1. Introduction

Trade-off theory can be used to adjust a firm's capital structure, more specifically, interest tax shield and financial distress cost are trade-offs that firms make when determining their capital structure. Trade-off theory suggests that interest payments from the use of financial leverage can reduce tax expense and thus increase after-tax cash flow, however, if debt is overused, a company may increase its financial distress cost, which can lead to some effects such as an increased risk of insolvency for the company and a decrease in the rating of the business [1]. The trade-off theory is also widely used in real life, after Serrasqueiro and Caetano's survey of small and medium-sized enterprises (SMEs) in the interior of Portugal, using the LSDVC dynamic estimator as an estimation methodology, it was concluded that they arrived at optimal debt ratios through debt financing, which confirms the assumptions of the trade-off theory [2]. However, Martinez et al found that only two papers are supportive of the applicability of the trade-off theory in explaining the financial behavior of SMEs by analyzing, among other things, the layout data model among 23 newly published papers in Scopus in 2019, and, in addition, Serrasqueiro and Caetano suggested that firms with higher profitability are inconsistent with the prediction of the trade-off theory about the change of their corporate capital structure [3]. To further validate the role of trade-off theory in analyzing changes in corporate capital structure, this paper first introduces what trade-off theory is, then analyses the advantages of applying trade-off theory to corporate finance, then analyses the realities of a company's interest tax shield and the probability of a company's insolvency affects its capital structure to prove that the trade-off theory has utility, and then the paper refutes the idea that the trade-off theory can't account for the fact that a company's profitability is high, but it has a low debt ratio. Generally, this paper confirms that in reality firms adjust their capital structure concerning the trade-off theory, enhancing the credibility of the theory's practicability.

