1. Introduction

Inflation, a phenomenon rooted in the theories of the renowned economist David Hume in the 18th century, has consistently remained a focal point in the fields of economics and finance. Its pervasive influence not only affects the daily lives of individuals but also places significant pressure on the stability of financial markets, forcing governments into a continuous balancing act between inflation and deflation. Despite centuries of scholarly attention, the intricate complexities of inflation and its extensive implications continue to present formidable challenges for economists, policymakers, and researchers.

Particularly in 2023, a series of policies implemented by the Federal Reserve to combat inflation have resulted in significant shocks in the financial market following their announcement. Each instance of a rate hike has produced a potent impact. Inflation and strategies to navigate its effects have become the prevailing themes in this year’s market dynamics. Investors worldwide are grappling with the volatile market conditions and striving to adapt and strategize accordingly. Even institutional investors are persistently adjusting their positions in this unpredictable environment.

In this research paper, our aim is to examine the impacts of inflation on financial markets, shedding light on its effects in the financial market.

2. Literature Review

Since the inception of the concept of inflation, its impact on the financial market has deepened, leading to periodic and systemic financial crises. This influence extends to the global macroeconomy, with central banks continuously refining their policies to address inflation. In order to safeguard people’s livelihoods, the Federal Reserve is expected to take swift actions in 2023 to counter inflation, including significant interest rate hikes.

Relevant to this paper, several studies have examined the robust correlation between inflation and the stock market, investment portfolios, and financial activities. These studies have also explored the accuracy of inflation data using correlation models. Elisabeth Huybens and Bruce D. Smith proposed a theoretical model that demonstrates a strong positive correlation between real activity, bank lending, and stock market trading volume. Additionally, long-term relationships have shown a significant negative correlation between inflation, financial market activity, and real equity returns [1]. John H. Boyd, through linear regression and sensitivity analysis, identified a notable negative correlation between inflation, banking development, and stock market activity. This relationship is non-linear, with the impact of inflation on banking and stock market activities diminishing as inflation increases [2]. Michael F. Bryan and Stephen G. Cecchetti, drawing from the Consumer Price Index (CPI), emphasize the importance of closely examining the price index that underpins monetary policy, particularly as inflation approaches zero. They suggest that utilizing dynamic factor models allows for the calculation of common inflationary factors across a wide range of consumer price changes [3].

Another segment of literature focuses on the macroeconomic challenges posed by inflation and the subsequent tests for policymakers and their monetary strategies. Kwamie Dunbar and Johnson Owusu-Amoako highlight the challenge of forecasting short-term inflation trends. They advocate for adjusting the Hybrid New Keynes Phillips Curve (HNKPC) to include a hedge factor, aiming to shield risk-averse economic agents from inflation-driven uncertainties [4]. In a context where the Federal Reserve has implemented multiple interest rate hikes, data on the CPI, labor market, and non-agriculture remain pertinent. Brent Bundick and Andrew Lee Smith’s research underscores that U.S. inflation expectations improved post the Fed’s introduction of a numerical inflation target. The research contrasts with Japan, where even the Bank of Japan’s adoption of a similar target sees nominal wage projections still reacting to current inflation [5]. Michael Thiel emphasizes that a functional financial sector is essential for efficient resource allocation and the cultivation of economic growth [6].

Further literature delves into the correlations between financial and economic volatility, considering asset prices, risk, and interest rates within portfolio behaviors. John H. Cochrane’s model, through distinct mechanisms, establishes that macroeconomics is not solely driven by interest rate shifts or intertemporal substitution [7]. Zvi Bodie elaborates on the effects of household portfolio behavior on equilibrium market interest rates, factoring in inflation uncertainty and the risk premium of real assets, and contrasts between the covariances of investment portfolios and inflation rates [8].

In conclusion, this paper aims to make three pivotal contributions to inflation studies. Firstly, we will engage in a regression model, followed by employing a heterogeneity analysis to assess two decades of inflation data. Lastly, the paper will explore the ramifications on the economy and financial markets and potential policies that might emerge from policymakers.

