1. Introduction

Crude oil plays a vital role in today's world and influences the various aspects of today's society due to crude oil’s widespread utilization in energy production, in transportation, and in industrial processes.

Specifically, crude oil’s products serve primarily as a fuel for internal combustion engines and as chemical raw material.

Research shows 90 % of chemical products contain crude oil’s product, plastics being the most well-known. While the world stives to avoid carbon fuels, the climate-friendly resources can meet the requirements. However, in the future, oil is expected be demanded particularly, in sea-faring transport [1].

In this paper, we want to discover why investors want to trade crude oil futures in today's world by evaluating the characteristics of crude oil futures. we will also assess several hedging mechanisms for mitigating risks and protecting oil futures price.

Firstly, we briefly introduce crude oil.

Then, we explain that the high volatility of crude oil prices justifies hedging via crude oil futures. We describe the hedging mechanisms using the crude oil futures, (e.g., short/long hedging, cross hedging), and introduce the principles of hedging.

Furthermore, we render three real-life cases, including a jet fuel case, the Metallgesellschaft AG, and Sinopec cases. The basic question is why did so many companies use the crude oil futures to hedge? We list the pros and cons of crude oil futures to offer a comprehensive evaluation..

Lastly, we conclude this paper and further illustrate using hedging to protect price of crude oil futures.

2. Crude Oil Market

West Texas Intermediate “WTI” and Brent North Sea are dominant in crude oil market [2]. Crude oil prices fluctuate greatly, and it is susceptible to geopolitical and weather events (e.g., North Sea crude oil operations and U.S. crude oil production levels).

As an Investopia article states, in the oil industry, the upstream involves identifying, extracting, and producing materials, and the downstream centers on post-production activities [3].

Crude oil can be broken down into 46% to motor gasoline and diesel, 25% to distillate fuel oil and No. 2 heating oil, 9.7% to jet kerosene, 4% to liquid petroleum gases, 5% to coke, 4% to residual fuel oil, with the remaining 6% to different types of materials [4].

2.1. Futures and Crude Oil Futures

Futures are contracts that oblige parties to trade an asset at a predetermined price and future date [5] The buyer commits to buying, and the seller commits to selling the underlying asset at a fixed price, regardless of market conditions at contract expiry. Additionally, futures contracts enable traders to speculate on price changes and hedge against potential losses.

In the crude oil market, participants continue the longstanding tradition of some individuals selling risk to others who eagerly purchase it, hoping to profit. Once the price is agreed, crude oil will be traded on a future date.

However, crude oil is differentiated from other commodities by its frequency. According to Investopia article, crude oil futures are traded daily but quoted monthly, commodities like soybeans are traded at 4 times a year [6]. Thus, the higher frequency of oil contracts offers investors more chances to analyze present and anticipated oil price trends. As CME (Chicago Mercantile Exchange) Group states, "Over 1 million contracts of WTI futures and options trade daily, with approximately 4 million contracts of open interest" (Crude Oil Overview, n.d.).

2.2. Hedging in the Crude Oil Futures Market

In this, section, we will discussion the basic principle of hedging and introduce how the companies use futures to hedge. The hedge can be can be divided into long hedge and short hedge. And the basic risk is a significant risk behind the hedging strategy. Besides, many companies use the cross hedge to reduce the risk.

2.3. Short hedge and long hedge

When a hedger uses the futures to hedge, he wants to protect against price movement. For example, if one company worries about the volatility of the oil market and wishes to fix the oil price in the future, the company will use the oil futures to hedge; there are two basic hedging strategies: long and short.

A short hedge means that if the company already has exposure to the commodity and wants to sell it, it will use sell a crude oil contract (the short hedge). For example, the crude oil company has 1000 barrels of crude oil and will sell all the barrels in the future. However, the oil price will fluctuate in this period. If the oil price increases, the company will make a profit. Nevertheless, if the price decreases, this company will lose money. So the company can buy the same amount of short hedging contracts. Consider the initial futures price is \( {p_{1}} \) and the crude oil spot price is \( {p_{0}} \) .

Moreover, at maturity, the convergence property ensures that the futures price will be the same as the spot price at the delivery point. The profit by selling the crude oil is \( {p_{0}} \) p/barrel, and the short hedging strategy's profit is \( {{p_{1}}-p_{0}} \) p/barrel. As a result, the total profit is \( {p_{1}} \) . This price is fixed, and the oil market will not influence the company's profit.

Long hedging is the exact opposite of short hedging. Usually, the companies want to buy a commodity in the future and hedge the risk of increasing price. They will use the long hedge to fix the price of purchasing.

2.4. Basis risk

The companies will likely eliminate the risk by using short or long hedges. However, many companies go bankrupt because of using the future. One of the main reasons for this is the so-called basis risk.

