1. Introduction

Nowadays, the development and dissemination of social media has become a powerful tool for individuals and organizations to express their views, disseminate information and determine public discourse. At the same time, many public figures are communicating their thoughts through social media while spreading a sentiment and influencing the audience's views at the same time. In recent years, these social media platforms not only have a social role but also influence the economy, especially virtual currencies. Twitter can be seen as a virtual trading floor for cryptocurrencies such as Bitcoin and emotionally reflects its trading dynamics [1]. In this area, Elon Musk's (Tesla's CEO) Twitter account has received a lot of attention due to his active participation in discussions about virtual currencies. Musk's behaviors as a business leader and innovator in the virtual currency market has generated a lot of attention and controversy. His personal social media accounts have become a platform for him to express his views and intentions, and these statements often have a direct impact on the market. Musk has tweeted a number of tweets about Bitcoin, causing the price of Bitcoin to instantly skyrocket or plummet. He has also taken to social media to express his support for Dogcoin, driving the popularity and recognition of the virtual currency. Musk's statements and actions have not only affected the price of virtual currencies and market confidence, but have also created a great deal of uncertainty for investors and market participants. His tweets are widely followed in the investment community, and whether or not Musk's tweets are seen as financial advice or recommendations, investors may follow the implied message for favourable information in trading in the cryptocurrency market [2].

There is now a great deal of research on the widespread phenomenon of social media influencing markets and economies. However, there is still a lack of exploration of the unique case of Elon Musk's tweets and their impact on virtual currencies and how investment sentiment can be spread through Twitter. Instead of convincing people to buy virtual currencies through a traditional advertising model, Musk's tweets convey his views on virtual currencies through his influence, sending a sentiment to people. These emotions represent his optimistic endorsement of virtual currencies and thus influence people's judgement. Emotions can cause customers to form an attachment to a person or object, thus increasing the likelihood of purchase [3].

This study aims to fill the knowledge gap identified by the above intentions by thoroughly investigating the extent to which Elon Musk's tweets have influenced the public dialogue around virtual currencies and determined subsequent perceptions of virtual currencies, thereby influencing the market. Key themes and topics contained in Elon Musk's tweets about Tesla - Insight into key areas to focus on in his online communications.

Finally, this study aims to consolidate the views and sentiments expressed in Musk's tweets about virtual currencies and thus how they influence people's value judgements about virtual currencies, and the potential impact of positive or negative sentiments on investments should be reasonably considered. In doing so, this study seeks to contribute to the existing knowledge about social media influence and in particular the tweets of influential individuals. Understanding the impact of what individuals say - or are perceived to say - through their news tweets is important in the body of knowledge of academic scholars as well as industry practitioners related to marketing and public relations. This study aims to provide new findings on the intricate dynamics of the relationship between the emotions held by social media and making market investments by investigating the particular case of virtual currencies. These substantive issues will be integrated into the established body of knowledge in the field, thus providing new findings for the management of organisations in environments affected by trends in social media use and influence.

2. Literature Review

Musk is known to be the owner of Twitter and one of the richest people in the world, but he is often vocal on social media platforms. More than just virtual currencies, Musk is known for his tweets providing alerts about new Tesla products, announcements, or information, which in turn draws the interest of the financial community and various media outlets to report on corporate news and the market's reaction to it [4]. In addition to talking about his brand Tesla, Musk has also begun to use Twitter to influence the business value of cryptocurrencies. As stated by [5], Musk's tweets did cause the price of Bitcoin to rise by 16.9% or fall by almost 11.8%. This shows the impact of Musk's statements on cryptocurrencies. Elon Musk's general tweets related to the crypto market enhanced the crazy growth of Bitcoin price [1]. If virtual currencies are viewed as individual brands, these tweets are even more effective because they promote direct, unfiltered communication, enable faster and more direct channels of communication, and provide the opportunity to reach a wider audience that can better embrace the concept of virtual currencies. Customers prefer brands to communicate with them in a more direct and authentic way [6]. Therefore, Twitter holds great promise in building brand value by helping CEOs to enhance their company's brand voice, attract the attention of investors, and respond directly to consumer concerns [1]. Not coincidentally, based on extensive social media data collection, celebrities such as Musk can have a more positive impact on brands on social media [8].

