1. Introduction

Shadow banking is a widely discussed topic but is not well understood. It is the subject of intense regulatory scrutiny but is not yet clearly defined [1]. Shadow banking pertains to a framework of financial transactions that transpire beyond the conventional banking sector while encompassing intermediation, credit generation, and risk assumption. Shadow banks represent financial entities that execute analogous operations and undertake comparable risks as traditional banks [2]. These entities provide services similar to traditional banks, such as borrowing and lending, but they operate with less regulatory oversight and are often funded by short-term, less stable sources.

Shadow banking is pivotal in the financial system by enhancing credit availability and liquidity. However, it also raises concerns due to its potential to amplify financial risks. The opacity of its operations, limited regulatory supervision, and interconnectedness with the broader financial system can lead to systemic vulnerabilities, as seen during the 2007-2008 global financial crisis.

Efforts have been made to regulate and monitor shadow banking activities to prevent systemic instability. Regulatory reforms seek to address issues related to transparency, risk management, and capital requirements. Despite these efforts, the complex and evolving nature of shadow banking continues to challenge regulators in maintaining a balance between financial innovation and stability.

In this paper, the work is trying to compare the systems of shadow banking in China and the United States to compare them. After much searching of the literature and the literature review done by previous authors, the work will be divided into three parts. Firstly, the work will systematically state the structure of shadow banking in China and the United States separately. The work will compare the two, and finally, it will further discuss the future development prospect of shadow banking in light of the current practical hotspots, such as ESG and AI.

1.1. China's shadow banking system structure

China's shadow banking system encompasses a variety of financial operations taking place beyond the confines of the conventional banking industry, frequently involving non-banking financial entities and diverse off-balance-sheet arrangements. This system had grown rapidly in the years leading up to 2021, raising concerns about its potential risks to financial stability [2]. The structure of China's shadow banking system included several key components.

1.2. Wealth Management Products (WMPs)

These are investment products offered by banks and other financial institutions to investors seeking higher yields than traditional deposits. WMPs often invest in various underlying assets, including corporate bonds, trust loans, and other higher-risk instruments. Wealth management products (WMPs) and shadow banking are closely related concepts in China's financial landscape, often intertwined due to regulatory and market dynamics. Let's break down their relationship. The work studies the rise and risks in bank issuance of Wealth Management Products (WMPs), which are off-balance-sheet substitutes for deposits without the regulatory interest rate ceilings [3]. These products typically include fixed-income assets, equities, and other financial instruments. WMPs gained significant popularity in China due to their promise of higher yields than traditional deposit accounts.

In China, there has been a close relationship between WMPs and shadow banking due to a combination of factors:

Regulatory Arbitrage: Banks and financial institutions sometimes use WMPs to bypass stricter regulatory requirements imposed on traditional banking activities. By structuring certain assets as WMPs, financial institutions could circumvent capital adequacy and other prudential regulations.

Yield Hunger: Chinese savers have historically sought higher returns on their investments, which WMPs offered due to their investment in various assets. This demand for higher yields incentivized financial institutions to create complex and sometimes risky products.

Risks and Defaults: As the Chinese economy faced challenges and certain shadow banking assets turned sour, WMPs encountering liquidity issues and defaults emerged. This led to concerns about the risks associated with investing in these products, which prompted the Chinese government to tighten regulations.

In response to these risks and potential systemic vulnerabilities, the Chinese government has implemented various measures to curtail the growth of shadow banking and bring greater transparency and oversight to WMPs. These measures include stricter regulations on issuing WMPs, enhancing risk management, and pushing for greater alignment between these products and genuine asset allocation strategies.

Overall, the relationship between wealth management products and shadow banking in China has highlighted the challenges of balancing innovation, investor demands, and regulatory stability within the financial system. The government's efforts to address these issues have led to significant changes in the landscape of both WMPs and shadow banking in the country.

1.3. Trust Companies

Trust companies played a significant role in China's shadow banking system. They offered trust products often invested in real estate projects, infrastructure, and other higher-yielding assets [4]. These products attracted investors looking for better returns but were associated with higher risks. Shadow banking and trust funds are both financial concepts that play a role in China's financial landscape, but they are not directly linked. Let's explore both concepts and their relationship to the Chinese financial system:

Shadow banking refers to financial transactions that occur beyond the confines of traditional banking institutions, encompassing credit intermediation and assuming various levels of risk. These activities include lending, borrowing, and investing, often involving non-bank financial institutions. Shadow banking activities can include money market funds, asset-backed securities, repurchase agreements (repos), and other forms of credit provision.

