1. Introduction

The wave of the Industrial Revolution ushered in rapid economic expansion while simultaneously triggering increasingly severe environmental challenges, such as global warming, posing substantial threats to humanity's long-term development. Developed nations acted earlier, leveraging financial innovation to reduce pollution and accumulating invaluable experience in establishing green financial systems. This catalyzed the emergence of green finance—a mechanism that achieves dual economic-ecological benefits through optimal resource allocation, balancing growth pursuits with environmental stewardship. With the publication of the Paris Agreement, global decarbonization standards have been tightened and financial instruments have been a critical leveraging mechanism for industrial emission reduction. As the world's largest industrial producer, China contributes a disproportionately high share of global industrial carbon emissions, making green transformation of its industrial sector and energy mix restructuring urgent imperatives [1-3].

2. Theoretical hypothesis

2.1. Theoretical basis

Assessing the link between a nation's industrial activity and its carbon footprint relies heavily on the metric of carbon emission intensity. This metric reflects the ecological footprint of economic development in nations or regions. Given the absence of direct monitoring data for this indicator, this paper adopt the estimation methodology established by Chen et al., utilizing provincial statistical yearbook energy data as the baseline for calculating energy consumption carbon emissions to eliminate statistical discrepancies [4]. This method entails calculating the calorific output from different energy consumption volumes, calculating the aggregate carbon emissions using standard coal equivalents, and finally defining industrial carbon emission intensity (ICEI) as the ratio of total carbon output to the value of production in industry.

Building upon the aforementioned carbon emission intensity measurement methodology, existing research has further explored its driving factors from diverse perspectives, including mechanisms where the emissions intensity is influenced by financial development and digital economy. For instance, provincial-level studies have verified that industrial carbon emission intensity can be reduced by enhancing green innovation capabilities under the development of digital economy [5]. At the same time, global studies show that financial development and carbon intensity have an inverse U-shaped relationship —initial industrial expansion increases emissions, while advanced stages enable emission reduction through green investments [6]. Additional empirical work employing fixed-effects and mediation models demonstrates how Inner Mongolia's green finance development lowers industrial carbon intensity by facilitating industrial restructuring and energy mix optimization [7]. Furthermore, analyses grounded in Pigouvian tax theory and the Porter Hypothesis confirm that environmental protection taxes increase industrial pollution costs, thereby incentivizing emission reduction and catalyzing environmentally friendly Research and Development (R&D)—ultimately generating carbon mitigation benefits for society [8].

While existing research has extensively investigated factors influencing industrial carbon emission intensity—including the digital economy, spatial-temporal evolution patterns, as well as the structure of energy expenditure, —a significant research gap persists regarding the impact of green finance development through local pilots (GFPZ) on provincial-level industrial carbon emissions. Current literature predominantly examines either this policy’s effect on prefecture-level city carbon intensity or other determinants of industrial emission intensity. This study addresses this void by employing a difference-in-differences (DID) methodology to empirically examine the impact on industrial carbon emission intensity across provinces.

2.2. Hypothetical development

The GFPZ policy constitutes an integral component of China's green finance development, maintaining a synergistic relationship with broader green finance initiatives. This policy mechanism gradually establishes innovative financial institutional frameworks through localized experimentation, while green finance fundamentally supports environmental industries and sustainable development via specialized financial instruments—collectively providing robust underpinnings for the green economy. The primary objective is to cultivate replicable models for nationwide adoption, thereby accelerating China's economic green transition. Green finance, as defined by Cowan, achieves synergistic development between economy and environment through systematic financing channel optimization for green economic activities [9].

Building on 2013–2019 provincial data from China, Zhang et al. demonstrate that GFPZ implementation significantly reduces carbon emissions in pilot regions, with particularly pronounced effects in less-developed areas, high carbon-intensity zones, and pollution-intensive energy sectors [10]. Similarly, examining this policy's emission-reduction impact, Tan et al. employ provincial panel data between 2013 and 2020 and a DID model to analyze the policy's effect on carbon emission intensity [11]. Their findings further confirm this policy's efficacy in lowering carbon emission intensity across pilot regions. Crucially, Tan et al. identify the core transmission channel: this policy primarily achieves emission intensity reduction through industrial restructuring and upgrading.

