1. Introduction

With the strengthening of China's economic power, the status of the RMB in the international arena has also increased significantly. Additionally, the Chinese government has worked hard to encourage the RMB's internationalization. Since 2009, China has been launching a pilot RMB settlement for cross-border trade; In 2015, the "8-11 Exchange Reform" enhanced the mechanism for forming the RMB exchange rate, the RMB increasingly strengthened, and the RMB's globalization moved quickly; October of the same year, CIPS constructed by the People's Bank of China (PBOC) was officially put into use; In 2016, the IMF announced the inclusion of the RMB in the SDR as the fifth international currency with a weight of 10.92%, ranking third [1], which is an important milestone in the internationalization of the RMB, reflecting the recognition of the RMB's function of international use; Relying on opportunities such as the "Belt and Road" initiative, China has become the world's second-largest economy and the first trading country, and its national strength has gradually increased, with the international monetary function of the RMB further developing in depth and breadth.

In addition, according to the IMF, the RMB accounts for 2.37% of global foreign exchange reserves in 2023Q3 [1], and the RMB is playing an increasingly important role in international markets. There are numerous discussions about whether the RMB will replace the US dollar as the global currency: In the past ten years, changes in the level of RMB internationalization have gone through three periods of development, namely "rapid increase - oscillation and repetition - slow growth", and is still in the primary stage [2]. RMB may be possible to complete the internationalization process quickly if the authorities set their minds to it and it does not presuppose the demise of the dollar [3]. China has challenges in advancing the RMB as a significant trade-invoicing currency, including low per capita income, restricted financial openness, and the existence of U.S. dollar zone nations in Asia [4].

In this article, we will comprehensively discuss the potential and challenges of the RMB becoming an international currency. After analyzing the two dominant factors (financial markets and capital restrictions) that have prevented the RMB from becoming an international currency, this paper also innovatively briefly describes some other factors.

2. Characteristics of global currency

2.1. Factors influencing global currency

International currencies are generally currencies that are used for the valuation and settlement of international transactions in financial assets and trade in goods and services and are held by private individuals, economic sectors, and monetary authorities as internationally liquid and reserve assets. The international currency function is an extension of the domestic function of the currency abroad [5]. Many economic scholars and experts have analyzed the economic factors that influence a currency to become an international currency. To summarize, there are the following 3 factors: the country's economic status, the stability of the macro environment, and a sound financial system [6]. At present, the US dollar, as the main international currency in use, performs well in these 3 aspects, the RMB scores high in the two aspects of economic status and macro-environmental stability, and needs to be further improved in the financial system. (Specifically analyzed below)

2.2. Benefits of global currency

The benefits of internationalizing the currency are numerous, which explains why the Chinese government is actively promoting the internationalization of the RMB. Summarizing the previous literature, the benefits of an international currency are as follows: 1) It brings mint tax benefits. The so-called mint tax refers to the export of national currencies in exchange for real resource imports, i.e., the amount by which the nominal value of the currency obtained by the currency issuer by virtue of its issuance privileges exceeds the cost of issuance and management [5]; 2) Reducing exchange rate risk, further improving terms of trade, and enhancing international status; 3) Asymmetric policy advantages. As national currencies evolve into international currencies, the central bank of the country issuing the international currency becomes, in a sense, the world's central bank, and its liabilities become the standard of value and the ultimate means of payment for the entire world [7]. In other words, the issuing countries of international currencies have a proactive advantage in the formulation of monetary policy, and they tend to focus on their own national interests.

