1.Introduction

According to the definition of the Ministry of Industry and Information Technology of the People's Republic of China, new energy vehicles refer to cars that use of non-traditional vehicle fuel as a power source (or the use of traditional vehicle fuel and the use of new on-board power devices), the integration of the advanced technology of vehicle power control and drive, the formation of advanced technical principles, with new technology and new structure. According to their structure and working mode, they can be mainly divided into five types: hybrid electric vehicle (HEV), battery electric vehicle(BEV), fuel cell electric vehicle (FCEV), range extender electric vehicle (REEV), plug-in hybrid electric vehicle(PHEV).

In the international context of global carbon emission reduction and continuous breakthroughs in energy technology, the green and clean industry represented by new energy vehicles has received attention from all countries. In recent years, the export volume of China's new energy vehicles has shown explosive growth, increasing from 310,000 in 2021 to 679,000 in 2022, accounting for the share of total automobile exports from 15% to 21%, and has become the main driving force for China's automobile exports. Against this background, the preferred export destination for Chinese car companies has gradually shifted from the traditional Asian market to Europe. As of 2023, the European market has accounted for 55% of China's new energy vehicle exports. In Europe, a huge market rarely involved in the past and relatively unfamiliar, China's new energy car manufacturers are undoubtedly facing many problems to be solved. Europe is the world's second-largest market for new energy vehicles, and whether Chinese auto companies can successfully overcome the difficulties encountered in Europe and seize market share determines whether China's auto industry can be strong and go global. Expanding the European market is the only way and key for Chinese auto brands to realize the auto industry power and realize the Chinese auto dream.

At present, although there are many academic analyses on China's new energy vehicle industry, the studies on overseas competitiveness and market segments are too few and general, and the time is relatively long, which cannot accurately reflect the great changes in China's new energy industry in the past two years, let alone provide a guide for new energy manufacturers to urgently solve the problems. This paper focuses on the reality of the sales of Chinese new energy vehicles in Europe in recent years and uses literature analysis and data analysis to specifically study the key problems exposed in the European market. Based on the analysis results, this paper puts forward relevant countermeasures and suggestions to provide a theoretical basis for the development of China’s new energy vehicles in the European market and enrich the existing research. In addition, this paper starts with key issues such as international competitiveness, brand image, sales and service ability, technological innovation, and anti-political risk. Combined with the specific situation of the European market, the relevant assessment of the competitiveness of China’s new energy vehicles in Europe will help provide a realistic basis for the strategic decisions of new energy vehicle enterprises in the future.

2.Current Sales Status of Chinese New Energy Vehicles in Europe

2.1.Quantity of Exports to Europe

Table 1: China’s new energy vehicles export data to Europe[1-4]

|

Year Index |

2018 |

2019 |

2020 |

2021 |

2022 |

First half of 2023 |

|

Export to Europe (unit: 10,000 vehicles) |

0.51 |

2.3 |

7 |

15 |

33 |

34 |

|

Total sales volume of European new energy vehicle market (unit: 10,000 units) |

39 |

57 |

136 |

230 |

260 |

142 |

|

Proportion (%) |

1.3 |

4 |

5.1 |

6.5 |

12.69 |

23.9 |

According to Table 1, China’s new energy vehicles exported to Europe in 2018 were less than 10,000. However, since 2019, China's exports to Europe have grown rapidly, from 23,000 vehicles to 330,000 in 2022. As of the first half of 2023, China's exports of new energy vehicles to Europe have reached nearly 350,000, exceeding the total in 2022. In addition, the proportion of new energy vehicles imported from China in the European market has rapidly increased from less than 1.3% to 23.9% in the first half of 2023. This shows that China's new energy industry is expanding rapidly in Europe.

2.2.Average Export Price

Figure 1: Average export price of China's new energy vehicles over the years[1]

Figure 2: Average sales price in major European countries in 2022[1]

As shown in Figure 1 and Figure 2, although the average export price of China's new energy vehicles dropped in 2020 due to the impact of the COVID-19 epidemic, the overall price still maintained an upward trend. The average export price will increase from US$12,500 in 2019 to US$21,300 in 2022. Among the major countries in the European market, Spain and Norway have the highest export unit prices, reaching US$39,000, while the overall average unit price in the European market is US$30,000, which is higher than the average export price of China's new energy vehicles. It is worth noting that as the main exporter of China's new energy vehicles to Europe, Tesla's high price has increased the average price of China's new energy vehicles exported to Europe to a certain extent. But in general, China's own-brand new energy vehicles have advantages in technology and cost. They have been initially recognized by the European market, and their export quality and brand image have gradually improved.

