1. Introduction

Chinese securities companies originated from the securities outlets of banks and trusts in the 1980s. In 1990, the Shanghai Stock Exchange and the Shenzhen Stock Exchange were established successively, marking the official birth of the centralized securities market in China. Over the past 20 years, along with the reform of economic system and the development of market economy, China's securities market system is constantly improving, the system is constantly improving, and the scale is constantly expanding, and it has become an important part of our economic system. At the same time, China's securities companies have also experienced a period of continuous standardization and development [1]. This paper chooses Huatai Securities for two reasons: First, Huatai Securities attaches great importance to wealth management business with an early start, and its experience is worthy of reference for other securities companies; Second, Huatai Securities, as a leading securities company, has the foundation to transform its wealth management business [2].

As shown in Table 1, the performance report of the first half of 2023 announced by Huatai Securities on August 14 pointed out that the company achieved a total operating income of 18.369 billion yuan, an increase of 13.63% compared to last year [3]. As the most major source of income for securities companies, brokerage business income has always been an important indicator to evaluate the core competitiveness of securities companies, and Huatai Securities brokerage business accounted for 26.3%, and in the first half of this year, brokerage business income ranked third. However, it can be found that it is still 11.27% lower than the same period last year. However, the wealth management business, which contributed the most to Huatai Securities' total revenue, saw its revenue decline by 18.99% year-on-year in the first half of this year, but its revenue was 6.802 billion yuan, accounting for 37.03%. Huatai Securities pointed out that the contraction of the wealth management business was mainly caused by a decline in the securities brokerage business, which was affected by market fluctuations. Huatai Securities also released a research report pointing out that brokers are generally under pressure, and the commission decline continues, but the market share of the head brokerage firm has risen steadily. With the strengthening of the supervision of the securities industry and the improvement of laws and regulations, the dividends of financial technology innovation are gradually disappearing, and Huatai Securities, as the three largest securities companies, seems to be surrounded by crisis.

Table 1: Huatai Securities operating data for the first half of 2023.

Name | Revenue (RMB) | proportion |

Wealth management | 6.802 Billion | 37.03% |

Organization service | 4.079 Billion | 22.2% |

International business | 3.875 Billion | 21.1% |

others | 3.614 Billion | 19.67% |

Table 2: 2023 first half of the performance of the head brokerage.

Stock code | Security name | Total revenue in the first half of 2023 (RMB 100 million) | Year-on-year change | Net profit returned to mother in the first half of 2023 (RMB 100 million) | Year-on-year change |

600030.SH | Citic Securities | 315.00 | -9.70% | 113.06 | 0.98% |

601688.SH | Huatai Securities | 183.69 | 13.63% | 65.56 | 21.94% |

601066.SH | China CITIC Construction Investment | 134.65 | -6.64% | 43.07 | -1.66% |

601995.SH | China International Capital Corporation | 124.21 | 2.38% | 35.61 | -7.31% |

According to the Table 2, one can see that CITIC Securities continues to take the lead in various operating indicators. In the first half of 2023, the total revenue reached 31.5 billion yuan, down 9.7% year on year, and the net profit returned to the parent reached 11.306 billion yuan, up 0.98% year on year. Its brokerage business declined by 4.26%. Huatai Securities achieved operating income of 18.369 billion yuan in the first half of the year, and net profit increased by 22% year-on-year. Although CITIC Securities' revenue in the first half of the year exceeded 10 billion yuan, its revenue and net profit were negative year-on-year growth, and CITIC Securities' operating expenses in wealth management business increased by 2.6% year-on-year. Cicc achieved revenue of more than 10 billion yuan in the first half of the year, an increase of 2.38%; The total profit of returning to the mother was 3.561 billion yuan, down 7.31% year-on-year [4]. Although Huatai Securities achieved a large year-on-year revenue growth in the period when the overall net profit of securities companies declined or evened out, its brokerage business revenue declined significantly year-on-year, which indicates that Huatai Securities brokerage business still has a lot of room for development and improvement.