There is a lot of research on the topic of how sentiment information on social media affects the investment market, for example, after analysing that sentiment at key points has a significant predictive power for major market returns, it also consistently predicts market volatility [9]. Not coincidentally, Bollen et al. also mentioned that the sentiment of tweets can help people to make choices and thus predict the stock market through the sentiment of tweets [10]. However, these are all analysed links between the sentiment reflected on Twitter and the market, while this paper will focus on exploring what kind of sentiments are brought up below the comment section of Elon Musk's tweets, and also how these sentiments will affect the cryptocurrency's market.

3. Methodology

In order to verify how Musk's tweets about cryptocurrencies influence people's buying sentiment and the market, this study selected ten of Musk's most representative tweets about cryptocurrencies and analysed their comment sections. These ten representative tweets were posted about Bitcoin and Dogecoin. The relationship will be found by calculating the sentiment factor of 50 comments in the comment section compared to the virtual currency market in the week following the tweet.

First, under the comment section of each tweet, 50 comments were collected into an Excel file. Then the R language readxl package was used to read the Excel file from it, which contains data on Twitter comments. For the comment text, the R language stringr package is used for preprocessing, including the removal of meaningless special characters, punctuation marks and numbers. This results in clean text data for subsequent sentiment analysis. Immediately after that, the preprocessed comment text is converted to tibble format using the tidytext package of the R language, and the text is subjected to a word-splitting operation using the unnest_tokens function. In this way, each word is split into a separate line to facilitate sentiment analysis. For measuring sentiment, the read.delim function of R was used to load an external sentiment dictionary, NRC-Emotion-Lexicon-Wordlevel, which contains one word per line and the corresponding sentiment score.The NRC Emotion Lexicon is a list of English words and their associations with the eight basic emotions (anger, fear, anticipation, trust, surprise, sadness, joy, and disgust) and two emotions (negative and positive) and a list of associations with two emotions (negative and positive). Immediately after this, the sentiment scores are merged with the original comment text using the cbind function of the R language to form a dataset containing both the comment words and the sentiment scores. In this way, it is possible to view both the comment text and the corresponding sentiment tendencies. Finally, using the openxlsx package for R, the merged results are saved and exported to an Excel file so that the data can be further analysed and visualised.