2.3.Structure of Export

Figure 3: China’s new energy vehicle export structure in the first half of 2023[5]

Figure 4: New energy vehicle sales structure in the European market in 2022[2]

According to Figure 3 and Figure 4, China's new energy vehicle exports are mainly BEV, and the export proportion of PHEV is relatively low. It can be seen from the European market's demand for different types of electric vehicles that China's new energy vehicle export structure is basically in line with European market demand, but PHEV exports need to be further improved.

2.4.Investment in Europe

Figure 5: Investment amount and field distribution in Europe in recent years/billion euros[1]

Due to the impact of the COVID-19 epidemic, the amount of Chinese investment in Europe has declined in the past three years. However, it can be found from Figure 5 that China’s greenfield investment in Europe has increased year by year, surpassing the traditional M&A investment method and becoming the main method of China’s investment in Europe. In addition, among investments in Europe, automobile-related investment is growing, and its proportion continues to expand, rising from 20% in 2021 to 53% in 2022, becoming the main driving force for investment in Europe. This growth is mainly related to China's new energy corporations such as CATL and SVOLT accelerating the construction of overseas factories. It can be seen that the new energy field will be the focus of China's investment in Europe in the future, and the market maintains optimistic expectations for the future development of Chinese car companies in Europe.

3.Analysis of the Problems of Chinese New Energy Vehicles in the European Market

After conducting data analysis and literature analysis on China's new energy vehicles in the European market, the author found that although China's new energy vehicle exports to Europe continue to rise, they are also facing many problems. For example, own-brands are not very competitive in Europe, the corresponding supporting facilities are not enough, and they face certain political risks. These problems have greatly affected the development of China's new energy vehicle brands in Europe.

3.1.Weak Market Competitiveness

Table 2: BEV registrations in Europe Top 10, Q1, 2023[6]

|

# |

EV model |

Units |

Vs Q1-2022 |

|

1 |

Tesla Model Y |

71,683 |

173% |

|

2 |

Tesla Model 3 |

19,621 |

40% |

|

3 |

Volkswagen ID.3 |

17,316 |

105% |

|

4 |

Volkswagen ID.4 |

16,646 |

52% |

|

5 |

Dacia Spring |

14,066 |

56% |

|

6 |

Volvo XC40 |

13,786 |

173% |

|

7 |

Fiat 500 |

13,543 |

1% |

|

8 |

Peugeot 208 |

13,266 |

48% |

|

9 |

MG 4 |

12,720 |

--- |

|

10 |

Renault Megane |

10,876 |

--- |

Table 3: China's EV market share in Europe[1]

|

Chinese brand |

Market share in 2022 |

|

Geely |

5.5% |

|

SAIC |

3.4% |

|

BYD |

0.3% |

|

FAW |

0.2% |

|

NIO |

0.1% |

|

Xiao Peng |

0.1% |

|

AIWAYS |

0.1% |

|

VOYAN |

0.1% |

|

DFAC |

0.1% |

|

Great Wall |

0.1% |

According to Table 2, among the top ten BEV sales brands in Europe in the first quarter of 2023, Volvo XC40 owned by Geely, and MG 4 owned by SAIC ranked sixth and ninth respectively, with sales exceeding 10,000 vehicles and are growing rapidly, but there is still a huge gap with Tesla. Combining the data in Table 3, we can see that in 2022, Geely and SAIC performed better, with market shares exceeding 3%. This was due to the development layout of these two Chinese companies in Europe for decades. It is worth noting that the market share of other Chinese brands was less than 0.5%. BYD, which produces the largest number of new energy vehicles in the world, even had a market share of only 0.3%. NIO, which has already been deployed in the European market, performed poorly in 2022. The annual sales volume is only 1,200. The reason for the weak competitiveness of China’s brand is partly related to the weak influence and technological innovation.

