Volume 42

Published on November 2023Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

The study’s main focus is on the Fama-French Three-Factor Model’s capacity to account for cross-sectional volatility in stock returns. The Fama-French Three-Factor Model was used to assess a sample of 720 equity funds and determine each fund’s excess returns and three-factor risk exposures. The exposure of each element was then tested using linear regression to see if it could predict the excess returns. The study’s focus is on the shortcomings of the traditional Capital Asset Pricing Model (CAPM) and the possibility that the 3-factor model could offer a more precise and thorough explanation of stock returns. The empirical results indicate that it may not be robust all the time, and there could be other factors functioning meanwhile, which are not captured by the model. Furthermore, the Efficient Market Hypothesis (EMH) may not be effective and accurate in its strictest form. The study’s empirical examination of the Three-Factor Model and its implications for the Efficient Market Hypothesis (EMH) and other related ideas are what give it its value.

View pdf

View pdf

The halo effect is a cognitive bias that twists people’s judgment in the rating process and has a significant influence on HRM(human resource management) practices. However, as a heuristic, the halo effect has shown much potential for improving the economic outcomes of corporate business and management as well. This essay gives a review of the halo effect and its applications at the corporate level based on the literature from 1920 to 2022. While the concept of the halo effect has been fully developed throughout the century, the problem of distinguishing true halo from illusory halo remains unsolved, which leads to the stagnation of further research on HRM practice. However, the study of the halo effect in brand marketing is rather mature, providing diverse advertising, sales, and crisis strategies for corporations to increase long-term gain. Furthermore, the literature on the halo effect has been focusing on more contemporary fields of application, such as the promotion of cultural products in the context of globalization, which could be a trend for researchers in the near future.

View pdf

View pdf

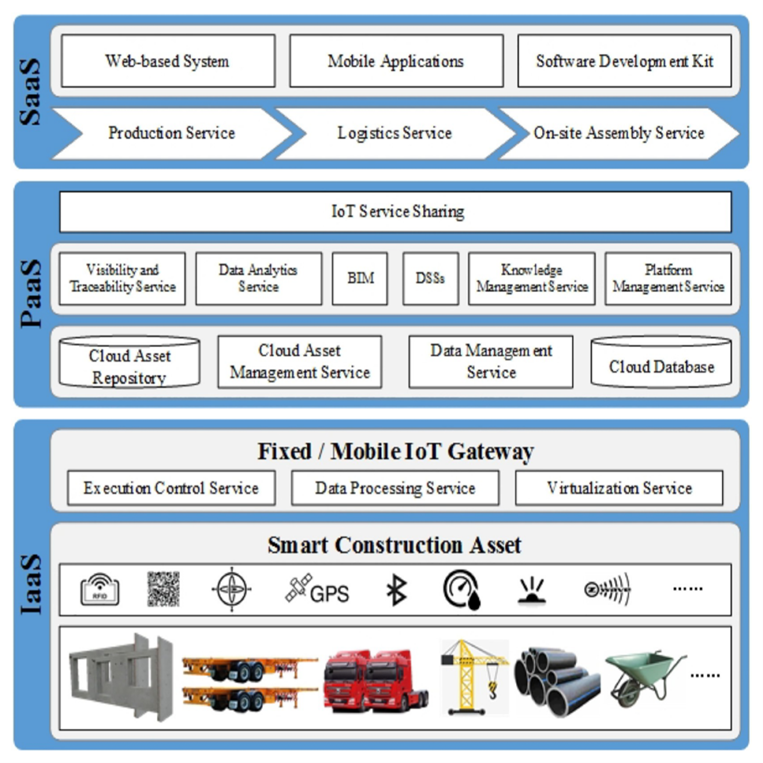

With the development of technology, digital twin has played a non-negligible positive impact on the development of smart cities. From the mutually influential nature of digital twin and smart city, this paper analyzes the progress of digital twin technology in smart city applications through theory and case studies. The author examines three key cases: city brain, IoT cloud platform, and smart hub, to explore the application of digital twin technology in smart cities. In addition, the paper presents the potential problems of digital twin in smart cities, such as insufficient infrastructure, insufficient systematic data integration and few application scenarios. In future research, the author suggests that digital twin technology holds promise for enabling innovative applications in areas such as environmental protection, security, energy, healthcare, and tourism within smart cities.

View pdf

View pdf

As a fundamental solution to block the intergenerational transmission of poverty, poverty alleviation through education is still the direction and focus of Chinese poverty governance in the post-poverty era. Faced with the existing problems in poverty alleviation through education concerning the young and middle-aged rural teachers could be introduced but cannot stay, as well as various psychological and living needs problems of rural teachers. In order to ensure the continuous inflow of fresh blood in the construction of rural teachers, it urgently needs strong and precise support from financial policies. This paper takes an example of education poverty alleviation in poor counties of Shanxi Province. With the help of literature review and interviewing methods, this paper demonstrates the actual internal and external problems faced by the construction of rural teachers, such as the personal promotion of rural teachers, psychological problems, and the organizational structure of teachers. From the perspective of financial solutions, this paper explores the basic ideas of the construction of rural teachers and then puts forward new ideas on the construction of rural teachers in terms of structural adjustment of fiscal policy implementation.