Trust funds are a type of financial arrangement where one party (the trustor) transfers assets to a trustee, who manages those assets on behalf of beneficiaries according to the terms specified in a trust agreement. Trust funds can be used for various purposes, including estate planning, wealth preservation, and charitable giving. Trusts offer flexibility in asset management and distribution while providing potential tax benefits.

In China, trust funds have been used for various purposes, and they have gained popularity as investment vehicles. They are often structured to invest in a diverse range of assets, including real estate, stocks, bonds, and more. Investors, including individuals and institutional investors, can participate in trust funds to potentially earn investment returns [5].

While shadow banking and trust funds are distinct concepts, they can intersect in the sense that some shadow banking activities may involve trust funds. In the context of China, shadow banking activities might involve the creation and issuance of financial products, such as wealth management products (WMPs), that are structured as trusts. These WMPs are essentially investment products offered by non-bank financial institutions, often with promised returns to investors.

1.4. Off-Balance-Sheet Vehicles

Some banks and financial institutions used off-balance-sheet vehicles to move certain assets and liabilities off their balance sheets. This practice sometimes obscured the true financial risks of these institutions.

1.5. Peer-to-Peer (P2P) Lending Platforms

P2P lending platforms allow individuals and small businesses to borrow and lend money directly without going through traditional banks. These platforms were initially seen as a way to improve access to credit but faced regulatory challenges due to fraudulent schemes and defaults.

1.6. Interbank Market Activities

Many financial institutions engaged in complex interbank transactions, sometimes involving repurchase agreements (repos) and other short-term lending arrangements. These activities could create interconnected risks in the financial system.

1.7. Non-Bank Financial Institutions

Diverse non-bank financial entities, such as brokerage firms and insurers, also engaged in the shadow banking network by providing investment vehicles and involvement in lending operations.

