1.Introduction

Since the 21st century, China's economy has been developing rapidly, and the income of Chinese consumers has been increasing. During the last two decades, societies of this big emerging market (BEM) have undergone dramatic transformations toward privatization, liberal trade policies, and free market forces [1]. There is a prosperous development of the free market in China, with the improvement of consumption level, other consumption in addition to daily necessities gradually emerged. The new-style tea-drinking industry (milk tea is one of the most popular types) is one of them. Even though it is a totally new industry in the Chinese market, its trend has exponentially risen since 2017, with dramatic social attention and preferences. Recently, the Chinese new-style tea-drinking market has become the third largest one after traditional cups of hot drinks and industrialized bottled ready-to-drink tea [2]. The Modern China Tea Shop from Changsha, a city in China, is a popular brand of new-type milk tea. It was founded in December 2013 with another more well-known name, Sexy Tea. In this decade, it has been developing continuously, and it has then grown to the level of national fame. With the emerging Internet, it is now all over social media, furthermore, it is even one of the reasons why many people travel to Changsha. However, it is difficult to buy products of Sexy Tea in other cities in China, due to the marketing strategies of Sexy Tea. In this paper, three different strategies of Sexy Tea are introduced and analyzed. Additionally, proposals about these strategies are provided to observe the market performance, so as to learn from Sexy Tea’s successful experience in brand building.

2.Analysis on the Marketing Strategies of Sexy Tea

2.1.Brand Marketing

The first core strategy of Sexy Tea is brand marketing. There are some differences between brand marketing and traditional marketing (such as traditional advertising) because brand marketing pays more attention to exploring the brand value and presenting it to consumers, while traditional methods focus on attracting the eyes of the buyers. In the 2000s, while traditional advertising still commands the largest percentage of media spending, its relative share has been shrinking and mass media ad revenues have been declining steeply [3]. It can be seen that a shift occurred in traditional types of marketing modes, which has a diminishing effect on consumption promotion. As a result, marketing managers and advertisers have begun to re-evaluate conventional, mass media-based models of persuading consumers [4]. There is a tendency that more and more firms are getting interested in communications with consumers and brand touchpoints for influencing consumers. Sexy Tea exactly has the willingness to build connections with its customers, and one of the marketing methods Sexy Tea usually uses is event marketing. In contrast to the distant, one-way, and broad-based nature of mass media advertising, event marketing allow for direct, highly interactive, and local consumer–brand encounters where consumers can experience the brand in an immediate way [4]. Indeed, event marketing provides access for consumers to have memorable brand experiences, and this can help create more meaningful brand value and deeper connections. For instance, Sexy Tea once created an activity called ‘bangbangmai’, which aimed to help the disabled to earn money themselves and be self-reliant. In this public benefit activity, Sexy Tea provided distribution channels for the disabled to sell their handiwork, and they could receive all the benefits. This is not only a typical event marketing, but also a socially useful activity, and Sexy Tea represents the charm of the brand and sends a positive signal to consumers.

Sexy Tea is not the first event-marketing-user. Other examples include the ‘Diesel Black Friday’ organised in Italy, during which Diesel actors playing bank clerks and bank directors gave away a coupon to get 30% off; in the UK, Vodafone brought cricket to the street in an event featuring cricket competitions, complete with DJ music, barbecues, drinks, and special appearances by legends of the game [4]. These events can take various forms, such as exhibitions, competitions, charity fundraisers, public benefit activities, incentive programme, and road shows. Moreover, rather than defining the objectives of events in terms of persuasion and attitude changes, event practitioners increasingly emphasise that events can create a deeper and more meaningful brand-equity connection with consumers through these experiences [5].

