1. Introduction

The primary sector in Africa continues to play a crucial role in the domestic economy, providing income and job opportunities for a large portion of the population, which includes agriculture, mining, forestry, and fishing. Agriculture is a dominant component of the primary sector in Africa, with a large percentage of the population engaged in farming and related activities. Africa introduced more advanced technology and machinery to conquer challenges such as low productivity. However, although technological innovations can help to improve productivity, enhance market access, and promote sustainable practices, the significant inequality gap still needs to be solved in Africa.

Some reasons are causing this phenomenon from which the underdevelopment of secondary and tertiary sectors has led to a significant dependency on the import of manufactured goods, consequently weakening the competitiveness of African enterprises in the global marketplace. Besides, Africa's exports rely predominantly on raw materials like minerals, oil, and agricultural products. The prices of these commodities are susceptible to international market fluctuations. In addition, since the secondary and tertiary sectors are vital drivers of innovation, research, and development, the underdeveloped sectors may miss opportunities to create new products, services, and technologies to improve overall quality of life and enhance economic growth.

In theory, overall growth in the scale of international trade and trade liberalization is anticipated to enhance economic efficiency and drive economic growth. However, due to its unique circumstances, such as homogeneous export structure, unequal trade, and systemic deficiencies, Africa has yet to see a significant alleviation in regional poverty despite a substantial increase in international trade and exports. Social class contradictions remain sharply defined.

The rest of the paper is organized as follows. Section 2 reviews the impact of trade on poverty by focusing on the transmission channels and the conditional variables that can influence the trade–poverty relationship. Section 3 sets up the theoretical & empirical analysis of the impact of international trade on African countries. Section 4 used the Gini coefficient & Lorenz curve, PPF, and spillover model to measure income or wealth distribution inequality and determine the reasons for the generation of poverty in Africa. Section 5 mainly discusses the political reasons affecting international trade on poverty. Conclusions are presented in Section 6.

2. Literature review

2.1. The definition of poverty

At its core, poverty signifies a state of deprivation characterized by the absence or inadequacy of resources necessary to attain a decent standard of living and participate fully in society. From different perspectives, poverty can be defined in many ways. Westover points out poverty refers to unproductive or low-producing livestock and farmland [1]. According to the Welfare School, the concept of poverty comes from the modern microeconomic theory and the hypothesis according to which individuals maximize their welfare. They argue that it is a feeling provided by the satisfaction of a need, and this satisfaction can come from marketable or non-marketable goods and services [2]. However, the other define poverty as having insufficient resources or receiving income below the average level [3].

Another description of poverty refers to the situation where society struggles to make ends meet, coupled with limited access to physiological necessities such as food, clothing, and appropriate accommodation, from the perspective of maintaining a basic standard of living [4].

Relative and absolute poverty are commonly used frameworks to approach poverty assessment. Absolute poverty focuses on a fixed standard of living, often defined by an income threshold that accounts for basic needs, regardless of the broader socio-economic context. In contrast, relative poverty acknowledges that poverty is a relative concept, varying with societal norms and economic conditions. Relative poverty considers an individual or group poor if their standards fall significantly below the average.

2.2. The poverty in Africa

Africa has the most abundant natural resources and rich cultural diversity, yet a substantial portion of the African population grapples with various dimensions of poverty. Africa is still one of the poorest continents in the world [3].

Historical legacies, including colonial exploitation and uneven development, continue to shape the economic and social disparities that contribute to the persistence of poverty. Factors such as inadequate access to education, healthcare, and basic infrastructure, along with high levels of unemployment and corruption of government, exacerbate the issue [3]. Geographical factors also play a substantial role in Africa’s poverty landscape. The continent’s diverse geography includes arid deserts, fertile plains, lush rainforests, and expansive coastlines. While these varied landscapes offer potential for agriculture, tourism, and other industries, they also bring challenges. Droughts, desertification, and limited arable land can lead to food insecurity and hamper agricultural productivity. Additionally, inadequate infrastructure in some regions impedes trade and access to markets. South Africa has the highest rural poverty, followed by 77 percent of the rural population living in poverty [5-7].

2.3. Current status of globalization in Africa

Over the years, in the background of the gradual integration of the world economy, known as globalization [2], the volume of international trade has increased considerably and was more significant than ever before. Exports from African countries have increased annually, on average, by 2.6 percent in the 1980s, 8 percent in the 1990s, and 15 percent in the 2000s, respectively. The increase in imports and exports has resulted in greater trade openness in Sub-Saharan Africa [8].