4. Evaluate

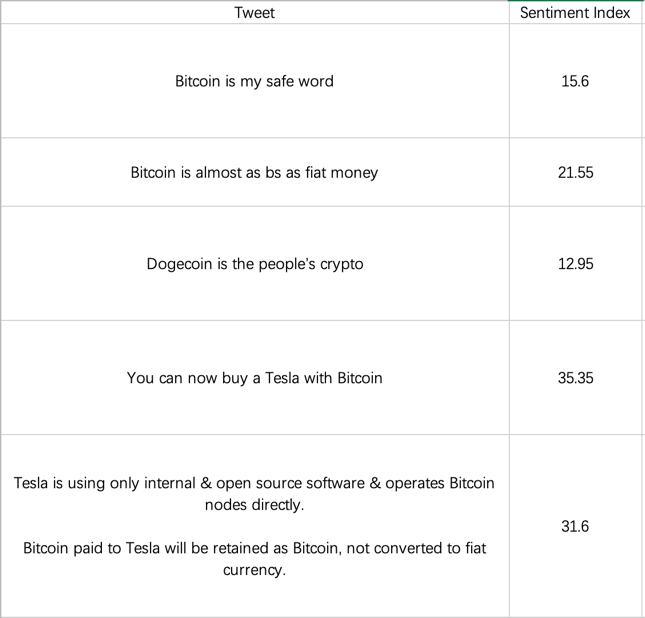

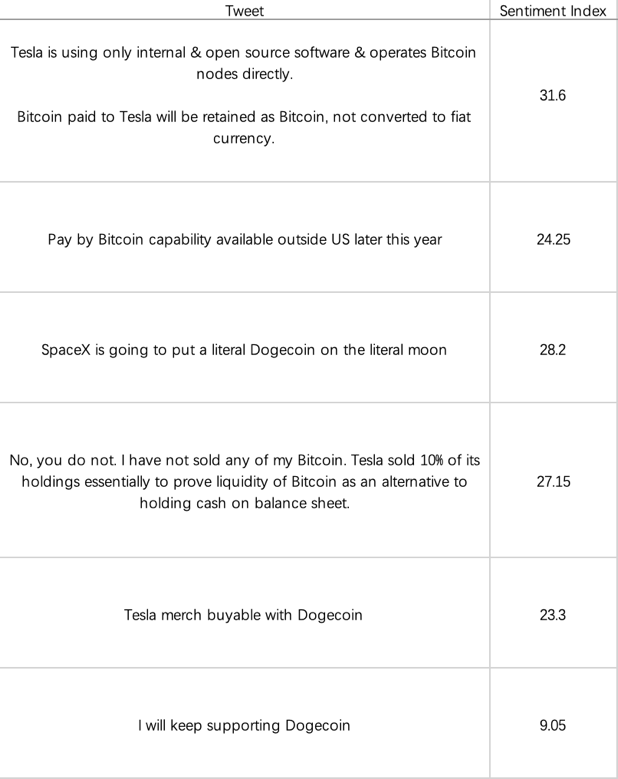

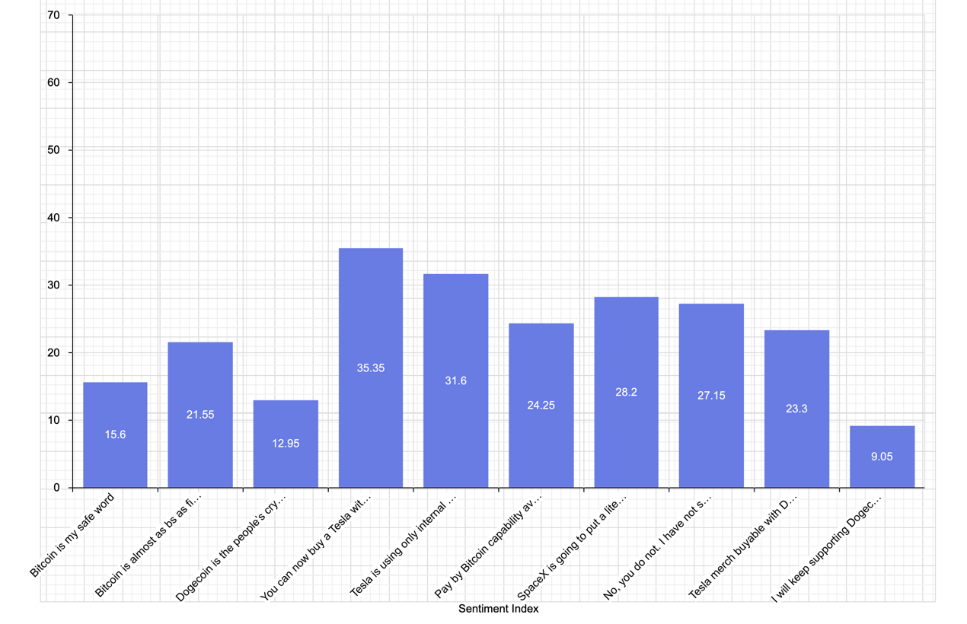

After intercepting 50 comments underneath 10 Musk tweets about cryptocurrencies, it was found that all the scores were positive after being coded by the sentiment dictionary. This proves that all of Musk's tweets have an impact on cryptocurrencies all towards the positive side, making people face the cryptocurrency market with a more optimistic mindset. The specific tweets and coefficients are shown in figure1 and 2. The bar chart in figure3 shows this better, bringing the highest sentiment coefficient up to 35.35 and the lowest to 9.05.

