Volume 207

Published on August 2025Volume title: Proceedings of ICEMGD 2025 Symposium: Innovating in Management and Economic Development

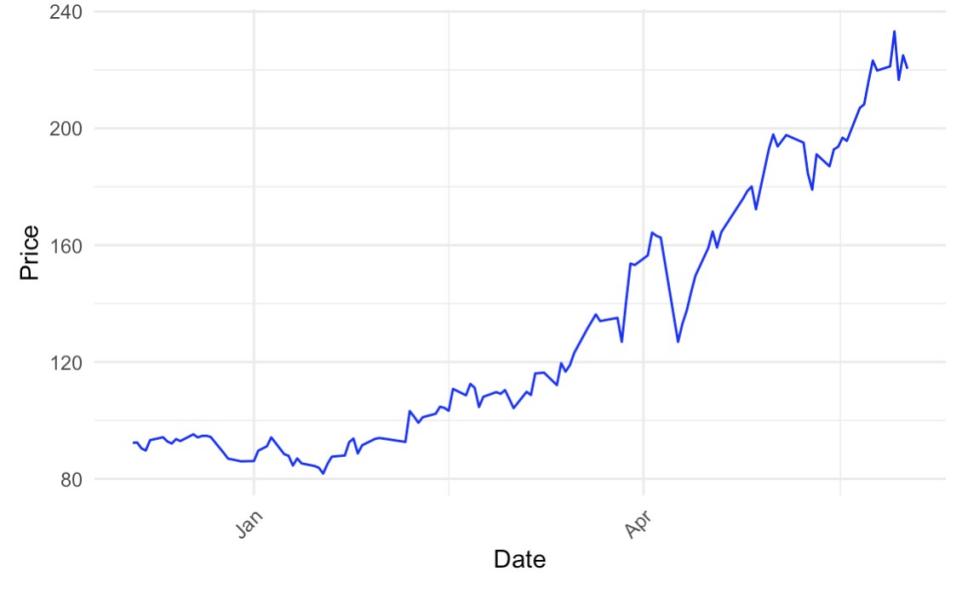

With the increasing sophistication of financial management techniques, the ability to predict stock prices has become a critical endeavor for investors and traders. The Autoregressive Integrated Moving Average (ARIMA) model stands out as a widely used method for forecasting stock price movements. This model, which belongs to the class of time series analysis, is particularly adept at estimating daily returns with associated confidence intervals. The present study aims to apply the ARIMA model to forecast the share prices of Pop Mart. The dataset encompasses the period from December 2024 to May 2025, focusing on the opening prices as key variables. The analysis reveals that the ARIMA model is capable of capturing the fluctuations in stock prices with a certain degree of accuracy. The Mean Absolute Percentage Error (MAPE) value of 6.86%, which is significantly below 10%, suggests that the predictive performance is commendable. Furthermore, the insights gleaned from this model offer investors and traders valuable guidance for interpreting market trends and assessing potential risks, thereby enhancing their decision-making capabilities.

View pdf

View pdf

This study examines the incentive dilemmas faced by food-delivery riders in the digital economy, focusing on how algorithmic management shapes workers’ psychology and behavior. Drawing on Self-Determination Theory and the crowding-out effect, it explores, via a literature review of journals, industry reports, how platform algorithms as forms of extrinsic motivation interact with riders’ intrinsic motivation. Through a labor-quota mechanism and the dispatch logic, platforms systematically suppress riders’ autonomy, alienate their sense of competence, and erode their relatedness, leading to a crowding-out effect in which extrinsic motivation undermine intrinsic motivation and manifest as professional burnout and identity loss. The study proposes a three-fold improvement path: reconstructing algorithmic transparency mechanisms, establishing career-development systems, and building multi-stakeholder collaborative networks. Platform employment models must move beyond a purely extrinsic framework and, through institutional design, better coordinate intrinsic and extrinsic motivation to achieve both decent work and sustainable development for riders. These findings offer a theoretical foundation and practical insights for breaking the “incentive trap” of algorithmic management and address a key gap in understanding how intrinsic and extrinsic motivations interact in digital labor.

