1. project background

Hong Kong, China and Singapore, both known as the 'Four Little Dragons of Asia', are often compared by scholars due to their favorable geographical conditions for foreign trade, small territorial size, and shared history of colonial rule. The phenomenon of their parallel progress and subsequent economic differentiation has been studied from various perspectives.

While Hong Kong has developed into a structurally diversified free port, it is important to examine any inadequacies in comparison to Singapore, which has already established itself as a highly open trade free port. From a macro perspective, the new structural economics emphasizes the impact of industrial structural changes on economic development and the underlying reasons for such changes. We will analyze the actions of the governments of Hong Kong and Singapore and their economic performance and development over time. This study aims to identify development concepts that are in line with current trends and can withstand changes. The analysis indicates that Hong Kong lags behind Singapore in terms of economic performance indicators, including macroeconomic performance, investment, and innovation. Hong Kong has faced various socio-political and economic challenges while implementing the principle of 'Patriotism in Hong Kong.' This paper is guided by the theory of New Social Structural Economics (NSSE) and affirms the crucial role of institutions and rules in the economy. Changes in institutions may lead to adjustments in market behavior and economic structure, which can affect overall economic performance. This text assesses the economic resilience and sustainability of two financial centers, considering the two-way driving forces of policy regimes and industrial structure. Additionally, it provides policy recommendations for the future of Hong Kong, China, as an international financial center in the context of economic globalization.

2. industrial structure

2.1. Changes in Hong Kong's industrial structure

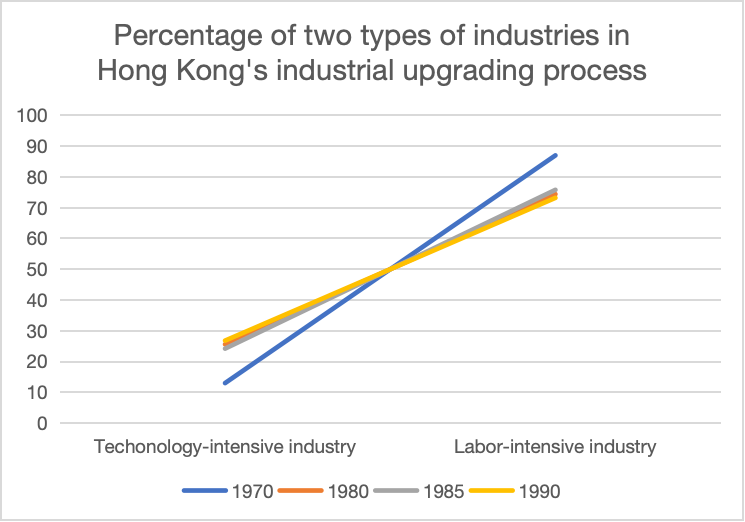

Hong Kong, as the freest economy today, has been undergoing structural changes in its industries in the midst of global changes. [1] Financial services, tourism, trade and industrial/commercial voluntary services are the four traditional industries of Hong Kong, China, in addition to its own prosperity and development, but can also create employment in other industries and the development of Hong Kong's economy is the driving force. [2] However, the industrial structure of Hong Kong, China, since 1950 has occurred around the four traditional industries in the continuous transformation, can be divided into three stages.

The first stage is the industrialization phase from 1950 to 1980, which is mainly defined by the significant increase of 14.7% of Hong Kong's GDP in the manufacturing sector during this period. [3] During the same period, Hong Kong shifted from re-export trade to labor-intensive industries, with the production of the financial services sector. The decline of nearly 7% in the GDP share of the financial services sector confirms the dominance of the manufacturing sector in this phase of industrialization, making Hong Kong one of the "Four Little Dragons of Asia". Hong Kong one of the "Four Little Dragons of Asia”.

The second phase was the deindustrialization phase from 1981 to 1998, defined mainly by the rapid decline in the share of manufacturing in GDP. During this phase, Hong Kong experienced labor shortages, increased labor and land costs, and a massive and rapid relocation of Hong Kong's manufacturing sector to inland China within a few years, attracted by policies such as China's reform and opening up. It was also during this period that the financial services industry developed rapidly and Hong Kong achieved the status of an international financial center. According to the statistics provided by the Census and Statistics Department of Hong Kong, the Gross Domestic Product (GDP) of the service sector reached a high percentage of 84.7% in 1998, confirming the absolute dominance and influence of Hong Kong's service sector at that stage.