3. Potential for RMB to become a global currency

3.1. High trade&GDP share

3.1.1. Trade share

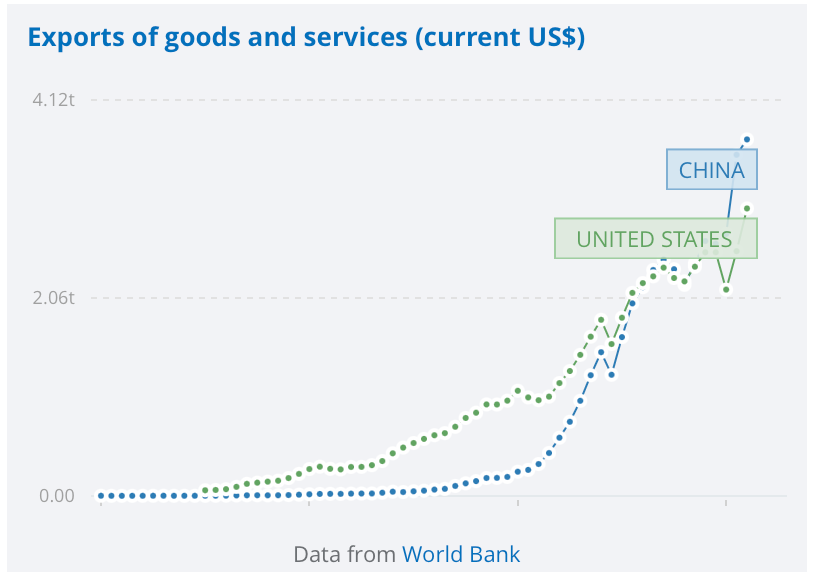

The share of trade directly determines how the country's currency is used internationally. Figure 1 shows the merchandise exports of China and the United States, and it can be seen that China's exports have been climbing year by year, even surpassing the United States in recent years. Let's review the internationalization of the dollar: Table 2 shows the Total exports of major capitalist countries during the gold standard period. During the period of the international gold standard, when the pound sterling dominated, Britain exported far more than any other capitalist country. During the two world wars, however, the value of United States exports continued to rise [8], which laid an important foundation for the subsequent emergence of the US dollar as the global currency.

Figure 1: Exports of goods and services (current US$) - China, United States [9].

Table 1: Total exports of major countries Current boundaries (millions 1913$) [9-10].

UK | France | Italy | US | China | |

1830 | 182.4 | 78.7 | 29.8 | 59.0 | 44.2 |

1870 | 976.2 | 488.5 | 117.2 | 422.5 | 88.7 |

1914 | 2097.3 | 949.9 | 424.9 | 2523.0 | 299.0 |

1938 | 2302.2 | 1061.8 | 490.9 | 3057.0 | 348.6 |

2022 | 1030000 | 963970 | 750820 | 3000000 | 3710000 |

3.1.2. GDP

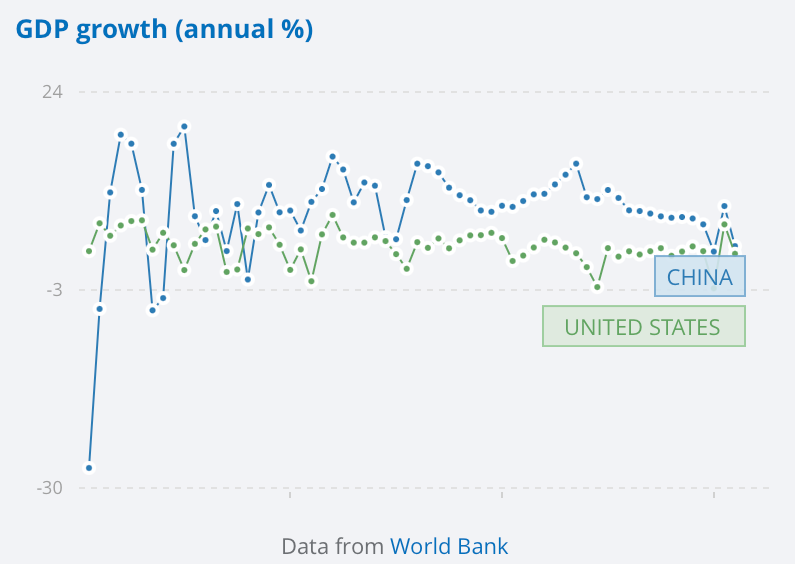

GDP is a crucial metric for assessing a nation's economic standing. Figure 2 demonstrates the comparison of the GDP growth rates of China and the United States, from which we can see that: in recent years, China's GDP has been growing at a phenomenal rate, consistently higher than that of the United States, which has laid a solid foundation for the RMB to become a global currency.

Figure 2: GDP growth (annual %) - China, United States [9].

