1. Introduction

In the contemporary business landscape characterized by intense competition, customers assume a crucial role as the ultimate consumers of goods and services. Consumer behavior is a significant indicator of customers' preferences in buying and consuming, hence exerting an influence on market supply and shaping a company's product development and marketing strategy. Hence, the examination and anticipation of customer behavior hold immense importance for enterprises.

Consumer behavior, in its strictest sense, pertains solely to the tangible act of consuming consumer products and the purchasing behavior of the consumer. However, in a broader context, consumer behavior encompasses the multitude of actions that consumers undertake to obtain, utilize, and discard goods or services, including the decision-making operation[1] that precedes and influences these actions. Consumer behavior can be viewed as comprising two elements: the consumer's process of making purchase decisions and the subsequent actions taken by the consumer. The factors influencing consumer behavior can be classified into two categories: individual and environmental factors. Various factors play a role in shaping consumer behavior. On an individual level, various factors such as needs, perception, disparities, memory and learning, attitude, personality, self-concept, and lifestyle can all have an inclination to the behavior of consumers. In addition, consumer behavior is influenced by various environmental factors such as cultural influences, social class, social groups, and family dynamics. Studying consumer behavior forms the foundation for making marketing decisions and developing marketing strategies[2]. It also contributes to expanding market share and enhancing the value of a company's brand.

Consumer behavior prediction involves the analysis of data and the creation of models to forecast a customer's behavior and actions before they actually happen. It is based on various factors such as historical data and trends that affects consumers’ choices. Companies’ main objectives are to use these predictions to make the best strategic decision. consumer behavior prediction mainly includes the following steps: data collection, data analysis, model building, model development, prediction and final decision. It is crucial in several sectors, for instance, marketing, retailing and finance. However, it is essential to be aware that consumer behavior predictions are only based on historical data and assumptions, so there will be uncertainties.

Currently, there are several consumer behavior prediction techniques that can be utilized to forecast consumer behavior, such as big data analysis, decision tree and consumer relationship management. With the use of these scientific prediction tools, the businesses can better control market trends and understand future consumer needs, guiding market positioning and product development, and formulating more targeted marketing strategies.

Big data refers to a dataset that consists of a greater variety of information, which is continuously growing in volume and being generated at a faster pace. This is commonly referred to as the three Vs: Velocity, Volume and Variety[3]. With the aid of big data, a company will be more efficiently and cost-savingly achieve its goal. Once again, the significance of big data is not only represented in value finding, but also in making assumptions and avoiding risks. In short term, the main difference between the big data and traditional data is about the values we may obtain from them. From the traditional dataset, we are looking forward to analyzing the patterns from the data, and summarizing feedbacks as well.

Decision trees are a commonly used economic forecasting model. By using decision trees, businesses can better understand the needs of different consumer groups and identify key market factors[4]. This helps in precise marketing and staying updated with market trends, and develop personalized marketing strategies which improves consumer experience, boosts sales[5], and enhances consumer loyalty.

Consumer Relationship Management (CRM) is a comprehensive business model that integrates various aspects such as marketing, service, technical support, and consumer satisfaction[6]. Its goal is to enhance consumer service, improve consumer satisfaction, and increase the competitiveness of the enterprise. CRM allows businesses to target specific consumer groups and allocate resources efficiently to improve marketing effectiveness. By utilizing a CRM system, businesses can evaluate the effectiveness of marketing activities, understand input and output ratios of each campaign, and develop optimal marketing plans for rapid development.

Although predictive analytics has used in multiple fields, there is currently no literature summarizing these technologies and their applications in a systematic manner. In this article, we will be summarizing the application scenarios of machine learning methods and big data analytics in business decision-making, as well as the advantages and disadvantages of their use. Based on this, we are seeking to find better methods.

2. Basics of Consumer Behavior

2.1. Categorization of consumer behaviors

Consumer behaviors are the phenomenon which can be fully or partially explaining the factors making the consumers to conduct a purchase, as well as the consumer’s emotions, attitudes and preferences. It was mentioned by Gordon Foxall from Keele University in 1998 that the types of consumer behaviors can be approximately categorized into four: Accomplishment; Hedonism; accumulation; and maintenance [7]. However, these were further modelled and remodeled to more advanced and precise categories in according to the buying behaviors of consumers later on, in according to the involvement of consumers and differences in between alternative products, as shown in the Table 1.

Table 1: Categories of consumer behavior.

High involvement | Low involvement | ||

Conspicuous differences between alternatives | Complex buying behaviors | Variety seeking behaviors | |

Limited disparities between alternatives | Dissonance reducing buying behaviors | Habitual buying behaviors | |

Complex buying behavior, normally take place in the purchase process with risks involved, highly involves the consumers, concerns the situation when consumers are in need to receive information from the outside sources to confirm and validate the purchase decision. An example can be the first time a consumer buying a car. With the risks that the consumer may be an amateur for such a big decision, he/she would be willing to seek external assistances to be convinced to make the purchase. Complex buying behavior can also be recognized as intellectual purchasing behavior.

The concept of dissonance-reducing buying behavior refers to the behavior of consumers who engage in minimal research due to time or budget constraints. In this scenario, the purchases are rather infrequent or in high price, and normally the consumer are in urgent demand of the product, which means they would conduct the purchase easily with high availability. Again, consumers are highly involved in this behavior but mostly likely the differences between products would be neglected.

Habitual buying behavior can be viewed as one of the major consumer behaviors because of its major dominance in the overall market. It describes an action that consumer tends to buy products which they have already built trust on, such as daily supply or long-term trustable associations. If a company has been booking tickets from the same airline for a reasonable time, it is highly likely that they will have higher tendency when it comes to the future ticket booking even if it’s a new trade line that they wish to explore. In this behavior, consumers are low in involvement, as well as the differences of the choices they have.