The third stage began in 1999 and focused on strengthening Hong Kong's service industries. Internal restructuring of these industries has continued. The growth rate of the six new industries, including cultural and creative industries, medical industries, education industries, innovation and technology industries, and testing and certification industries, is significant, but their contribution to economic growth is weak. [4]

Figure 1: The proportion of two types of industries in the process of industrial upgrading in Hong Kong

2.2. Changes in Singapore's industrial structure

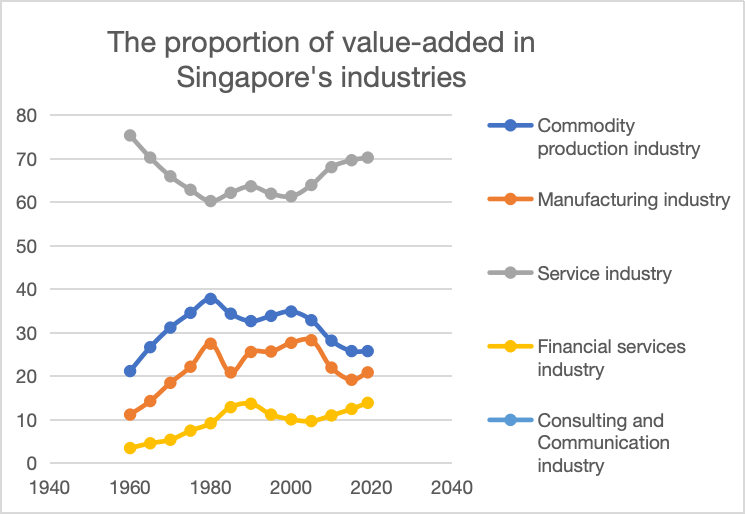

During Singapore's modernization process, industrial transformation has always been considered a crucial factor in driving economic development and structural change.As a city-state, Singapore has a minimal share of agriculture among its three major industries. Therefore, its industrial restructuring mainly affects non-production sectors such as industry, transportation, and business services, as well as the economic relationships within each sector [5].

Singapore underwent four phases of industrial restructuring.The first phase occurred during the transition period from 1959 to around 1965, during which import-substituting industries were developed from the traditional and monotonous re-export trade.Due to its favorable geographical location, Singapore had long been a globally renowned free port, making re-export trade a major contributor to its economic growth.To mitigate the economic impact of direct foreign trade after the independence of the East Asian countries, the Singaporean government implemented a policy of shifting economic development towards import-substituting industries.In 1965, Singapore's new industrial enterprises reached 95, with an output value of 320 million dollars. During this period, Singapore's gross domestic product grew at an average rate of 7.4% per year. These measures resulted in remarkable success in achieving a breakthrough and adjustment of the monotonous industrial structure.

The second phase, which lasted from 1965 to 1979, was characterized by moving from import substitution to export-oriented industrialization.After being forced to leave Malaysia due to insufficient supply of raw materials and a rapidly shrinking sales market, the Singaporean government accelerated the development of the export economy through policy regulation. This was achieved by vigorously developing industries and attracting foreign investment.During this period, Singapore's service sector saw a decline in its contribution to economic development. The country emphasized and formed an industrial structure with the export industry as the core, and trade, manufacturing, transportation, finance, and tourism as the main pillars. This diversified industrial structure was able to withstand internal and external crises. During the same period, Singapore's national economy developed rapidly, with an average annual growth rate of 10.1%, and the unemployment rate decreased to 3.3% in 1979. [5].

The industrial restructuring phase from 1979 to 1985 was the third phase.

During this period, the United States, as a large economy, suffered a major blow due to the international financial crisis. Singapore, which was highly externally oriented, was also deeply affected, and its manufacturing exports were hampered by the shrinking market demand. The export of manufacturing industries was hindered by the shrinking market demand, leading to a decline in their proportion and even negative growth in 1985.

The Singaporean government implemented policy instruments, but some were over-optimistic and adventurous, resulting in a deterioration of the domestic employment and investment environment.

The fourth stage was the development of the knowledge economy from 1985 to the present.

In response to changing domestic and international environments, the medium and long-term economic development strategy was revised in the early 1990s.This strategy led to the flourishing of high-value-added industries, such as the IT industry, which provided Singapore with the opportunity to meet the challenges of today's knowledge-based economy.

