1. INTRODUCTION

At the end of the 19th century, digital information technology developed rapidly, and humanity gradually stepped into the digital era, in which digital technology is the rule of operation. In the digital age, digital technology is widely used in various fields such as science and technology, life, economy, and society. It has improved the operational efficiency of the whole society.

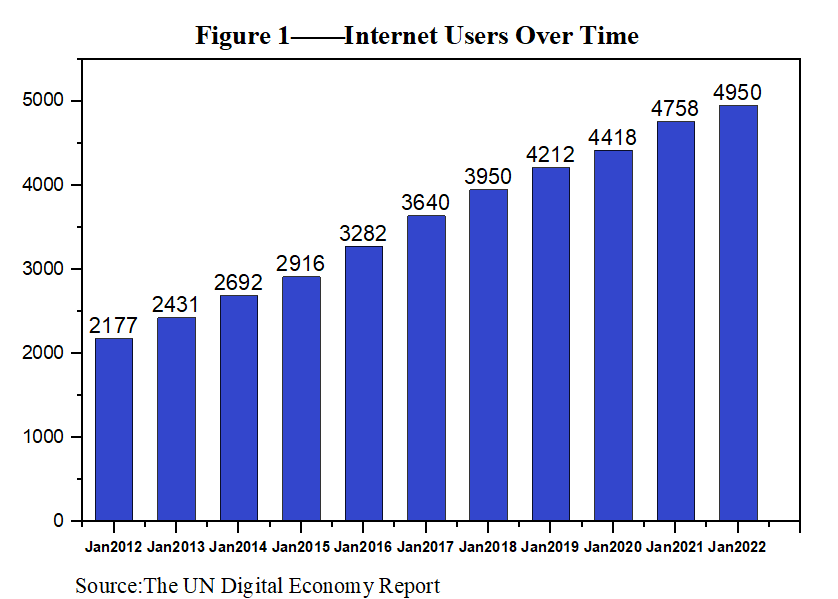

According to a white paper on the global digital economy, in terms of scale, the U.S. digital economy reigns as the world's first in 2021, with a scale of $15.3 trillion, with China in second place, with a scale of $7.1 trillion. Dollars; again, Japan, Germany, and the United Kingdom[1]. The UN Digital Economy Report further shows that most of the digital economy is concentrated in China and the United States, with 75% of patents related to blockchain, 50% of global investment in the IoT industry, 75% of the cloud computing market, and 90% of the most prominent digital economy platforms located in China and the United States[2]. Figure 1 illustrates that from 2.18 billion at the beginning of 2012 to 4.95 billion by 2022, Internet users have more than doubled in the last 10 years[2].

Figure 1: Internet Users Over Time.

The changes in the digital age have disrupted people's lifestyles, accompanied by a change in demand, which continues to drive the digital age forward. This article summarises previous literature in two directions as shown in Table 1 and Table 2.

Table 1: The history and status of the digital economy, for instance.

Title | Summary |

The evolution of the global digital platform economy: 1971–2021 | Acs et al. provide a comprehensive overview of the evolution of the global digital platform economy over the past 50 years, highlighting the opportunities and challenges this rapidly evolving sector presents[3]. |

Model of a Prospective Digital Platform to Consolidate the Resources of Economic Activity in the Digital Economy | Zatsarinnyy and Shabanov focus on the platform’s role as a mediator between the supply and demand sides of the market and a facilitator of cooperation and coordination among the participants[4]. The article also discusses the potential benefits of the platform for improving the quality, reliability, and security of economic transactions, as well as for stimulating innovation and development in the digital economy. |

Table 2: Important factors and typical cases of monopoly, for instance.

Title | Summary |

Second-degree Price Discrimination by a Two-sided Monopoly Platform | Jeon et al. analyse how the optimal pricing scheme depends on the degree of heterogeneity, the elasticity of participation, and the strength of network effects on each side of the market[5]. |

Google, Facebook, Amazon, eBay: Is the Internet driving competition or market monopolisation? | Haucap and Heimeshoff explore the competitive dynamics and market structures of three online markets: search engines, online auction platforms, and social networks. The article examines the sources of market power, the barriers to entry, the potential for competition in these markets, and the implications for competition policy[6]. |

Subsequently, the article discusses the importance and necessity of antitrust. Existing literature rarely combines antitrust cases and regulations with the monopolisation of digital platforms, so this paper's Part II (Anti-Monopoly Case and Regulations) highlights antitrust cases and national regulations.

