs.

The implementation of a carbon price also provides businesses and sectors with a financial incentive to innovate and adopt greener methods. Companies are encouraged to investigate and invest in cleaner alternatives by internalizing the external cost of carbon emissions, which pushes the market toward a low-carbon economy. Although it is an important instrument in the battle against climate change, several other policies and actions must be added to it. This includes laws governing energy efficiency, encouragement of renewable energy, financial assistance for green infrastructure, and campaigns to shift consumer behavior.

The rising revenue from carbon pricing is encouraging and indicates the countries’ increased commitment to combating climate change. Investors play a crucial role, and the shifting carbon price scenario has a big impact on their decisions and tactics. The evolving carbon pricing landscape is reshaping investment priorities. Investors’ financial calculations now must take into account the carbon footprint of their assets and any possible expenses related to emissions as a result of the introduction of carbon pricing. This change has significant effects on risk assessment, portfolio management, and investment choices.

2. Carbon Pricing Policies and Investment Decisions

Carbon risk in investment portfolios can be greatly decreased by carbon pricing regulations. Risk associated with carbon pricing and other regulatory actions to restrict emissions may be present for industries with disproportionately high carbon dioxide emissions. Businesses that depend on fossil fuels the most are also more vulnerable to technical risk offered by cheaper renewable energy sources. Future-focused investors may look for compensation for holding the stocks of companies with disproportionately large carbon dioxide emissions and the higher carbon risk they subject themselves to, leading to a positive relationship in the cross-section between a firm’s own carbon dioxide emissions and its stock returns [7].

As carbon pricing regulations become stricter, the carbon tax rate has the trend of increasing. Carbon tax rates saw a rise in 2021 and early 2022. While carbon tax rates were mostly unchanged in 2020, but in 2021, they increased by an average of approximately USD 6/tCO2e, with an additional rise of USD 5/tCO2e by April 1, 2022. This is due to an increase in carbon tax rates in most jurisdictions compared to the previous year. For the upcoming years, some jurisdictions have likewise planned more aggressive pricing trajectories. For example, Singapore plans to incrementally increase the carbon tax rate to SGD 25/tCO2e by 2025, SGD 45/tCO2e by 2027, aiming for SGD 50-80/tCO2e by 2030. The South African government has also proposed raising the carbon tax rate from its present level of just under USD 10 per tCO2e to USD 20 per tCO2e by 2026, USD 30 per tCO2e by 2030, and USD 120 per tCO2e beyond 2050. These price rises come after Canada said last year that it will raise its minimum carbon costs by CAD 15/tCO2e each year until they reached or exceeded CAD [6].

Figure 2: Global carbon pricing revenues over time.

Investors are being compelled by the rise in carbon tax rates to carefully evaluate the exposure of the firms in their portfolios to these levies. Companies that operate in areas with high carbon taxes and regions with high emissions would likely have greater operational expenses, which might have an impact on their profitability and, eventually, the value of their stock. A thorough re-evaluation of asset values is required due to the increase in carbon prices. Given the additional expenses spent owing to higher tax rates, investments in businesses with a strong reliance on fossil fuels or significant carbon emissions may be seen as risky. On the other hand, businesses that invest in environmentally friendly technology or have fewer carbon emissions may have their value increase, providing profitable prospects for investors.

