1. Introduction

Corporate governance, also known as corporate management, is a set of procedures, practices, policies, laws, and institutions that influence the manner in which a company leads, manages and controls itself. Corporate governance is an important mechanism for protecting the rights and interests of the company's stakeholders, standardizing the internal operations of the company, and promoting the long-term sustainable development of the company. And the corporate governance approach is one that includes the relationship between stakeholders within the company and the many objectives of corporate governance. In particular, corporate stakeholders are also categorized into the primary stakeholders and other stakeholders, with the primary stakeholders including shareholders, senior executives, and directors, and other stakeholders including employees, suppliers, customers, banks and other lenders, government administrators, and the community, etc. The effectiveness of corporate governance is directly related to the performance of enterprises and the protection of shareholders' rights and interests.

As the market economy develops and globalized competition intensifies, a favorable corporate governance mechanism has become one of the key factors in the development and competition of enterprises. Therefore, in-depth study of the impact of corporate governance on enterprise performance is essential to the sustainable development of enterprises. Although there are costs associated with corporate governance measures, the balance between costs and benefits associated with these measures is critical to the long-term development of a company. The purpose of this article is to discuss the measures, costs, and benefits of corporate governance and and to suggest measures to address the current problems in corporate governance. This will provide theoretical support for firms in adapting their corporate governance practices and optimizing their returns.

2. Causes of corporate governance

The emergence of corporate governance problems requires the satisfaction of two conditions, the existence of agency problems or conflicts of interest between members of the organization. and the existence of transaction costs, which means that agency problems cannot be solved by a complete contract. In other words, wherever there are agency problems and incomplete contracts, corporate governance problems arise. Corporate governance can be seen as a mechanism for making decisions on issues that are not explicitly specified in the initial contract. It followed that even in small and closed enterprises, corporate governance problems exist, and that they are even more important in the case of large and publicly traded companies. In addition, corporate governance arises due to the development and evolution of modern enterprises. With the development of industry and commerce, large-scale venture capital investment, and the globalization of companies, the traditional family control model is gradually unable to adapt to the increasingly complex economic environment. Thus, there are 3 main reasons for corporate governance, separation of ownership and control, information asymmetry, and diversity of stakeholder needs.

First, the ownership of a company is usually held by shareholders, while corporate control is usually held by managers or management. The separation of ownership and control can lead to conflicts of interest and agency issues, which require corporate governance to harmonize relationships between different stakeholders. Second, information asymmetry occurs mainly among management and stakeholders. Managers or management usually have more information, while shareholders and other stakeholders have difficulty accessing meaningful information. Corporate governance can reduce information asymmetry by requiring disclosure and transparency, thereby increasing investor trust and protecting stakeholders' rights. Third, the company's stakeholders include shareholders, employees, suppliers, customers and other stakeholders. The needs of different stakeholders for the company are also characterized by the diversity of their attributes. Corporate governance can promote sustainable development and the common good by balancing the interests of different stakeholders.

In the case of large public companies with dispersed shareholdings, the primary task of corporate governance is to resolve the agency problem between owners and operators. In addition, due to the intricate relationships among shareholders, managers, creditors, and workers in large public companies, this requires a set of governance rules that can balance the relationships among all parties. Also, stakeholder relations within an enterprise involve optimal ownership arrangements. Corporate governance is about dealing with the relationships between these stakeholders [1]. Corporate governance focuses on solving three problems. First, in the case of separation of ownership and control, solve the issue of entrustment and agency between operators and shareholders to ensure the maximization of shareholders' interests. Second, under the condition of equity dispersion, how to coordinate the relationship between owners, especially to protect small and medium-sized investors from being infringed by large shareholders. Third, coordinate the relationship between stakeholders in the context of shareholders' pursuit of maximizing interests.

3. The cost of corporate governance

The cost of corporate governance refers to all the expenses spent to reduce insider control issues through control, constraints, authority, directives, etc. There are many studies on the concept of corporate governance costs at home and abroad. Zhou proposed that the cost of corporate governance includes the transaction costs of governance (such as information collection costs, contract costs, supervision costs and mandatory performance costs), agency costs, the organizational costs of the governance structure, and follow the cost or execute the cost [2]. Sang believes that corporate governance costs specifically include agency costs, risk-bearing costs, costs caused by conflicts of interest between shareholders, market governance costs incurred between enterprises and stakeholders, and governance costs caused by excessive government supervision [3]. Yan believes that the cost of corporate governance should also include the second type of agency costs, market governance costs, government governance costs, and institutional friction costs [4]. First corporate governance emerged with the emergence of the shareholding system, and due to the separation of capital owners (shareholders) and capital operators (managers), the goals pursued by managers and shareholders are often inconsistent. That is, there is what Burler and Mees call the separation of ownership and control. Specifically, corporate governance costs include supervision costs, Search costs, incentive costs, agency costs, stakeholder costs, information disclosure costs, and collective decision-making cost.