Firstly, the section "Digital Platform and Monopoly" explores four critical factors that may lead to the emergence of monopolies in the digital economy, using Alibaba and Amazon as typical examples. Then, anti-monopoly will be elaborated further in Part II. Finally, the conclusion and future prediction of the digital platform economy will be discussed in the last section.

2. Digital Platform and Monopoly

In recent years, types of digital platforms, such as business digital platforms and embedded system intelligent platforms, have continued to evolve and have impacted various industries. For instance, according to Digital Experience Platform Market Size & Share Report, the digital experience platform (DXP) market size was valued at USD 11,541.75 million in 2021 and is projected to reach USD 35,293.23 million by 2030[7]. Therefore, the market size of digital platforms is expected to grow at a significant rate in the coming years.

However, even though the digital economy is proliferating in terms of overall market size, its unique mechanisms can likely lead to internal problems: monopolies. There might be some possible reasons for causing monopolies:

Network effects: In the industry of digital platform economy, network effects probably affect the size of these individual platforms. As Li et al. mentioned, the number of sellers and buyers a platform can attract, and the interaction between these groups are essential factors that can significantly influence the platform's success[8]. One example is the direct solid network effect that people usually want to use the digital platform or social media that most people use, possibly leading to many users progressively choosing the same platform. In addition, attraction spirals are also an understanding of positive direct network effects, which imply that a platform can benefit from a rise in its activity, reflecting that it is more attractive to users from other platforms[9].

Winner-Take-All Dynamics (WTA): attraction loops, which define users tend to follow the actions of other users and act. The attraction loops can sometimes lead to a winner-take-all dynamic, where a single platform dominates the market. As that platform attracts more users, it will gain a more significant market share, making it difficult for competitors to catch up. As Janansefat pointed out, platforms with a solid user base and foundation are more likely to gain a strategic competitive advantage due to network effects[10].

Economies of scale: Another critical factor is that large digital platforms achieve economies of scale that reduce the marginal cost of their products or services, ultimately leading to lower selling prices, increased competitiveness, and, eventually, a higher monopoly.

Convenience and Accessibility: Popular digital platforms often offer a wide range of features, services, and content due to their large user base. This makes them more convenient and accessible for users, as they can find everything they need in one place[11]. Thus, smaller platforms may struggle to provide the same level of convenience and variety, making it less appealing for users to switch. As a result, increased user dependence on the larger platforms will reduce the source of new customers for other platforms, eventually leading to a monopoly.

The following two examples of Amazon and Alibaba will be analysed to increase our understanding of digital platforms’ monopolies.

First and foremost, Alibaba Group had put forward the " Either-or" requirement, which prohibits the platform merchants from opening shops or participating in promotional activities on other competitive platforms, such as JD.com, for the merchants on its platform. Meanwhile, with the help of its market share and other means, Alibaba has taken many measures to enforce this requirement, maintain and strengthen its position in the market and gain competitive benefits through this unfair way. As the Procuratorate Daily mentioned, Alibaba's behaviour had restricted the free competition of retail service platforms, hindered the circulation of goods, affected the legitimate rights of merchants, and to some extent, harmed the rights and interests of consumers[12].

In addition, Amazon's monopoly approach is also a prime example of a trickle-down monopoly as Weigel pointed out that a group of hidden middlemen, 3P sellers, who are Amazon's third-party selling option that allows businesses to sell their products on Amazon's marketplace through seller central, have contributed a lot to making Amazon great[13]. Amazon had gained global retail clouts by motivating and limiting their agents rather than removing them from the market. Thus, many small businesses grow in Amazon's image through this approach.

Moreover, Alibaba launched Taobao (its online retail platform) in 2003, while Amazon was founded in 1995 when it was in the early stages of internet development and e-commerce was not widespread. Hence, the industry was not yet mature. Both platforms entered the market during that time. Taobao surpassed eBay and Yahoo in 2005 to become Asia's largest shopping site, surpassing Walmart’s turnover that year. While Amazon was one of the first companies to start e-commerce on its website, it became an online retailer with the most goods bottles worldwide and the second largest worldwide internet company. However, according to Jin and Yuxin, who have discussed the relationship between early market entrants and platform monopoly, the technical features of the platform economy allow early market entrants to grab a significant market share, which also makes it more difficult for later merchants to compete for it[14]. The rationale behind this is that due to the platform's network effect, to be more specific, as more people enter the market, the platform's value will also increase. Thus, early market entrants will gain a breakthrough advantage.