International trade is often considered a powerful tool for poverty reduction and economic growth. However, although trade to and from Africa has significantly expanded, this continent is still among the poorest in the world, with more than half of the population living below US$1.25 a day [8].

2.4. Relationship between international trade and poverty in Africa

While international trade has the potential to drive economic growth, create jobs, and alleviate poverty, its impact on poverty reduction in African nations is far from straightforward. The relationship between the level of poverty and international trade has been discussed extensively in previous studies, while various methodology and consideration leads to various conclusions.

International trade in those developing countries should be pro-poor since these countries are likely to have more primary sectors than developed country, which has a comparative advantage in producing goods with unskilled labor [9]. Professor Alan Winters points out that international trade contributes favorably to reducing poverty by encouraging innovation and improving people’s productivity. A study on developing countries shows that absolute poverty has been reduced significantly in the past two decades as per capita income increases because of trade growth [10]. However, some extant studies have argued that trade significantly negatively impacts economic growth since it will cause higher inequalities and, thus, higher poverty.

However, another suggestion is that trade liberalization should not be viewed as isolated, and more policies will need to be adopted to strengthen its impact, including on poverty. The two variables have no direct relationship, depending on many factors [11]. In Agénor’s research, he finds that, to some extent, globalization is detrimental to people experiencing poverty, and beyond this certain level, globalization seems to be effective in reducing poverty [12].

McCulloch also points out that although there is clear evidence that growth positively impacts poverty, it is difficult to establish a connection between trade and growth. This may be largely due to the difficulty in measuring trade barriers and their openness [13].

3. Analysis of International Trade and African Economy Through Theoretical and Empirical Lens

This part will elaborate on the impact of international trade on African countries, from theoretical and empirical perspectives.

3.1. Merits of International Trade

As a prevalent economic activity with a long history dating back to the origin of nations, international trade has contributed significantly to human civilization's progress. The benefits of international trade can be theoretically explained by the net export multiplier effect, the comparative advantage theory, economies of scale, and technology dissemination.

3.1.1. Net Export Multiplier Effect

In The General Theory of Employment, John Maynard Keynes first introduced the concept of multiplier as a key parameter in the study of macroeconomics [14]. A multiplier is a factor in economics that proportionally augments other related variables when it is applied. The total income is composed of consumption, investment, government expenditure and net export. After decomposing the four parts and creating a more sophisticated expression,

\( Y=(\bar{C}+\bar{I}+\bar{G}+({m_{1}}+c)+\bar{TR}+\bar{NX}+{x_{1}}∙{Y_{f}}+v∙R)+(c-{m_{1}})(1-t)∙Y-{b_{i}} \)

we can differentiate \( Y \) and \( \bar{NX} \) , and get \( {a_{NX}}=\frac{∆Y}{∆NX}=\frac{1}{1-(c-{m_{1}})(1-t)} \) . In most conditions, the marginal propensity to consume is larger than the marginal propensity to import, so the multiplier is a positive number larger than 1. Explained in plain terms, an increase in net export raises GDP, increasing consumption and import(subtraction). Because people usually consume more domestic goods than imported goods, the aggregate effect on GDP is still positive. This goes in a cycle, thus generating the multiplier effect.

3.1.2. Comparative Advantage

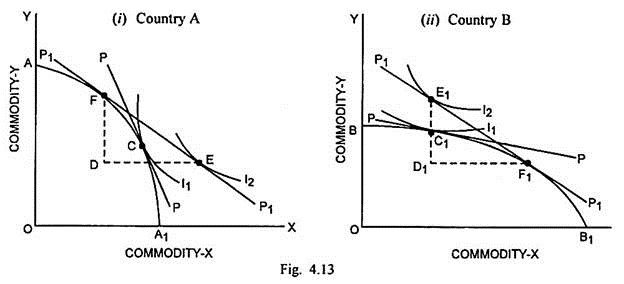

According to the theory of comparative advantage, a country has a comparative advantage because of endowments, such as abundant labor or capital. Respectively, they should specialize in labor-intensive or capital-intensive products and engage in international trade to attain a higher social utility than the pre-trade level (Figure 1).

Figure 1: Two Country Trade Equilibrium

3.1.3. Economies of Scale and Dissemination of Technology

According to economies of scale theory, if the production scale increases, the activity of a company or industry is expected to become more efficient due to the spread of fixed cost, bulk purchases & and discounts, learning by doing effects, and more access to finance, etc. Also, the dissemination of technology promotes economic growth in African countries in two ways: 1) industrial and technological goods can serve directly as production tools to increase productivity; 2) through the import of technological products, these countries can gradually master the production and, by utilizing their advantage in abundant labor and low wages, enter the global market and take a large share (like the case in East Asia).