3. Characteristics of Financial Market Performance

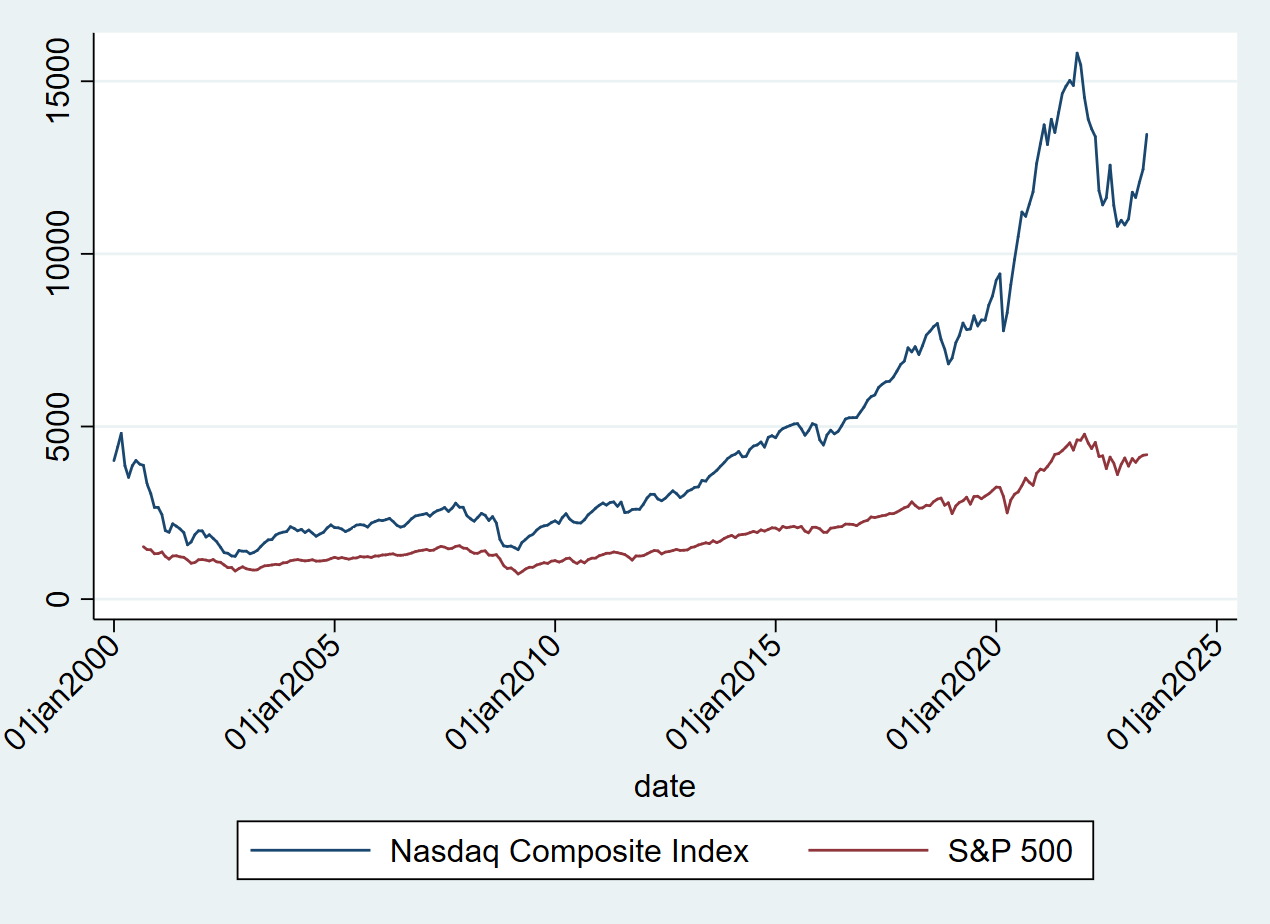

Figure 1 illustrates the trend of both the Nasdaq Composite Index and the S&P 500 from January 1, 2000, to August 1, 2023. Overall, both indices have displayed consistent growth over this period, with a particularly notable surge between 2020 and 2022 achieving the highest point in the past decades. However, this growth was interrupted by significant downturns, such as during the 2008 financial crisis which precipitated a swift decline in the market. Similarly, in 2019-2020, the onset of the COVID-19 pandemic induced widespread market apprehension, triggering four circuit breakers that temporarily halted trading.

