1. Introduction

The COVID-19 pandemic has had significant economic consequences for Japan and China. This essay analyzes the impact on small and medium-sized enterprises (SMEs), supply chains, unemployment rates, and government finances in both countries and determines what each country should do in the future. It is significant to know the current situation well and reflect on the past, to construct a stronger economic structure and system worldwide, that can be sustainable and resilient in future economic shocks. Quantitative data analysis was used when comparing the survey and data among Japan and China, and qualitative case studies were used as well, focusing on and having analyzed Japan and China.

2. Japanese economy overview

2.1. Number of bankruptcies in Japan

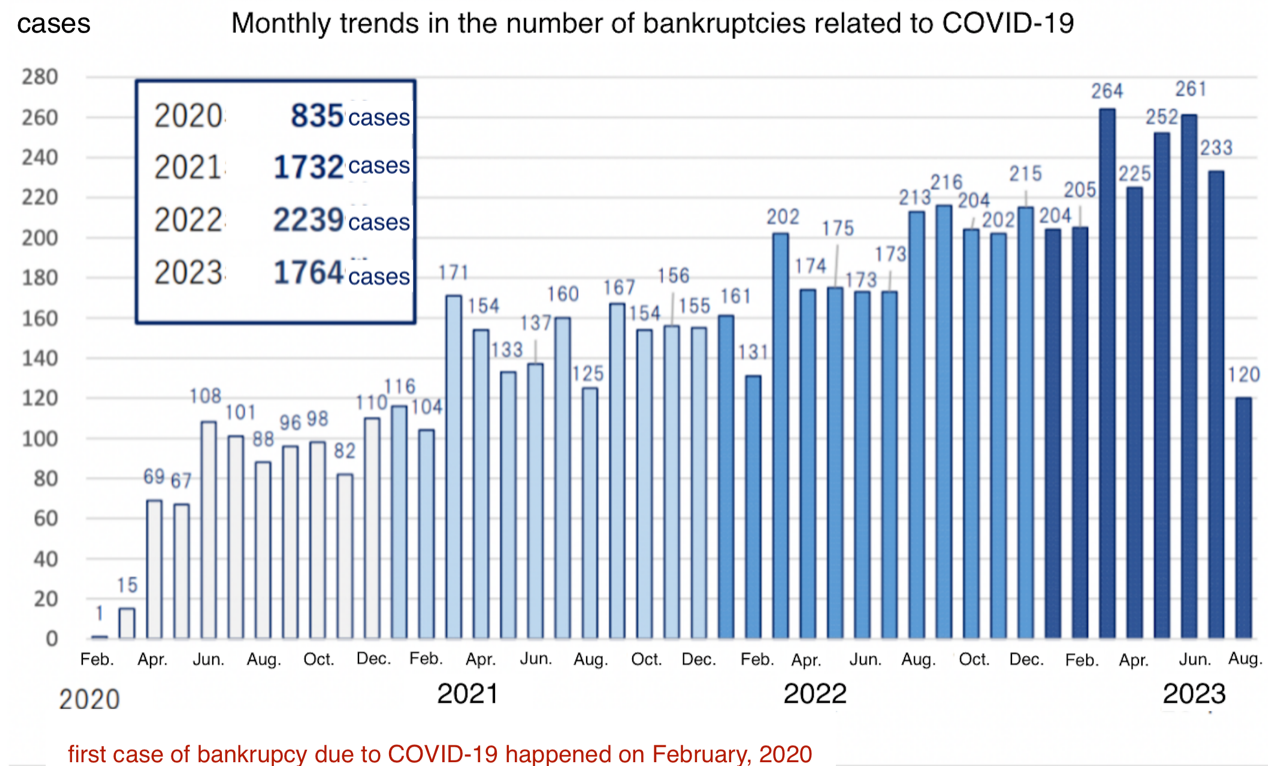

By year, there were 835 cases of bankruptcy due to COVID-19-related factors in 2020, 1732 cases in 2021, 2239 cases in 2022, and 1764 cases in 2023 [1, 2]. The number of bankruptcies in 2021 reached a record low, the lowest for 65 years after the end of the war [1]. This was surprising, as people expected the economic situation to be unfavorable due to the declaration of emergency in April 2020 as well as the pre-emergency measures that continued for a considerable period. A major factor behind the decline in bankruptcies in 2021 is the existence of a loan system called Zero-Zero Loan, which supports financing for small and medium-sized businesses suffering from financial difficulties due to the pandemic-caused insufficient profit, avoided many bankruptcies by utilizing the zero-zero loan system and borrowed money from the government almost without requisitions [1].

The bankruptcy of small and medium-sized enterprises is one of the biggest effects of the COVID-19 outbreak on the economy. As of 16:00 on August 31, there have been a total of 6,570 cases of COVID-19-related bankruptcies nationwide in Japan (*including legal liquidation or suspension of business [not subject to suspension of bank transactions], liabilities of less than 10 million yen, and sole proprietorships) [1]. The number consists of 6,274 cases of legal liquidation and 296 cases of business suspension. Small-scale bankruptcies with debts of less than 100 million yen accounted for 60.4%, which is 3,966 cases [1].