Another mentionable consumer behavior can be the variety seeking buying behavior. There is a quite number of consumers who is willing to explore what benefits can be brought to them from different products. In this behavior, the consumer involvement is really low, and normally conducted by curiosity or boredom rather than dissatisfaction [8], which means there will be some differences in the products that they intend to purchase. For instance, a consumer who had bought a cookie from a bakery shop still has high tendency to buy cookies in different type or from another shop, not because they are not satisfied with the former cookie, but probably simply just because they would like a taste of other alternatives.

2.2. Constituent factors of consumer behavior

Consumer behavior can be understood as comprising of two main components: the consumer's purchase decision-making procedure and the customer's actions. The first part involves consumers carefully evaluating[8] the characteristics of a product, brand, or service, and selecting goods that fulfill a specific requirement. Consumer’s purchasing behavior refers to the process where consumers transform their purchase intentions into actual purchase actions.

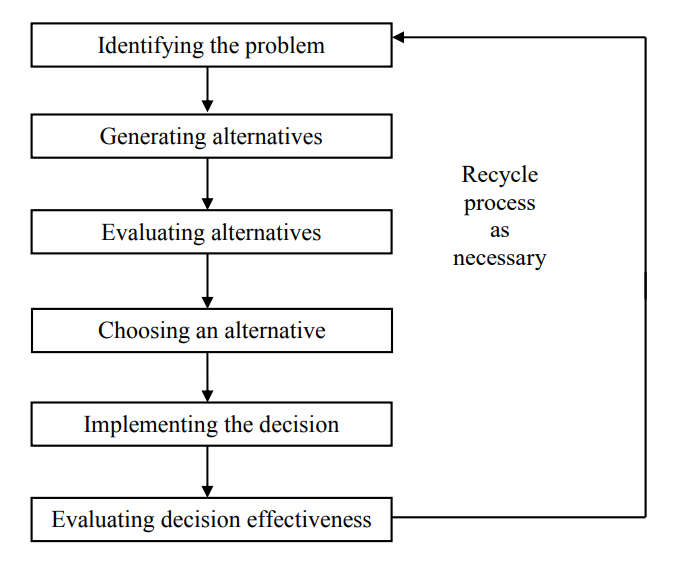

Even though the process of making a purchase decision can differ between products and services, all customers go through a similar set of stages which is crucial in determining which products they ultimately decide to purchase. As shown in the figure 1, the decision-making process mostly consists of five stages [9].

Figure 1: The cyclical procedure of decision-making [10].

In the need (problem) recognition stage, the consumer identifies their needs and relates them to specific products or services. During the information search stage, decision tree model gathers product or service information from various sources such as individuals, businesses, the public, and personal experiences. During the alternatives evaluation stage, the consumer considers the attributes, benefits, and value of different products or services to form various purchase options [11] and confirm their attitude towards purchasing. In the purchase decision stage, the consumer forms an intention to purchase and develops preferences among different options. Finally, in the post-purchase behavior phase, customers evaluate the value obtained from the purchase and expresses satisfaction or dissatisfaction through their actions.

Consumer purchasing actions encompass more than just the mere act of consumers buying products and consuming them, but indicate the entire objective material process in which individuals follow the innate tendency to search for, choose, acquire, utilize, assess, and dispose various goods and services in order to meet their wants and requirements [12]. It is a dynamic process that is constantly influenced by individual and interpersonal factors, which have a mutually influential effection on consumer purchasing behavior.

2.3. Factors that affect consumer behaviour

Real-life consumer behaviour is decided by a range of factors that are internal or external. By understanding the relationship between the factors and consumer behaviour, businesses are able to proceed further analytics to help make market strategies. Table 2 shows briefly what the factors are and how they influence on consumer behaviour.

Table 2: Factors that affect consumer behaviours.

Factors | Example | Influence | |

Personal Factors | Age | Technology adoption and brand loyalty | |

Economic factors | Income level and financial situations | Purchasing power and risk level | |

Marketing and Advertising | Social network advertisement | Brand recognition and loyalty | |

Social Influences | Peer pressure | Product preference | |

Personal factors play an essential role in influencing customers' choices when purchasing products or services, for example, age. Young consumers embrace new technologies such as computers and phones more often than older ones, as they have a low demand for the development of modern technology. While young people are more open to new trends, elders have higher brand loyalty. Businesses should develop different products for people of different stages, for instance, young singles, unmarried couples and married couples[13].

Income levels and financial situations also determine consumer behaviour. A person with a high-income level has a larger budget and a higher confidence level, thus having more substantial purchasing power. If a consumer has a stable financial situation, he may purchase more luxuries instead of necessities as he has more budget to spend to raise his living quality. He may also focus on long-term investments because it has a lower risk despite earning less than short-term investments. By understanding how economic factors affect consumers, businesses can change their strategies according to the economic conditions in the whole society.

Additionally, marketing and advertising significantly impact consumer behaviour as they build brand awareness[14]. By consistently exposing the brand across multiple social networks, consumers become more familiar with its products and develop a connection to recognise and consider the brand an option. After the consumer finishes his first purchase, if the quality of the product is fine, he will build more recognition and slowly foster brand loyalty. Through consistent engagement of brand values, advertising campaigns will create a sense of consumer trust.

What’s more, consumers' behaviours might be affected due to their interaction with their family, friends, or social media. As people receive peer recommendations, they would often rely on others. For example, a person is more inclined to buy a product when they observe their preferred influencers endorsing it. Additionally, advertisements can influence consumer behaviour by creating a desire for specific products or services.