2. General Overview

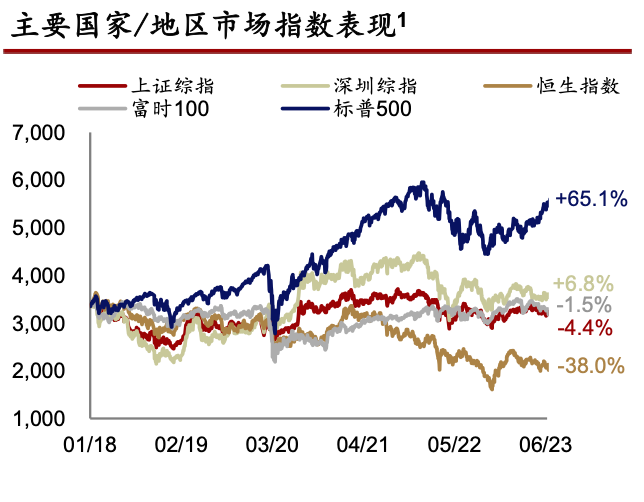

On December 2, 2021, the 7th Executive Committee Meeting of the China Securities Regulatory Commission in 2021 deliberated and adopted the Measures for the Administration of Securities Brokerage Business. Strict supervision has become the key word in China's asset management industry. Since the outbreak of the epidemic in 2019, all walks of life have been affected to varying degrees, although the haze brought by the new corona virus epidemic continues to reduce, but the economic form is not clear, and investors are increasingly worried about the global economic recession. Although the US Federal Reserve has raised interest rates six times, the RMB exchange rate has decreased relative to the US dollar, which has a certain impact on the investment willingness of consumers and the business of securities companies. However, China's overall foreign exchange reserves are stable, economic resilience is strong, positive factors in economic development are increasing, and cross-border funds are generally in the inflow trend. Meanwhile, China's financial system is integrating the development of the Internet into digitization. Coupled with the impact of the epidemic, more and more financial service scenarios are turning to online services. Therefore, the sustainable development of securities companies requires continuous innovation and integration, and strengthening distribution capabilities has become the driving force for sustainable development. Seen from the Fig. 1, in the first half of 2023, the international political and economic situation is still complex and severe, China's society has fully returned to normal operations, and the full landing of the registration system reform has become an important milestone in the development of the capital market. The A-share market fluctuated widely, market trading picked up, the scale of credit trading increased slightly, and the scale of public fund management increased further [5].

Figure 1: Performances of major country/region market indices

The brokerage business of securities company is a kind of business mode from its essence, and its business mode is basically the same, which is difficult to innovate. The cost of providing personalized customization to customers to meet their diversified needs is extremely high, and the market demand is small, so the brokerage business competition of major securities companies is always at the lower level of competition [6]. With the increasing number of securities companies in the market, the market competition is intensifying, and homogenization competition is unavoidable. In order to better attract and retain customers, major securities companies have to continuously reduce the commission rate to seize market share, which makes the commission and commission fee of securities companies closer to the cost line. At the same time, with the improvement of relevant securities laws and regulations in China, it is necessary to provide appropriate products to appropriate people in appropriate ways and procedures, which means that securities companies need to invest a lot of human resources, and labor costs are rising. Moreover, with the increase of customers, the service difficulty is increased, and it is inevitable that the service details are not in place, leading to the loss of customers.

Brokerage business and wealth management are also mistakenly two kinds of compatible business, there is no inevitable transformation, the two have many differences, can be compatible and drive. The first is its value proposition. The brokerage business relies on licenses to provide agent trading services to investors, while the wealth management business uses asset allocation and other means to provide customers with financial planning. The second is the customer target group. Brokerage business targets trading investors, while wealth management business targets financial customers with wealth management needs. The last is the income model. The main income of brokerage business is the commission income brought by channel business and the interest income of securities and financial margin, while the main income of wealth management business is the income of asset management fee and the income of financial products sold on commission.