The discussion above is based on one principle: the convergence property. It means that at the delivery point, the spot price is the same as the futures price. However, in the actual market, it is only valid at the delivery point.

Basis is the difference between the futures price and the spot price at certain market [7]. If we assume that at the initial time, the spot price is \( {S_{1 }} \) and the future price is \( {F_{1}} \) , at the maturity, the spot price is \( {S_{2}} \) , and the future price is \( {F_{2}} \) and the basis is \( {b_{2}} \) . If the company uses the short hedge strategy, the profit of the company will be (during the lifetime of the contract)

\( {S_{2}}+{F_{1}}-{F_{2}}={b_{2}}+{F_{1}} \)

Some companies cannot close out their position on the delivery point and they may have to close out ahead. So they will face the problem of the uncertainty of the basis. And this risk is called basis risk. Many companies try to reduce the basis risk to make sure that their hedging strategies are useful.

2.5. Cross Hedge

Sometimes we want to hedge a commodity, but there is no contract on the futures market for a particular commodity. So some companies will use another type of futures to hedge the risk. When the underlying asset of the futures used in hedging differs from the asset being hedged, the strategy is called cross strategy.

The basic principle behind the cross hedge is to find another asset the price has a strong relationship with the hedging assert (especially when we talk about crude oil and oil products) . Besides, the hedging ratio is not equal to one in the cross hedging, and the companies have to find a proper hedging ratio to hedge.

2.6. Case Analysis

In this section, we use three examples to illustrate how the companies use crude oil futures to hedge and why they use oil futures. By analyzing their hedging strategies, we can determine the advantages and disadvantages of crude oil futures and find the features of the oil futures.

2.7. Jet fuel cross-hedging

Jet fuel costs are vital for airlines, accounting for 15% to 30% of operating expenses [8]. This fact has led to significant challenges in managing these costs due to price fluctuations influenced by oil market instability and unforeseen macroeconomic factors.

To navigate these challenges, airlines employ a method called cross-hedging. This approach utilizes hedging contracts with commodities highly correlated with jet fuel, such as West Texas Intermediate (WTI), Brent North Sea Oil or heat oil [9]. The underlying complexity in cross-hedging between jet fuel and crude oil futures revolves around implementing various strategies to offset price volatility.

One such popular strategy involves using crude oil futures to hedge the jet fuel that airline plans to consumption, capitalizing on their strong positive correlation as jet fuel is derived from crude oil. It's a type of petroleum-based fuel that's refined from crude oil, specifically from the portions of crude oil known as "middle distillates."

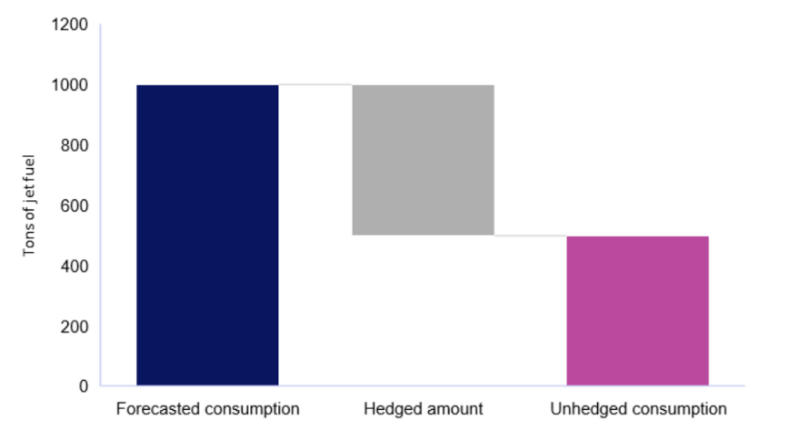

Figure 1: Base case scenario: 50% of the forecasted fuel consumption is hedged [10].

According to the Figure 1, airlines would hedge about 50% of forecasted fuel consumption, by entering into long-term contracts, often up to 24 months. They can ensure their fuel needs in this way for a significant portion of the year, making financial planning and budgeting more predictable [11].

In addition to utilizing the futures market, airlines often collaborate with insurance companies to further manage their risk. They agree on a price for the remaining fuel they will consume for the year, creating a threshold. If the cost of fuel exceeds this agreed-upon range, the insurers cover the difference in price. This arrangement provides another layer of protection against unexpected spikes in fuel prices and helps in maintaining financial stability.

Figure 2: US Gulf Coast Jet Fuel vs. WTI.

Figure 2 shows the Jet fuel Price and the West Texas Intermediate Monthly Price from Jan-19 to Nov-21 generally trend together. By calculating its correlation, result shows 0.925133559. A high correlation could be expected between these two commodities, given that they are both influenced by many of the same underlying factors. However, this correlation does not always lead to a perfect hedge, as external factors such as refining costs, geopolitical events, and environmental regulations can interfere.