2.4. Consumer buying habits

2.4.1. Shopping method

According to Scout's Consumer Trends Report 2021, it is observed that consumers typically engage in two types of shopping methods: online shopping and offline shopping. The report reveals that among the surveyed consumers, 78% of individuals prefer online shopping, with 46% exclusively shopping online. Additionally, 54% of consumers gravitate towards physical stores, with 22% exclusively shopping at brick-and-mortar locations [15].

2.4.2. Shopping location

Shopping locations can be categorized into two types, depending on the shopping method: online and offline. Online shopping platforms include Amazon, Walmart online store, Target, etc. Offline shopping locations include Walmart stores, Target stores, Kohl's department stores, etc [16].

2.4.3. Shopping frequency

Shopping seems to be part of everyday life for most people. According to the research conducted by Brusdal, Ragnhild and Randi Lavik, it was found that 63% of Norwegian teenagers shop at least once a week, with girls shopping more frequently than boys. Age is not a significant factor that affects shopping frequency. The shopping frequency is similar across different age groups [17].

3. Predictive Analysis Techniques

Predictive analysis refers to a type of analysis that predicts future events, behaviors, and outcomes based on assumptions about data. It encompasses the utilization of data mining methodologies, past data, and conjectures regarding forthcoming circumstances. In this section, we will introduce three commonly used techniques for predictive analysis, namely big data, decision trees, and customer relationship management.

3.1. Big data

Definitions of big data can vary based on factors like time and data type. However, most definitions describe it as the analytical process where a significant amount of data points undergo processing to generate a final outcome. The objective of this result is to address questions and resolve issues. The definition of big data cannot solely rely on dataset size, but also on the capability to search, combine, and cross-reference large datasets. Big data becomes essential when a substantial amount of data is collected and traditional data management methods are inadequate for analysis[18].

Predictive analytics encompasses a series of procedures aimed at identifying patterns and connections among variables in order to make future predictions using both current and past data[19].

a. Data collection. The aim of the prediction should be precise before developing a prediction model. The type of data required is determined. Analysts will then collect datasets from different sources, for example, online activities, transaction histories and surveys, when predicting consumer behavior.

b. Data analysis. Data analysts examine the data and make it ready for utilization in the predictive model. All data is transformed into a standardized format that can be easily interpreted by the machine. Additionally, any outliers or missing values are dealt with to maintain a high-quality dataset, as the performance and efficacy of the model are greatly dependent on the data's quality.

c. Machine learning. The field of predictive analytics utilizes a wide range of statistical and machine-learning techniques. Certain techniques, such as moving averages, analyze historical patterns in outcome variables and project them into the future. Methods such as linear regression are designed to explore the connection between outcome variables and explanatory variables with the purpose of making predictions [20].

d. Predictive modelling. A model is built based on the learning techniques and the original dataset. The model's validity is subsequently assessed. If it is successful, the model is fit and can be used to make accurate predictions on the new data inputted into the system, which means that it is able to help businesses make predictions on how consumers will react due to different factors and then, change marketing strategies or targeted market to optimize profit.

e. Monitoring. The model will not be 100% accurate in prediction, as there are always minor factors that the model does not consider. As time progresses, the model's accuracy will decrease due to changing variables. Therefore, it is crucial to regularly monitor the model to ensure accurate results. When it is not fit anymore, the variables or data should be changed to enhance the precision of the model. As the model becomes more accurate, it is able to predict deeper into the future. Hence businesses can make changes earlier to prevent losses and focus on better long-term strategies.

