1. Introduction

Affected by the popularity of COVID-19, the high inflation rate in Germany has attracted social attention in the post-flow era. Therefore, the German monetary authorities have triggered the research of most scholars on the target positioning of inflation and the monetary policy and impact of Germany. This paper is divided into the following four parts: the first part is to analyze the adaptive monetary policy theory. The quantity theory of money can be used to explain German monetary policy. The second part is about the monetary policy actions adopted by the German monetary authorities after COVID-19. Germany is the most important economy in the European Union, and as one of the countries in the euro area, Germany follows the various monetary policies promulgated by the European Central Bank. For example, carrying out the PEPP plan, keeping borrowing affordable, supporting access to credit for firms and households, ensuring short-term concerns do not prevent lending, and increasing banks' lending capacity. In addition, Germany has itself special monetary policies, such as releasing the bank's anti-cyclical capital buffer, reintegrating the company's short-term liquidity supply, and allocating euros to the Newly Created Economic Stabilization Fund (WSF) to directly acquire the equity.

The third part is the impact of monetary policy on German society including inflation, unemployment, and real estate. The fourth part is the reason for discussing the failure of monetary policy. It may be due to external political factors such as the Russian and Ukraine Wars that caused German monetary policy to fail in the short term. Finally, it can be concluded that monetary policy is not the only factor affecting the economy, and political and external factors are other forces to determine the economy.

2. Monetary policy theory

The quantity theory of money (usually abbreviated as QTM) is a theory of economics. It originated in the 16th century and is the oldest economics theory [1]. The quantity theory of money refers to the overall price level of goods and services proportional to the number of currencies in circulation. The quantity theory of money is usually expressed in the equation \( MV=PY \) . M is the currency supply, V is the currency circulation speed, P is the price index, and Y is the actual output. The quantity theory of money is a new debate on the relationship between currency growth and inflation. In this case, it can be used to explain inflation. Some critics believe that the rise of inflation is a proof of the effectiveness of currency. The core of the quantity theory of money is that there is a long-term relationship between currency growth and inflation [2]. The occurrence of inflation and tightening is proportional to the increase in currency supply. Although the quantity theory of money was very popular in the 1980s, as time passed, people found that strict compliance with currency supply control could not solve the problem of economic slowdown. Pinter found that the link between money growth and inflation weakens over time in 2021 [3]. After the COVID-19, a study of Greece showed that the eurozone countries also need to conduct QTM empirical analysis, and QTM is valid for the eurozone countries. It can be used to test the impact of the total currency contributions of each eurozone and the European Central Bank's total currency contribution on the inflation rate of these euro countries [4].

3. Monetary policy actions

The monetary authorities of the eurozone economy aim to maintain stability and maximum employment. The German monetary authorities hope to control the target of inflation by 2% [5].

3.1. European Central Bank’s action

Extraordinary times need extraordinary measures. The European Central Bank adopted the following measures to support the economy of the eurozone. This includes the impact of helping the economic absorption of the current crisis, keeping borrowing affordable, supporting enterprises and families to obtain credit, ensuring that short-term concerns will not hinder lending, and improving bank loan capacity [5].

3.1.1. Help the economic absorption of the current crisis

In order to cope with the outbreak of COVID-19, the failure of the monetary policy transmission mechanism and the serious risk to the economic prospects of the eurozone. The European Central Bank invested 18.5 trillion euros in March 2020 to launch a non-standard monetary policy measure for pandemic emergency purchase plans (PEPP) [5]. PEPP is a temporary asset purchase plan for private and public sector securities, which allows the European Central Bank to purchase different types of assets in the financial market [5]. The purpose of this measure is to reduce the borrowing costs of the euro area and increase loans. More specifically, when the European Central Bank purchases bonds directly from the bank, more funds can be provided so that the bank can loan from families or enterprises. By doing so, the price of assets rises, thereby reducing market interest rates. All of this reduces the cost of lending to people, enterprises, and governments, and promotes the economy. In addition, the European Central Bank can also purchase corporate bonds to provide other credit sources. This helps citizens, enterprises, and governments obtain the funds required for emergencies and also helps stimulate consumers' expenditure and investment and support economic growth.

3.1.2. Keep borrowing affordable

Interest rates will affect loan costs. When interest rates are low, the cost of lending is also low, which will attract more investment. The Central Bank of Europe maintains its main interest rate at a historical low, making it easier for individuals and companies to borrow funds and support expenditure and investment. Among them, the main interest rate includes the main recycling operation (MRO) interest rate for banks that can provide banks with a large amount of liquidity funds [5]. Banks can be used to deposit the interest rate for overnight deposits in the euro system.

3.1.3. Supporting access to credit for firms and households

The Central Bank of Europe has reduced the standards of mortgage loans to the greatest extent and increased bank loans. After the outbreak of COVID-19, the economy declined, and the European Central Bank extended its support for banks lending to the real economy through targeted loan operations in December 2020. More specific measures are that the preferential interest rate period for banks that lend to the real economy will be extended from 12 months to June 2022, and the borrowing subsidy will be increased to 55% of the qualified loan [5]. These measures make it easier for banks to issue loans to those who are most affected by COVID-19, especially small and medium-sized enterprises. In this way, small and medium-sized enterprises have more economic capabilities to fight the economic crisis and have more turnover funds. In this case, economic transactions are more flexible and can better survive economic difficulties.

