1. Introduction

Netflix is a subscription streaming media platform based in Los Gatu, California, United States. Founded in 1997, it was once an online DVD and Blu-ray rental provider that allowed users to rent and return physical discs of Netflix's vast inventory of movies via free Courier envelopes. Netflix has revolutionized the entertainment industry. With its extensive collection of movies and television shows available for streaming at a monthly subscription fee, Netflix has successfully capitalized on the digital revolution. The company's astute analysis of market trends and consumer preferences has helped establish it as a dominant player in the streaming market. The epidemic at the end of 2019 had a great impact on all walks of life around the world, with some companies facing bankruptcy, some companies making a lot of money because of the epidemic, and some companies actively seeking change and innovation. Overall, the COVID-19 pandemic has brought changes to many industries and companies, and Netflix is not an exception. This paper is to study the competition situation of Netflix before and after the epidemic era, including the change of data before and after the epidemic, relevant industry analysis and how to break the game. This paper includes market overview, analysis of Netflix ‘s business model, the competitor analysis and the future strategies.

2. Market Overview

2.1. Reviews of industry and market

Netflix operates in the entertainment industry, specifically the streaming media and video-on-demand sector. Entertainment is defined as an action that holds the attention of an audience and brings pleasure [1], Movies is one form of entertainment. Given the widespread of internet, video streaming platforms have become a part of people's lives. In the 21st century, individuals are confronted with various pressures in their daily lives. As a result, streaming media services have emerged as a popular means of relaxation and stress relief for many people. Consequently, the video streaming market is experiencing rapid expansion, especially during the period of COVID-19. During the epidemic, due to lockdowns and other restrictions of offline activities, people switched to a different mode of entertainment (i.e. from cinema to streaming platforms). Sihombing et al. (2022) observed a shift from conventional threatres to online platforms (e.g. Netflix) in Indonesia during epidemic [2]. Apart from Indonesia's situation, globally, there was a 72% decrease in the number of audience in public spaces since the epidemic (i.e. which was likely shift to private online mode), and this trend was expected to continue [3]. Therefore, the streaming market has burst into new vitality during epidemic.

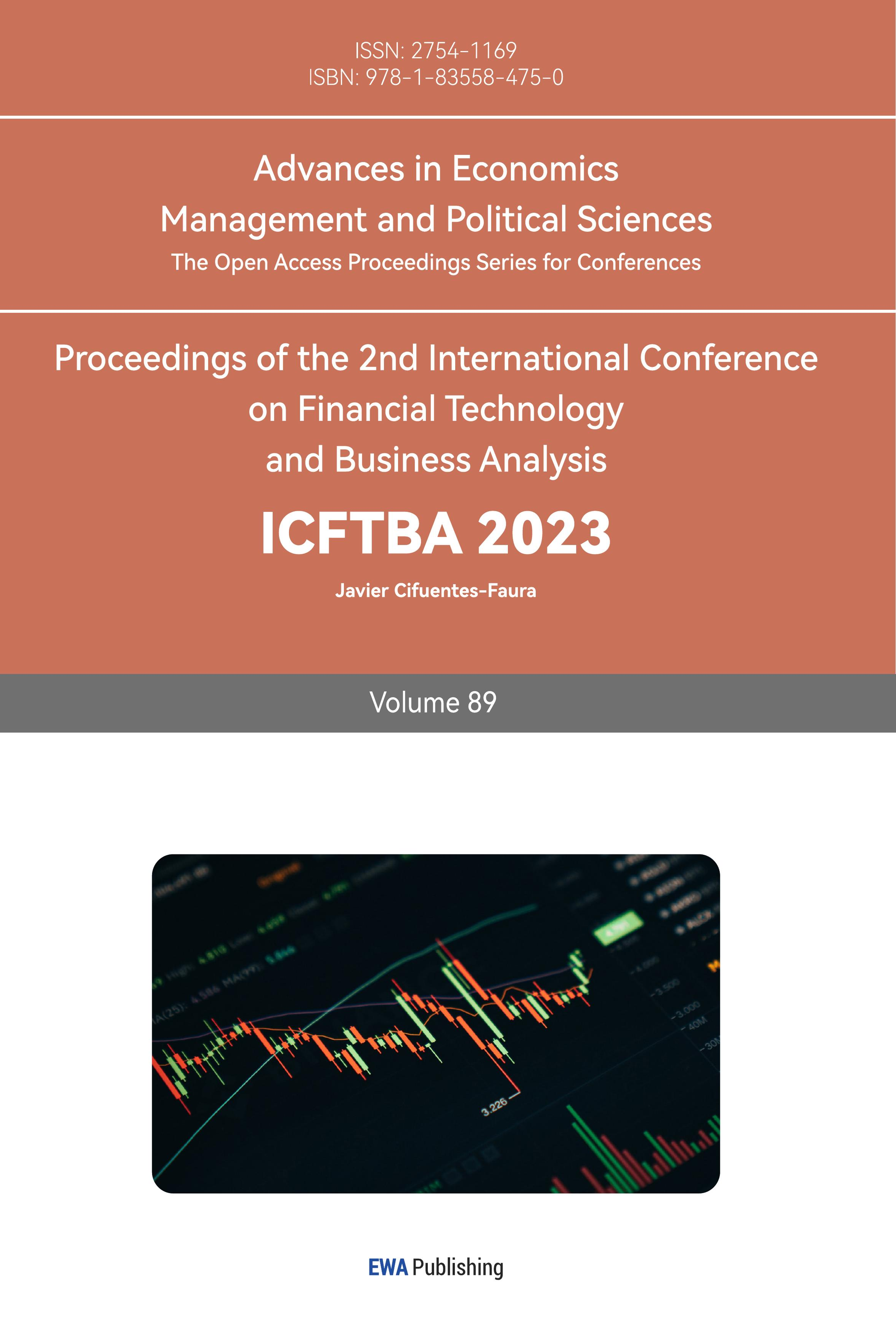

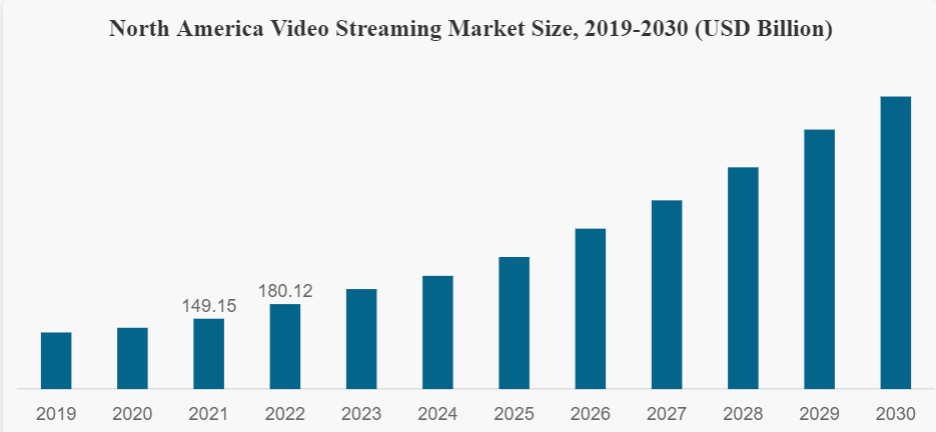

In addition, the video streaming market is rapidly expanding because of the innovation and marketing strategies. The video streaming market has witnessed notable advancements with the introduction of artificial intelligence (AI) and blockchain technology. An instance of this occurred in 2016 when Netflix leveraged AI technology to provide a "superior personalized" service to its subscribed customers. As one of Netflix's signature competitiveness, this key technology is getting better and better with every iteration. For years, the main goal of Netflix's personalized recommendation system has been to deliver the right movies to members at the right time. To achieve this goal, Netflix has truly integrated personalization into AI technology, through massive data collected from users, Netflix feeds into sophisticated machine learning models that analyze patterns and correlations to generate truly personalized recommendations [4]. By employing an AI-empowered system, Netflix successfully delivered customized recommendations for shows, films, and programs through the utilization of machine learning techniques. What’s more, the skyrocketing popularity of social media platforms provide chance for branding and marketing, which might stimulate a further market expansion. According to the report, the global video streaming market size was valued at USD 89.03 billion in 2022 [5]. Even after the end of the pandemic in 2023, the streaming market still has a strong expanding power, which was projected to experience a compound annual growth rate (CAGR) of 21.5% from 2023 to 2030 in the North America video streaming market, as shown in Figure 1. A similar growth tendency was predicted in the global video streaming market after 2023, as shown in Figure 2.