3.2. Decision-tree model

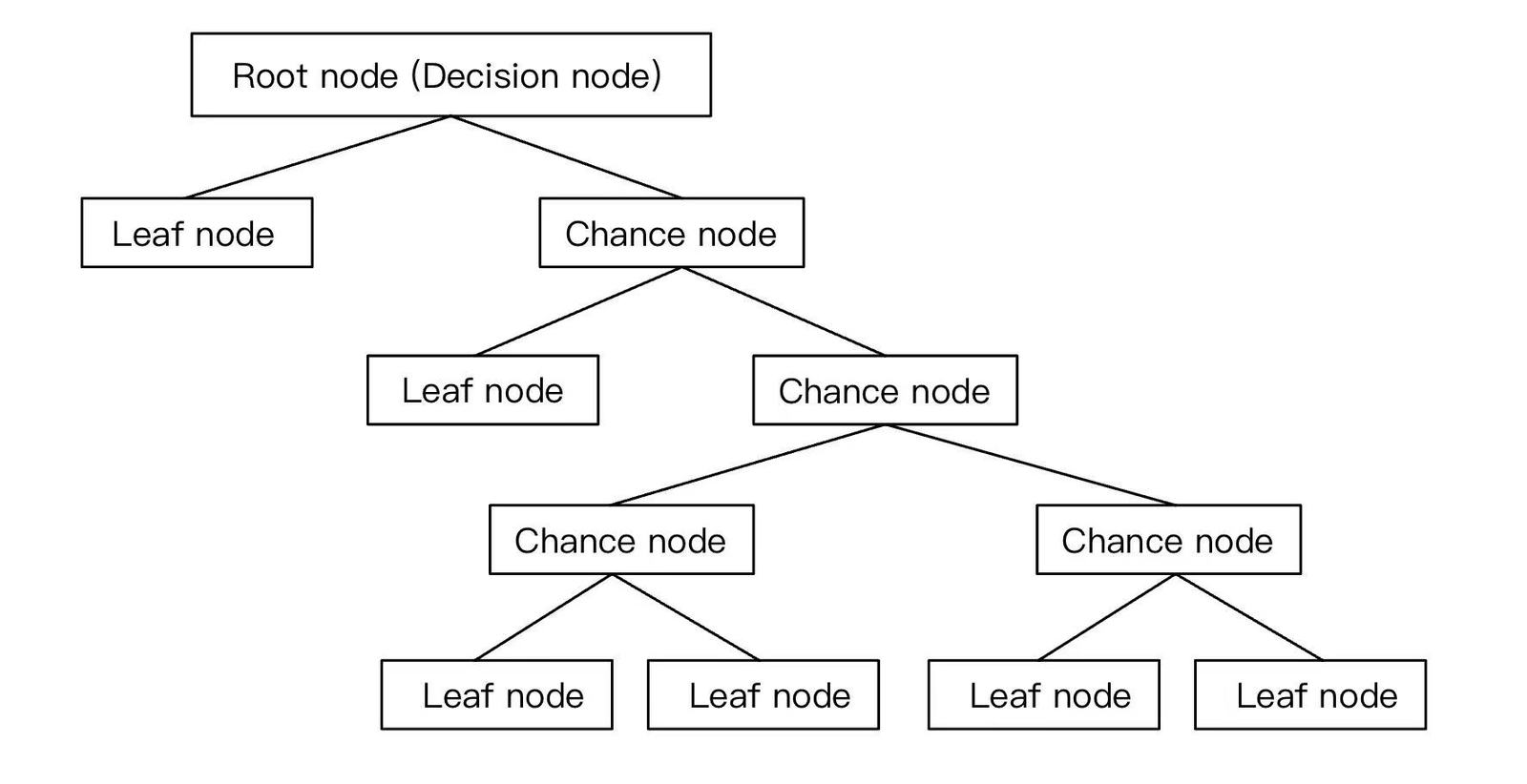

A decision tree is a specific type of machine-learning algorithm that falls under the category of supervised learning. It is constructed using past data and is mainly employed to solve classification tasks. It forms a visual representation in the form of a tree structure[21], starting with selecting variables from the data that have discriminative power, then splits the dataset into two or more subsets, and repeats this process.

Figure 2: Structure of decision tree [22].

In Figure 2, the root node symbolizes the complete dataset. It is split into distinct subsets that do not overlap. Internal nodes, also referred to as chance nodes, represent the different options available within the tree structure. The upper boundary is linked to the parent node, while the lower boundary is connected to leaf nodes (child nodes). Leaf nodes explain the final prediction result derived from a sequence of choices or occurrences [23].

Decision trees find extensive use in predicting consumer behavior, particularly in consumer segmentation. This model divides the consumer into target market through progressively dividing the consumer population based on distinct consumption habits and preferences. Consequently, each target market consists of consumers exhibiting different purchasing characteristics. For businesses, decision trees can be instrumental in identifying target customers, understanding their specific needs, and developing personalized marketing strategies.

\( G(P)=\sum _{i=1}^{n}Pi(1-Pi)=\sum _{i=1}^{n}(Pi-{Pi^{2}})=1-\sum _{i=1}^{n}({Pi^{2}}),G(P)∈[0,1] \) (1)

\( E(P)=-\sum _{i=1}^{n}Pi*{log_{2}}{Pi} \) (2)

Where \( Pi \) represents relative frequency of class \( i \)

When evaluating the branching effect of tree models, we commonly use a metric called Gini Impurity [24]. It measures the probability of a randomly chosen subset being misclassified into other categories, thus reflecting the classification effectiveness of the node. The closer the value of \( G(P) \) approaches zero, the more effective the splitting of branches in the model becomes. This indicates that the selected chance node is more representative.

In addition to the mentioned Gini impurity, we can also evaluate the effectiveness of decision node splitting using Information Gain [25]. This metric measures the reduction in uncertainty of the entire system, and the higher amount indicates a better splitting effect. In tree models, we use Entropy Analysis [26] to measure the uncertainty of information. If a single leaf node in the tree model contains more classifications, the entropy is higher and the splitting effect is worse. The optimal scenario is when a single leaf node only contains one classification.

3.3. Consumer Relationship Management(CRM)

CRM allows for unlimited expansion of customer information, creating a 360-degree view of the customer. When combined with data sampling and analysis modules, CRM can be used to create various customer analysis and prediction models based on specific needs. To establish a prediction model, data sampling is first conducted, and then customer behavior prediction data is generated through customizable data analysis modules in CRM based on certain rules.

CRM utilizes complex modeling and data mining techniques, along with any historical data relevant to customer behavior, to forecast future behavior. By analyzing purchase tendencies for specific products, we can identify which types of customers are more likely to purchase them. Additionally, by analyzing product affinity, we can determine which specific products are commonly purchased together by certain customer segments. This trend plays a crucial role in forming marketing decisions. The data mining activities conducted through CRM provide companies with valuable insight about their most valuable consumers, ultimately leading to maximum sales revenue [27].

Data is the most critical part of any CRM model solution. The types of data that CRM needs to utilize primarily include identity data, descriptive data, quantitative data, and qualitative data [28]. The more understanding a company has about its customers, the better it can accurately predict their needs and behaviors, and develop more precise marketing and management strategies.

4. Application in Different Industries

4.1. Retail industry

Most of retail data are transactional data with the following mainly characteristics: massiveness, sparseness and heterogeneity [29].

BDA can provide assistance for retail store owners in procurement, represent what to bundle up products for sales, what are the lately trends of purchase. But as for the larger enterprises, Amazon for example, they have already developed BDA into detailed finance refinement and adjustment. According to the data from Amazon, it has lowered shipping costs by 10 to 40% by choosing the warehouses to vendor [30]

Carlos Vaca; Daniel Riofrlo; Noel Oerez; Diego Benltez;(2020) proposed a forecasting model to analysis Buy&Sell Trends and the research yielded that the AUC score is 0.81 which indicates the decision tree model has a high level of authenticity as the detection method for this study [31].

Harsh Valecha; Aparna Varma; (2018) proposed a model predicting consumer behavior influenced by changing parameters such as environmental, organizational, individual and interpersonal factor, giving 94% accuracy using decision tree [32].