3.2. Drawbacks of International Trade in Africa

Despite many benefits brought by trade to Africa, trade is still in progress, especially in African countries where the trade pattern is locked in an inferior state—most export mainly raw materials and import mainly industrial goods. International trade in Africa can sometimes be a curse in disguise.

3.2.1. Natural Resource Curse

In light of the high profits that can be obtained from limited natural resources, economic diversification and education may be delayed or neglected by the authorities and people, as they see no immediate need. In addition, the boom of natural resource sector can lead to “Dutch Disease”, where the natural resource sector, due to its high short-term profits, attracts capital and workforce from other important sectors, such as manufacturing industry, causing the other sectors to decline. We should also note that natural resources in Africa are not limitless; as countries keep exploiting and exporting these resources, the reserve is gradually being drained. The damage done to the local ecosystems will impair the long-term potential of African economy.

3.2.2. Immiserizing Growth

Immiserizing growth refers to the theoretical situation proposed by Bhagwati, where economic growth could result in a country being worse off than before the growth [15]. If growth is heavily export-based, it might lead to a fall in the terms of trade of the exporting country. In rare circumstances, this fall in the terms of trade may be so large as to outweigh the gains from growth (Figure 2). Similarly, the Prebisch-Singer Hypothesis raised in the late 1940s testified the immiserizing effect of international trade, arguing that the price of primary commodities(agricultural produce, natural resources, etc.) tends to decline relative to the price of industrial goods (machines, vehicles, etc) over the long term, causing the terms of trade of primary-product-based economies to deteriorate.

Figure 2: Illustration of Immiserizing Growth

3.3. Empirical Analysis of International Trade in Africa

In a preliminary analysis, we collect the data of 48 sub-Saharan African countries over the past 20 years (2003-2022) from the World Bank databank [7]. Using the panel data regression model, we find a significant positive correlation between trade openness (independent variable) and GDP per capita growth rate (dependent variables). Factors of corruption (here, control of corruption is used, an index that denotes the Z score of the country’s control of corruption; the higher the indicator, the less corruption in the government), political stability, and industry GDP ratio are also considered. We hoped to include other important variables to explain the economic growth, such as infrastructure and education, but unfortunately, those data are highly unavailable and incomplete. The results are presented in Table 1. The results show that trade openness, industry GDP ratio, and political stability significantly affect the GDP per capita growth rate. In contrast, control of corruption has a positive but insignificant effect.

Notably, it is an oversimplified preliminary analysis, so the results may not have much validity. The deficits include endogeneity, collinearity, and lack of control for many other important factors, such as population, GDP per capita, and geographical factors. Therefore, it needs improvement before it can be considered a sound analysis. Still, this might provide a policy implication that African countries can develop their economies by encouraging trade and industry, controlling corruption, and maintaining political stability.

Table 1: Econometric Results

gdppercapitagrowth | coefficient | Std.err. | t | P>|t| | [95% conf. interval] | |

tradeopenness | .0551919 | .0140978 | 3.91 | 0.000 | .027515 | .0828688 |

controlofcorruption | .4069282 | .9453371 | 0.43 | 0.667 | -1.448963 | 2.262819 |

industrygdpratio | .1073036 | .0386157 | 2.78 | 0.006 | .0314931 | .1831141 |

politicalstability | 1.149669 | .4982114 | 2.31 | 0.021 | .1715776 | 2.127761 |

cons | -4.525306 | 1.377226 | -3.29 | 0.001 | -7.229083 | -1.821529 |

Sigma_u | 4.3243074 | |||||

Sigma_e | 4.5940141 | |||||

rho | .46978577 | |||||

4. Analysis of International Trade and African Economy Through Theoretical and Empirical Lens

4.1. The impact of international trade on poverty and inequality in Africa

Substantial empirical data, from WORLD BANK & WID. WORLD, clearly shows the rapid growth of international trade in Africa, but poverty and inequality problems are still severe. The level of the top 10% national income share is higher than other regions, and the level of the bottom 50% national income share is lower. So even though Sub-Saharan Africa has a significant increase in international trade, the actual poverty situation has not improved much, as shown in Figure 3 [16].

Figure 3: Top 10% and Bottom 50% national income share in different regions [16]

With the increase of international trade scale, the economic inequality between sub-Saharan African countries has decreased, but on average, the inequality within each country has increased.