Figure 1: The Market Size of North America Video Streaming Industry. Resource: fortunebusinessinsights.com.

Figure 2: The Market Size of Global Video Steaming Industry (Unit in USD Billion). Resource: micro.medium.com.

2.2. Users on video streaming industry

With over 90 million members in more than 130 countries, Netflix has proven itself to be a leader in the global Internet TV industry [6]. As for the customer segmentation in the video streaming market, the customer preferences mainly differed in gender, age, and nationality. The data from Similarweb showed that more men than women used the streaming entertainment in 2021, of which 58% were man and 42% were women. In terms of age distribution, about 57% of the streaming entertainment users are under the age of 35. In addition, the largest user number of streaming services was clustered in the United States, which takes up 20.2%, five times more than that in Russia, Japan, Brazil, and the UK. Meanwhile, 70 percent of stream service users in the United States, including TV, movies, and streaming websites, are between the ages of 18 and 44 [7, 8].

3. Analysis of Business Model

3.1. The Overview of Business Strategies

3.1.1. Key Partners

Netflix main partners are distributed in hardware, software, and market cooperation, aiming to strengthen connection and development. Netflix already has about 35 partners in their business stream in 2023, to offer millions of types of options for subscribers, who can choose from a wide variety of content they want [9]. To deliver engaging and interesting content to customers, Netflix has secured partnerships with content production companies and studios.

About hardware, Netflix has successfully built relationships with smart TV companies such as SONY and LG, optimize hardware performance to accommodate Netflix's 4K and HDR support, ensuring continued technical collaboration and joint marketing, targets to exchange a higher market position and share for both parties.

At the same time, Netflix also takes a serious look at the gaming market, for console games to play. What 's more, Netflix has also managed to forge alliances with PlayStation, X-Box, and many others in the gaming industry [10]. It has established a partnership with the gaming industry to provide all gamers with meticulously modulated local viewing experience. ion, Netflix has also formed partnerships with telecommunication companies to expand streaming services through bundle sales. This advanced streaming platform successfully offers its services through more than a dozen different operators worldwide, many excellent service providers like AT&T and T-Mobile among them.

Netflix even announced a partnership with General Motors in which the automaker's electric vehicles will appear in new shows and TV series. More notably, Netflix has also entered a formal partnership with the Tourism Authority of Thailand (TAT) to promote tourism and culture in Thailand, and Bangkok will be the first featured destination in Netflix's new documentary series [11].

3.1.2. Key Activities

The activity system enables the firm, in concert with its partners, to create value and also to appropriate a share of that value [12]. Netflix focuses on its own global goals and diversified development, Netflix ‘s business segments are domestic streaming, international streaming and domestic DVD. It aims to provide the most appropriate content for users in different countries and cultures. The main activities of Netflix involve content acquisition, content creation, marketing, data analytics, technology development, and maintenance of its platform [10].

Netflix cares so much about the using experience that it employs software and technology geeks dedicated to providing customers with the best possible service. Netflix has been trying to expand and enrich its platform, so it has been improving its mobile app, website, and TV app. Besides, Netflix has developed a subscriber friendly subscription model and pricing strategy as well as great user recommendations to attract new customers and keep old ones happy. The principle of activity that Netflix follows has made it a huge success in the market.

3.1.3. Key Resources

One of Netflix's key resources is big data and efficient algorithms. Netflix uses selection preferences and AI-based algorithms to provide the best experience for users. It will also collect data from user searches to form a database, and more accurately recommend video content that customers may be interested in, thus forming an efficient circular chain from supply to demand and back to supply.

One key aspect of Netflix's business model is its focus on content creation and acquisition. By investing heavily in original programming, the company has been able to differentiate itself from its competitors and attract a loyal customer base. This strategy has paid off with critically acclaimed shows like Stranger Things and Narcos, which have garnered a dedicated following and increased subscriber number.

In addition, Netflix also invests billions of dollars annually in content creation, including original programming and content acquisition, which further enhances the user experience. From the Q1 earning report in 2021, Netflix disclosure a $17 billion investment on content [13].

3.1.4. Value Propositions

There are 9 traits it put into its Valued Behaviors part: Judgment, Selflessness, Courage, Communication, Inclusion, Integrity, Passion, Innovation and Curiosity [14]. They look for employees who can make wise decisions, be open to the boundless world with their curiosity and have sympathy to the society [15]. The value proposition specifies what is offered (the product or service) and at what price (the pricing model). It must be both sustainable for the firm and suitable to the market [16].

3.1.5. Customer Relationship

CRM is a tool and strategy for managing customers’ interaction using technology to automate business processes. CRM consists of sales, marketing, and customer service activities [17]. Customer relationship management is critical to a company because no one can make profits if you don’t have anyone to purchase your products. Netflix's algorithm-based recommendation system enhances the user experience by providing personalized content suggestions. By analyzing user behavior and viewing patterns, Netflix can offer curated content that aligns with individual preferences, keeping users engaged and increasing their satisfaction. This customization is a significant factor in Netflix's ability to retain customers and foster long-term relationships. Netflix has a massive library of TV shows and movies which can keep you are interested and hooked. It provides with customers with multiple choices [18].

Netflix does not use any third-party CRM software; but an in-house system to collect its customer data and information. It adopts IDIC model to better manage its customer relationship. IDIC stands for identification, differentiation, interaction, and customizations. In short, Netflix understands your needs, and once you create your account, Netflix begins to collect your personal preferences to recommend relevant content to you, and then achieve a differentiated effect by combining original content, exclusive programming, and user-friendly features, and then recommend content to you through its recommendation algorithm to achieve interactive results. It takes personalization to a whole new level with its customization capabilities.

Finally, Netflix also implemented the membership system, and achieved remarkable results. The member economy, which is further developed from the membership system, is an important cornerstone business model. The core of the membership economy is to focus on continuous, cohesive relationships rather than one-time sales; to help businesses build user loyalty and ultimately breakthrough growth by leasing or providing access rather than just 'ownership'. This unique subscription approach makes it easier for subscribers to choose the subscription plan that best suits their needs, giving subscribers a comfortable consumer experience.

3.1.6. Channels

Netflix's primary channel is its online streaming platform, which can be accessed through smart TVS, game consoles, computers, tablets, and smartphones. Netflix has a variety of channels through which subscribers can subscribe. For example, users can use Netflix's software or website. Besides, people can use streaming on TV apps and gaming consoles and mail delivery for DVDs [9].

