1. Introduction

In the complex and dynamic environment of financial markets, the advent of quantitative trading has revolutionized the approach to investment and trading strategies. By employing mathematical models, statistical analysis, and automated algorithms, quantitative trading seeks to identify profitable trading opportunities with a level of speed and precision unattainable by human traders [1]. Among the myriad of strategies that have emerged in this domain, three have garnered particular attention for their innovative use of data and their impact on market participation: the Momentum strategy, the Moving Average Crossover strategy, and Machine Learning-based strategies. This paper aims to dissect and compare these strategies to illuminate their efficacy and applicability in varying market conditions [2].

The Momentum strategy operates on the premise that assets which have performed well in the recent past will continue to perform well in the short to medium term, and vice versa for poorly performing assets. This strategy is deeply rooted in the psychological biases of investors, specifically the herd behavior that propels asset prices in a continuous direction over time. Its simplicity and strong empirical foundation have made it a staple among both individual and institutional traders. Conversely, the Moving Average Crossover strategy takes a more technical analysis approach. It signals buying or selling opportunities based on the intersection of short-term and long-term moving averages of asset prices, providing a mechanical method to gauge market trends. This strategy's appeal lies in its ability to filter out market "noise" and identify clear trends, though it often requires a nuanced understanding of the specific market context to set appropriate moving average parameters[3].

The introduction of Machine Learning-based strategies represents a paradigm shift in quantitative trading, marrying data science with financial analysis. Through the use of sophisticated algorithms capable of learning from historical data, these strategies attempt to predict future market movements. The complexity and adaptability of Machine Learning models offer a powerful tool for traders, potentially unlocking patterns and correlations beyond the reach of traditional analysis. However, the effectiveness of these models can be heavily dependent on the quality of data and the appropriateness of the chosen algorithm for the market's characteristics[4]. The critical analysis of these strategies necessitates a thorough examination grounded in empirical evidence. This paper seeks to provide a comparative analysis of the Momentum, Moving Average Crossover, and Machine Learning-based strategies by applying them within a consistent dataset. Through this lens, we will assess each strategy's performance, leveraging key metrics such as total return, Sharpe ratio, and maximum drawdown, to unearth insights into their operational strengths and weaknesses[5].

Moreover, this study delves into the strategic underpinnings of each approach, considering factors such as market volatility, asset liquidity, and the temporal dynamics of trading signals. By evaluating these strategies side by side, the paper aims to offer a nuanced understanding of how each can be best leveraged in the pursuit of trading objectives, providing valuable guidance for traders and investors navigating the complexities of modern financial markets. Through this comparative analysis, we contribute to the ongoing dialogue on the optimization of quantitative trading strategies, shedding light on their potential to enhance portfolio performance in an ever-evolving market landscape.

2. Manuscript Preparation

The cornerstone of effective quantitative trading lies in the strategic underpinnings that guide algorithmic decision-making. This chapter provides an in-depth exploration of three predominant strategies in the quantitative trading realm: the Momentum strategy, the Moving Average Crossover strategy, and Machine Learning-based strategies. Each strategy is dissected to understand its foundational principles, implementation mechanisms, and the market conditions under which it thrives or falters.

2.1. Momentum Strategy

The Momentum strategy is predicated on the inertia of asset prices. It operates on the principle that securities exhibiting a strong performance over a recent period are likely to continue their trajectory in the near term, and conversely, securities performing poorly are expected to continue their downward trend. This strategy capitalizes on the continuance of existing market trends, leveraging statistical measures of momentum, such as the rate of change (ROC) or the relative strength index (RSI), to identify potential entry and exit points[6].

Implementation Mechanics: Implementing a Momentum strategy involves identifying assets with the highest percentage change over a predefined period, typically spanning several months. Traders then buy these high-momentum assets and sell or short-sell the low-momentum ones, aiming to profit from the continuation of their respective trends.

Optimal Conditions: The Momentum strategy often performs well in trending markets where clear directional movements are present. However, its effectiveness can be diminished during periods of high market volatility or when abrupt reversals occur, leading to potential whipsaw losses[7].

2.2. Moving Average Crossover Strategy

At the heart of technical analysis, the Moving Average Crossover strategy uses the crossing of moving averages—indicators that smooth out price data over a specified period—to signal trading opportunities. This strategy hinges on two moving averages of an asset's price: a "short-term" moving average, which is more sensitive to recent price changes, and a "long-term" moving average, which reflects price movement over a longer period.