Furthermore, Google ads use computer technology algorithms to control prices and achieve a price monopoly. For instance, one of Google's algorithms is called Product Bernanke, which improves its advertiser's win rate on Google's ad trading platform, AdX, which helps advertisers to win the auction process in favour of its customers, and with the constant changes in the auctions could lead to unfair competition and reduce the revenue of publishers who sell advertising resources on the AdX platform. Nonetheless, the publishers were unaware that Google was dropping the second-highest bids and was misleading publishers and advertisers about the auction execution. This behaviour led to a significant reduction in the revenue that the publishers got their hands on. Besides, the entire program was roughly a second-price auction format, precisely, with the highest auction winner paying the second-highest bid price. But in fact, Google used a third-price auction, meaning that the highest-price winner wins, and Google pretends that the second bid does not exist and falls back on the third price. Therefore, Google kept the difference between that and used it to raise bids in other auctions to ensure that it could beat out competing platforms. Having achieved a monopoly, the platform will "kill" users by price discrimination. This strategy charges customers different prices for the same products or services based on what the seller thinks they can get the customer to agree to, which may also result in losing loyal users.

The above are some classic cases. However, many other possibilities, such as virtuous cycles, are also caused by attraction loops. Another example is that as the adequate size of firms increases, the number of firms in the market decreases.

In summary, the natural dependence of the user base on platforms that are large-scale or enter market-making will ultimately prevent some platforms from gaining a fair share of the market, which means that monopolies will emerge sooner or later and force some firms to exit the market or merge with those winner-take-all platforms, etc.

3. Anti-Monopoly Case and Regulations

3.1. Case Study

With the rise of digital platforms, anti-monopoly policies targeting their monopolistic behaviour have become a hot topic worldwide. In the past few years, some countries and regions have successfully taken proactive measures to address digital platforms' monopolistic behaviour.

3.1.1. Case 1: EU's Anti-Monopoly Investigation into Google

The EU's antitrust investigation into Google is one of the most famous cases in recent years. The European Union believes that Google has abused its monopoly in the search engine market by placing its products prominently in search results and squeezing out competitors. The European Union ultimately imposed a significant fine on Google and demanded that it change how its products are displayed in search results.

There are two reasons for a successful case:

Active involvement of government agencies: The European Commission took a positive stance in the investigation and resolutely demonstrated its determination to combat monopolistic behaviour[15]. The active involvement of government agencies is an essential factor in successful cases.

Strengthening market regulatory power: Through the investigation and fine of Google, the EU has sent a clear signal to other digital platforms that monopolistic behaviour will be severely punished. This strengthened market regulatory force has been essential to the case’s success.

3.1.2. Case 2: Legal Litigation Against Amazon in the United States

Another successful case is the US legal lawsuit against Amazon. The United States believes that Amazon, through its dominant position in online retail, has abused its market influence and imposed unfair treatment on third-party sellers[16]. In the end, the US government reached a settlement agreement with Amazon, demanding that Amazon improve the treatment of third-party sellers and engage in more transparent and fair competition. There are some reasons for the successful case:

Willingness to cooperate: The US government and Amazon have demonstrated a willingness to cooperate to solve the problem. Through dialogue and negotiation, both parties have reached a beneficial agreement, further improving the competitive environment in the digital platform market.

Public attention: Amazon's abuse of power has attracted widespread public attention, prompting the government to act. Public opinion played a crucial role in the success of the case.

These two successful cases provide valuable lessons and are significant for understanding digital platform antitrust policies' effectiveness and critical elements. The active intervention of government agencies and the strengthening of market regulatory forces are essential factors in successful cases. At the same time, willingness to cooperate and public attention also play a crucial role. The experience of these successful cases can provide a reference for other countries and regions when facing monopolistic behaviour on digital platforms, promoting fair competition and protecting consumer rights.