3.2. Cost Structure

3.2.1. Cost of content

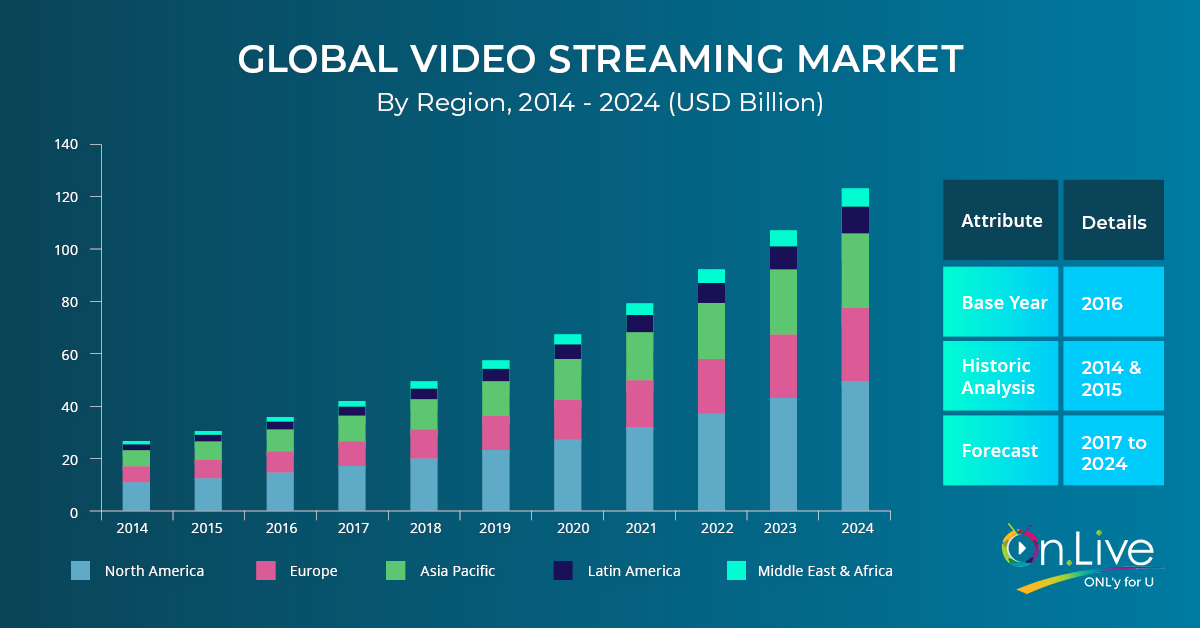

With more than 250 million combined subscribers, Netflix and Amazon are major new players in the global mediascape. In 2017, Netflix spent $7 billion and $4.5 billion on video content [19]. Netflix invests heavily in purchasing and producing original content, including television shows, movies, documentaries, and other programming. This includes the cost of licensing third-party content and the cost of producing its own original content. As shown in Figure 3, the annual cash spent on original content was increasing every year from 2012 to 2020, which means Netflix was caring more and more about the original content.

3.2.2. Technology and Development

Netflix incurs costs associated with the development, enhancement, and maintenance of its streaming platform, including costs associated with software development, infrastructure, and cloud computing services.

3.2.3. Marketing and Advertising

Netflix spends a significant portion of its budget on marketing and advertising campaigns to promote its content and attract new subscribers. This includes digital marketing campaigns, partnerships, and advertising placements.

3.2.4. Administrative and general costs

These costs include various administrative functions such as executive salaries, employee benefits, legal fees, and other general operating expenses.

3.2.5. Customer Acquisition

Netflix invests in customer acquisition activities, including free trial offers, promotions, and customer support services, designed to attract new subscribers and retain existing subscribers. Content licenses are for a fixed fee and a specific availability window. Certain content licensing and content production payment terms require more upfront cash than amortization expense. Content payments, which include additions to streaming assets and changes in related liabilities, are classified in the consolidated statement of cash flows as "net cash used from operating activities." In addition, there are the costs of producing movies, TV series, marketing, maintaining, and monitoring the platform, utilizing big data, employee salaries, ESG, etc.

Figure 3: Netflix Annual Cash Spent on Original Content (Unit in USD Billion). Source: williamblair.com

3.3. Revenue Streams

Netflix generates revenue primarily through the following channels:

3.3.1. Subscription Fees

Beginning in 2007, Netflix began offering existing mail rental subscribers the opportunity to view a limited number of movies through internet streaming and no additional fee. This “free streaming” continued until mid-2011 when Netflix announced a split to their business with separate monthly fees (and separate websites and names) for streaming and mail disk subscriptions [20]. Most of the Netflix's revenue comes from subscription fees paid by users. Users pay a monthly or annual fee to access streaming content on the Netflix platform, and Netflix offers a variety of subscription plans with different features and price tiers to meet the needs of different customer segments.

3.3.2. International Streaming

Netflix operates in multiple countries around the world and generates revenue from international markets through its streaming services. Subscribers outside of the United States generate revenue for the Company through subscription fees.

3.3.3. DVD and Blu-ray Disc Rentals

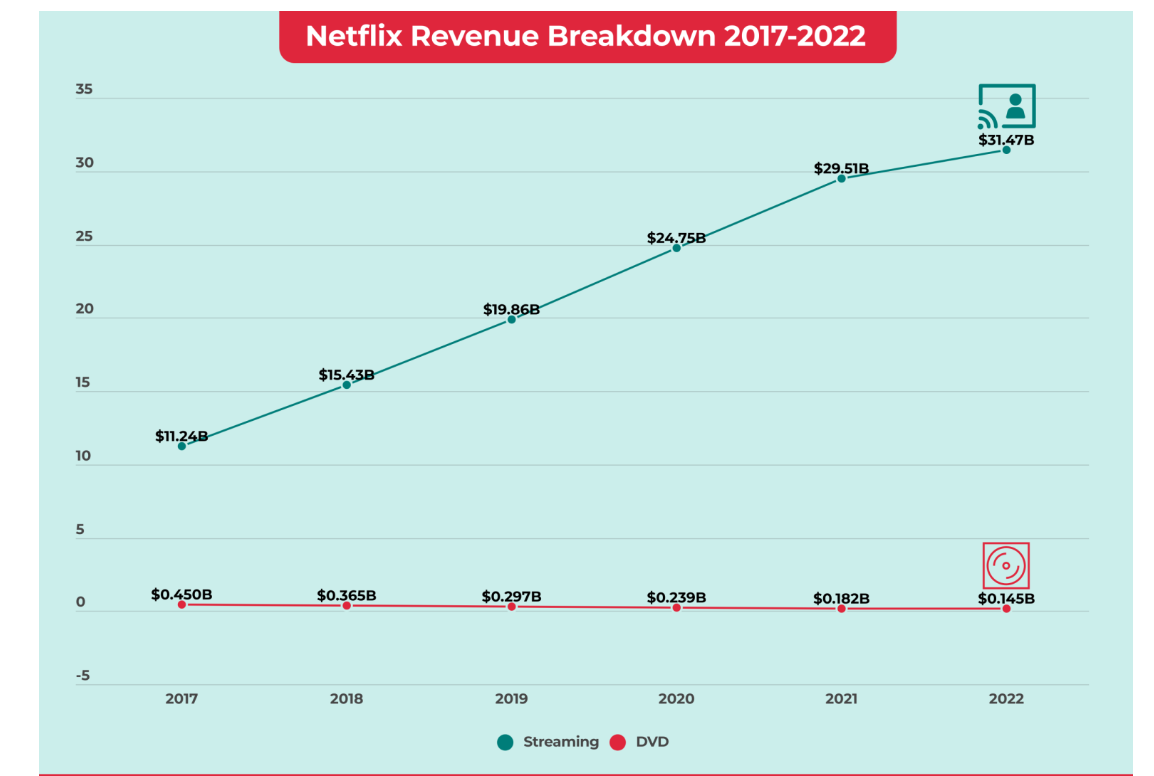

Although this revenue source has declined in importance over time, Netflix originally started as a mail-in DVD rental service. Customers could rent DVDs or Blu-rays and have them delivered to their door. While the focus has shifted to streaming, Netflix still offers DVD and Blu-ray disc rentals as a separate subscription service. As shown in the Figure 4, the revenue from DVD was decreasing while the revenue from streaming was increasing steadily. It shows us the reason why Netflix implement such strategy.

3.3.4. Licensing and Distribution

Netflix licenses its original content and acquires the rights to third-party movies, television shows and other programming. The Company earns revenue by licensing this content to other streaming platforms, traditional broadcasters, and cable networks. In addition, Netflix distributes its content through the sale of DVDs and Blu-rays and through licenses to airlines and hotels.

3.3.5. Merchandise and Product Sales

Netflix generates revenue from the sale of merchandise related to its popular shows and movies. This includes apparel, accessories, collectibles, and other branded merchandise. The company also sells related products such as DVDs and Blu-ray Discs through its online store.

Figure 4: Netflix Revenue Breakdown from 2017 to 2022 (Unit in Percentage). Source: fourweekmba.com.