A significant drop can be observed in both datasets around Mar-20 and Apr-20, corresponding to the economic fallout of the COVID-19 pandemic.

With travel restrictions, lockdowns, and fear of contagion, the demand for air travel plummeted. Airlines were forced to ground many of their flights, resulting in significantly reduced need for jet fuel. At the same time, the global economic downturn led to a sharp decline in crude oil prices, and consequently, jet fuel prices fell as well. The OPEC and allies' initial inability to agree on production cuts further contributed to this price collapse.

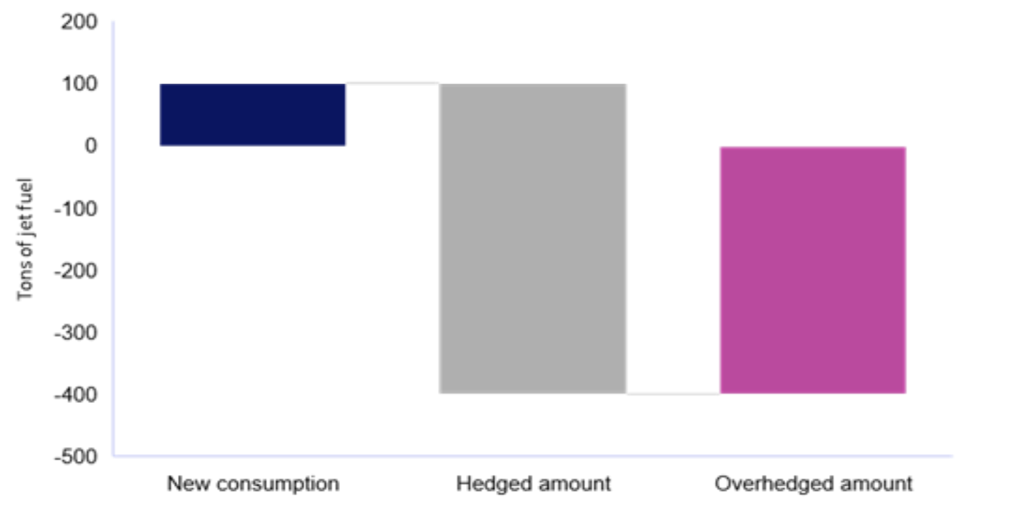

An analysis of European airlines in April 2020 revealed losses of $6.82 billion due to shrinking jet fuel demand and numbers of traveler s [12]. The Figure 3 indicates new jet fuel consumption after the pandemic. It declines to 10% (compared to base case scenario), therefore, airlines are expericing an overhedging. As of mid-February 2019, Air France-KLM has 65% of its anticipated fuel requirements for 2020 covered at a price of about $65 per barrel for Brent crude. When Brent reached $69 in early January, the group briefly benefited from this strategy, making it appear to be advantageous.

However, the advantages vanished quickly. The start of a bad trend was signaled by a dip in Brent to $53 in early February 2020, which was linked to China's decreased economic activity amid coronavirus containment. The situation deteriorated in North America and Europe, and on March 6, 2020, Brent closed at $45 due to OPEC+'s failure to reach an agreement on a supply cut.

Air France-KLM anticipated a $300 million hedging loss while Brent was at $57, growing to a $650 million loss at $52, as fuel prices continued to decline. The group's pre-hedging fuel expenditures might be around $4.5 billion if the price of fuel remained constant at $45, but hedging losses may drive up the final bill by $1 billion. However, this sum would be lower than the $6.2 billion in 2019, which represented 23% of the group's operational expenses [13].

Figure 3: COVID-19 scenario: the forecasted fuel consumption declines to 10% of the base case. Source: (IATA, n.d.).

Therefore, airlines that had hedged fuel at higher prices found themselves locked into those higher prices even as actual market prices for jet fuel plummeted. They had to buy fuel at the hedged (higher) price for the quantities contracted, while the market price was much lower, leading to financial losses. Since many flights were canceled, airlines did not need the quantities of fuel they had hedged. Some hedging contracts might not have allowed for enough flexibility in such an unprecedented situation.

Similarly to the airlines' hedging dilemma, Metallgesellschaft AG faced unexpected disruptions. Next case underscores the unpredictability of global events on strategic planning.

3. Metallgesellschaft AG

Metallgesellschaft AG (we call it M.G. in the following passage) is a traditional German metal company, and the company developed into the company that offered the risk management services in 1990. M.G. offered the contracts to their customers to fix the fuel oil price risk for 10 years. And their customers can reduce the risk of the changing oil price and get the crude oil, heating oil and gasoline from M.G. The futures contracts used to hedge was the No.2 heating oil and unleaded gasoline on the New York Mercantile Exchange (NYMEX). Initially, M.G.’s contracts proved to be very successful and the margin profit of the contract is up to $5 per barrel.