3. Transformation Measures and Achievements of Huatai Securities

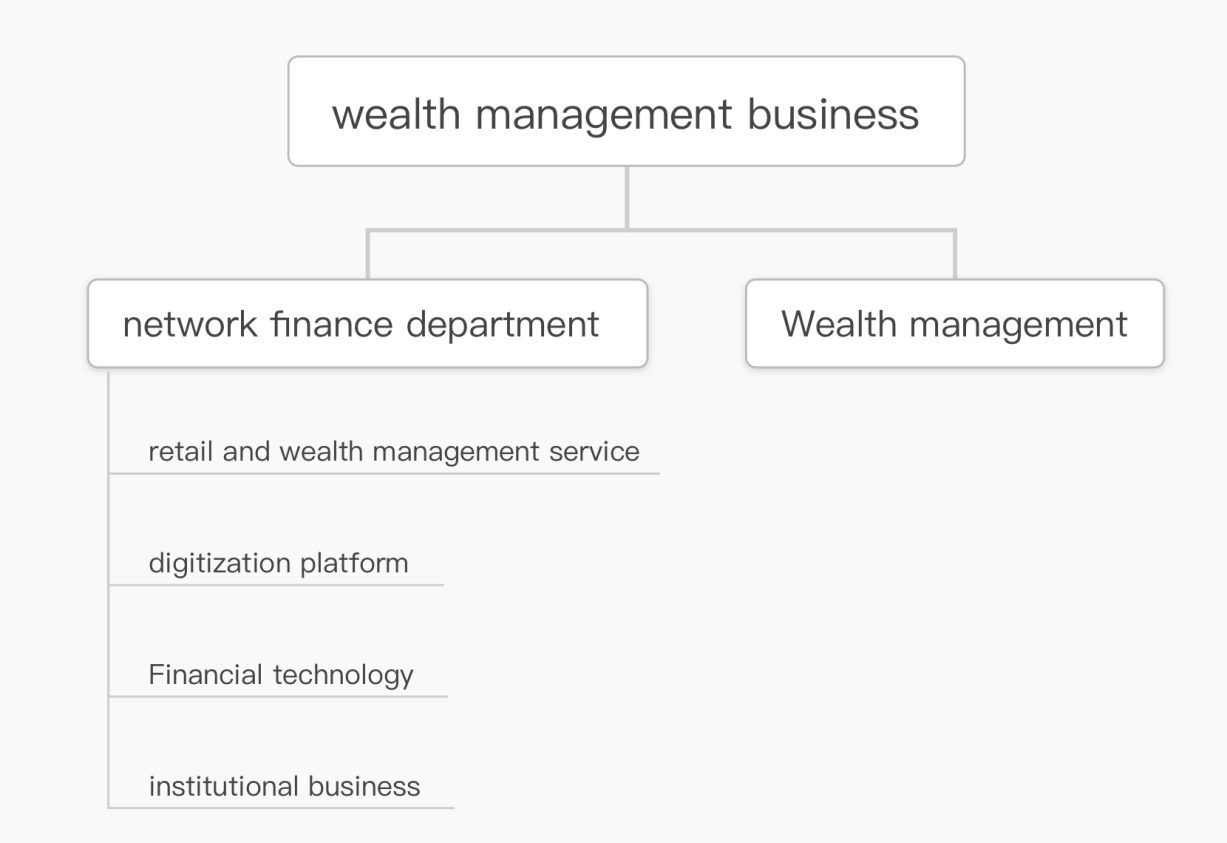

Huatai Securities merged the relevant functions and teams of the brokerage and wealth management department into the Network finance Department to strengthen the integration of online and offline development from the institutional setting [7]. As early as 2013, Huatai Securities created its own software "Zhanglecaifutong" to attract users to open an account by reducing the commission rate through online account opening. At the same time, CRM customer management system has also become a major boost to brokerage services. Through in-depth analysis of customers' detailed information, it excavates customers' exclusive needs and provides customers with targeted services, thereby increasing customer stickiness and enhancing enterprise competitiveness. Huatai Securities is further integrating online and offline, from the marketing side, the service side to the full digitization of the operation mechanism system, with the two "touch points" of Zhangle Fortune and investment advisory, to realize the integration of online and offline customers, and firmly implement the strategy of wealth management transformation around the concept of "customer-centric".

In order to seize for higher market share, Huatai Securities has continuously lowered its commission to attract customers [8]. Since 2013, the average commission rate of the brokerage business of Huatai Securities has been declining continuously, from the initial 0.65% to the current 0.30%. On August 28 this year, Huatai Securities once again lowered the transaction fees for customers' securities trading, reducing the two-way fees for A-share and B-share securities trading from 0.00483% of the transaction amount to 0.00341% of the two-way fees, effectively reducing the transaction costs for investors. At the same time, to implement the customer-centric business philosophy of Huatai Securities and better serve customers, Huatai Securities also launched a differentiated charging package, which uses big data to divide retail customer service into three categories: low net worth, medium net worth and high net worth customers, and provides basic standardized services and ordinary value-added services for the first two types of customers respectively by the network finance department. The high net worth will be assigned to the wealth management department for its dedicated wealth management business. Let customers choose the most suitable products according to their own needs, so that the company is profitable at the same time, customer needs are also maximized to meet. A sketch of wealth management business is shown in Fig. 2.

Since 2019, Huatai Securities has greatly adjusted its personnel structure. First, the president and vice president were replaced with a CEO and executive committee. Secondly, the executive Committee is divided into two main lines, namely institutional services and wealth management. Committed to creating a new model of online and offline integration of operational services, transactional services to online development, and offline into exclusive customized services for wealthy customers. Huatai launched the dual-platform interconnection model of AORTA investment advisory work platform and Changle Tenpay, enabling investment advisory with new intelligent application scenarios and creating an integrated vertical operation system. Huatai Securities also actively excavates young talents and absorbs innovative inspiration, and half of the team members of the network finance Department is post-90s. After removing the operating costs of hierarchical management, a more efficient and high-quality wealth management platform for clients is realized.