4. The Competitor Analysis

4.1. Main Player

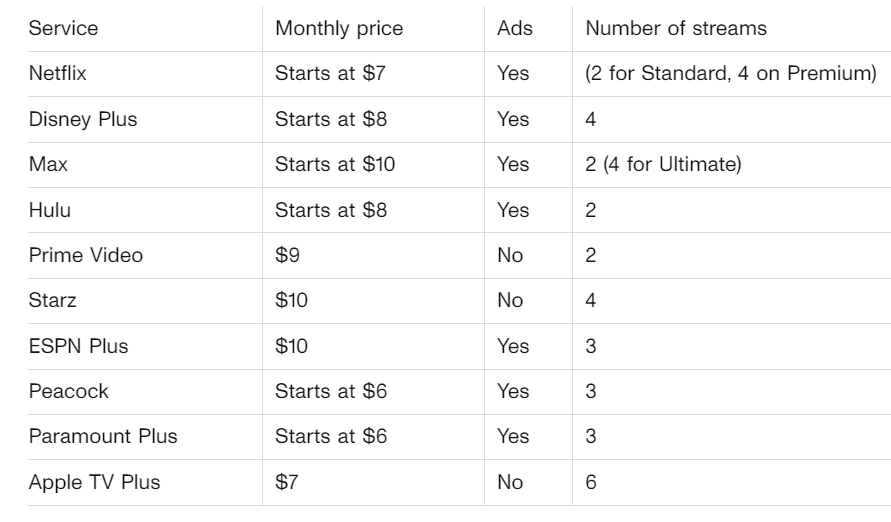

Even though Netflix is one of the most popular streaming video subscription platforms in the world recently, it’s counter-parties are also considered to be very competitive.As Netflix’s direct competitors, Disney+ has Strong brand recognition; Amazon Prime provides convenient offline video options; HBO Max contains many popular and classic films; Hulu has access to FX’s original Channel content and so on [21]. When each one has its own merits, who’s going to be the most popular in 2023? The data will perform the answer intuitively. For 2023's Q2 data, Disney+ has about 157.8 million subscribers with total revenue of approximately $4.01 billion [22]. Amazon Prime has approximately 1.17 billion subscribed users [23]. It is noteworthy that many users subscribe to Amazon Prime not solely for its video content but primarily for the benefit of free shipping. Therefore, the data pertaining to Amazon Prime cannot accurately represent the usage or popularity of Prime Video.

Figure 5: Streaming Service Comparison. Source: CNET.com.

Figure 5 not only listed Netflix's competitors comprehensively, but also made each one's comparisons be shown. From these datas, it's not hard to see a fact that these streaming services' subscription prices were all at about the same amount, and none of them are very different from each other. These shows that Netflix's counterparts are all very competitive.

Main while, Netflix is also facing another type of competition. In China, North Korea, Crimea, Syria, and Russia where Netflix could not reach, the local platforms turn out to be Netflix’s special competitors [24]. For example, China’s iQIYI, which is a Chinese platform with similar charging system as Netflix’s, filling in the streaming media void in China as a substitution. Thus, the local media of the blocked region might also cause impacts on Netflix’s goal of global footprint.

4.2. Netflix's Competitive Strategies before the COVID-19 Pandemic

Before the epidemic, Netflix in 2019 was already the world's largest streaming provider, offering premium services to over 190 countries worldwide. The financial annual report in 2019 provide that Netflix has over 167 million paid subscribers and $20.1 billion in global revenue in 2019 alone. And, Netflix is committed to providing high-quality original content. One of the most popular movies of all time until 2019, "House of Cards," is Netflix's first major original series, which Netflix produces and broadcasts exclusively on its platforms, marking Netflix's transition from a streaming provider to an original content producer [25].

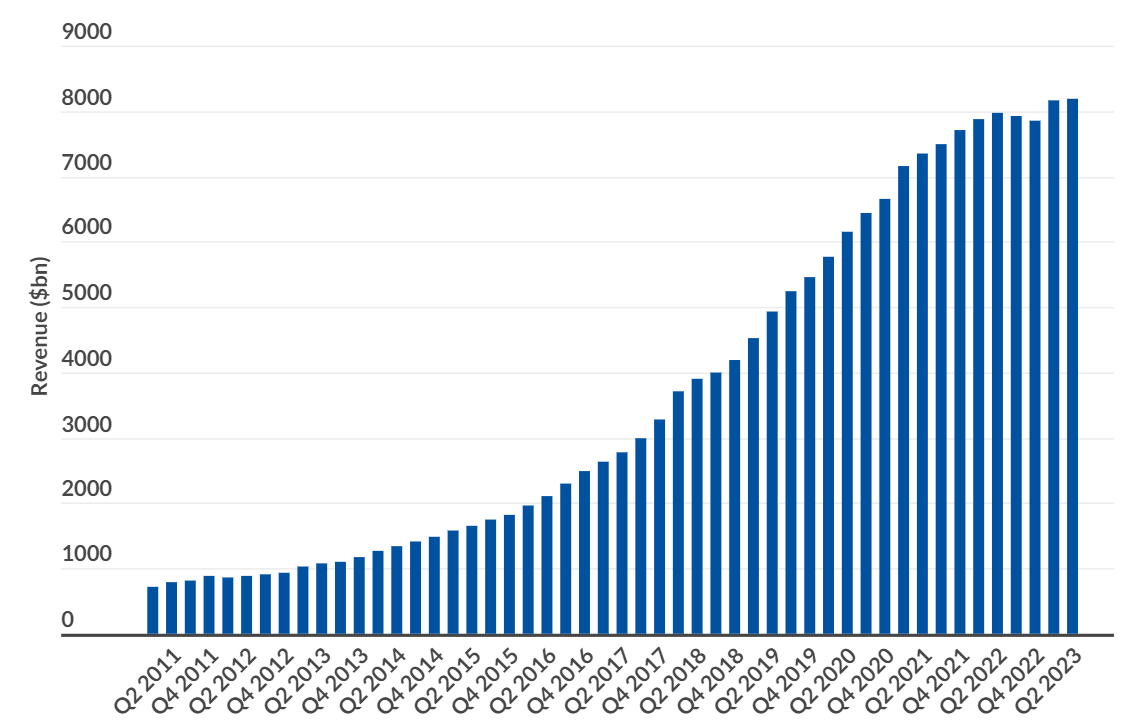

In CNN's "House of Cards' made Netflix a powerhouse. What now?", it is mentioned that in the fourth quarter of 2012, before the premiere of House of Cards, Netflix's streaming subscription number was only 3,300w, and after the show aired, Netflix have steadily risen, and as of November 2017, its subscriptions came to 109 million, and Netflix's quarterly sales came to nearly $3 billion from less than $1 billion before the broadcast, and the company's market capitalization grew from $5.7 billion to $85 billion [26]. The explosion of House of Cards made this production a major milestone for Netflix in original content, and its outstanding performance not only achieved widespread attention and won multiple awards, but also inspired Netflix's corporate approach of making original works its core competitive advantage, investing heavily in the production of its exclusive content every year, and successfully bringing later "Orange Is the New Black," "The Crown" and "Stranger Things." As shown in Figure 6, Netflix’s revenue has experienced rapid growth since 2012. There is no doubt that Netflix created a new form of audio-visual circulation through innovative technology and seized key areas that broke the value chain of the audio-visual market, thus gaining global dominance [27].

Figure 6: Netflix Quarterly Revenue from 2011 to 2022($ million). Source: Statista, Inc.

4.3. Netflix's Competitive Strategies during the COVID-19 Pandemic

At the end of 2019, the COVID-19 epidemic was raging, and the global economy suffered a huge impact from the epidemic. However, the epidemic brought huge opportunities to streaming media service providers. According to the 2021 American community survey released by the U.S. Census Bureau, which shows "The Number of People Primarily Working from Home Tripled Between 2019 and 2021", only in the United States, the number of people working from home has increased to 17.9%, which is approximately 27.6 million people [28]. Looking around the world, even if there are no specific data, it is certain that many countries and regions have implemented lockdowns and quarantine measures, made hundreds of millions of people have been asked to stay at home to slow the spread of the virus. Undoubted, people during the epidemic have more time to watch TV and movies. For a time, the number of users of each streaming media platform increased. According to data provided by Statista, in the first quarter of 2020 alone, the number of Netflix users increased rapidly from 167 million in Q4 2019 to 182 million [29]. However, huge opportunities also come with strong competition. Netflix’s direct competitor Disney+ also seized the opportunity of the epidemic and gained 73 million subscribers in 2020 alone [30]. Unlike Netflix's independent investment in original content, Disney+ integrates content from Disney's major entertainment studios, including Disney, Pixar, Marvel, Lucas, and National Geographic. It provides subscribers with classic Disney content. movies, new original films, and content from acquisitions like Fox. Disney+ strong competitiveness also comes from its relatively low monthly subscription fee. Compared with Netflix’s tiered pricing, Disney+ is not only cheaper, but can also be bundled with other competitors Hulu or ESPN. Facing fierce competition in the industry, Netflix increased its investment in original content during the epidemic and launched many popular TV series and movies to further consolidate its leading position in the industry. To sum up, at the juncture of people turning to streaming services during the blockade, Disney+ copyright advantages and low prices have allowed its number of subscribers to surge, and it has been rapidly expanding in stages around the world. With its high-quality content and strong user base, Netflix has also successfully seized this opportunity and achieved double growth in users and revenue during the epidemic. Revenue in 2020 increased from 20.1 billion in 2019 to 24.9 billion U.S. dollars, but due to competition from Disney+, the demand distribution for its original works has decreased [31]. From Q1 2020 to Q4 2020, the market share dropped from 55.7% to 50.4% [32].