3.1.4. Ensuring short-term concerns do not prevent lending

The goal of the European Central Bank is to provide real-time borrowing options with preferential interest rates to help solve any temporary financing problems with solvency [5]. This can solve the difficulties banks face in meeting the difficulties required by the public during the economic downturn and uncertain periods. This monetary policy is conducive to banks with loans to citizens and enterprises.

3.1.5. Increasing banks' lending capacity

To cope with the buffer of difficult periods, the European Central Bank has relaxed strict requirements for banks holding money and gives banks greater flexibility in various procedures. This measure helps the eurozone bank focusing on the important role of its lender during the COVID-19 [5]. For example, the European Central Bank coordinated a further increase in the supply of dollar liquidity, and the ECB established swap lines with foreign banks to provide euro liquidity [5].

3.2. German monetary authorities' actions

In addition to the measures at the eurozone level, the German monetary authorities also adopted additional monetary policy measures to alleviate the phenomenon of economic overheating. The International Monetary Federation announced the policies and measures for COVID-19. The first measure taken by the German monetary authorities was to release the bank's anti-cyclical capital buffer from 0.25% to 0. When judging whether cyclical systemic risks are rising, financial institutions should accumulate capital to buffer economic pressure to enhance the banking industry's ability to resist during the pressure period. The second measure is to reintegrate the company's short-term liquidity supply. An additional 100 billion euro to refinance expanded short-term liquidity provision to companies through the public development bank KfW, in partnership with commercial banks. The third measure is to allocate 100 billion euros to the Newly Created Economic Stabilization Fund (WSF) to directly acquire the equity of affected companies and enhance their capital status [5].

4. The impact of monetary policy on German society

4.1. Inflation

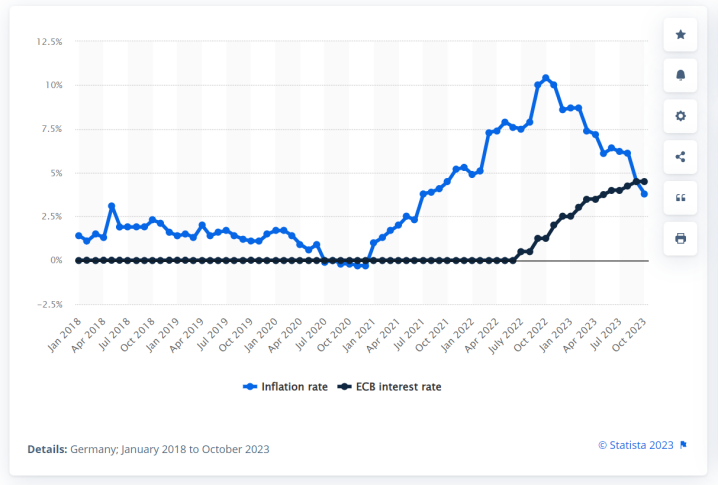

Figure 1 shows the average inflation rate of Germany from 2018 to 2023 and the interest rate data released by the European Central Bank [6]. The blue curve represents the inflation rate, and the black curve represents the interest rate released by the ECB. From the chart, we can see that the growth rate of the inflation rate is significantly higher than that of interest rates. This can solve the difficulties banks face in meeting the difficulties required by the public during the economic downturn and uncertain periods. As of now, the inflation rate has fallen to 3.8%, and there is still a certain gap between the goal of 2% of the inflation rate of German monetary authorities. Inflation has increased so rapidly that it is unprecedented. The European Central Bank and the German monetary authorities immediately adopted a tightening of interest rate hikes to alleviate the overheated economy. However, it is not difficult to see from the figure that the inflation rate has not occurred since the monetary policy adopted in April 2022, and the inflation rate has not appeared in the same trend as expected.

Figure 1: Average inflation rate and European Central Bank (ECB) interest rate in Germany from January 2018 to October 2023