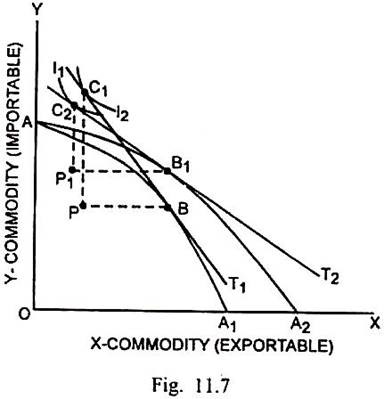

4.2. Gini coefficient and Lorenz curve

This article introduces two economic tools, the Gini coefficient, and the Lorenz curve, to analyze the income or wealth distribution inequality in sub-Saharan Africa, especially in South Africa. The Lorenz curve is a cumulative income distribution graph, where the horizontal axis represents the cumulative percentage of the population, and the vertical axis represents the percentage of income that this part of the population accounts for in the total income. If the income distribution is completely equal, then the Lorenz curve is a straight line with a slope of 1; if the income distribution is completely unequal, then the Lorenz curve is a broken line composed of a horizontal line and a vertical line. In reality, the Lorenz curve is usually a curve convex to the horizontal axis, and its degree of curvature reflects the degree of income distribution inequality [17]. Next, we calculate the Gini coefficient to quantify the degree of income distribution inequality. The Gini coefficient is an index between 0 and 1, where the larger it is, the more unequal the income distribution is. The Gini coefficient can be obtained by calculating the ratio of the area under the Lorenz curve to the total area [18].

Using Python to draw and calculate the Lorenz curve and Gini coefficient of sub-Saharan Africa and South Africa in 2019, as shown in Figure 4, the relevant data comes from the World Bank [7].

Figure 4: Lorenz curves for sub-Saharan Africa and South Africa [17]

Figure 4 shows that income distribution inequality in these regions is very high. South Africa's Lorenz curve is far from the straight line of complete equality and close to the broken line of complete inequality, which means that South Africa's income is concentrated in the hands of a few people while most people are in poverty. The calculation results show that the Gini coefficient of sub-Saharan Africa is 0.44, and that of South Africa is 0.63, one of the world's highest. The export volume of sub-Saharan Africa, especially South Africa, has increased significantly, but the income situation has yet to improve significantly. A possible explanation is that the fruits of economic growth have not been evenly distributed. In other words, even if trade reforms help to increase national wealth and reduce income inequality between countries, they also accompany some local income distribution polarization. The income of the top layer increases rapidly, while that of the bottom layer stagnates. Low-income people may not get corresponding benefits, resulting in a significant increase in domestic income inequality.

4.3. Spatial spillover model

Next, this article uses the spillover effect model to analyze the phenomenon of international trade and income distribution inequality in sub-Saharan Africa. The spillover effect model is used to analyze a country's economic activity's positive or negative impact on other countries or regions [19]. For example, a country’s export growth may increase its income level, thereby increasing its import demand for other countries, which is a positive spillover effect. Conversely, a country’s import growth may reduce its export demand for other countries, which is a negative spillover effect.

First, it calculates the spillover effect coefficient between the region and its main trading partners. The spillover effect coefficient refers to the proportion of income change of a country or region that causes income change of its main trading partners. According to the spillover effect model, the spillover effect coefficient can be calculated by the following formula:

\( {β_{ij}}=\frac{{X_{ij}}{Y_{i}}}{{∈_{Xj}}}+\frac{{M_{ij}}{Y_{i}}}{{∈_{Mj}}} \)

Where, \( {β_{ij}} \) represents the spillover effect coefficient of \( i \) country or region on \( j \) country or region, \( {X_{ij}} \) represents the export value of \( i \) country or region to \( j \) country or region, \( {M_{ij}} \) represents the import value of \( i \) country or region from \( j \) country or region, \( {Y_{i}} \) represents the income level of \( i \) country or region, \( {∈_{Xj}} \) represents the export elasticity of \( j \) country or region, and \( {∈_{Mj}} \) represents the import elasticity of \( j \) country or region.