3.2. Stable macro-environment

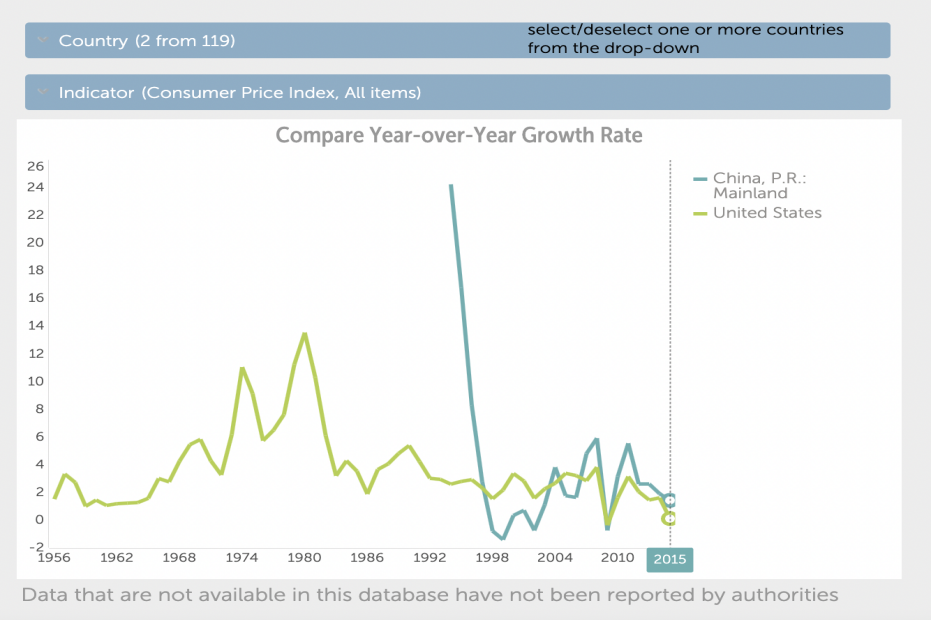

The stability of the macro environment determines the volatility of the country's currency. The stability of the currency in turn directly determines whether the currency has the potential to become an international currency. Figure 3 shows the comparison of the CPI index between China and the U.S. It is evident that China has maintained a comparatively low rate of inflation in recent times. This provides a guarantee for the RMB to become a global currency. Nevertheless, poor sales, financing, and debt issues have thrown the real estate sector into disarray, posing certain challenges to China's macro environment. This situation needs to be moderated if China is to provide the required macroenvironment.

Figure 3: Consumer Price Index (CPI)--China; United State [1].

3.3. Gradual improvement of the financial system

A series of financial policies introduced by the Chinese government in recent years have greatly facilitated the process of RMB becoming an international currency. With the needs of national development, China has gradually relaxed its capital controls: In the 811 exchange rate reform, the central bank proposed a new mechanism for the formation of the mid-price, which is based on the "reference to the previous day's closing price to determine the current day's mid-price". Based on "a reference to the previous day's closing price to determine the current day's mid-price", the central bank introduced the factor of "stabilizing the 24-hour basket of currencies"[11]. The mid-rate mechanism of the RMB/USD exchange rate is further marketized, fully reflecting the demand and supply in the foreign exchange market. With the introduction of a series of policies such as the "8-11 Exchange Reform" and the emergence of the offshore RMB(it can be simply understood as RMB traded outside mainland China e.g.CNH), China's financial system has gradually been improved, and the RMB has been used more and more frequently and has become more and more important in the international arena.

4. Chinese financial system

4.1. Financial Depth & Financial Breadth

This paper adopts two indicators, financial depth and financial breadth, which are commonly used by academics to measure the current development of China's financial system.