View pdf

View pdf

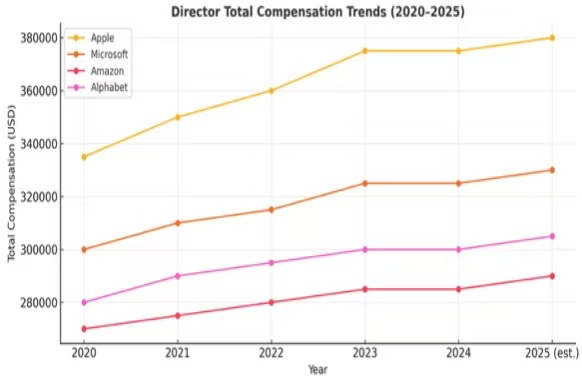

As global technology companies compete more and more, the way companies design their pay systems has become very important. A good pay system can help a company do well and keep talented people from leaving. This paper looks at the pay system of Amazon. This study examines the structural logic of Amazon's pay system through empirical case analysis, analyzes its benefits and drawbacks, and offers specific recommendations for improvement. First, the paper explains how Amazon pays its board members and key employees. This includes stock rewards (called RSUs), yearly pay, and the fact that Amazon does not give extra money for attending meetings. Then, the paper looks at how this system works in terms of motivation, fairness, and how well it fits the competitive job market. It also compares Amazon’s pay system with those used by other large tech companies, like Google and Microsoft, to see how well Amazon’s system helps it keep top talent and stay competitive. In the end, the paper gives some ideas for how Amazon could improve its system. These include linking pay more closely to performance, and creating more kinds of pay, not just stock.

View pdf

View pdf

This study provides an in-depth analysis of Alphabet's executive compensation policies for the fiscal years 2020 to 2024. Through the systematic content analysis of public documents such as shareholder proxy letters, it is revealed that its compensation structure is centered on basic salary, annual bonus and the dominant long-term equity incentive. Research has found that Alphabet's compensation strategy aims to attract, retain and motivate top talents through market-leading compensation levels, while striving to closely align the interests of executives with the company's long-term strategy, shareholder value creation and corporate governance requirements through a sophisticated performance-linked mechanism. And it shows an evolving trend of strengthening performance orientation, paying attention to ESG factors and responding to market dynamics. This study provides a key reference for understanding how global tech giants balance incentives, risks and long-term value, and deal with complex governance environments. The findings offer valuable implications for executive incentive design in other innovation-driven enterprises navigating dynamic market conditions and increasing stakeholder scrutiny.

View pdf

View pdf

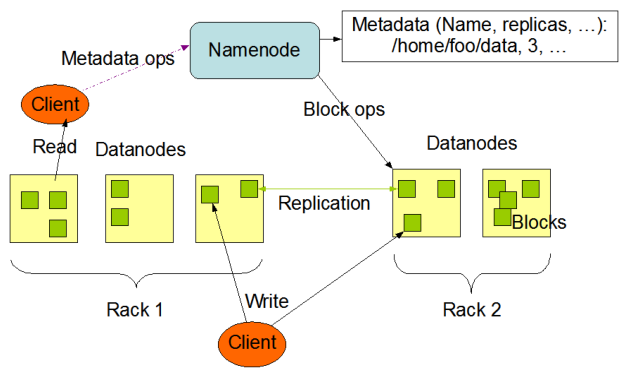

This paper aims to explore the innovation of social management system and digital governance based on big data visualization analysis. Firstly, the relevant technologies and theories are introduced, including an overview of Hadoop and Spark, as well as the significance of data visualization. Then, a social management event data classification and governance algorithm based on improved Naive Bayes classification algorithm is proposed, and a big data-driven social management system innovation system is designed. This system includes modules for data warehouse, data collection, and statistical analysis. Through experiments and evaluations, the improved Naive Bayes algorithm is proven to have accurate classification and effective performance on social management event data in a standalone environment. This research provides support and assistance for social management decision-making and proposes future research directions, including algorithm optimization and system scalability.

View pdf

View pdf

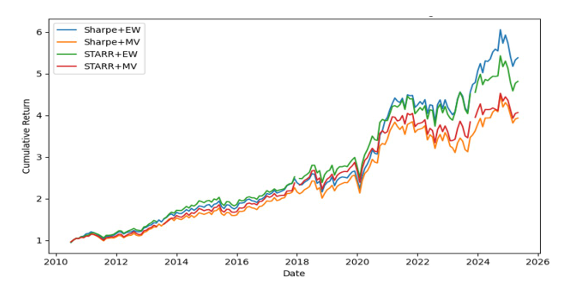

This study proposes a risk-adjusted momentum strategy based on the STARR (Stable Tail-adjusted Return Ratio) indicator and investigates its performance across different industry sectors in the U.S. and Japanese equity markets. Using monthly data from 2010 to 2025, the strategy constructs Sharpe- and STARR-based momentum factors and applies mean-variance optimization to industry-level ETFs from the S&P 500 and Nikkei 225. Empirical results show that the STARR-based strategy offers superior downside risk control, particularly under extreme market conditions such as the COVID-19 crisis. Moreover, performance varies significantly across sectors and volatility regimes, confirming the presence of industry heterogeneity. The strategy demonstrates robust performance through various parameter configurations and cross-market validation. These findings suggest that incorporating downside-sensitive metrics like CVaR into momentum signal construction can enhance risk-adjusted returns and improve portfolio stability in diverse market environments. This research aims to evaluate the STARR-based momentum strategy's effectiveness across heterogeneous industries under uncertain market conditions.