Figure 1: Nasdaq and S&P 500 Index Chart.

4. Empirical Design

4.1. Variable Selection

Inflation serves as the primary explanatory variable, for which the Consumer Price Index (CPI) is chosen as its proxy to assess its impact on financial market indicators. To represent the financial market, I utilize data from the S&P 500 Index and the NASDAQ Index to demonstrate and elucidate the adverse effects of inflation on the financial sector.

4.2. Data Sources

This study predominantly focuses on empirical research centered on the United States, covering the observation period from 2000 to 2023. The primary data source is derived from the Federal Reserve Economic Data (FRED). The descriptive statistics in empirical analysis are shown in Table 1.

Table 1: Descriptive Statistics.

Variable | Obs | Mean | Std Dev. | Min | Max |

Consumer Price Index | 282 | 94.81 | 13.97 | 71.22 | 128.7 |

NASDAQ Index | 282 | 4773 | 3664 | 1242 | 15815 |

S&P 500 Index | 276 | 1948 | 1035 | 729.6 | 4778 |

Median Consumer Price Index | 283 | 2.747 | 1.403 | -0.286 | 8.464 |

4.3. Modeling

The main research model in this paper is the linear regression model. The formula used is:

\( {Y_{i}}={b_{0}}+{b_{1}}{X_{i}}+{ε_{i}} \)

In this model, \( {Y_{i}} \) represents the dependent variable, which is the financial market performance of the United States, and \( {X_{i}} \) represents the explanatory variable, which is inflation. \( {ε_{i}} \) represents the residual.

5. Empirical Results

5.1. Correlation Analysis

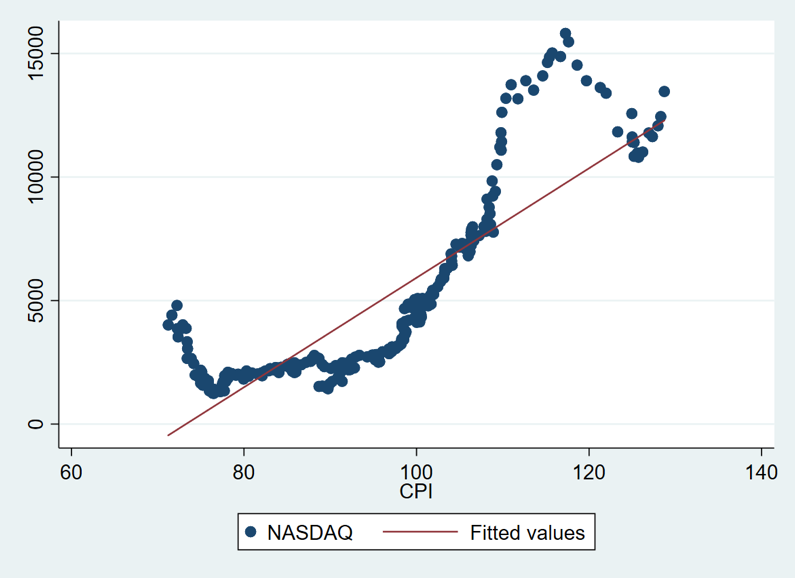

Figure 2 presents a comprehensive graphical illustration of financial market performance by juxtaposing Consumer Price Index (CPI) data against stock market indices, specifically the NASDAQ. Spanning the timeline from 2000 to 2023, it is evident that the two datasets exhibit a segmented, yet predominantly upward trajectory.

To further assess the intricate relationship between these financial markers, a correlation analysis was employed. Figure 2 provides a quantifiable measure of the direction and strength of a linear association between two variables. In essence, a positive correlation indicates that the values of both variables either ascend or descend concomitantly, while a negative correlation signifies that as one variable’s value increases, the other’s decreases, and vice versa. Notably, the interrelationship between NASDAQ indices and the CPI data predominantly showcases a positive correlation. However, it is imperative to acknowledge that this correlation is not ubiquitous. There are pronounced deviations, especially during unforeseen “black swan” events which instigate significant market volatilities.