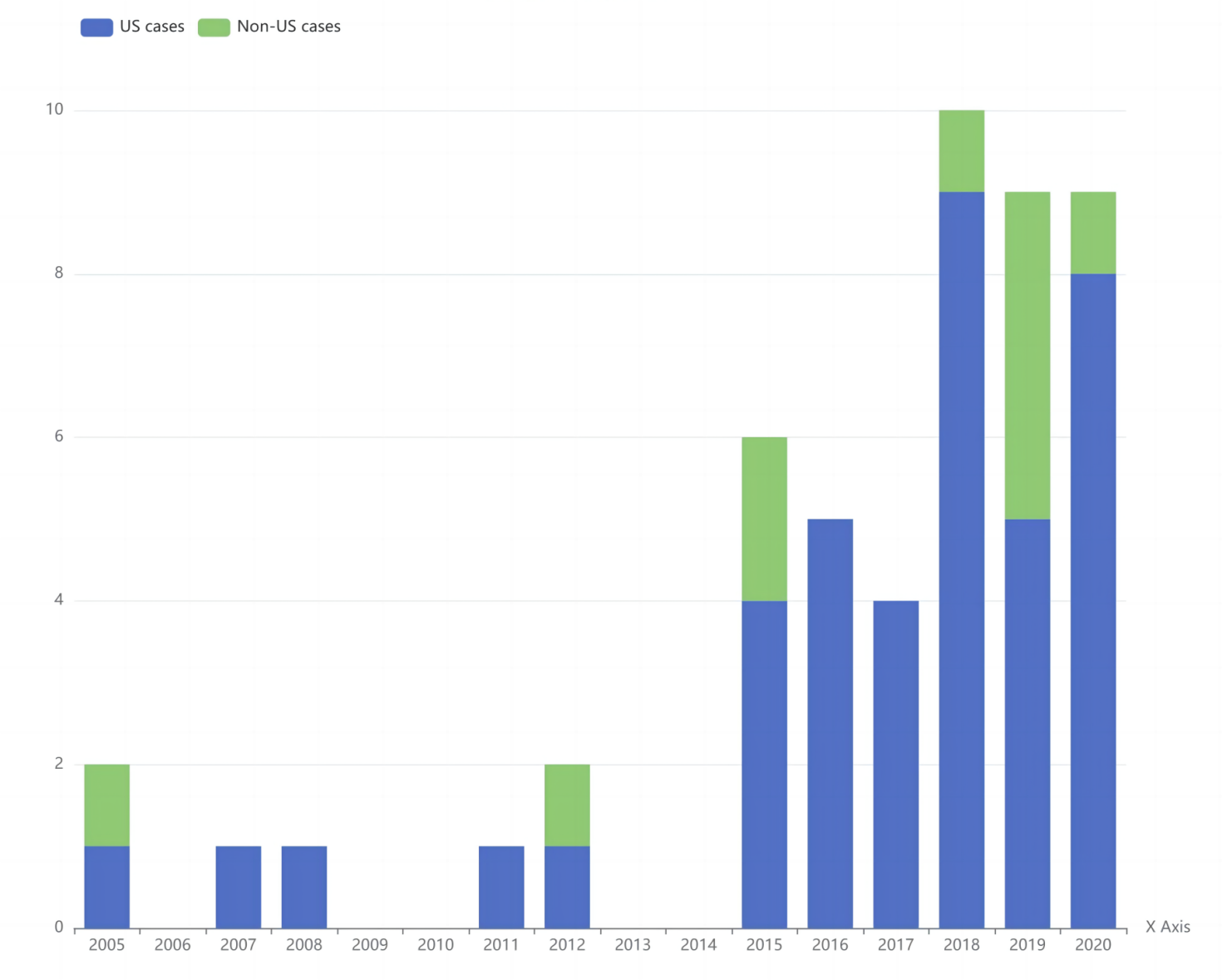

Carbon pricing policies introduce new environmental and legal risks to the investors. Investors become more likely to monitor carbon emissions regulations and the development of carbon markets to assess the carbon risk in their portfolios. Studies have shown that companies with high carbon risks face future legal litigation, environmental regulations, and reputational risks, so investors focus more on the potential impact of these risks on their investments and try to avoid those potential risk [8]. According to the data and research from Stezer and Byrnes in 2020, climate change prosecutions against high-carbon-emitting businesses are becoming more frequent. This result give investors a heads up and keep their money out of these industries.

Figure 3: Carbon Majors cases in US and Non-US.

A “green new deal” valued at US$ 60 billion in assistance for green infrastructure and cutting-edge technical research was unveiled by South Korea in the summer of 2020. During the 2020 US presidential campaign, then-candidate Joe Biden provided a year-one legislative strategy on combating climate change. This proposal included record expenditures in clean and resilient infrastructure, communities, and research and innovation in energy and climate [9]. With the government’s support, low-carbon industries have better policy support and funding in the marketplace around the world. Carbon pricing policies provide investors opportunities to help finance sustainable, low-carbon development projects. By investing in clean technologies, renewable energy, and carbon reduction projects, investors can benefit from government incentives and opportunities in carbon markets. These sectors offer long-term growth and profit potential for investors.

