1. Introduction

Beginning in 2018, the epidemic period, economic factors do not have a clear relationship with the healthcare sector. The healthcare sector differs from real GDP, CPI, and other leading factors. During the first half year of 2023, the Healthcare Sector showed a poor performance, but the Healthcare Sector is recovering in the second half of the year [1]. The healthcare sector has shown a different increasing trend during COVID-19, which has led to a volatile growth trend until now. Therefore, it is still difficult for us to predict the future performance of the Healthcare sector, which makes investing more risky.

As one of the largest healthcare companies in the U.S., CVS Health Corporation provides both healthcare and retail pharmacy services. CVS provides prescription medications, beauty, personal care, cosmetics, and health care products for retailing. Beyond that, CVS also delivers healthcare plan services, which include pharmacy benefit management (PBM), disease management, and administrative services. There are four main segments in which CVS operates: pharmacy services, retail, health care benefits, and others.

Pharmacy Services is the largest segment of CVS, which accounts for 45 percent of total profits. CVS dispenses its drugs through particular pharmacy retail stores, specialty mail-order pharmacies, and mail-order dispensing pharmacies. CVS also operates medical branches. Most are ambulatory infusion sites, but some specialist infusion and enteral service facilities are also available. CVS also has other offerings, including plan design and administration, formulary management, discounted drug purchase arrangements, and several other services.

The retail segment is the second largest segment of CVS, which contains 30% of the total revenue. CVS is running over 9,000 pharmacies and 1100MinuteClinic locations. Pharmacy accounts for more than 75% of the total revenue for this segment, and “front store” stands for about 25%. MinuteClinics consists of nurse practitioners and physician assistants. They treat minor conditions, perform health screenings, and deliver vaccinations. Some locations even provide chronic conditions. The Health Care Benefits segment represents about 25% of the total revenue. CVS serves 35 million people for health care benefits. This segment provides traditional, voluntary, and consumer-directed health insurance products and related services.

Unlike other healthcare plan companies, CVS tries to provide more value to its customers and tries to bring this goal into its strategy. CVS wants to reconstruct consumers’ healthcare experiences to be more comfortable. CVS wants to provide consumers with a more accessible and more affordable healthy life. Instead of only focusing on healthcare, CVS is trying to improve the satisfaction level of providers and consumers. CVS uses a consumer-centric strategy that they believe will drive sustainable long-term growth and deliver value for all stakeholders.

Beyond the company itself, several recent news stories seem unfriendly to CVS. First, there is a lot of news about the healthcare insurance sector [2]. Since enhanced Obamacare subsidies will expire at the end of 2025, health insurance companies will face a potentially massive loss of revenue. The coming elections also bring the risks that the Republican Congress will revive Obamacare repeal. Though this restoration probably won’t happen, there is a more significant risk that enhanced marketplace subsidies may be phased out. The enhanced marketplace subsidies are always the catalyst for enrollment growth. Although health insurance is not the largest segment of CVS, the Health Care Benefits segment still represents 25% of the total revenue. CVS won’t be influenced as much as Centene and UnitedHealth, but CVS will still be significantly affected.

Secondly, CVS is facing much pressure from the public. There is a report that the tainted eye drops pulled by CVS made by barefoot workers in India, and these tainted eye drops will cause blindness [3]. Though eye drops are not an essential product of CVS, the loss caused by the pressure of publicity is immeasurable. What’s more, workers of CVS pharmacy are striking for “dangerous” workloads [4]. According to those workers, the increased workload and cut hours are the main reasons for the medication errors, and those errors can be fatal. All this news could bring a lot of publicity pressure. Also, there are some negative events inside the company. Considering the volatile situation of the Healthcare Sector, CVS wants to reduce store density in certain areas. CVS plans to close 900 stores by the end of 2024 to cut costs and avoid losses [5]. In 2023, CVS Health completed the acquisition of Signify Health, which may influence the company’s financial statement for 2023.

2. Accounting Analysis

CVS published the most recent 10-Q form of CVS on September 30, 2023, and the accounting analysis is based on the latest 10-Q form. Revenue recognition and Acquisitions and Assets Held for Sale are essential to assess the financial statements to the situation and recent events of CVS. Thus, the accounting analysis will be around these two areas.