1.8. Regulatory Challenges

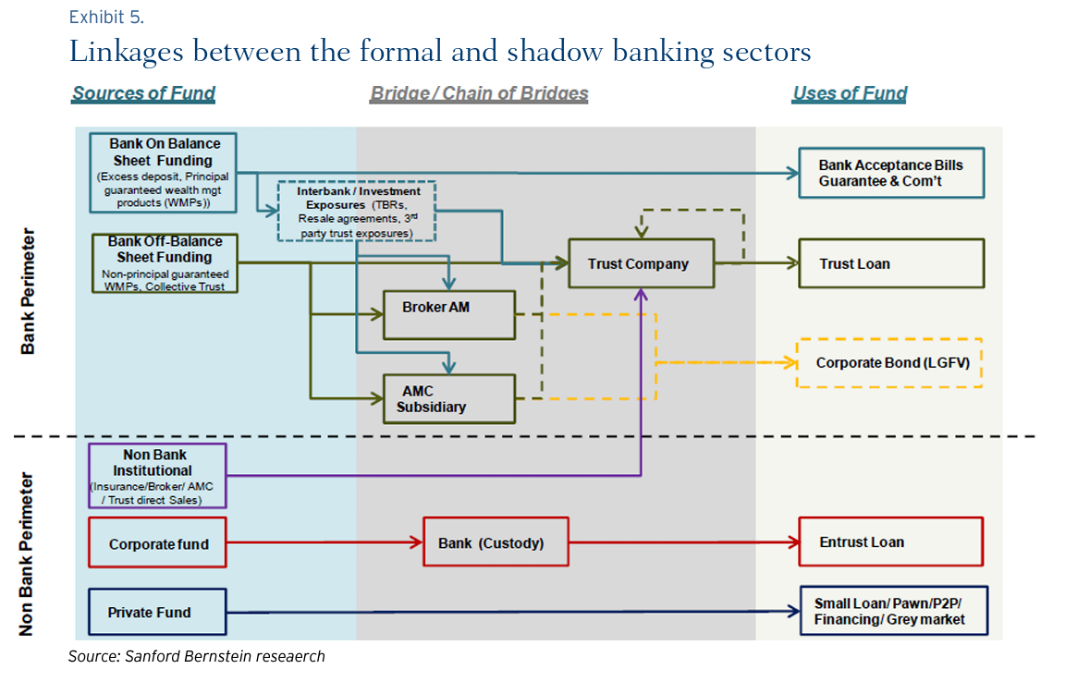

China's authorities have been attempting to address the risks associated with the shadow banking system. Efforts included implementing stricter regulations on wealth management products, reining in P2P lending platforms, and enhancing oversight of trust companies. Figure 1 shows the linkages between the formal and shadow banking sectors. These measures aimed to reduce systemic risks and improve transparency in the financial sector.

Figure 1: Linkages between the formal and shadow banking sectors.

2. The shadow banking system in the US market

2.1. Main bodies in the shadow banking system

Shadow banking pertains to creditors, intermediaries, and other credit facilitators who operate beyond the purview of conventional regulated banking institutions. They act as intermediaries between investors and borrowers, facilitating the flow of funds from investors to corporations. These institutions engage in a variety of securitization and secured funding techniques, such as asset-backed commercial paper (CP), asset-backed securities (ABS), collateralized debt obligations (CDOs), and repurchase agreements (repos). They generate profits through fees or by taking advantage of the interest rate differential between what they pay investors and what they receive from borrowers.

BlackRock, with over $6 trillion in assets under management, is recognized as the largest shadow bank globally due to its leading position as a global asset manager. Additional major participants in the shadow banking industry encompass investment banking institutions such as mortgage lenders, money market mutual funds, and so on [6].

2.2. The Size of US shadow banking

Major institutions in the U.S. are 1. Investment banks: JP Morgan, Goldman Sachs 2. Parts of commercial banks: Citibank, Bank of America 3. Hedge fund: Bridgewater 4. Money Market Funds: PIMCO.

Major institutions in China are commercial banks: ICBC, CCB, ABC, and BC.