Figure 1: Monthly trends in the number of bankruptcies related to COVID-19 [2]

Only looking at bankruptcies due to COVID-19-related factors (figure 1), there were more bankruptcies last year in 2022 than this year in 2023, and it appears that the adverse impact of the coronavirus on the economy is about to pass [2]. But 2023 isn't over yet, with three months left. If we add up the total for October, November, and December in the future, the difference may increase by (2239-1764 =) 475 cases, and the possibility of overtaking last year's number is not small. Furthermore, by month, March 2023 (264 cases) had the highest number of cases, followed by June 2023 (261 cases) and May 2023 (252 cases) [2]. Looking at the number of bankruptcies by month, we can see that the number of bankruptcies in 2023 will be extremely high [2]. It also be said that the situation is still not optimistic, especially for small and medium-sized enterprises, due to the rising cost of raw materials due to the situation in Ukraine. The economic impact of COVID-19 is still causing widespread repercussions.

Observing the numbers for each prefecture, Tokyo has the most cases of bankruptcy (1083 cases), followed by Osaka (683 cases), Kanagawa (370 cases), Fukuoka (366 cases), and Hyogo (316 cases) [2]. 2818 cases of bankruptcy filed, accounting for 42.9% of the total number, the five cities are the most urbanized prefectures in Japan [2]. Overall, around 4.5 thousand businesses in Japan had filed for bankruptcy as of October 21 2022 because of the virus's emergence [3].

2.2. Impact on Different Business Sectors in Japan

Analyzing different businesses, following the restaurant business - which had the most bankruptcy cases of 975 - the construction industry (856 cases), the food wholesale industry (327 cases), and the food retail industry (277 cases) had suffered serious losses [2]. The total number of bankruptcies combining the categories of manufacturing, wholesale, and retail businesses is 785 for food, 428 for apparel, and 386 for tourism-related businesses, which include hotels, travel agencies, tourism buses, and souvenir shops [2].

2.3. Supply-side shock for Japan

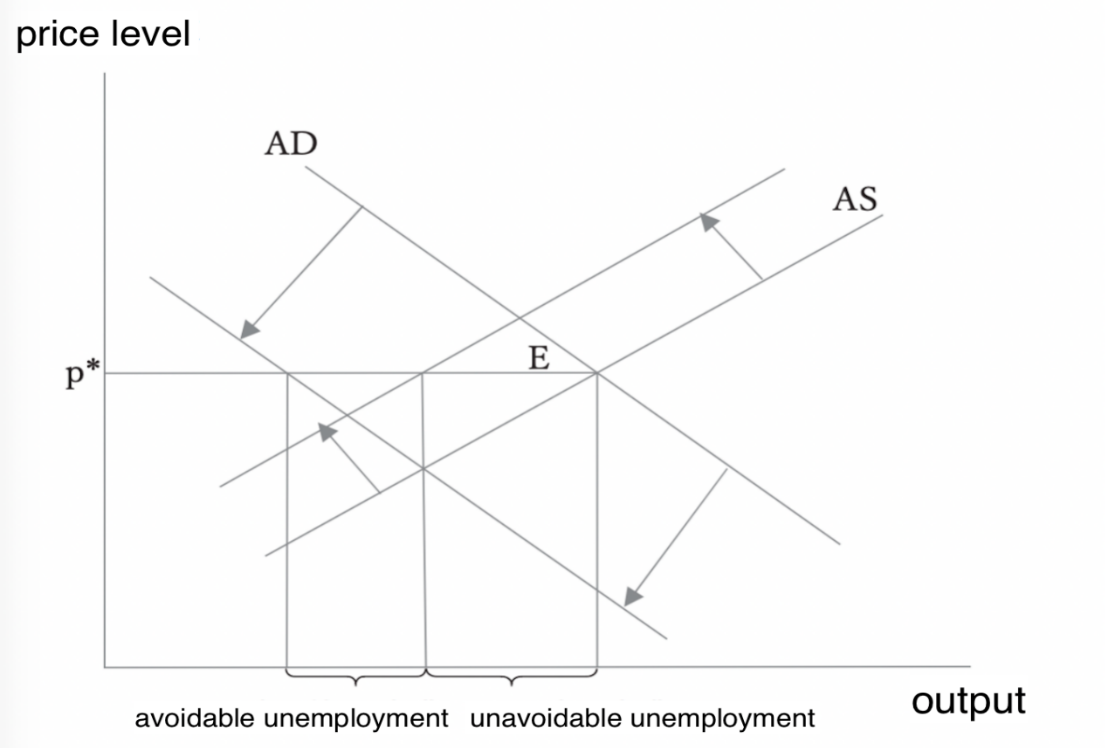

The impact of COVID-19 on the supply side is that when an infected person is confirmed, operations such as factories will stop, and employees, including the infected person and those who have been in close contact, will be asked to wait at home. As workers are asked to take time off work unpredictably, fewer products are manufactured. Furthermore, for nearly three years, the government has implemented infection control measures such as restricting the holding of live performances and events held at domes and setting limits on the number of people [4]. As a result, the “value added to a firm” that should have been obtained there, that is, the consumption added to GDP, was drastically reduced. When these are considered using ADAS analysis, AS (Aggregate Supply), or total supply, shifts to the right, causing a decrease in total production. A decrease in gross domestic product (GDP) due to a supply shock is called unavoidable unemployment, and it is as unavoidable as natural disasters [5]. Forcibly trying to reduce this decline could lead to the spread of infection and threaten the health of the public.