4.4. Netflix's Competitive Strategies after the COVID-19 Pandemic

After COVID-19, a virus which had trap the whole world for nearly two years, gradually fade out from everyone’s visual center, every walk of life and professions starts to make new differences. The streaming platforms are not the exception in this trend. Netflix as a great example, it sells DVDs as its origin business of entrepreneurial and has been keeping this service line for many years, recently declared to cancel all the physical DVD mailings in its future [33]. This decision can be a tow-edged sword for Netflix. For one side, Netflix is likely to lose customers who are found of collecting physical DVDs. However, on the other hand, as the number of DVD users is on the decrease, this serves line could no longer bring Netflix more benefits as before. The data shows that DVD’s operational share is only 1 per cent of total. The DVD program generated about $145.7 million in revenue in the most recent fiscal year, which is 20% below the same period in the past year [34]. What's more, the cancellation of the DVD service might make Netflix gain more by putting focus on other big profits program, such as producing original films.

Losing customers will make disastrous consequences for companies whose main incomes are based on subscriptions, but Netflix finds many effective ways to increase their customers with positive attitude. Firstly, Netflix started to curb its subscribers’ behavior of password sharing, which enable people who did not set up personal subscription due to password sharing finally start their subscriptions. Moreover, the advertising package with cheap price of $6.99 per month is also attracting bunches of new customers. These two vital changes lead Netflix increasing 5.9 million subscribers in the recent quarter [35]. Undoubtedly, it is a significant data when other media industries are struggling. In Alex Sherman's article, he pointed out that during the same period, as Netflix revenues tended to increase gradually, both Disney and HBO chose to lay off thousands of employees for their cash-flow [36]. In addition, Netflix accurately analyses the constituents and needs of its customers and expects to lower prices in more than 30 countries or regions for its subscribers. Mr. Peters, the CEO of Netflix, has expressed that Netflix wishes to amplify its audience range, and serves as more as possible subscribers all over the planet [37]. He and his company are working hard to offer appropriate services for different price.

5. Future Strategies

Netflix's streaming content obligations have experienced rapid growth since 2010, escalating from an annual expenditure of $1.3 billion to $23.16 billion in just 11 years, reaching its highest recorded level in 2021. However, as competition for original content intensifies within the industry, Netflix reduced its content obligations in 2022, decreasing from $23.16 billion to $21.83 billion [38]. Presently, Netflix's share in users' demand for original content has declined from 55.7% to 45.2%. Despite maintaining its industry-leading position with a significant lead over second-place Amazon Prime Video at 11.4%, the notable 10% drop in just two years should warrant Netflix's attention [39].

Therefore, based on the current scenario, we propose the following decisions to further extend Netflix's competitive advantage in the industry.

5.1. Investment in regionalized original content

During the competitive landscape amid the pandemic, content expenditures across streaming platforms have consistently increased each year. In 2022, Netflix's global content expenditure reached a staggering $16.7 billion [40]. Furthermore, Netflix's projected expenditure on original content for 2023 stands at $7.2 billion, ranking fifth, below Disney's first-place position at $10.5 billion [41]. Following Disney's announcement of cost-cutting measures of $5 billion after incurring a net loss of over $1 billion in the first quarter of 2023, to ensure profitability in their streaming business, Netflix should capitalize on this opportunity to create more high-quality productions that attract user subscriptions. Additionally, Netflix should prioritize regionalization of original content by investing in and producing more localized original content that caters to the diverse demands of audiences in different regions and cultures.

5.2. Flexible subscription models

Undoubtedly, the consistent increase in monthly fees by Netflix in recent years contributed to the user churn experienced in the first half of 2022. During this period, Netflix lost 300,000 subscription users, marking the first decline in over a decade. This necessitates a reevaluation of Netflix's subscription model. Historically, Netflix has operated independently with minimal sales strategies. However, the changing landscape calls for Netflix to explore more flexible subscription models, such as student discounts and short-term subscriptions, These measures can further reduce the barriers to user adoption and cultivate user habits [42]. Additionally, actively forging partnerships and collaborations can be beneficial. Netflix can bundle its subscriptions with memberships from platforms in different industries, providing more options for single-platform users while enhancing user stickiness between the two platforms. Previously, Netflix adhered to a no-advertising policy. However, starting from November 2022, Netflix introduced a new Ad-Supported Tier, allowing users to access a standard plan at a lower cost but with ads. On the one hand, Launch the ad-supported tier represents company's tacit endorsement of its economic appeal, and illustrates how quickly can a company's change relationship with its users, this change may cast doubt on people's trust in Netflix [43], but regardless how, This lower-barrier subscription model undoubtedly aligns with the expectations of some users. Data provided by Statista shows that while most non-subscribers are still reluctant to subscribe to streaming services, 11% of non-subscribers of Disney+ are willing to subscribe to the Ad-Supported Tier, while 15% of non-subscribers of Netflix express a willingness to subscribe to the Ad-Supported Tier [41]. Furthermore, 35% of Disney+ subscribers and 24% of Netflix subscribers expressed a desire to switch to the Ad-Supported Tier [44]. Although this may lead to potential declines in subscription revenue, it can also generate additional advertising revenue. The introduction of the new Ad-Supported Tier highlights the value of a hybrid business model in the streaming media market. This new subscription model has indeed helped mitigate the user churn in 2022, as evidenced by Netflix reaching its highest subscription count in its history, with 238.39 million subscribers as of Q2 2023.

5.3. Persistent efforts to combat password sharing

Netflix now acknowledges the saturation of the streaming media market. To increase revenue in this saturated market, Netflix needs to undertake a series of actions to combat password sharing, aiming to encourage those sharing passwords to subscribe to their own accounts. An article by CNBC titled "Netflix password-sharing crackdown rolls out in the U.S." highlights that Netflix has previously stated that over 100 million households share accounts on its platform, accounting for approximately 43% of its global user base, which has significantly impacted its ability to invest in new content [45]. Therefore, despite Netflix previously expressing sentiments on Twitter like "Love is sharing a password," it is imperative for Netflix to vigorously implement measures against password sharing to ensure the successful operation of its streaming media business.

Currently, Netflix explicitly reminds its customers that the days of password sharing are over. An article by Time titled "Netflix is cracking down on password sharing in the U.S. Here's what to know" mentions that Netflix is gradually introducing new password protocols globally and states, "Your Netflix account is for you and the people you live with—your household." Netflix will utilize information such as IP addresses, device IDs, and account activity to determine if a device belongs to a household [46]. This new measure has indeed proven successful. Although such measures initially impacted international user growth, Netflix still added 1.75 million customers in the first quarter after the implementation of these measures. Netflix executives in Latin America have reported instances of canceled subscriptions, which temporarily affected recent growth. However, they found that these password borrowers subsequently activated their own accounts, resulting in additional revenue for the company.

5.4. Feasibility of expanding non-video content

Diversifying its offerings beyond video content is also a possibility for Netflix to pursue. Apart from video streaming, avenues such as audio content, interactive content, e-books and magazines, offline screenings, and concerts can be considered for development. In the audio streaming market, rather than competing in the saturated music market, audiobooks are undoubtedly a more suitable choice for Netflix. The company can adapt its original film and television content into scripted audiobooks, sell related e-books and podcasts, and complement them with audiobooks, thus providing users with more options. In the realm of e-books and magazines, Netflix can not only publish e-books featuring its original content exclusively but also collaborate with other publishers to launch magazine subscription services. Additionally, innovative interactive content may attract more users. For example, Netflix's "Black Mirror: Bandersnatch" demonstrated the potential for interactive movies to thrive and could even incorporate new technologies such as VR and stereoscopic filming to deliver a completely new level of viewing experience. However, considering cost and revenue trade-offs, the development of interactive movies may not be a perfect choice. Furthermore, offline screenings and concerts can serve not only as promotional activities but also bring in some revenue. Netflix can organize touring film score concerts or hold offline screenings of its original series in specific regions, which would be a good choice to simultaneously gain publicity and generate income.