2.1. Revenue Recognition

As a company focuses on many different businesses, the disaggregation of revenue is complex [6]. The 10-K form has disaggregated the company’s revenue into five significant sources: Health Care Benefits, Health Services, Pharmacy and consumer Wellness, Corporate/Other, and Intersegment Eliminations. To differentiate the revenue sources, CVS makes it easier to judge the company’s financial statement and the impact of recent news on specific areas. CVS has also provided the retail balance sheet of receivables and contract liabilities from customer contracts. Because of the retail business, CVS provided the redemption of ExtraBucks Rewards or Company gift cards and breakage of Company gift cards.

Generally, compared to competitors, CVS has provided detailed information about revenue recognition. Investors can recognize the influence of news and events on the company’s financial statements.

2.2. Acquisitions and Assets Held for Sale

On May 2, CVS used cash to purchase the entire ownership, including 100% of the outstanding shares and voting interest of Oak Street Health. In the 10-Q form, CVS has shown the very detailed transaction sheet of the purchasing action.

However, as the 10-Q form mentioned, the preliminary evaluation of fair value relies on information accessible to management during the preparation of the unaudited condensed consolidated financial statements. Key areas under review include the treatment of income taxes and contingencies. Management is awaiting further details to conclude their assessment of these aspects. Adjustments during the measurement period will be reflected in the period when determined, as though they were finalized at the acquisition date. Completing the company’s purchase accounting assessment may lead to material changes in the valuation of acquired assets and assumed liabilities [7]. Generally, the Acquisitions and Assets Held for Sale may be inaccurate, but it is enough for investors to evaluate a preliminary financial statement.

3. Performance Evaluation

3.1. Key Data

CVS has a low WACC, which is only 5.1%. The low rate implies that CVS can obtain financing at a lower overall cost, indicating that CVS has a high and stable profitability. A lower WACC rate also brings the ability to outperform competitors by undertaking projects that generate positive returns even at a lower risk-adjusted rate. The annual dividends have been quite stable in recent years: from 2017-2021, they are all $2.00. The annual dividend has grown in 2022, but only at a low rate: from $2.00 to $2.20. Based on the history of CVS, the performance of dividends may still be stable.

CVS has had a strong performance in free cash flow for both now and history. After 2019, CVS's free cash flow was always above 10,000 million. Though the free cash flow is lower in 2022, which was only 4190 million, based on the prediction, the future free cash flow will recover soon. The healthy free cash flow shows that CVS has a healthy financial system, flexibility, and liquidity. Moreover, using free cash flow to calculate the stock price is higher than the market price, further indicating that CVS has a strong free cash flow performance.

The performance of enterprise value is interesting. The ratios of EV/EBITDA, EV/EBIT, EV/SALES, and EV/FCF are all lower than their historical average, which means the company is valued more attractively about its earnings. However, the main reason for the good ratios is the decreasing enterprise value. In 2021, the enterprise value was 200,158 million, but it went down to 151,178 million for the last 12 months. Therefore, the data couldn’t show CVS's real enterprise value situation. However, based on the prediction, the EV ratios will perform even better.

3.2. Ratios and Comparing with Competitors

From 2019 to 2022, the current ratio will always be around 0.90. The current ratio is 0.86 for the last 12 months. The quick and cash ratios are also stable, around 0.60 and 0.20 for recent years. As a huge and regular company, CVS did well in keeping good liquidity; investors do not need to worry about the health of financial statements.

Compared to competitors, CVS’s liquidity ratios are at a high level. In the healthcare sector, Merck shows the best performance in terms of liquidity, which has the highest data for all current, quick, and cash ratios. However, as a huge and stable company, CVS shows that it has a healthy system of liquidity, which can help it have enough resources to deal with various contingencies.

There was a huge increase in Total Debt to Total Assets and LT Debt to Total assets ratio. CVS incorporated Aetna in 2018 and 2019, so the financial statement of that year is a little strange. However, after 2019, these two ratios slowed down and became more stable. For the last 12 months, the Total Debt to Total Assets ratio has been 31.87, and the LT Debt to Total assets ratio has been 24.64. These changes indicate that CVS has had better solvency in recent years. Compared to competitors, CVS’s liquidity ratios are at a middle level. UnitedHealth Group Inc shows a strong performance solvency. Their Total Debt to Total Assets ratio in the last 12 months is only 22.47, much lower than CVS’s. However, CVS’s performance is still at a middle level compared to other competitors.