M.G.’s hedging strategy is special: they used " stack" rolling hedging strategy. Sometimes, the company has to hedge the asset for a long time, but we do not have such a future in the market to match the hedging time. So the company can divide the whole hedging into several periods and use the short-time futures to hedge. M.G.'s strategy was to use the front-end month futures contracts on the NYMEX. Since the futures didn’t provide such a long period futures contacts. M.G. company cut the long period hedge into short-dated delivery months.

However, there is a problem in this case: when we close out at the end of each hedging period, we will face the problem of basis risk. First, we want to explain the definition of backwardation and contango. When the spot price is higher than the futures price, the market is on backwardation. Otherwise, the market is on contango. And M.G.’s the stack rolling strategy indicates that when the market is on backwardation, they would make profit and their hedge could be successful. But on a contango market, there would be a huge loss. Furthermore, because M.G. held the futures, they had to pay the margin calls when the oil price decreased. This would cause the company to face short-term cash flow pressure.

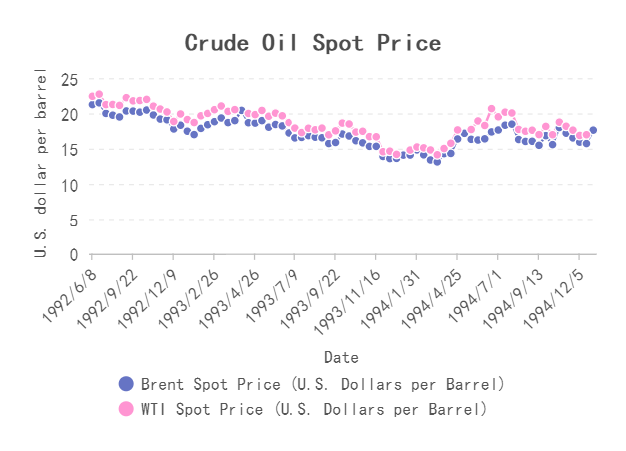

The disaster came in December 1993. Figure 4 shows that the energy market was depressed, and the crude oil price plunged. The energy spot price fell from almost $20 per barrel to less than $14 per barrel. Therefore, M.G. had to pay a tremendous amount of margin calls (about $1.9 billion) and this caused the company a significant cash flow problem.

Besides, because the spot price was decreasing and it cause the markets in contango. As we discuss above, the stack strategy would induce a huge loss.

Figure 4: WTI and Brent Crude oil spot price from 1992/6 to 1994/12.

The main error behind this disaster is the assumption of the oil market's economy. M.G. company assumed that the oil spot price would continue to increase, and initially, the contract proved very successful; some studies have shown the efficiency of the "stack" hedging strategies.

From M.G’s mistake, we know that the petroleum market is an environment with a significant price fluctuation. And this fact will cause the companies’ misjudgment. Furthermore, the basis risk of the oil existed: the spot price was usually higher than the futures price. This will make the markets in a backwardation and when the contango happens, the companies will face the basis risk.

Using M.G's experience as a backdrop, the complexities of volatile markets like petroleum become clear. Similarly, SINOPEC case will show how political factors influence price fluctuation of crude oil and other oil products and also influence the way SINOPEC hedges its risks - the dual insurance mechanism.

4. SINOPEC

China Petroleum & Chemical Corporation (hereinafter collectively referred to as "SINOPEC"), established in 1998 and located in Beijing, is a centralized enterprise at the vice-ministerial level directly under the State-owned Assets Supervision and Administration Commission of the State Council (SASAC). SINOPEC is the biggest provider of refined oil products and in petrochemical products in China. SINOPEC exercises funder's power over its investee companies in compliance with the law, operates and controls national assets in conformity with the law and bears the corresponding liability for value maintenance and enhancement. SINOPEC's operations mainly encompass the production and sale of petrochemical products, storage and transportation, and investment in financial derivatives. SINOPEC's crude oil imports will reach 138 million tons in 2022, accounting for 70% of China's crude oil imports.

SINOPEC hedges its risks by means of a dual insurance mechanism: the parent company spreads its business (and also spreads its risks) by setting up numerous subsidiaries, and the subsidiaries use futures for hedging. China International Petrochemical Union Limited (hereinafter collectively referred to as "UNIPEC") is a privately owned subsidiary of SINOPEC. The huge loss in SINOPEC's futures trading was caused by UNIPEC's futures trading.