Next, determine the main trading partners and trade structure of the region. According to the data from the World Bank, sub-Saharan Africa’s total merchandise trade in 2019 was 654.7 billion US dollars, of which exports were 360.4 billion US dollars and imports were 294.3 billion US dollars [7]. The region’s largest trading partner is the European Union (accounting for 23.5% of total trade), followed by China (accounting for 15.4%), the United States (accounting for 7.4%), India (accounting for 6.7%) and Japan (accounting for 3.8%). The region mainly exports bulk commodities such as fuels, minerals and metals, and mainly imports manufactured products such as machinery, transport equipment, chemicals and food. In addition, we need to estimate the trade elasticity between the region and its main trading partners. Trade elasticity refers to the degree of reaction of a country or region’s import and export demand to its income level or relative price changes. Generally speaking, the higher the trade elasticity, the more sensitive trade is to economic fluctuations, and the more significant the spillover effect is. According to a study, sub-Saharan Africa’s average export elasticity with the European Union, China, the United States, India and Japan are 0.95, 1.04, 0.87, 0.91 and 0.89 respectively, and average import elasticity are 1.14, 1.19, 1.11, 1.16 and 1.13 respectively [8]. According to data from the World Bank and United Nations, sub-Saharan Africa’s income level (calculated by GDP) in 2019 was 1647 billion US dollars.

Based on these data and formulas above, we can calculate that sub-Saharan Africa’s spillover effect coefficients on European Union, China, United States, India and Japan are 0.14, 0.10, 0.05, 0.04 and 0.02 respectively, and these countries or regions’ spillover effect coefficients on sub-Saharan Africa are 0.02, 0.03, 0.01, 0.01 and 0.01 respectively.

Next, we analyze the impact of the significant increase in the scale of international trade on income distribution inequality in the region. According to the spillover effect model, the income change of a country or region can be expressed by the following formula:

\( ∆{Y_{i}}={α_{i}}∆{Y_{i}}+\sum _{j≠i}{β_{ij}}∆{Y_{j}} \)

Where, \( ∆{Y_{i}} \) represents the income change of \( i \) country or region, \( {α_{i}} \) represents the own-income elasticity of \( i \) country or region, \( {β_{ij}} \) represents the spillover effect coefficient of \( i \) country or region on \( j \) country or region, and \( ∆{Y_{j}} \) represents the income change of \( j \) country or region.

Assuming that sub-Saharan Africa’s own-income elasticity is 1, that is, its income change is equal to its economic growth rate. According to the World Bank’s forecast, sub-Saharan Africa’s economic growth rate in 2021 is 3.4%, European Union is 4.2%, China is 8.1%, United States is 6.8%, India is 10.1%, and Japan is 3.3%. Using the above formula, we can calculate that sub-Saharan Africa’s income change in 2021 is 3.7%, of which 3.4% comes from its own economic growth, and 0.3% comes from its main trading partners’ economic growth. It can be seen that sub-Saharan Africa’s trade scale growth has a small contribution to income growth, so even if trade scale has a large increase, income change is not large [7].

4.4. Summary

According to the above model analysis, the increase in international trade scale promotes sub-Saharan Africa’s economic growth and improves the modern sector's productivity and wage level. However, at the same time, it also widens the wage gap between sectors, aggravating income distribution inequality. International trade may have reduced income inequality between sub-Saharan African countries and other countries worldwide. However, it may have also contributed to the increase of income inequality within each country or region in sub-Saharan Africa. Of course, the impact of international trade scale increase on poverty and inequality issues is complex, with both positive and negative effects, and there are significant differences among countries. This article only analyzes some simple economic models, especially regarding income.

5. Trade barriers

When discussing the impact of international trade on poverty in Africa, we cannot ignore the vital role played by political reasons. While international trade theory suggests that free trade should be able to promote economic growth and reduce poverty, on the African continent, political factors have become major trade barriers preventing it from reaping the benefits of trade.