Figure 2: Line chart of the proportion of value-added in Singapore's industries

3. Industrial Policy

Both Hong Kong and Singapore are located in the East Asian cultural circle and share a similar colonial history. After World War II, both developed into international financial centers. However, despite their similar status, there are significant differences in their industrial policies and development strategies. This section will analyze in depth the industrial policies of Hong Kong and Singapore since the 1960s, in order to explore and compare their different economic development paths.

3.1. Hong Kong Industrial Policy

In 1950, the Hong Kong government established the Trade and Industry Department with the aim of promoting local industrial development, attracting investments, and regulating import and export trade. This initiative marked Hong Kong's initial attempt in industrial policy and laid the foundation for subsequent economic development. The establishment of the Hong Kong Trade Development Council in 1966 further promoted the export of Hong Kong products and enhanced its competitiveness in the international market. During this period, the Hong Kong government significantly pushed for the development of import and export trade through these institutions, laying a solid foundation for its policy support and funding for industry and technology industries in the late 1980s. After the return of Hong Kong in 1997, the Special Administrative Region government adopted a more proactive and explicit approach in industrial policy. By signing free trade agreements and strengthening cooperation with external economies, the SAR government strove to align Hong Kong's industries with the international market, enhancing its position in the global industrial chain. At the same time, the government recognized the significant potential of cooperation with the mainland economy and actively promoted the economic integration of the Guangdong-Hong Kong-Macao Greater Bay Area, opening up new paths for the development of Hong Kong industries. In order to promote the development of high value-added and high-tech industries, the SAR government clearly outlined corresponding policy guidelines and increased its support for industries. Additionally, the government started to establish industrial parks and technology parks, and strengthened the construction of cyberport and research infrastructure, providing solid hardware support for technological innovation. In conclusion, Hong Kong's industrial policy has undergone a significant shift from an industry and trade orientation to a service and technology orientation. Throughout this process, the role of the SAR government in economic development has gradually transitioned from a laissez-faire approach to a more proactive and interventionist role, guiding industry upgrades and transformations in response to circumstances.

3.2. Singapore Industrial Policy

The Singapore government is a typical government that adapts its policies to the situation, actively intervening in the economy by implementing tax incentives to attract foreign investment, promoting the development of foreign investments, and driving domestic economic growth and industrial structural upgrading. In 1967, the Singapore government enacted the Economic Expansion Incentives Act, which provided tax incentives and financial encouragement for the development of industries in Singapore. The government offered tax relief for the influx of foreign capital brought about by industrial expansion, attracting a large amount of foreign investment into Singapore and greatly developing its financial services industry. In 1985, Singapore was also affected by the economic recession in the United States, and the government adopted a highly interventionist economic policy by implementing "economic restructuring," shifting domestic industries towards higher value-added and technology-intensive directions. Singapore's government-led economy gives it a comparative advantage among the Asian Tigers. Starting in 1990, the Singapore government guided industries into the fourth industrial transformation period, actively developing high value-added industries, expanding industrial parks, and building the "Singapore Comprehensive Network" to address the challenges of rising labor costs and scarce economic resources in order to maintain Singapore's competitive advantage in the international market.[6]

4. Comparison Analysis

The author summarizes and analyzes the industrial policies and economic development of Hong Kong and Singapore before and after they became international financial centers. The main characteristic of the economies of Singapore and Hong Kong is small open economies. After independence, the Singapore government focused on industrialization and actively implemented policies to attract foreign investment, changing Singapore's previously sole commercial economy. With the development of Singapore's import-export trade, manufacturing and international trade became the pillar industries of Singapore. Subsequently, Singapore shifted its focus to the financial market, leading to rapid growth in the financial industry. The share of industries in Singapore's GDP increased from 14% in 1971 to 21% in 1982. As financial-related services rapidly developed, Singapore's unemployment rate gradually decreased, reaching 3.3% [7]in 1979. This laid the foundation for Singapore to become an international financial center. The Singapore government then shifted the focus of its industrial structure to high-value-added industries, such as artificial intelligence and high technology, in the early 21st century.

On the other hand, Hong Kong, as an international financial center, benefits from favorable tax systems and lower tax rates. However, the Hong Kong government's guidance on the economy is insufficient. During the development of the Hong Kong economy, the lack of active government guidance led to a lack of industrial structure transformation when facing changes in mainland China's policies and international situations. Although Hong Kong began transitioning towards high-tech industries in the 21st century, with plans to develop platforms for researching robotics technology in its science park in 2018, its industrial structural upgrade lagged behind Singapore, which introduced the "Smart Nation 2025 Plan" in 2014.