5.5. Abandoning the DVD service

Netflix's DVD business, especially during its early stages, was a significant source of revenue and played a crucial role in the company's successful development. However, in today's streaming media market, Netflix's success in streaming has had a ripple effect on its DVD business, diminishing its importance and revenue. Data from Statista clearly indicates the alarming decline of the DVD market over the years. In the United States, DVD sales plummeted from 7.57 million units in 2014 to 2.9 million units in 2019 [47], directly impacting Netflix's DVD business. Profits from the domestic DVD market in the United States also decreased from $305 million in 2014 to $77 million in 2019 [47], accounting for only 4% of Netflix's net profit in 2019. As times have changed, more and more people are shifting towards streaming services and abandoning bulky DVD players. In the second quarter of 2018, the continuous decline over the years led to Netflix's DVD subscribers falling below 3 million for the first time [48], while simultaneously, its streaming subscription user base doubled over an eight-year period. Today, DVDs as a playback medium belong to the past and have been rendered obsolete by the times. Netflix announced the closure of its DVD business this year, and we believe this strategy will bring a better future for Netflix.

5.6. Maintaining high-quality and stable regular upgrades

To maintain Netflix's leading position in the streaming media market and meet the ever-changing demands of users, it is crucial for Netflix to continuously update high-quality and stable regular upgrades. This is a key means to address competition and maintain market position, satisfying user expectations and achieving better economic benefits. Netflix's technical team should continually enhance the technological infrastructure, invest in higher-quality streaming media technologies, more intelligent personalized content recommendation algorithms, user interfaces, security, and privacy. Providing a better user experience directly is critical to increasing user satisfaction and improving retention rates. At the same time, regularly collecting and analyzing user feedback, as well as actively building new partnerships, is also necessary to enhance service standards. By conducting stable regular upgrades in these areas, Netflix can ensure that its service always maintains the highest standards, meets user needs, and responds to market changes.

6. Conclusion

As the global economy suffered with the COVID-19 outbreak, media consumption habits around the world underwent profound changes. Netflix, which had built its position as the world's leading streaming media provider after shifting from being a mere streaming operator to a maker of original content, also experienced significant growth during this period. Prior to the epidemic, Netflix had already established a solid base in the global market, but during the epidemic, its subscriber base and viewing hours were boosted as people were forced to stay home. This not only accelerated Netflix's global expansion, but also prompted it to invest more in original content. However, as the outbreak gradually came under control and people's lifestyles began to return to normal, Netflix faced new challenges. First, as people start getting out and about again, the amount of time spent watching at home is likely to decrease. Second, the gradually saturated streaming market, as well as the emergence of new streaming competitors during the outbreak, has put tremendous pressure on Netflix. To address these challenges, the following strategies are recommended for Netflix, including, but not limited to, continuing to invest more in original diverse and regionalized content to meet the diverse needs of its global audience. Adding more subscription models for different needs or partnering with other company across industries to sell bundles. Further expand its non-video content, such as audiobooks, e-books, interactive videos, and offline concerts, to appeal to a wider audience. Gradually crack down on password sharing and encourage those who borrow passwords to create their own accounts. Abandon the DVD business and move with the times in order to invest more money into original streaming services. Maintain a high quality and stable of regular upgrades to improve subscriber satisfaction and grow retention. In conclusion, despite Netflix's more notable success during the epidemic, the road ahead remains challenging. Only by continuing to innovate and adapt to change can Netflix continue to maintain its leadership position in the streaming market.

Acknowledgement

Yankun Chen, Xiang Li, Youshu Song and Zhuowen Wu contributed equally to this work and should be considered co-first authors.

We extend our heartfelt gratitude to Ziyun Luo for the invaluable editorial support and insightful suggestions. Her expertise and meticulous attention to detail were instrumental in refining the content and structure of this thesis.

Furthermore, We are deeply indebted to Professor Marianne Szymanski of the University of Southern California for her invaluable mentorship and academic guidance. Her profound knowledge, inspiring teachings, and unwavering support have been pivotal in shaping my research and scholarly pursuits.

This work benefitted immensely from their combined contributions, and we are profoundly thankful for their involvement and dedication.

References

[1]. Craig, D., Cunningham, & Cunningham, S. (2019). Social Media Entertainment: The New Intersection of Hollywood and Silicon Valley.

[2]. Sihombing, L. H., Lestari, P., & Dante, J. (2022). The effects of COVID-19 pandemic towards conventional theaters and online streaming services in Indonesia. International Journal of Communication and Society, 4(1), 153-162.

[3]. Okumuş, M. S. (2022). The effects of Covid-19 pandemic on audience practices in cinema, television, and OTT platforms. İstanbul Ticaret Üniversitesi Sosyal Bilimler Dergisi, 21(43), 133-147.

[4]. Gil, F.A., Chandrashekar, A., Jebara, T., & Basilico, J.D. (2018). Artwork personalization at netflix. Proceedings of the 12th ACM Conference on Recommender Systems.

[5]. Moreno, D.E., Mauricio, E., Gabatin, R.A., David, J., Gutierrez, J.R., & Nullas, S.C. (2023). The Role of SVoD Service Attributes in Building Customer Loyalty: A Study of Repurchase Behavior in the Philippines. Journal of Business and Management Studies.

[6]. Rataul, P., Tisch, D., & Zámborský, P., (2018). Netflix: Dynamic capabilities for global success. In Sage Business Cases. SAGE Publications, Ltd.

[7]. Wayne, M. (2018). Netflix, Amazon, and branded television content in subscription video on-demand portals. Media, Culture & Society, 40, 725 - 741.

[8]. Alfayad, K., Murray, R.L., Britton, J., & Barker, A.B. (2021). Content analysis of Netflix and Amazon Prime Instant Video original films in the UK for alcohol, tobacco and junk food imagery. Journal of Public Health (Oxford, England), 44, 302 - 309.

[9]. CleoBridges, Umar, Sg, Glycerin, Luca, Kirby, Swamynathan, Lora, & Gupta, S. K. (2023, February 3). Netflix business model (2023): How does netflix make money. Business Strategy Hub.

[10]. Rahe, V., Buschow, C., & Schlütz, D. (2020). How users approach novel media products: brand perception of Netflix and Amazon Prime video as signposts within the German subscription-based video-on-demand market. Journal of Media Business Studies, 18, 45 - 58.

[11]. Hendrikx, A. (2019). Keep fans coming and don’t forget to make them stay A qualitative analysis of Netflix’s brand community relationship management.

[12]. Christop Zott, Raphael Amit,Business Model Design: An Activity System Perspective,Long Range Planning,Volume 43, Issues 2–3,2010,Pages 216-226,ISSN 0024-6301.

[13]. Netflix. (2021, April 22). Form 10-Q. https://www.prnewswire.com/news-releases/netix-releasessecond-quarter-2021-nancial-results-301337757.html

[14]. Netflix. (2023). Company Culture. Netflix. https://jobs.netflix.com/culture

[15]. Hracs, B.J., & Webster, J. (2020). From selling songs to engineering experiences: exploring the competitive strategies of music streaming platforms. Journal of Cultural Economy, 14, 240 - 257.

[16]. Thierry Rayna & Ludmila Striukova (2016) 360° Business Model Innovation: Toward an Integrated View of Business Model Innovation, Research-Technology Management, 59:3, 21-28.

[17]. Muhammad Anshari, Mohammad Nabil Almunawar, Syamimi Ariff Lim, Abdullah Al-Mudimigh,Customer relationship management and big data enabled: Personalization & customization of services,Applied Computing and Informatics,Volume 15, Issue 2,2019,Pages 94-101,ISSN 2210-8327.