3.1. The company's supervision costs

The so-called supervision cost refers to the cost necessary to accurately divide the responsibilities and rights between the board of directors, the shareholders' meeting, the board of supervisors, the managers, and the employee representative organization according to the various rules and regulations and legal provisions expressly stipulated by the enterprise, and to form a relationship of mutual supervision and checks and balances to ensure the interests of shareholders. That is, in most listed companies, the owners must cede the management of the company to the managers they recruit, resulting in the separation of owners and operators, but the board of directors needs to monitor the efficiency and performance of these operators to prevent opportunistic costs that harm the rights and interests of the company's owners and hinder the company's development.

3.2. Search costs and incentive costs

In a joint-stock enterprise, the board of directors is the permanent representative body of investors (shareholders), responsible for selecting appropriate and high-quality managers, screening, negotiating, and evaluating them, and finally reaching an agreement and signing a contract with them. We refer to all expenses incurred by the board in this process as search costs [5].

It is mainly an incentive policy for the company's senior managers, such as through annual salary, dividends, bonuses, shares, etc., to achieve the incentive effect on the company's senior managers, to pursue the goal of maximizing the company's value and ensure the company's long-term stable development.

3.3. Agency costs and Stakeholder costs

It means that in the case of information asymmetry, the agent may not fully work in accordance with the contract or deviate from the expected goal of the principal to maximize its own interests, resulting in the loss of the company's value.

Including the costs incurred by the company's shareholders, creditors, employees, government agencies, suppliers, the public and other stakeholders in pursuing the company's long-term profits and ensuring the effective operation of the corporate governance mechanism, such as the cost of obtaining information about the operation of the enterprise and exchanging opinions between owners.

3.4. Information disclosure costs and Collective decision-making costs.

In enterprises whose goal is to maximize shareholder value, all shareholders are required to have the right to know the company's business operations and management decisions, so for most shareholders, to obtain all the information related to the decision, the relevant decision-making costs will increase accordingly, resulting in a high information disclosure cost.

When the number of shareholders of a company is large, differences may arise in the decision-making of the company's strategic planning and management operations, and the necessary costs must be paid to resolve these differences.

4. Governance

4.1. Benefits of governance

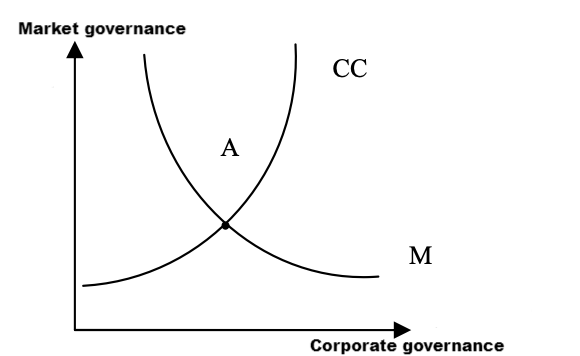

Governance in general can be divided into corporate governance and market governance, and both are ways of maximizing the value of the firm.

The benefits of corporate governance refer to the benefits obtained by enterprises through corporate governance, which reduces insider control, thus maximizes the interests of corporate governance subjects. Good corporate governance can improve investor trust, thereby attracting more investment and financing, and reducing financing costs. Secondly, effective corporate governance can help companies identify and manage potential risks and reduce operational and reputational risks. In addition, corporate governance can balance the rights and interests of different stakeholders and enhance the sustainable development of the company while improving the satisfaction of employees, suppliers, and customers.

The benefits of market governance refer to the maximization of the shared value of each participant in the market. In other words, the benefits of market governance are mainly reflected in the maximization of common surplus pursued by all stakeholders in the enterprise.