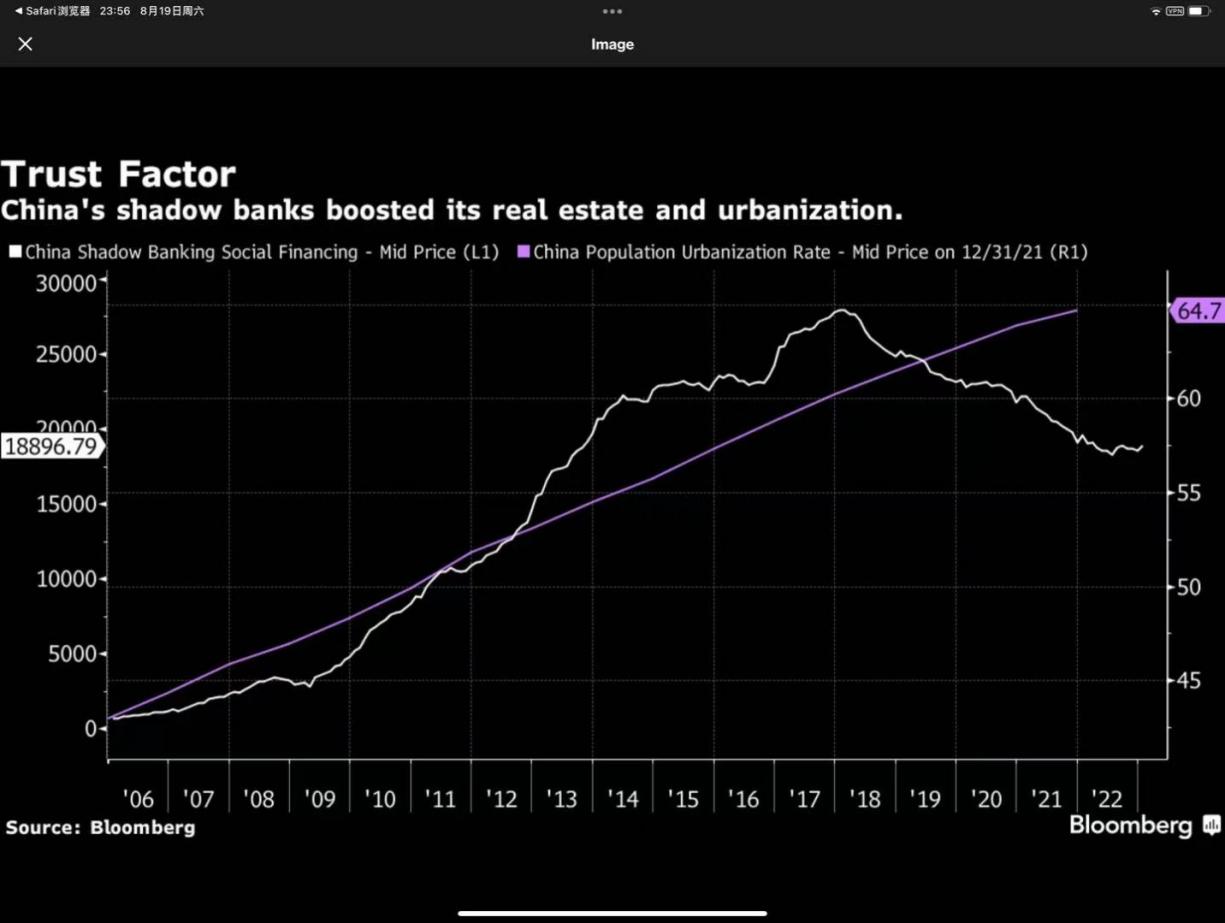

Note: Resource: Bloomberg

Figure 2: The Social Financing via Shadow Banking in China.

Figure 2 shows the social financing via shadow banking in China. Figure 3 shows the developing trend of shadow banks in China. China’s shadow banks have a positive correlation with more urbanization. The urbanization rate in 2018 at the peak, compared with the data in 2022, has decreased by about 22%. Whereas China’s shadow banks continue the boosting rate, key reasons for the stable development of China’s shadow banks are the regulation of P2P in 2018 and increasing investment in social financing, for example, ESG and socially responsible investing.