Due to the company’s history, in 2018, the EBIT to Interest Expense and Profit margin ratios of CVS were quite low. From 2019-2021, these ratios increased and became more stable. However, because of the coming election and the expiration of the enhanced Obama healthcare, EBIT to Interest Expense and Profit Margin decreased significantly that year. For the last 12 months, these two ratios were higher, which shows that CVS is recovering from the recent volatile situation. Compared to competitors, CVS’s profitability ratios are at a low level. Walgreens Boots Alliance Inc. shows an even worse performance than CVS: both EBIT to Interest Expense and Profit Margin ratios are negative. However, both Merck and UnitedHealth Group show much higher ratios than CVS. Though CVS’s ratios are lower than those of its competitors, since 2018, CVS has shown a middle level in value compared to its historical data.

After 2018, Asset Turnover ratios were around 1.3, ROE ratios were around 14, and ROA ratios were around 4. However, ROE and ROA ratios in the last 12 months were much lower, at 7.98 and 0.61, respectively. This decline is probably due to the volatile situation, as mentioned before. However, as a huge and stable company, CVS can recover soon. According to the prediction, both ROE and ROA ratios will recover to the normal level in 2023. CVS’s investment ratios are high in the healthcare sector compared to competitors. UnitedHealth Group Inc. is the only company that performs better than CVS. Moreover, if the prediction is accurate, the CVS will perform better in the future.

CVS has a low Expected EPS growth Rate and a high PEG Ratio compared to its competitors, as Table 1 shown. These ratios indicate that CVS's stock price will increase at a relatively low rate compared to its competitors. The P/E ratio, which is lower than its competitors, is an advantage of CVS. However, due to the historical data, CVS always had lower P/E ratios than its competitors. CVS may still be stable, but its growing speed will be slower than its competitors.

Table 1: Forecast ratios.

Name | TTM Earnings | RTM Earnings | TTM P/E RATIO | RTM P/E RATIO | Expected Growth Rate in EPS | Revenue growth rate | PEG Ratio | Profitability ratios |

United Healthcare | 24.3 | 26.95 | 21.88 | 19.73 | 10.91% | 13.73% | 2.01 | 32.40% |

Anthem | 32.72 | 35.76 | 13.65 | 12.49 | 9.29% | 8.81% | 1.47 | 26.31% |

CVS | 8.49 | 8.62 | 8.1 | 7.97 | 1.53% | 9.50% | 5.29 | 23.78% |

Cigna Corporation | 22.54 | 26.46 | 13.73 | 11.69 | 17.39% | 6.49% | 0.79 | 16.31% |

4. Forecasting

4.1. Stock Price

CVS's stock price has dropped very quickly in one year, mainly due to the uncertainty created by recent elevated utilization trends within CVS’ Medicare Advantage business [8]. However, according to a recent analysis, this trend of decline will stop soon. The 12-month target price of CVS shows that the price will go up to somewhat higher than now: $66.74, at most to $100.

Reflecting on the recent news about the Healthcare Insurance industry, it’s normal to see the stock price drop. However, since investors started to realize that Republicans will probably abandon their fight to repeal Obamacare, and the price is about to drop to the lowest point, the price will likely rebound [9]. Since CVS has a healthy cash flow and a stable financial system, it will probably recover from the recent bad news.