2. Analysis of the Advantages of the Use of Trade-off Theory for Companies

2.1. The Brief of Trade-off Theory

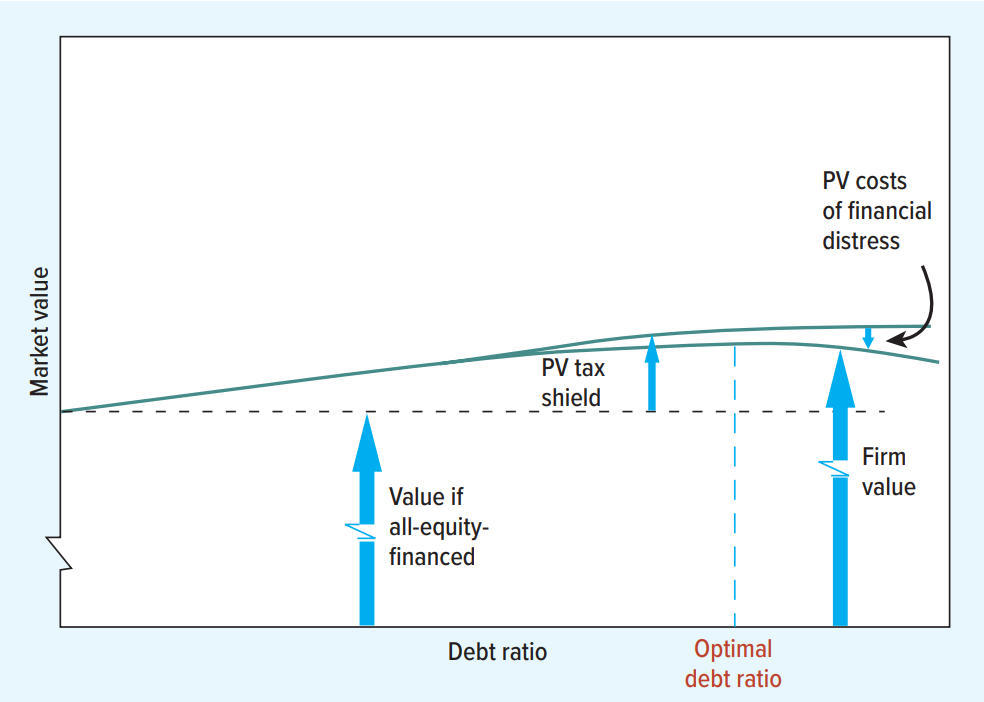

Usually, when considering whether a company should use debt financing, a company manager will weigh the interest tax shield that comes with the use of debt financing against the risk of financial distress that may come along with it. As shown in Figure 1, where the likelihood of financial distress that a company may suffer is low when the company's use of debt financing is low, and the interest expenses associated with the debt will reduce the tax expenses by the company, which in turn will increase the company's after-tax cash flow. However, as the firm continues to use debt financing, the risk of financial distress becomes higher and the advantage generated by the interest tax shield becomes smaller, finally, the firm reaches the theoretical optimum for the size of its debt borrowing when the present value of the tax savings from further borrowing is offset by the present value of the increased financial distress. After the firm's debt size exceeds this equilibrium, the risk of financial distress from debt financing outweighs the savings in the interest tax shield, and the firm suffers the negative effects of debt financing [4]. Thus, this equation shows the relationship between the interest tax shield and the cost of financial distress and firm value.

\( \begin{array}{c} {V^{L}}={V^{U}}+PV( Interest Tax Shield )-PV( Financial Distress Costs ) \\ \end{array} \) (1)

\( \begin{array}{c} {V^{L}}={V^{U}}+PV( Interest Tax Shield )-PV( Financial Distress Costs ) \\ \end{array} \) (1)

Figure 1: The impact of the interest tax shield and risk of financial distress on the value of the company due to the increase in the company's debt [4]

2.2. Debt Tax Deduction

The government taxes corporations, but interest is a tax-exempt expense, and every extra dollar of interest a corporation pays reduces its tax bill by a dollar [5]. As shown in Table 1, suppose two identical corporations have earnings before interest and tax (EBIT) of 100, considering only interest and a 30% tax expense, and assume that one of them, Company A, pays $30 in interest and Company B does not. Then Company A's earnings before tax (EBT) is $70 and Company B's EBT is $100, so Company A's tax expense is $70*30% = $21, while Company B's tax expense is $100*30% = $30, which is a $9 difference in the tax deduction from interest, which may increase the total after-tax return on the debt and equity holders' investments and increases the value of the company. Therefore, firms can gain the advantage of a debt tax deduction by using the trade-off theory.

Table 1: Tax benefits available to companies paying interest

Account name | Company A | Company B |

Earnings before income and tax (EBIT) | 100 | 100 |

Interest expense | 30 | 0 |

Earning before tax (EBT) | 70 | 100 |

Tax expense (tax rate=30%) | 70*30%=21 | 100*30%=30 |

Tax shield (Tax benefit) | 30-21=9 | 0 |

3. Some Cases of Firms Adjusting Their Capital Structure Using the Assumptions of Trade-off Theory

3.1. Case of Commercial Banks in Bangladesh

To verify whether the trade-off theory is used by the firms to adjust their capital structure in real life, Rahman selects the variables of profitability, growth rate, dividend payout ratio, tangibility, and leverage ratio of 27 listed commercial banks in Bangladesh based on their annual reports to test it [6]. The leverage ratio is the company's total debt to its total assets, and a high leverage ratio means that a company is using more debt to finance its assets. Commercial banks' profitability can be calculated by dividing net income before interest and taxes by the value of their net assets. The growth rate is the percentage increase in total assets over time, the tangibility is determined by its fixed assets to its total assets ratio, and profitability is the return on assets of these commercial banks, which is net income before interest and taxes divided by the value of net assets, and Rahman assumes that the higher it is, the less the bank relies on external financing. Rahman then uses a pooled ordinary least squares model for each bank in the sample, assuming no whole and individual effects. He also uses a fixed and random effects model for each bank, assuming every bank has cross-sectional effects. Conclusions are then drawn. He found that profitability, which is the return on assets, has a statistically significant positive effect on capital structure, which indicates that highly profitable firms rely on external financing, which is consistent with the trade-off theory. In addition, the dividend payout ratio is also positively correlated with leverage, which may be because firms use the tax benefits saved through debt financing to pay dividends. Furthermore, the positive relationship between growth rate and leverage ratio indicates that banks with high growth tend to favor external financing and that banks tend to favor external financing when they have high tangibility ratios. This is because tangibles increase the collateral capacity of the bank, giving it the ability to borrow more funds from external sources. Therefore, these variables in this study affect the capital structure of banks, which indicates that the sample banks follow the trade-off theory of financing. Because tangible assets can be used as collateral for corporate debt thus inducing banks to borrow more money from outside and it also indicates that the profits of the firm are stable and hence the firm can get money from creditors at a lower cost of debt, so firms tend to use debt financing and that is the reason why firms with high tangible assets have high debt ratios and firms with high debt ratios get more tax shield relief and use the advantage of the tax shield to increase the value of their firms.