Carbon pricing policy is a long-term policy, and its emergence means that controlling carbon dioxide emissions becomes achievable and traceable. Investors are increasingly examining a company’s environmental effect and carbon emission profiles, especially those who are concerned with long-term sustainability. Carbon pricing may result in greater expenses for businesses with significant carbon emissions, which may have an effect on their profitability and, as a result, their investment appeal. As a result, asset valuations have been revised, and money has been redistributed to companies that are more environmentally conscious and sustainable. Investors need to consider the long-term benefits of their portfolios since the enterprise with high carbon risk might not have good future under the big picture of a low carbon environment. Enterprises with high carbon emissions might need to buy more emission targets to make their emission legally. Moreover, carbon prices may also rise in the future, industries like mining, steel, cement, and chemicals, which are carbon-intensive, contribute to about half of all industrial emissions [10]. Therefore, investors may need to reevaluate their long-term investment strategies to ensure the competitiveness of their portfolios in a carbon pricing environment. Investor choices are significantly impacted by carbon price. It acts as a concrete indicator of a business’s dedication to sustainability and aptitude for navigating a changing economy. Understanding and considering the consequences of carbon pricing is essential for investors focused on long-term wealth creation and social responsibility to make wise and significant investment decisions.

Some investors view carbon pricing policies as an opportunity that aligns with their social and environmental responsibility investment goals. These investors often follow Environmental, Social, and Governance (ESG) standards, view carbon pricing as a concrete indicator of a company’s commitment to lowering its carbon footprint and fostering ecological balance. They may actively support low-carbon and sustainable projects to promote environmental protection and social sustainability. A firm with a positive reputation is more likely to attract investors than one with a negative reputation [11]. In addition to pursuing financial rewards, investors that diversify their portfolios with low-carbon and sustainable enterprises also help the global effort to combat climate change. Such investments are especially enticing to a group of investors that value long-term environmental benefits over short-term financial profits due to their connection with socially responsible aims. Furthermore, a company’s response to carbon pricing might have a big impact on its reputation. An organization that promotes sustainability and actively lowers its emissions is more likely to have a favorable public image, boost its brand value, and thus draw in more investment. This reputational improvement is especially important in sectors where customer perception plays a significant role in determining market success. This change in investment objectives is crucial for encouraging business behavior that promotes social and environmental well-being. Low-carbon and sustainable projects will increase the reputation of the firms and make their stock value going up. In this case, this socially responsible investment may receive support from shareholders and stakeholders.

However, in order to invest in socially responsible investments, one must know how their actions might affect the environment. Studies indicate that investors regarding the effects of carbon pricing policies may have on business decisions and aim to precisely evaluate these impacts. Investors consider various risks associated with carbon pricing policies. They can review related literature and consult with experts to understand the economic, legal, environmental, and financial aspects of carbon pricing policies. The impact of carbon pricing on investor choices is complex and crucial in determining investment landscapes. Investors carefully evaluate how carbon pricing regulations may affect a company’s financial viability and its conformity with environmental goals, especially those that adhere to ESG criteria. A company’s operating expenses are inevitably impacted by carbon pricing, which may change the company’s profitability and, consequently, its appeal to investors.

Carbon price may promote innovation and efficiency, which is a key factor. Companies are encouraged to adopt greener technology and improve their operations by increased costs associated with emissions, which eventually results in a smaller carbon footprint. This change can strengthen a business's standing in the market and attract investors looking for sustainable investment possibilities. The potential for new markets and income streams to be generated by carbon pricing is another factor for investors to consider. The growth of carbon markets and the trade of carbon credits give businesses a way to earn more money and a way to reduce their emissions. This may be especially tempting to investors searching for businesses that can take advantage of possibilities like these for expansion.