Figure 2: Correlation of Financial Market Performance and Inflation.

5.2. Benchmark Regression

Table 2 presents the main regression results for the impact of the Consumer Price Index on the NASDAQ Index. Specifically, Model (1) reports the estimated coefficient of the core explanatory variable as 221.5956, which is statistically significant. The regression results suggest that, in general, the Consumer Price Index has a positive impact on the NASDAQ Index.

5.3. Robustness Tests

To assess the stability and reliability of the benchmark regression estimates, this paper conducts a robustness analysis. Model (2) in Table 2 replaces the CPI with the Median Consumer Price Index, while Model (3) in the same table substitutes the NASDAQ Index with the S&P 500 as a metric for financial market performance. The regression outcomes demonstrate a notably significant and positive influence of inflation on financial market performance, confirming the robustness of the benchmark model.

Table 2: Benchmark Regression and Robustness Tests.

(1) | (2) | (3) | |

y | y | y | |

x | 221.5956*** | 1424.7323*** | 66.1847*** |

(26.4428) | (10.9177) | (31.9382) | |

_cons | -1.62e+04*** | 856.5992** | -4.39e+03*** |

(-20.2174) | (2.1269) | (-21.9672) | |

N | 282 | 282 | 118 |

R2 | 0.7141 | 0.2986 | 0.7895 |

t statistics in parentheses

* p < 0.1, ** p < 0.05, *** p < 0.01

5.4. Temporal Heterogeneity Analysis

To examine the varying impacts of the Consumer Price Index (CPI) on the financial market at different time periods, this paper utilizes temporal heterogeneity analysis. This method analyzes the changes in the influence of the CPI on the financial market by dividing the periods before and after significant events. Taking the 2007 subprime mortgage crisis as an example, the resulting value is -34.1385. This suggests that the CPI had a negative impact on the Nasdaq index prior to the August 2007 financial crisis. However, following this crisis and leading up to the emergence of the COVID-19 pandemic in January 2020, a value of 4912.9838 indicates a positive correlation between the CPI and the financial market. However, after the onset of the COVID-19 pandemic, there is not a substantial correlation between the CPI and the market index.

Table 3: Temporal Heterogeneity Analysis.

(1) | (2) | (3) | |

y | y | y | |

x | -34.1385** | 329.8423*** | 53.5506 |

(-2.1093) | (37.7718) | (1.2619) | |

_cons | 4912.9838*** | -2.81e+04*** | 5951.3769 |

(3.8383) | (-32.7793) | (1.1927) | |

N | 91 | 149 | 42 |

R2 | 0.0476 | 0.9066 | 0.0383 |

t statistics in parentheses

* p < 0.1, ** p < 0.05, *** p < 0.01

6. Conclusion

This research emphasizes the influence of inflation on financial markets, with inflation represented as the independent variable and the financial market as the dependent variable. The reliability of the data sources supports the findings of this study. The Consumer Price Index (CPI) serves as a measure of inflation, while the Nasdaq index and S&P500 act as market indicators. Analyzing data regressions and correlations over the past 23 years reveals a predominantly positive correlation between the CPI and the Nasdaq Index. To gain deeper insights, a benchmark regression was conducted on these datasets, revealing significant core explanatory variables that confirm the positive impact of CPI on the Nasdaq. To ensure the stability and reliability of the benchmark regression estimates, this paper also undertakes a robustness analysis. Furthermore, a time heterogeneity analysis was performed, using significant market events as segmentation points. This analysis demonstrates that the correlation between the CPI and the market varies before and after these events, indicating a dynamic relationship rather than a consistently or normally positive correlation.

Future studies aim to further explore the nuanced impacts on both macroeconomic markets and at the micro-level, encompassing individual consumers and firms. One of the key areas of focus will be the influence of other factors on financial markets, such as currency, savings rate, and the labor market. Simultaneously, the research will strive to enhance predictive capabilities regarding market directions during periods of inflation or deflation, with the goal of better safeguarding personal financial interests.