4.2. Unemployment

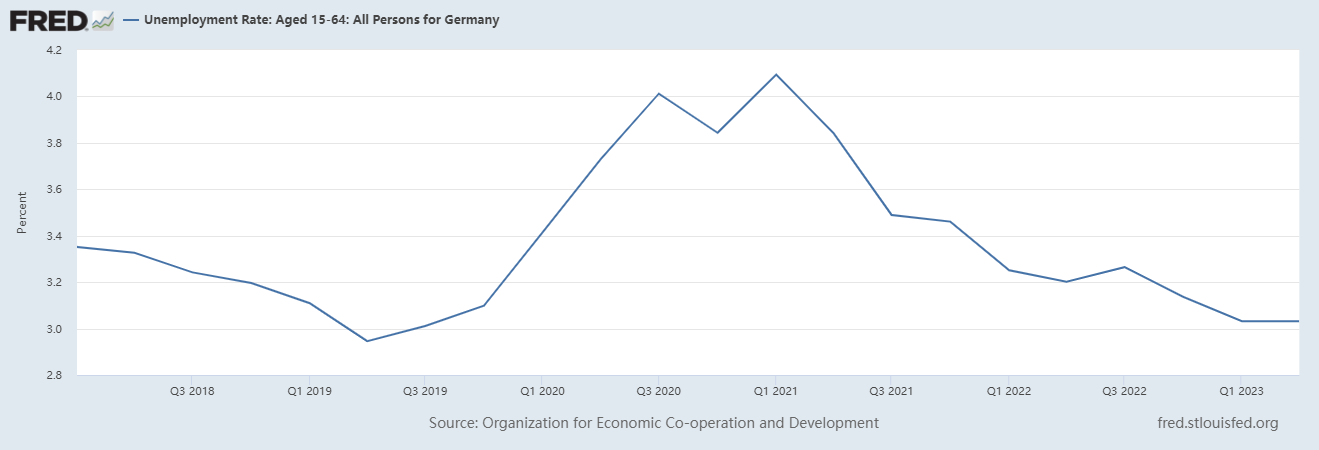

Since the beginning of COVID-19, the prospects of the labor market have attracted widespread attention from the whole society. As we all know, almost global employment has been hit after the COVID-19. The economic impact caused by COVID-19 is as global as the health crisis itself. Figure 2 shows the unemployment rate of people aged 15 to 64 years old in Germany from 2018 to 2023 [7]. The overall curve follows a mountain trend, with the influence of unemployment rates for people aged 15 to 64 peaking after the COVID-19 pandemic in 2020 and falling from 2021 onwards. The reason is that the big blockade of cities under the epidemic brought a serious environment to the economy and many corporate failures, so many employees were forced to be dismissed.

Figure 2: The unemployment rate of people aged 15 to 64 years old in Germany from 2018 to 2023

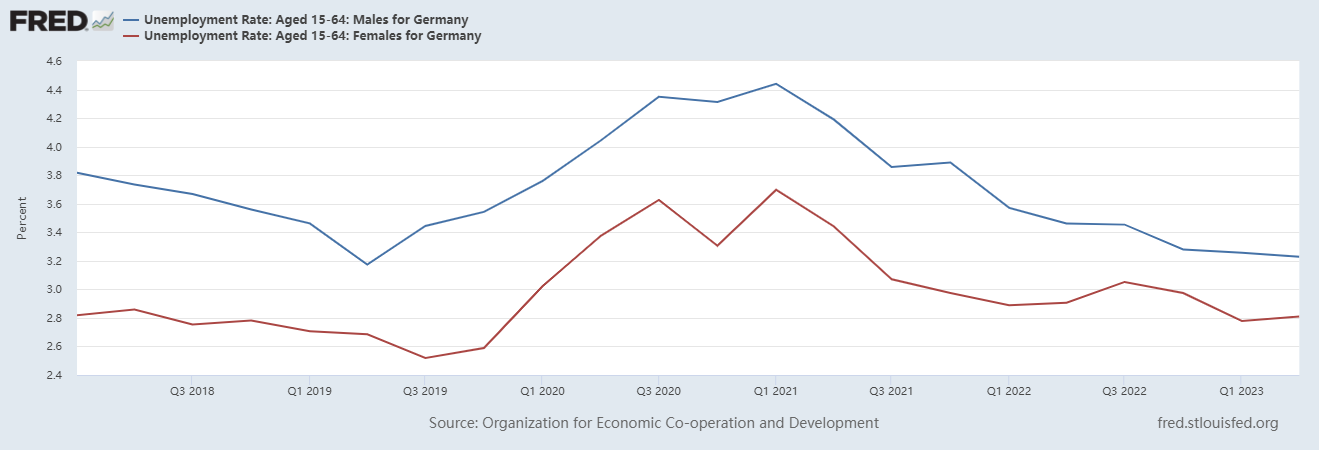

Understanding the unemployment rate can be more intuitive to compare the unemployment rate into two groups of males and females. The blue curve in Figure 3 represents the males' unemployment rate, and the red curve represents the females' unemployment rate [7]. From this figure, it can be clearly seen that male unemployment rates are higher than females at any time. Due to the impact of the COVID-19, the unemployment rate has reached its peak in 2020. Generally speaking, males are mainly engaged in product production industries such as construction and manufacturing, while most females work in the service industry and government departments [8]. Germany is one of the world's largest exporters and has the largest manufacturing economy in Europe, which is famous for its heavy industry [9]. Therefore, in the case of a large blockade of the COVID-19, the exports were blocked, resulting in a sharp decline in manufacturing, the closure of manufacturing companies, or a reduction in labor positions, which caused an increase in males' unemployment rates.