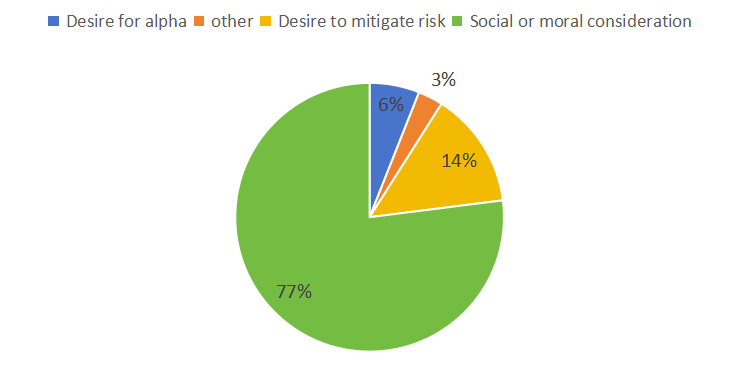

Figure 4: Drivers of ESG investing.

Carbon pricing policies play a pivotal role in shaping investment decisions in today’s rapidly changing environmental landscape. These policies represent a critical tool in the fight against global climate change, aiming to reduce carbon emissions and promote the growth of a low-carbon economy. Investors must recognize the significance of carbon risk within their portfolios and take proactive measures to mitigate these risks, safeguarding their investments. Carbon pricing policies not only introduce new dimensions to risk management but also provide investors with opportunities to engage in low-carbon and sustainable development projects. These projects hold the promise of long-term growth and profit potential, aligning with the goals of responsible and socially conscious investing. As carbon prices may continue to rise in the future, a forward-looking approach to investment strategy is essential to maintain portfolio competitiveness within a carbon-priced environment. Furthermore, socially responsible investment practices gain traction under carbon pricing policies, as investors actively support initiatives that promote environmental protection and social sustainability, ultimately enhancing the reputation and value of the companies they invest in. In this dynamic investment landscape, adaptability is key, and investors must embrace the opportunities presented by carbon pricing policies to achieve sustainable financial returns while addressing the difficulties caused by climate change. In this dynamic investment landscape, adaptability is key, and investors must embrace the opportunities presented by carbon pricing policies to achieve sustainable financial returns while addressing the challenges posed by climate change.

3. Conclusion

The prominence of the global climate change crisis prompts investors to exercise vigilance with regards to carbon risk in their portfolios. The absence of uniform comparison standards subjects investors to quandaries. Carbon pricing provides a standardized tool to measure carbon emissions and tremendously influences investment verdicts and strategies, reshaping investment priority rankings.

Carbon pricing policies can affect business decisions of companies by altering their profitability, promoting innovation and efficiency, and bolstering their market position. Moreover, carbon trading can create new markets and revenue streams, making them more appealing to investors. Carbon pricing policies reduce carbon risk in investments, promote sustainable low-carbon projects, and provide long-term growth opportunities and profit potential for investors in the sector. Higher carbon taxes have prompted investors to meticulously assess risk exposure and pay closer attention to new environmental and legal risks. Low-carbon and sustainable development can enhance corporate reputation and valuation, and investors who prioritize socially responsible investments are supported by both shareholders and stakeholders. Consequently, investors should be mindful of the ramifications of carbon pricing policies and must make purposeful, informed decisions that alleviate carbon emissions while concurrently fostering sustainable financial growth.

Given the significance of carbon pricing policies for investment decisions, the authors provide policy recommendations. The first recommendation is to enhance the transparency of carbon emissions data and information disclosure, followed by comprehensive investor education. Additionally, promoting sustainable investment products and strengthening the development of innovative green technology should also be prioritized. Additionally, it is crucial to further develop the carbon market and promote close collaboration among stakeholders. Furthermore, standardizing ESG systems to assess sustainability performance is recommended. Strengthening the adaptability of dynamic investment environments and supporting small and medium-sized enterprises (SMEs) to meet the challenges posed by carbon pricing policies is also important. A well-structured carbon market will emit a clear pricing signal, enabling investors to evaluate the financial implications of carbon pricing on their investments more accurately.

In conclusion, by adopting these recommendations, a conducive environment can be cultivated, where investors are well-positioned to tackle the challenges and leverage the opportunities arising from carbon pricing policies. This will not only contribute to individual financial gains but also align with the broader objective of combatting climate change and fostering sustainability.

References

[1]. Stern, Nicholas and Joseph Stiglitz. (2017) Report of the high-level commission on carbon prices.