3.2. Case of US Manufacturing Companies

According to the trade-off theory, the optimal level of leverage for a firm is the marginal benefit from an increase in debt is equal to the marginal cost of the risk of bankruptcy, and an increase in the probability of bankruptcy of a firm leads to a deviation from the optimal level of leverage in the firm's actual leverage, Howe and Jain wanted to test the accuracy of the theory by selecting US manufacturing firms in the aftermath of the terrorist attacks of 11 September 2001 and using a hypothetical test with an \( {H_{0}} \) of a high-debt firm as opposed to a low-debt firm having a more pronounced response to the stock market reaction after the terrorist attacks is more pronounced [7]. If the hypothesis is accepted, then this prediction holds that an increase in the probability of bankruptcy leads to a decrease in the optimal level of debt and a decrease in the value of firms with a high level of debt, Howe and Jain use three debt ratios to test this relationship, the total debt divided by total assets ratio, the short-term debt divided by total assets ratio and the long-term debt divided by total assets ratio. In addition, if highly indebted firms suffer more in a crisis due to the increased probability of bankruptcy, this relationship can be judged by looking at the solvency of the firm. Therefore, the second hypothesis is that the stock market reaction is more pronounced for companies with interest earnings multiples after the terrorist attacks than for companies with high-interest earnings multiples. Accepting \( {H_{0}} \) as higher solvency leads to a lower negative stock market reaction when the crisis increases the probability of bankruptcy, They then assumed that all the sample firms had the same date of occurrence and applied the multiple regression model to calculate the abnormal returns before and after the terrorist attacks, after the calculations, Howe and Jain concluded that, for the first hypothesis, the negative value of the total debt to total assets ratio indicates the existence of a market reaction with the level of total debt have a negative relationship, and insignificant results of short-term debt to total assets indicate that the market is not related to short-term debt level, on the contrary, significant long-term debt level and market reaction relationship indicates a relationship between the two, therefore, the study concludes that high debt level increases the risk of insolvency, and increased risk of insolvency will firms to reduce their optimal debt level. For the second hypothesis, Howe and Jain found that the higher the interest income multiple (debt servicing capacity), the more positive the market reaction, and therefore it holds. Therefore, highly indebted firms and firms with lower solvency experienced higher negative abnormal returns in the days following the terrorist attacks, which confirms that increased bankruptcy risk leads to a greater decline in value for firms with high debt levels, which suggests that the trade-off theory can reflect reality.