Figure 1: Tweet from Elon Musk and comment Sentiment Index

Figure 2: Tweet from Elon Musk and comment Sentiment Index

Figure 3: Bar chat about different tweet’s sentiment index

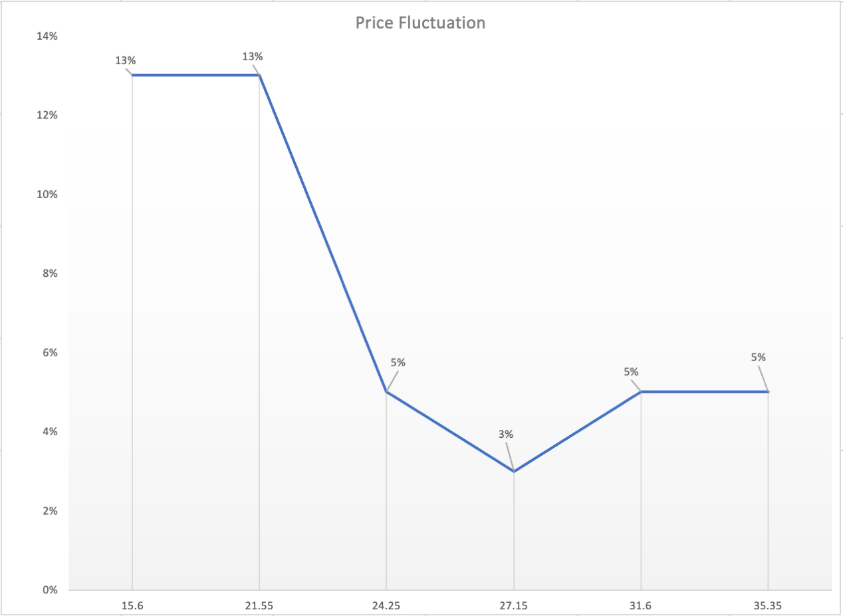

Next, these sentiment coefficients were compared to cryptocurrency market volatility, taken one week after Musk made these statements. Of this selection of tweets, six were about Bitcoin, while the remaining four were about Dogecoin. Of these six tweets about Bitcoin, there were three main posting dates of 20 December 2020, 24 March 2021 and 27 April 2021 respectively. After arranging the coefficients of these six tweets from smallest to largest and cross-referencing the market volatility data one week after the release, we obtain figure 4. The horizontal coordinate represents the sentiment coefficient of each tweet, while the vertical coordinate represents the price volatility of Bitcoin. It is clear to see that in the realm of Bitcoin, every time Musk finishes posting about Bitcoin, both the sentiment coefficient reflected in the comment section and the market price of Bitcoin are positive phenomena. Although the sentiment coefficient and the growth value do not possess a year-on-year relationship, it can at least be proven that the positive sentiment in the comment section also makes the market more optimistic, which in turn leads to a higher price of the cryptocurrency.