2.4. Demand side shock for Japan

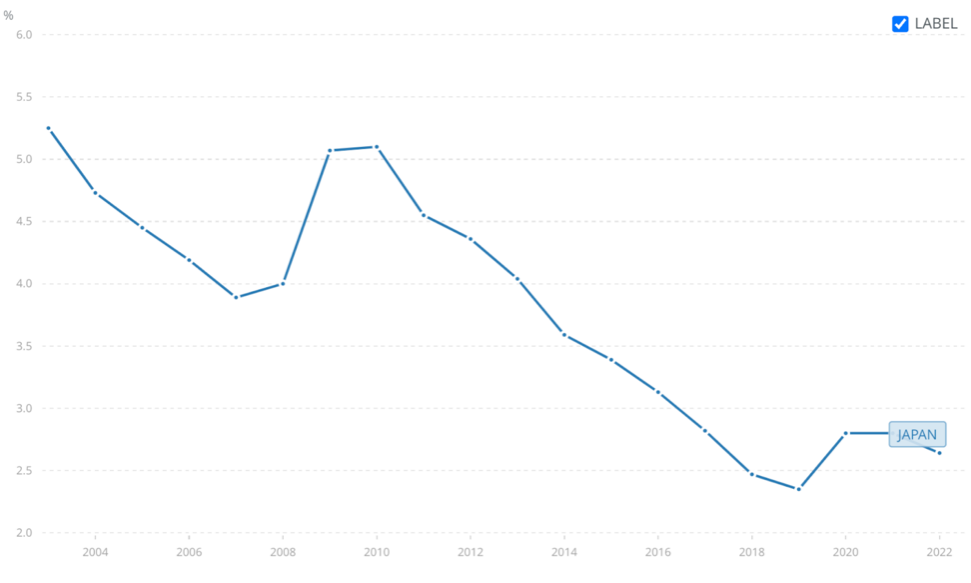

Numerous measures to prevent the spread of COVID-19 have also affected AD or aggregate demand. First, restrictions on going out have reduced demand for face-to-face services, such as banquets, dining out, travel, and accompanying accommodation [6]. In other words, AD shifts to the left, causing gross product (GDP) to fall further from the demand side. These losses due to demand shocks are called avoidable unemployment, in addition to unavoidable unemployment, making the economy need expansionary policies [5]. While not as drastic as the 1.1 percentage point jumped in the unemployment rate between 2008 and 2009, given the steady decline since 2010, the unemployment rate rised 0.4%, from 2.4% to 2.8% in 2019-20 [7]. The fact that the number increased to 2.8% shows the magnitude of the impact of COVID-19 on Japan's economy and society (Figure 2).

Figure 2: Unemployment rate in Japan [7]