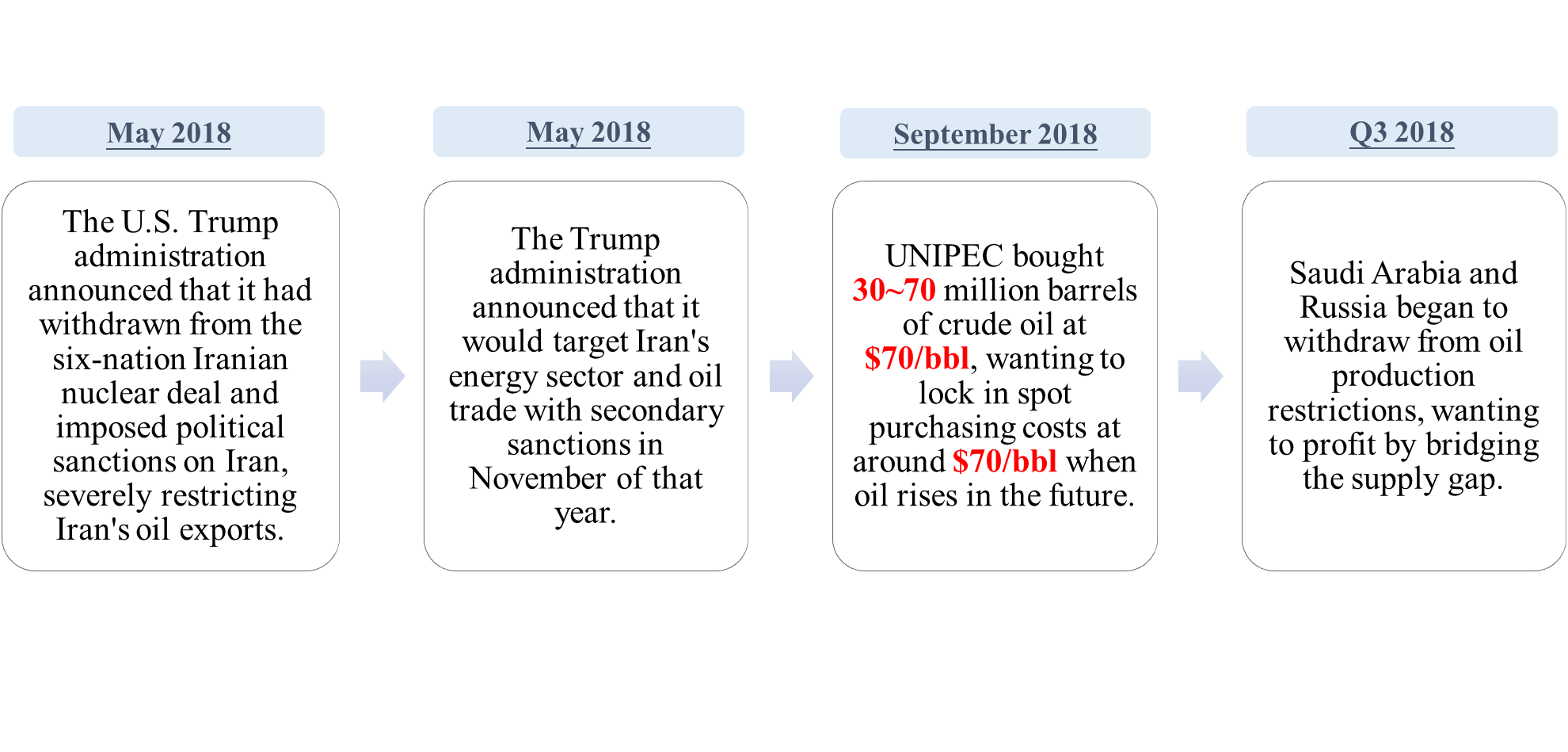

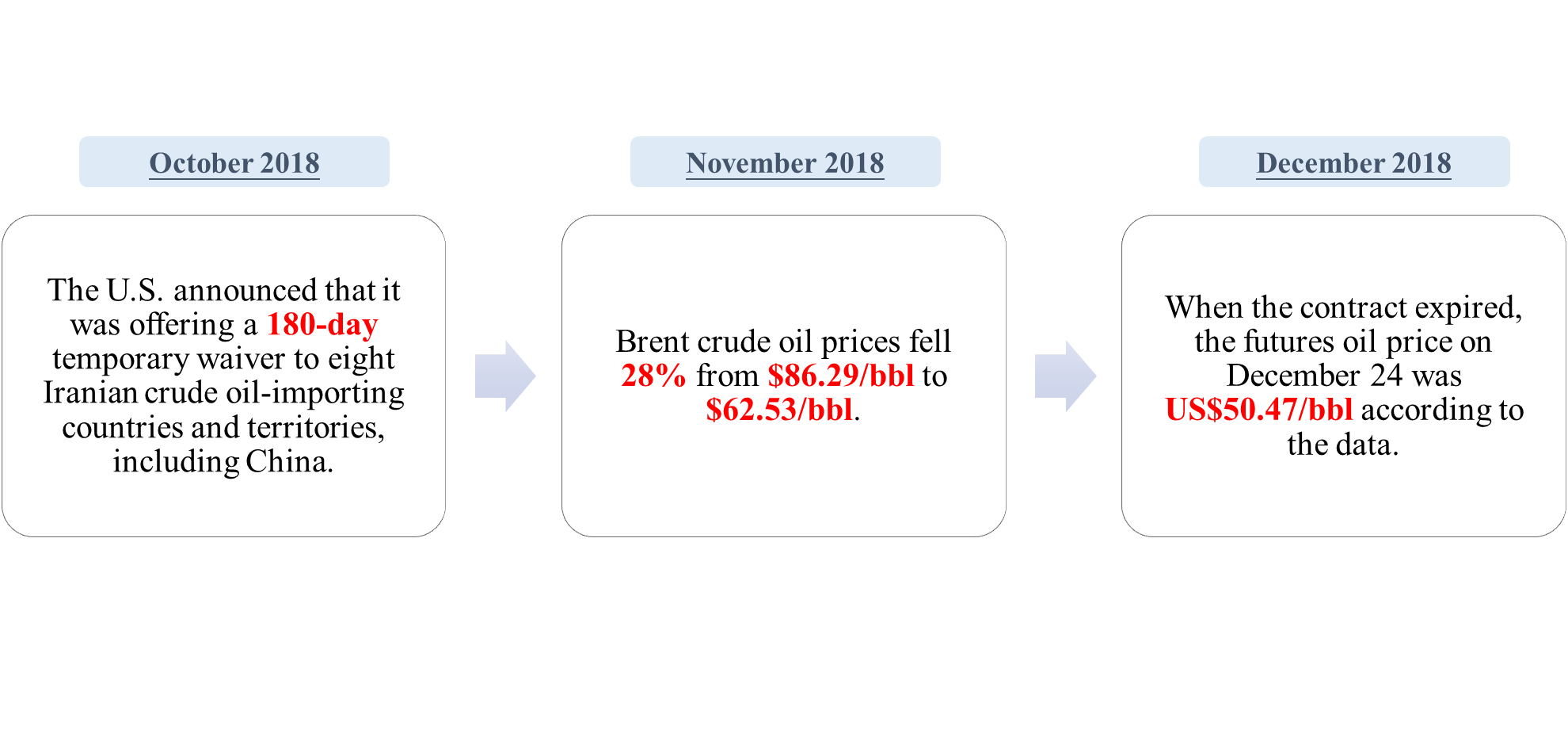

Political events can have a huge impact on market supply and demand in a short period of time, thus affecting prices, and sudden changes in prices can make the hedging effect of futures ineffective. In this case, UNIPEC's loss was caused by its unreasonable purchase of futures after ignoring the impact of potential political risks on spot prices and misjudging the trend of international oil prices. Figure 5 and Figure 6 show the full course of events.

Figure 5: Timeline of events combing 1.

Figure 6: Timeline of events combing 2.

Iran was suddenly hit with sanctions, leading to a supply gap on the international crude oil market. Demand is far greater than supply, stimulating the soaring crude oil prices. UNIPEC believes that international crude oil prices will continue to be high in the short term. Therefore, in September 2018, UNIPEC bought 30~70 million barrels of crude oil at $70/barrel, wanting to lock in the purchase cost of spot at around $70/barrel when oil rises in the future.

Figure 7: Russia and Saudi Arabia's average daily oil production.

According to the Figure 7, however Saudi Arabia and Russia are starting to pull out of oil production restrictions, looking to profit by closing the supply gap. Meanwhile the sanctions imposed by the US against Iran were not as strong as previously expected. Iran's exported oil production did not decrease as significantly as expected which, combined