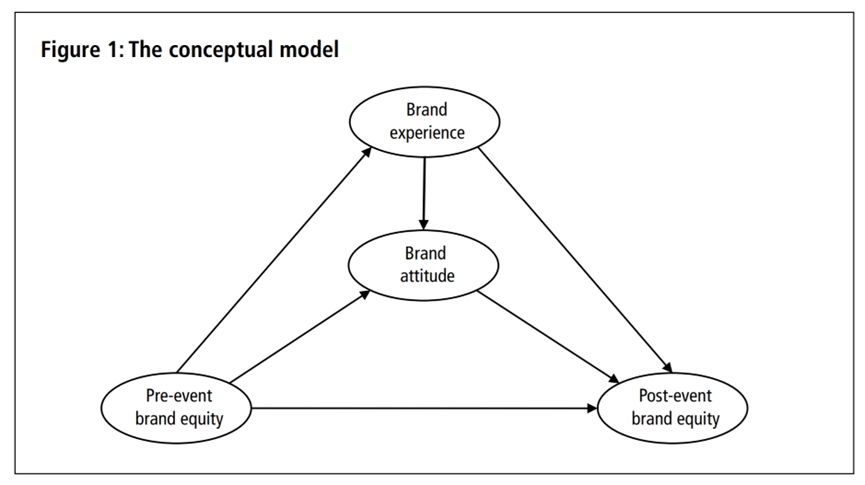

In a recent event, Sexy Tea had an opportunity to cooperate with a master in the Chinese painting field and created some interesting and cultural works. It is infrequent that a milk tea brand chooses to cooperate with an aged painting master instead of a celebrity with many fans, and this might be related to another brand marketing method of Sexy Tea. Sexy Tea insists on building the brand with Chinese culture, and it incorporates a large amount of the regional culture of China into its drinking products, from making the package with Chinese paintings to constructing a series of Chinese-style concept stores. The biggest one is built on the site of an ancient granary. This is a sign of cultural confidence, and it can inject value and connotation into the brand. According to the adopted perspective [4], all the experiences, including events and cultural exports, can create brand value and promote brand equity. As Figure 1 represents, the brand experience can show the brand’s attitude towards its consumers and then pose an impact on the changes between pre-event and post-event brand equity.

Figure 1: The conceptual model [4].

2.2.Hunger Marketing

It is widely argued that Sexy Tea habitually uses hunger marketing to appeal to more customers and make profits. The “hunger marketing” strategy comes from the “utility theory” in economic theory, that is, to make consumers feel satisfied [6] in order to build a solid psychological foundation for marketing [7]. Hunger marketing strategy is a kind of aggregation promotion, mainly manifested as the combination of artificially low-price control and supply restriction [8], which is why long queues are always seen outside the Sexy Tea shop. In addition to Changsha, the first Sexy Tea shop opened in another city was located in Wuhan, a city in China and not far from Changsha. It was selected as the first provincial shop of Sexy Tea at the end of 2020. Based on the statistics from Weibo, the average waiting time for a cup of Sexy Tea reached 8 hours on the opening day of the first Sexy Tea shop in Wuhan, and this is long enough for a consumer to travel to Changsha to buy one and then travel back to Wuhan [9]. Moreover, some customers were even willing to buy a cup by paying ten times the original price. Sexy Tea successfully made the crowd crazy on the first day its offline shop opened out of Changsha. Despite the long waiting hours, the reputation of Sexy Tea even rises to a new level.

Against this background, a research article gives an assumption that other factors such as good services, successful customer engagement strategies, and the construction of the Internet platform can be the compensation for the inconvenience caused by the long waiting time, which is also a strategy of hunger marketing and stimulate customers' desire to buy [9]. Sexy Tea has created an entire service system in the offline shops. Firstly, the staff are trained to have a polite smile on their faces and speak specific words and sentences in dialogue to make the conversation relaxing and friendly. Secondly, Sexy Tea set the price 30% to 40% lower than that of its competitors [10]. Thirdly, thanks to the publicity on the Internet and recommendations from Key Opinion Leaders, Sexy Tea has become a successful brand today with its reputation spreading nationwide. It is even considered a “must-try” when travelling to Changsha [9]. Based on the Changsha Evening News, 30 tourist reception units in Changsha received a total of 1.69 million visitors during the May Day holiday on May 5 [11]. Overall, Sexy Tea has provided many ‘conveniences’ to make consumers ignore the negative influences caused by its inconvenience.