The aforementioned hypotheses and empirical evidence substantiate influence of GFPZ on industrial carbon emission intensity. This study thus formulates Hypothesis 1:

Hypothesis 1: The ICEI is remarkably inhibited by the GFPZ policy.

3. Research design

3.1. Samples

Panel data of 30 Chinese provinces is employed by this paper (2011–2022, excluding Tibet due to data unavailability), with core variables including energy consumption by type, CO₂ emissions, industrial output value, value added of secondary industry, GDP growth, and R&D expenditure, sourced from the China Emission Accounts and Datasets (CEADs), China Energy Statistical Yearbook, China Statistical Yearbook, and provincial statistical yearbooks. ICEI is calculated using Chen et al.'s methodology by dividing total carbon emissions by industrial output value.

3.2. Model design

3.2.1. Model specification

Until now, China has established ten GFPZ: Huzhou and Quzhou (Zhejiang), Guangzhou (Guangdong), Hami, Changji, and Karamay (Xinjiang Uygur Autonomous Region), Guian New Area (Guizhou), Ganjiang New Area (Jiangxi), and Lanzhou New Area (Gansu). (Chongqing was excluded due to incomplete data coverage following its 2022 designation.) These GFPZ represent not only a strategic advancement in China's green finance development—marking the operational implementation of regional green financial systems—but also a critical opportunity to leverage green finance mechanisms for catalyzing corporate green innovation, transforming traditional industries, and establishing comprehensive green financial frameworks. The pilot cities or districts will pioneer reforms that subsequently drive green finance transitions in adjacent areas and entire provinces. This study treats the establishment of GFPZ across six provincial-level regions (Zhejiang, Guangdong, Guizhou, Jiangxi, Xinjiang, Gansu; Chongqing excluded) as a quasi-natural experiment, designating them as the treatment group with non-pilot provinces as the control group. Using a DID model with panel data from 30 provinces (2011–2022) and 2017 as the policy treatment time point, it examine the effect of GFPZ policy on how much industrial greenhouse gas has emitted. The baseline DID specification is constructed as follows:

3.2.2. Variable

|

Types |

Name |

Calculating Methods |

|

Explained Variable |

Industrial carbon emission intensity( |

|

|

Explaining Variable |

||

|

Control Variable |

Degree of openness(open) |

(Imports + Exports) * Exchange Rate / GDP |

|

GDP per capita(pgdp) |

GDP/ Permanent Population |

|

|

Research and development(RD) |

R&D Expenditure/GDP100% |

|

|

Industrial structure(stru) |

Value Added of Secondary Industry /GDP |

|

|

Urbanization Rate(urban) |

Urban Population / Total Population |

|

|

Degree of Government Intervention(gov) |

Local Fiscal Expenditure / Regional GDP |

Herein: Industrial carbon emission intensity (denoted as ) is used to measure the carbon emissions per unit of output value, calculated as the ratio of industrial carbon emissions to industrial output value as shown in table 1. represents the ICEI of province in year (unit: 10⁴t/(10⁸ yuan)); represents the industrial carbon emissions of province in year (unit: 10⁴t); represents the industrial output value of province in year (unit: 10⁸ yuan). The calculation formula for is as follows:

4. Results analysis

4.1. Descriptive statistical analysis

|

N |

Mean |

SD |

Min |

Median |

Max |

|

|

QCO2 |

330 |

.073 |

0.056 |

.018 |

.053 |

.26 |

|

did |

330 |

.091 |

0.288 |

0 |

0 |

1 |

|

open |

330 |

2.654 |

2.684 |

.076 |

1.447 |

13.541 |

|

pgdp |

330 |

6.069 |

3.084 |

1.895 |

5.211 |

19.031 |

|

RD |

330 |

1.822 |

1.159 |

.45 |

1.525 |

6.83 |

|

stru |

330 |

1.388 |

0.750 |

.611 |

1.222 |

5.244 |

|

urban |

330 |

.608 |

0.117 |

.363 |

.593 |

.896 |

|

gov |

330 |

.26 |

0.111 |

.105 |

.232 |

.758 |

|

(1) |

(2) |

|

|

QCO2 |

QCO2 |

|

|

did |

-0.064 |

-0.063 |

|

(0.014) |

(0.014) |

|

|

open |

0.010 |

|

|

(0.006) |

||

|

pgdp |

0.019 |

|

|

(0.006) |

||

|

RD |

0.002 |

|

|

(0.016) |

||

|

stru |

0.052 |

|

|

(0.024) |

||

|

urban |

0.519 |

|

|

(0.304) |

||

|

gov |

0.096 |

|

|

(0.137) |

||

|

_cons |

0.074 |

-0.401 |

|

(0.009) |

(0.180) |

|

|

Firm Fixed Effects |

√ |

√ |

|

Year Fixed Effects |

√ |

√ |

|

Observations |

330 |

330 |

|

R2 |

0.089 |

0.156 |

Based on the benchmark regression analysis of the effect of the GFPZ policy on ICEI, the results demonstrate that after the paper employs a two-way fixed effects model, the policy variable (DID) exerts a remarkable negative effect on ICEI (

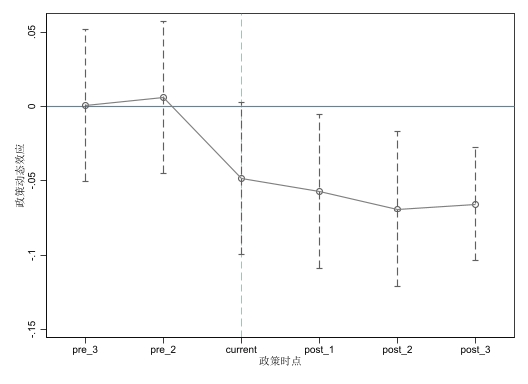

4.2. Parallel trend test

As shown in figure 1, before the policy enforcement, the confidence intervals of the policy's dynamic effects all included 0, indicating that there was no significant difference in the changes in industrial carbon emission intensity comparing the treatment group with the control one. The study compares the intensity of industrial carbon emission in the treatment group with those in the control one, which satisfies the parallel trend assumption. Since the policy came into effect, the policy’s dynamic effect was significantly negative, approximately -0.05, implying that the policy exerted an immediate inhibitory effect on ICEI. The treatment effect of the policy continued to be negative throughout the post-intervention period. and the confidence intervals basically did not include 0, which shows that the policy effect is persistent. In multiple periods following the policy implementation, the GFPZ policy continuously inhibited industrial carbon emission intensity. Overall, this policy has a remarkable and sustained effect on decarburizing.

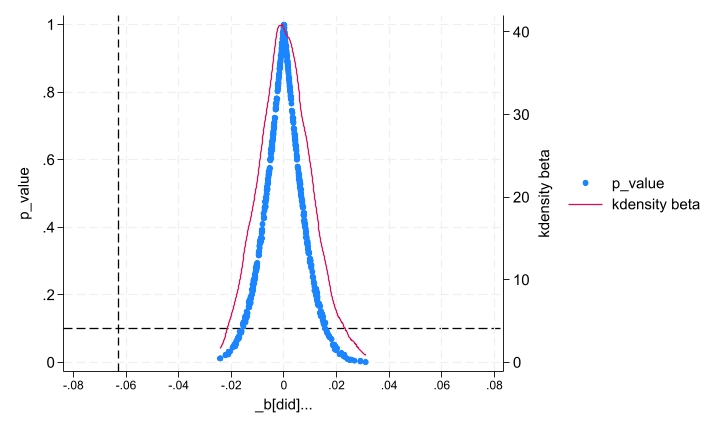

4.3. Placebo test

Figure 2 presents the results of the placebo test, where the horizontal axis captures the estimated policy impact. These estimates approximately follow a normal distribution with a mean of 0, and are significantly larger than the DID coefficient value of -0.06 in column (2) of Table 3 (indicated by the vertical dashed line in the figure). The above results indicate that the impact of the GFPZ policy in inhibiting firms' ICEI is not driven by unobservable factors at the firm or year level.