with increased crude oil production from Saudi Arabia and Russia, led to a spike in international crude oil supply. At the same time, demand for oil decreased due to a general lack of optimism about global economic conditions in 2019. Figure 8 shows that the increase in supply coupled with the decrease in demand caused international crude oil prices to start tumbling back down.

This makes the actual effect of the implementation of the trading strategy of the UNIPEC spot purchasing costs rose to about $70 U.S. dollars / barrel, making the actual loss of about $20 U.S. dollars / barrel, combined with the number of contracts traded, the total loss of the total loss of billions of U.S. dollars, equivalent to ten billion yuan. On January 25, 2019, SINOPEC's progress announcement concerning the UNIPEC crude oil trading incident directly indicated that UNIPEC's annual operating loss in 2018 was as high as ¥4.65 billion yuan, and that the spot end of the deal saved ¥6.4 billion yuan [14].

Figure 8: Crude Oil Futures Historical Price.

Although the subsidiary's hedging risk failed, it was due to SINOPEC's diversification of risk. Despite the high number of losses, SINOPEC and UNIPEC were able to maintain their normal operations. SINOPEC's 2018 annual report disclosed that it still achieved a net profit of ¥63 billion yuan in 2018. The dual insurance mechanism hedges the risk in the futures market, so that the impact of this crude oil trading loss event on SINOPEC is limited.