[18]. Wayne, M. (2021). Netflix audience data, streaming industry discourse, and the emerging realities of ‘popular’ television. Media, Culture & Society, 44, 193 - 209.

[19]. Michael L. Wayne (2020) Global streaming platforms and national pay-television markets: a case study of Netflix and multi-channel providers in Israel, The Communication Review, 23:1, 29-45.

[20]. Robinson, D., & Oltersdorf, M., (2013). Netflix: Pricing decision 2011. In Sage Business Cases. SAGE Publications, Ltd.

[21]. Wayne, M., & Sienkiewicz, M. (2023). “We Don’t Aspire to Be Netflix”: Understanding Content Acquisition Practices Among Niche Streaming Services. Television & New Media, 24, 298 - 315.

[22]. Shewale, R. (2023, September 18). Disney+ statistics - users and revenue facts (2023). DemandSage. https://www.demandsage.com/disney-users/

[23]. Song, M. (2021). A Comparative Study on Over-The-Tops, Netflix & Amazon Prime Video: Based on the Success Factors of Innovation. The International Journal of Advanced Smart Convergence, 10, 62-74.

[24]. News. (2022, September 8). Gulf Nations and Egypt Demand Netflix Remove Offensive Titles. Retrieved from https://www.news.com.au/entertainment/tv/streaming/gulf-nations-and-egypt-demand-netflix-remove-offensive-titles/news-story/68bca5ad9331dace30cf747f7215d0af

[25]. Netflix, Inc. (2020). Financial statements 2019. Netflix, Inc. https://www.annualreports.com/HostedData/AnnualReports/PDF/NASDAQ_NFLX_2019.pdf

[26]. Rios, S., & Scarlata, A. (2018). Locating SVOD in Australia and Mexico: Stan and Blim contend with Netflix. Critical Studies in Television: The International Journal of Television Studies, 13, 475 - 490.

[27]. Gómez, R., & Muñoz Larroa, A.E. (2022). Netflix in Mexico: An Example of the Tech Giant’s Transnational Business Strategies. Television & New Media, 24, 88 - 105.

[28]. U.S. Census Bureau. (2022, September 8). The Number of People Primarily Working From Home Tripled Between 2019 and 2021. Retrieved from https://www.census.gov/newsroom/press-releases/2022/people-working-from-home.html

[29]. Netflix. (October 18, 2023). Number of Netflix paid subscribers worldwide from 1st quarter 2013 to 3rd quarter 2023 (in millions) [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/250934/quarterly-number-of-netflix-streaming-subscribers-worldwide/

[30]. Statista. (2023). Number of Disney Plus subscribers worldwide from 1st quarter 2020 to 3rd quarter 2023. Retrieved from https://www.statista.com/statistics/1095372/disney-plus-number-of-subscribers-us/

[31]. Netflix. (January 27, 2023). Netflix's annual revenue from 2002 to 2022 (in million U.S. dollars) [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/272545/annual-revenue-of-netflix/

[32]. Parrot Analytics. (December 1, 2022). Distribution of demand for original programming worldwide from 1st quarter 2020 to 1st quarter 2022, by video streaming service [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/1248406/vod-services-most-in-demand-original-series-worldwide/

[33]. Veltman, C. (2023, August 21). Some customers are confused as Netflix sends out disks before ending DVD mail program. NPR. https://www.npr.org/2023/08/21/1195137236/some-customers-are-confused-as-netflix-sends-out-disks-before-ending-dvd-mail-pr

[34]. Jupowicz-Ginalska, A., & Wróblewska, K. (2021). The media marketing of the VOD platforms in Poland during the COVID-19 pandemic – an exploratory study. Zarządzanie Mediami.

[35]. Forristal, L. (2023, July 19). Netflix gains nearly 6m subscribers as paid sharing soars. TechCrunch. https://techcrunch.com/2023/07/19/netflix-gains-nearly-6m-subscribers-as-paid-sharing-soars/

[36]. Sherman, A. (2023, July 19). Netflix earnings showcase strength as the rest of the media industry struggles. CNBC. https://www.cnbc.com/2023/07/19/netflix-earnings-show-strength-amid-media-chaos.html

[37]. Jenner, M. (2018). Introduction: Netflix and the Re-invention of Television.

[38]. Netflix. (January 27, 2023). Netflix's streaming content obligations from 2010 to 2022 (in billion U.S. dollars) [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/258724/netflix-streaming-content-obligations/

[39]. Stoll, J. (2022, December 20). Most in-demand originals by VOD Service Worldwide 2022. Statista. https://www.statista.com/statistics/1248406/vod-services-most-in-demand-original-series-worldwide/

[40]. Statista. (February 21, 2023). Spending on original content worldwide in 2023, by company (in billion U.S. dollars) [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/1367854/companies-original-content-spending/

[41]. Hub Entertainment Research. (December 19, 2022). Reactions of Disney Plus and Netflix non-subscribers to new ad-supported tiers in the United States as of November 2022 [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/1358110/reaction-non-subscribers-new-ad-supported-tier-netflix-disney-plud/

[42]. Turner, G. (2019). Approaching the cultures of use: Netflix, disruption and the audience. Critical Studies in Television: The International Journal of Television Studies, 14, 222 - 232.

[43]. Bradbury-Rance, C. (2023). ‘Unique joy’: Netflix, pleasure and the shaping of queer taste. New Review of Film and Television Studies, 21, 133 - 157.

[44]. Hub Entertainment Research. (December 19, 2022). Reactions of Disney Plus and Netflix subscribers to new ad-supported tiers in the United States as of November 2022 [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/1358103/reaction-new-ad-supported-tier-netflix-disney-plus/

[45]. Yalkin, Ç. (2019). TV series: marketplace icon. Consumption Markets & Culture, 24, 217 - 224.

[46]. Mumpuni, R.A., Amaliyah, A., Noor, F., Laksmiwati, I.A., & Lukkitawati, L. (2021). Understanding the intention of generation Z on Netflix and Viu streaming services. ProTVF.

[47]. Laricchia, F. (2022, February 10). DVD players unit sales U.S. 2014-2019. Statista. https://www.statista.com/statistics/191275/dvd-players-unit-sales-in-the-us/

[48]. Laricchia, F. (2022a, February 10). DVD players Market Revenue U.S. 2014-2019. Statista. https://www.statista.com/statistics/191268/dvd-players-revenue-in-the-us/

Cite this article

Chen,Y.;Li,X.;Song,Y.;Wu,Z. (2024). The Impacts of Epidemics on Netflix's Business Strategies and Market Competitiveness. Advances in Economics, Management and Political Sciences,89,138-154.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Craig, D., Cunningham, & Cunningham, S. (2019). Social Media Entertainment: The New Intersection of Hollywood and Silicon Valley.

[2]. Sihombing, L. H., Lestari, P., & Dante, J. (2022). The effects of COVID-19 pandemic towards conventional theaters and online streaming services in Indonesia. International Journal of Communication and Society, 4(1), 153-162.

[3]. Okumuş, M. S. (2022). The effects of Covid-19 pandemic on audience practices in cinema, television, and OTT platforms. İstanbul Ticaret Üniversitesi Sosyal Bilimler Dergisi, 21(43), 133-147.

[4]. Gil, F.A., Chandrashekar, A., Jebara, T., & Basilico, J.D. (2018). Artwork personalization at netflix. Proceedings of the 12th ACM Conference on Recommender Systems.

[5]. Moreno, D.E., Mauricio, E., Gabatin, R.A., David, J., Gutierrez, J.R., & Nullas, S.C. (2023). The Role of SVoD Service Attributes in Building Customer Loyalty: A Study of Repurchase Behavior in the Philippines. Journal of Business and Management Studies.

[6]. Rataul, P., Tisch, D., & Zámborský, P., (2018). Netflix: Dynamic capabilities for global success. In Sage Business Cases. SAGE Publications, Ltd.

[7]. Wayne, M. (2018). Netflix, Amazon, and branded television content in subscription video on-demand portals. Media, Culture & Society, 40, 725 - 741.

[8]. Alfayad, K., Murray, R.L., Britton, J., & Barker, A.B. (2021). Content analysis of Netflix and Amazon Prime Instant Video original films in the UK for alcohol, tobacco and junk food imagery. Journal of Public Health (Oxford, England), 44, 302 - 309.