With the rise of globalization and market saturation, retailers are adopting Consumer Relationship Management (CRM) strategies to effectively manage customer relationships and gain a competitive edge. This is particularly important in an era of increased competition through mergers and acquisitions[33].

Minami and Dawson (2008) proposed that the effect of CRM in the retail industry on loyalty development and financial return. In this study, the model indicated that there is a positive impact of CRM implementation on financial outcome which increases the Return on Equity (ROE) [34].

In the retail industry, CRM's limitation lies in data collection. Retailers need to gather customer information data through methods such as membership cards and online surveys in order to establish a CRM model.

4.2. E-commerce

In the age of electronic commerce, the need to reshape the marketing function of a company arises from the structural changes occurring in the competitive environment in which the company operates. Companies are shifting from a highly competitive market where there are many different products and services, standardization is common, products have long lifecycles, and limited information is exchanged in one-time transactions. Companies are entering a new global competitive environment. In this new competitive environment, the focus of company operations shifts from production equipment to customers, making it particularly urgent to reshape the marketing function of the company.

Big data analytics (BDA) has been a technique in a rising trend for the past decade. Until 2016, a significant majority of Fortune 1000 companies, accounting for 91%, were actively engaging in investments in Big Data Analytics (BDA) projects. This marked an impressive increase of 85% compared to the previous year. In return, companies who applied BDA has experienced 5-6% boost in productivity, and meanwhile, according to Alliance in the USA, BDA is one of the major factors (10% or more) of growth of 56% of companies in the past year. Not only can the BDA enhance the revenue, but it also can provide assistance in deescalating the cost. For example, Premier Healthcare has successfully downsized the cost by 2.85 billion through applying BDA into business strategies.[35]

Safara, F. (2020) proposed a prediction matrix to anticipate the consequences of the COVID-19 epidemic related to consumer behavior in the realm of online shopping, achieving a result of 94.6% accuracy and gaining superior results of 95.3% where DT is improved by combining with Bagging and Boosting methods [36].

Lee and Park (2007) developed a tree model to forecast the achievement of online business for a particular service. The accuracy of the prediction made by the decision-tree model was 77.49%, surpassing the accuracy of other models. This suggests that the decision-tree approach is highly valuable[37].

Using modern technology, an automated management system called Consumer Relationship Management (CRM) can effectively coordinate and optimize the three key elements: customers, competition, and brand. CRM is a powerful tool that can quickly capture customer opportunities and cater to customer needs, reshaping an enterprise's marketing system to be information-driven, action-coordinated, and responsive. The study by Chan, Cheng, and Hsu (2007) put forward a dynamic pricing method that involves agents using strategies based on CRM concepts. According to their findings, using CRM can enhance customers' bargaining gain by 16.2%. Additionally, the study suggests that by achieving similar bargaining gains, a CRM-based bargaining agent can generate higher levels of customer satisfaction (4.43) and customer loyalty (4.31)[38].

In the era of e-commerce, businesses are shifting from mass production systems to agile competitive systems. CRM can enhance customer value and improve competitiveness through collaboration. It leverages the power of personnel and information to elevate the level of customer relationship management, helping businesses establish a profitable and stable foundation for operations [39].

4.3. Financing industry

The concept of Big Data differs greatly between the finance and retail industries. In finance, Big Data analysis primarily involves structured data collected from specific sources such as exchanges and data vendors. Unlike the retail industry, which analyzes random and unorganized data from social media. For instance, Facebook has developed an underwriting model that has shown a significant improvement of 25% in accuracy and precision compared to historical data[40]. Algorithmic trading, a subset of Big Data, has experienced significant growth in recent decades. In 2009, it reached its peak with over 70% of US equity trading volume being influenced by this method[40]. The utilization of Big Data can also contribute to the enhancement of risk management. An exemplary case is the UOB bank in Singapore, which effectively implemented a big data system to significantly reduce the time required for calculating VaR (Value at Risk) from approximately 18 hours to just a few seconds[40].

In the field of finance, Wang and Yang (2007) introduced a decision tree approach to assess the risk of money laundering by customers. Their study proved the effectiveness of using a decision-tree model within a real-time transaction system of a bank. This model enabled the identification of illegal transactions and the automatic determination of the money laundering risk level for each customer[41].

Consumer Relationship Management, is a valuable tool used by financial service institutions like investment banks, hedge funds and insurance companies. It helps these institutions manage and enhance their relationships with customers by providing a centralized platform for customer-centric activities.

Krasnikov, A., Jayachandran, S., & Kumar, V. (2009) proposed that CRM applications can enhance revenue efficiency as a means to improve profit efficiency which indicates that the company can achieve a high economic output with relatively low input[42].

Eid, R. (2007) put forth a comprehensive model that combines CRM and critical success factors (CSF) to examine the implementation of CRM in the banking industry. According to the findings of the research, we can conclude that when CSF variables are combined with CRM, they are able to explain a significant portion of relationship quality (56.1%), transaction quality (60.3%), and cost reduction (60.9%)[43].

Customers are crucial to the financial service industry, and ensuring the solidity of these relationships is vital to the success of institutions. Financial service professionals use financial CRM software to coordinate customer outreach, manage documents, perform account analysis, schedule meetings, establish and maintain sales channels, and execute Know Your Customer verification.

5. Conclusion

The interpretation of consumer behaviors differentiates a purchase down to scratches, which helps decision makers to target for buyers with specific needs. This thesis discussed consumer behaviors in categorizations, the constituent factors of consumer behaviors, factors which affect different consumer behaviors, and as well as the consumer buying habits in order to enhance the knowledge and comprehension of consumer behaviors.

Big Data Analytics helps with the vast amount of data it provides to analysts. It narrows down from the massive dataset with different variables to a possible prediction for the business to take reference and decide on marketing strategies.