3.1.1.Low Brand Awareness

Due to problems such as a late start, confusing positioning, weak marketing capabilities, and low quality, China's automobile brands have never had a strong influence in the world. People in many countries even have heard of them[7]. In China, manufacturers such as BYD and NIO are almost synonymous with new energy vehicles. However, in Europe, these companies are not yet well-known by consumers. On the contrary, traditional fuel vehicle companies such as SAIC and Geely, which have been engaged in foreign business for a long time, have higher recognition in Europe. Although Chinese new energy vehicle companies already have some advantages in terms of technology and cost, it will take some time to build a good brand image in the European market.

3.1.2.Weak Core Technologies

In terms of power battery technology for new energy vehicles, CATL's cell-to-pack technology and BYD's blade battery are already at the forefront of the world. But at the same time, European and American manufacturers are constantly strengthening the research and development of power batteries and are fiercely competing with Chinese companies in this field. It is worth noting that China’s automotive research in the field of chips is still in its infancy, and there is a large gap between the technical levels of mask aligners, wafers, and automotive chips compared with European and American manufacturers. In addition, in terms of some auto parts, Chinese car companies are still restricted by foreign countries, and these gaps in technical levels will lead to the rising production costs of China's new energy vehicles [8].

3.2.Lack of Sales Services and Supporting Facilities

Table 4: Number of stores in Europe by 2023

|

Brands |

Quantity |

|

BYD |

140 |

|

MG 4 |

790 |

|

NIO |

12 |

|

Tesla |

226 |

Due to SAIC's long-term development in the European market, SAIC has a large number of stores in Europe, so in the first half of 2023, MG4 can achieve a higher share. However, as shown in Table 4, in contrast, Chinese brands such as BYD and NIO are still insufficient in the number of stores, which means that in terms of sales and after-sales service, Chinese car companies cannot better serve European customers.

Table 5: Number of charging points [2]

|

2020 |

2021 |

2022 |

|

|

China |

810,000 |

1,150,000 |

1,760,000 |

|

Europe |

252,000 |

356,000 |

518,000 |

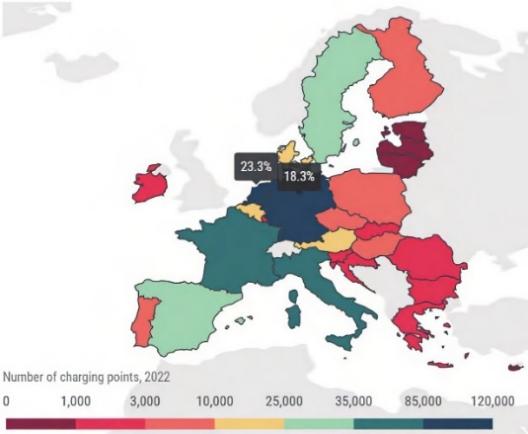

Figure 6: Distribution of charging stations[9]

As can be seen from Table 5, although the number of charging points in Europe has grown rapidly in the past three years, there is still a big gap between the number of charging points in China. In 2022, the number of charging points in China is already 3.4 times that of Europe. There is a development trend of "disconnection" between vehicles and chargers in the European market. The ratio of vehicles to chargers is too large and the distribution is extremely uneven. As shown in Figure 6, almost half of the charging points are concentrated in Germany and the Netherlands. The slow development of charging infrastructure has largely affected the development of the new energy vehicle market, including China's brands[9].

3.3.Political Risk

Since the outbreak of the Russia-Ukraine conflict in 2022, the EU has imposed an embargo on Russian natural gas, oil, and coal. Affected by the embargo, Europe has been under the threat of energy shortages. The increase in energy prices even reached 40%. Some Energy Freedom Index of the leaders of the European ratings decreased, especially Germany, France, and Italy, which are more dependent on Russia. In countries with energy shortages, their natural gas and electricity prices have increased significantly [10]. This will undoubtedly have a greater impact on the new energy vehicle market.

3.4.Tariff Barriers

On September 23, 2023, the EU announced that it would launch a countervailing investigation into electric vehicles imported from China. It is believed that China's new energy vehicles have received a large amount of subsidies from the Chinese government, making the market flooded with cheap Chinese cars and harming fair competition. If the final assessment results confirm this view, countervailing duties will be levied on Chinese car companies, forming a tariff barrier and disrupting the expansion plans of Chinese companies in Europe in a short period[11].