4. Limitations of the Trade-off Theory

Trade-off theory also has many limitations. According to Myers, a lower effective tax rate on capital gains offsets the value of the corporate interest tax shield, specifically that in some countries or regions, the tax rate of capital gains may be lower than that of interest income [8]. If a company uses debt financing and takes advantage of the interest tax shield, but has a low tax rate on capital gains, the company may find that the tax deduction from the interest tax shield is offset by the higher interest expense they paid, at which point the company may prefer to use equity financing with a lower tax rate. Thus, in a study by Myers, taxes affect corporate financing decisions, and the trade-off theory does not consider the relationship between the interest tax and the capital gains tax. Serrasqueiro et al. also found that the size of the firm affects the validity of trade-off theory assumptions [9]. To determine whether the debts of SMEs and large corporations are adjusted to trade-off theory target debt ratios, they used the Generalized Moments Method (GMM) system estimator. The results show that SMEs in the service sector tend to use debt financing because of insufficient internal funds, independent of the target debt ratio. Besides, the trade-off theory does not explain why many companies have high profitability but low debt ratios, Myers believes that companies in many industries that are highly profitable tend to borrow less, and according to the trade-off theory, highly profitable companies can afford to take on higher levels of debt because they have enough capacity to make interest payments and debt repayments without risking financial distress, and so they may choose to take on higher debt ratios, and use debt financing to the tax advantages that come with it to reduce the cost of equity. However, Abel disagrees with this view. Abel makes the following assumptions: 1). debt must be repaid immediately upon issuance. 2). Information is symmetric, which means that the lender and the equity holders of the firm have access to the same information, so in the event of default they need to be paid a premium over the risk-free rate to cover their expected losses. 3). He assumes that Earnings Before Interest and Taxes (EBIT) is a continuous process [10]. When a company's EBIT reaches a sufficiently high level, the value of the company increases as EBIT increases. In this case, debt as a proportion of the firm's value decreases as the firm's value increases. He argues that whilst increased profitability increases the ongoing value of the firm, it increases the value that existing shareholders lose in the event of a default, thus increasing the cost of default that they face, and to reduce the cost, firms will adjust their capital structure. So, after finding the result that optimal leverage and EBIT are negatively correlated, Abel concludes that the trade-off theory explains why highly profitable firms have low debt ratios.

5. Conclusion

This paper discusses the impact of the trade-off theory on real-life capital structure changes and describes the advantages that come with the use of the trade-off theory by firms, followed by the selection of case studies of commercial banks in Bangladesh and manufacturing firms in the U.S.A. to demonstrate the usefulness of the trade-off theory in real life, then the paper points out the limitations of the trade-off theory, and although some of the concepts in the trade-off theory have been shown to work, it is questionable whether the trade-off theory can actually be applied to real-life firms adjusting their capital structure, as it ignores the relationship between interest taxes and capital structure. However, Myers and Abel have a different view on the low debt ratios of highly profitable firms, which they argue can be explained by the trade-off theory, thus strongly supporting the utility of the trade-off theory. However, this paper only analyses the trade-off theory on the theoretical level that tax cuts may enhance firm value, ignoring the intervention of other factors in the real world, hence this paper has some limitations. Finally, to demonstrate the generalizability of the trade-off theory, this paper proposes to test the trade-off theory on the capital structure of as many firms as possible from different industries to exclude chance and error as much as possible.

References

[1]. Jahanzeb, A., Khan, S.-R., Bajuri, N. H., Karami, M., & Ahmadimousaabad, A. (2013, October). (PDF) Trade-Off Theory, Pecking Order Theory and Market Timing Theory: A Comprehensive Review of Capital Structure Theories. ResearchGate. https://www.researchgate.net/publication/264422625_Trade-Off_Theory_Pecking_Order_Theory_and_Market_Timing_Theory_A_Comprehensive_Review_of_Capital_Structure_Theories

[2]. Serrasqueiro, Z., & Caetano, A. (2014). TRADE-OFF THEORY VERSUS PECKING ORDER THEORY: CAPITAL STRUCTURE DECISIONS IN A PERIPHERAL REGION OF PORTUGAL. Journal of Business Economics and Management, 16(2), 445–466. https://doi.org/10.3846/16111699.2012.744344

[3]. Martinez, L. B., Scherger, V., & Guercio, M. B. (2019). SMEs capital structure: trade-off or pecking order theory: a systematic review. Journal of Small Business and Enterprise Development, 26(1), 105–132. https://doi.org/10.1108/JSBED-12-2017-0387

[4]. Brealey, R. A., Myers, S. C., Allen, F., & Edmans, A. (2020). Principles of Corporate Finance (13th ed., p. 503). McGraw-Hill Education.