Figure 2: A sketch of wealth management business.

Huatai Securities has also achieved many results by transforming its brokerage business into wealth management through a series of measures. Up to now, more than 95% of Huatai Securities' trading customers have transacted through "ZHANGLECAIFUTONG". In June 2023, the number of monthly active users of ZHANGLECAIFUTONG APP has reached 8.9094 million, and the total number of downloads has exceeded 72.23 million. Far more than any other company. The goal of coordinated online and offline development has been achieved. Secondly, with the reduction of commission, Huatai business attracted the attention of some consumers, and its market share rose steadily, accounting for about 8% of the market brokerage business, and the brokerage business revenue ranked third in the industry. Finally, with the adjustment of wealth management organizational structure, since the brokerage business transformation was put on the corporate strategy in 2011, the ratio of brokerage personnel in Huatai Securities has decreased significantly, but the per capita output value has increased significantly, achieving more efficient development.

4. Disadvantages and Further Development Methods

4.1. Disadvantages

Consumers have not seen a significant economic recovery in recent years after emerging from the haze of the new corona virus, and the Federal Reserve has raised interest rates six times, resulting in the depreciation of the yuan against the dollar, which will make US assets more attractive. The outflow of capital will reduce the liquidity of China's stock market and increase the difficulty of financing, while making the bond market more attractive and reducing the incentive for consumers to invest in stocks. According to the Securities Association of China [9], as of July 31, 2023, the number of active investment advisers of the company was 3,153, ranking eighth in the industry, and the number of investment advisory team personnel of the company was slightly weak. Due to the uneven level of employment standards for personnel in China's securities industry, frequent adjustments between various departments of enterprises, and frequent turnover of personnel, people can not be fine in an employment position, and can only be coarse and broad. Foreign investment consultants are required to obtain the CFA certificate, but the earliest investment advisers in China are from the original sales department of marketing personnel transformation, this group of employees with low education, and lack of professional training of professional investment advisers, can not really provide small and micro customers with personalized services. And as market competition intensifies, securities firms have to lower commissions to attract clients, which makes many people choose to leave the brokerage business.

Due to the serious homogenization of product structure in brokerage and wealth management business, Huatai business has not introduced new products with unique company, and the product innovation is insufficient. Each major brokerage has launched its own financial app, and through cooperation with financial media and financial V drainage. Under the market, the relevant product advertisements are varied, and the services and products provided are identical, resulting in difficult choices for consumers, and Huatai Securities may not be able to achieve the goal of profit after spending huge sums of money on publicity.

4.2. Improvement Methods

In recent years, with the increasing efforts of anti-money laundering, the continuous improvement of national laws and regulations, the strict management of the market has been normalized. The international situation is constantly volatile, and the stock market is also fluctuating, so securities companies should accelerate the construction of a compliance assessment and control system based on the current situation of the company, optimize data management, and improve the risk response system. It is necessary to set up a department responsible for risk detection to set up different levels of early warning according to the company's own situation, timely monitoring, once the early warning appears, the corresponding response measures will be launched according to the level, and improve the efficiency of risk management. Find problems and respond accordingly in a timely manner to enhance consumer confidence in enterprises.

Investment advisers play an indispensable role in guiding consumers to invest. They should not only formulate personalized investment plans according to the needs of customers and the consumption level of customers, but also understand the risk performance of each product in detail, and do a good job of guiding investors to achieve mutual benefit and win-win situation of investors and companies. In order to maintain sustainable development, first of all, Huatai Securities needs to continuously attract talents, seize the publicity during the recruitment of universities, attract young blood, and expand the team of investment advisers. Secondly, it is necessary to improve the training mechanism, regularly conduct systematic training for employees, ensure that employees can timely understand the company's new products, and better apply them to reality through the form of competition, and improve their professional service capabilities. Finally, one should optimize the performance appraisal method, improve the appraisal management mechanism, combine the evaluation of customers, and carry out the work with customers as the center.

With the continuous development of the economy and the gradual prosperity of the people, the demand for personalized investment is increasing day by day. For the development of society, the financial department of securities brokerages should provide more diversified financial products with the market demand. The wealth management departments of securities brokerages should launch different financial products for different consumer groups [10], so that the diversified needs of customers can be satisfied. Create products with Huatai Securities characteristics, link with the market environment, timely pay attention to the market situation to adjust, seize market opportunities to maximize the personalized needs of customers. At the same time, the evaluation system of financial products should be improved, the after-sales service should be continuously optimized, the unpopular products should be eliminated timely, and the problems of customer dissatisfaction should be corrected.