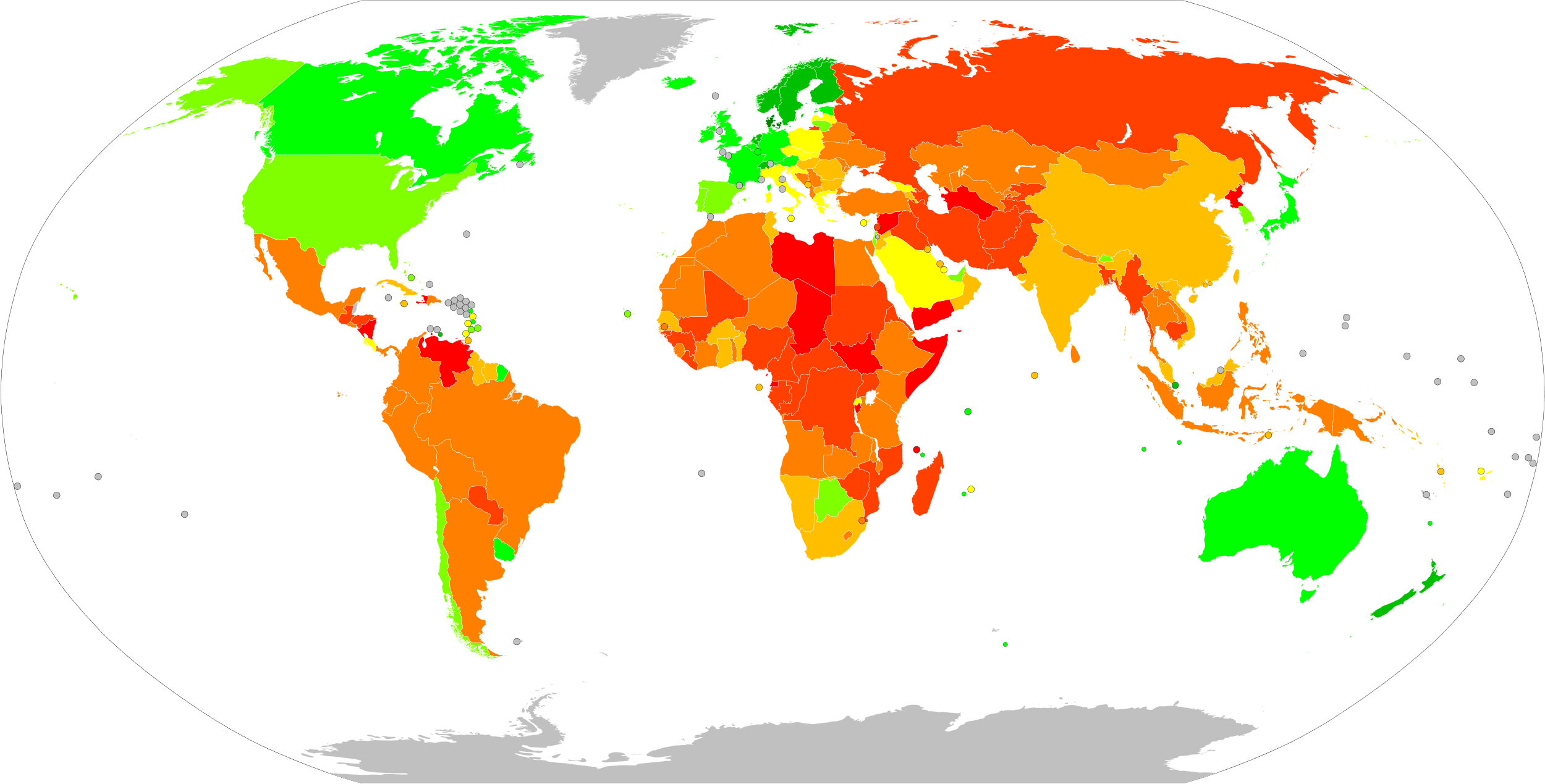

The Corruption Perceptions Index (CPI) was established in 1995 as a composite indicator used to measure perceptions of corruption in the public sector in different countries worldwide [20].

>89 80-89 70-79 60-69 50-59 40-49 30-39 20-29 10-19 <10

Figure 5: Corruption Perceptions Index Conner Miner 2022 [21]

Figure 5 shows that an unstable political environment and corruption are prevalent in Africa. Government corruption, opaque administrative procedures, and weak law enforcement all pose significant obstacles to business activity [22].

Lack of investor confidence in the investment climate and officials' abuse of power and resources make it difficult for African countries to attract foreign investment and establish a healthy business environment. This political corruption undermines the potential of international trade to reduce poverty. Corruption does not just reduce foreign direct investment; it also affects domestic imports and exports. For example, African ports have lost much money due to corrupt port officials, inefficiencies, and poor infrastructure. Corruption affects economic growth and slows the clearance and transshipment of goods. Customs officials extend the time a ship stays in port by requiring ships to present all necessary clearances from standards agencies such as the FDA (Food and Drug Administration) or the EPA (Environmental Protection Agency). However, once cargo ship shipment arrives at the port, the vessel has four days to clear customs. Over four days, a fee of $100 per day will be charged, which will be added to the total import duty [23].

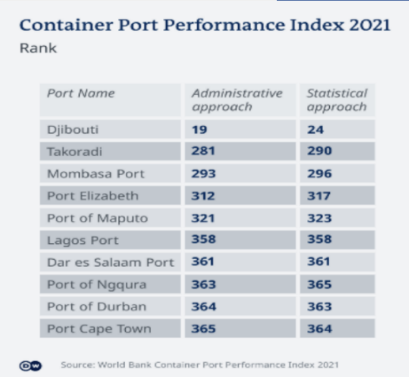

Figure 6: Container Port Performance Index word bank 2021[7]

According to the World Bank's 2021 Container Port Performance Index (CPPI), South African ports are operating inefficiently (Figure 6). The index assesses the performance of global ports and shows Durban, Cape Town, and Ngqura (ports in Africa) in the bottom 10 out of 370 ports worldwide. This phenomenon is undoubtedly a restriction on trade [7].

