1. Introduction

Exchange-Traded Funds (ETFs) and traditional stocks are two key elements in this area, each with its own features and effects on investment portfolios. ETFs are famous for their variety, low costs, and low risk. This trend highlights the need for a deeper comparison of the returns between these two types of investments.

The reason behind this study comes from the wide range of investment options and the urgent need for clear evidence on how ETFs compare to traditional stocks in terms of performance. This research aims to fill that gap by offering insights into which investment tool gives higher returns when considering market ups and downs, costs, and other important factors.

This essay specifically looks at the return profiles of ETFs and traditional stocks through a detailed analysis of historical market data to see how they perform. The method includes collecting and analyzing data on returns over a set period to make a strong comparison between the two types of investments.

The importance of this research is that it could help shape investment strategies, offering valuable insights to both individual and institutional investors. By providing a clearer understanding of how ETFs and traditional stocks compare in terms of returns, this study helps make smarter decisions in managing investment portfolios. Furthermore, the findings of this study can help future researchers, adding to the discussion on investment strategies and market performance. Ultimately, this research aims to help investors make better choices in the varied market landscape, improving their investment returns in the process.

2. Reasons for ETF Stock Selection

2.1. ETF Definition and Characteristics

Exchange-traded funds, or ETFs, are like a basket of different types of investments that you can buy and sell on a stock market platform the same way you would buy and sell ordinary stocks. Imagine that you are shopping, and instead of picking out individual fruits, you are carrying a basket that already contains a variety of fruits. This is what buying an ETF feels like; You invest in a bunch of assets at the same time, including stocks, bonds or commodities.

The best thing about ETFs is that they are very diverse. Because each ETF has a different investment, when you buy an ETF, you're spreading your money over many assets. It's like not putting all your eggs in one basket, which can make investing safer and less bumpy. This is especially good for those who don't want to take too much risk or are just starting to invest.

ETFs are also known for being cost-effective. They typically have lower fees than other types of funds, such as mutual funds. This is because ETFs typically follow a fixed index (such as the S&P 500) and do not try to beat the market by picking investments, which requires less work for the fund manager and thus reduces costs.

Another great feature of ETFs is that they are very easy to buy and sell. Since ETFs are traded on a stock exchange, you can buy and sell ETF shares at the same price as the individual stock price during the trading day. This is unlike mutual funds, which can only be bought or sold at a fixed price at the end of each trading day.

In conclusion, ETFs stand out because they offer a variety of investments in a portfolio, are cheaper to own, and are easy to trade. These features make ETFs an attractive option for many investors, from those just starting out to more experienced investors looking for an efficient way to diversify their portfolios.

2.2. Market Performance Overview

When we talk about how well Exchange-Traded Funds (ETFs) and traditional stocks have done in the market, it's kind of like comparing the performance of two athletes in different sports. Both have their strengths and challenges, and understanding these can help investors decide where to put their money.

ETFs have been like a rising star in the investing world. They've become really popular because they offer a way to invest in lots of different stocks or bonds all at once. This has made them a go-to choice for people who want to spread out their risk instead of betting everything on one company. For example, if you buy an ETF that tracks the S&P 500, you're essentially investing a little bit in each of the 500 companies in that index. This way, if one company doesn't do so well, you have 499 others that might balance things out.

One important thing about ETFs is that they've made it easier for people to invest in all sorts of things, not just companies. There are ETFs for gold, oil, and even for the debt of different countries. This variety has helped people diversify their investments even more, which is like having different types of workouts in your exercise routine to improve overall fitness.

Now, if we look at traditional stocks, investing in them is like picking a specific sport to play. When you buy shares in a company, your investment's success depends entirely on how well that company does. If the company has a great year, you could see a big payoff. But if it doesn't, your investment might not do so well. This makes stocks a bit riskier than ETFs, but it also means there's a chance for higher rewards if you pick the right company.

Historically, both ETFs and stocks have had their ups and downs. Stocks can give you a wild ride with big highs and lows, while ETFs tend to be more steady, offering a smoother journey through the market's ups and downs. But it's important to remember that the market changes all the time, and past performance isn't always a guarantee of what will happen in the future.