4.Countermeasures for Selling Chinese New Energy Vehicles in Europe

4.1.Improve Sales and Service Capabilities

Customer experience is the most important factor affecting brand influence[12]. Service capabilities, including pre-sales and after-sales services, affect whether customers are willing to purchase the company's products. It can be seen from the analysis in 3.2 that Chinese new energy manufacturers currently have an insufficient number of stores in Europe and cannot provide customers with good services. Therefore, Chinese new energy companies should build more overseas service departments, strengthen online consumer services, and cooperate with European dealers to learn from local service experience to create a comprehensive service system [13].

4.2.Improve Charging Infrastructure

In response to the shortage of charging stations in Europe, Chinese new energy companies should actively cooperate with local energy supply companies and government departments to build more charging stations. At the same time, they can learn from Chinese experience to establish charging networks in high-density residential areas for new energy vehicles, and provide support for consumers’ needs to build their own charging piles to solve charging problems [14].

4.3.Strengthen Core Technology Research and Development

Increase research and development efforts in key areas such as control systems and automotive-grade chips, and strengthen cooperation with universities and scientific research institutions. Build top-level coverage of new energy vehicle industry policies and vigorously promote the intelligentization of new energy vehicles, networked development, and build the core advantages of China’s brands [15].

4.4.Legal Responses to Tariff Barriers

In response to the EU's anti-dumping and countervailing investigations against Chinese car companies, Chinese new energy companies can use international trade rules to defend their legitimate rights and interests, and stabilize their economic status in the market. Besides, the Chinese government should also negotiate with the EU on new anti-dumping and countervailing regulations or file a lawsuit with the WTO [16].

5.Conclusion

This paper mainly discusses the current situation of China's new energy vehicles, especially its own brands, in the European market in recent years, analyzes the main issues affecting their development in the European market, and puts forward relevant suggestions and methods. This paper finds that there are major flaws in the international competitiveness of Chinese companies in Europe, which are mainly related to low brand image, weak core technology, and insufficient marketing and service capabilities. In addition, Chinese car companies have also encountered the serious problem of insufficient basic charging facilities in the European market, and are affected by political factors such as the Russia-Ukraine conflict and countervailing investigations. In the short term, their development in the European market may be restricted and their expansion will slow down. Based on this, this paper believes that Chinese new energy vehicle companies should focus on strengthening core technical capabilities and new investment and infrastructure investment in Europe to consolidate their position in the European market and enhance brand influence. When facing risks such as tariff barriers, They must also be good at operating international trade rules to safeguard their interests.

It should be pointed out that this paper has not conducted an in-depth discussion on the internal strategic management of Chinese enterprises. It is hoped that some scholars can guide the internal management and strategic decision-making of Chinese new energy automobile enterprises by means of value chain and SWOT analysis, to promote the better development of Chinese brands of new energy automobiles in Europe, contributing to the globalization of China's automobile industry and the expansion of China's new energy industry.

References

[1]. KPMG, China’s new energy vehicles in Europe, 06-2023, https://kpmg.com/cn/zh/home/insights/2023/06/china-s-new-energy-vehicles-in-europe.html.

[2]. IEA, Global EV DATA Explorer, https://www.iea.org/data-and-statistics/data-tools/global-ev-data-explorer.

[3]. Ministry of Industry and Information Technology of the People's Republic of China, Statistical analysis of equipment industry, https://wap.miit.gov.cn/gxsj/tjfx/zbgy/index.html.

[4]. Sun Yuan. China's new energy vehicle export status, opportunities and challenges. Practice in Foreign Economic Relations and Trade. 03(2022):02.

[5]. Kang Chengwen, Gou Jiaxin. A Study on the Current Development of China's New Energy Vehicle Export Trade. Modern Industrial Economy and Informationization. 13.08(2023):01.

[6]. JATO, Tesla Mode Y becomes Europe’s best-selling car for Q1 2023, https://www.jato.com/tesla-model-y-becomes-europes-best-selling-car-for-q1-2023/.

[7]. Zhai Yubo, Hang Yuhang, Li Huan. The existing problems and countermeasures of self-owned brand automobile export. Modern Business. 02(2023):03.

[8]. Wen Zhengjian. Research on the International Competitiveness of Chinese New Energy Vehicle Industry. Yunnan University, MA thesis. 2023:28.