Figure 3: The unemployment rate of people aged 15 to 64 years old males and females in Germany from 2018 to 2023

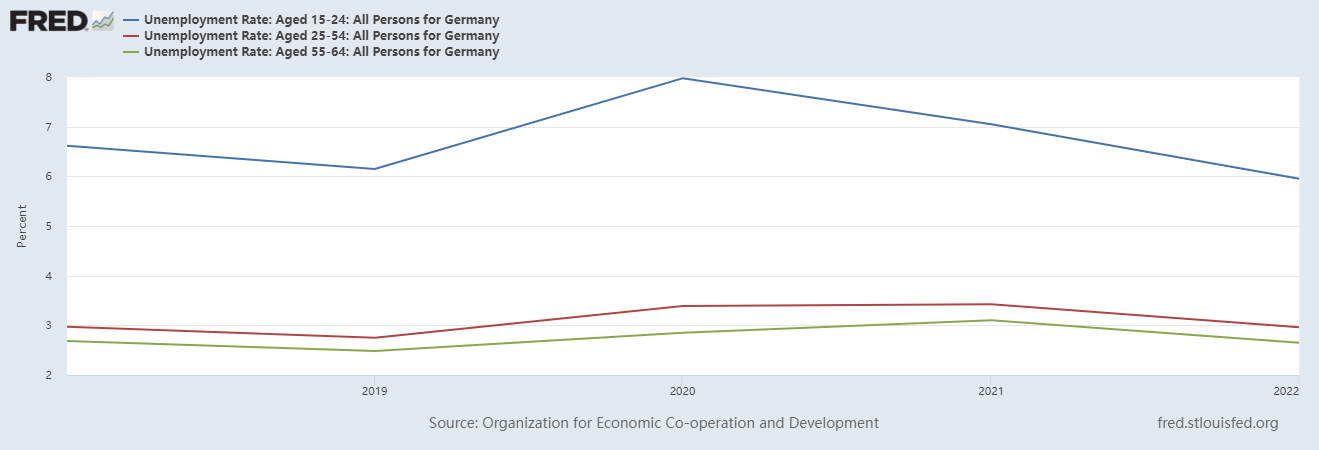

People's curiosity about employment after COVID-19 will extend to the unemployment rate, which is of concern to all ages. Figure 4 divides the German unemployment rate into three parts according to age [7]. The blue curve represents 15 to 24 years old, the red curve represents 25 to 54 years old, and 55 to 64 years old is represented by a green curve. It is not difficult to see from the picture that Germany's unemployment rate at 15 to 24 years old is higher than other ages. The reason for the economic level may be that during the recession of the economy of the COVID-19, German companies cannot support daily expenses due to economic downturn. Therefore, the enterprise has made a large number of layoffs to provide fewer jobs to achieve the purpose of reducing labor costs. In addition, the reason for the high unemployment rate of young people aged 15 to 24 may be due to the lack of work experience. Due to the need to pay a lot of time and labor costs to cultivate young people who are proficient in a job. During the period when the COVID-19 was popular, companies did not have extra time and energy to cultivate young people. Therefore, the possibility of firing young people is more, which has led to an increase in the unemployment rate of young people.

Second, the age of 15 to 24 is in the study period. Due to the popularity of the COVID-19, a large number of enterprises have closed or reduced their job’s opportunities. Many graduates have fewer opportunities to enter their jobs after graduation, facing the situation of unemployment when they graduate. Third, Christian Hohendanner's research on regular contracts in Germany showed that compared with the crisis, the contract for contracts holding non-standard employment contracts was low and the termination frequency was high, so the unemployment rate rose [10]. This is consistent with the trend of unemployment of young people in the early days of the COVID-19 period.

Figure 4: The unemployment rate of people aged 15 to 64 years old in Germany from 2018 to 2023