Overall, Hong Kong's government initially played a passive role in response to domestic and international changes, benefiting more from the spontaneously formed market, primarily accepting foreign capital from the United States. Unlike Singapore, Hong Kong's banking industry does not have regulations restricting the entry of foreign banks. Hong Kong missed the opportunity of the new generation information technology revolution by not actively seizing and establishing high-tech industrial parks. After the handover, Hong Kong's role as an intermediary weakened, prompting the government to learn from Singapore's success by prioritizing industrialization and actively attracting foreign investment. By guiding policies, Hong Kong can promote the upgrading of its industrial structure towards higher value-added sectors, such as increasing support for technology innovation and research and developing local tech enterprises to become an innovation hub for high-tech industries. Additionally, the Hong Kong government should strengthen cooperation with universities and research institutions to drive the commercialization and application of research outcomes, promoting industrial upgrading and continued economic development. Through these measures, Hong Kong can better adapt to global industrial changes, maintain economic competitiveness, and achieve sustainable development.

5. Policy Recommendations

In 2023, Singapore successfully attracted numerous foreign enterprises to settle in, surpassing Hong Kong, China, to become the leading financial center in Asia due to its stable business environment and market appeal. Under this backdrop, Hong Kong, China, as another important international financial center, faces competitive pressure from rivals like Singapore. To address this challenge, Hong Kong, China, can learn from Singapore's successful experiences in industrial development while leveraging its own unique advantages. By comprehensively considering domestic and international environments, market trends, and its own strengths, Hong Kong, China can seize opportunities in future financial competition to achieve more stable and sustainable development.

5.1. Deepen global financial cooperation, explore emerging markets

Given Hong Kong, China's characteristics as a small open economy with relatively limited resources, maximizing the use of its limited resources is crucial amidst increasing globalization and international market competition.

Firstly, strengthening financial cooperation with mainland China is essential. The economic ties between Hong Kong, China, and the mainland are close, and deepening financial cooperation can promote the mutual development of both economies. Specifically, promoting the internationalization of the renminbi and enhancing the development of the offshore renminbi market can attract more international capital inflows into the Hong Kong market. This not only enhances Hong Kong's position as an international financial center but also provides more financing channels for mainland enterprises, promoting mutual benefit.

Secondly, Hong Kong, China should enhance financial and economic ties with members of the Regional Comprehensive Economic Partnership (RCEP). As the world's largest free trade area, RCEP provides vast market opportunities for Hong Kong, China. Strengthening financial cooperation with RCEP member countries can further consolidate and expand Hong Kong's position in the Asian financial markets.

Additionally, Hong Kong, China should actively seek potential opportunities in emerging markets such as the Middle East, Africa, and Latin America. These regions have experienced rapid economic growth in recent years, with huge market potential. By conducting in-depth research on the characteristics and demands of these markets, Hong Kong, China can provide more targeted financial services and products for enterprises, thereby gaining more market share in these emerging markets.

5.2. Talent Introduction and Technological Innovation

In the context of economic globalization, as other international financial centers compete for limited resources, the Hong Kong government should also transform its functions, actively lead policies, and make reasonable use of its geographical advantage with mainland China to introduce and train talents in high-tech industries such as finance and artificial intelligence, encouraging financial and technological innovation.

Firstly, the Hong Kong government needs to take a more proactive approach in policy-making to ensure that industrial development stays in sync with global economic trends. Through forward-looking planning, the government can ensure sustained competitive advantages in key areas such as finance and artificial intelligence.

Secondly, the Hong Kong government should fully utilize its geographical advantage of being backed by mainland China by strengthening economic cooperation with the mainland. This will promote deep integration in areas such as finance and technology, creating a more internationally competitive economic system together. Facing competition from international financial and technological centers, efforts should be increased to attract talents in high-tech industries like finance and artificial intelligence, providing corresponding training and support to enable these talents to contribute to Hong Kong's economic development.

Lastly, the Hong Kong SAR government needs to establish an open economic system. In the context of globalization, Hong Kong needs to build a more open and inclusive economic system. This includes further relaxing market access, enhancing international cooperation, and promoting trade and investment liberalization and facilitation. The government should establish relevant incentive mechanisms to encourage financial institutions and technology companies to innovate. This can be achieved through providing tax incentives, financial support, etc., to stimulate the innovation vitality of market entities.