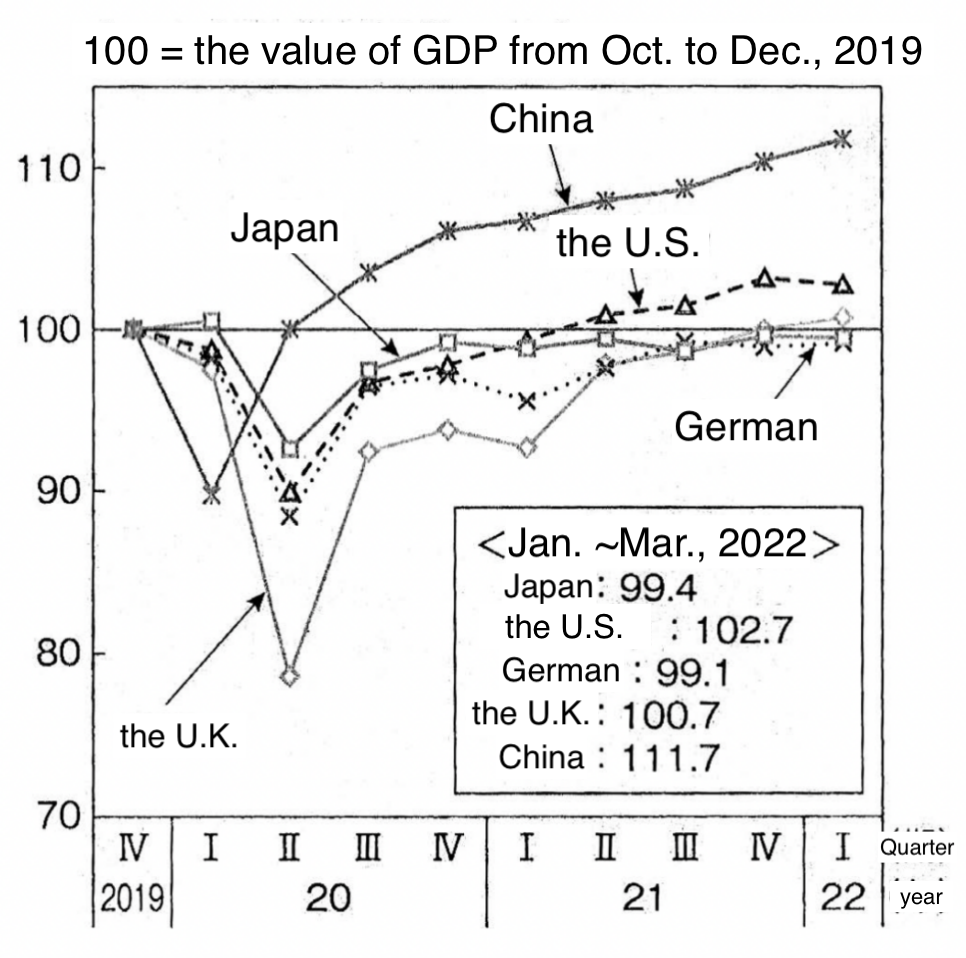

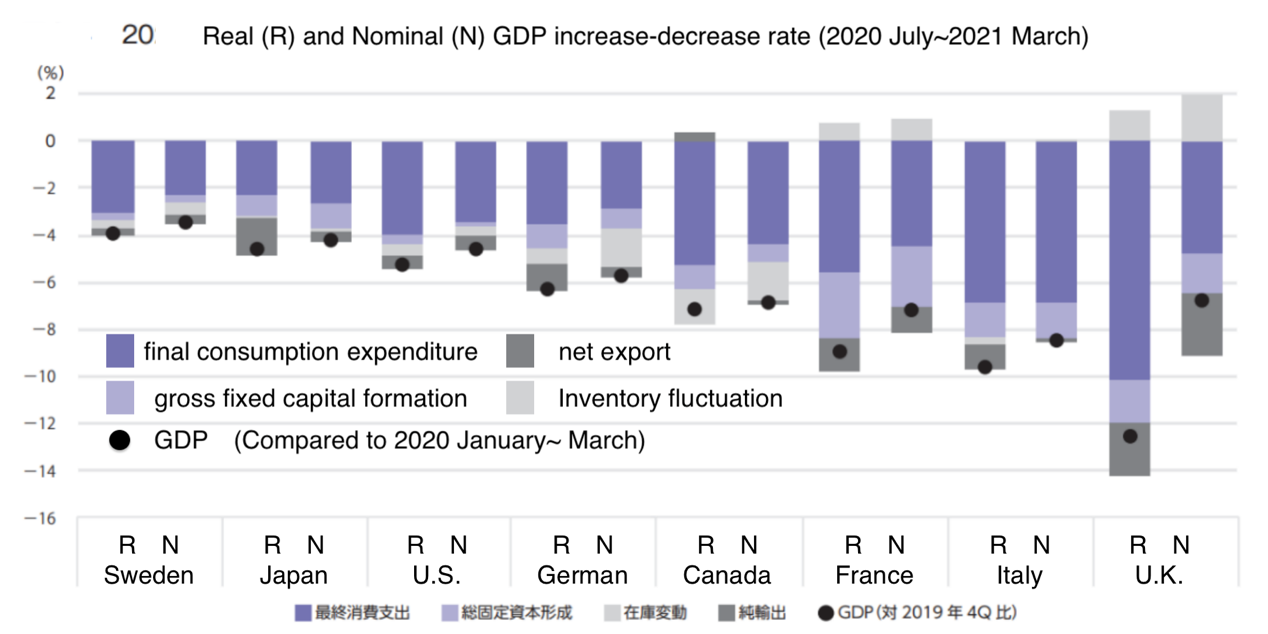

In this way, the economic downturn caused by COVID-19 has had a significant impact not only on the supply side but also on the demand side. The reason that led to this decrease in GDP (Figure 3) is different from Lehman Shock - which was only a demand shock - nor the Great East Japan Earthquake - which was only a supply shock [5]. This COVID-19-caused shock is on both sides of supply and demand, moving adversely at a close time (Figure 3 and Figure 4)

Figure 3: Change in real GDP over time (2019-2022) [5]