4.3. Real estate market

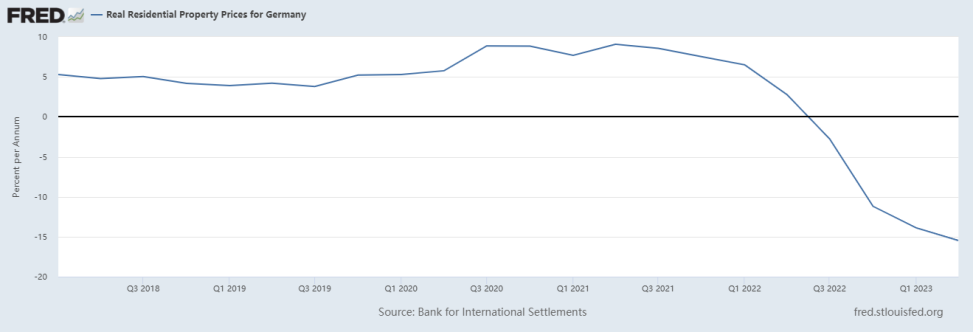

COVID-19 has had a devastating impact on the German economy. Even real estate, which is usually not affected by market fluctuations, is unstable due to the impact of coronal virus. Germany is the country with the largest population in Europe, making it one of the largest participants in the real estate market. First of all, pay attention to the price of residential real estate. From Figure 5, it can be seen that the residential price has shown a downward trend from 2018 to 2023 [11]. Since the first quarter of 2020, it has risen slightly. Since the influence of the COVID-19 and German monetary policy, the residential prices in the first quarter of 2022 began to quickly decrease from 6.5% to -15% in the second quarter of 2023. The reason for the slight rise in 2020 may be that the global economy has suffered the COVID-19, which has hit the price of urgent need for economic aversion and pushing up residential real estate. The economic reason for the plunge in German residential real estate prices is that since July 2022, the European Central Bank continued to raise interest rates 10 times until the fourth quarter of 2023. Investors were in an uncertain interest rate environment, and many possible commercial negotiations were forced to be suspended. The heavy pressure of high-interest rates has led to an increase in loan pressure from German real estate agents. Under the implementation of the tightening monetary policy of continuous interest rate hikes, expensive real estate prices reduce real estate investment. Therefore, the cost of high-interest rates and rising materials has a negative impact on the real estate market of the largest economy in Europe. Therefore, in an environment of economic depression and rising unemployment, adopting a tightening monetary policy will have a significant negative impact on the growth rate of house prices [12].

Figure 5: Real Residential Property Prices for Germany

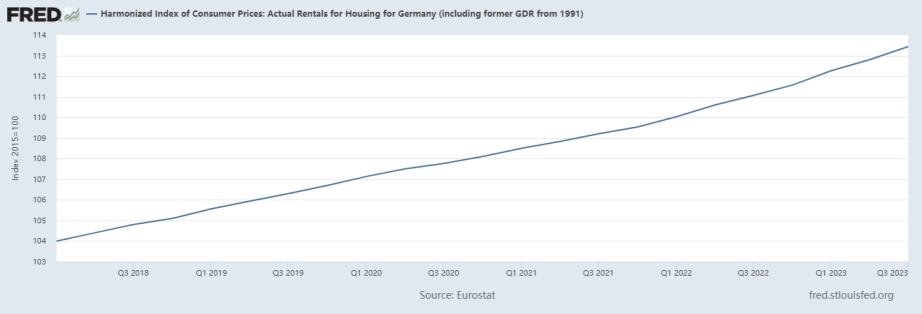

As many potential buyers avoid the expensive real estate trading market, the leasing market has become more hot. It can be seen from Figure 6 that the rent price has risen rapidly since 2018 [13]. Although the house prices in Germany have fallen since 2022 because people are experiencing high inflation, high-interest rates, and an economic downturn. The general purchasing power of the people has not improved, and the high cost of living forced people to have more possibilities to rent instead of purchasing house property. This is also proof of the rising price of the German leasing market under the dual influence of the COVID-19 and the European Central Bank's interest rate hike.

Figure 6: Harmonized Index of Consumer Prices: Actual Rentals for Housing for Germany (including former GDR from 2018 to 2023)

5. Discussion of the causes of monetary policy failure

5.1. The Russian and Ukraine Wars

First of all, in terms of inflation, the major reason for the failure of monetary policy in 2022 was due to the external environmental factors of the Russian and Ukraine Wars. The Russian and Ukraine Wars cut off the Nord Stream pipeline and embargoed food and resources from the war zones, which brought about rising grain and energy prices, which also caused German inflation [14].

5.2. Food price index

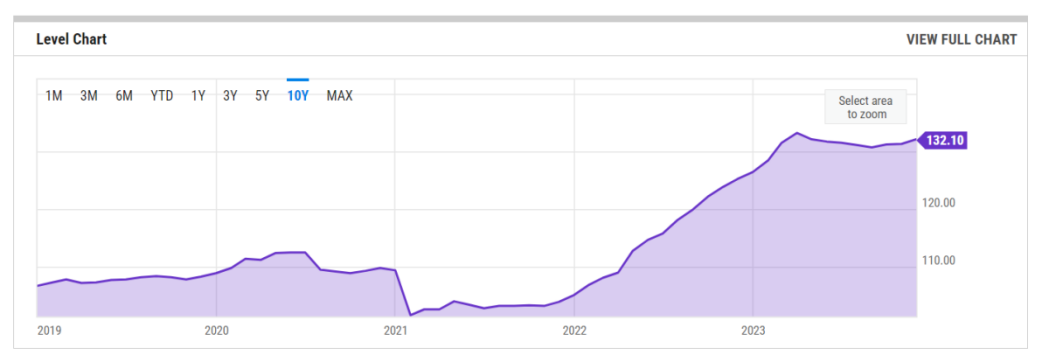

Figure 7 shows that the food price index of Germany from 2019 to 2023 has shown a rising trend of well-spraying since 2022 [15]. The significant rise in food prices is a rise in price levels from another level, which only occurs under the circumstances of overheating.