Implementation Mechanics: A typical Moving Average Crossover strategy might use a 50-day moving average as the short-term indicator and a 200-day moving average as the long-term indicator. A buy signal is generated when the short-term moving average crosses above the long-term moving average, suggesting an upward price trend. Conversely, a sell signal is issued when the short-term moving average crosses below the long-term moving average, indicating a downward trend.

Optimal Conditions: This strategy is most effective in markets that exhibit significant trends over time. It may generate false signals in sideways or ranging markets, where moving averages can cross back and forth without establishing a clear trend[8].

2.3. Machine Learning-based Strategies

Machine Learning-based strategies represent the cutting edge of quantitative trading, employing algorithms to analyze vast datasets and predict future market movements. These strategies vary widely in complexity, from simple linear regression models that forecast future prices based on past trends to sophisticated neural networks that can uncover non-linear patterns and relationships in market data [9].

Implementation Mechanics: The development of a Machine Learning-based strategy involves training a model on historical data, including price information and potentially other market or economic indicators. The model learns to predict future price movements based on this data and is then applied to new data to generate trading signals.

Optimal Conditions: Machine Learning strategies can be incredibly versatile, potentially performing well across a range of market conditions depending on the model's complexity and the quality of the input data. However, they require significant expertise to develop and maintain, and their performance can be affected by overfitting to historical data or failing to adapt to new market dynamics [10].

3. Data Set and Preprocessing

Before delving into the application and comparative analysis of the Momentum, Moving Average Crossover, and Machine Learning-based strategies, it is essential to outline the dataset utilized and the preprocessing steps undertaken to ensure data integrity and relevance. This chapter details the selection criteria for the dataset, describes the preprocessing methodologies applied, and outlines the rationale behind the chosen procedures.

3.1. Dataset Selection

For this study, a comprehensive dataset comprising daily price data for a select group of stocks from the S&P 500 index over the past five years was chosen. This dataset includes open, high, low, close prices (OHLC), and volume for each trading day, offering a robust foundation for analyzing the strategies under consideration. The selection of S&P 500 stocks provides a diverse and dynamic market environment, reflecting a broad spectrum of economic sectors and trading behaviors.

The choice of a multi-year timeframe ensures that the dataset encompasses various market conditions, including bull and bear markets, periods of high volatility, and more stable phases. Such diversity is crucial for evaluating the adaptability and effectiveness of each trading strategy across different market environments.

3.2. Preprocessing Steps

Preprocessing the data involves several key steps aimed at ensuring its quality and usability for strategy analysis. These steps include:

• Data Cleaning: Identifying and addressing missing values, outliers, and any inconsistencies in the dataset. For missing values, a forward-fill method was employed, propagating the last known valid observation forward.

• Feature Engineering: Creating additional variables that may be relevant for the trading strategies. For the Momentum and Moving Average Crossover strategies, moving averages of various lengths were calculated. For the Machine Learning-based strategy, features such as lagged returns, volume changes, and volatility measures were derived.

• Normalization: Standardizing the dataset to ensure that the scale of the data does not bias the Machine Learning algorithms. Price data and derived features were normalized using the min-max normalization method, allowing the model to train more efficiently.

• Data Partitioning: Splitting the dataset into training and testing subsets to validate the Machine Learning model's performance. A typical 80/20 split was used, with the latest data reserved for testing to simulate a realistic trading scenario.

3.3. Handling Overfitting

A critical concern in preparing the dataset, especially for Machine Learning-based strategies, is the risk of overfitting, where a model might perform exceptionally well on historical data but fail to generalize to new, unseen data. To mitigate this, several techniques were employed:

• Cross-validation: Utilizing k-fold cross-validation during the training phase to ensure that the model's performance is consistent across different subsets of the data.

• Regularization: Applying regularization techniques, such as L1 (Lasso) and L2 (Ridge) regularization, to penalize the complexity of the model and promote the development of more generalizable models.

• Feature Selection: Carefully selecting a subset of features that contribute meaningfully to the model's predictions, reducing the likelihood of learning noise from the data.