[9]. Zhao Ziyao. Europe and the United States’ charging pile industry chain needs to be broken. Auto Review. 04(2023):01-02.

[10]. Zgurovsky, Michael, et al. The Energy Independence of the European Countries: Consequences of Russia’s Military Invasion of Ukraine. 2022 IEEE 3rd International Conference on System Analysis & Intelligent Computing (SAIC). IEEE, 2022.

[11]. Zeng xing. EU launches anti-subsidy probe into China's electric vehicles. Automotive Observer. 05(2023):02.

[12]. Zhang, Xiangxiang, et al. Research on the brand equity of the automobile industry based on customer experience and modern service. 2011 International Conference on Management and Service Science. IEEE, 2011.

[13]. Song Deyong, Liu Han. The problems and countermeasures faced by China's new energy automobile enterprises export. Practice in Foreign Economic Relations and Trade. 08(2018):03.

[14]. Zhang Liang. Current situation and development prospect of China’s new energy vehicle export in the new era. Prices Monthly.07(2022):04.

[15]. Gong Peiming. International competitiveness of China's new energy automobile industry: influencing factors, characteristics and improvement paths[J]. Modern Management Science. 2022, (04):9.

[16]. Sun Yi. Strategies for new energy vehicle exports to deal with non-tariff barriers. Industrial Innovation.13(2023):03.

Cite this article

Gao,N. (2024). The Current Sales Status and Countermeasures of Chinese New Energy Vehicles in Europe. Advances in Economics, Management and Political Sciences,74,150-158.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. KPMG, China’s new energy vehicles in Europe, 06-2023, https://kpmg.com/cn/zh/home/insights/2023/06/china-s-new-energy-vehicles-in-europe.html.

[2]. IEA, Global EV DATA Explorer, https://www.iea.org/data-and-statistics/data-tools/global-ev-data-explorer.

[3]. Ministry of Industry and Information Technology of the People's Republic of China, Statistical analysis of equipment industry, https://wap.miit.gov.cn/gxsj/tjfx/zbgy/index.html.

[4]. Sun Yuan. China's new energy vehicle export status, opportunities and challenges. Practice in Foreign Economic Relations and Trade. 03(2022):02.

[5]. Kang Chengwen, Gou Jiaxin. A Study on the Current Development of China's New Energy Vehicle Export Trade. Modern Industrial Economy and Informationization. 13.08(2023):01.

[6]. JATO, Tesla Mode Y becomes Europe’s best-selling car for Q1 2023, https://www.jato.com/tesla-model-y-becomes-europes-best-selling-car-for-q1-2023/.

[7]. Zhai Yubo, Hang Yuhang, Li Huan. The existing problems and countermeasures of self-owned brand automobile export. Modern Business. 02(2023):03.

[8]. Wen Zhengjian. Research on the International Competitiveness of Chinese New Energy Vehicle Industry. Yunnan University, MA thesis. 2023:28.

[9]. Zhao Ziyao. Europe and the United States’ charging pile industry chain needs to be broken. Auto Review. 04(2023):01-02.

[10]. Zgurovsky, Michael, et al. The Energy Independence of the European Countries: Consequences of Russia’s Military Invasion of Ukraine. 2022 IEEE 3rd International Conference on System Analysis & Intelligent Computing (SAIC). IEEE, 2022.

[11]. Zeng xing. EU launches anti-subsidy probe into China's electric vehicles. Automotive Observer. 05(2023):02.

[12]. Zhang, Xiangxiang, et al. Research on the brand equity of the automobile industry based on customer experience and modern service. 2011 International Conference on Management and Service Science. IEEE, 2011.

[13]. Song Deyong, Liu Han. The problems and countermeasures faced by China's new energy automobile enterprises export. Practice in Foreign Economic Relations and Trade. 08(2018):03.

[14]. Zhang Liang. Current situation and development prospect of China’s new energy vehicle export in the new era. Prices Monthly.07(2022):04.

[15]. Gong Peiming. International competitiveness of China's new energy automobile industry: influencing factors, characteristics and improvement paths[J]. Modern Management Science. 2022, (04):9.

[16]. Sun Yi. Strategies for new energy vehicle exports to deal with non-tariff barriers. Industrial Innovation.13(2023):03.