4.2. The boundaries of governance are determined

Corporate governance is an alternative mechanism for market governance and two important governance mechanisms for modern corporate governance. The determination of corporate governance boundaries can determine when it is more effective to improve the internal governance of the company, or when it is more favorable to strengthen the external market governance. Corporate governance and market governance replace each other, as shown in Figure 1. Point A in the figure is the optimal boundary of corporate governance. [5]

Figure 1: Corporate governance and market governance

5. Recommendations for improving corporate governance

5.1. Establish an accountability mechanism for the Board of Directors

In general, the board of directors is composed of shareholders, and the board of directors appoints and supervises management. Boards often fail to perform their oversight functions. In practice, the board of directors does not necessarily have a supervisory function. The board of directors shares legal responsibilities for management based on an accountability mechanism to ensure compliance with the procedures of the "triple one" matter. The establishment of independent directors in the board system can effectively exercise the supervisory function of an independent board of directors [6]. However, when the legal responsibility of the independent board is extremely low, the incentive of the board to supervise the management will be reduced; When the legal responsibility of independent directors increases, the supervisory role of the board of directors will also be strengthened. Therefore, an accountability mechanism for independent boards should be established to enhance the legal responsibility and risk awareness of independent boards.

5.2. Optimize the shareholding structure

Equity structure refers to the proportion of shares to the number of shares of the enterprise owner, which is the subject of the rights and interests of the enterprise owner and the key element affecting the decision-making of the enterprise. The owner of the shares has the right to speak on the decision-making issues in the operation of the enterprise, and provides suggestions for the scientific formulation of decision-making, to promote the decision-making to be more in line with the development of the enterprise. The relationship between corporate governance and equity structure is close, and to improve corporate governance, it is necessary to start with the adjustment of equity structure. However, it is difficult in practice, especially in the context of the intensification of enterprise market competition, and the control of the concentration and dispersion of shareholdings in enterprises must be strengthened through the implementation of democratic management systems and monitoring mechanisms. In addition, it is necessary to use the external market to decentralize equity thereby achieving a virtuous circle and coordinated development between corporate governance and equity structure [7]. However, some major shareholders have interfered with the management of enterprises or even interfered with the operation of enterprises because of their own shares, leading to chaos in the internal operation and management of enterprises. Therefore, to solve the management problems of enterprises should scientifically optimize the shareholding structure and further standardize the review process of internal information [8]. This includes adjusting the company's equity, avoiding excessive concentration of equity, and eliminating the leader's "one-word" management mode, etc. In addition, the adjustment of equity needs to be careful not to let the equity too loose.

5.3. Establish a sound incentive mechanism

First of all, when formulating the performance appraisal system of mixed reform enterprises, whether KPIs or OKRs are adopted, it is necessary to convey the company's vision and mission in the formulation of indicators, so that employees can find common goals, understand their own contributions, and find a sense of accomplishment. The second needs to play the role of the board of directors' supervision and align the interests of management with the interests of the board of directors through reasonable incentive mechanisms [8]. Thirdly, a multi-level positive incentive mechanism is established, such as salary incentives, job promotions, equity distribution, and spiritual personal honor and sense of achievement.

5.4. Establish a sound manager market

The government should improve the construction of the manager market and strengthen the restraint and incentive role of the reputation of the managers of private enterprises [9]. For example, those who cause the loss of state-owned assets are included in the list of untrustworthy persons, and the relevant responsible persons are investigated for responsibility based on the circumstances of the loss of state-owned assets. Only by accurately analyzing responsibilities and rights can we better play a supervisory and management role and guide responsible persons to pay more attention to the development of relevant work.

6. Conclusion

While there are costs associated with corporate governance measures, there are many benefits to be gained by increasing transparency, protecting shareholders' rights, and regulating corporate operations, including increased corporate value, avoiding crisis risks, and gaining access to finance. By strengthening the accountability mechanism of the board of directors, optimizing the equity structure, establishing a sound incentive mechanism, and establishing a sound manager market, it can effectively promote the sustainable development and performance of enterprises.

However, this paper does not conduct actual research, and the literature reading reference is relatively limited, the future will be based on for enterprise management and risk control and other aspects of corporate governance analysis for further optimization and adjustment.

References

[1]. YANG Ruilong,YANG Qijing.Exclusivity, exclusivity and enterprise system[J].Economic Research Journal,2001(03):3-11+93.)