View pdf

View pdf

Sustainability has become a key concern for businesses and government agencies around the world. Companies are increasingly recognizing that achieving the Sustainable Development Goals (SDGs) not only has a positive impact on the environment and society, but also has a significant impact on their own performance and competitiveness. Therefore, this thesis aims to explore in depth the impact of SDGs on business performance and analyze the key factors for achieving SDGs. Through comprehensive analysis of relevant literature and case studies, this thesis concludes that actively promoting the realization of SDGs is an effective way to improve corporate performance. In pursuing SDGs, companies can ensure the relevance of their business activities to SDGs through the rational formulation and implementation of sustainability strategies and integrate sustainability into core business decisions and processes. At the same time, enhancing stakeholder engagement is one of the key factors in achieving the SDGs. Working closely with stakeholders, including employees, consumers, suppliers, communities, and governments, can help companies gain broader support and cooperation to jointly drive sustainability. In summary, the findings of this thesis suggest that actively promoting the achievement of SDGs is critical to improving business performance. To successfully achieve SDGs, companies need to develop and implement sustainability strategies, enhance stakeholder engagement, and adopt innovative business models and technology solutions. This will provide companies with a long-term sustainable competitive advantage and make a positive contribution to society and the environment.

View pdf

View pdf

The financial industry has long been a source of fluctuation and instability, and the recent events have further complicated post-COVID economic performances. This paper generalizes the theory of bank failures, the banking crisis, and the following economic consequences from past literature. It then analyses recent bank collapses and government responses, paying particular attention to Silicon Valley Bank and Credit Suisse. Finally, the conclusion draws on the validity of the theories in terms of being applied to the post-COVID banking system, yet current prudential policies and rescue plans need to be reviewed and upgraded.

View pdf

View pdf

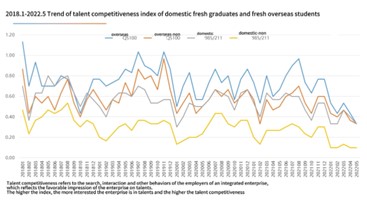

China's economic progress has been meteoric in recent years, leading numerous students to pursue their academic majors overseas. The objective of this article is to investigate the influence of international study experiences on the career prospects of Chinese students upon their return, encapsulating both the beneficial and detrimental effects. This research aims to provide robust guidance for Chinese students contemplating international study. Utilizing extensive data and market research, this paper initially elucidates the contemporary circumstances of Chinese international students returning home to seek employment. Subsequently, it delves into the various pros and cons of an international study experience with respect to job hunting, amalgamating existing data and literature. Lastly, detailed interviews with two returnee students shed light on their job-hunting experiences. This research shows that learning abroad cannot be categorized as univocal good or bad; the benefits of studying abroad come with accompanying challenges. The most important thing is to choose the path that suits students based on their circumstances rather than follow popular trends.

View pdf

View pdf

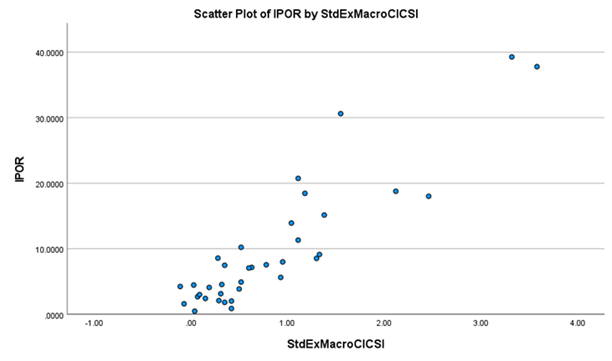

By combining economics, psychology, and neuroscience, behavioral finance aims to analyze how human emotions and biases influence financial decision-making. The research utilizes the Investor Sentiment Index (CICSI) as a tool to measure market sentiment and examines its correlation with variables such as IPO first-day returns, turnover rate, and new account openings. The findings demonstrate that investor sentiment significantly impacts market behavior. This suggests that individual emotions and cognitive biases play a crucial role in shaping market trends. These conclusions provide valuable insights for investors, financial analysts, and policymakers seeking to better understand and predict market behavior. By incorporating behavioral finance insights into traditional financial models, a more comprehensive understanding of financial markets can be achieved, enabling informed decision-making.

View pdf

View pdf

Children’s academic backgrounds can vary widely because of the different resources that come with income inequality. Thus, children can become increasingly stressed academically. Under pressure that is difficult to regulate, young people’s mental health can easily be af-fected. Therefore, we need to understand such a situation and take countermeasures. This article explores the relationship between income inequality, sources of competitive stress, anxiety, and suicidal behavior, and potential psychological treatments for these problems. Finally, this work concludes that income inequality is associated with significant social class differences that can increase children’s academic competitive stress and affect their mental health.

View pdf

View pdf

With the development of the global economy and the improvement of the technology level, the integration of information technology and the manufacturing industry has accelerated. The global manufacturing sector is moving in major directions as a result of digitalization, networking, and intelligence. The auto industry is also innovating, and artificial intelligence and new energy have accelerated the innovation and change of the auto industry. How automotive companies can improve their profitability and gain advantages in the competition during the transition period has become a key issue. This paper takes Volkswagen (VW) Group as the research object and analyzes its relevant indicators in FY2022, and also selects enterprises in the same industry for comparison. The current financial situation of VW Group is analyzed in terms of solvency, operating capacity, and profitability. The financial indicators such as total debt ratio, profit margin, total asset turnover ratio, and return on equity are used to make a comprehensive assessment of VW Group's financial status. With the gradual diversification of corporate sales revenue, revenue measurement, and recognition have become more complex. This paper also accounts for elements such as revenue and intangible assets of VW Group to make sure accounting data is accurate. The analysis is conducted from the perspective of corporate strategy to understand the strategic objectives and future direction of the VW Group. The VW Group's risks and difficulties are evaluated and projected within the framework of the overall company plan.

View pdf

View pdf