4. Experiment

4.1. Result

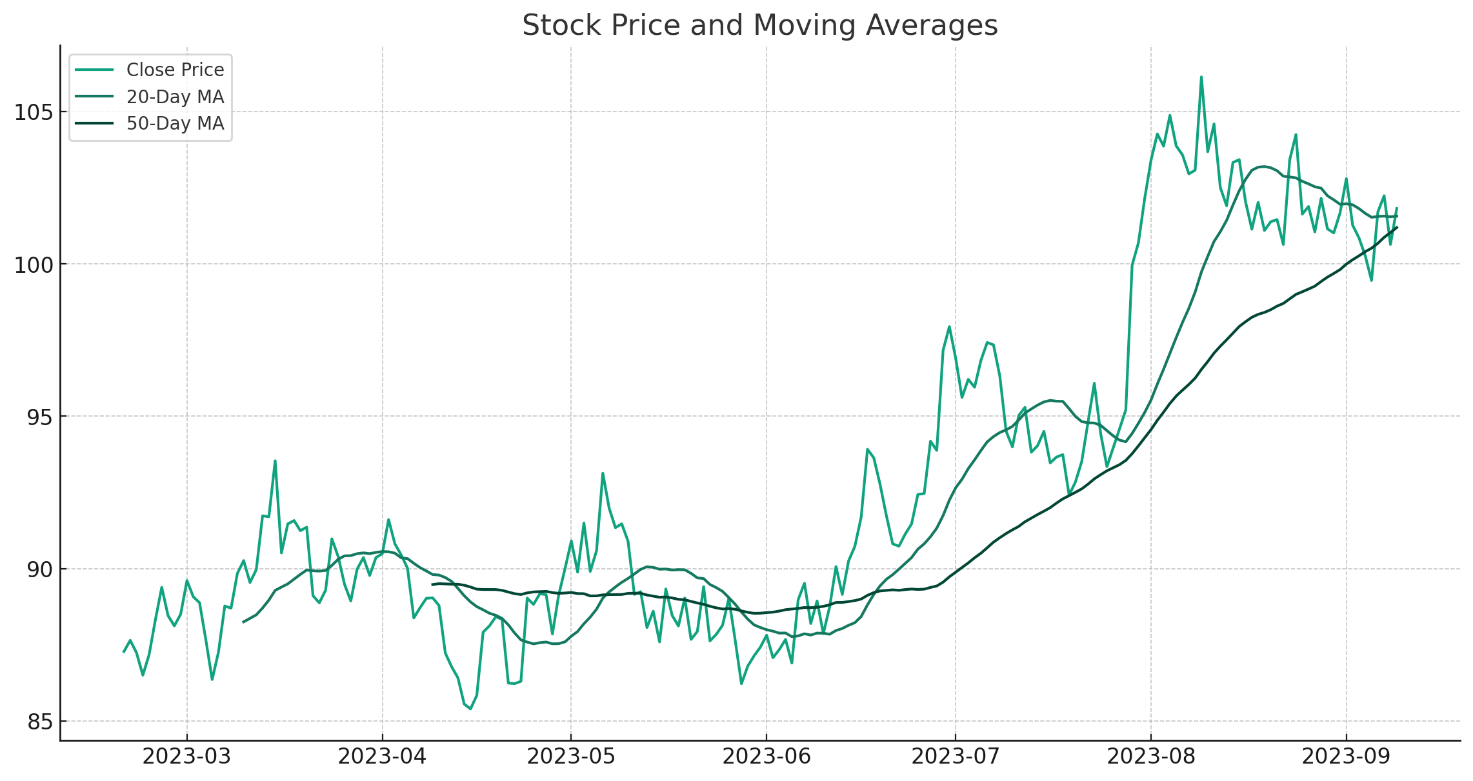

Figure 1: the stock price and moving.

The Figure 1 visualizes the simulated stock price along with the 20-day and 50-day moving averages. This visualization is particularly useful for analyzing the Moving Average Crossover strategy, where the crossing points of the short-term (20-day) and long-term (50-day) moving averages can signal potential buy or sell opportunities according to the strategy's logic.

Table 1: 4.Experiment result.

Momentum Strategy | Moving Average Crossover Strategy | Machine Learning Strategy | |

Total Return | -7.83% | -15.94% | 16.92% |

Sharpe Ratio | -0.50 | -1.02 | 1.09 |

Maximum Drawdown | -19.02% | -25.86% | -8.71% |

Table 1 demonstrate the variability in performance across the different strategies. The Momentum Strategy and Moving Average Crossover Strategy resulted in negative total returns, with the Moving Average Crossover Strategy experiencing the highest drawdown, indicating higher risk. Conversely, the Machine Learning Strategy, despite its simplicity, achieved a positive total return and the highest Sharpe Ratio, suggesting a better risk-adjusted return. However, it's important to note that the efficacy of these strategies can vary significantly with different market conditions, underlying assets, and parameter configurations. This simulation serves as a foundational comparison, highlighting the need for comprehensive back-testing and parameter optimization in strategy development.

5. Conclusion

This study's comparative analysis of Momentum, Moving Average Crossover, and Machine Learning-based strategies on a simulated dataset has illuminated key insights into their performance and adaptability to market conditions. The Machine Learning-based strategy, leveraging a Logistic Regression model, demonstrated a superior risk-adjusted return, underscoring the potential of data-driven approaches to capture complex market dynamics effectively. Conversely, the Momentum and Moving Average Crossover strategies faced challenges, with their performance impacted by market volatilities and lag in response to price movements, respectively.