5. The features of the crude oil futures when hedging

On one hand, the crude oil futures market is highly active with great trading flexibility. Companies can purchase as little as 1,000 barrels, a smaller volume than in the spot market. Airline companies often hedge fuel prices using crude oil futures, as the market is larger and more accommodating than the fuel futures market.

In our observations, crude oil’s spot price is usually higher than its futures price, therefore, trading futures can make profit for hedgers. In M.G.’s case, they used the basis difference of crude oil to make profit while hedging risks.

On the other hand, drawbacks of using crude oil futures to hedge risks exist.

The crude oil features price has high fluctuation, and one of the factors causing it is the economic sanctions that correspond with political circumstances. As economic sanctions influence the supply and demand for crude oil, which leads to sharp fluctuations in the price of crude oil. Overall, the volatility of the price of crude oil can lead huge increased economic losses and put the market into dilemma.

Basis risk exists in oil futures. Specifically, basis risk can lead to hedging outcomes that differ from expectations, undermining the original purpose of buying futures. In the airline’s case, basis risk arises when jet fuel price changes don't align with shifts in crude oil futures prices. In Sinopec's case, basis risk causes huge losses due to the unexpected price movements.

Crude oil futures involve leverage risk. High leverage can also amplify losses, leading to the potential for significant financial setbacks. In M.G.’s case, the crude oil price plunged, which makes the cost of equity unaffordable.

Implementing cross-hedging strategy could be risky, since it requires a deep understanding of market trends and regulations, exposing it to operational and market risks.

6. Conclusion

In conclusion, by examining hedging strategies in the crude oil futures market, we find that crude oil futures are widely used. The crude oil futures market provides valuable hedging opportunities for companies to manage their exposure to oil price movements. By combining specific examples, we find oil futures are highly liquid and easy to trade to complete a hedge and make a profit. This is why many companies choose to trade crude oil futures.

However, prudent decision-making, solid risk management practices, and a thorough understanding of the international political situation and market dynamics are essential to navigate the complexities of crude oil futures trading successfully. Enterprises need to focus on cultivating high-quality talent, improving their internal risk management and control supervision systems, and choosing other bulk futures products to improve risk hedging. As long as the method is appropriate, enterprises can benefit from the advantages of crude oil futures while minimizing potential risks and ensuring financial stability.

References

[1]. Crude Oil: Powerful & Indispensable.(2023).Wintershall Dea AG. https://wintershalldea.com/en/what-we-believe/why-crude-oil.

[2]. Hecht, A. (2022). Understanding the Crude Oil Market: Pricing Differentials Between Brent Crude Oil and WTI. The Balance. https://www.thebalancemoney.com/crude-oil-brent-versus-wti-808872.

[3]. Smith, R. A. (2023). The Job Market for Remote Workers Is Shrinking. Wall Street Journal. https://www.wsj.com/articles/the-job-market-for-remote-workers-is-shrinking-11674526943.

[4]. Turner, P. A., & Lim, S. H. (2015). Hedging jet fuel price risk: The case of U.S. passenger airlines. Journal of Air Transport Management, 44–45, 54–64. https://doi.org/10.1016/j.jairtraman.2015.02.007.

[5]. Fernando, J. (2023). Futures in Stock Market: Definition, Example, and How to Trade. Investopedia. https://www.investopedia.com/terms/f/futures.asp.

[6]. McFarlane, G.(2021). Introduction To Trading In Oil Futures. Investopedia. https://www.investopedia.com/articles/active-trading/040615/introduction-trading-oil-futures.asp.

[7]. Bodie, Z., Kane, A., & Marcus, A. (2013). Investments (10th ed.). The McGraw-Hill.

[8]. Cao, M., & Conlon, T. (2023). Composite jet fuel cross-hedging. Journal of Commodity Markets, 30, 100271. https://doi.org/10.1016/j.jcomm.2022.100271.

[9]. Turner, P. A, & Lim, S. H. (2015). Hedging jet fuel price risk: The case ofU.S. passenger airlines. Journal of Air Transport Management, 44-45, 54-64, https://doi.org/10.1016/j.jairtraman.2015.02.007.

[10]. IATA. (n.d.). Over Hedging Under Covid 19. https://www.iata.org/contentassets/5e5ce0cfe03e474c90a82285cb2b86a7/twg-over-hedging-under-covid-19.pdf.

[11]. Ravindran A. G. B. (2021). Airline losses from hedging against oil price fluctuations amount to over $4.7 billion. Business Insider. https://www.businessinsider.com/airfrance-iag-iata-aviation-worst-year-coronavirus-passenger-traffic-2021-3.