Figure 4: The economic shock caused by COVID-19 using ADAS model

2.5. Impact on the government budget

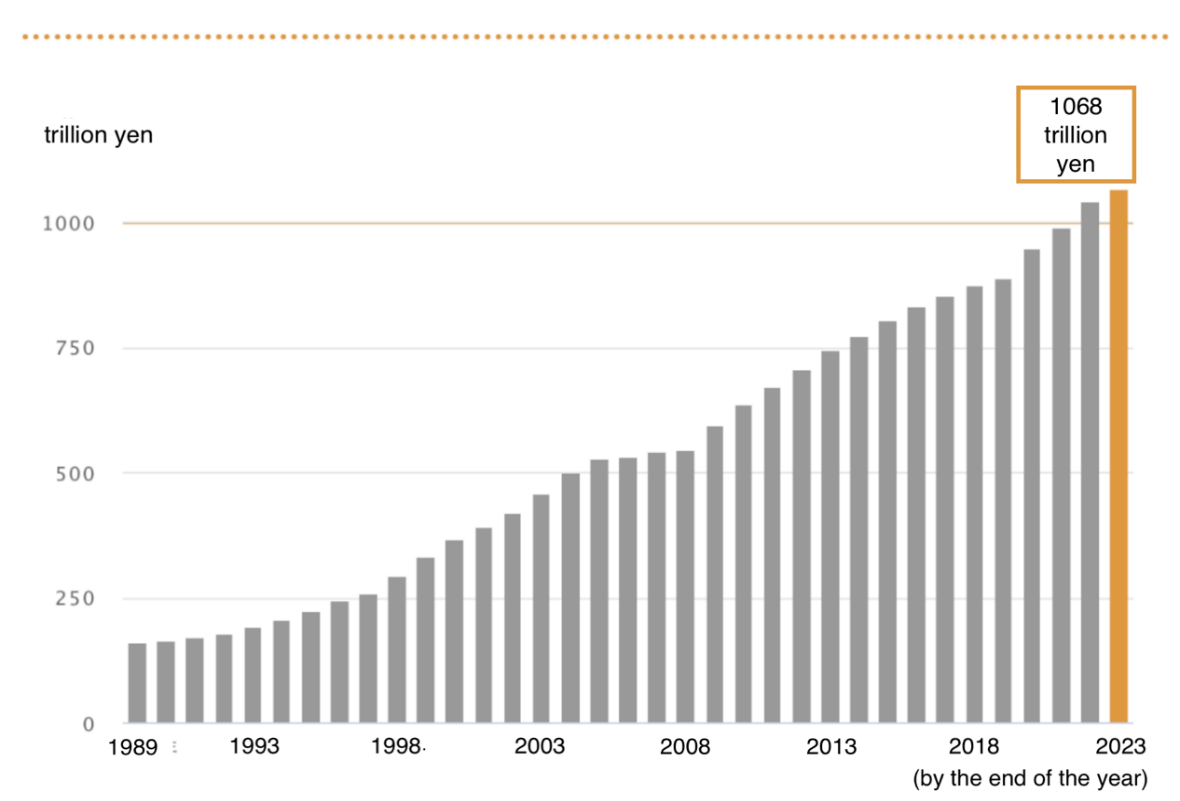

A gradual but obvious decrease in the number of businesses - mainly small and medium-sized enterprises - influences several aspects. One major factor is that the government's tax revenue has to be concerned. Due to the "Zero-zero" loan policy and other subsidies given to companies, government consumption was boosted during the outbreak. Small and medium-sized enterprises (SMEs) have to pay 15% of their revenue [8]. Although the amount of tax that could have been collected is not an extremely large portion of the government's tax revenue, the impact is still unignorable (Figure 5).

Figure 5: the Japanese government bonds issued [9]

The government budget is surely growing year by year, but tax revenue is not. The financial situation in Japan is currently reaching a limitation, so the future budget is a problem with which to be concerned as well. In the latest budget for 2023, the size of the general account exceeded 110 trillion yen for the first time as an initial budget, making it the largest ever [9]. As a result, tax revenues alone could not cover expenditures, and fiscal management had to continue relying heavily on debt. The ratio of government bonds to total revenue - the level of dependence on government bonds - is 31.1%, which exceeds 30%, demonstrating the strong reliance on government bonds, and enlarging the risk of the fiscal system in Japan [9]. The Japanese government has set the goal of achieving a surplus in the primary fiscal balance of the national and local governments by 2025 [9]. Even though the government's serious attitude toward the issue is shown, concerns regarding whether the goal can be achieved or not remain.

2.6. What Japan can do?

Preliminary results indicate a sharp contraction in both economies during the early months of the pandemic, with varying recovery trajectories. While China's export-driven economy showed resilience with a swift bounce back, buoyed by global demand for medical supplies and electronics, Japan grappled with declining consumer spending and disruptions in its manufacturing sector. However, Japan's robust fiscal response helped in mitigating prolonged economic downturns.

While continuing to increase revenues through economic growth is crucial, it is indispensable for policymakers to reduce unnecessary expenditures. Kishida administration has set goals such as doubling child-rearing-related budgets and expanding investments related to decarbonization [9]. Nevertheless, what matters is whether it can be achieved at a minimum cost, considering the severe budget situation.

In addition to thinking about reducing the budget, there are moves to increase corporate and wealth taxes in the United States, and the United Kingdom is also trying to raise its corporate tax rate [10]. The government must consider a "new normal and new tax system" [10].

Summarizing what has been discussed so far and analyzing it using the ADAS model of macroeconomics, as discussed earlier, an increase in corporate bankruptcies reduces supply. In addition, the number of unemployed people will increase due to people being unable to go to work or being fired to prevent the spread of infection. Therefore, supply decreases, and AS shifts to the left. The government tried to stimulate consumption by providing money to the people. However, since the future is uncertain and people do not know what will happen next, some people use the money to save [10]. A negative correlation of -0.79 was found between time spent at home and the rate of change in average real GDP in 2020 in major countries (Figure 6). In other words, although the request for people to stay at home was quite different from the lockdown that was implemented in Japan, and was gentle and non-enforceable, it was confirmed that consumption had fallen as a result.

Figure 6: Real (R) and Nominal (N) GDP increase-decrease rate (2020 July-2021 March [10]

Therefore, AD will not shift even if there is a stipend. As a result, AS has shifted to the left the economy remains depressed, and the society has yet to get out of this situation.