In the end, deciding between ETFs and traditional stocks depends on what kind of investor you are. If you're someone who likes the idea of spreading out your risk and having a more stable investment, then ETFs might be more up your alley. But if you're all about diving deep into research and are okay with a bit more risk for the chance of higher returns, then investing in individual stocks could be more exciting for you.

2.3. Reasons for Investor Preference

Investor preferences between Exchange-Traded Funds (ETFs) and traditional stocks vary widely and are influenced by several key factors. These include risk tolerance, investment goals, and the desire for diversification or specific market exposure.

Investors' comfort with risk plays a significant role in their choice between ETFs and stocks. ETFs are generally perceived as less risky than individual stocks because they are diversified across various assets, reducing the impact of poor performance by any single asset. On the other hand, individual stocks can offer higher potential returns but come with increased volatility and risk. As noted by Segal, “Portfolio diversification reduces an investor's risk. Duplicating that benefit by buying individual stocks would be much more cumbersome in terms of the time, research, and trading required, and likely more expensive” [1].

The long-term objectives of an investor also guide their choice. Some may seek steady income, favoring ETFs that focus on bonds or dividend-paying stocks. Others may aim for capital appreciation and might prefer investing in individual stocks of companies with high growth potential. Norris highlights that “Bond ETFs are favored by those seeking stability and income, while stock ETFs are chosen by those aiming for growth and willing to accept higher market volatility” [2].

Diversification is a cornerstone of investment strategy, aimed at reducing risk by spreading investments across various assets. ETFs inherently offer diversification, making them a preferred choice for investors looking to achieve a balanced portfolio with a single transaction. Tucker, M., & Grancio, J points out, “Vehicles like ETFs that allow investors to access challenging markets may be the beneficiary of the broadening and diversification of bond portfolios” [3].

Some investors have specific interests or beliefs about certain sectors or geographic regions. ETFs and stocks can cater to these preferences differently. ETFs offer a straightforward way to gain exposure to a broad sector, industry, or country. For example, an investor bullish on the technology sector might choose an ETF that tracks tech companies. Conversely, investors confident in the potential of a specific company may choose to invest directly in its stock for targeted exposure.

The ease of trading and associated costs are practical considerations affecting investor choice. ETFs are known for their liquidity and generally lower fees compared to mutual funds, but trading costs and bid-ask spreads can vary. In contrast, trading individual stocks involves brokerage fees, which can accumulate with frequent trading. At the same time, the liquidity of ETFs also takes other benefits, as T Krause, S Ehsani, and D Lien mentioned, “Any shock to the ETF price, whether created by new fundamental information or simply by liquidity traders taking advantage of ETF market depth, should be eliminated quickly with a correction in the price of ETF, the underlying stocks or both” [4].

3. ETFs Versus Regular Stocks

3.1. Empirical Data

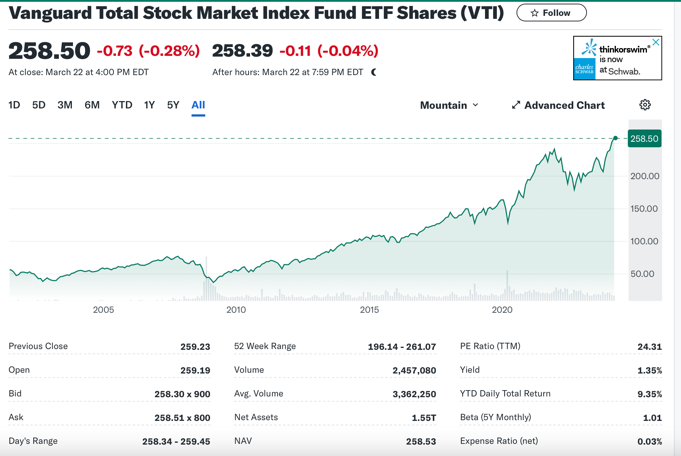

When we look at the historical performance of a range of exchange-traded funds (ETFs) such as Vanguard Total Stock Market Index Fund ETF (VTI), Invesco QQQ Trust Series 1 (QQQ), SPDR S&P 500 ETF Trust (SPY), and iShares Russell 2000 ETF(IWM), what stands out is the long-term growth trend that these funds have shown. As shown in Figure 1, it spans many years and shows a clear upward trajectory and reinforces the view that ETFs can be excellent long-term investment vehicles. As Brown, H mentioned “It is now commonplace for investors to buy-and-hold an ETF tracking a large market index like the S&P 500. Over a long period of time, like 40 years, investors are confident that such an ETF will provide a positive log-return that is favorable over most other available ETFs” [5].