[12]. Dunbar N., & Singh M. (2021). Asia Pacific airlines hit by $3.2 billion fuel hedging losses. EuroFinance. https://www.eurofinance.com/news/asia-pacific-airlines-hit-by-3-2-billion-fuel-hedging-losses/.

[13]. Horton, W. (2020). Air France-KLM Faces $1 Billion Fuel Hedging Loss As Oil Price Falls Due To Coronavirus. Forbes. https://www.forbes.com/sites/willhorton1/2020/03/08/air-france-klm-faces-1-billion-fuel-hedging-loss-as-oil-price-falls-due-to-coronavirus/.

[14]. Zhang Yining.(2020).Case Study of Huge Loss in China International United Petroleum &Chemicals Company Limited Futures Trading.https://kns.cnki.net/kcms2/article/abstract?v=DwbYnX8C4XORfZkkckLOM4GrTVTwkmyeU3mK_vHfuIOIi59RbAvOsdklUtX7ZVNV9B7JAYOERyBuKGh0J148Q2iBUbJ8Irmc6Z93xm7UazLBJzYIdV6qNh4zh6wSXIYc-jRbhn33KyQ=&uniplatform=NZKPT&language=CHS.

Cite this article

Li,B.;Li,Z.;Yang,J.;Yang,J. (2024). Analysis of Hedging Strategies in the Crude Oil Futures Market. Advances in Economics, Management and Political Sciences,82,85-95.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Crude Oil: Powerful & Indispensable.(2023).Wintershall Dea AG. https://wintershalldea.com/en/what-we-believe/why-crude-oil.

[2]. Hecht, A. (2022). Understanding the Crude Oil Market: Pricing Differentials Between Brent Crude Oil and WTI. The Balance. https://www.thebalancemoney.com/crude-oil-brent-versus-wti-808872.

[3]. Smith, R. A. (2023). The Job Market for Remote Workers Is Shrinking. Wall Street Journal. https://www.wsj.com/articles/the-job-market-for-remote-workers-is-shrinking-11674526943.

[4]. Turner, P. A., & Lim, S. H. (2015). Hedging jet fuel price risk: The case of U.S. passenger airlines. Journal of Air Transport Management, 44–45, 54–64. https://doi.org/10.1016/j.jairtraman.2015.02.007.

[5]. Fernando, J. (2023). Futures in Stock Market: Definition, Example, and How to Trade. Investopedia. https://www.investopedia.com/terms/f/futures.asp.

[6]. McFarlane, G.(2021). Introduction To Trading In Oil Futures. Investopedia. https://www.investopedia.com/articles/active-trading/040615/introduction-trading-oil-futures.asp.

[7]. Bodie, Z., Kane, A., & Marcus, A. (2013). Investments (10th ed.). The McGraw-Hill.

[8]. Cao, M., & Conlon, T. (2023). Composite jet fuel cross-hedging. Journal of Commodity Markets, 30, 100271. https://doi.org/10.1016/j.jcomm.2022.100271.

[9]. Turner, P. A, & Lim, S. H. (2015). Hedging jet fuel price risk: The case ofU.S. passenger airlines. Journal of Air Transport Management, 44-45, 54-64, https://doi.org/10.1016/j.jairtraman.2015.02.007.

[10]. IATA. (n.d.). Over Hedging Under Covid 19. https://www.iata.org/contentassets/5e5ce0cfe03e474c90a82285cb2b86a7/twg-over-hedging-under-covid-19.pdf.

[11]. Ravindran A. G. B. (2021). Airline losses from hedging against oil price fluctuations amount to over $4.7 billion. Business Insider. https://www.businessinsider.com/airfrance-iag-iata-aviation-worst-year-coronavirus-passenger-traffic-2021-3.

[12]. Dunbar N., & Singh M. (2021). Asia Pacific airlines hit by $3.2 billion fuel hedging losses. EuroFinance. https://www.eurofinance.com/news/asia-pacific-airlines-hit-by-3-2-billion-fuel-hedging-losses/.

[13]. Horton, W. (2020). Air France-KLM Faces $1 Billion Fuel Hedging Loss As Oil Price Falls Due To Coronavirus. Forbes. https://www.forbes.com/sites/willhorton1/2020/03/08/air-france-klm-faces-1-billion-fuel-hedging-loss-as-oil-price-falls-due-to-coronavirus/.

[14]. Zhang Yining.(2020).Case Study of Huge Loss in China International United Petroleum &Chemicals Company Limited Futures Trading.https://kns.cnki.net/kcms2/article/abstract?v=DwbYnX8C4XORfZkkckLOM4GrTVTwkmyeU3mK_vHfuIOIi59RbAvOsdklUtX7ZVNV9B7JAYOERyBuKGh0J148Q2iBUbJ8Irmc6Z93xm7UazLBJzYIdV6qNh4zh6wSXIYc-jRbhn33KyQ=&uniplatform=NZKPT&language=CHS.