What the government can do is encourage companies to make new investments; small and medium-sized businesses should invest in IT and money for e-commerce and cashless technologies, as well as big corporations [11]. To promote these investments, the government can offer tax breaks: national banks must give financial institutions money for IT loans and investments [11].

3. Economic Impact on China

Focusing on the short run, the impact on both the demand and supply sides is obvious in China as well. China was forced into a large-scale lockdown and strict refraining from going out, and it was as if not only the economy, but the entire society's activities came to a halt. In regions that were slow to lift lockdowns (particularly hard-hit areas such as Hubei province), production and service provision fell as workers were unable to work [12]. This can be classified as a supply-side shock. This is the same story as the supply shock in Japan, but since China's refraining from going out was more severe than in Japan, with almost no people going out on the streets, the damage to China's economy was greater [13].

As COVID-19 spread worldwide, its impacts on supply chains became apparent. Electrical equipment (telephones, integrated circuits, televisions, and monitors), general machinery (automatic data processing machines, office equipment parts, printers), furniture, clothing, and precision machinery (liquid crystal devices, medical equipment) were the top of Chinese exports; not only machinery items but light industrial items also occupy a high ranking of Chinese exports [14]. However, whether it is electronic equipment or energy sources, it is not produced from scratch in mainland China; many of the opportunity items, original accessories, were exported from South Korea and Japan, and many of the energy resources were exported from the Middle East, so the loss of raw materials caused a crack in the supply chain [12]. The infection of the virus also rapidly spread to regions of South Africa, which has a friendly relationship with China and exports agricultural products to China, disrupting the agricultural supply chain [12].

3.1. China's Unemployment and Supply Chain Impact

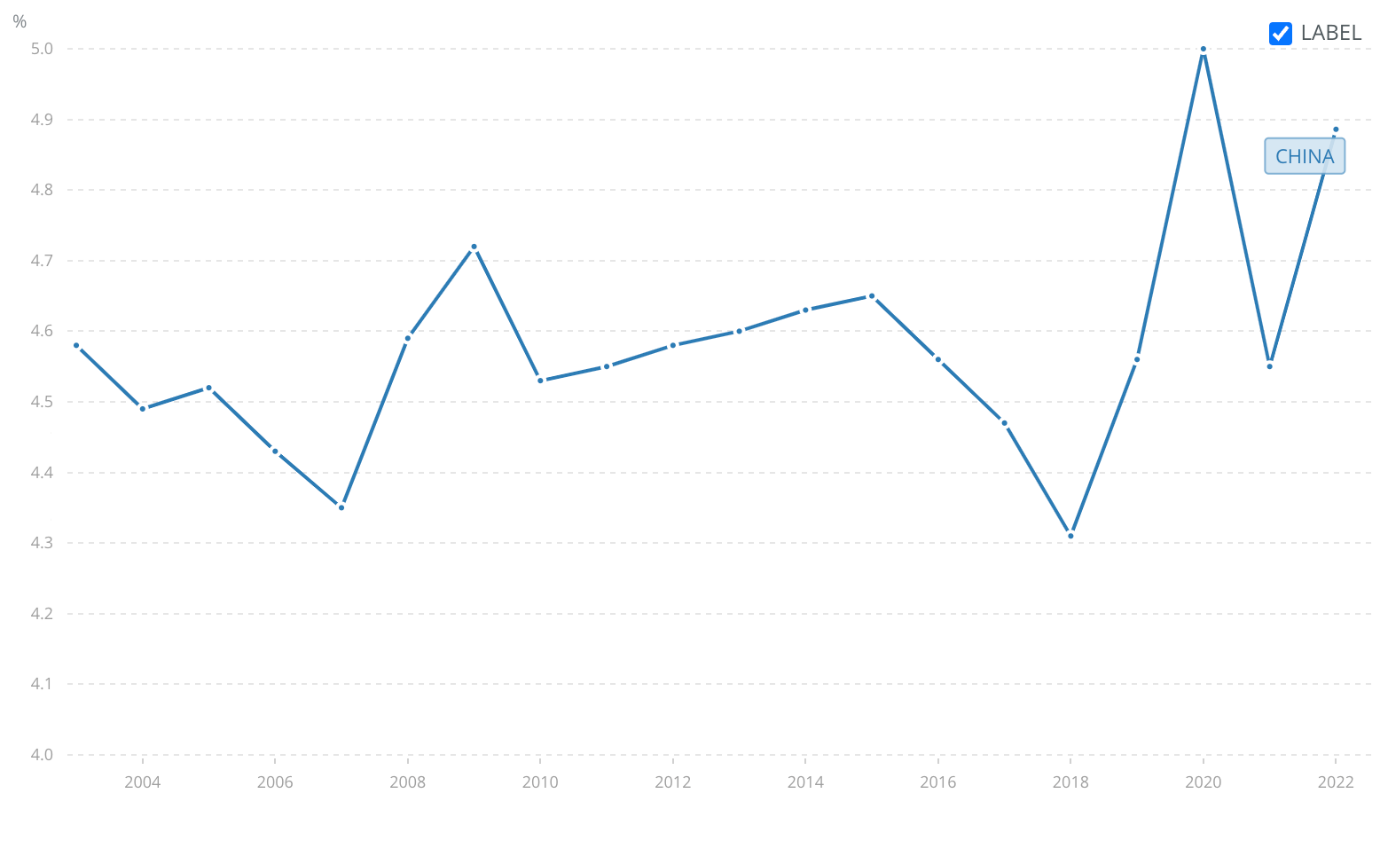

China's unemployment rate, which had been decreasing, rose by 0.4% in 2019-20, reaching 5.0% from 4.6% [15]. This underscores the severe impact on the supply side and economic activity (Figure 7).