Figure 1: Vanguard Stock Market Index Fund Total year chart of ETF shares

Each Figure shows that despite short-term dips and volatility, for example, the epidemic period from 2020-2022, the general movement over many years is upward. This is reflective of the general behavior of the stock market. Despite cycles of boom and bust, tends to increase in value over the long term. The VTI tracks broad market indices and demonstrates a clear pattern of growth that mirrors the expansion of the economy.

Figure 2: Vanguard S&P 500 ETF Total year chart of ETF shares

As shown in Figure 2, not only it show a consistent upward trend, but also the yield data for ETFs like VOO, which shows a yield of 1.36%, and the reinvestment of dividends, allows investors to benefit from the power of compounding. Over the long term, these reinvested dividends can significantly boost the total returns of an ETF.

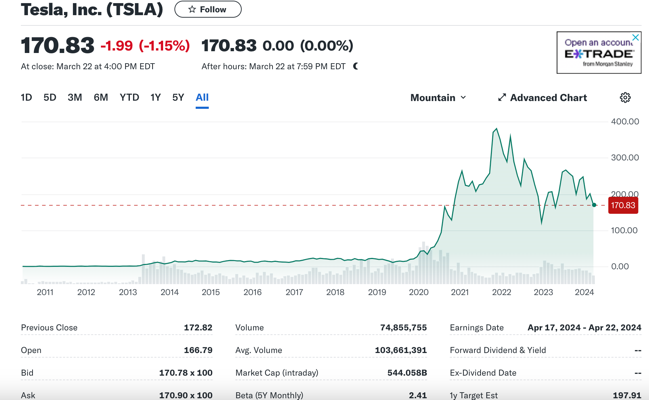

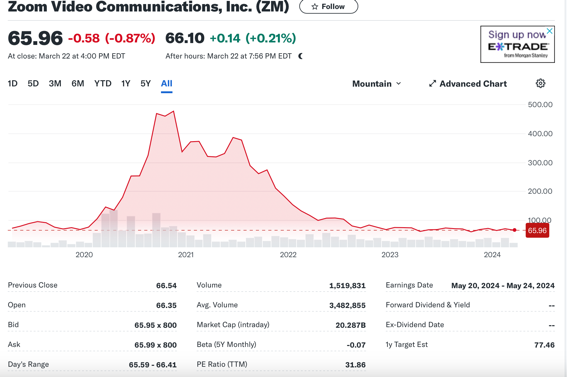

In contrast, individual stocks such as Tesla, Inc. (TSLA) and Zoom Video Communications, Inc. (ZM) have shown significant short-term gains but also considerable volatility. As shown in figure 3, Tesla's chart demonstrates potential for high return, as shown in figure 4, while Zoom's chart illustrates how external factors, such as the epidemic, can rapidly change a stock's fortune, highlighting the unpredictable nature of individual stock investments. Such volatility can be difficult for individual investors to endure, especially those with a lower tolerance for risk or those who require stable returns.

Figure 3: Tesla,Inc. total year chart of shares

Figure 4: Zoom Video Communications,Inc. total year chart of shares

3.2. Influencing Factor

The comparative analysis of ETFs and individual stocks that are informed by empirical data highlights several factors influencing their returns. These factors include diversification, Risk Tolerance, Liquidity, Emotional Investing and Market Timing.

ETFs, such as VTI, QQQ, SPY, and IWM, inherently offer diversification across various sectors and asset classes. It reduces the risk associated with individual stocks. Extent to some extent, the blended performance of many companies insulates the investor from the extreme volatility that can affect single stocks like Tesla or Zoom.

Under normal conditions, ETFs offer higher liquidity, enabling investors to buy and sell shares easily throughout the trading day. This contrasts with individual stocks, which may see periods of low liquidity, especially in times of market stress. As Ben‐David, I., Franzoni, F., & Moussawi, R. mentioned, “One of the main results of the paper is that stocks with more ownership by ETFs display higher volatility than otherwise similar securities. A quasi-natural experiment based on the reconstitution of the Russell indexes suggests a causal interpretation for this finding”[6].