[2]. ZHOU Qingjie. Corporate Governance Efficiency: An Analysis Based on Institutional Economics[C]//Beijing Institute of Economics, Economic Research Center, Shandong University, Preparatory Committee of China Institutional Economics.Proceedings of the Annual Conference of Chinese Institutional Economics. [Publisher unknown], 2003:1119-1126.

[3]. SANG Shijun,WU Desheng,LV Feishi.Corporate Governance Mechanism and Corporate Governance Efficiency——Based on the Analysis of Corporate Governance Cost[J].Accounting Research,2007(06):83-85+96.)

[4]. Yan Ruosen.Research on the composition of corporate governance cost and the optimization of corporate governance efficiency[J].Accounting Research,2005(02):59-63+95.)

[5]. LIU Hanmin,LI Yanli. Corporate governance: costs, benefits and boundaries[C]//Intelligent Information Technology Application Association.Proceedings of 2011 International Conference on Applied Social Science(ICASS 2011 V3).INFORMATION ENGINEERING RESEARCH INSTITUTE,2011:223-227.

[6]. Yan Rong. Research on the impact of mixed reform on corporate governance in the new world[D].Northwest Normal University,2021.DOI:10.27410/d.cnki.gxbfu.2021.000140.)

[7]. On Equity Structure and Corporate Governance[J].National Distribution Economy, 2021(27) :38-40. DOI:10.16834/j.cnki.issn1009-5292.2021.27.011.

[8]. On Equity Structure and Corporate Governance[J].Industrial Innovation Research,2021(15):69-70+73.) [1] HUANG Changsheng,WANG Zhenghan.Mixed ownership reform and enterprise value enhancement: An empirical study based on listed state-owned enterprises[J].Industrial Technological Economics,2021,40(08):78-88.)

[9]. Shang Yixuan.Research on the Dilemma and Path of Mixed Ownership Reform of State-owned Enterprises——Commenting on "Mixed Reform of State-owned Enterprises: Theory, Model and Path"[J].Journal of Guangdong University of Finance and Economics,2021,36(02):113-114.)

Cite this article

Chen,P. (2024). Research on the Measures and Cost Benefits of Corporate Governance. Advances in Economics, Management and Political Sciences,91,195-200.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. YANG Ruilong,YANG Qijing.Exclusivity, exclusivity and enterprise system[J].Economic Research Journal,2001(03):3-11+93.)

[2]. ZHOU Qingjie. Corporate Governance Efficiency: An Analysis Based on Institutional Economics[C]//Beijing Institute of Economics, Economic Research Center, Shandong University, Preparatory Committee of China Institutional Economics.Proceedings of the Annual Conference of Chinese Institutional Economics. [Publisher unknown], 2003:1119-1126.

[3]. SANG Shijun,WU Desheng,LV Feishi.Corporate Governance Mechanism and Corporate Governance Efficiency——Based on the Analysis of Corporate Governance Cost[J].Accounting Research,2007(06):83-85+96.)

[4]. Yan Ruosen.Research on the composition of corporate governance cost and the optimization of corporate governance efficiency[J].Accounting Research,2005(02):59-63+95.)

[5]. LIU Hanmin,LI Yanli. Corporate governance: costs, benefits and boundaries[C]//Intelligent Information Technology Application Association.Proceedings of 2011 International Conference on Applied Social Science(ICASS 2011 V3).INFORMATION ENGINEERING RESEARCH INSTITUTE,2011:223-227.

[6]. Yan Rong. Research on the impact of mixed reform on corporate governance in the new world[D].Northwest Normal University,2021.DOI:10.27410/d.cnki.gxbfu.2021.000140.)

[7]. On Equity Structure and Corporate Governance[J].National Distribution Economy, 2021(27) :38-40. DOI:10.16834/j.cnki.issn1009-5292.2021.27.011.

[8]. On Equity Structure and Corporate Governance[J].Industrial Innovation Research,2021(15):69-70+73.) [1] HUANG Changsheng,WANG Zhenghan.Mixed ownership reform and enterprise value enhancement: An empirical study based on listed state-owned enterprises[J].Industrial Technological Economics,2021,40(08):78-88.)

[9]. Shang Yixuan.Research on the Dilemma and Path of Mixed Ownership Reform of State-owned Enterprises——Commenting on "Mixed Reform of State-owned Enterprises: Theory, Model and Path"[J].Journal of Guangdong University of Finance and Economics,2021,36(02):113-114.)