3.2. Regulation of Monopoly

At the same time, various countries and regions have made adjustments to their market rules in response to monopolistic behaviour. For example, the European Union intervened in the monopoly phenomenon through legislation: These EU antitrust regulations aim to protect market competition, prevent monopolies from forming in the market, and promote innovation and consumer welfare[17]. The European Commission is responsible for implementing these regulations and imposing penalties and sanctions on companies and actors that violate them to ensure healthy competition and fair operation in the European market.

4. Conclusion

This paper is a review of the literature related to digital platforms and the economics of monopoly. The first part summarises and categorises four causes of monopoly in the context of the digital economy. The formation of monopolies on Internet platforms and their consequences, i.e., unfair competition, are illustrated through a detailed analysis of the cases of Amazon, Alibaba, and Google. The second part of the paper describes some of the proactive measures countries took to address antitrust issues, particularly the antitrust investigations of Google in Europe and the United States and the legal proceedings against Amazon in the United States. The paper shows that the active intervention of government agencies and the strengthening of market surveillance powers are essential factors for success. Finally, monopolisation has also become a public concern during the development of the Internet platform economy. The literature review in this paper provides readers with helpful help in understanding the causes of monopoly in the Internet platform economy and the measures countries take to address the monopoly problem.

Primarily, the principal purpose of digital platform antitrust is to reduce the monopolistic behaviour of digital platforms and maintain market order. In future antitrust actions, government platforms can supervise the signing of antitrust agreements between platforms and other behaviours by enacting laws, regulations, or other effective measures. These measures will protect the healthy competition in the digital flat market, safeguard the rights and interests of consumers, and enable the digital platform economy to form a virtuous cycle in the development process, leading to the sustainable and stable development of the national economy.

References

[1]. China Academy of Information and Communication Research, (2022) White Paper on the Global Digital Economy. http://www.caict.ac.cn/kxyj/qwfb/bps/202212/P020221207397428021671.pdf.

[2]. UNCTAD, (2021) Digital Economy Report 2021 | UNCTA. https://unctad.org/system/files/official-document/der2021_en.pdf.

[3]. Acs, Z., Song, A., Szerb, L., Audretsch, D. and Komlosi, E. (2021) The evolution of the global digital platform economy: 1971–2021. Small Bus. Econ.,57:1–31.

[4]. Zatsarinnyy, A. A. and Shabanov, A. P. (2019) Model of a Prospective Digital Platform to Consolidate the Resources of Economic Activity in the Digital Economy. Procedia Comput. Sci.,150: 552–557.

[5]. Jeon, D.-S., Kim, B.-C. and Menicucci, D. (2020) Second-Degree Price Discrimination by a Two-Sided Monopoly Platform Am. Econ. J. Microecon., 14(2):322–369.

[6]. Haucap, J. and Heimeshoff, U.(2013) Google, Facebook, Amazon, eBay: Is the Internet driving competition or market monopolization? DICE Discussion Paper, Working Paper, 83:1-17.

[7]. Grand View Research, (2021) Digital Experience Platform Market Size, Share & Trends Analysis Report, https://www.grandviewresearch.com/industry-analysis/digital-experience-platform-market.

[8]. Li, S., Liu, Y. and Bandyopadhyay, S. (2010) Network effects in online two-sided market platforms: A research note. Decis. Support Syst., 49(2): 245–249.

[9]. Belleflamme, P. and Peitz, M. (2021) The Economics of Platforms: Concepts and Strategy. Cambridge University Press, Cambridge.

[10]. Janansefat, S. (2018) THREE ESSAYS ON COMPETITIVE STRATEGIES FOR DIGITAL PLATFORM BUSINESSES. https://www.semanticscholar.org/paper/THREE-ESSAYS-ON-COMPETITIVE-STRATEGIES-FOR-DIGITAL-Janansefat/8ff867219195bbce9b09c7fcddd8069a8f35923b.

[11]. Gawer, A. (2021) Digital platforms and ecosystems: remarks on the dominant organizational forms of the digital age. INNOVATION: ORGANIZATION & MANAGEMENT, 24:1–15.

[12]. Procuratorate Daily. (2021) Ali fined $18.2 billion, Internet platform antitrust breakthroughs. https://www.spp.gov.cn/spp/zdgz/202104/t20210419_516009.shtml.

[13]. Weigel, M. (2023) Amazon’s Trickle-Down Monopoly: Third-Party Sellers and the Transformation of Small Business. SSRN Electronic Journal.1-47.