High tariffs, non-tariff barriers, and unfair trade agreements limit African countries' competitiveness in global markets. This unequal treatment makes it difficult for African products to enter developed markets and limits the integration of African economies into global value chains. In addition, some multinational companies dominate the African market and control critical industries and resources, which significantly limits the development of local enterprises. The emergence of local competition behind a tariff wall often prompts foreign firms to make direct investments [24].

Therefore, addressing these political issues is critical to enhancing African countries' benefits from international trade. Addressing these trade barriers will require government measures to improve economic diversification, promote local enterprise development, enhance technological innovation capabilities, strengthen social stability, and improve the investment climate. In addition, international cooperation and assistance can support African countries in overcoming trade barriers and achieving sustainable developments.

6. Conclusion

In summary, the outcomes derived from our study align with contemporary scholarly discourse that highlights the challenges arising from elevated tariffs, non-tariff impediments, and inequitable trade pacts. These issues collectively hinder the entry of African goods into advanced markets and curtail the incorporation of African economies within the broader global value networks. Additionally, while trade and growth within the primary sector have brought certain advantages to Africa, its impact on elevating the incomes of the less privileged segments has remained limited.

To this end, the study recommends that improving inequality in Africa requires comprehensive and targeted policy interventions that address the root causes of disparity and promote inclusive growth, some policy implementations are suggested:

Africa can strengthen their regional cooperation and promote trade integration, including implementation of the African Continental Free Trade Area. Intra-African trade can open up new market opportunities and contribute to inclusive economic growth. In addition, progressive tax systems can be established which can place a higher burden on higher-income individuals and corporations. The additional revenue generated can be used to fund social services, infrastructure projects, and targeted initiatives to uplift marginalized communities.

References

[1]. Westover, J.(2008). The Record of Microfinance: The effectiveness/Ineffectiveness of Microfinance programs as a means of Alleviating Poverty. Electronic Journal of Sociology.

[2]. Koffi, S. L. Y., Gahé, Z. S. Y., & Ping, Z. X. (2018). Globalization effects on Sub-Saharan Africa: The impact of international trade on poverty and inequality. International Journal of Innovation and Economic Development, 4(3), 41-48.

[3]. Addae-Korankye, A. (2014). Causes of poverty in Africa: A review of literature. American International Journal of Social Science, 3(7), 147-153.

[4]. Balogun, E. D. (1999). Analyzing poverty: Concept and methods. Central Bank of Nigeria Bullion 23(4), 11-16.

[5]. World Bank (2005a) African Development Indicators 2005. New York :Oxford University Press

[6]. World Bank (2005b) World Development Indicators 2005. New York :Oxford University Press.

[7]. World Bank. DataBank. Available at: https://data.worldbank.org/country

[8]. Le Goff, M., & Singh, R. J. (2013). Can trade reduce poverty in Africa

[9]. Krueger, A., 1983. Trade and employment in developing countries. Synthesis and Conclusions, vol. 3. NBER, New York.

[10]. Dollar, D., & Kraay, A. (2004) Trade, growth and poverty. The Economic Journal, 114(493), 22-49.

[11]. Le Goff, M., & Singh, R. J. (2014). Does trade reduce poverty? A view from Africa. Journal of African Trade, 1(1), 5-14

[12]. Agénor, P.-R., 2004. Does globalization hurt the poor? IEEP 1 (1), 21–51.

[13]. McCulloch, N., Winters, L. A., & Cirera, X. (2001). Trade liberalization and poverty: A handbook. Department for International Development, United Kingdom.

[14]. Keynes, J. M. (1937). The general theory of employment. The quarterly journal of economics, 51(2), 209-223.

[15]. Bhagwati, J.(1958), Immiserizing growth: A geometrical note, Review of Economic Studies, 25(3), 201-205, DOI: 10.4236/ib.2010.23033.

[16]. World Inequality Database. Available at: https://wid.world/

[17]. Lorenz curve. (2023, May 6). In Wikipedia. https://en.wikipedia.org/wiki/Lorenz_curve

[18]. Gini coefficient. (2023, July 21). In Wikipedia. https://en.wikipedia.org/wiki/Gini_coefficient

[19]. N Atikah and S Rahardjo. Spatial spillover model: a moment method approach. Journal of Physics: Conference Series. DOI 10.1088/1742-6596/1872/1/012031

[20]. Donchev, D., & Ujhelyi, G. (2013). Online Appendix to “What Do Corruption Indices Measure?”.