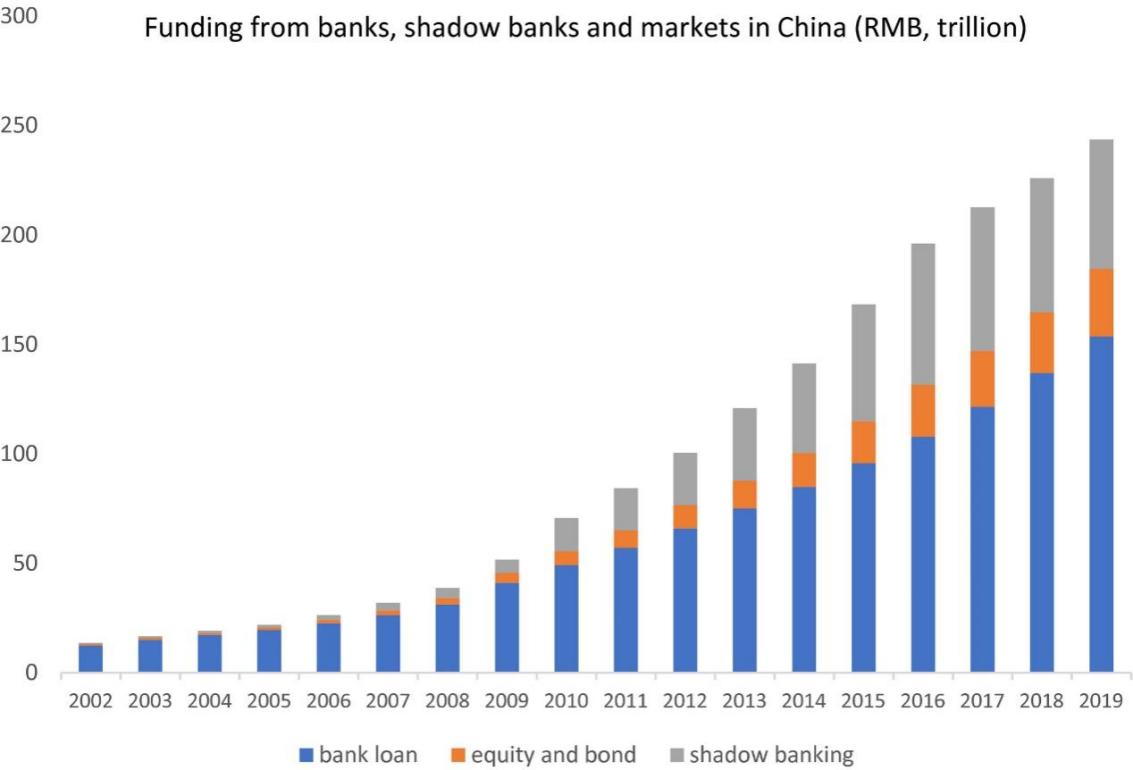

Figure 3: Developing trend for bank loan, equity, and bond shadow banking in China during the past 20 years.

2.3. The management system of shadow banking in the US

As some shadow banks are controlled by commercial banks while others have no affiliation to the banking system but to investment companies, huge business groups have a branch of subsidiary corporations. Some subsidiaries have complete data acquisition capabilities in specific fields, outstanding data analysts, data integration, and processing technology. For others, they specialize in money management portfolio allocation and even act directly as shadow banks.

2.4. The risk of high leverage

Shadow entities are non-banking entities that operate independently from banks and regulatory authorities, evading the same prudential oversight imposed on deposit-taking banks. Consequently, they are not obliged to maintain substantial financial reserves in proportion to their market exposure. This allows them to employ significant financial leverage, characterized by a substantial debt-to-liquid-assets ratio. It enables them to generate amplified profits during economic upswings and suffer exacerbated losses during downturns. The high leverage employed by shadow institutions may not be readily apparent to investors, leading to the illusion of superior performance during prosperous periods. However, the perils associated with excessive leverage are immense, and the deceptive optimism projected toward investors can trap them in a precarious situation [7].

2.5. Maturity transformation

Obtaining short-term funds (for instance, 1 commercial paper in US Money market mutual funds, which pool investors' funds to invest in commercial paper or mortgage-backed securities, are also categorized as shadow banks. Similarly, in many countries, there are financial entities known as finance companies that issue commercial paper and utilize the proceeds to provide credit to households. 2 WMP, which has short maturity, offers an annualized interest rate of 3 to 5 percent; 3 trust products in China has less regulation but has relatively good guarantee) to invest in longer-term assets such as mortgages assets in US, social financing.

2.6. Liquidity transformation

This concept resembles maturity transformation, involving easily convertible liabilities to acquire less liquid assets like loans. Credit risk transfer involves assuming the risk of a borrower defaulting and transferring it from the original lender of the loan (or issuer of a bond) to another entity.

2.7. 2007-2008 financial crisis influence the US shadow banking system

Before 2007, there was a great development of shadow banking due to the huge demand for subprime houses. During 2007-2008 it dropped a lot due to the financial crisis, lack of demander and a lot of landers bankrupted. From data since 2010, 70 percent increase for a decade. In comparison with 2019-2022 COVID-19, the US government pursued to stimulate the economy by decreasing the required reserve rate, the interest rate on loans and limiting loans for small independent firms on the verge of collapse, which led to less demand for shadow banks.

3. The comparison between China and the US market

Since the United States is a capitalist country, while China is a socialist country, the difference in countries in the financial field is mainly reflected in the organization of the government, the degree of intervention, the flexibility of the market, and other aspects. These shadow banks engage in bank-like lending activities and have similar risks to banks. Still, they have much less regulatory protection than banks and are not directly under the jurisdiction of any government agency. The crisis has clearly and unequivocally shown that "too big to fail" is not just a banking problem but also applies to the failure of large, complex, and interconnected shadow banks.

3.1. The regulation between China and the US market

In the US market, the financial jurisdiction of the judiciary is too isolated and, therefore, not fully communicated with each other, resulting in contradictions and information inequality between the judiciary, banks, and non-bank institutions. However, by focusing too much on their financial sectors and ignoring risks across jurisdictions or beyond the jurisdiction of any one regulator, they have understated risks and increased the likelihood of accidents caused by various uncertainties [8]. Directly affect all kinds of decision-making. No regulator is mandated to identify and address risks to the financial system as a whole and to help coordinate the complex relationships within the financial system. In the Chinese market the growing financial complexity in China brings both advantages and disadvantages. Businesses and investors appreciate the expanded range of financial instruments now accessible, but regulators confront the task of upholding financial stability within a progressively intricate marketplace.