5.3. Improving the Legal Regulatory Framework

As a financial hub in the Asia-Pacific region, Hong Kong faces fierce competition from markets such as Singapore and Tokyo, Japan. In order to maintain and enhance its status as an international business and trade center, Hong Kong needs to continuously improve its legal, financial, monetary, and regulatory framework.

In terms of the legal system, Hong Kong should continue to strengthen its rule of law, ensuring fair, transparent, and efficient enforcement of laws to provide stable legal protection for multinational companies and investors. Additionally, enhancing cooperation and exchanges with other financial centers in the Asia-Pacific region in the legal field will collectively raise the level of legal governance in the entire region. In terms of the regulatory system, Hong Kong should maintain the flexibility and foresight of regulatory policies, promptly adapting to changes and challenges in the global financial markets.

6. Conclusion

This study analyzed the industrial structure and industrial policies of Hong Kong and Singapore before and after they became international financial centers. The findings highlight significant differences in the industrial development paths taken by the two regions. Hong Kong has transitioned from a manufacturing-led industrial structure to a service-led one, with a particular emphasis on the development of the financial services industry. This shift has enabled Hong Kong to establish itself as an international financial center. In contrast, Singapore has successfully restructured and diversified its industrial structure through continuous transformation, providing a stable foundation for its economic development and adaptation to changing domestic and international environments.

The research also suggests that Hong Kong's industrial development lags behind that of Singapore. Following its handover, Hong Kong's role as an "intermediary" has diminished. To address this, the Hong Kong government should provide policy guidance to promote the upgrading of the industrial structure towards a higher value-added direction. In light of future development opportunities, Hong Kong should focus on deepening global financial cooperation and exploring emerging markets, attracting talent, innovating in technology, and improving the legal regulatory system. These measures will be crucial in strengthening Hong Kong's position as an international financial center and enhancing its overall industrial development.

References

[1]. Zhang W, Tang Q, Yao Y. Causes of the industrial composition in contemporary Hong Kong, analysis of industrial structure and trend prediction[J]. Chinese Market, 2023, No.1141(06):32-34.

[2]. Census and Statistics Department of the Hong Kong Special Administrative Region Government. Four major industries of the Hong Kong economy[J]. Hong Kong Monthly Statistics, 2021(12).

[3]. Feng B. Research on industrial structure of Hong Kong[M]. Beijing: Economic Management Press, 2002.

[4]. Zhong Y, He S. Research on the impact of industrial structure upgrading in Hong Kong on economic growth since the return[J]. Hong Kong and Macao Studies, 2017, (2):44-51.

[5]. Tian X, Long Z. Analysis on the adjustment of industrial structure in Singapore[J]. Journal of Yunnan University of Finance and Economics, 2001(S1):115-118.

[6]. Zhu L, Qiu S, Wu Z. Development ideas, changes in industrial structure, and economic growth: a case study of Singapore and Hong Kong, China[J]. Contemporary Finance and Economics, 2022, No.448(03):3-15. Hu T.

[7]. Development strategy and economic policies of Singapore[J]. World Economic and Political Forum, 1987(08):9-14.

Cite this article

Yang,Q.;Long,Z. (2024). Changes and Prospects of Industrial Structure in International Financial Centers: A Case Study of Hong Kong and Singapore. Advances in Economics, Management and Political Sciences,88,118-125.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang W, Tang Q, Yao Y. Causes of the industrial composition in contemporary Hong Kong, analysis of industrial structure and trend prediction[J]. Chinese Market, 2023, No.1141(06):32-34.

[2]. Census and Statistics Department of the Hong Kong Special Administrative Region Government. Four major industries of the Hong Kong economy[J]. Hong Kong Monthly Statistics, 2021(12).

[3]. Feng B. Research on industrial structure of Hong Kong[M]. Beijing: Economic Management Press, 2002.

[4]. Zhong Y, He S. Research on the impact of industrial structure upgrading in Hong Kong on economic growth since the return[J]. Hong Kong and Macao Studies, 2017, (2):44-51.

[5]. Tian X, Long Z. Analysis on the adjustment of industrial structure in Singapore[J]. Journal of Yunnan University of Finance and Economics, 2001(S1):115-118.

[6]. Zhu L, Qiu S, Wu Z. Development ideas, changes in industrial structure, and economic growth: a case study of Singapore and Hong Kong, China[J]. Contemporary Finance and Economics, 2022, No.448(03):3-15. Hu T.

[7]. Development strategy and economic policies of Singapore[J]. World Economic and Political Forum, 1987(08):9-14.