Decision tree is a learning algorithm built based on historical data and is primarily used for classification problems by continuously dividing the entire dataset into multiple subsets. The model is widely used for consumer segmentation, thus the company can target specific market by developing personalized marketing strategies.

Consumer Relationship Management (CRM) is a analysis technique showing a 360-degree view of the customer. through data sampling based on complex modeling and historical data, thus generate specific customer behavior prediction. Companies can accurately predict customer needs and behaviors through CRM, so as to develop more accurate marketing and management strategies.

References

[1]. Jisana, T. K. (2014). Consumer behaviour models: an overview. Sai Om Journal of Commerce & Management, 1(5), 34-43.

[2]. Peter, J. P., Olson, J. C., & Grunert, K. G. (1999). Consumer behavior and marketing strategy.

[3]. Su, X. (2017). Introduction to big data. IFUD1123.

[4]. Lee, C. S., Cheang, P. Y. S., & Moslehpour, M. (2022). Predictive analytics in business analytics: decision tree. Advances in Decision Sciences, 26(1), 1-29.

[5]. Tirenni, G., Kaiser, C., & Herrmann, A. (2007). Applying decision trees for value-based customer relations management: Predicting airline customers' future values. Journal of Database Marketing & Customer Strategy Management, 14, 130-142.

[6]. Duan, L., Bo, W., Wu, C., Ning, H., & Zhang, C. (2019). Customer Classification-Based Pre-sale Multi-value-chain Collaborative Mechanism Verification. In Human Centered Computing: 5th International Conference, HCC 2019, Čačak, Serbia, August 5–7, 2019, Revised Selected Papers 5 (pp. 86-97). Springer International Publishing.

[7]. Foxall, G. R. (1998). Radical Behaviorist Interpretation: Generating and evaluating an account of consumer behavior. Behavior Analyst, 21(2), 321-354.

[8]. Achar, C., So, J., Agrawal, N., & Duhachek, A. (2016). What we feel and why we buy: the influence of emotions on consumer decision-making. Current Opinion in Psychology, 10, 166-170.

[9]. Stankevich, A. (2017). Explaining the consumer decision-making process: Critical literature review. Journal of international business research and marketing, 2(6).

[10]. Lunenburg, F. C. (2010, September). The decision making process. In National Forum of Educational Administration & Supervision Journal (Vol. 27, No. 4).

[11]. ]McGill, A. L., & Anand, P. (1989). The effect of vivid attributes on the evaluation of alternatives: The role of differential attention and cognitive elaboration. Journal of consumer Research, 16(2), 188-196.

[12]. Bucko, J., Kakalejčík, L., & Ferencová, M. (2018). Online shopping: Factors that affect consumer purchasing behaviour. Cogent Business & Management, 5(1), 1535751.

[13]. Gajjar, N. B. (2013). Factors affecting consumer behavior. International Journal of Research in Humanities and Social Sciences, 1(2), 10-15.

[14]. Rehman, F. U., Ilyas, M., Nawaz, T., & Hyder, S. (2014). How Facebook advertising affects buying behavior of young consumers: The moderating role of gender. Academic Research International, 5(4), 395-404.

[15]. Pentz, C. D., Du Preez, R., & Swiegers, L. (2020). The online shopping behaviour of technologically enabled consumers: a South African Generation Y study. African Journal of Business and Economic Research, 15(3), 227.

[16]. Ratchford, B., Soysal, G., Zentner, A., & Gauri, D. K. (2022). Online and offline retailing: What we know and directions for future research. Journal of Retailing, 98(1), 152-177.

[17]. Brusdal, R., & Lavik, R. (2008). Just shopping? A closer look at youth and shopping in Norway. Young, 16(4), 393-408.

[18]. Cui, L., Yu, F. R., & Yan, Q. (2016). When big data meets software-defined networking: SDN for big data and big data for SDN. IEEE network, 30(1), 58-65.

[19]. Kumar, V., & Garg, M. L. (2018). Predictive analytics: a review of trends and techniques. International Journal of Computer Applications, 182(1), 31-37.

[20]. Gandomi, A., & Haider, M. (2015). Beyond the hype: Big data concepts, methods, and analytics.International journal of information management, 35(2), 137-144.

[21]. Sharma, H., & Kumar, S. (2016). A survey on decision tree algorithms of classification in data mining. International Journal of Science and Research (IJSR), 5(4), 2094-2097.

[22]. Kotsiantis, S. B. (2013). Decision trees: a recent overview. Artificial Intelligence Review, 39, 261-283.

[23]. Song, Y. Y., & Ying, L. U. (2015). Decision tree methods: applications for classification and prediction. Shanghai archives of psychiatry, 27(2), 130.

[24]. Suthaharan, S., & Suthaharan, S. (2016). Decision tree learning. Machine Learning Models and Algorithms for Big Data Classification: Thinking with Examples for Effective Learning, 237-269.

[25]. Tangirala, S. (2020). Evaluating the impact of GINI index and information gain on classification using decision tree classifier algorithm. International Journal of Advanced Computer Science and Applications, 11(2), 612-619.

[26]. Wellmann, J. F., & Regenauer-Lieb, K. (2012). Uncertainties have a meaning: Information entropy as a quality measure for 3-D geological models. Tectonophysics, 526, 207-216.

[27]. Sigala, M. (2004). Customer relationship management (CRM) evaluation: diffusing CRM benefits into business processes. ECIS 2004 Proceedings, 172.

[28]. Kracklauer, A. H., Mills, D. Q., & Seifert, D. (2004). Customer management as the origin of collaborative customer relationship management. In Collaborative customer relationship management: taking CRM to the next level (pp. 3-6). Berlin, Heidelberg: Springer Berlin Heidelberg.