In addition, Sexy Tea has a large number of sticky "fans" because of the mystery caused by information asymmetry, which makes consumers have a strong willingness to pay [9]. There is a similar example of hunger marketing in China: Xiaomi, a smartphone company in China, is one of the leading tech firms, and it requires purchasing mobile phones by booking in advance on the Internet. In fact, Xiaomi deliberately limits the product supply to create a buying frenzy among consumers and a part of them cannot get the phone [12]. Xiaomi makes use of scarcity effects, which assist both Sexy Tea and Xiaomi in enhancing consumers’ perceived value and desirability for the product. Although the strategy is useful in the case of Sexy Tea and Xiaomi, it does not confirm the widespread use of a marketing strategy for all the brands. Sexy Tea is a local brand, focusing on the local market in Changsha, and it has no arrangement about expansion for a long time. Therefore, due to the geographical scarcity, high network visibility, an already huge success in Changsha before the expansion, and the strategy of hunger marketing, the success of this ‘be-constrained’ hunger marketing occurs to Sexy Tea might be occasional.

2.3.Market Segmentation

Market segmentation strategy divides consumers into different groups, and the target consumers can be precisely selected. The milk tea industry is a new type of consumption, so younger people generally have more interest in it. The product strategy of Sexy Tea firmly grasps the post-80s and post-90s consumers with a "pursuit of literature and quality", and 70% of them are female [10]. It focuses on combining some fashion elements and Chinese traditional culture, at a lower price compared with its competitors, and these properties grasp young consumers. In the last ten years, the social economic environment has supported people to purchase these products.

Figure 2: CPI of China in the past 20 years [13].

Figure 2 shows the Consumer Price Index (CPI) during the last two decades. It can be seen that the CPI was stable from 2010 to 2019 (between the 2008 financial crisis and COVID-19), and China’s economy has been in a great situation. Under this situation, market segmentation has the access to attract customers to consume. One of the largest consumer groups of Sexy Tea is the students. As an investigation demonstrates, a total of 63% and 27% of the participants reported to drink respectively regular and diet soft drinks twice a week or more, and 24% and 8%, respectively, reported drinking soft drinks once a week or more at school [14]. Sexy Tea prefers to set up offline shops near schools and universities since the brand adopts the target concentration strategy so that the store operation, product quality, and raw material inventory can be effectively controlled [10]. This investigation also states that preferences, accessibility, modelling, and attitudes were the strongest determinants of drink consumption [14]. The elements in the design of Sexy Tea are filled with entertainment and the ancient style, which is popular in China and can be an advantage in market competition. Another characteristic of Sexy Tea to choose the target consumer is that it still regards Changsha as the core consumption area. It is known that China is a multi-cultural country, thus there exist different food habits in each region. Multinational corporations (MNCs) can be taken as an example in market expansion in China where a significant number of these MNCs invested in local manufacturing. As the number of corporations increased, they moved beyond the stage of initial entry and then had trouble facing stiff competition and instability. Overall, MNCs have achieved only limited success in penetrating the local markets [16]. There are over 400 local Sexy Tea shops, but only approximately less than 20 shops out of Changsha. The slow process of expansion seems to be a secure way in the situation, and Sexy Tea may make new creations for new market segmentation if there is a massive expansion in the future.