[5]. Myers, S. C. (2001). Capital Structure. The Journal of Economic Perspectives, 15(2), 81–102. https://www.jstor.org/stable/2696593

[6]. Rahman, M. T. (2019). TESTING TRADE-OFF AND PECKING ORDER THEORIES OF CAPITAL STRUCTURE: EVIDENCE AND ARGUMENTS. International Journal of Economics and Financial Issues, 9(5), 63–70. https://doi.org/10.32479/ijefi.8514

[7]. Kovacova, M., Krajcik, V., Michalkova, L., & Blazek, R. (2022). Valuing the Interest Tax Shield in the Central European Economies: Panel Data Approach. Journal of Competitiveness, 14(2), 41–59. https://doi.org/10.7441/joc.2022.02.03

[8]. Howe, J. S., & Jain, R. (2010). Testing the trade-off theory of capital structure. Review of Business, 31(1), 54

[9]. Serrasqueiro, Z. S., Armada, M. R., & Nunes, P. M. (2011). Pecking Order Theory versus Trade-Off Theory: are service SMEs’ capital structure decisions different? Service Business, 5(4), 381–409. https://doi.org/10.1007/s11628-011-0119-5

[10]. ABEL, A. B. (2018). Optimal Debt and Profitability in the Trade-Off Theory. The Journal of Finance (New York), 73(1), 95–143. https://doi.org/10.1111/jofi.12590

Cite this article

Qin,J. (2024). Application of Trade-off Theory in Real-Life Corporate Capital Structure Adjustments. Advances in Economics, Management and Political Sciences,76,88-93.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jahanzeb, A., Khan, S.-R., Bajuri, N. H., Karami, M., & Ahmadimousaabad, A. (2013, October). (PDF) Trade-Off Theory, Pecking Order Theory and Market Timing Theory: A Comprehensive Review of Capital Structure Theories. ResearchGate. https://www.researchgate.net/publication/264422625_Trade-Off_Theory_Pecking_Order_Theory_and_Market_Timing_Theory_A_Comprehensive_Review_of_Capital_Structure_Theories

[2]. Serrasqueiro, Z., & Caetano, A. (2014). TRADE-OFF THEORY VERSUS PECKING ORDER THEORY: CAPITAL STRUCTURE DECISIONS IN A PERIPHERAL REGION OF PORTUGAL. Journal of Business Economics and Management, 16(2), 445–466. https://doi.org/10.3846/16111699.2012.744344

[3]. Martinez, L. B., Scherger, V., & Guercio, M. B. (2019). SMEs capital structure: trade-off or pecking order theory: a systematic review. Journal of Small Business and Enterprise Development, 26(1), 105–132. https://doi.org/10.1108/JSBED-12-2017-0387

[4]. Brealey, R. A., Myers, S. C., Allen, F., & Edmans, A. (2020). Principles of Corporate Finance (13th ed., p. 503). McGraw-Hill Education.

[5]. Myers, S. C. (2001). Capital Structure. The Journal of Economic Perspectives, 15(2), 81–102. https://www.jstor.org/stable/2696593

[6]. Rahman, M. T. (2019). TESTING TRADE-OFF AND PECKING ORDER THEORIES OF CAPITAL STRUCTURE: EVIDENCE AND ARGUMENTS. International Journal of Economics and Financial Issues, 9(5), 63–70. https://doi.org/10.32479/ijefi.8514

[7]. Kovacova, M., Krajcik, V., Michalkova, L., & Blazek, R. (2022). Valuing the Interest Tax Shield in the Central European Economies: Panel Data Approach. Journal of Competitiveness, 14(2), 41–59. https://doi.org/10.7441/joc.2022.02.03

[8]. Howe, J. S., & Jain, R. (2010). Testing the trade-off theory of capital structure. Review of Business, 31(1), 54

[9]. Serrasqueiro, Z. S., Armada, M. R., & Nunes, P. M. (2011). Pecking Order Theory versus Trade-Off Theory: are service SMEs’ capital structure decisions different? Service Business, 5(4), 381–409. https://doi.org/10.1007/s11628-011-0119-5

[10]. ABEL, A. B. (2018). Optimal Debt and Profitability in the Trade-Off Theory. The Journal of Finance (New York), 73(1), 95–143. https://doi.org/10.1111/jofi.12590