[29]. Apte, C., Liu, B., Pednault, E. P., & Smyth, P. (2002). Business applications of data mining. Communications of the ACM, 45(8), 49-53.

[30]. Prasad, J., & Venkatesham, T. (2021). Big Data Analytics- in retail sector. International journal of computer science and mobile computing, 10(7), 34-38.

[31]. Vaca, C., RiofrÍo, D., Pérez, N., & BenÍtez, D. (2020, August). Buy & Sell Trends Analysis Using Decision Trees. In 2020 IEEE Colombian Conference on Applications of Computational Intelligence (IEEE ColCACI 2020) (pp. 1-6). IEEE.

[32]. Valecha, H., Varma, A., Khare, I., Sachdeva, A., & Goyal, M. (2018, November). Prediction of consumer behaviour using random forest algorithm. In 2018 5th IEEE Uttar Pradesh section international conference on electrical, electronics and computer engineering (UPCON) (pp. 1-6). IEEE.

[33]. Anderson, J. L., Jolly, L. D., & Fairhurst, A. E. (2007). Customer relationship management in retailing: A content analysis of retail trade journals. Journal of Retailing and Consumer services, 14(6), 394-399.

[34]. Minami, C., & Dawson, J. (2008). The CRM process in retail and service sector firms in Japan: Loyalty development and financial return. Journal of Retailing and Consumer Services, 15(5), 375-385.

[35]. Akter, S., & Wamba, S. F. (2016). Big Data Analytics in e-commerce: A Systematic Review and Agenda for Future research. Electronic Markets, 26(2), 173/185

[36]. Safara, F. (2022). A computational model to predict consumer behaviour during COVID-19 pandemic. Computational Economics, 59(4), 1525-1538.

[37]. Lee, S., Lee, S., & Park, Y. (2007). A prediction model for success of services in e-commerce using decision tree: E-customer’s attitude towards online service. Expert Systems with Applications, 33(3), 572-581.

[38]. Chan, C. C. H., Cheng, C. B., & Hsu, C. H. (2007). Bargaining strategy formulation with CRM for an e-commerce agent. Electronic Commerce Research and Applications, 6(4), 490-498.

[39]. Fan, Y. W., & Ku, E. (2010). Customer focus, service process fit and customer relationship management profitability: the effect of knowledge sharing. The Service Industries Journal, 30(2), 203-223.

[40]. Fang, B., & Zhang, P. (2016). Big data in finance. En Springer eBooks (pp. 391-412). 400-403

[41]. Wang, S. N., & Yang, J. G. (2007, August). A money laundering risk evaluation method based on decision tree. In 2007 international conference on machine learning and cybernetics (Vol. 1, pp. 283-286). IEEE.

[42]. Krasnikov, A., Jayachandran, S., & Kumar, V. (2009). The impact of customer relationship management implementation on cost and profit efficiencies: evidence from the US commercial banking industry. Journal of marketing, 73(6), 61-76.

[43]. Eid, R. (2007). Towards a successful CRM implementation in banks: An integrated model. The service industries journal, 27(8), 1021-1039.

Cite this article

Xu,Y.;Ma,Y.;Hu,R.;Wang,H. (2024). Predictive Analytics Techniques in Consumer Behaviour: A Literature Review. Advances in Economics, Management and Political Sciences,97,20-31.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jisana, T. K. (2014). Consumer behaviour models: an overview. Sai Om Journal of Commerce & Management, 1(5), 34-43.

[2]. Peter, J. P., Olson, J. C., & Grunert, K. G. (1999). Consumer behavior and marketing strategy.

[3]. Su, X. (2017). Introduction to big data. IFUD1123.

[4]. Lee, C. S., Cheang, P. Y. S., & Moslehpour, M. (2022). Predictive analytics in business analytics: decision tree. Advances in Decision Sciences, 26(1), 1-29.

[5]. Tirenni, G., Kaiser, C., & Herrmann, A. (2007). Applying decision trees for value-based customer relations management: Predicting airline customers' future values. Journal of Database Marketing & Customer Strategy Management, 14, 130-142.

[6]. Duan, L., Bo, W., Wu, C., Ning, H., & Zhang, C. (2019). Customer Classification-Based Pre-sale Multi-value-chain Collaborative Mechanism Verification. In Human Centered Computing: 5th International Conference, HCC 2019, Čačak, Serbia, August 5–7, 2019, Revised Selected Papers 5 (pp. 86-97). Springer International Publishing.

[7]. Foxall, G. R. (1998). Radical Behaviorist Interpretation: Generating and evaluating an account of consumer behavior. Behavior Analyst, 21(2), 321-354.

[8]. Achar, C., So, J., Agrawal, N., & Duhachek, A. (2016). What we feel and why we buy: the influence of emotions on consumer decision-making. Current Opinion in Psychology, 10, 166-170.

[9]. Stankevich, A. (2017). Explaining the consumer decision-making process: Critical literature review. Journal of international business research and marketing, 2(6).

[10]. Lunenburg, F. C. (2010, September). The decision making process. In National Forum of Educational Administration & Supervision Journal (Vol. 27, No. 4).

[11]. ]McGill, A. L., & Anand, P. (1989). The effect of vivid attributes on the evaluation of alternatives: The role of differential attention and cognitive elaboration. Journal of consumer Research, 16(2), 188-196.

[12]. Bucko, J., Kakalejčík, L., & Ferencová, M. (2018). Online shopping: Factors that affect consumer purchasing behaviour. Cogent Business & Management, 5(1), 1535751.

[13]. Gajjar, N. B. (2013). Factors affecting consumer behavior. International Journal of Research in Humanities and Social Sciences, 1(2), 10-15.