3.Conclusion

To sum up, Sexy Tea is one of the most successful tea brands in the past decade, and this paper introduces 3 marketing strategies it uses, namely brand marketing, hunger marketing, and market segmentation. Brand marketing is a core strategy of Sexy Tea, and it enriches brand connotation by holding various events. Sexy Tea is skilled in combining products and traditional cultural elements. Brand marketing is available to increase the brand value and build connections with consumers, but there are no quantified benefits, maybe the specific data can provide support from another aspect. Hunger marketing is a widely known strategy for consumers, however, Sexy Tea’s hunger marketing is distinct from the regular one. There exists inconvenience in Sexy Tea consumption, and it eliminates the negative effects by improving the quality of service. It should be noted that this strategy may not be useful to other brands, since the ‘hunger marketing’ of Sexy Tea is not the normalized form. The last one is market segmentation. Sexy Tea focuses on 3 types of target consumers—young students, literature lovers, and Changsha local customers. These choices make it keep in a stable condition, and this market segmentation can be deepened by building some models. Market segmentation trees (MSTs) is a general methodology, and it builds interpretable decision trees for joint market segmentation and response model, which can be used for a variety of personalized decision-making applications [17]. This is a more detailed way to accurately analyse the market and target consumers. In this paper, there are merely superficial analyses and simple summaries, nevertheless, the market is complicated, and more data and models can be tools for such a complex object in future research.

References

[1]. Garten, J. (1998) “The Big Ten: The Big Emerging Markets and How They Will Change Our Lives”, Basic Books, New York, NY.

[2]. Fan, Y. and Yan, K. (2022) “Opportunities and Challenges for the Development of New-style Milk Tea Drinking Industry in China-Take Sexy Tea as an Example”, 2022 2nd International Conference on Management Science and Industrial Economy Development (MSIED 2022).

[3]. Vranica, S. (2009) “WPP chief tempers hopes for ad upturn”, Wall Street Journal, 21 September, Section B, Column 1, 1.

[4]. Zarantonello, L. and Schmitt, B. (2013) “The impact of event marketing on brand equity”, International Journal of Advertising, 32(2), 255-280.

[5]. Miller, R.K. and Washington, K. (2012) “Event and experiential marketing”, in Miller, R.K. & Washington, K. (eds) Consumer Behaviour. Atlanta GA: Richard K. Miller & Associates, 427–429.

[6]. Guan, P.C. and Xiang, Y. (2016) “On the guiding effect of hunger marketing strategy on consumer behavior”, J. Commer. Econ., 4, 53–55.

[7]. Zhang, Z.F., Zhang, N. and Wang J.G. (2022) “The Influencing Factors on Impulse Buying Behavior of Consumers under the Mode of Hunger Marketing in Live Commerce”, Sustainability, 14, 2122.

[8]. Feng, H., Fu, Q. and Zhang, L. (2020) “How to launch a new durable good: A signaling rationale for hunger marketing”, Int. J. Ind. Organ, 70, 102621.

[9]. Fu, Y.W., Li X.H. and Liu X.S. (2021) “Based on SWOT Analysis to Explore the Marketing Strategy of Sexy Tea’s Inconvenience”, Advances in Economics, Business and Management Research, Atlantis Press, volume 203.

[10]. Wang, Y.C. (2020) “Analysis of the 4P marketing strategy of new-style tea drinks--Take Sexy Tea as an example.” Economist, 280-81.

[11]. Hu, Z.H. (2021) “Masses of People”- May Day travel Big Data Report 2021” was released, and Changsha was listed as one of the top ten tourist cities.” Changsha Evening News 5.5.

[12]. Chen, Y., Kuo, C.J., Jhan, Y.C. and Chiu, P.N. (2014) “Hunger marketing on smartphone”, Portland International Conference on Management of Engineering & Technology (PICMET), IEEE, pp. 1950-1957.

[13]. National Bureau of Statistics of China (2023). Available at: https://www.stats.gov.cn/zs/tjws/tjzb/202301/t20230101_1903757.html.

[14]. Bere, E., Glomnes, E.S., te Velde, S.J and Klepp, K. (2007) “Determinants of adolescents’ soft drink consumption”, Public Health Nutrition, 11(1), 49–56.

[15]. Cui, G. and Liu, Q.M. (2000) “Regional market segments of China: opportunities and barriers in a big emerging market”, Journal of Consumer Marketing, 17(1), 55-72.