[9]. CleoBridges, Umar, Sg, Glycerin, Luca, Kirby, Swamynathan, Lora, & Gupta, S. K. (2023, February 3). Netflix business model (2023): How does netflix make money. Business Strategy Hub.

[10]. Rahe, V., Buschow, C., & Schlütz, D. (2020). How users approach novel media products: brand perception of Netflix and Amazon Prime video as signposts within the German subscription-based video-on-demand market. Journal of Media Business Studies, 18, 45 - 58.

[11]. Hendrikx, A. (2019). Keep fans coming and don’t forget to make them stay A qualitative analysis of Netflix’s brand community relationship management.

[12]. Christop Zott, Raphael Amit,Business Model Design: An Activity System Perspective,Long Range Planning,Volume 43, Issues 2–3,2010,Pages 216-226,ISSN 0024-6301.

[13]. Netflix. (2021, April 22). Form 10-Q. https://www.prnewswire.com/news-releases/netix-releasessecond-quarter-2021-nancial-results-301337757.html

[14]. Netflix. (2023). Company Culture. Netflix. https://jobs.netflix.com/culture

[15]. Hracs, B.J., & Webster, J. (2020). From selling songs to engineering experiences: exploring the competitive strategies of music streaming platforms. Journal of Cultural Economy, 14, 240 - 257.

[16]. Thierry Rayna & Ludmila Striukova (2016) 360° Business Model Innovation: Toward an Integrated View of Business Model Innovation, Research-Technology Management, 59:3, 21-28.

[17]. Muhammad Anshari, Mohammad Nabil Almunawar, Syamimi Ariff Lim, Abdullah Al-Mudimigh,Customer relationship management and big data enabled: Personalization & customization of services,Applied Computing and Informatics,Volume 15, Issue 2,2019,Pages 94-101,ISSN 2210-8327.

[18]. Wayne, M. (2021). Netflix audience data, streaming industry discourse, and the emerging realities of ‘popular’ television. Media, Culture & Society, 44, 193 - 209.

[19]. Michael L. Wayne (2020) Global streaming platforms and national pay-television markets: a case study of Netflix and multi-channel providers in Israel, The Communication Review, 23:1, 29-45.

[20]. Robinson, D., & Oltersdorf, M., (2013). Netflix: Pricing decision 2011. In Sage Business Cases. SAGE Publications, Ltd.

[21]. Wayne, M., & Sienkiewicz, M. (2023). “We Don’t Aspire to Be Netflix”: Understanding Content Acquisition Practices Among Niche Streaming Services. Television & New Media, 24, 298 - 315.

[22]. Shewale, R. (2023, September 18). Disney+ statistics - users and revenue facts (2023). DemandSage. https://www.demandsage.com/disney-users/

[23]. Song, M. (2021). A Comparative Study on Over-The-Tops, Netflix & Amazon Prime Video: Based on the Success Factors of Innovation. The International Journal of Advanced Smart Convergence, 10, 62-74.

[24]. News. (2022, September 8). Gulf Nations and Egypt Demand Netflix Remove Offensive Titles. Retrieved from https://www.news.com.au/entertainment/tv/streaming/gulf-nations-and-egypt-demand-netflix-remove-offensive-titles/news-story/68bca5ad9331dace30cf747f7215d0af

[25]. Netflix, Inc. (2020). Financial statements 2019. Netflix, Inc. https://www.annualreports.com/HostedData/AnnualReports/PDF/NASDAQ_NFLX_2019.pdf

[26]. Rios, S., & Scarlata, A. (2018). Locating SVOD in Australia and Mexico: Stan and Blim contend with Netflix. Critical Studies in Television: The International Journal of Television Studies, 13, 475 - 490.

[27]. Gómez, R., & Muñoz Larroa, A.E. (2022). Netflix in Mexico: An Example of the Tech Giant’s Transnational Business Strategies. Television & New Media, 24, 88 - 105.

[28]. U.S. Census Bureau. (2022, September 8). The Number of People Primarily Working From Home Tripled Between 2019 and 2021. Retrieved from https://www.census.gov/newsroom/press-releases/2022/people-working-from-home.html

[29]. Netflix. (October 18, 2023). Number of Netflix paid subscribers worldwide from 1st quarter 2013 to 3rd quarter 2023 (in millions) [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/250934/quarterly-number-of-netflix-streaming-subscribers-worldwide/

[30]. Statista. (2023). Number of Disney Plus subscribers worldwide from 1st quarter 2020 to 3rd quarter 2023. Retrieved from https://www.statista.com/statistics/1095372/disney-plus-number-of-subscribers-us/

[31]. Netflix. (January 27, 2023). Netflix's annual revenue from 2002 to 2022 (in million U.S. dollars) [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/272545/annual-revenue-of-netflix/

[32]. Parrot Analytics. (December 1, 2022). Distribution of demand for original programming worldwide from 1st quarter 2020 to 1st quarter 2022, by video streaming service [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/1248406/vod-services-most-in-demand-original-series-worldwide/

[33]. Veltman, C. (2023, August 21). Some customers are confused as Netflix sends out disks before ending DVD mail program. NPR. https://www.npr.org/2023/08/21/1195137236/some-customers-are-confused-as-netflix-sends-out-disks-before-ending-dvd-mail-pr

[34]. Jupowicz-Ginalska, A., & Wróblewska, K. (2021). The media marketing of the VOD platforms in Poland during the COVID-19 pandemic – an exploratory study. Zarządzanie Mediami.

[35]. Forristal, L. (2023, July 19). Netflix gains nearly 6m subscribers as paid sharing soars. TechCrunch. https://techcrunch.com/2023/07/19/netflix-gains-nearly-6m-subscribers-as-paid-sharing-soars/

[36]. Sherman, A. (2023, July 19). Netflix earnings showcase strength as the rest of the media industry struggles. CNBC. https://www.cnbc.com/2023/07/19/netflix-earnings-show-strength-amid-media-chaos.html

[37]. Jenner, M. (2018). Introduction: Netflix and the Re-invention of Television.

[38]. Netflix. (January 27, 2023). Netflix's streaming content obligations from 2010 to 2022 (in billion U.S. dollars) [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/258724/netflix-streaming-content-obligations/

[39]. Stoll, J. (2022, December 20). Most in-demand originals by VOD Service Worldwide 2022. Statista. https://www.statista.com/statistics/1248406/vod-services-most-in-demand-original-series-worldwide/

[40]. Statista. (February 21, 2023). Spending on original content worldwide in 2023, by company (in billion U.S. dollars) [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/1367854/companies-original-content-spending/

[41]. Hub Entertainment Research. (December 19, 2022). Reactions of Disney Plus and Netflix non-subscribers to new ad-supported tiers in the United States as of November 2022 [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/1358110/reaction-non-subscribers-new-ad-supported-tier-netflix-disney-plud/

[42]. Turner, G. (2019). Approaching the cultures of use: Netflix, disruption and the audience. Critical Studies in Television: The International Journal of Television Studies, 14, 222 - 232.

[43]. Bradbury-Rance, C. (2023). ‘Unique joy’: Netflix, pleasure and the shaping of queer taste. New Review of Film and Television Studies, 21, 133 - 157.

[44]. Hub Entertainment Research. (December 19, 2022). Reactions of Disney Plus and Netflix subscribers to new ad-supported tiers in the United States as of November 2022 [Graph]. In Statista. Retrieved November 09, 2023, from https://www.statista.com/statistics/1358103/reaction-new-ad-supported-tier-netflix-disney-plus/

[45]. Yalkin, Ç. (2019). TV series: marketplace icon. Consumption Markets & Culture, 24, 217 - 224.

[46]. Mumpuni, R.A., Amaliyah, A., Noor, F., Laksmiwati, I.A., & Lukkitawati, L. (2021). Understanding the intention of generation Z on Netflix and Viu streaming services. ProTVF.

[47]. Laricchia, F. (2022, February 10). DVD players unit sales U.S. 2014-2019. Statista. https://www.statista.com/statistics/191275/dvd-players-unit-sales-in-the-us/

[48]. Laricchia, F. (2022a, February 10). DVD players Market Revenue U.S. 2014-2019. Statista. https://www.statista.com/statistics/191268/dvd-players-revenue-in-the-us/