[14]. Rehman, F. U., Ilyas, M., Nawaz, T., & Hyder, S. (2014). How Facebook advertising affects buying behavior of young consumers: The moderating role of gender. Academic Research International, 5(4), 395-404.

[15]. Pentz, C. D., Du Preez, R., & Swiegers, L. (2020). The online shopping behaviour of technologically enabled consumers: a South African Generation Y study. African Journal of Business and Economic Research, 15(3), 227.

[16]. Ratchford, B., Soysal, G., Zentner, A., & Gauri, D. K. (2022). Online and offline retailing: What we know and directions for future research. Journal of Retailing, 98(1), 152-177.

[17]. Brusdal, R., & Lavik, R. (2008). Just shopping? A closer look at youth and shopping in Norway. Young, 16(4), 393-408.

[18]. Cui, L., Yu, F. R., & Yan, Q. (2016). When big data meets software-defined networking: SDN for big data and big data for SDN. IEEE network, 30(1), 58-65.

[19]. Kumar, V., & Garg, M. L. (2018). Predictive analytics: a review of trends and techniques. International Journal of Computer Applications, 182(1), 31-37.

[20]. Gandomi, A., & Haider, M. (2015). Beyond the hype: Big data concepts, methods, and analytics.International journal of information management, 35(2), 137-144.

[21]. Sharma, H., & Kumar, S. (2016). A survey on decision tree algorithms of classification in data mining. International Journal of Science and Research (IJSR), 5(4), 2094-2097.

[22]. Kotsiantis, S. B. (2013). Decision trees: a recent overview. Artificial Intelligence Review, 39, 261-283.

[23]. Song, Y. Y., & Ying, L. U. (2015). Decision tree methods: applications for classification and prediction. Shanghai archives of psychiatry, 27(2), 130.

[24]. Suthaharan, S., & Suthaharan, S. (2016). Decision tree learning. Machine Learning Models and Algorithms for Big Data Classification: Thinking with Examples for Effective Learning, 237-269.

[25]. Tangirala, S. (2020). Evaluating the impact of GINI index and information gain on classification using decision tree classifier algorithm. International Journal of Advanced Computer Science and Applications, 11(2), 612-619.

[26]. Wellmann, J. F., & Regenauer-Lieb, K. (2012). Uncertainties have a meaning: Information entropy as a quality measure for 3-D geological models. Tectonophysics, 526, 207-216.

[27]. Sigala, M. (2004). Customer relationship management (CRM) evaluation: diffusing CRM benefits into business processes. ECIS 2004 Proceedings, 172.

[28]. Kracklauer, A. H., Mills, D. Q., & Seifert, D. (2004). Customer management as the origin of collaborative customer relationship management. In Collaborative customer relationship management: taking CRM to the next level (pp. 3-6). Berlin, Heidelberg: Springer Berlin Heidelberg.

[29]. Apte, C., Liu, B., Pednault, E. P., & Smyth, P. (2002). Business applications of data mining. Communications of the ACM, 45(8), 49-53.

[30]. Prasad, J., & Venkatesham, T. (2021). Big Data Analytics- in retail sector. International journal of computer science and mobile computing, 10(7), 34-38.

[31]. Vaca, C., RiofrÍo, D., Pérez, N., & BenÍtez, D. (2020, August). Buy & Sell Trends Analysis Using Decision Trees. In 2020 IEEE Colombian Conference on Applications of Computational Intelligence (IEEE ColCACI 2020) (pp. 1-6). IEEE.

[32]. Valecha, H., Varma, A., Khare, I., Sachdeva, A., & Goyal, M. (2018, November). Prediction of consumer behaviour using random forest algorithm. In 2018 5th IEEE Uttar Pradesh section international conference on electrical, electronics and computer engineering (UPCON) (pp. 1-6). IEEE.

[33]. Anderson, J. L., Jolly, L. D., & Fairhurst, A. E. (2007). Customer relationship management in retailing: A content analysis of retail trade journals. Journal of Retailing and Consumer services, 14(6), 394-399.

[34]. Minami, C., & Dawson, J. (2008). The CRM process in retail and service sector firms in Japan: Loyalty development and financial return. Journal of Retailing and Consumer Services, 15(5), 375-385.

[35]. Akter, S., & Wamba, S. F. (2016). Big Data Analytics in e-commerce: A Systematic Review and Agenda for Future research. Electronic Markets, 26(2), 173/185

[36]. Safara, F. (2022). A computational model to predict consumer behaviour during COVID-19 pandemic. Computational Economics, 59(4), 1525-1538.

[37]. Lee, S., Lee, S., & Park, Y. (2007). A prediction model for success of services in e-commerce using decision tree: E-customer’s attitude towards online service. Expert Systems with Applications, 33(3), 572-581.

[38]. Chan, C. C. H., Cheng, C. B., & Hsu, C. H. (2007). Bargaining strategy formulation with CRM for an e-commerce agent. Electronic Commerce Research and Applications, 6(4), 490-498.

[39]. Fan, Y. W., & Ku, E. (2010). Customer focus, service process fit and customer relationship management profitability: the effect of knowledge sharing. The Service Industries Journal, 30(2), 203-223.

[40]. Fang, B., & Zhang, P. (2016). Big data in finance. En Springer eBooks (pp. 391-412). 400-403

[41]. Wang, S. N., & Yang, J. G. (2007, August). A money laundering risk evaluation method based on decision tree. In 2007 international conference on machine learning and cybernetics (Vol. 1, pp. 283-286). IEEE.

[42]. Krasnikov, A., Jayachandran, S., & Kumar, V. (2009). The impact of customer relationship management implementation on cost and profit efficiencies: evidence from the US commercial banking industry. Journal of marketing, 73(6), 61-76.

[43]. Eid, R. (2007). Towards a successful CRM implementation in banks: An integrated model. The service industries journal, 27(8), 1021-1039.