Figure 4: Bitcoin Price Fluctuation

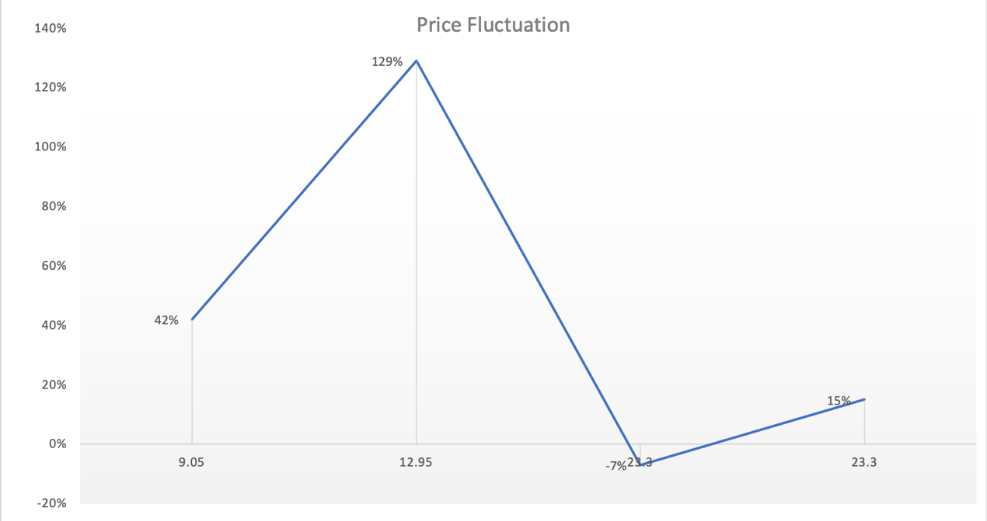

On the other hand, in the case of the four tweets about Dogecoin, the same methodology was used to plot the sentiment coefficients of the four tweets from smallest to largest in a graph figure 5. It is clear to see that the ups and downs are more pronounced this time around than in the case of Bitcoin before it, and at the same time there is the only time in the 10 data instances when the value of Dogecoin decreases despite the positive sentiment coefficient. situation. It is also worth noting that one of the tweets with a sentiment factor of just 12.95 resulted in a whopping 129% increase in Dogecoin's market. The reason for this could be that the tweet was published on the 4th of February 2021, a time when Dogecoin was not yet known to the world, and Musk's tweet greatly increased Dogecoin's influence and attracted investors' attention, thus leading to larger ups and downs.

Figure 5: Dogecoin Price Fluctuation

5. Conclusion

Overall, the tweets Musk posted, both for Bitcoin and Dogecoin, and the sentiments contained in the comments were positive, which demonstrates Musk's appeal to people. At the same time, in the vast majority of cases, these positive sentiments are reflected in the cryptocurrency market. Although this study also has some limitations, such as the fact that there are many factors that affect market price fluctuations, there is no way to explore whether Musk's statements are the main factor that affects market fluctuations by controlling for variables. However, this study still proves that Musk's social media postings affect people's emotions, and that social media has become a direct bridge for transmitting ideas and opinions, breaking down barriers and communicating directly to the public. It also shows that a celebrity with a certain degree of influence can easily control people's emotions about events, and when these emotions are linked to the financial markets, the biggest beneficiaries are the spokespersons who provide the public with their views and stir up sentiments.

References

[1]. Shahzad, Syed Jawad Hussain, et al. “Price Explosiveness in Cryptocurrencies and Elon Musk’s Tweets.” Finance Research Letters, Jan. 2022, p. 102695, https://doi.org/10.1016/j.frl.2022.102695.

[2]. Huynh, Toan Luu Duc. “When Elon Musk Changes His Tone, Does Bitcoin Adjust Its Tune?” Computational Economics, 13 Jan. 2022, https://doi.org/10.1007/s10614-021-10230-6.

[3]. Zhang, Xiuping, and Jaewon Choi. “The Importance of Social Influencer-Generated Contents for User Cognition and Emotional Attachment: An Information Relevance Perspective.” Sustainability, vol. 14, no. 11, 1 Jan. 2022, p. 6676, www.mdpi.com/2071-1050/14/11/6676, https://doi.org/10.3390/su14116676.

[4]. Strauss, Nadine. “Buying on Rumors: How Financial News Flows Affect the Share Price of Tesla.” Emerald Insight, 4 June 2019, www.emerald.com/insight/content/doi/10.1108/CCIJ-09-2018-0091/full/pdf?title=buying-on-rumors-how-financial-news-flows-affect-the-share-price-of-tesla.

[5]. Ante, Lennart. “How Elon Musk’s Twitter Activity Moves Cryptocurrency Markets.” Technological Forecasting and Social Change, vol. 186, Jan. 2023, p. 122112, https://doi.org/10.1016/j.techfore.2022.122112.

[6]. Charlotte, McEleny. “Social Media Are the Best Way to Boost Brand - ProQuest.” Www.proquest.com, 2009, www.proquest.com/docview/225128883/9621B0686CC24A3BPQ/5?accountid=11862. Accessed 10 June 2023.

[7]. Craig, Russell, and Joel Amernic. “Benefits and Pitfalls of a CEO’s Personal Twitter Messaging.” Strategy & Leadership, vol. 48, no. 1, 21 Nov. 2019, pp. 43–48, https://doi.org/10.1108/sl-10-2019-0154.