5. Conclusion

With the continuous development of society and the improvement of people's living standards, people gradually realize the importance of wealth management, which provides a steady stream of power for the sustainable development of wealth management. The rapid development of the Internet is bound to change people's lifestyle and work mode. The traditional brokerage business of securities companies is also facing huge challenges and needs to be reformed to gain a foothold in the increasingly competitive society. Driven by social factors and internal factors, Huatai Securities should deepen its wealth management reform, analyze disadvantages and opportunities from its own perspective, and formulate leading marketing strategies. Through investigation and research, this paper comprehensively applies the theory of strategic management analysis to clarify the current social environment and internal measures and disadvantages of the company, clearly analyze its shortcomings, analyze from three aspects of consumer psychology, company personnel structure and products, propose improvement suggestions, implement differentiated competition strategy, provide suggestions for Huatai Company's wealth management business and promote its sustainable development. At the same time, it gives reference to other securities companies and provides some suggestions for the future development of the securities industry.

Since China's wealth management business is only in the initial stage, the relevant documents are still not comprehensive enough, and the development methods and conclusions are lacking. At the same time, based on the current situation of Huatai Company, this paper does not specifically analyze other companies, which has certain limitations. In view of these shortcomings, I hope to think more comprehensively in the future and find a more effective way to promote the transformation of Huatai Securities brokerage business to wealth management business, so as to help the securities industry develop better in wealth management business.

References

[1]. Yang, F. (2019). Development status and problems of China's securities industry. Business and Management, 12.

[2]. Hu, J. (2023). International Development of Chinese Securities Companies based on SWOT Analysis: taking Huatai Securities as an example. Economic Research Guide, 15.

[3]. Li, H. (2021). The performance of listed brokerages is improving as a whole. The Economic Times, 17, 3.

[4]. Tang, Y. (2022). Brokerage revenue decline Brokerages want to borrow fund advisory and institutional business "break the game". Shanghai Securities News, 7, 1.

[5]. Liu, Y. (2021). Listed securities companies transform wealth management dividends. China Business Times,16, 8.

[6]. Bu, Z. (2021). Opportunities and Challenges for the development of wealth management in China. Financial Market Research 2, 1.

[7]. Wang, Y., Sun, Y. (2022). Consignment sales of financial products revenue decline brokerage wealth management transformation brewing new methods. Shanghai Securities News, 22, 12.

[8]. Xu, L. (2020). The development experience of Charles Schwab and its enlightenment to the innovative development of our country's securities industry. Modern Business 15, 6.

[9]. Yu, X. (2020). Wealth management transformation of securities companies: Motivation, path and countermeasures. Gansu Finance, 07.

[10]. Chen, Z. (2021). Research on realistic dilemma and solution strategy of wealth management transformation of securities firms. Marketing, 31.

Cite this article

Zhu,Z. (2024). Analysis of Transformation from Brokerage Business to Wealth Management Business of Huatai Securities. Advances in Economics, Management and Political Sciences,71,304-310.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yang, F. (2019). Development status and problems of China's securities industry. Business and Management, 12.

[2]. Hu, J. (2023). International Development of Chinese Securities Companies based on SWOT Analysis: taking Huatai Securities as an example. Economic Research Guide, 15.

[3]. Li, H. (2021). The performance of listed brokerages is improving as a whole. The Economic Times, 17, 3.

[4]. Tang, Y. (2022). Brokerage revenue decline Brokerages want to borrow fund advisory and institutional business "break the game". Shanghai Securities News, 7, 1.

[5]. Liu, Y. (2021). Listed securities companies transform wealth management dividends. China Business Times,16, 8.

[6]. Bu, Z. (2021). Opportunities and Challenges for the development of wealth management in China. Financial Market Research 2, 1.

[7]. Wang, Y., Sun, Y. (2022). Consignment sales of financial products revenue decline brokerage wealth management transformation brewing new methods. Shanghai Securities News, 22, 12.

[8]. Xu, L. (2020). The development experience of Charles Schwab and its enlightenment to the innovative development of our country's securities industry. Modern Business 15, 6.

[9]. Yu, X. (2020). Wealth management transformation of securities companies: Motivation, path and countermeasures. Gansu Finance, 07.

[10]. Chen, Z. (2021). Research on realistic dilemma and solution strategy of wealth management transformation of securities firms. Marketing, 31.