|

(1) |

(2) |

|

|

QCO2 |

QCO2 |

|

|

did |

-0.061 |

-0.067 |

|

(0.014) |

(0.014) |

|

|

open |

0.002 |

|

|

(0.006) |

||

|

pgdp |

0.024 |

|

|

(0.008) |

||

|

RD |

0.002 |

|

|

(0.019) |

||

|

stru |

0.016 |

|

|

(0.031) |

||

|

urban |

0.886 |

|

|

(0.345) |

||

|

gov |

0.082 |

|

|

(0.161) |

||

|

_cons |

0.074 |

-0.556 |

|

(0.007) |

(0.209) |

|

|

Firm Fixed Effects |

√ |

√ |

|

Year Fixed Effects |

√ |

√ |

| Table 4. (continued) | ||

|

Observations |

240 |

240 |

|

R2 |

0.110 |

0.180 |

4.4. Robustness test: excluding the impact of the pandemic

In the robustness test on the effects of the GFPZ policy on ICEI, by excluding data from the pandemic period to eliminate interference from special external shocks, the regression results still stably support the effectiveness of the policy. Specifically, in the two columns of regressions, the coefficients of the core explanatory variable—the GFPZ policy—are -0.061 and -0.067, respectively, both significantly negative at the 1% significance level. This indicates that after excluding the impact of the pandemic, carrying out the policy still inhibited the ICEI by an average of approximately 6.1% - 6.7%. Consistent in direction and close in magnitude to the benchmark regression results, this highlights the stability of the policy effect as shown in table 4.

5. Conclusion

In this paper, the Difference-in-Differences (DID) method is employed, using panel data of 30 Chinese provinces from 2011 to 2022 as the research sample, and taking the GFPZ policy implemented in 2017 as a quasi-natural experiment to study the impact of green finance policies on industrial carbon emission intensity. The consequences of the benchmark regression analysis illustrate that there is a pronounced decline in ICEI is observed following the policy's implementation., and this conclusion remains valid in the placebo test and the robustness test after excluding the impact of the pandemic. Finally, it is concluded that the industrial carbon emission intensity can be effectively inhibited by GFPZ policy, with a statistically significant drop in carbon emissions per unit of GDP. Drawing on these insights, the paper concludes with a series of policy implications:

Firstly, the government should continue to promote the GFPZ policy and strengthen support for green innovation. On the one hand, efforts should be made to accelerate the optimization of the carbon trading system, promote as well as the rapid monetization of carbon emission reduction effects, and inspire enterprises' passion for green innovation. What is more, the treatments should be taken to deepen exchanges and cooperation among enterprises, encourage leading enterprises to drive upstream and downstream industries to carry out collaborative innovation in green technologies, promote the sharing of innovation achievements, and strengthen the knowledge spillover effect.

Secondly, government supervision should be strengthened. The government should continuously refine environmental regulation laws and regulations, strengthen supervision over environmental issues, continuously improve law enforcement efficiency, and promote the cultivation of enterprises' awareness of green innovation.

Thirdly, the government should deepen the supply-side reform of green finance, smooth the channels for connecting supply and demand, break down resource flow barriers and institutional obstacles that restrict balanced regional development, accurately match green finance supply and demand, and pull for the growth of local green financing.

In addition, this paper still has shortcomings and limitations. For example, there is a lack of research on the micro-transmission path—how the policy affects individual enterprises; it is difficult to control provincial spillover effects, which may lead to deviations in results; the author's research experience is still limited, with insufficient grasp of theoretical analysis and economic situations, resulting in possibly insufficient depth in the analysis of the policy's impact results.

References

[1]. Ma, Y.Y., Yao, W.Y., Jiang, L. et al. (2024) Impact and Mechanism of the Green Finance Reform and Innovation GFPZ Policy on Urban Pollution Reduction and Carbon Emission Reduction. Chinese Journal of Population, Resources and Environment, 34, 45-55.

[2]. Xu, W., Feng, X. & Zhu, Y. (2023) The Impact of Green Finance on Carbon Emissions in China: An Energy Consumption Optimization Perspective. Sustainability, 15, 10610.

[3]. Liu, W. & Zhu, P. (2024) The Impact of Green Finance on the Intensity and Efficiency of Carbon Emissions: The Moderating Effect of the Digital Economy. Frontiers in Environmental Science, 12, 136-139.

[4]. Chen, H.L., Yang, X.K. & Wang, Z.B. (2024) Impact and Spillover Effect of Digital Economy on Industrial Carbon Emission Intensity. Research of Environmental Sciences, 37, 672-685.