Figure 7: Germany Consumer Price Index: Food

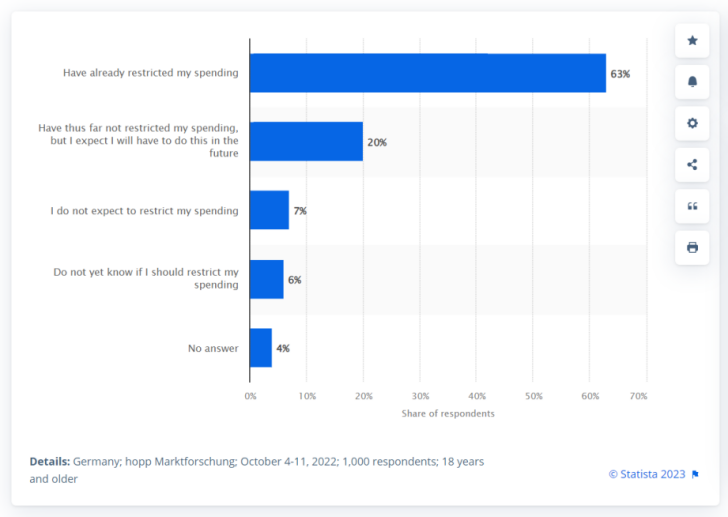

A problem raised by a survey shown in Figure 8 is that the rise in energy prices has led to rising prices in many areas. How much does this affect your (consumer) expenditure? 63% of the recipients said they had started to restrict their expenses [16]. This can be proved by the amount of currency. The equation of the quantity theory is \( MV=PQ \) . Rising energy prices at present and restricting consumption mean a decrease in currency circulation. If the currency supply in the market is constant, only when the number of goods in the market decreases, the equivalence is balanced, which means that the total supply in the market decreases reduction. Essentially, the above conclusions are consistent with the theoretical results of the quantity theory of money.

Figure 8: A Survey: The higher energy prices currently lead to price increases in many areas. How much does this situation influence your (consumer) spending?

5.3. Unemployment rate

5.3.1. Higher financial subsidies for Ukrainian refugees

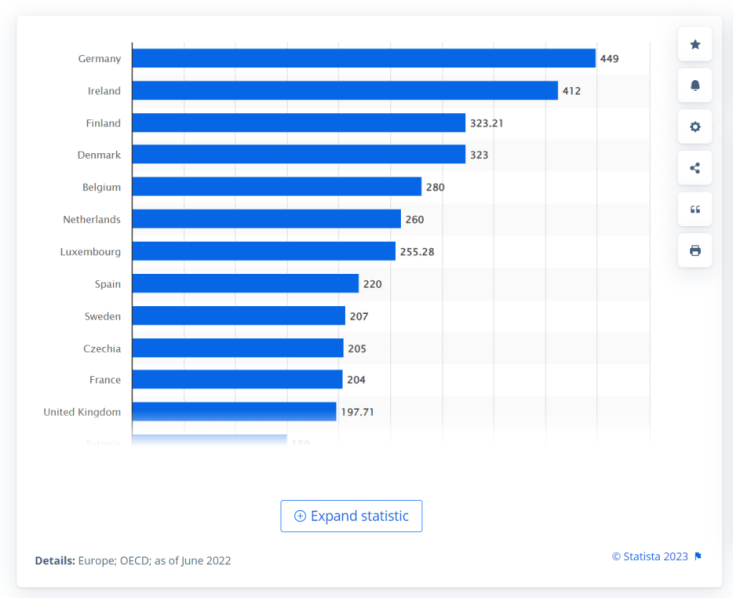

As far as the unemployment rate is concerned, Figure 9 shows that the monthly financial subsidies of Germany's Ukrainian refugees since June 2022 are the highest in the world [17]. This policy has attracted more Ukraine refugees. As of September 2023, nearly 1.09 million refugees from Ukraine to Germany. Ukrainian refugee immigrants may increase the unemployment rate of Germany by 0.4%.

Figure 9: Financial support for a single Ukrainian refugee in accommodation per month in Europe as of June 2022 (in euros)

5.3.2. Vacant positions

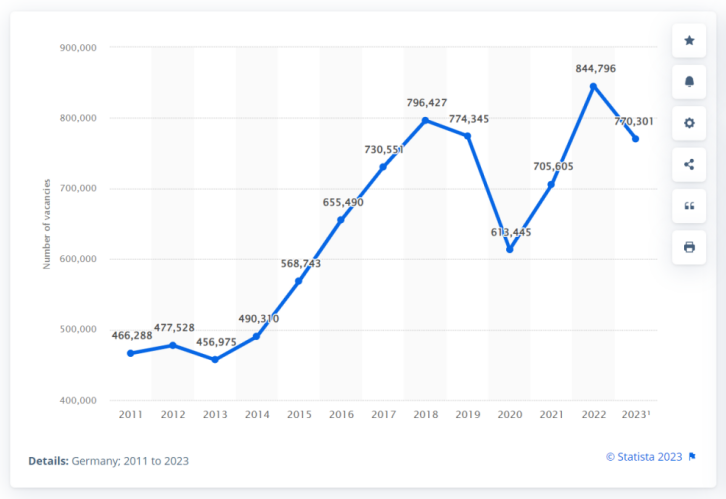

In addition, Figure 10 shows that the number of vacant positions in Germany from 2011 to 2023 also proves that the number of vacant positions and unemployment rates are positively proven [18]. As of 2022, the vacancy of registered positions will decline, which means that employment demand has declined.