[8]. Huaman-Ramirez, Richard, and Dwight Merunka. “Celebrity CEOs’ Credibility, Image of Their Brands and Consumer Materialism.” Journal of Consumer Marketing, vol. 38, no. 6, 30 Aug. 2021, pp. 638–651, https://doi.org/10.1108/jcm-08-2020-4026.

[9]. Yang, Steve Y., et al. “Twitter Financial Community Sentiment and Its Predictive Relationship to Stock Market Movement.” Quantitative Finance, vol. 15, no. 10, 16 Sept. 2015, pp. 1637–1656, https://doi.org/10.1080/14697688.2015.1071078.

[10]. Bollen, Johan, et al. “Twitter Mood Predicts the Stock Market.” Journal of Computational Science, vol. 2, no. 1, Mar. 2011, pp. 1–8, https://doi.org/10.1016/j.jocs.2010.12.007.

Cite this article

Zhang,D. (2024). Study Analyses How Elon Musk's Tweets Affect the Market Value of Cryptocurrencies in Terms of Sentiment. Advances in Economics, Management and Political Sciences,73,292-298.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Shahzad, Syed Jawad Hussain, et al. “Price Explosiveness in Cryptocurrencies and Elon Musk’s Tweets.” Finance Research Letters, Jan. 2022, p. 102695, https://doi.org/10.1016/j.frl.2022.102695.

[2]. Huynh, Toan Luu Duc. “When Elon Musk Changes His Tone, Does Bitcoin Adjust Its Tune?” Computational Economics, 13 Jan. 2022, https://doi.org/10.1007/s10614-021-10230-6.

[3]. Zhang, Xiuping, and Jaewon Choi. “The Importance of Social Influencer-Generated Contents for User Cognition and Emotional Attachment: An Information Relevance Perspective.” Sustainability, vol. 14, no. 11, 1 Jan. 2022, p. 6676, www.mdpi.com/2071-1050/14/11/6676, https://doi.org/10.3390/su14116676.

[4]. Strauss, Nadine. “Buying on Rumors: How Financial News Flows Affect the Share Price of Tesla.” Emerald Insight, 4 June 2019, www.emerald.com/insight/content/doi/10.1108/CCIJ-09-2018-0091/full/pdf?title=buying-on-rumors-how-financial-news-flows-affect-the-share-price-of-tesla.

[5]. Ante, Lennart. “How Elon Musk’s Twitter Activity Moves Cryptocurrency Markets.” Technological Forecasting and Social Change, vol. 186, Jan. 2023, p. 122112, https://doi.org/10.1016/j.techfore.2022.122112.

[6]. Charlotte, McEleny. “Social Media Are the Best Way to Boost Brand - ProQuest.” Www.proquest.com, 2009, www.proquest.com/docview/225128883/9621B0686CC24A3BPQ/5?accountid=11862. Accessed 10 June 2023.

[7]. Craig, Russell, and Joel Amernic. “Benefits and Pitfalls of a CEO’s Personal Twitter Messaging.” Strategy & Leadership, vol. 48, no. 1, 21 Nov. 2019, pp. 43–48, https://doi.org/10.1108/sl-10-2019-0154.

[8]. Huaman-Ramirez, Richard, and Dwight Merunka. “Celebrity CEOs’ Credibility, Image of Their Brands and Consumer Materialism.” Journal of Consumer Marketing, vol. 38, no. 6, 30 Aug. 2021, pp. 638–651, https://doi.org/10.1108/jcm-08-2020-4026.

[9]. Yang, Steve Y., et al. “Twitter Financial Community Sentiment and Its Predictive Relationship to Stock Market Movement.” Quantitative Finance, vol. 15, no. 10, 16 Sept. 2015, pp. 1637–1656, https://doi.org/10.1080/14697688.2015.1071078.

[10]. Bollen, Johan, et al. “Twitter Mood Predicts the Stock Market.” Journal of Computational Science, vol. 2, no. 1, Mar. 2011, pp. 1–8, https://doi.org/10.1016/j.jocs.2010.12.007.