[21]. WILL KENTON (2021) <Corruption Perceptions Index (CPI): Definition, Country Rankings>

[22]. Eelke de Jong (2010). <Does Corruption discourage international trade?>

[23]. Anazodo, U. C., Ng, J. J., Ehiogu, B., Obungoloch, J., Fatade, A., Mutsaerts, H. J., ... & Consortium for Advancement of MRI Education and Research in Africa (CAMERA). (2023). A framework for advancing sustainable magnetic resonance imaging access in Africa. NMR in Biomedicine, 36(3), e4846.

[24]. Dale Weigel (1974). <Multinational approaches to multinational corporations: Developing countries are pressing for changes.>

Cite this article

Shao,Q.;Guo,X.;Jiang,Z.;Ding,M.;Zhou,W. (2024). Why Has International Trade Not Significantly Improved Poverty in Africa. Advances in Economics, Management and Political Sciences,82,255-265.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Westover, J.(2008). The Record of Microfinance: The effectiveness/Ineffectiveness of Microfinance programs as a means of Alleviating Poverty. Electronic Journal of Sociology.

[2]. Koffi, S. L. Y., Gahé, Z. S. Y., & Ping, Z. X. (2018). Globalization effects on Sub-Saharan Africa: The impact of international trade on poverty and inequality. International Journal of Innovation and Economic Development, 4(3), 41-48.

[3]. Addae-Korankye, A. (2014). Causes of poverty in Africa: A review of literature. American International Journal of Social Science, 3(7), 147-153.

[4]. Balogun, E. D. (1999). Analyzing poverty: Concept and methods. Central Bank of Nigeria Bullion 23(4), 11-16.

[5]. World Bank (2005a) African Development Indicators 2005. New York :Oxford University Press

[6]. World Bank (2005b) World Development Indicators 2005. New York :Oxford University Press.

[7]. World Bank. DataBank. Available at: https://data.worldbank.org/country

[8]. Le Goff, M., & Singh, R. J. (2013). Can trade reduce poverty in Africa

[9]. Krueger, A., 1983. Trade and employment in developing countries. Synthesis and Conclusions, vol. 3. NBER, New York.

[10]. Dollar, D., & Kraay, A. (2004) Trade, growth and poverty. The Economic Journal, 114(493), 22-49.

[11]. Le Goff, M., & Singh, R. J. (2014). Does trade reduce poverty? A view from Africa. Journal of African Trade, 1(1), 5-14

[12]. Agénor, P.-R., 2004. Does globalization hurt the poor? IEEP 1 (1), 21–51.

[13]. McCulloch, N., Winters, L. A., & Cirera, X. (2001). Trade liberalization and poverty: A handbook. Department for International Development, United Kingdom.

[14]. Keynes, J. M. (1937). The general theory of employment. The quarterly journal of economics, 51(2), 209-223.

[15]. Bhagwati, J.(1958), Immiserizing growth: A geometrical note, Review of Economic Studies, 25(3), 201-205, DOI: 10.4236/ib.2010.23033.

[16]. World Inequality Database. Available at: https://wid.world/

[17]. Lorenz curve. (2023, May 6). In Wikipedia. https://en.wikipedia.org/wiki/Lorenz_curve

[18]. Gini coefficient. (2023, July 21). In Wikipedia. https://en.wikipedia.org/wiki/Gini_coefficient

[19]. N Atikah and S Rahardjo. Spatial spillover model: a moment method approach. Journal of Physics: Conference Series. DOI 10.1088/1742-6596/1872/1/012031

[20]. Donchev, D., & Ujhelyi, G. (2013). Online Appendix to “What Do Corruption Indices Measure?”.

[21]. WILL KENTON (2021) <Corruption Perceptions Index (CPI): Definition, Country Rankings>

[22]. Eelke de Jong (2010). <Does Corruption discourage international trade?>

[23]. Anazodo, U. C., Ng, J. J., Ehiogu, B., Obungoloch, J., Fatade, A., Mutsaerts, H. J., ... & Consortium for Advancement of MRI Education and Research in Africa (CAMERA). (2023). A framework for advancing sustainable magnetic resonance imaging access in Africa. NMR in Biomedicine, 36(3), e4846.

[24]. Dale Weigel (1974). <Multinational approaches to multinational corporations: Developing countries are pressing for changes.>