Figure 10: Number of open job positions reported in Germany from 2011 to 2023

In summary, the rise in inflation and unemployment in Germany was caused by the interruption of global value chains related to great popularity. Later, it was caused by the strong rise in energy prices after Russia invaded Ukraine. Therefore, monetary policy only played a secondary auxiliary role, because the surge in inflation was largely affected by external factors.

6. Conclusion

Monetary policy is the most predictable method to reduce the inflation rate and unemployment rate in German, but it cannot completely affect the results. In this study, we found that due to the impact of COVID-19, under the heavy pressure of the European Central Bank continuously implementing a tightening monetary policy, the inflation rate in Germany was difficult to decrease in the short term. Unemployment rate was rising amid the impact of COVID-19 and the influx of refugees from Ukraine, and the real estate market has also experienced an increase in downturns due to interest rate hikes. However, external factors and political factors, for example, COVID-19 and the Russian-Ukraine War had a huge impact on the German economy. This is difficult to measure because this is an irresistible factor. This constitutes an obstacle to research to further discover how to seek an accurate number. It is important to consider other factors, which help rebuild monetary policy to reduce unemployment and inflation. In the future, the European Central Bank and the German monetary authorities should re-prudent international situation and new financial risks to formulate and issue monetary policy that is more conducive to maintaining 2% inflation targets.

References

[1]. Friedman, M. (1989). Quantity theory of money. In Money (pp. 1-40). London: Palgrave Macmillan UK.

[2]. Friedman, B. M., Hahn, F., & Woodford, M. (2010). Handbook of monetary economics 3A. Elsevier.

[3]. Pinter, J. (2021). Monetarist arithmetic at COVID‐19 time: A take on how not to misapply the quantity theory of money. Economic Notes - Monte Paschi Siena, 51(2). https://doi.org/10.1111/ecno.12200

[4]. Ongan, S., Gocer, I., & Ongan, A. (2022). Revisiting the quantity theory of money in Euro Area: the case of Greece. The European Journal of Comparative Economics : EJCE, 19(1), 63–77. https://doi.org/10.25428/1824-2979/007

[5]. Bank, E. C. (2021, November 10). Two per cent inflation target. European Central Bank. https://www.ecb.europa.eu/mopo/strategy/pricestab/html/index.en.html

[6]. Statistisches Bundesamt. (November 28, 2023). Average inflation rate and European Central Bank (ECB) interest rate in the Germany from January 2018 to October 2023 [Graph]. In Statista. Retrieved January 07, 2024, from https://www.statista.com/statistics/1312145/germany-inflation-rate-central-bank-rate-monthly/

[7]. Organization for Economic Co-operation and Development, Unemployment Rate:Aged 15-64: All Persons for Germany [LRUN64TTDEQ156S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LRUN64TTDEQ156S, January 7, 2024.

[8]. Albanesi, S., & Şahin, A. (2018). The gender unemployment gap. Review of Economic Dynamics, 30, 47-67.

[9]. Balogh, T. (1938). The national economy of Germany. The Economic Journal, 48(191), 461-497.

[10]. Dietrich, H., Henseke, G., Achatz, J., Anger, S., Christoph, B., & Patzina, A. (2021). Youth unemployment in Germany and the United Kingdom in times of Covid-19. In IAB-Forum: das Magazin des Instituts für Arbeitsmarkt-und Berufsforschung der Bundesagentur für Arbeit.

[11]. Bank for International Settlements, Real Residential Property Prices for Germany [QDER368BIS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/QDER368BIS, December 30, 2023.

[12]. Kirikkaleli, D., Gokmenoglu, K., & Hesami, S. (2021). Economic policy uncertainty and house prices in Germany: evidence from GSADF and wavelet coherence techniques. International Journal of Housing Markets and Analysis, 14(5), 842-859.

[13]. Eurostat, Harmonized Index of Consumer Prices: Actual Rentals for Housing for Germany (including former GDR from 1991) [CP0410DEM086NEST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CP0410DEM086NEST, January 5, 2024.