[5]. Yi, Q.G. & Tao, H.M. (2024) A Study on the Impact of Digital Economy on Industrial Carbon Emission Intensity. Journal of Green Science and Technology, 26, 192-196.

[6]. Wang, Y. (2023) Can the Green Credit Policy Reduce Carbon Emission Intensity of "High-Polluting and High-Energy-Consuming" Enterprises? Insight from a Quasi-Natural Experiment in China. Global Finance Journal, 58, 100-108.

[7]. Wang, X.X. (2024) A Study on the Impact of Green Finance on Industrial Carbon Emission Intensity in Inner Mongolia. Master's thesis, Inner Mongolia University of Finance and Economics, 15, 18-20.

[8]. Ke, X.Q. (2023) A Study on the Spillover Effect of Environmental Protection Tax on Carbon Emissions of Industrial Enterprises. Master's thesis, Zhongnan University of Economics and Law, 16, 12-19.

[9]. Cowan, E. (1998) Topical Issues in Environmental Finance. Research Paper Commissioned by Asia Branch of the Canadian International Development Agency, 12, 18-19.

[10]. Zhang, Q.J. & Huang, L. (2023) Can the Establishment of Green Finance Reform and Innovation Pilot Zones Promote Enterprise Technological Innovation? Reform of Economic System, 1, 182-190.

[11]. Tan, X.C., Gao, J.X. & Zeng, A. (2023) Impact Assessment of the Green Finance Reform and Innovation Pilot Zone Policy on Carbon Emissions. Advances in Climate Change Research, 19, 213-216.

Cite this article

Wang,T. (2025). The Impact of Setting up Pilot Zones for Green Finance Reform and Innovations on Industrial Carbon Emission Intensity. Advances in Economics, Management and Political Sciences,222,38-46.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Financial Framework's Role in Economics and Management of Human-Centered Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ma, Y.Y., Yao, W.Y., Jiang, L. et al. (2024) Impact and Mechanism of the Green Finance Reform and Innovation GFPZ Policy on Urban Pollution Reduction and Carbon Emission Reduction. Chinese Journal of Population, Resources and Environment, 34, 45-55.

[2]. Xu, W., Feng, X. & Zhu, Y. (2023) The Impact of Green Finance on Carbon Emissions in China: An Energy Consumption Optimization Perspective. Sustainability, 15, 10610.

[3]. Liu, W. & Zhu, P. (2024) The Impact of Green Finance on the Intensity and Efficiency of Carbon Emissions: The Moderating Effect of the Digital Economy. Frontiers in Environmental Science, 12, 136-139.

[4]. Chen, H.L., Yang, X.K. & Wang, Z.B. (2024) Impact and Spillover Effect of Digital Economy on Industrial Carbon Emission Intensity. Research of Environmental Sciences, 37, 672-685.

[5]. Yi, Q.G. & Tao, H.M. (2024) A Study on the Impact of Digital Economy on Industrial Carbon Emission Intensity. Journal of Green Science and Technology, 26, 192-196.

[6]. Wang, Y. (2023) Can the Green Credit Policy Reduce Carbon Emission Intensity of "High-Polluting and High-Energy-Consuming" Enterprises? Insight from a Quasi-Natural Experiment in China. Global Finance Journal, 58, 100-108.

[7]. Wang, X.X. (2024) A Study on the Impact of Green Finance on Industrial Carbon Emission Intensity in Inner Mongolia. Master's thesis, Inner Mongolia University of Finance and Economics, 15, 18-20.

[8]. Ke, X.Q. (2023) A Study on the Spillover Effect of Environmental Protection Tax on Carbon Emissions of Industrial Enterprises. Master's thesis, Zhongnan University of Economics and Law, 16, 12-19.

[9]. Cowan, E. (1998) Topical Issues in Environmental Finance. Research Paper Commissioned by Asia Branch of the Canadian International Development Agency, 12, 18-19.

[10]. Zhang, Q.J. & Huang, L. (2023) Can the Establishment of Green Finance Reform and Innovation Pilot Zones Promote Enterprise Technological Innovation? Reform of Economic System, 1, 182-190.

[11]. Tan, X.C., Gao, J.X. & Zeng, A. (2023) Impact Assessment of the Green Finance Reform and Innovation Pilot Zone Policy on Carbon Emissions. Advances in Climate Change Research, 19, 213-216.