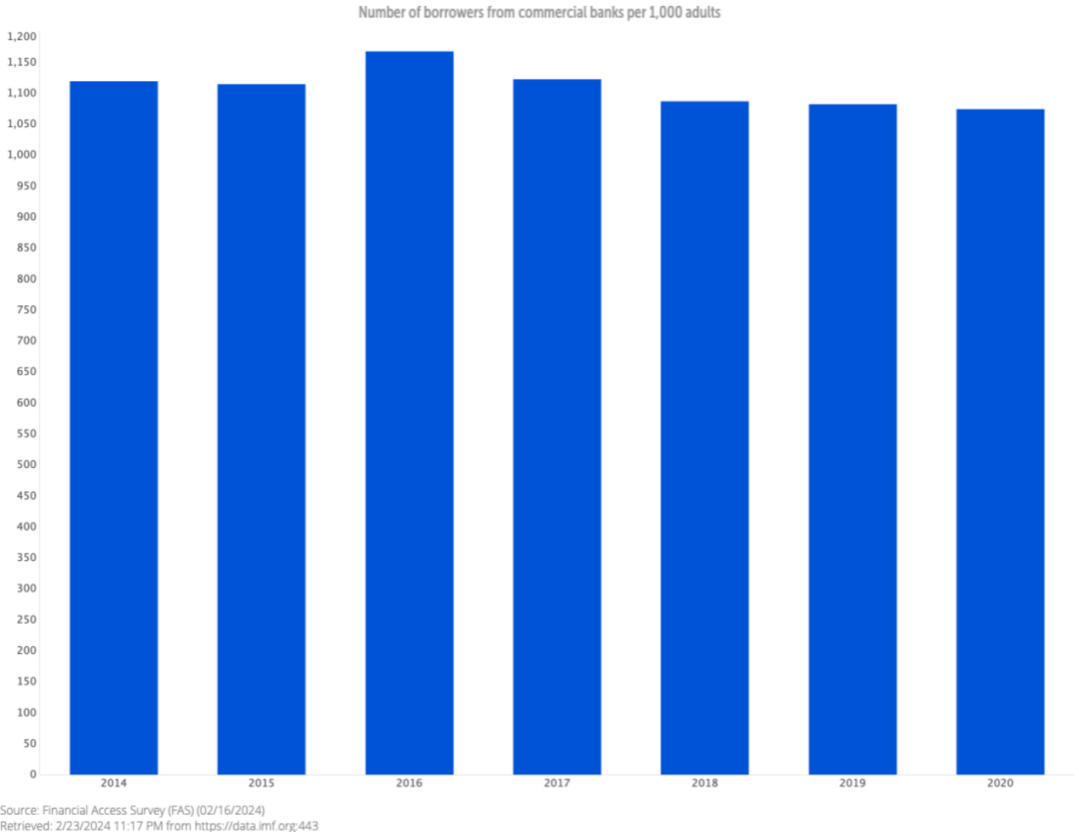

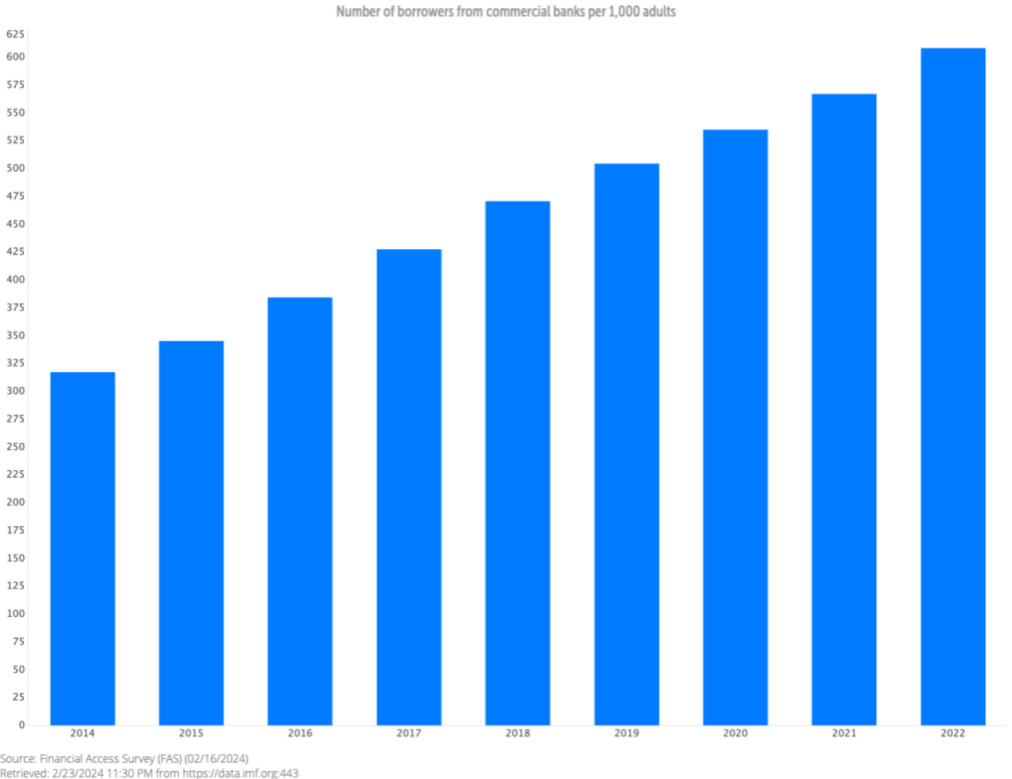

Financial depth refers to the increase in the quantity of money in a country or region, and M2 /GDP or financial assets/GDP is commonly used as an indicator, which reflects the degree of financialization of the economy. According to the data of the World Bank: the ratio of M2 /GDP in China in 2022 is as high as 216.2% [9]. The financial depth is higher than the average developed country. But because banking finance dominates it and there aren't many market-based products, it's not broad enough. Since the government owns or controls banks of all sizes, the debt markets presently pose little threat to them. Since the major state-owned companies have easy access to bank funding and retained earnings, corporate debt markets in the form of commercial paper and asset-backed securities are still in their infancy [12]. This reflects China's current relatively homogeneous financial instruments and lack of financial innovation. According to IMF data, comparing the financial breadth (as measured by the number of borrowings from commercial banks per 1,000 adults [13]) of China and more financially developed countries (represented by Singapore because of missing data published by the World Bank). The comparison shows that China's financial breadth is relatively narrow and still has a lot of room for development. In addition, there are still large loopholes in financial regulation in China, which need to be further standardized.

Figure 4: Number of borrowers from commercial banks per 1000 adults--Singapore [1].

Figure 5: Number of borrowers from commercial banks per 1000 adults--China [1].