[14]. Zhou, X.-Y., Lu, G., Xu, Z., Yan, X., Khu, S.-T., Yang, J., & Zhao, J. (2023). Influence of Russia-Ukraine War on the Global Energy and Food Security. Resources, Conservation and Recycling, 188, 106657-. https://doi.org/10.1016/j.resconrec.2022.106657

[15]. Germany consumer price index: Food. (n.d.). YCharts. Retrieved January 7, 2024, from https://ycharts.com/indicators/germany_consumer_price_index_food_nsa

[16]. Verbraucherzentrale Bundesverband. (November 24, 2022). The higher energy prices currently lead to price increases in many areas. How much does this situation influence your (consumer) spending? [Graph]. In Statista. Retrieved January 07, 2024, fromhttps://www.statista.com/statistics/1371730/consumer-behavior-energy-prices-inflation-germany/

[17]. OECD. (June 8, 2022). Financial support for a single Ukrainian refugee in accommodation per month in Europe as of June 2022, by selected country (in euros) [Graph]. In Statista. Retrieved January 07, 2024, from https://www.statista.com/statistics/1321509/monthly-support-per-ukrainian-refugee-europe-by-country/

[18]. Bundesagentur für Arbeit. (September 29, 2023). Number of open job positions reported in Germany from 2011 to 2023 [Graph]. In Statista. Retrieved January 07, 2024, from https://www.statista.com/statistics/1292971/job-vacancies-germany/

Cite this article

Yu,S. (2024). Analysis of German’s Monetary Policy and Social Impact During COVID-19. Advances in Economics, Management and Political Sciences,76,126-135.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Friedman, M. (1989). Quantity theory of money. In Money (pp. 1-40). London: Palgrave Macmillan UK.

[2]. Friedman, B. M., Hahn, F., & Woodford, M. (2010). Handbook of monetary economics 3A. Elsevier.

[3]. Pinter, J. (2021). Monetarist arithmetic at COVID‐19 time: A take on how not to misapply the quantity theory of money. Economic Notes - Monte Paschi Siena, 51(2). https://doi.org/10.1111/ecno.12200

[4]. Ongan, S., Gocer, I., & Ongan, A. (2022). Revisiting the quantity theory of money in Euro Area: the case of Greece. The European Journal of Comparative Economics : EJCE, 19(1), 63–77. https://doi.org/10.25428/1824-2979/007

[5]. Bank, E. C. (2021, November 10). Two per cent inflation target. European Central Bank. https://www.ecb.europa.eu/mopo/strategy/pricestab/html/index.en.html

[6]. Statistisches Bundesamt. (November 28, 2023). Average inflation rate and European Central Bank (ECB) interest rate in the Germany from January 2018 to October 2023 [Graph]. In Statista. Retrieved January 07, 2024, from https://www.statista.com/statistics/1312145/germany-inflation-rate-central-bank-rate-monthly/

[7]. Organization for Economic Co-operation and Development, Unemployment Rate:Aged 15-64: All Persons for Germany [LRUN64TTDEQ156S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LRUN64TTDEQ156S, January 7, 2024.

[8]. Albanesi, S., & Şahin, A. (2018). The gender unemployment gap. Review of Economic Dynamics, 30, 47-67.

[9]. Balogh, T. (1938). The national economy of Germany. The Economic Journal, 48(191), 461-497.

[10]. Dietrich, H., Henseke, G., Achatz, J., Anger, S., Christoph, B., & Patzina, A. (2021). Youth unemployment in Germany and the United Kingdom in times of Covid-19. In IAB-Forum: das Magazin des Instituts für Arbeitsmarkt-und Berufsforschung der Bundesagentur für Arbeit.

[11]. Bank for International Settlements, Real Residential Property Prices for Germany [QDER368BIS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/QDER368BIS, December 30, 2023.

[12]. Kirikkaleli, D., Gokmenoglu, K., & Hesami, S. (2021). Economic policy uncertainty and house prices in Germany: evidence from GSADF and wavelet coherence techniques. International Journal of Housing Markets and Analysis, 14(5), 842-859.

[13]. Eurostat, Harmonized Index of Consumer Prices: Actual Rentals for Housing for Germany (including former GDR from 1991) [CP0410DEM086NEST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CP0410DEM086NEST, January 5, 2024.

[14]. Zhou, X.-Y., Lu, G., Xu, Z., Yan, X., Khu, S.-T., Yang, J., & Zhao, J. (2023). Influence of Russia-Ukraine War on the Global Energy and Food Security. Resources, Conservation and Recycling, 188, 106657-. https://doi.org/10.1016/j.resconrec.2022.106657

[15]. Germany consumer price index: Food. (n.d.). YCharts. Retrieved January 7, 2024, from https://ycharts.com/indicators/germany_consumer_price_index_food_nsa

[16]. Verbraucherzentrale Bundesverband. (November 24, 2022). The higher energy prices currently lead to price increases in many areas. How much does this situation influence your (consumer) spending? [Graph]. In Statista. Retrieved January 07, 2024, fromhttps://www.statista.com/statistics/1371730/consumer-behavior-energy-prices-inflation-germany/

[17]. OECD. (June 8, 2022). Financial support for a single Ukrainian refugee in accommodation per month in Europe as of June 2022, by selected country (in euros) [Graph]. In Statista. Retrieved January 07, 2024, from https://www.statista.com/statistics/1321509/monthly-support-per-ukrainian-refugee-europe-by-country/

[18]. Bundesagentur für Arbeit. (September 29, 2023). Number of open job positions reported in Germany from 2011 to 2023 [Graph]. In Statista. Retrieved January 07, 2024, from https://www.statista.com/statistics/1292971/job-vacancies-germany/