The level of volatility in individual stocks is often higher than that of ETFs, as evidenced by the beta values. In some cases, Tesla's high beta suggests its price is more volatile than the broader market. Zoom’s negative beta indicated an inverse relationship. This is likely due to the unique market conditions during the observation period. ETFs generally have a beta close to 1, indicating that their price movements are closely aligned with the market.

Under some conditions, the volatility of individual stocks often leads to emotional investing, where fear or greed drives decisions. In that situation, the steadier climb of ETFs can help investors maintain a disciplined approach, focusing on long-term financial goals rather than short-term market fluctuations.

4. Conclusion

This paper examined the comparative returns of ETFs and individual stocks and considered the various factors that influence the performance. The findings in this paper provide a message: although individual stocks like TSLA and ZM can offer significant returns, they come with higher volatility and require a market-timing strategy that is not necessary with ETFs in some way.

The volatility of individual stocks is highlighted by the dramatic price movements of Zoom during the pandemic and Tesla’s fluctuating valuation. It may be suitable for investors with a high-risk tolerance or those who engage in active trading. However, for those with a long-term investment horizon seeking to build wealth with reduced risk and steady growth, ETFs emerge as a compelling option.

Investors should estimate their choice of investment vehicles with their risk tolerance and investment goals. For those inclined towards a hands-off approach and wishing to minimize the stress of market fluctuations, the evidence points towards the value of including ETFs within their investment portfolio. Although this paper has addressed the comparative returns of ETFs and traditional stocks, it leaves room for deeper quantitative analysis, such as using predictive modeling techniques. Future research could benefit from incorporating machine learning to forecast returns more accurately. Additionally, this paper did not explore the new field of environmental, social, and governance (ESG) investing, which is of a growing interest to investors. Future studies could examine how ESG-focused ETFs perform in comparison to traditional stocks within the ESG area.

References

[1]. Segal, T. (n.d.). The Pros and cons of etfs. Investopedia(2024). https://www.investopedia.com/articles/exchangetradedfunds/11/advantages-disadvantages-etfs.asp9

[2]. Norris, E. (n.d.). Bond etfs: A viable alternative. Investopedia(2024). https://www.investopedia.com/investing/bond-etfs-viable-alternative/

[3]. Tucker, M., & Grancio, J. (2012). Transforming the Bond Markets with Fixed Income ETFs. Режим доступу: http://us. ishares. com/content/en_us/repository/resource/nosite/transforming_bond_markets_fi_etfs. pdf.

[4]. Krause, T., Ehsani, S., & Lien, D. (2014). Exchange-traded funds, liquidity and volatility. Applied Financial Economics, 24(24), 1617-1630.

[5]. Brown, H. (2023). Long-term returns estimation of leveraged indexes and ETFs. Financial Markets and Portfolio Management, 1-26.

[6]. Ben‐David, I., Franzoni, F., & Moussawi, R. (2018). Do ETFs increase volatility?. The Journal of Finance, 73(6), 2471-2535.

Cite this article

Tu,S. (2024). The Comparison of Returns Between ETFs and Conventional Stocks. Advances in Economics, Management and Political Sciences,87,279-284.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Segal, T. (n.d.). The Pros and cons of etfs. Investopedia(2024). https://www.investopedia.com/articles/exchangetradedfunds/11/advantages-disadvantages-etfs.asp9

[2]. Norris, E. (n.d.). Bond etfs: A viable alternative. Investopedia(2024). https://www.investopedia.com/investing/bond-etfs-viable-alternative/

[3]. Tucker, M., & Grancio, J. (2012). Transforming the Bond Markets with Fixed Income ETFs. Режим доступу: http://us. ishares. com/content/en_us/repository/resource/nosite/transforming_bond_markets_fi_etfs. pdf.

[4]. Krause, T., Ehsani, S., & Lien, D. (2014). Exchange-traded funds, liquidity and volatility. Applied Financial Economics, 24(24), 1617-1630.

[5]. Brown, H. (2023). Long-term returns estimation of leveraged indexes and ETFs. Financial Markets and Portfolio Management, 1-26.

[6]. Ben‐David, I., Franzoni, F., & Moussawi, R. (2018). Do ETFs increase volatility?. The Journal of Finance, 73(6), 2471-2535.