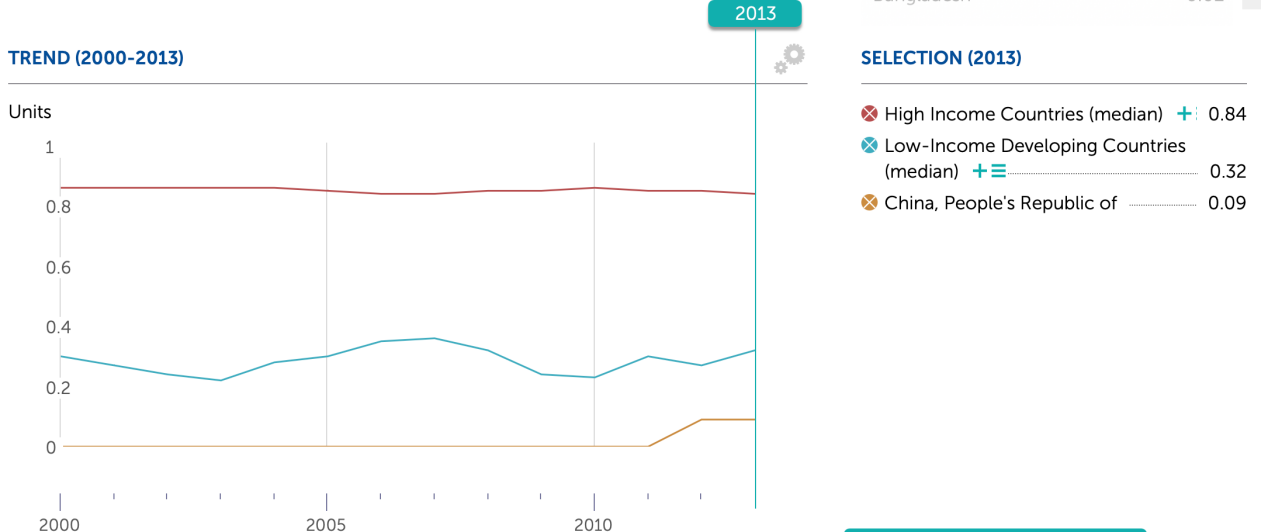

4.2. Capital flow

According to the "ternary paradox", China has chosen an independent monetary policy and stable exchange rate, giving up the free flow of capital, and the renminbi has not yet realized free convertibility. Summarizing the previous research results, the strictness of capital control has a direct negative impact on international trade [14], which in turn affects the process of RMB internationalization; in the short term, RMB internationalization, and capital account opening are causal to each other, capital account opening serves as the foundation and predicate for the steady advancement of RMB internationalization, and RMB internationalization provides the condition and chance for furthering capital account opening [15]. IMF's Annual Report on Exchange Arrangements and Exchange Restrictions" shows that, as of 2021, among the 40 sub-items of China's capital account, China has achieved full convertibility in 4 sub-items, partial convertibility in 35 sub-items, and the remaining non-convertible items are mainly about the participation of non-residents in the sale and issuance of derivatives [15]. Figure 6 shows the capital account openness of China, high-income countries, and low-income countries in 2013, and It is evident that China's capital account openness is not only lower than that of high-income countries but also a certain level away from low-income countries. China has more space to improve capital flows.

Figure 6: Overall Capital Account Openness Index (all asset categories) [1].

Other reasons why the RMB cannot replace the dollar as the global currency

Inertia effect. As an international currency, the dollar has long dominated international trade settlements, especially after being anchored to oil, the dollar has penetrated every aspect of the economy and trade along with oil, an industrial necessity, and has solidified the payment and settlement habits of international trade for all countries in the world [16].The replacement of international currencies requires a large amount of cost, and in the international context of the rise of the trend of anti-globalization, the status of the United States dollar as the global currency will not change in a short time, and the internationalization process of the yuan will face serious challenges.

Account deficit. As a big exporter, China's foreign exports account for a considerable portion of its GDP: according to the National Bureau of Statistics, China's import and export trade will total 31.54 trillion yuan in 2022, accounting for 18.5% of GDP. If the RMB becomes an global currency, there will be a massive increase in demand for the RMB and it will appreciate significantly, which will deal a severe blow to China's exports, and the Chinese government will be faced with a series of problems such as how to adjust its economic policies.

Traditional culture. Influenced by Confucian culture, China is a saving country rather than a spending country. Chinese people prefer to store the RMB rather than export it for consumption or investment, which to a certain extent also reduces the circulation of the RMB in the international arena.

Being an international currency must be backed by strong military and economic power. Currency is also a political instrument that has a direct impact on international relations, and it is worth exploring whether other countries will allow the yuan to replace the dollar.

5. Conclusion

After summarizing the past literature, this paper analyzes the main factors hindering the RMB from becoming an international currency - insufficient development of the financial system and capital flow restrictions - and briefly discusses the other influencing factors, finally concluding that with the gradual improvement of the RMB's status in the international arena, There is a lot of room for the RMB to grow as a global currency, but due to a series of limitations, such as the degree of advancement of development of the financial system and capital flows, it has a low likelihood of replacing the U.S. dollar as an international currency in a short period.

The shortcomings and deficiencies of this paper include the following: only two perspectives of the financial system and capital flows are briefly discussed, and other factors are only generalized and not discussed. It only analyzes whether the RMB will become a global currency and does not discuss the possibility of the RMB becoming a regional currency. After studying the current status of the internationalization process of the RMB, we can analyze the feasibility of the RMB becoming a regional currency like the euro, and explore whether the RMB will become an "Asian currency" in the future.

References

[1]. INTERNATIONAL MONETARY FUND,2024,https://www.imf.org/en/Data

[2]. Wang Tianqian,Zhu Xiaomei(2022),Measurement of RMB Internationalization Level and Analysis of Its Influencing Factors:An Empirical Study from a Dual-Circulation and National Finance Prespective.Financial Economics Research,2022,37(06),127-143

[3]. Barry Eichengreen(2011).The renminbi as an international currency.Volume 33, Issue 5, September–October 2011, Pages 723-730

[4]. Hiro Ito,Masahiro Kawai(2016).Trade invoicing in major currencies in the 1970s–1990s: Lessons for renminbi internationalization.Volume 42, December 2016, Pages 123-145

[5]. Xu Xinhua (2006).Research theory and demonstration of RMB internationalization.