Figure 7: Unemployment rate in China [15]

3.2. Suggestion for China

The COVID-19 pandemic has presented substantial economic challenges to China, impacting both the demand and supply sides of its economy. In this context, it is imperative to explore potential strategies to aid China's recovery.

Stimulate Domestic Demand: The pandemic has disrupted global demand, necessitating a shift towards domestic demand as a growth driver. Increasing government spending on infrastructure projects, supporting consumption through targeted stimulus packages, and encouraging private investment are vital measures to spur domestic demand and boost the economy [16].

Support Small and Medium Enterprises (SMEs): SMEs constitute a significant portion of China's economy. Implementing targeted financial support programs, providing tax relief, and streamlining bureaucratic processes can help these enterprises recover and contribute to economic growth [12].

Enhance Digital Transformation: Accelerating digitalization across sectors can bolster efficiency and resilience. Investments in 5G technology, cloud computing, and e-commerce platforms will not only drive economic recovery but also position China as a leader in the digital economy [16].

Promote International Trade and Investment: China should actively engage in trade and investment agreements to bolster its export-oriented industries. Encouraging foreign direct investment and reducing trade barriers can enhance market access, further aiding economic recovery [16].

Ensure Supply Chain Resilience: The pandemic exposed vulnerabilities in global supply chains. Diversifying supply sources and strengthening domestic production capabilities, especially for critical goods and materials, will enhance resilience and reduce dependency on external factors [16].

Invest in Healthcare and Biotechnology: Given the importance of health security, increasing investments in healthcare infrastructure and research, including vaccine development and production, is essential. A robust healthcare system is crucial for managing and responding to any future health crises [12].

Promote Sustainable Development: Integrating sustainability into economic recovery plans can have long-term benefits. Investments in renewable energy, environmental conservation, and sustainable agriculture not only stimulate economic growth but also contribute to a greener future [16].

Optimize Public Health Measures: Maintaining effective public health measures, including early detection and efficient contact tracing, is fundamental to preventing future outbreaks. Continuously updating and improving the public health infrastructure will be crucial for safeguarding public health and ensuring a stable economy [12].

4. Conclusion

In conclusion, the COVID-19 pandemic has profoundly impacted the economies of both Japan and China, particularly affecting small and medium-sized enterprises (SMEs), supply chains, unemployment rates, and government finances, and the influence can be observed and analyzed through both the supply and demand side. A multifaceted approach from not only the government but the whole society is needed for both countries to boost the economy in this post-pandemic era. Reflecting on the current situation and learning from past experiences, what both China and Japan should do is construct stronger and more resilient economic structures to better withstand instabilities in the current world economy and possible future shocks.

In Japan, the pandemic caused a surge in bankruptcies, especially among SMEs. The Zero-Zero Loan system providing financial support was implemented by the government to mitigate the repercussions on businesses, but the effectiveness was not apparent, as demonstrated by the rising number of bankruptcies. The supply side underwent disrupted operations -resulting in a supply shock- while demand was hit by restrictions on face-to-face services. The financial situation in Japan was not in a favorable situation as well, considering the decreasing amount of tax revenue and increasing budget. What the Japanese government can do is manage tax revenues, control expenditures, encourage investments, and focus on a new tax system to achieve fiscal sustainability.

China, facing a severe supply-side shock due to strict lockdown measures, needs to prioritize stimulating domestic demand, supporting SMEs, accelerating digital transformation, promoting international trade, and investing in healthcare and biotechnology. Enhancing supply chain resilience and incorporating sustainable development goals into recovery plans are crucial strategies. Furthermore, optimizing public health measures will be vital to prevent and effectively respond to future health crises, ensuring both public health and economic stability.

In navigating the post-pandemic era, proactive and strategic economic policies should guide Japan and China, setting them on a path toward recovery, growth, and sustainable development. Collaboration, innovation, and adaptability will be key as these nations seek to reconstruct and fortify their economic landscapes in the face of unprecedented challenges.

References

[1]. Yayoi KK. (n.d.). Media Report on COVID-19 Impact [PDF file]. Retrieved from https://media.yayoi-kk.co.jp/17627/

[2]. ©TEIKOKU DATABANK, LTD.. (n.d.). TDB COVID-19 Data [PDF file]. Retrieved from https://www.tdb.co.jp/tosan/covid19/pdf/tosan.pdf

[3]. Statista. (2021). Number of bankruptcies due to the impact of the coronavirus (COVID-19) in Japan as of August 31, 2021, by prefecture. https://www.statista.com/statistics/1118255/japan-number-of-bankruptcies-impact-coronavirus-by-prefecture/

[4]. Imai, R. (2022). 2021: Corona disaster and the Japanese economy.