View pdf

View pdf

Artificial intelligence offers applications in a variety of professions, especially in the beauty industry. Sephora used a lot of innovations like virtual try-on and personalized recommendations. This paper suggests a SWOT analysis to prove Sephora’s AI adaptation’s strengths, weaknesses, opportunities, and threats. Its aim is to assess how AI’s enhancement can improve Sephora’s retail strategies. In the case study methodology, the paper analyzes Sephora’s AI applications and data is drawn from corporate reports, industry publications, and technology assessments. This paper finds that AI significantly improves consumers’ experience and satisfaction through personalization and increases operational efficiency. Nevertheless, there are some issues, such as data privacy concerns and the expensive costs of AI need to be improved and also the analysis reveals potential growth of emerging technologies and strategic partners. Results reveal that although Sephora has advantages, Sephora requires more innovations in AI techniques. As a result, the study recommends further research into consumers’ acceptance of AI and comparative analysis with competitors’ technology adoption.

View pdf

View pdf

With the progress of the times and the advancement of technology, the inequality of opportunities between people has gradually widened and become a social issue, leading to inequalities in opportunities, education, and employment, resulting in an uneven distribution of human resources. As inequality expands, it ultimately leads to the fragmentation of regional economic growth, making it challenging for the national economy as a whole to maintain unity and remain continuously stable and developed. This article mainly explores the causes of inequality in education opportunities in China and the United States, analyzes these viewpoints, and proposes corresponding solutions based on the analysis of countries with relatively equal opportunities. The study underscores that keeping high-quality education standards and lowering the differences in education between parts of the country are important for keeping talent output stable, which will help the economy grow more steadily. Also, China can copy some Nordic education practices, like how they handle tests and rankings, which would help get rid of the inequality.

View pdf

View pdf

The escalating challenges posed by global warming, environmental degradation, and resource scarcity are pushing enterprises to rethink conventional practices and pursue development strategies that align environmental responsibility with economic performance. In this context, Green Supply Chain Management (GSCM) has emerged as a key strategy, gaining increasing attention from both industry and academia. By embedding environmental principles into every stage of the supply chain, such as procurement, production, logistics, sales, and recycling, GSCM improves resource efficiency, minimize carbon emissions, and ultimately achieve a balanced integration of economic, environmental, and social benefits. This study investigates Apple Inc.’s global green supply chain practices through literature review and case analysis, thus exploring its strategic drivers, implementation pathways, and operational mechanisms. The results show that Apple has built a closed-loop green supply chain integrating green design, clean energy, eco-friendly procurement, green logistics, and recycling, forming a sustainable development mechanism driven by strategy, technological innovation, and organizational synergy. Despite progress, Apple faces challenges in cost, regulation, technology, and transparency, pointing to future research on green tech, SMEs, consumer feedback, and performance evaluation.

View pdf

View pdf

This paper provides a comprehensive analysis of The Coca-Cola Company's director compensation policies from 2019 to 2023, evaluating their effectiveness in aligning board member incentives with long-term shareholder value creation. Grounded in agency theory and optimal contracting principles, the study examines three critical dimensions of Coca-Cola's compensation structure: cash versus equity composition, performance-based incentives, and stock ownership requirements. Through comparative benchmarking against industry peers (PepsiCo, Procter & Gamble, Nike, and McDonald's), the analysis reveals that while Coca-Cola maintains baseline governance standards, including a 55:45 cash-equity split and a 3x stock ownership guideline lag behind leading practices in key areas. Notably, the absence of performance-vested equity (e.g., PSUs) and ESG-linked metrics contrasts with innovations adopted by peers like P&G (50% PSUs) and McDonald's (ESG-linked awards). The paper proposes concrete measures to strengthen the alignment between director incentives and shareholder value creation through compensation policy reforms. A critical recommendation involves introducing performance-based equity that incorporates both financial metrics such as a three-year return on invested capital and revenue growth targets alongside material sustainability indicators including water usage efficiency and packaging recyclability goals. The analysis further advocates for elevating stock ownership requirements to five times the annual cash retainer amount, which would bring Coca-Cola's policy in line with industry leaders while allowing for a five-year transitional implementation period for current board members.

View pdf

View pdf