Volume 222

Published on October 2025Volume title: Proceedings of ICFTBA 2025 Symposium: Financial Framework's Role in Economics and Management of Human-Centered Development

This article focuses on the impact of artificial intelligence, or AI, on the application of commercial big data and its functional dimensions, and explores all its specific values in the retail industry. First of all, this article elaborates in detail on the connotations of artificial intelligence and commercial big data, their respective characteristics, and development situations. It also analyzed a transformation model such as "data - algorithm - business value" formed after the integration of the two, which has brought about significant changes to the traditional analysis methods. This article then specifically elaborates on the role that artificial intelligence can play in customer analysis, how it functions in marketing optimization, what assistance it offers to operational efficiency improvement, as well as its roles in risk control and dynamic cycle mechanisms. Subsequently, it discusses the application strategies in different scenarios, demonstrating the feasibility of these strategies from the perspectives of technology, cost, and benefit. This article summarizes the research results, points out the limitations of the research and the future development direction. These contents can provide some references for enterprises to formulate intelligent data strategies.

View pdf

View pdf

In the rapidly evolving digital reading market, Tomato Novel—a core platform under ByteDance—faces the critical challenge of improving user stickiness. This study explores the current status and issues of Tomato Novel in terms of user engagement, real-time feedback, personalized recommendations, and sense of community belongingness from an interactive marketing perspective. Findings reveal improvement opportunities in Tomato Novel’s interactive features, feedback mechanisms, personalized algorithms, and community culture. For instance, its comment and rating systems lack interactivity, feedback channels are obscure, personalized recommendation accuracy needs enhancement, and strategies to foster community belongingness are ineffective. To address these, the study proposes: integrating with platforms like Douyin to elevate user interaction; leveraging AI to optimize feedback mechanisms; refining personalized recommendation algorithms for precision; and adopting WeChat Reading’s'Co-Reading’feature to create a Tomato-Douyin user book circle, thereby strengthening community ties. These actionable pathways offer key strategies for Tomato and other digital reading platforms to optimize interactive marketing.

View pdf

View pdf

The global aging population has been intensifying the demand for innovative elderly care solutions, with technology-driven entrepreneurship emerging as a key response. However, current approaches tend to prioritize technological progress over human factors, resulting in an imbalance in service delivery and a gap with real needs. This study explores the integration of technology and humanism in elderly care entrepreneurship through business model innovation, leveraging the Business Model Generation framework. Based on the framework of business model theory, this study proposes a technology-humanity balance model that emphasizes the integration of humanistic values into scientific and technological applications to meet the functional and spiritual needs of the elderly through case studies and theoretical integration. The findings highlight that business model innovation, especially through the value proposition and customer relationship dimensions of the Business Model Canvas, can effectively harmonize technological efficiency with humanistic care, achieve the dual drive of “function + emotion”, provide practical reference for technology-based elderly care entrepreneurs, and contribute to academic discussion and practical application.

View pdf

View pdf

In the aftermath of the COVID-19 pandemic, insurance has become increasingly essential in helping individuals mitigate financial shocks from unexpected adverse events. Nevertheless, insurers face the persistent challenge of premium pricing calibration, a process imperative for maintaining financial solvency and actuarial equity. Among various machine learning techniques, the Bayesian framework stands out due to its unique ability to incorporate new data in real-time, making it particularly suitable for dynamic risk environments. This study conducts a systematic review of Bayesian methodologies, emphasizing their deployment in risk assessment and actuarial pricing. It examines the strengths of Bayesian methods in uncertainty modeling across high-stakes industries, as well as their limitations—such as computational complexity, lack of interpretability, and sensitivity to prior assumptions. Furthermore, the investigation interrogates cutting-edge innovations—such as hybrid Bayesian-machine learning hybrids and Bayesian AI—designed to mitigate aforementioned constraints and extend the operational scope of Bayesian frameworks. This study concludes that while the Bayesian framework offers a powerful approach for dynamic risk modeling, its future practicality hinges on the development of hybrid models that can effectively balance predictive accuracy, interpretability, and computational feasibility. Future research should focus on real-world case studies to further validate these advancements.

View pdf

View pdf

Leveraging emerging blockchain technology and visionary metaverse concepts, digital collectibles have emerged as an indispensable force in the digital economy. However, developing markets are increasingly exposed to issues such as information asymmetry, technical vulnerabilities, and market manipulation, leading to disorder and hindering sustainable economic growth. The underdeveloped regulatory framework has yet to resolve these challenges effectively, making standardized development imperative. By constructing a multi-stage Stakelberg game model to analyze strategic interactions among regulators, platforms, investors, and consumers, this study proposes recommendations including appropriate policy intensity, optimized trading mechanisms, rational investment practices, and consumer education to facilitate the standardized evolution of the digital collectibles market.

View pdf

View pdf

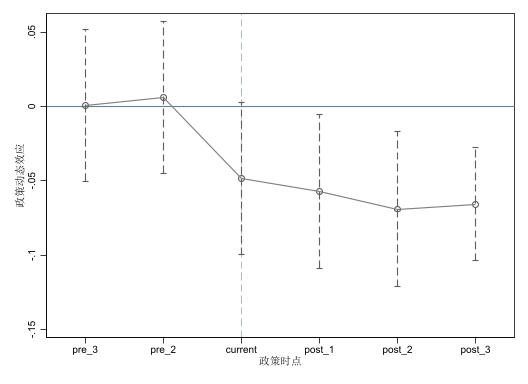

With the rise of the Industrial Revolution, economic development and technological progress have been accompanied by increasingly severe environmental issues. Global warming poses threats and adverse impacts on humanity's long-term development. Many countries have begun taking measures to curb pollution, and the actions of developed nations have provided valuable experience for Developing a green financial system for a sustainable future. Therefore, green finance has emerged. Regarded as the world's largest industrial producer, there is a relatively high proportion of industrial carbon emissions in China. To achieve sustainable goals, China needs to focus on measures addressing industrial carbon emissions. In 2017, China launched the policy to set up pilot zones for green finance reform and innovations, aiming to explore effective pathways for green finance development through local pilots (GFPZ), thereby reconciling economic growth with environmental protection. The empirical strategy of this research is based on a difference-in-differences (DID) model, a quasi-experimental design used to estimate the policy's causal effect on industrial carbon emission intensity (ICEI). What is more, a conclusion could be found verified by the research---- this policy accounts for lessening industrial carbon emission intensity, and this effect could remain statistically significant under the employment of robustness tests.

View pdf

View pdf