3.2. The oversight system between China and the US market

The United States advocates a market economy, and all kinds of market operations that meet the legal requirements are recognized. The SEC has strict financial reporting requirements for listed companies, which effectively reduces investment risks for both individual investors and institutional investors. If there is any violation in accordance with the legal standards for fines, suspension. The market is very transparent. In China, the relationship between the government and regulators is complicated; low-interest bank loans come from state-owned enterprises, and the sec is barred from using ordinary regulatory methods for Chinese companies that are listed in the U.S. and refuse to provide some core data. This is unfriendly to international investors.

3.3. Risk in nonbank financial institutions

In the Chinese market, trust companies and securities brokerages often employ shadow banking to shift loans off their balance sheets and repackage them as investment products. These loans are, therefore subject to lower risk weights and require lower capital buffers. This practice allows certain entities to obscure non-performing loans (NPLs) on their balance sheets and potentially achieve higher ratings, contributing to market opacity in some ways. On the other hand, in the US market, the expansion in size, scope, and interconnectedness of shadow banks poses an increased threat to financial stability and the safety of the regulated banking sector.

3.4. The future of shadow banking (in relation to ESG and AI)

In the process of researching shadow banking, with the ever-changing changes and the development of technology, the work found that shadow banking also has inextricable links with the current hotspots of ESG and AI in the process of operation. After reviewing the literature and summarizing, the work found the following links.

The influence of corporations on the well-being of society has attracted considerable scrutiny in different spheres. The efforts made by companies in this realm are commonly known as Environmental, Social, and Governance (ESG) initiatives or Corporate Social Responsibility (CSR). There exists a connection between Shadow Banking and ESG practices. Below are several facets of their correlation:

1. Sustainable financing: Increased awareness of ESG has driven the development of sustainable financing, including green bonds, social bonds, and sustainability bonds. Shadow banks can meet investor demand for low-carbon, environmentally, and socially responsible investments by issuing and trading these sustainable financing instruments. This not only provides access to investors but also financing support for environmentally and socially sustainable development projects.

2. Risk management: ESG factors are an important part of financial risk. Shadow banking institutions should consider ESG-related factors, such as climate change risk, environmental regulation risk, and social reputation risk when conducting risk management. Shadow banking institutions must ensure that their investment portfolios are consistent with ESG standards and take measures to assess and manage related risks.

3. Transparency and disclosure: ESG implementation requires financial institutions to increase the transparency of disclosure and make ESG-related information publicly available to investors and stakeholders. For shadow banking institutions, transparency and disclosure are key factors in building trust, managing risk, and attracting sustainable investment. By publicly disclosing ESG-related information, shadow banks can increase market acceptance and promote more responsible and sustainable business practices.

4. Social impact: The way shadow banking develops and operates may have direct or indirect impacts on society. For example, the financing activities of shadow banking institutions may involve environmentally sensitive areas, social issues, and businesses with poor corporate governance. When making investment decisions, shadow banks need to take these factors into account to avoid negative impacts on society and to actively support the SDGs.

4. Conclusion

It is important to note that the application of ESG in the financial sector is an evolving area. Shadow banks, as an important part of the financial system, also need to pay attention to ESG-related trends and requirements and gradually integrate ESG considerations into their business models.

There is a relationship between Shadow Banking and Artificial Intelligence, even though the two fields are fundamentally different. Here are a few aspects of their relationship:

1. Data analytics and decision support: Shadow banking institutions can utilize AI technologies for large-scale data analysis and processing to help improve risk management, investment decisions, and operational efficiency. By applying machine learning and data mining techniques, shadow banks can better understand market trends, predict risks, and optimize investment portfolios.

2. Risk management: shadow banking involves complex financial transactions and liquidity risks, and AI can provide more powerful risk management tools. Using AI technology, shadow banks can build more accurate risk models, monitoring systems, and early warning systems to help identify potential risks and take appropriate risk control measures.