[16]. Prahalad, C.K. and Lieberthal, K. (1998), “The end of corporate imperialism”, Harvard Business Review, 76(4), 68-79.

[17]. Aouad, A., Elmachtoub, A.N., Ferreira, K.J. and McNellis, R. (2023) “Market Segmentation Trees: Manufacturing & Service Operations Management”, 25(2), 648-667.

Cite this article

Liu,W. (2024). Research on the Marketing Strategy of Sexy Tea. Advances in Economics, Management and Political Sciences,78,13-18.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Garten, J. (1998) “The Big Ten: The Big Emerging Markets and How They Will Change Our Lives”, Basic Books, New York, NY.

[2]. Fan, Y. and Yan, K. (2022) “Opportunities and Challenges for the Development of New-style Milk Tea Drinking Industry in China-Take Sexy Tea as an Example”, 2022 2nd International Conference on Management Science and Industrial Economy Development (MSIED 2022).

[3]. Vranica, S. (2009) “WPP chief tempers hopes for ad upturn”, Wall Street Journal, 21 September, Section B, Column 1, 1.

[4]. Zarantonello, L. and Schmitt, B. (2013) “The impact of event marketing on brand equity”, International Journal of Advertising, 32(2), 255-280.

[5]. Miller, R.K. and Washington, K. (2012) “Event and experiential marketing”, in Miller, R.K. & Washington, K. (eds) Consumer Behaviour. Atlanta GA: Richard K. Miller & Associates, 427–429.

[6]. Guan, P.C. and Xiang, Y. (2016) “On the guiding effect of hunger marketing strategy on consumer behavior”, J. Commer. Econ., 4, 53–55.

[7]. Zhang, Z.F., Zhang, N. and Wang J.G. (2022) “The Influencing Factors on Impulse Buying Behavior of Consumers under the Mode of Hunger Marketing in Live Commerce”, Sustainability, 14, 2122.

[8]. Feng, H., Fu, Q. and Zhang, L. (2020) “How to launch a new durable good: A signaling rationale for hunger marketing”, Int. J. Ind. Organ, 70, 102621.

[9]. Fu, Y.W., Li X.H. and Liu X.S. (2021) “Based on SWOT Analysis to Explore the Marketing Strategy of Sexy Tea’s Inconvenience”, Advances in Economics, Business and Management Research, Atlantis Press, volume 203.

[10]. Wang, Y.C. (2020) “Analysis of the 4P marketing strategy of new-style tea drinks--Take Sexy Tea as an example.” Economist, 280-81.

[11]. Hu, Z.H. (2021) “Masses of People”- May Day travel Big Data Report 2021” was released, and Changsha was listed as one of the top ten tourist cities.” Changsha Evening News 5.5.

[12]. Chen, Y., Kuo, C.J., Jhan, Y.C. and Chiu, P.N. (2014) “Hunger marketing on smartphone”, Portland International Conference on Management of Engineering & Technology (PICMET), IEEE, pp. 1950-1957.

[13]. National Bureau of Statistics of China (2023). Available at: https://www.stats.gov.cn/zs/tjws/tjzb/202301/t20230101_1903757.html.

[14]. Bere, E., Glomnes, E.S., te Velde, S.J and Klepp, K. (2007) “Determinants of adolescents’ soft drink consumption”, Public Health Nutrition, 11(1), 49–56.

[15]. Cui, G. and Liu, Q.M. (2000) “Regional market segments of China: opportunities and barriers in a big emerging market”, Journal of Consumer Marketing, 17(1), 55-72.

[16]. Prahalad, C.K. and Lieberthal, K. (1998), “The end of corporate imperialism”, Harvard Business Review, 76(4), 68-79.

[17]. Aouad, A., Elmachtoub, A.N., Ferreira, K.J. and McNellis, R. (2023) “Market Segmentation Trees: Manufacturing & Service Operations Management”, 25(2), 648-667.