[14]. Jin, Z. and Yuxin, Y. (2021) The Monopoly and Governance of the Platform Economy in the Digital Era. Contemporary Social Sciences,2021(3): 77-88.

[15]. Mandrescu, D. (2018) Applying (EU) competition law to online platforms: Reflections on the definition of the relevant market(s). World Competition: Law and Economics Review, 41(3):1-24.

[16]. Khan, L. M. (2017) Amazon’s antitrust paradox. Yale Law J, 26: 710–805.

[17]. EPRSauthor, (2014) EU competition policy: key to a fair Single Market. https://epthinktank.eu/2014/06/09/eu-competition-policy-key-to-a-fair-single-market/.

Cite this article

Jiang,Q.;Chen,Y.;Han,C.;Lin,E. (2024). Platform Economy in the Digital Age: A Literature Review of Digital Platform and Monopoly. Advances in Economics, Management and Political Sciences,92,316-322.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. China Academy of Information and Communication Research, (2022) White Paper on the Global Digital Economy. http://www.caict.ac.cn/kxyj/qwfb/bps/202212/P020221207397428021671.pdf.

[2]. UNCTAD, (2021) Digital Economy Report 2021 | UNCTA. https://unctad.org/system/files/official-document/der2021_en.pdf.

[3]. Acs, Z., Song, A., Szerb, L., Audretsch, D. and Komlosi, E. (2021) The evolution of the global digital platform economy: 1971–2021. Small Bus. Econ.,57:1–31.

[4]. Zatsarinnyy, A. A. and Shabanov, A. P. (2019) Model of a Prospective Digital Platform to Consolidate the Resources of Economic Activity in the Digital Economy. Procedia Comput. Sci.,150: 552–557.

[5]. Jeon, D.-S., Kim, B.-C. and Menicucci, D. (2020) Second-Degree Price Discrimination by a Two-Sided Monopoly Platform Am. Econ. J. Microecon., 14(2):322–369.

[6]. Haucap, J. and Heimeshoff, U.(2013) Google, Facebook, Amazon, eBay: Is the Internet driving competition or market monopolization? DICE Discussion Paper, Working Paper, 83:1-17.

[7]. Grand View Research, (2021) Digital Experience Platform Market Size, Share & Trends Analysis Report, https://www.grandviewresearch.com/industry-analysis/digital-experience-platform-market.

[8]. Li, S., Liu, Y. and Bandyopadhyay, S. (2010) Network effects in online two-sided market platforms: A research note. Decis. Support Syst., 49(2): 245–249.

[9]. Belleflamme, P. and Peitz, M. (2021) The Economics of Platforms: Concepts and Strategy. Cambridge University Press, Cambridge.

[10]. Janansefat, S. (2018) THREE ESSAYS ON COMPETITIVE STRATEGIES FOR DIGITAL PLATFORM BUSINESSES. https://www.semanticscholar.org/paper/THREE-ESSAYS-ON-COMPETITIVE-STRATEGIES-FOR-DIGITAL-Janansefat/8ff867219195bbce9b09c7fcddd8069a8f35923b.

[11]. Gawer, A. (2021) Digital platforms and ecosystems: remarks on the dominant organizational forms of the digital age. INNOVATION: ORGANIZATION & MANAGEMENT, 24:1–15.

[12]. Procuratorate Daily. (2021) Ali fined $18.2 billion, Internet platform antitrust breakthroughs. https://www.spp.gov.cn/spp/zdgz/202104/t20210419_516009.shtml.

[13]. Weigel, M. (2023) Amazon’s Trickle-Down Monopoly: Third-Party Sellers and the Transformation of Small Business. SSRN Electronic Journal.1-47.

[14]. Jin, Z. and Yuxin, Y. (2021) The Monopoly and Governance of the Platform Economy in the Digital Era. Contemporary Social Sciences,2021(3): 77-88.

[15]. Mandrescu, D. (2018) Applying (EU) competition law to online platforms: Reflections on the definition of the relevant market(s). World Competition: Law and Economics Review, 41(3):1-24.

[16]. Khan, L. M. (2017) Amazon’s antitrust paradox. Yale Law J, 26: 710–805.

[17]. EPRSauthor, (2014) EU competition policy: key to a fair Single Market. https://epthinktank.eu/2014/06/09/eu-competition-policy-key-to-a-fair-single-market/.