To delve into these consequences, mathematical and statistical models will be employed to simulate strategies and analyze their performance based on historical data. This approach will allow for the isolation and examination of the unique and wide-ranging effects of inflation, providing insights into its reverberating impacts across different financial instruments.

To gain a better understanding of the effects of inflation, it is instructive to consider specific examples. For instance, high inflation rates can erode purchasing power, effectively reducing the value of money and diminishing the standard of living for individuals, particularly those on fixed incomes. On a broader scale, persistent inflation can lead to market volatility, uncertainty, and even economic stagnation, as observed in hyperinflation scenarios such as post-World War I Germany or more recently, Zimbabwe and Venezuela. These effects can, in turn, result in detrimental socio-economic consequences, ranging from surges in unemployment to societal unrest.

To this end, the study will explore whether the implementation of anti-inflationary policies has indeed resulted in effective control of inflation, as suggested by conventional economic wisdom. By employing robust and comprehensive data analysis, the aim is to uncover evidence-based insights that can critically inform policy-making decisions and strategies.

The research will also examine the strategic countermeasures adopted by governments and evaluate the efficacy of these interventions. This exploration will be grounded in empirical analysis, utilizing a large dataset consisting of derivatives transaction data from financial markets during inflationary periods, as well as company-specific financial data. By offering detailed insights into the causes and effects of inflation, its influence on financial markets, and the effectiveness of governmental countermeasures, this study hopes to contribute to the broader discourse on economic stability and inflation management strategies.

References

[1]. Huybens, E., & Smith, B. D. (1999). Inflation, financial markets and long-run real activity. Journal of monetary economics, 43(2), 283-315.

[2]. Boyd, J. H., Levine, R., & Smith, B. D. (2001). The impact of inflation on financial sector performance. Journal of monetary Economics, 47(2), 221-248.

[3]. Bryan, M. F., & Cecchetti, S. G. (1993). The consumer price index as a measure of inflation.

[4]. Dunbar, K., & Owusu-Amoako, J. (2023). Predicting inflation expectations: A habit-based explanation under hedging. International Review of Financial Analysis, 102816.

[5]. Bundick, B., & Smith, A. L. (2018). Does communicating a numerical inflation target anchor inflation expectations? Evidence & bond market implications. Federal Reserve Bank of Kansas City, Research Working Paper, (18-01).

[6]. Thiel, M. (2001). Finance and economic growth-a review of theory and the available evidence. European Economy-Economic Papers 2008-2015, (158).

[7]. Cochrane, J. H. (2017). Macro-finance. Review of Finance, 21(3), 945-985.

[8]. Bodie, Z. (1979). Inflation risk and capital market equilibrium (No. w0373). National Bureau of Economic Research.

Cite this article

Liu,Q.(. (2024). Empirical Analysis Impact of Inflation Dynamics on Financial Market Performance. Advances in Economics, Management and Political Sciences,67,293-299.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Huybens, E., & Smith, B. D. (1999). Inflation, financial markets and long-run real activity. Journal of monetary economics, 43(2), 283-315.

[2]. Boyd, J. H., Levine, R., & Smith, B. D. (2001). The impact of inflation on financial sector performance. Journal of monetary Economics, 47(2), 221-248.

[3]. Bryan, M. F., & Cecchetti, S. G. (1993). The consumer price index as a measure of inflation.

[4]. Dunbar, K., & Owusu-Amoako, J. (2023). Predicting inflation expectations: A habit-based explanation under hedging. International Review of Financial Analysis, 102816.

[5]. Bundick, B., & Smith, A. L. (2018). Does communicating a numerical inflation target anchor inflation expectations? Evidence & bond market implications. Federal Reserve Bank of Kansas City, Research Working Paper, (18-01).

[6]. Thiel, M. (2001). Finance and economic growth-a review of theory and the available evidence. European Economy-Economic Papers 2008-2015, (158).

[7]. Cochrane, J. H. (2017). Macro-finance. Review of Finance, 21(3), 945-985.

[8]. Bodie, Z. (1979). Inflation risk and capital market equilibrium (No. w0373). National Bureau of Economic Research.