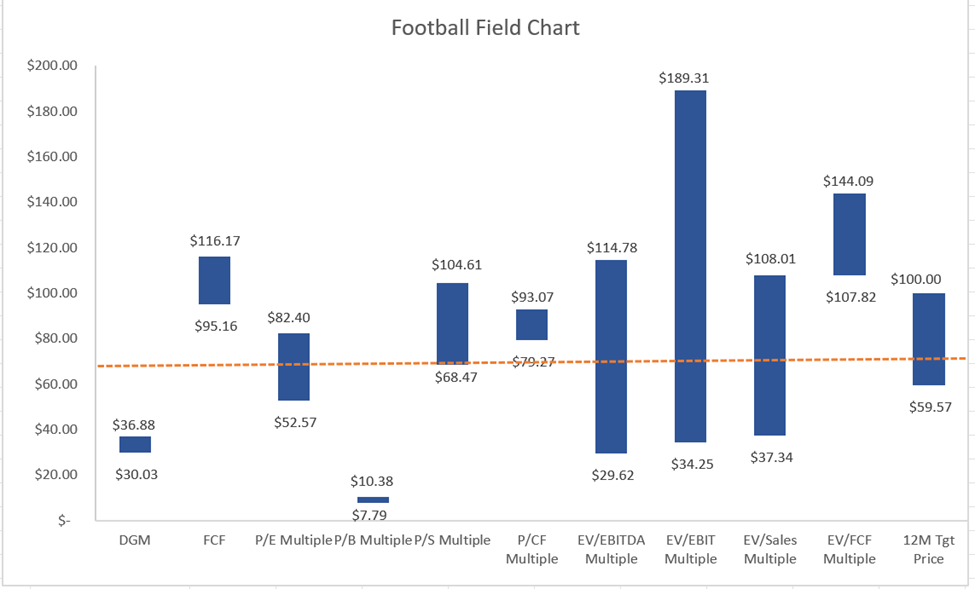

According to different models, the price varies a lot. As shown in Figure 1, DGM, and P/E, multiple models show that the intrinsic price of the stock is much lower than the market price, but the EV/EBIT Multiple shows that the stock price is much lower than the stock's intrinsic value. The performance of enterprise value is attractive. The ratios of EV/EBITDA, EV/EBIT, EV/SALES, and EV/FCF are all lower than their historical average, which means the company is valued more attractively about its earnings. However, the main reason for the good ratios is the decreasing enterprise value. In 2021, the enterprise value was 200,158 million, but it went down to 151,178 million for the last 12 months. Therefore, the data couldn't show CVS's actual enterprise value situation. Generally, as mentioned before, these models cannot reflect the actual intrinsic price of CVS's stock. Due to the negative news and the company's strategies, the main prediction in the market is overestimating CVS's stock.

Figure 1: Football field chart (Picture credit: Original).

4.2. Strategic Plan & Risks

In 2023, CVS will trim down its retail footprint while simultaneously expanding into other sectors. The collaboration between Oak Street and Signify with CVS has the potential to enhance synergy, resulting in a boost in market share that could contribute to increased revenue and operating income, ultimately fostering a turnaround [10].

The 10-K form of CVS has listed many risk factors. The uncertainty surrounding the impact of COVID-19 on businesses, operating results, cash flows, and financial conditions still raises concerns, with the potential for material and adverse consequences. Therefore, it’s still hard for CVS to accurately forecast health care and other benefit costs. Moreover, adverse economic conditions in the U.S. and abroad have the potential to affect the company’s businesses, operating results, cash flows, and financial condition significantly and adversely. Also, each company segment operates within a highly competitive and ever-evolving business environment [11]. As mentioned, changes in the Health Care Benefits product mix may adversely affect profit margins, and the company cannot guarantee success and profitability on Public Exchanges. Pressure from the public is also a huge risky factor: negative public perception of the industries in which the company operates can adversely affect its businesses, operating results, cash flows, and prospects. The company must consistently maintain and enhance customer relationships while increasing its product and service demand. Under the existing market situation, CVS has to navigate risks related to the availability, pricing, and safety profiles of prescription drugs purchased and sold.

5. Conclusion

In conclusion, while recent challenges have cast a shadow on CVS, the company's diversified portfolio and robust performance in other sectors, such as Pharmacy Services and Retail, mitigate the potential impact of setbacks in the health insurance sector. The comprehensive accounting analysis underscores CVS's resilience as a major player in the market. Despite short-term fluctuations evident in the last 12 months, the company's stability and size indicate a strong likelihood of a swift recovery. Even in the face of external uncertainties, CVS exhibits commendable ratios, reflecting its ability to navigate challenging environments. The data further highlights that the current undervaluation of the stock presents an attractive opportunity for investors. Projections indicate a positive trajectory for CVS, suggesting that its stock has the potential for upward movement in the future. CVS emerges as a stable and promising investment option, characterized by a relatively low and steady rate. Investors can find reassurance in the company's resilience, diverse revenue streams, and positive forecasts, affirming CVS's status as a favorable long-term investment within the dynamic landscape of the market.

References

[1]. Kaye, A. D., Okeagu, C. N., Pham, A. D., Silva, R. A., Hurley, J. J., Arron, B. L., Sarfraz, N., Lee, H. N., Ghali, G., Gamble, J. W., Liu, H., Urman, R. D., & Cornett, E. M. (2021). Economic impact of COVID-19 pandemic on healthcare facilities and systems: International perspectives. Best Practice & Research Clinical Anaesthesiology, 35(3), 293–306.