[2]. Stern, Nicholas and Joseph Stiglitz. (2021) The social cost of carbon, risk, distribution, market failures: An alternative approach. NBER Working Paper 28472

[3]. Lindsey, R. (2023, May 12) Climate Change: Atmospheric Carbon Dioxide. Climate.gov. Retrieved 2023, Sep 9, from https://www.climate.gov/news-features/understanding-climate/climate-change-atmospheric-carbon-dioxide

[4]. Li, Y., Ding, T., & Zhu, W. (2022). Can Green Credit Contribute to Sustainable Economic Growth? An Empirical Study from China. Sustainability, 14(11), 6661.

[5]. The London School of Economics and Political Science. (2019, November 1). What is a carbon price and why do we need one? https://www.lse.ac.uk/granthaminstitute/explainers/what-is-a-carbon-price-and-why-do-we-need-one/

[6]. World Bank. (2022). State and Trends of Carbon Pricing 2022. Retrieved from http://hdl.handle.net/10986/37455.

[7]. Bolton, Patrick and Kacperczyk, Marcin T. (October 30, 2020) Do Investors Care about Carbon Risk? Columbia Business School Research Paper Forthcoming, Journal of Financial Economics (JFE), Forthcoming, European Corporate Governance Institute - Finance Working Paper 711/2020

[8]. Setzer, J. (2022). The Impacts of High-Profile Litigation against Major Fossil Fuel Companies. In C. Rodríguez-Garavito (Ed.), Legal Strategy in Rights-Based Climate Litigation

[9]. Allan, B., Lewis, J. I., & Oatley, T. (2021). Green Industrial Policy and the Global Transformation of Climate Politics. Global Environmental Politics, 21(4), 1–19.

[10]. United States Department of State & United States Executive Office of the President. (2021). The Long-Term Strategy of the United States: Pathways to Net-Zero Greenhouse Gas Emissions by 2050. Washington, DC: Global Publishing Solutions

[11]. Campbell, K. (2021). Measuring corporate reputation based on shareholder value.

Cite this article

Hu,Z. (2024). Carbon Risk Assessment in Investing Decision-Making: The Role of Carbon Pricing Policies. Advances in Economics, Management and Political Sciences,67,94-101.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Stern, Nicholas and Joseph Stiglitz. (2017) Report of the high-level commission on carbon prices.

[2]. Stern, Nicholas and Joseph Stiglitz. (2021) The social cost of carbon, risk, distribution, market failures: An alternative approach. NBER Working Paper 28472

[3]. Lindsey, R. (2023, May 12) Climate Change: Atmospheric Carbon Dioxide. Climate.gov. Retrieved 2023, Sep 9, from https://www.climate.gov/news-features/understanding-climate/climate-change-atmospheric-carbon-dioxide

[4]. Li, Y., Ding, T., & Zhu, W. (2022). Can Green Credit Contribute to Sustainable Economic Growth? An Empirical Study from China. Sustainability, 14(11), 6661.

[5]. The London School of Economics and Political Science. (2019, November 1). What is a carbon price and why do we need one? https://www.lse.ac.uk/granthaminstitute/explainers/what-is-a-carbon-price-and-why-do-we-need-one/

[6]. World Bank. (2022). State and Trends of Carbon Pricing 2022. Retrieved from http://hdl.handle.net/10986/37455.

[7]. Bolton, Patrick and Kacperczyk, Marcin T. (October 30, 2020) Do Investors Care about Carbon Risk? Columbia Business School Research Paper Forthcoming, Journal of Financial Economics (JFE), Forthcoming, European Corporate Governance Institute - Finance Working Paper 711/2020

[8]. Setzer, J. (2022). The Impacts of High-Profile Litigation against Major Fossil Fuel Companies. In C. Rodríguez-Garavito (Ed.), Legal Strategy in Rights-Based Climate Litigation

[9]. Allan, B., Lewis, J. I., & Oatley, T. (2021). Green Industrial Policy and the Global Transformation of Climate Politics. Global Environmental Politics, 21(4), 1–19.

[10]. United States Department of State & United States Executive Office of the President. (2021). The Long-Term Strategy of the United States: Pathways to Net-Zero Greenhouse Gas Emissions by 2050. Washington, DC: Global Publishing Solutions

[11]. Campbell, K. (2021). Measuring corporate reputation based on shareholder value.