3. Automation and efficiency gains: AI technology can automate the business processes of shadow banking institutions, increasing efficiency and reducing costs. For example, automated algorithmic trading systems can autonomously execute trading strategies based on market conditions, improving trading efficiency and execution speed. In addition, AI can be applied to customer service, compliance monitoring, and anti-money laundering of shadow banks to improve operational efficiency and service quality.

4. Customer experience and personalized service: shadow banks can use AI technology to provide personalized financial products and services. By analyzing large amounts of user data, AI can provide customers with customized investment advice, financial planning, and risk management strategies. This helps to improve customer satisfaction and enhances shadow banks' competitive edge in the market [9,10]. It should be noted that the application of AI technology in the financial sector also brings some challenges and risks, such as data privacy and security, algorithmic bias, and regulatory and ethical issues. Therefore, when introducing AI into shadow banking, the associated risks need to be carefully assessed and managed, and compliance with regulatory requirements and ethical standards is ensured.

References

[1]. Pozsar, Z., Adrian, T., Ashcraft, A., & Boesky, H. (2010). Shadow banking. New York, 458(458), 3-9.

[2]. Elliott, D., Kroeber, A., & Qiao, Y. (2015). Shadow banking in China: A primer. Economic Studies at Brookings, 3(2015), 1-7.

[3]. Acharya, V. V., Qian, J., Su, Y., & Yang, Z. (2020). In the shadow of banks: wealth management products and issuing banks' risks in China.

[4]. Tao, S., Lu, Z., Li, H., & Liu, X. (2022, March). The impact of shadow banking on small and medium enterprise in China-based on trust company statistics. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 1108-1116). Atlantis Press.

[5]. Marlene Amstad, Guofeng Sun, Wei Xiong, Darrell Duffiffiffie. "The Handbook of China's Financial System", Walter de Gruyter GmbH, 2020.

[6]. Amit Seru (2019). Regulating Banks in the era of Fintech Shadow banks. Bank for International Settlement.

[7]. Jiayue Huang (2021). China’s new shadow banking rules signal fresh push to clamp down systemic risk. S&P Global.

[8]. Aidan Yao, Tri Vi Dang (2019). Shadow Banking Modes: The Chinese versus US System. Columbia.edu.

[9]. Gillan, S. L., Koch, A., & Starks, L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 66, 101889.

[10]. Halbritter, G., & Dorfleitner, G. (2015). The wages of social responsibility—where are they? A critical review of ESG investing. Review of Financial Economics, 26, 25-35.

Cite this article

Sun,R.;Sun,Z. (2024). The Comparison of Shadow Banking System Between in US & China: Definition, the Formation Way, Reason for Lack of Regulation, the Development, and Shadow Banking System . Advances in Economics, Management and Political Sciences,101,181-189.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Pozsar, Z., Adrian, T., Ashcraft, A., & Boesky, H. (2010). Shadow banking. New York, 458(458), 3-9.

[2]. Elliott, D., Kroeber, A., & Qiao, Y. (2015). Shadow banking in China: A primer. Economic Studies at Brookings, 3(2015), 1-7.

[3]. Acharya, V. V., Qian, J., Su, Y., & Yang, Z. (2020). In the shadow of banks: wealth management products and issuing banks' risks in China.

[4]. Tao, S., Lu, Z., Li, H., & Liu, X. (2022, March). The impact of shadow banking on small and medium enterprise in China-based on trust company statistics. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 1108-1116). Atlantis Press.

[5]. Marlene Amstad, Guofeng Sun, Wei Xiong, Darrell Duffiffiffie. "The Handbook of China's Financial System", Walter de Gruyter GmbH, 2020.

[6]. Amit Seru (2019). Regulating Banks in the era of Fintech Shadow banks. Bank for International Settlement.

[7]. Jiayue Huang (2021). China’s new shadow banking rules signal fresh push to clamp down systemic risk. S&P Global.

[8]. Aidan Yao, Tri Vi Dang (2019). Shadow Banking Modes: The Chinese versus US System. Columbia.edu.

[9]. Gillan, S. L., Koch, A., & Starks, L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 66, 101889.

[10]. Halbritter, G., & Dorfleitner, G. (2015). The wages of social responsibility—where are they? A critical review of ESG investing. Review of Financial Economics, 26, 25-35.