[6]. Tavlas George S.,(1991).On the international use of currencies: The case of the deutsche mark.Princeton essays in international finance, No. 181, March (1991);Zhang Guiwen (2012).Study on currency internationalization

[7]. Zhang Yuyan,Zhang Jingchun (2008). The Cost and Benefits of International Currency.World Knowledge, Year 2008 No.21.:Pages 58-63

[8]. Zhang Guiwen (2012).Study on currency internationalization

[9]. WORLD BANK,2024,https://data.worldbank.org.cn

[10]. The World Trade Historical Database,2024,https://cepr.org/voxeu/columns/world-trade-historical-database

[11]. Yu Yongding., Xiao Lisheng( 2017). Completing the "8.11 exchange rate reform: an analysis of the direction of reform of the RMB exchange rate formation mechanism . International Economic Review (1): 23-41.

[12]. Wendy DOBSON, Paul R. MASSON(2009),Will the renminbi become a world currency?,China Economic Review,Volume 20, Issue 1:Pages 124-135.

[13]. Li Meng(2008). Factors Influencing Financial Breadth and Depth: A Cross-Country Analysis[J].Southern Economy, 2008

[14]. S. Edwards, J.D. Ostry(1992).Terms of trade disturbances, real exchange rates, and welfare: The role of capital controls and labor market distortions.Oxford Economic Papers, 44 (1) :pp. 20-34

[15]. Bian Weiwei(2023),Research on the interactive relationship between RMB internationalization, capital account opening and the pressure of China's foreign exchange market

[16]. Gong Xiuguo(2021),Opportunities, Challenges and Paths of RMB Internationalization under the Perspective of US-China Competition[J]Journal of Chang'an University (Social Science Edition),2021,23(06):15-24

Cite this article

Liu,J. (2024). Will RMB Replace the Dollar as the Global Currency?. Advances in Economics, Management and Political Sciences,88,165-172.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. INTERNATIONAL MONETARY FUND,2024,https://www.imf.org/en/Data

[2]. Wang Tianqian,Zhu Xiaomei(2022),Measurement of RMB Internationalization Level and Analysis of Its Influencing Factors:An Empirical Study from a Dual-Circulation and National Finance Prespective.Financial Economics Research,2022,37(06),127-143

[3]. Barry Eichengreen(2011).The renminbi as an international currency.Volume 33, Issue 5, September–October 2011, Pages 723-730

[4]. Hiro Ito,Masahiro Kawai(2016).Trade invoicing in major currencies in the 1970s–1990s: Lessons for renminbi internationalization.Volume 42, December 2016, Pages 123-145

[5]. Xu Xinhua (2006).Research theory and demonstration of RMB internationalization.

[6]. Tavlas George S.,(1991).On the international use of currencies: The case of the deutsche mark.Princeton essays in international finance, No. 181, March (1991);Zhang Guiwen (2012).Study on currency internationalization

[7]. Zhang Yuyan,Zhang Jingchun (2008). The Cost and Benefits of International Currency.World Knowledge, Year 2008 No.21.:Pages 58-63

[8]. Zhang Guiwen (2012).Study on currency internationalization

[9]. WORLD BANK,2024,https://data.worldbank.org.cn

[10]. The World Trade Historical Database,2024,https://cepr.org/voxeu/columns/world-trade-historical-database

[11]. Yu Yongding., Xiao Lisheng( 2017). Completing the "8.11 exchange rate reform: an analysis of the direction of reform of the RMB exchange rate formation mechanism . International Economic Review (1): 23-41.

[12]. Wendy DOBSON, Paul R. MASSON(2009),Will the renminbi become a world currency?,China Economic Review,Volume 20, Issue 1:Pages 124-135.

[13]. Li Meng(2008). Factors Influencing Financial Breadth and Depth: A Cross-Country Analysis[J].Southern Economy, 2008

[14]. S. Edwards, J.D. Ostry(1992).Terms of trade disturbances, real exchange rates, and welfare: The role of capital controls and labor market distortions.Oxford Economic Papers, 44 (1) :pp. 20-34

[15]. Bian Weiwei(2023),Research on the interactive relationship between RMB internationalization, capital account opening and the pressure of China's foreign exchange market

[16]. Gong Xiuguo(2021),Opportunities, Challenges and Paths of RMB Internationalization under the Perspective of US-China Competition[J]Journal of Chang'an University (Social Science Edition),2021,23(06):15-24