[2]. Carlton, S., Lee, M., & Prakash, A. (2022). Insights into the 2022 individual health insurance market. McKinsey & Company. https://www.mckinsey.com/industries/healthcare/our-insights/insights-into-the-2022-individual-health-insurance-market

[3]. Carballo, R. (2023). Eyedrops from major brands may cause infection, F.D.A. says. The New York Times. https://www.nytimes.com/2023/10/29/us/eyedrops-fda-warning.html

[4]. Sainato, M. (2023). US pharmacy workers strike over ‘dangerous’ workloads as CVS and Walgreens rake in profits. The Guardian. https://www.theguardian.com/business/2023/oct/19/cvs-walgreens-strike-pharmacy-workers

[5]. Warburton, J. (2023). CVS is permanently closing hundreds of stores for a surprising reason. TheStreet. https://www.thestreet.com/retailers/cvs-is-permanently-closing-hundreds-of-stores-for-a-surprising-reason

[6]. Caylor, M. L. (2010). Strategic revenue recognition to achieve earnings benchmarks. Journal of Accounting and Public Policy, 29(1), 82–95.

[7]. Paugam, L., Astolfi, P., & Ramond, O. (2015). Accounting for business combinations: Do purchase price allocations matter? Journal of Accounting and Public Policy, 34(4), 362–391.

[8]. Pifer, R. (2023). CVS beats expectations in Q3, but high costs weigh on profit outlook. Healthcare Dive. https://www.healthcaredive.com/news/cvs-health-caremark-ma-utilization-q3-2023/698365/

[9]. Republicans abandon Obamacare repeal. (2022). NBC News. https://www.nbcnews.com/politics/congress/republicans-abandon-obamacare-repeal-rcna49538

[10]. Smith, J. (2023). Trimming the Retail: The investment outlook for CVS’s growth strategy. International Journal of Business & Economic Development, 11(02).

[11]. Guo, K. H., & Eschenbrenner, B. (2018). CVS Pharmacy: An instructional case of internal controls for regulatory compliance and IT risks. Journal of Accounting Education, 42, 17–26.

Cite this article

Guo,H. (2024). Financial Analysis and Forecast of CVS Pharmacy, Inc.. Advances in Economics, Management and Political Sciences,76,197-203.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kaye, A. D., Okeagu, C. N., Pham, A. D., Silva, R. A., Hurley, J. J., Arron, B. L., Sarfraz, N., Lee, H. N., Ghali, G., Gamble, J. W., Liu, H., Urman, R. D., & Cornett, E. M. (2021). Economic impact of COVID-19 pandemic on healthcare facilities and systems: International perspectives. Best Practice & Research Clinical Anaesthesiology, 35(3), 293–306.

[2]. Carlton, S., Lee, M., & Prakash, A. (2022). Insights into the 2022 individual health insurance market. McKinsey & Company. https://www.mckinsey.com/industries/healthcare/our-insights/insights-into-the-2022-individual-health-insurance-market

[3]. Carballo, R. (2023). Eyedrops from major brands may cause infection, F.D.A. says. The New York Times. https://www.nytimes.com/2023/10/29/us/eyedrops-fda-warning.html

[4]. Sainato, M. (2023). US pharmacy workers strike over ‘dangerous’ workloads as CVS and Walgreens rake in profits. The Guardian. https://www.theguardian.com/business/2023/oct/19/cvs-walgreens-strike-pharmacy-workers

[5]. Warburton, J. (2023). CVS is permanently closing hundreds of stores for a surprising reason. TheStreet. https://www.thestreet.com/retailers/cvs-is-permanently-closing-hundreds-of-stores-for-a-surprising-reason

[6]. Caylor, M. L. (2010). Strategic revenue recognition to achieve earnings benchmarks. Journal of Accounting and Public Policy, 29(1), 82–95.

[7]. Paugam, L., Astolfi, P., & Ramond, O. (2015). Accounting for business combinations: Do purchase price allocations matter? Journal of Accounting and Public Policy, 34(4), 362–391.

[8]. Pifer, R. (2023). CVS beats expectations in Q3, but high costs weigh on profit outlook. Healthcare Dive. https://www.healthcaredive.com/news/cvs-health-caremark-ma-utilization-q3-2023/698365/

[9]. Republicans abandon Obamacare repeal. (2022). NBC News. https://www.nbcnews.com/politics/congress/republicans-abandon-obamacare-repeal-rcna49538

[10]. Smith, J. (2023). Trimming the Retail: The investment outlook for CVS’s growth strategy. International Journal of Business & Economic Development, 11(02).

[11]. Guo, K. H., & Eschenbrenner, B. (2018). CVS Pharmacy: An instructional case of internal controls for regulatory compliance and IT risks. Journal of Accounting Education, 42, 17–26.