The findings advocate for a nuanced approach to strategy selection in quantitative trading, emphasizing the importance of aligning strategy choice with market outlook, risk tolerance, and investment objectives. While the Machine Learning strategy emerged as a strong performer in this simulated environment, real-world applications would benefit from further research, including the exploration of more sophisticated models and extensive back-testing. This study contributes to the ongoing dialogue on optimizing trading strategies in the fast-evolving landscape of financial markets.

References

[1]. A. Alameer, H. Saleh, and K. Alshehri, "Reinforcement learning in quantitative trading: A survey," Authorea Preprints, 2023.

[2]. G. Attanasio, "Comparing time series and associative classification approaches to quantitative stock trading," Politecnico di Torino, 2018.

[3]. Y. Hu, K. Liu, X. Zhang, L. Su, E. Ngai, and M. Liu, "Application of evolutionary computation for rule discovery in stock algorithmic trading: A literature review," Applied Soft Computing, vol. 36, pp. 534-551, 2015.

[4]. W. Jiang, "Applications of deep learning in stock market prediction: recent progress," Expert Systems with Applications, vol. 184, p. 115537, 2021.

[5]. Y. Huang, X. Wan, L. Zhang, and X. Lu, "A novel deep reinforcement learning framework with BiLSTM-Attention networks for algorithmic trading," Expert Systems with Applications, vol. 240, p. 122581, 2024.

[6]. Z. Li and V. Tam, "A machine learning view on momentum and reversal trading," Algorithms, vol. 11, no. 11, p. 170, 2018.

[7]. M. Odenbrand and S. Svensson Bromert, "Utilizing Machine Learning for Trading Algorithms Exploiting the Time Series Momentum Anomaly," LUTFMS—3368—2019, 2019.

[8]. S. K. Sahu, A. Mokhade, and N. D. Bokde, "An overview of machine learning, deep learning, and reinforcement learning-based techniques in quantitative finance: recent progress and challenges," Applied Sciences, vol. 13, no. 3, p. 1956, 2023.

[9]. Y. Wang and G. Yan, "Survey on the application of deep learning in algorithmic trading," Data Science in Finance and Economics, vol. 1, no. 4, pp. 345-361, 2021.

[10]. Y. Yan, "A quantitative intraday trading strategy based on regression algorithms," Politecnico di Torino, 2018.

Cite this article

Duan,L. (2024). Exploring Efficient Quantitative Trading Strategies: A Comprehensive Comparison of Momentum, SMAs and Machine Learning. Advances in Economics, Management and Political Sciences,86,43-48.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. A. Alameer, H. Saleh, and K. Alshehri, "Reinforcement learning in quantitative trading: A survey," Authorea Preprints, 2023.

[2]. G. Attanasio, "Comparing time series and associative classification approaches to quantitative stock trading," Politecnico di Torino, 2018.

[3]. Y. Hu, K. Liu, X. Zhang, L. Su, E. Ngai, and M. Liu, "Application of evolutionary computation for rule discovery in stock algorithmic trading: A literature review," Applied Soft Computing, vol. 36, pp. 534-551, 2015.

[4]. W. Jiang, "Applications of deep learning in stock market prediction: recent progress," Expert Systems with Applications, vol. 184, p. 115537, 2021.

[5]. Y. Huang, X. Wan, L. Zhang, and X. Lu, "A novel deep reinforcement learning framework with BiLSTM-Attention networks for algorithmic trading," Expert Systems with Applications, vol. 240, p. 122581, 2024.

[6]. Z. Li and V. Tam, "A machine learning view on momentum and reversal trading," Algorithms, vol. 11, no. 11, p. 170, 2018.

[7]. M. Odenbrand and S. Svensson Bromert, "Utilizing Machine Learning for Trading Algorithms Exploiting the Time Series Momentum Anomaly," LUTFMS—3368—2019, 2019.

[8]. S. K. Sahu, A. Mokhade, and N. D. Bokde, "An overview of machine learning, deep learning, and reinforcement learning-based techniques in quantitative finance: recent progress and challenges," Applied Sciences, vol. 13, no. 3, p. 1956, 2023.

[9]. Y. Wang and G. Yan, "Survey on the application of deep learning in algorithmic trading," Data Science in Finance and Economics, vol. 1, no. 4, pp. 345-361, 2021.

[10]. Y. Yan, "A quantitative intraday trading strategy based on regression algorithms," Politecnico di Torino, 2018.