[5]. Katayama, S. (2023). Macroeconomics of COVID-19. Economic Science Research, 26(2), 63-71.

[6]. Kaneme, T. (2021). Policy issues for regional economy and local finance in the post-corona era. Hirosaki University Graduate School of Regional Studies Annual Report, 17, 45-56.

[7]. World Bank. (n.d.). Unemployment Rate in Japan. Retrieved from https://data.worldbank.org/indicator/SL.UEM.TOTL.ZS?end=2022&locations=JP&start=2003

[8]. Ministry of Finance, Japan. (n.d.). Corporation Tax Summary. Retrieved from https://www.mof.go.jp/tax_policy/summary/corporation/c03.htm

[9]. NHK. (n.d.). Special Report on Government Bonds 2023. Retrieved from https://www3.nhk.or.jp/news/special/yosan2023/government-bonds/

[10]. Okina, Y. (2021). Characteristics and challenges of Japan's coronavirus countermeasures: What can be seen from an international comparison perspective. NIRA Opinion Paper, 57, 1-12.

[11]. Yamazaki, Y. (2022). Macroeconomic overview of coronavirus economic countermeasures. Fukuoka University Economics Series, 66(2), 113-126.

[12]. Zhou, T. (2020). Functional master's observation area under the new crown epidemic information and policy information. Modern Commercial and Industrial Technology, 41(20), 2.

[13]. Kanazawa, T. (2021). Fiscal policy in China during the COVID-19 pandemic in 2020. Keizai Riron, (405), 17-34.

[14]. METI. (2018). Annual Report on National Accounts for 2018, Analysis of China's foreign trade and investment. Ministry of Economy, Trade and Industry. Retrieved from https://www.meti.go.jp/report/tsuhaku2018/2018honbun/i2330000.html

[15]. World Bank. (n.d.). Unemployment Rate in China. Retrieved from https://data.worldbank.org/indicator/SL.UEM.TOTL.ZS?end=2022&locations=CN&start=2000

[16]. Jiang, D., Wang, X., & Zhao, R. (2022). Analysis on the economic recovery in the post-COVID-19 era: evidence from China. Frontiers in Public Health, 9, 787190.

Cite this article

Hayashi,Y. (2024). Economic Repercussions of COVID-19 in Japan and China. Advances in Economics, Management and Political Sciences,73,158-167.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yayoi KK. (n.d.). Media Report on COVID-19 Impact [PDF file]. Retrieved from https://media.yayoi-kk.co.jp/17627/

[2]. ©TEIKOKU DATABANK, LTD.. (n.d.). TDB COVID-19 Data [PDF file]. Retrieved from https://www.tdb.co.jp/tosan/covid19/pdf/tosan.pdf

[3]. Statista. (2021). Number of bankruptcies due to the impact of the coronavirus (COVID-19) in Japan as of August 31, 2021, by prefecture. https://www.statista.com/statistics/1118255/japan-number-of-bankruptcies-impact-coronavirus-by-prefecture/

[4]. Imai, R. (2022). 2021: Corona disaster and the Japanese economy.

[5]. Katayama, S. (2023). Macroeconomics of COVID-19. Economic Science Research, 26(2), 63-71.

[6]. Kaneme, T. (2021). Policy issues for regional economy and local finance in the post-corona era. Hirosaki University Graduate School of Regional Studies Annual Report, 17, 45-56.

[7]. World Bank. (n.d.). Unemployment Rate in Japan. Retrieved from https://data.worldbank.org/indicator/SL.UEM.TOTL.ZS?end=2022&locations=JP&start=2003

[8]. Ministry of Finance, Japan. (n.d.). Corporation Tax Summary. Retrieved from https://www.mof.go.jp/tax_policy/summary/corporation/c03.htm

[9]. NHK. (n.d.). Special Report on Government Bonds 2023. Retrieved from https://www3.nhk.or.jp/news/special/yosan2023/government-bonds/

[10]. Okina, Y. (2021). Characteristics and challenges of Japan's coronavirus countermeasures: What can be seen from an international comparison perspective. NIRA Opinion Paper, 57, 1-12.

[11]. Yamazaki, Y. (2022). Macroeconomic overview of coronavirus economic countermeasures. Fukuoka University Economics Series, 66(2), 113-126.

[12]. Zhou, T. (2020). Functional master's observation area under the new crown epidemic information and policy information. Modern Commercial and Industrial Technology, 41(20), 2.

[13]. Kanazawa, T. (2021). Fiscal policy in China during the COVID-19 pandemic in 2020. Keizai Riron, (405), 17-34.

[14]. METI. (2018). Annual Report on National Accounts for 2018, Analysis of China's foreign trade and investment. Ministry of Economy, Trade and Industry. Retrieved from https://www.meti.go.jp/report/tsuhaku2018/2018honbun/i2330000.html

[15]. World Bank. (n.d.). Unemployment Rate in China. Retrieved from https://data.worldbank.org/indicator/SL.UEM.TOTL.ZS?end=2022&locations=CN&start=2000

[16]. Jiang, D., Wang, X., & Zhao, R. (2022). Analysis on the economic recovery in the post-COVID-19 era: evidence from China. Frontiers in Public Health, 9, 787190.